|

|

市場調査レポート

商品コード

1730661

データセンター向けGPUの世界市場:展開別、機能別、用途別、エンドユーザー別、地域別 - 2030年までの予測Data Center GPU Market by Deployment (Cloud, On-premises), Function (Training, Inference), Application (Generative AI, Machine Learning, Natural Language Processing, Computer Vision), End User (CSP, Enterprises) & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| データセンター向けGPUの世界市場:展開別、機能別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月15日

発行: MarketsandMarkets

ページ情報: 英文 288 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のデータセンター向けGPUの市場規模は、2024年に873億2,000万米ドルとなりました。

2025年から2030年の予測期間中のCAGRは13.7%と見込まれ、2030年には2,280億4,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | 展開別、機能別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

データセンター向けGPU市場は、人工知能(AI)や機械学習(ML)の普及、高性能コンピューティングに対する需要の増加、クラウドサービスの拡大など、いくつかの主な要因により急成長しています。企業は、ディープラーニング、大規模言語モデル、データ分析の改善にGPUを活用しています。生成AIの応用やリアルタイム推論システムの台頭は、堅牢なGPUインフラの必要性をさらに高めています。ハイパースケールデータセンターへの投資や、国のAI能力を支援する政府の取り組みも、この成長に一役買っています。Amazon Web Services、Google Cloud、Microsoft Azureのような主要なクラウドプロバイダーは、GPUの提供を強化しており、NVIDIAやAMDのような企業は、トレーニングや推論ワークロード用に調整された高度なGPUを発表しています。

オンプレミス・ソリューションは、銀行、自動車、小売、ヘルスケアなどの分野でデータ保護、低遅延、規制遵守のニーズが高まっていることから、CAGRが最も高くなると予想されています。企業は、サードパーティのクラウド・サービスに依存するよりも、社内のGPUハードウェアで機密データを管理し、より優れた管理を行うことを好みます。オンプレミスのデータセンターでは、インフラのカスタマイズも可能で、自律システムや高頻度取引などのリアルタイムアプリケーションに不可欠な低レイテンシーを必要とするAIタスクのワークロードを最適化できます。GPUサーバーの価格が手頃になるにつれ、中堅企業は専用インフラに投資できるようになっています。アジア太平洋、欧州、中東など、クラウド接続が限られていたり、データ主権に懸念がある地域では、オンプレミス展開が好まれることが多いです。

トレーニングセグメントは、大規模な機械学習やAIモデルの開発や最適化を行う企業によって、データセンター向けGPU市場で最も高い成長が見込まれています。ジェネレーティブAI、コンピュータビジョン、自然言語処理などのアプリケーションのためのディープニューラルネットワークのトレーニングには、GPUが効果的に提供する大幅なコンピューティングパワーが必要です。OpenAIのGPT、MetaのLLaMA、GoogleのGeminiなど、大規模な言語モデルの台頭により、テクノロジー、金融、ヘルスケア分野で強力なGPUへの需要が高まっています。これらのモデルは、数週間にわたる大規模な学習と大規模なデータセットを必要とするため、専用のGPUクラスタの必要性が高まっています。また、企業は競争優位のために独自のAIモデルを作成しています。AWS、Microsoft Azure、Google Cloudなどのクラウドプロバイダーは、GPUベースのトレーニングインフラを強化しています。AIがビジネス変革の最前線にある今、トレーニング・インフラに対する需要は大きく伸びると思われます。

クラウドサービスプロバイダ(CSP)セグメントは、その規模、AIインフラ支出の増加、企業や開発者のニーズを満たす能力により、データセンター向けGPU市場で最大の市場シェアを占めると予想されます。Amazon Web Services、Microsoft Azure、Google Cloudなどの大手CSPは、AIトレーニング、推論、データ分析、クラウドゲーミングの需要増に対応するため、GPUデータセンターを急速に拡張しています。これらのCSPはGPU-as-a-Serviceソリューションを提供しており、企業は多額の先行投資をすることなく高度なGPUテクノロジーにアクセスできます。さらに、基盤モデルやジェネレーティブAIの台頭により、CSPは何千ものGPUを搭載したAI専用スーパーコンピュータの構築に取り組んでいます。世界なインフラと強固な開発者エコシステムを持つCSPは、収益と台数の両面でデータセンター向けGPU市場をリードする立場にあります。

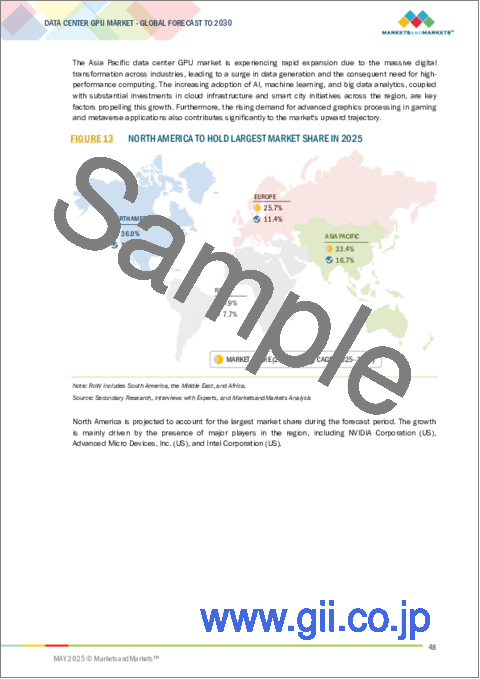

北米は先進的な技術エコシステムと確立されたクラウドインフラにより、データセンター向けGPU市場をリードすると予想されます。アマゾンウェブサービス、マイクロソフトアジュール、グーグルクラウドなどの大手クラウドコンピューティング企業は、AIワークロード、高性能コンピューティング、データ分析をサポートするためにGPUベースのデータセンターを構築しています。北米はまた、ヘルスケア、金融、自動車、政府機関などの業界にわたって強力な企業顧客基盤を有しており、GPUアクセラレーションを必要とするAI主導型ソリューションへの依存が高まっています。多大な研究開発投資、有利な政府政策、早期からの技術導入が、このリーダーシップを支えています。

データセンター向けGPU市場の主要な業界専門家に広範な1次インタビューを実施し、2次調査で収集したさまざまなセグメントとサブセグメントの市場規模を決定、検証しました。本レポートの主要参加者の内訳は以下の通りです。

当レポートでは、世界のデータセンター向けGPU市場について調査し、展開別、機能別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- エコシステム分析

- バリューチェーン分析

- 規制状況

- 貿易分析

- 価格分析

- 技術分析

- 特許分析

- ケーススタディ分析

- 主要な利害関係者と購入基準

- 2025年~2026年の主な会議とイベント

- 投資・資金調達シナリオ、2023年第1四半期~2024年第2四半期

- 顧客ビジネスに影響を与える動向/混乱

- トランプの影響の概要

- 主要関税率

- さまざまな地域への主な影響

- アジア太平洋のサプライチェーンへの影響

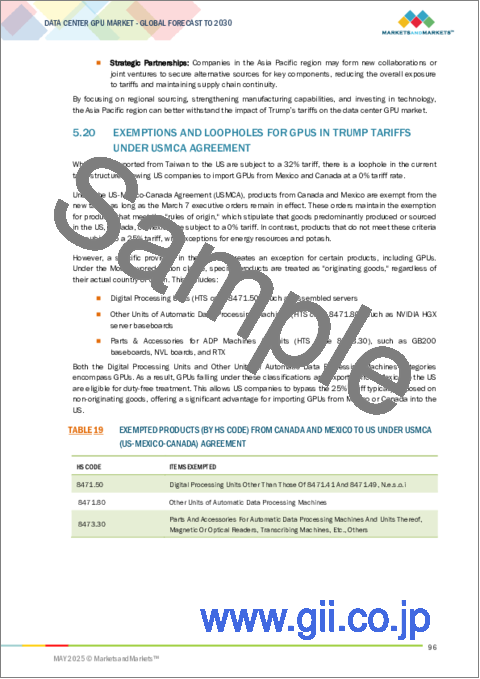

- USMCA協定に基づくトランプ関税におけるGPUの免除と抜け穴

- 最終用途産業レベルへの影響

第6章 GPU-AS-A-SERVICE(GPUAAS)の情勢

- イントロダクション

- サービスモデル

- IAAS

- PAAS

- 展開

- パブリッククラウド

- プライベートクラウド

- ハイブリッドクラウド

第7章 データセンター向けGPU市場(展開別)

- イントロダクション

- クラウド

- オンプレミス

第8章 データセンター向けGPU市場(機能別)

- イントロダクション

- トレーニング

- 推論

第9章 データセンター向けGPU市場(用途別)

- イントロダクション

- 生成AI

- 機械学習

- 自然言語処理

- コンピュータービジョン

第10章 データセンター向けGPU市場(エンドユーザー別)

- イントロダクション

- クラウドサービスプロバイダー

- 企業

- 政府機関

第11章 データセンター向けGPU市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 韓国

- 日本

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 南米

- アフリカ

- 中東

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2022年~2025年

- 収益分析、2018年~2022年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- データセンター向けGPUの企業評価マトリックス:主要参入企業、2024年

- GPU-as-a-service(GPUAAS)の企業評価マトリックス:主要参入企業、2024年

- GPU-as-a-service(GPUAAS)の企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオと動向

第13章 企業プロファイル

- 主要参入企業

- NVIDIA CORPORATION

- ADVANCED MICRO DEVICES, INC.

- INTEL CORPORATION

- MICROSOFT

- AMAZON WEB SERVICES, INC.

- IBM

- ALIBABA CLOUD

- ORACLE

- COREWEAVE.

- TENCENT CLOUD

- LAMBDA

- その他の企業

- VAST.AI

- RUNPOD

- SCALEMATRIX HOLDINGS, INC.

- DIGITALOCEAN

- JARVISLABS.AI

- FLUIDSTACK

- OVH SAS

- E2E NETWORKS LIMITED

- ACE CLOUD

- SNOWCELL

- LINODE LLC

- YOTTA DATA SERVICES PVT LTD.

- VULTR

- RACKSPACE TECHNOLOGY

- GCORE

- NEBIUS B.V.

第14章 付録

List of Tables

- TABLE 1 DATA CENTER GPU MARKET: RISK ANALYSIS

- TABLE 2 DATA CENTER GPU MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 ROLE OF PLAYERS IN DATA CENTER GPU ECOSYSTEM

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 STANDARDS

- TABLE 9 IMPORT DATA FOR HS CODE 847330-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 INDICATIVE PRICING TREND OF DATA CENTER GPU OFFERED BY KEY PLAYERS, BY FUNCTION, 2024 (USD)

- TABLE 12 INDICATIVE PRICING TREND OF DATA CENTER GPUS, BY KEY PLAYER, 2024

- TABLE 13 AVERAGE SELLING PRICE TREND OF DATA CENTER GPU, BY REGION, 2021-2024 (USD)

- TABLE 14 LIST OF APPLIED/GRANTED PATENTS RELATED TO DATA CENTER GPU, JANUARY 2025

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS (%)

- TABLE 16 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 17 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 19 EXEMPTED PRODUCTS (BY HS CODE) FROM CANADA AND MEXICO TO US UNDER USMCA (US-MEXICO-CANADA) AGREEMENT

- TABLE 20 GPU-AS-A-SERVICE MARKET, BY SERVICE MODEL, 2021-2024 (USD MILLION)

- TABLE 21 GPU-AS-A-SERVICE MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 22 IAAS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 23 IAAS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 NORTH AMERICA: IAAS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 25 NORTH AMERICA: IAAS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 26 EUROPE: IAAS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 27 EUROPE: IAAS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 28 ASIA PACIFIC: IAAS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 29 ASIA PACIFIC: IAAS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 30 ROW: IAAS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 ROW: IAAS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 MIDDLE EAST: IAAS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 33 MIDDLE EAST: IAAS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 34 AFRICA: IAAS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 35 AFRICA: IAAS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 36 PAAS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 PAAS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 NORTH AMERICA: PAAS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 39 NORTH AMERICA: PAAS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 40 EUROPE: PAAS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 41 EUROPE: PAAS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 42 ASIA PACIFIC: PAAS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 43 ASIA PACIFIC: PAAS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 44 ROW: PAAS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 ROW: PAAS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 MIDDLE EAST: PAAS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 47 MIDDLE EAST: PAAS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 48 AFRICA: PAAS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 49 AFRICA: PAAS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 50 GPU-AS-A-SERVICE MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 51 GPU-AS-A-SERVICE MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 52 PUBLIC CLOUD: GPU-AS-A-SERVICE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 PUBLIC CLOUD: GPU-AS-A-SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 PRIVATE CLOUD: GPU-AS-A-SERVICE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 PRIVATE CLOUD: GPU-AS-A-SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 HYBRID CLOUD: GPU-AS-A-SERVICE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 HYBRID CLOUD: GPU-AS-A-SERVICE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 DATA CENTER GPU MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 59 DATA CENTER GPU MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 60 CLOUD: DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 CLOUD: DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 ON-PREMISES: DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 ON-PREMISES: DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 DATA CENTER GPU MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 65 DATA CENTER GPU MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 66 DATA CENTER GPU MARKET, BY FUNCTION, 2021-2024 (THOUSAND UNITS)

- TABLE 67 DATA CENTER GPU MARKET, BY FUNCTION, 2025-2030 (THOUSAND UNITS)

- TABLE 68 TRAINING: DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 TRAINING: DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 INFERENCE: DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 INFERENCE: DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 DATA CENTER GPU MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 73 DATA CENTER GPU MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 74 DATA CENTER GPU MARKET FOR GENERATIVE AI, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 75 DATA CENTER GPU MARKET FOR GENERATIVE AI, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 76 GENERATIVE AI: DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 77 GENERATIVE AI: DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 78 RULE-BASED MODELS: DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 79 RULE-BASED MODELS: DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 80 STATISTICAL MODELS: DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 81 STATISTICAL MODELS: DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 82 DEEP LEARNING: DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 83 DEEP LEARNING: DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 84 GENERATIVE ADVERSARIAL NETWORKS (GANS): DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 85 GENERATIVE ADVERSARIAL NETWORKS (GANS): DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 86 AUTOENCODERS: DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 87 AUTOENCODERS: DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 88 CONVOLUTIONAL NEURAL NETWORKS (CNNS): DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 89 CONVOLUTIONAL NEURAL NETWORKS (CNNS): DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 90 TRANSFORMER MODELS: DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 91 TRANSFORMER MODELS: DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 92 MACHINE LEARNING: DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 93 MACHINE LEARNING: DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 94 NATURAL LANGUAGE PROCESSING: DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 95 NATURAL LANGUAGE PROCESSING: DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 96 COMPUTER VISION: DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 97 COMPUTER VISION: DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 98 DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 99 DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 100 DATA CENTER GPU MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD MILLION)

- TABLE 101 DATA CENTER GPU MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD MILLION)

- TABLE 102 CLOUD SERVICE PROVIDER: DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 CLOUD SERVICE PROVIDER: DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 CLOUD SERVICE PROVIDER: DATA CENTER GPU MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 105 CLOUD SERVICE PROVIDER: DATA CENTER GPU MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 ENTERPRISES: DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 ENTERPRISES: DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 ENTERPRISES: DATA CENTER GPU MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 109 ENTERPRISES: DATA CENTER GPU MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 110 HEALTHCARE: DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 111 HEALTHCARE: DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 BFSI: DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 BFSI: DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 AUTOMOTIVE: DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 AUTOMOTIVE: DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 RETAIL & E-COMMERCE: DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 RETAIL & E-COMMERCE: DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 MEDIA & ENTERTAINMENT: DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 MEDIA & ENTERTAINMENT: DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 OTHERS: DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 OTHERS: DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 122 GOVERNMENT ORGANIZATIONS: DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 123 GOVERNMENT ORGANIZATIONS: DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 124 GOVERNMENT ORGANIZATIONS: DATA CENTER GPU MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 125 GOVERNMENT ORGANIZATIONS: DATA CENTER GPU MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 128 NORTH AMERICA: DATA CENTER GPU MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 129 NORTH AMERICA: DATA CENTER GPU MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: DATA CENTER GPU MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: DATA CENTER GPU MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: DATA CENTER GPU MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: DATA CENTER GPU MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 135 NORTH AMERICA: DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: DATA CENTER GPU MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD MILLION)

- TABLE 137 NORTH AMERICA: DATA CENTER GPU MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD MILLION)

- TABLE 138 EUROPE: DATA CENTER GPU MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 139 EUROPE: DATA CENTER GPU MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: DATA CENTER GPU MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 141 EUROPE: DATA CENTER GPU MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: DATA CENTER GPU MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 143 EUROPE: DATA CENTER GPU MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 144 EUROPE: DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 145 EUROPE: DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 146 EUROPE: DATA CENTER GPU MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD MILLION)

- TABLE 147 EUROPE: DATA CENTER GPU MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: DATA CENTER GPU MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 149 ASIA PACIFIC: DATA CENTER GPU MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: DATA CENTER GPU MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 151 ASIA PACIFIC: DATA CENTER GPU MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: DATA CENTER GPU MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 153 ASIA PACIFIC: DATA CENTER GPU MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 154 ASIA PACIFIC: DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 155 ASIA PACIFIC: DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: DATA CENTER GPU MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD MILLION)

- TABLE 157 ASIA PACIFIC: DATA CENTER GPU MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD MILLION)

- TABLE 158 ROW: DATA CENTER GPU MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 159 ROW: DATA CENTER GPU MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 160 ROW: DATA CENTER GPU MARKET, BY DEPLOYMENT, 2021-2024 (USD MILLION)

- TABLE 161 ROW: DATA CENTER GPU MARKET, BY DEPLOYMENT, 2025-2030 (USD MILLION)

- TABLE 162 ROW: DATA CENTER GPU MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 163 ROW: DATA CENTER GPU MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 164 ROW: DATA CENTER GPU MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 165 ROW: DATA CENTER GPU MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 166 ROW: DATA CENTER GPU MARKET, BY ENTERPRISE TYPE, 2021-2024 (USD MILLION)

- TABLE 167 ROW: DATA CENTER GPU MARKET, BY ENTERPRISE TYPE, 2025-2030 (USD MILLION)

- TABLE 168 AFRICA: DATA CENTER GPU MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 169 AFRICA: DATA CENTER GPU MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST: DATA CENTER GPU MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 171 MIDDLE EAST: DATA CENTER GPU MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 172 OVERVIEW OF STRATEGIES ADOPTED BY DATA CENTER GPU VENDORS AND CLOUD SERVICE PROVIDERS

- TABLE 173 DATA CENTER GPU MARKET SHARE ANALYSIS, 2024

- TABLE 174 DATA CENTER GPU MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 175 DATA CENTER GPU MARKET: DEPLOYMENT FOOTPRINT, 2024

- TABLE 176 DATA CENTER GPU MARKET: FUNCTION FOOTPRINT, 2024

- TABLE 177 DATA CENTER GPU MARKET: END USER FOOTPRINT, 2024

- TABLE 178 GPU-AS-A-SERVICE (GPUAAS) MARKET: LIST OF KEY STARTUPS/SMES, 2024

- TABLE 179 GPU-AS-A-SERVICE (GPUAAS) MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 180 DATA CENTER GPU MARKET: PRODUCT LAUNCHES, FEBRUARY 2022-JANUARY 2025

- TABLE 181 DATA CENTER GPU MARKET: DEALS, FEBRUARY 2022-JANUARY 2025

- TABLE 182 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 183 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 NVIDIA CORPORATION: PRODUCT LAUNCHES

- TABLE 185 NVIDIA CORPORATION: DEALS

- TABLE 186 ADVANCED MICRO DEVICES, INC.: COMPANY OVERVIEW

- TABLE 187 ADVANCED MICRO DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 ADVANCED MICRO DEVICES, INC.: PRODUCT LAUNCHES

- TABLE 189 ADVANCED MICRO DEVICES, INC.: DEALS

- TABLE 190 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 191 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 INTEL CORPORATION: PRODUCT LAUNCHES

- TABLE 193 INTEL CORPORATION: DEALS

- TABLE 194 GOOGLE: COMPANY OVERVIEW

- TABLE 195 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 GOOGLE: PRODUCT LAUNCHES

- TABLE 197 GOOGLE: DEALS

- TABLE 198 MICROSOFT: COMPANY OVERVIEW

- TABLE 199 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 MICROSOFT: DEALS

- TABLE 201 AMAZON WEB SERVICES, INC.: COMPANY OVERVIEW

- TABLE 202 AMAZON WEB SERVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 AMAZON WEB SERVICES, INC.: PRODUCT LAUNCHES

- TABLE 204 AMAZON WEB SERVICES, INC.: DEALS

- TABLE 205 IBM: COMPANY OVERVIEW

- TABLE 206 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 IBM: PRODUCT LAUNCHES

- TABLE 208 IBM: DEALS

- TABLE 209 ALIBABA CLOUD: COMPANY OVERVIEW

- TABLE 210 ALIBABA CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 ALIBABA CLOUD: PRODUCT LAUNCHES

- TABLE 212 ALIBABA CLOUD: DEALS

- TABLE 213 ORACLE: COMPANY OVERVIEW

- TABLE 214 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 ORACLE: PRODUCT LAUNCHES

- TABLE 216 ORACLE: DEALS

- TABLE 217 COREWEAVE: COMPANY OVERVIEW

- TABLE 218 COREWEAVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 COREWEAVE: DEALS

- TABLE 220 TENCENT CLOUD: COMPANY OVERVIEW

- TABLE 221 TENCENT CLOUD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 222 TENCENT CLOUD: EXPANSIONS

- TABLE 223 LAMBDA: COMPANY OVERVIEW

- TABLE 224 LAMBDA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 LAMBDA: DEALS

- TABLE 226 VAST.AI: COMPANY OVERVIEW

- TABLE 227 RUNPOD: COMPANY OVERVIEW

- TABLE 228 SCALEMATRIX HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 229 DIGITALOCEAN: COMPANY OVERVIEW

- TABLE 230 JARVISLABS.AI: COMPANY OVERVIEW

- TABLE 231 FLUIDSTACK: COMPANY OVERVIEW

- TABLE 232 OVH SAS: COMPANY OVERVIEW

- TABLE 233 E2E NETWORKS LIMITED: COMPANY OVERVIEW

- TABLE 234 ACE CLOUD: COMPANY OVERVIEW

- TABLE 235 SNOWCELL: COMPANY OVERVIEW

- TABLE 236 LINODE LLC: COMPANY OVERVIEW

- TABLE 237 YOTTA DATA SERVICES PVT LTD: COMPANY OVERVIEW

- TABLE 238 VULTR: COMPANY OVERVIEW

- TABLE 239 RACKSPACE TECHNOLOGY: COMPANY OVERVIEW

- TABLE 240 GCORE: COMPANY OVERVIEW

- TABLE 241 NEBIUS B.V.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 DATA CENTER GPU MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DATA CENTER GPU MARKET: RESEARCH DESIGN

- FIGURE 3 DATA CENTER GPU MARKET: RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 DATA CENTER GPU MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 5 DATA CENTER GPU MARKET: BOTTOM-UP APPROACH

- FIGURE 6 DATA CENTER GPU MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA CENTER GPU MARKET: DATA TRIANGULATION

- FIGURE 8 CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 9 INFERENCE FUNCTION SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 10 GENERATIVE AI SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 CLOUD SERVICE PROVIDERS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO LEAD MARKET IN 2030

- FIGURE 13 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 14 INCREASING INVESTMENT BY CLOUD SERVICE PROVIDERS AND GROWING ADOPTION OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING TO DRIVE MARKET

- FIGURE 15 ON-PREMISES SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 16 INFERENCE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 17 GENERATIVE AI APPLICATION TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 ENTERPRISES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 CHINA TO WITNESS HIGHEST CAGR IN GLOBAL DATA CENTER GPU MARKET DURING FORECAST PERIOD

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DATA CENTER GPU MARKET

- FIGURE 21 IMPACT ANALYSIS: DRIVERS

- FIGURE 22 DATA CENTER ELECTRICITY CONSUMPTION 2022-2026

- FIGURE 23 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 24 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 25 IMPACT ANALYSIS: CHALLENGES

- FIGURE 26 DATA CENTER GPU MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 DATA CENTER GPU: ECOSYSTEM ANALYSIS

- FIGURE 28 DATA CENTER GPU MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 IMPORT SCENARIO FOR HS CODE 847330-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2010-2024

- FIGURE 30 EXPORT SCENARIO FOR HS CODE 847330-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 31 AVERAGE SELLING PRICE OF DATA CENTER GPUS, BY REGION, 2021-2024 (USD)

- FIGURE 32 DATA CENTER GPU MARKET: PATENT ANALYSIS, 2014-2024

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO, 2023 Q1-2024 Q2

- FIGURE 36 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 37 IAAS SEGMENT TO DOMINATE GPU-AS-A-SERVICE MARKET DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO RECORD HIGHEST CAGR IN MARKET FOR PAAS BETWEEN 2025 AND 2030

- FIGURE 39 PUBLIC CLOUD SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 40 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF MARKET FOR PRIVATE CLOUD IN 2030

- FIGURE 41 CLOUD SEGMENT TO REGISTER HIGHER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 42 BENEFITS OF CLOUD-BASED DEPLOYMENT

- FIGURE 43 INFERENCE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 44 GENERATIVE AI SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 CLOUD SERVICE PROVIDERS SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 46 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA: DATA CENTER GPU MARKET SNAPSHOT

- FIGURE 48 US TO RECORD HIGHEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 49 EUROPE: DATA CENTER GPU MARKET SNAPSHOT

- FIGURE 50 UK TO BE FASTEST-GROWING MARKET IN EUROPE DURING FORECAST PERIOD

- FIGURE 51 ASIA PACIFIC: DATA CENTER GPU MARKET SNAPSHOT

- FIGURE 52 CHINA TO LEAD DATA CENTER GPU MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 53 ROW: DATA CENTER GPU MARKET SNAPSHOT

- FIGURE 54 SOUTH AMERICA TO LEAD DATA CENTER GPU MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 55 REVENUE ANALYSIS OF FIVE KEY PLAYERS IN DATA CENTER GPU MARKET, 2021-2024 (USD MILLION)

- FIGURE 56 DATA CENTER GPU MARKET: SHARE OF KEY PLAYERS

- FIGURE 57 COMPANY VALUATION, 2025 (USD TRILLION)

- FIGURE 58 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 59 BRAND/PRODUCT COMPARISON

- FIGURE 60 DATA CENTER GPU MARKET: COMPETITIVE EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 61 GPU-AS-A-SERVICE (GPUAAS) MARKET: COMPETITIVE EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 62 DATA CENTER GPU MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 63 GPU-AS-A-SERVICE (GPUAAS) MARKET: EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 64 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 66 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 GOOGLE: COMPANY SNAPSHOT

- FIGURE 68 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 69 AMAZON WEB SERVICES, INC.: COMPANY SNAPSHOT

- FIGURE 70 IBM: COMPANY SNAPSHOT

- FIGURE 71 ORACLE: COMPANY SNAPSHOT

- FIGURE 72 COREWEAVE: COMPANY SNAPSHOT

- FIGURE 73 TENCENT CLOUD: COMPANY SNAPSHOT

The global data center GPU market was valued at USD 87.32 billion in 2024. It is projected to reach USD 228.04 billion by 2030, at a CAGR of 13.7% during the forecast period of 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Deployment, Function, Application, End User and RegionC |

| Regions covered | North America, Europe, APAC, RoW |

The data center GPU market is growing rapidly due to several key factors, including the widespread adoption of artificial intelligence (AI) and machine learning (ML), increased demand for high-performance computing, and expanding cloud services. Enterprises are utilizing GPUs to improve deep learning, large language models, and data analytics. The rise of generative AI applications and real-time inference systems further boosts the need for robust GPU infrastructure. Investments in hyperscale data centers and government initiatives to support national AI capabilities also play a role in this growth. Major cloud providers like Amazon Web Services, Google Cloud, and Microsoft Azure are enhancing their GPU offerings, while companies like NVIDIA and AMD are launching advanced GPUs tailored for training and inference workloads.

"On-premises segment is expected to hold the highest CAGR during the forecast period."

On-premises solutions are expected to have the highest CAGR due to the increasing needs for data protection, low latency, and regulatory compliance in sectors like banking, automotive, retail, and healthcare. Organizations prefer to manage sensitive data with in-house GPU hardware for better control, rather than relying on third-party cloud services. On-premises data centers also allow for customized infrastructure, optimizing workloads for AI tasks that require low latency, which is crucial for real-time applications such as autonomous systems and high-frequency trading. As GPU servers become more affordable, mid-sized enterprises can invest in dedicated infrastructure. On-premises deployment is often preferred in regions with limited cloud connectivity or data sovereignty concerns, such as Asia Pacific, Europe, and the Middle East.

"Training segment is projected to record the second-highest CAGR during the forecast period."

The training segment is expected to see the highest growth in the data center GPU market, driven by businesses developing and optimizing large-scale machine learning and AI models. Training deep neural networks for applications like generative AI, computer vision, and natural language processing requires substantial computing power, which GPUs provide effectively. The rise of large language models, including OpenAI's GPT, Meta's LLaMA, and Google's Gemini, is increasing demand for powerful GPUs in technology, finance, and healthcare sectors. These models require extensive training over weeks and large datasets, leading to a need for dedicated GPU clusters. Companies are also creating proprietary AI models for competitive advantage. Cloud providers such as AWS, Microsoft Azure, and Google Cloud are enhancing their GPU-based training infrastructure. With AI at the forefront of business transformation, the demand for training infrastructure is set to grow significantly.

"Cloud service providers (CSPs) are expected to hold the highest share of the end-user market in 2030"

The Cloud Service Providers (CSPs) segment is expected to command the largest market share in the data center GPU market due to their scale, increasing AI infrastructure spending, and ability to meet the needs of enterprises and developers. Major CSPs like Amazon Web Services, Microsoft Azure, and Google Cloud are rapidly expanding their GPU data centers to meet the rising demand for AI training, inference, data analytics, and cloud gaming. They offer GPU-as-a-Service solutions, allowing companies to access advanced GPU technology without significant upfront investments. Additionally, the rise of foundation models and generative AI drives CSPs to create specialized AI supercomputers with thousands of GPUs. With their global infrastructure and robust developer ecosystems, CSPs are well-positioned to lead the data center GPU market in both revenue and volume.

"North America will likely register the second-highest market share in 2030."

North America is expected to lead the data center GPU market due to its advanced technological ecosystem and established cloud infrastructure. Major cloud computing companies like Amazon Web Services, Microsoft Azure, and Google Cloud are creating GPU-based data centers to support AI workloads, high-performance computing, and data analysis. North America also has a strong enterprise customer base across industries like healthcare, finance, automotive, and government, increasingly relying on AI-driven solutions that need GPU acceleration. Significant R&D investments, favorable government policies, and early technology adoption support this leadership.

Extensive primary interviews were conducted with key industry experts in the data center GPU market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-60%, Tier 2-10%, and Tier 3-30%

- By Designation: C-level executives-10%, Directors-30%, and Others-60%

- By Region: Europe-20%, North America-70%, Asia Pacific-5%, and RoW-5%

The data center GPU is dominated by a few globally established players, such as NVIDIA Corporation (US), Advanced Micro Devices, Inc. (US), and Intel Corporation (US). Other players include Google Cloud (US), Microsoft (US), Amazon Web Services, Inc. (US), IBM (US), Alibaba Cloud (Singapore), Oracle (US), Tencent Cloud (China), CoreWeave (US), Vast.ai (US), Lambda (US), DigitalOcean (US), and JarvisLabs.ai (India).

The study includes an in-depth competitive analysis of these key players in the data center GPU market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the data center GPU market and forecasts its size by deployment (cloud, on-premises), function (training, inference), application (generative AI, machine learning, natural language processing, computer vision), and end user (cloud service providers, enterprises, and government organizations). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes an ecosystem analysis of the key players.

Key Benefits of Buying the Report:

- Analysis of key drivers (growing adoption of AI and machine learning, demand for high-performance computing, cloud computing expansion, restraints (high costs of GPUs and infrastructure, short product lifecycle), opportunities (growth in autonomous systems, emergence of edge computing, advancements in quantum computing synergy), and challenges (existence of alternative technologies, stringent regulatory framework, supply chain disruptions)

- Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the data center GPU market

- Market Development: Comprehensive information about lucrative markets - the report analyses the data center GPU market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the data center GPU market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as NVIDIA Corporation (US), Advanced Micro Devices, Inc. (US), Intel Corporation (US), Google Cloud (US), Microsoft (US), and Amazon Web Services, Inc. (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DATA CENTER GPU MARKET

- 4.2 DATA CENTER GPU MARKET, BY DEPLOYMENT

- 4.3 DATA CENTER GPU MARKET, BY FUNCTION

- 4.4 DATA CENTER GPU MARKET, BY APPLICATION

- 4.5 DATA CENTER GPU MARKET, BY END USER

- 4.6 DATA CENTER GPU MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of AI and machine learning

- 5.2.1.2 Growing demand for high performance computing (HPC)

- 5.2.1.3 Cloud computing expansion

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs of GPUs and infrastructure

- 5.2.2.2 Short product lifecycle

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth in autonomous systems

- 5.2.3.2 Emergence of edge computing

- 5.2.3.3 Advancements in quantum computing synergy

- 5.2.4 CHALLENGES

- 5.2.4.1 Existence of alternative technologies

- 5.2.4.2 Stringent regulatory framework

- 5.2.4.3 Supply chain disruptions

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.2 STANDARDS

- 5.6.3 REGULATIONS

- 5.6.3.1 North America

- 5.6.3.1.1 US

- 5.6.3.1.2 Canada

- 5.6.3.2 Europe

- 5.6.3.2.1 Germany

- 5.6.3.2.2 France

- 5.6.3.3 Asia Pacific

- 5.6.3.3.1 Japan

- 5.6.3.3.2 China

- 5.6.3.4 RoW

- 5.6.3.4.1 Brazil

- 5.6.3.4.2 South Africa

- 5.6.3.1 North America

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT DATA (HS CODE 847330)

- 5.7.2 EXPORT SCENARIO (HS CODE 847330)

- 5.8 PRICING ANALYSIS

- 5.8.1 INDICATIVE PRICING TREND OF DATA CENTER GPU OFFERED BY KEY PLAYERS, BY FUNCTION, 2024 (USD)

- 5.8.2 INDICATIVE PRICING TREND OF DATA CENTER GPUS, BY KEY PLAYER, 2024

- 5.8.3 AVERAGE SELLING PRICE OF DATA CENTER GPUS, BY REGION, 2021-2024 (USD)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Parallel processing architectures

- 5.9.1.2 High bandwidth memory (HBM)

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Application-specific integrated circuits (ASIC)

- 5.9.2.2 Field-programmable gate arrays (FPGA)

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 Non-volatile memory express (NVMe)

- 5.9.3.2 Infiniband

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 DECENTRALIZED DIGITAL WORLD OF MEDIA AND ENTERTAINMENT

- 5.11.2 TERRAY THERAPEUTICS - LEVERAGING GENERATIVE AI FOR SMALL-MOLECULE DRUG DISCOVERY

- 5.11.3 SIEMENS HEALTHINEERS - STREAMLINING CANCER RADIATION THERAPY WITH AI

- 5.11.4 GAC R&D CENTER - BOOSTING VEHICLE AERODYNAMICS WITH NVIDIA GPUS

- 5.11.5 STONE RIDGE TECHNOLOGY - REDUCING COMPOSITIONAL MODEL RUNTIMES WITH ECHELON 2.0

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 INVESTMENT AND FUNDING SCENARIO, 2023 Q1-2024 Q2

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 TRUMP IMPACT OVERVIEW

- 5.17 KEY TARIFF RATES

- 5.18 KEY IMPACTS ON VARIOUS REGIONS

- 5.18.1 US

- 5.18.2 EUROPE

- 5.18.3 ASIA PACIFIC

- 5.19 IMPACT ON SUPPLY CHAIN IN ASIA PACIFIC

- 5.20 EXEMPTIONS AND LOOPHOLES FOR GPUS IN TRUMP TARIFFS UNDER USMCA AGREEMENT

- 5.21 END-USE INDUSTRY-LEVEL IMPACT

6 GPU-AS-A-SERVICE (GPUAAS) LANDSCAPE

- 6.1 INTRODUCTION

- 6.2 SERVICE MODEL

- 6.2.1 IAAS

- 6.2.1.1 Rise in edge computing and real-time data processing to boost segmental growth

- 6.2.2 PAAS

- 6.2.2.1 Cost efficiency, scalability, and operational simplicity to contribute to segmental growth

- 6.2.1 IAAS

- 6.3 DEPLOYMENT

- 6.3.1 PUBLIC CLOUD

- 6.3.1.1 Scalability and high-performance computing capabilities to augment segmental growth

- 6.3.2 PRIVATE CLOUD

- 6.3.2.1 Enhanced control, security, and customization to foster segmental growth

- 6.3.3 HYBRID CLOUD

- 6.3.3.1 Ability to handle dynamic workloads and data security to accelerate segmental growth

- 6.3.1 PUBLIC CLOUD

7 DATA CENTER GPU MARKET, BY DEPLOYMENT

- 7.1 INTRODUCTION

- 7.2 CLOUD

- 7.2.1 INCREASING FLEXIBILITY, SCALABILITY, AND COST EFFICIENCY TO DRIVE GROWTH

- 7.3 ON-PREMISES

- 7.3.1 GROWING DEMAND FOR CONTROL AND PERFORMANCE DRIVES ON-PREMISE GPU DEPLOYMENTS

8 DATA CENTER GPU MARKET, BY FUNCTION

- 8.1 INTRODUCTION

- 8.2 TRAINING

- 8.2.1 GPU-DRIVEN PARALLEL PROCESSING ACCELERATES MACHINE LEARNING MODEL DEVELOPMENT IN DATA CENTERS

- 8.3 INFERENCE

- 8.3.1 REAL-TIME DECISION-MAKING DRIVES DEMAND FOR LOW-LATENCY GPU INFERENCE IN DATA CENTERS

9 DATA CENTER GPU MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 GENERATIVE AI

- 9.2.1 GENERATIVE AI UNLEASHES UNPRECEDENTED GPU DEMAND IN DATA CENTERS

- 9.2.2 RULE-BASED MODELS

- 9.2.3 STATISTICAL MODELS

- 9.2.4 DEEP LEARNING

- 9.2.5 GENERATIVE ADVERSARIAL NETWORKS (GANS)

- 9.2.6 AUTOENCODERS

- 9.2.7 CONVOLUTIONAL NEURAL NETWORKS (CNNS)

- 9.2.8 TRANSFORMER MODELS

- 9.3 MACHINE LEARNING

- 9.3.1 MACHINE LEARNING'S EXPANDING FOOTPRINT DRIVES DATA CENTER GPU GROWTH

- 9.4 NATURAL LANGUAGE PROCESSING

- 9.4.1 GPU ACCELERATION DRIVES NLP'S DATA CENTER DOMINANCE

- 9.5 COMPUTER VISION

- 9.5.1 GPU-POWERED COMPUTER VISION DRIVES DATA CENTER GROWTH

10 DATA CENTER GPU MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 CLOUD SERVICE PROVIDERS

- 10.2.1 RISING USE OF DATA CENTER GPUS FOR AI AND MACHINE LEARNING APPLICATIONS TO DRIVE MARKET

- 10.3 ENTERPRISES

- 10.3.1 ENTERPRISE AI ADOPTION FUELS ROBUST GROWTH IN DATA CENTER GPU DEMAND

- 10.3.2 HEALTHCARE

- 10.3.2.1 Growing use of machine learning (ML) and deep learning (DL) models in medical field to propel market

- 10.3.3 BFSI

- 10.3.3.1 Increased use of HPC by BFSI enterprises to drive market

- 10.3.4 AUTOMOTIVE

- 10.3.4.1 Rising popularity of autonomous cars to fuel adoption of GPUs

- 10.3.5 RETAIL & E-COMMERCE

- 10.3.5.1 Rising need to handle massive amounts of retail and e-commerce data to accelerate adoption of GPUs

- 10.3.6 MEDIA & ENTERTAINMENT

- 10.3.6.1 Increasing use of AI for content creation and recommendation to drive market

- 10.3.7 OTHERS

- 10.4 GOVERNMENT ORGANIZATIONS

- 10.4.1 RISING ADOPTION OF AI BY GOVERNMENT ORGANIZATIONS FOR NATIONAL SECURITY TO DRIVE MARKET

11 DATA CENTER GPU MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 High demand for GPUs from AI workloads to drive market

- 11.2.3 CANADA

- 11.2.3.1 Strategic government initiatives to boost market growth

- 11.2.4 MEXICO

- 11.2.4.1 Increasing investments in Mexico by hyperscalers to support market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Increasing adoption of automation solutions in automotive industry to drive market

- 11.3.3 UK

- 11.3.3.1 Strong demand from essential IT services and advent for new startups to drive market

- 11.3.4 FRANCE

- 11.3.4.1 Significant AI investments to drive market

- 11.3.5 ITALY

- 11.3.5.1 Partnerships between technology providers and government incentives drive market

- 11.3.6 SPAIN

- 11.3.6.1 Surging investments by hyperscalers and other companies to drive market

- 11.3.7 POLAND

- 11.3.7.1 Growing cloud adoption and AI investments to boost market opportunities

- 11.3.8 NORDICS

- 11.3.8.1 Rising adoption of accelerated computing technologies in data center to drive market

- 11.3.9 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Rapid government funding and initiatives to drive market

- 11.4.3 SOUTH KOREA

- 11.4.3.1 Rising investment and need for real-time data processing to drive market

- 11.4.4 JAPAN

- 11.4.4.1 Increasing hyperscaler investments to drive market

- 11.4.5 INDIA

- 11.4.5.1 Government initiatives and incentives to drive market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Domestic HPC push signals Australia's commitment to AI advancement

- 11.4.7 INDONESIA

- 11.4.7.1 Indonesia's digital ambition drives significant investment

- 11.4.8 MALAYSIA

- 11.4.8.1 Global cloud leaders drive massive data center GPU expansion in Malaysia

- 11.4.9 THAILAND

- 11.4.9.1 Strategic location and policies position Thailand for HPC leadership

- 11.4.10 VIETNAM

- 11.4.10.1 NVIDIA's strategic partnerships catalyze market

- 11.4.11 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Global players investing in region for data center infrastructure to drive demand

- 11.5.3 AFRICA

- 11.5.3.1 Rising focus of manufacturing firms on streamlining workflow and improving product quality to create opportunities

- 11.5.4 MIDDLE EAST

- 11.5.4.1 Booming AI initiatives to drive demand

- 11.5.4.2 GCC

- 11.5.4.3 Bahrain

- 11.5.4.3.1 Increased government initiatives to drive market

- 11.5.4.4 Kuwait

- 11.5.4.4.1 Kuwait accelerates GPU-driven digital transformation with national cloud and AI initiatives

- 11.5.4.5 Oman

- 11.5.4.5.1 Regional HPC hub with GPU-backed data center growth

- 11.5.4.6 Qatar

- 11.5.4.6.1 Qatar scales AI infrastructure with GPU investments ahead of smart city and research expansion

- 11.5.4.7 Saudi Arabia

- 11.5.4.7.1 Leads Gulf GPU market with hyperscale AI data center mega projects

- 11.5.4.8 United Arab Emirates (UAE)

- 11.5.4.8.1 UAE advances AI supercomputing ambitions through massive GPU-powered data center investments

- 11.5.4.9 Rest of Middle East

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 12.3 REVENUE ANALYSIS, 2018-2022

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX FOR DATA CENTER GPUS: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.8 COMPANY EVALUATION MATRIX FOR GPU-AS-A-SERVICE (GPUAAS): KEY PLAYERS, 2024

- 12.8.1 STARS

- 12.8.2 EMERGING LEADERS

- 12.8.3 PERVASIVE PLAYERS

- 12.8.4 PARTICIPANTS

- 12.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.8.5.1 Company footprint

- 12.8.5.2 Regional footprint

- 12.8.5.3 Deployment footprint

- 12.8.5.4 Function footprint

- 12.8.5.5 End user footprint

- 12.9 COMPANY EVALUATION MATRIX FOR GPU-AS-A-SERVICE (GPUAAS): STARTUPS/SMES, 2024

- 12.9.1 PROGRESSIVE COMPANIES

- 12.9.2 RESPONSIVE COMPANIES

- 12.9.3 DYNAMIC COMPANIES

- 12.9.4 STARTING BLOCKS

- 12.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.9.5.1 Detailed list of key startups/SMEs

- 12.9.5.2 Detailed list of key startups/SMEs

- 12.10 COMPETITIVE SCENARIO AND TRENDS

- 12.10.1 PRODUCT LAUNCHES

- 12.10.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 NVIDIA CORPORATION

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 ADVANCED MICRO DEVICES, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 INTEL CORPORATION

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 GOOGLE

- 13.1.4.1 Business overview

- 13.1.4.2 Recent developments

- 13.1.4.2.1 Product launches

- 13.1.4.2.2 Deals

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses and competitive threats

- 13.1.5 MICROSOFT

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 AMAZON WEB SERVICES, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.7 IBM

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.8 ALIBABA CLOUD

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.9 ORACLE

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 COREWEAVE.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.11 TENCENT CLOUD

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Expansions

- 13.1.12 LAMBDA

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.1 NVIDIA CORPORATION

- 13.2 OTHER PLAYERS

- 13.2.1 VAST.AI

- 13.2.2 RUNPOD

- 13.2.3 SCALEMATRIX HOLDINGS, INC.

- 13.2.4 DIGITALOCEAN

- 13.2.5 JARVISLABS.AI

- 13.2.6 FLUIDSTACK

- 13.2.7 OVH SAS

- 13.2.8 E2E NETWORKS LIMITED

- 13.2.9 ACE CLOUD

- 13.2.10 SNOWCELL

- 13.2.11 LINODE LLC

- 13.2.12 YOTTA DATA SERVICES PVT LTD.

- 13.2.13 VULTR

- 13.2.14 RACKSPACE TECHNOLOGY

- 13.2.15 GCORE

- 13.2.16 NEBIUS B.V.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS