|

|

市場調査レポート

商品コード

1375844

ALD装置の世界市場:成膜方法別、薄膜タイプ別、半導体用途別、非半導体用途別、地域別 - 予測(~2028年)ALD Equipment Market by Deposition Method, Film Type, Semiconductor Application, Non-semiconductor Application and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ALD装置の世界市場:成膜方法別、薄膜タイプ別、半導体用途別、非半導体用途別、地域別 - 予測(~2028年) |

|

出版日: 2023年10月31日

発行: MarketsandMarkets

ページ情報: 英文 216 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

レポートの概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 100万米ドル |

| セグメント | 成膜方法別、薄膜タイプ別、半導体用途別、非半導体用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

世界のALD装置の市場規模は、2023年に39億米ドル、2028年までに62億米ドルに達し、2023年~2028年にCAGRで10.0%の成長が予測されています。

市場成長の主な促進要因は、3D NAND SSDの需要拡大、ALD装置が提供する利点、AIベースのサーバーからの記憶装置需要の高まりなどがあります。さらに、医療部門におけるAIやIoTの利用拡大や、太陽光発電からの需要の急増によってALD装置の展開が増加しており、市場参入企業に複数の成長機会を提供すると予測されています。

予測期間にフッ化物膜タイプが市場でもっとも高いCAGRを占める見込み

近年、その低い屈折率によりフッ化物膜のALDに対する需要が増加しています。この特性により、UV/IR波長での透過率が向上し、光学用途に非常に適しています。さらに、MgF2、AlF3、LiFなどの金属フッ化物のALD成膜は、吸収損失を防ぐ超薄膜の成膜を可能にしながら、UV波長での優れた透過率を確保します。したがって、UV波長における低い屈折率と優れた透過特性に対するニーズの高まりが、市場の成長を後押ししています。したがって、フッ化物膜ベースのALD装置は、市場でもっとも高いCAGRが見込まれています。

エネルギー用途が予測期間に市場で最大の市場規模を占める見込み

ALD装置は極めて均一な膜を形成することができるため、リチウムイオン電池や太陽電池など、さまざまなエネルギー用途において非常に価値の高い選択肢となります。近年、リチウムイオン電池(LIB)の採用がコンシューマーエレクトロニクスや自動車などの幅広い用途で急増しています。さらに、太陽電池の需要も近年大幅に増加しており、ALD装置におけるエネルギー用途の市場成長に重要な役割を果たしています。

予測期間に北米が第2位の市場規模を占める見込み

コンシューマーエレクトロニクスや半導体製造企業の製造工場や施設のプレゼンスが、同地域におけるALD装置市場の成長を促進すると予測されます。さらに、太陽電池のような再生可能エネルギーの採用の増加も、市場成長に寄与する見込みです。

当レポートでは、世界のALD装置市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- ALD装置市場の企業にとって魅力的な機会

- ALD装置市場:成膜方法別

- ALD装置市場:薄膜タイプ別

- ALD装置市場:用途別(半導体)

- ALD装置市場:用途別(非半導体)

- アジア太平洋のALD装置市場:用途別、国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- エコシステムマッピング

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- 液体ALD(L-ALD)

- ALDプロセスの進歩

- ALD装置におけるAIとMLの統合

- 価格分析

- ALD装置の平均販売価格の動向:用途別

- ALD装置の平均販売価格の動向:地域別

- 特許分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 購入プロセスにおける主なステークホルダー

- 購入基準

- ケーススタディ分析

- 貿易分析

- 規制情勢

- 世界の基準と規制機関

- 政府の規制

- 主な会議とイベント(2023年~2024年)

第6章 ALD装置市場:ウエハーサイズ別

- イントロダクション

- 150MM以下

- 200MM

- 300MM

第7章 ALD装置市場:成膜方法別

- イントロダクション

- プラズマ強化

- 熱

- 空間的

- ロールツーロール

- パウダー

- その他

第8章 ALD装置市場:薄膜タイプ別

- イントロダクション

- 酸化物

- 金属

- 硫化物

- 窒化物

- フッ化物

第9章 ALD装置市場:用途別(半導体)

- イントロダクション

- モアザンムーア

- MEMS、センサー

- RFデバイス

- 先進パッケージング

- パワーデバイス

- フォトニクス(LED、VCSEL)

- CMOSイメージセンサー

- 研究開発施設

- モアムーア

第10章 ALD装置市場:用途別(非半導体)

- イントロダクション

- エネルギー

- 医療

- 従来型光学

- コーティング

第11章 ALD装置市場:地域別

- イントロダクション

- 北米

- 北米のALD装置市場に対する景気後退の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のALD装置市場に対する景気後退の影響

- ドイツ

- 英国

- フランス

- その他の欧州

- アジア太平洋

- アジア太平洋のALD装置市場に対する景気後退の影響

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- その他の地域

- その他の地域のALD装置市場に対する景気後退の影響

- 中東・アフリカ

- 南米

第12章 競合情勢

- イントロダクション

- 競合の概要

- 有機/無機成長戦略

- 製品ポートフォリオ

- 地域のプレゼンス

- 製造フットプリント

- 市場シェア分析(2022年)

- 収益分析(2018年~2022年)

- 企業の評価マトリクス(2022年)

- スタートアップ/中小企業(SME)の評価マトリクス(2022年)

- 競合シナリオと動向

第13章 企業プロファイル

- イントロダクション

- 主要企業

- ASM INTERNATIONAL

- APPLIED MATERIALS, INC.

- TOKYO ELECTRON LIMITED.

- LAM RESEARCH CORPORATION.

- VEECO INSTRUMENTS INC.

- KURT J. LESKER COMPANY

- OPTORUN CO., LTD.

- CVD EQUIPMENT CORPORATION

- EUGENE TECHNOLOGY CO. LTD.

- BENEQ

- その他の企業

- ANRIC TECHNOLOGIES.

- FORGE NANO INC.

- WONIK IPS.

- ENCAPSULIX

- SENTECH INSTRUMENTS GMBH

- TEMPRESS

- NCD CO., LTD.

- JIANGSU MICROGUIDE NANOTECHNOLOGY CO., LTD.

- NAURA

- CN1 CO., LTD.

- SHOWA SHINKU CO., LTD.

- LEVITECH

- NANO-MASTER, INC.

- SAMCO INC.

- ARRADIANCE LLC

第14章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million) |

| Segments | By Deposition Method, Film Type, Semiconductor Application, Non-semiconductor Application and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East and Africa |

The ALD equipment market is projected to reach USD 6.2 billion by 2028 from USD 3.9 billion in 2023, at a CAGR of 10.0% from 2023 to 2028. The major factors driving the market growth of the ALD equipment includes the growing demand for 3D NAND SSDs, benefits offered by ALD equipment and the rising demand for memory devices from AI-based servers. Moreover, the increasing utilization of AI and IoT in the healthcare sector and the surging demand for photovoltaics has led to an increased deployment of ALD equipment which is expected to provide several growth opportunities for market players in the ALD equipment market.

Fluoride film type is expected to account for the highest CAGR in the ALD equipment market during the forecast period

In recent times, the demand for ALD of fluoride films has increased due to their low refractive index. This characteristic enhances transmission at both UV and IR wavelengths which makes them highly preferrable for optical applications. Moreover, ALD deposition of metal fluorides, such as MgF2, AlF3, and LiF, ensures superior transmission at UV wavelengths while allowing the deposition of ultra-thin films to prevent the absorption losses. Therefore, the increasing need for low refractive index and superior transmission properties at UV wavelengths drives the market growth. Hence, fluoride film-based ALD equipment is expected to have the highest CAGR in the ALD equipment market.

Energy application is expected to account for the largest market size in the ALD equipment market during the forecast period

ALD equipment can create exceptionally uniform films which makes it a highly valuable choice for various energy applications such as Li-ion batteries and solar cells, among others. In recent years, there has been a significant surge in the adoption of Li-ion batteries (LIBs) across a wide range of consumer electronics and automotive applications. Furthermore, there is a significant rise in demand for solar cells, in recent years, which plays a critical role in contributing towards the market growth of the energy application in ALD equipment market.

North America is expected to account for the second- largest market size during the forecast period

Presence of fabrication plants and establishments of consumer electronics and semiconductor manufacturing companies is expected to drive the market growth of ALD equipment in the region. Furthermore, the growing adoption of renewable energy such as solar cells, is anticipated to contribute to the market growth of ALD equipment in the region.

The break-up of profile of primary participants in the ALD equipment market-

- By Company Type: Tier 1 - 30%, Tier 2 - 50%, Tier 3 - 20%

- By Designation Type: C Level - 25%, Director Level - 35%, Others - 40%

- By Region Type: North America - 30%, Europe - 25%, Asia Pacific - 35%, Rest of the World (RoW) - 10%

The major players of ALD equipment market are ASM International N.V. (Netherlands), Tokyo Electron Limited. (Japan), Applied Materials, Inc. (US), LAM RESEARCH CORPORATION. (US), and Veeco Instruments Inc. (US) among others.

Research Coverage

The report segments the ALD equipment market and forecasts its size based on deposition method, film type, application (non-semiconductor), application (semiconductor), and region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing the market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall ALD equipment market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing market of semiconductor industry, the growing demand for 3D NAND SSDs, benefits offered by ALD equipment and the rising demand for memory devices from AI-based servers), restraints (High costs related to ALD equipment and lack of skilled workforce), opportunities (increasing utilization of AI and IoT in the healthcare sector and the surging demand for photovoltaics has led to an increased deployment of ALD equipment), and challenges (the increasing technical difficulties and process complexities) influencing the growth of the ALD equipment market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the ALD equipment market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the ALD equipment market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the ALD equipment market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like ASM International N.V. (Netherlands), Tokyo Electron Limited. (Japan), Applied Materials, Inc. (US), LAM RESEARCH CORPORATION. (US), and Veeco Instruments Inc. (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 ALD EQUIPMENT MARKET: SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS, BY COMPANY

- 1.3.4 INCLUSIONS AND EXCLUSIONS, BY FILM TYPE

- 1.3.5 INCLUSIONS AND EXCLUSIONS, BY DEPOSITION METHOD

- 1.3.6 INCLUSIONS AND EXCLUSIONS, BY WAFER SIZE

- 1.3.7 INCLUSIONS AND EXCLUSIONS, BY APPLICATION (NON-SEMICONDUCTOR)

- 1.3.8 INCLUSIONS AND EXCLUSIONS, BY APPLICATION (SEMICONDUCTOR)

- 1.3.9 INCLUSIONS AND EXCLUSIONS, BY REGION

- 1.3.10 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 ALD EQUIPMENT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- FIGURE 3 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis

- FIGURE 4 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS (APPROACH 1)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS (APPROACH 2)

- 2.3.2 GROWTH FORECAST ASSUMPTIONS

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- 2.4 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- TABLE 2 ALD EQUIPMENT MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 ALD EQUIPMENT MARKET: GLOBAL SNAPSHOT

- FIGURE 9 PLASMA-ENHANCED ALD TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 OXIDE FILMS TO ACCOUNT FOR LARGEST SHARE OF ALD EQUIPMENT MARKET IN 2028

- FIGURE 11 MORE MOORE APPLICATIONS TO REGISTER HIGHEST CAGR IN ALD EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 12 MEDICAL APPLICATIONS TO EXHIBIT HIGHEST CAGR IN ALD EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 13 ALD EQUIPMENT MARKET IN ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ALD EQUIPMENT MARKET

- FIGURE 14 CONSTANTLY EXPANDING SEMICONDUCTOR INDUSTRY TO CONTRIBUTE SIGNIFICANTLY TO MARKET GROWTH

- 4.2 ALD EQUIPMENT MARKET, BY DEPOSITION METHOD

- FIGURE 15 PLASMA-ENHANCED ALD TO DOMINATE ALD EQUIPMENT MARKET IN 2028

- 4.3 ALD EQUIPMENT MARKET, BY FILM TYPE

- FIGURE 16 OXIDE FILMS TO HOLD LARGEST SHARE OF ALD EQUIPMENT MARKET DURING FORECAST PERIOD

- 4.4 ALD EQUIPMENT MARKET, BY APPLICATION (SEMICONDUCTOR)

- FIGURE 17 MORE MOORE APPLICATIONS TO LEAD ALD EQUIPMENT MARKET IN 2028

- 4.5 ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR)

- FIGURE 18 ENERGY APPLICATIONS TO ACCOUNT FOR LARGEST SHARE OF ALD EQUIPMENT MARKET IN 2028

- 4.6 ALD EQUIPMENT MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- FIGURE 19 SEMICONDUCTOR APPLICATIONS AND CHINA HELD LARGEST SHARES OF ALD EQUIPMENT MARKET, BY APPLICATION AND COUNTRY, IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 ALD EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid expansion of semiconductor industry

- FIGURE 21 GLOBAL SEMICONDUCTOR MARKET SIZE, 2021-2024 (USD BILLION)

- 5.2.1.2 Increasing demand for 3D NAND SSDs

- 5.2.1.3 Multiple benefits offered by ALD equipment

- TABLE 3 ALD AND CVD COMPARISON

- 5.2.1.4 Growing demand for memory devices from AI-based servers

- FIGURE 22 IMPACT ANALYSIS OF DRIVERS ON ALD EQUIPMENT MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs related to ALD equipment

- 5.2.2.2 Lack of skilled workforce

- FIGURE 23 IMPACT ANALYSIS OF RESTRAINTS ON ALD EQUIPMENT MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing adoption of More than Moore devices

- 5.2.3.2 Growing integration of AI and IoT in healthcare sector

- 5.2.3.3 Surging demand for photovoltaics

- FIGURE 24 ANNUAL POWER GENERATION CAPACITY OF RENEWABLE ENERGY, BY TECHNOLOGY, 2019-2022

- FIGURE 25 IMPACT ANALYSIS OF OPPORTUNITIES ON ALD EQUIPMENT MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing technical difficulties and process complexities involved in semiconductor manufacturing

- FIGURE 26 IMPACT ANALYSIS OF CHALLENGES ON ALD EQUIPMENT MARKET

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 27 ALD EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM MAPPING

- FIGURE 28 ECOSYSTEM ANALYSIS

- TABLE 4 ALD EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 LIQUID ALD (L-ALD)

- 5.6.2 ADVANCEMENTS IN ALD PROCESS

- 5.6.3 AI AND ML INTEGRATION IN ALD EQUIPMENT

- 5.7 PRICING ANALYSIS

- TABLE 5 AVERAGE SELLING PRICE OF ALD EQUIPMENT

- 5.7.1 AVERAGE SELLING PRICE TREND OF ALD EQUIPMENT, BY APPLICATION

- FIGURE 30 AVERAGE SELLING PRICE TREND OF ALD EQUIPMENT, BY APPLICATION

- 5.7.2 AVERAGE SELLING PRICE TREND OF ALD EQUIPMENT, BY REGION

- FIGURE 31 AVERAGE SELLING PRICE TREND FOR LARGE-VOLUME PRODUCTION OF ALD EQUIPMENT, BY REGION

- 5.8 PATENT ANALYSIS

- TABLE 6 PATENTS FILED BETWEEN JANUARY 2012 AND DECEMBER 2022

- FIGURE 32 NUMBER OF PATENTS RELATED TO ALD EQUIPMENT GRANTED DURING 2012-2022

- FIGURE 33 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS GRANTED, 2012-2022

- FIGURE 34 TOP 20 PATENT OWNERS, 2012-2022

- TABLE 7 KEY PATENTS RELATED TO ALD EQUIPMENT

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 ALD EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 ALD EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS, 2022

- TABLE 8 ALD EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS, 2022

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO APPLICATIONS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO APPLICATIONS (%)

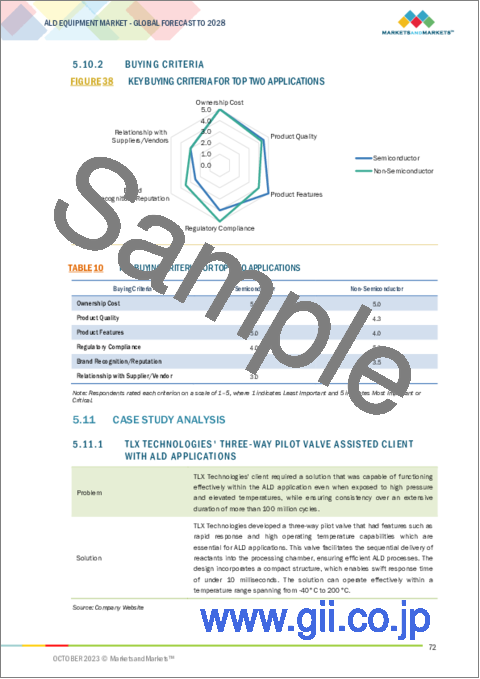

- 5.10.2 BUYING CRITERIA

- FIGURE 38 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

- TABLE 10 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 TLX TECHNOLOGIES' THREE-WAY PILOT VALVE ASSISTED CLIENT WITH ALD APPLICATIONS

- 5.11.2 PICOSUN (APPLIED MATERIALS) SELECTED 300 MM ALD TECHNOLOGY FROM STMICROELECTRONICS FOR POWER ELECTRONICS APPLICATIONS

- 5.11.3 BENEQ'S ALD EQUIPMENT SIGNIFICANTLY REDUCED RE-COATING COSTS FOR JAPAN-BASED JEWELRY AND COIN RETAILER

- 5.12 TRADE ANALYSIS

- TABLE 11 IMPORT VALUES FOR MAJOR COUNTRIES FOR MACHINES AND APPARATUS FOR MANUFACTURING SEMICONDUCTOR DEVICES OR ELECTRONIC INTEGRATED CIRCUITS, 2018-2022 (USD BILLION)

- FIGURE 39 IMPORT VALUES FOR MAJOR COUNTRIES FOR MACHINES AND APPARATUS FOR MANUFACTURING SEMICONDUCTOR DEVICES OR ELECTRONIC INTEGRATED CIRCUITS, 2018-2022

- TABLE 12 EXPORT VALUES FOR MAJOR COUNTRIES FOR MACHINES AND APPARATUS FOR MANUFACTURING SEMICONDUCTOR DEVICES OR ELECTRONIC INTEGRATED CIRCUITS, 2018-2022 (USD BILLION)

- FIGURE 40 EXPORT VALUES FOR MAJOR COUNTRIES FOR MACHINES AND APPARATUS FOR MANUFACTURING SEMICONDUCTOR DEVICES OR ELECTRONIC INTEGRATED CIRCUITS, 2018-2022

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 GLOBAL STANDARDS AND REGULATORY BODIES

- 5.13.2 GOVERNMENT REGULATIONS

- 5.13.2.1 Asia Pacific

- 5.13.2.2 North America

- 5.13.2.3 Europe

- 5.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 13 ALD EQUIPMENT MARKET: LIST OF CONFERENCES AND EVENTS

6 ALD EQUIPMENT MARKET, BY WAFER SIZE

- 6.1 INTRODUCTION

- 6.2 UP TO 150 MM

- 6.3 200 MM

- 6.4 300 MM

7 ALD EQUIPMENT MARKET, BY DEPOSITION METHOD

- 7.1 INTRODUCTION

- TABLE 14 ALD EQUIPMENT MARKET, 2019-2022 (THOUSAND UNITS)

- TABLE 15 ALD EQUIPMENT MARKET, 2023-2028 (THOUSAND UNITS)

- TABLE 16 ALD EQUIPMENT MARKET, BY DEPOSITION METHOD, 2019-2022 (USD MILLION)

- FIGURE 41 PLASMA-ENHANCED ALD TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 17 ALD EQUIPMENT MARKET, BY DEPOSITION METHOD, 2023-2028 (USD MILLION)

- 7.2 PLASMA-ENHANCED

- 7.2.1 DEPLOYMENT IN SEQUENTIAL DEPOSITION AT LOWER TEMPERATURES TO DRIVE SEGMENT

- TABLE 18 PLASMA-ENHANCED: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- FIGURE 42 SEMICONDUCTOR APPLICATIONS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- TABLE 19 PLASMA-ENHANCED: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.3 THERMAL

- 7.3.1 INCREASING NEED TO DEPOSIT METAL FILMS ONTO SUBSTRATES TO PROPEL SEGMENTAL GROWTH

- TABLE 20 THERMAL: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 21 THERMAL: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.4 SPATIAL

- 7.4.1 ABILITY TO DEPOSIT THIN FILMS AT AMBIENT PRESSURE TO FUEL SEGMENTAL GROWTH

- TABLE 22 SPATIAL: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 23 SPATIAL: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.5 ROLL-TO-ROLL

- 7.5.1 RISING ADOPTION OF COST-EFFICIENT ALD SOLUTIONS FOR COATING BARRIERS ON POLYMER SUBSTRATES TO BOOST SEGMENTAL GROWTH

- TABLE 24 ROLL-TO-ROLL: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 25 ROLL-TO-ROLL: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.6 POWDER

- 7.6.1 INCREASING FOCUS ON EXTENDING LIFESPAN OF SEMICONDUCTOR COMPONENTS TO FUEL SEGMENTAL GROWTH

- TABLE 26 POWDER: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 27 POWDER: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.7 OTHERS

- TABLE 28 OTHERS: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 29 OTHERS: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

8 ALD EQUIPMENT MARKET, BY FILM TYPE

- 8.1 INTRODUCTION

- TABLE 30 ALD EQUIPMENT MARKET, BY FILM TYPE, 2019-2022 (USD MILLION)

- FIGURE 43 OXIDE FILMS TO DOMINATE ALD EQUIPMENT MARKET IN 2028

- TABLE 31 ALD EQUIPMENT MARKET, BY FILM TYPE, 2023-2028 (USD MILLION)

- 8.2 OXIDE

- 8.2.1 INCREASING APPLICATIONS OF HIGH-K OXIDE DEPOSITS TO DRIVE MARKET

- 8.3 METAL

- 8.3.1 GROWING ADOPTION OF 3D NAND SSDS TO GENERATE NUMEROUS OPPORTUNITIES FOR MARKET PLAYERS

- 8.4 SULFIDE

- 8.4.1 INCREASING ADOPTION OF BATTERIES FOR VARIOUS APPLICATIONS TO BOOST MARKET

- 8.5 NITRIDE

- 8.5.1 RISING DEMAND FOR METAL BARRIERS FOR COPPER INTERCONNECTS TO PROPEL SEGMENT

- 8.6 FLUORIDE

- 8.6.1 INCREASING NEED FOR LOW REFRACTIVE INDEX AND SUPERIOR TRANSMISSION PROPERTIES AT UV WAVELENGTHS TO FUEL SEGMENTAL GROWTH

9 ALD EQUIPMENT MARKET, BY APPLICATION (SEMICONDUCTOR)

- 9.1 INTRODUCTION

- FIGURE 44 MORE MOORE APPLICATIONS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 32 ALD EQUIPMENT MARKET, BY APPLICATION (SEMICONDUCTOR), 2019-2022 (USD MILLION)

- TABLE 33 ALD EQUIPMENT MARKET, BY APPLICATION (SEMICONDUCTOR), 2023-2028 (USD MILLION)

- TABLE 34 APPLICATION (SEMICONDUCTOR): ALD EQUIPMENT MARKET, BY DEPOSITION METHOD, 2019-2022 (USD MILLION)

- TABLE 35 APPLICATION (SEMICONDUCTOR): ALD EQUIPMENT MARKET, BY DEPOSITION METHOD, 2023-2028 (USD MILLION)

- TABLE 36 APPLICATION (SEMICONDUCTOR): ALD EQUIPMENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 37 APPLICATION (SEMICONDUCTOR): ALD EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: ALD EQUIPMENT MARKET FOR APPLICATIONS (SEMICONDUCTOR), BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: ALD EQUIPMENT MARKET FOR APPLICATIONS (SEMICONDUCTOR), BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 40 EUROPE: ALD EQUIPMENT MARKET FOR APPLICATIONS (SEMICONDUCTOR), BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 41 EUROPE: ALD EQUIPMENT MARKET FOR APPLICATIONS (SEMICONDUCTOR), BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: ALD EQUIPMENT MARKET FOR APPLICATIONS (SEMICONDUCTOR), BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 43 ASIA PACIFIC: ALD EQUIPMENT MARKET FOR APPLICATIONS (SEMICONDUCTOR), BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 44 ROW: ALD EQUIPMENT MARKET FOR APPLICATIONS (SEMICONDUCTOR), BY REGION, 2019-2022 (USD MILLION)

- TABLE 45 ROW: ALD EQUIPMENT MARKET FOR APPLICATIONS (SEMICONDUCTOR), BY REGION, 2023-2028 (USD MILLION)

- TABLE 46 MIDDLE EAST & AFRICA: ALD EQUIPMENT MARKET FOR APPLICATIONS (SEMICONDUCTOR), BY REGION, 2019-2022 (USD MILLION)

- TABLE 47 MIDDLE EAST & AFRICA: ALD EQUIPMENT MARKET FOR APPLICATIONS (SEMICONDUCTOR), BY REGION, 2023-2028 (USD MILLION)

- 9.2 MORE THAN MOORE

- FIGURE 45 CMOS IMAGE SENSORS TO HOLD LARGEST MARKET SHARE IN 2028

- TABLE 48 MORE THAN MOORE: ALD EQUIPMENT MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 49 MORE THAN MOORE: ALD EQUIPMENT MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.2.1 MEMS & SENSORS

- 9.2.1.1 Increasing utilization of MEMS & sensors in consumer electronics and automotive applications to contribute to market growth

- 9.2.2 RF DEVICES

- 9.2.2.1 Growing need to develop encapsulation materials for RF devices to fuel market growth

- 9.2.3 ADVANCED PACKAGING

- 9.2.3.1 Increasing need to protect packaged and unpackaged devices from exposure to electrical contacts to support market growth

- 9.2.4 POWER DEVICES

- 9.2.4.1 Rising utilization of PEALD in GaN power devices to boost market

- 9.2.5 PHOTONICS (LED & VCSEL)

- 9.2.5.1 Increasing adoption of LEDs and VCSELs in LiDAR, magnetometers, and automotive applications to drive market

- 9.2.6 CMOS IMAGE SENSORS

- 9.2.6.1 Rising deployment of CMOS image sensors in consumer electronics applications to contribute to market growth

- 9.3 RESEARCH & DEVELOPMENT FACILITIES

- 9.3.1 MANUFACTURING OF 2D LAYERED MATERIALS AND ULSI DEVICE FABRICATION TO FUEL MARKET GROWTH

- 9.4 MORE MOORE

- 9.4.1 GROWING DEMAND FOR 3D NAND FLASH MEMORY TECHNOLOGY, LOGIC DEVICES, AND INTERCONNECT TECHNOLOGIES TO CONTRIBUTE TO MARKET GROWTH

10 ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR)

- 10.1 INTRODUCTION

- FIGURE 46 ENERGY APPLICATIONS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- TABLE 50 ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR), 2019-2022 (USD MILLION)

- TABLE 51 ALD EQUIPMENT MARKET, BY APPLICATION (NON-SEMICONDUCTOR), 2023-2028 (USD MILLION)

- TABLE 52 APPLICATION (NON-SEMICONDUCTOR): ALD EQUIPMENT MARKET, BY DEPOSITION METHOD, 2019-2022 (USD MILLION)

- TABLE 53 APPLICATION (NON-SEMICONDUCTOR): ALD EQUIPMENT MARKET, BY DEPOSITION METHOD, 2023-2028 (USD MILLION)

- FIGURE 47 ASIA PACIFIC TO REGISTER HIGHEST CAGR FOR APPLICATION (NON-SEMICONDUCTOR) SEGMENT DURING FORECAST PERIOD

- TABLE 54 APPLICATION (NON-SEMICONDUCTOR): ALD EQUIPMENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 APPLICATION (NON-SEMICONDUCTOR): ALD EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: ALD EQUIPMENT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: ALD EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 58 EUROPE: ALD EQUIPMENT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 59 EUROPE: ALD EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 60 ASIA PACIFIC: ALD EQUIPMENT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 61 ASIA PACIFIC: ALD EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 62 ROW: ALD EQUIPMENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 ROW: ALD EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 64 MIDDLE EAST & AFRICA: ALD EQUIPMENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 MIDDLE EAST & AFRICA: ALD EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 ENERGY

- 10.2.1 INCREASING DEMAND FOR SOLAR CELLS AND EVS TO DRIVE MARKET FOR ENERGY APPLICATIONS

- TABLE 66 ENERGY: ALD EQUIPMENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 67 ENERGY: ALD EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 MEDICAL

- 10.3.1 ADVANCEMENTS IN CARDIOLOGY AND NEUROLOGY TO FUEL ADOPTION OF ALD EQUIPMENT

- TABLE 68 MEDICAL: ALD EQUIPMENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 69 MEDICAL: ALD EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 CONVENTIONAL OPTICS

- 10.4.1 GROWING DEMAND FOR ANTI-REFLECTION COATINGS TO FUEL MARKET GROWTH

- TABLE 70 CONVENTIONAL OPTICS: ALD EQUIPMENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 71 CONVENTIONAL OPTICS: ALD EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5 COATING

- 10.5.1 ABILITY OF ALD EQUIPMENT TO DEPOSIT EXTREMELY THIN FILMS AT NANOMETER LEVEL TO BOOST MARKET GROWTH

- TABLE 72 COATING: ALD EQUIPMENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 73 COATING: ALD EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

11 ALD EQUIPMENT MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 48 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 74 ALD EQUIPMENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 75 ALD EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 49 NORTH AMERICA: ALD EQUIPMENT MARKET SNAPSHOT

- TABLE 76 NORTH AMERICA: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: ALD EQUIPMENT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: ALD EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.1 IMPACT OF RECESSION ON ALD EQUIPMENT MARKET IN NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Increasing demand for solar energy generation to drive market

- TABLE 80 US: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 81 US: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Ongoing advancements in photonics industry to fuel market growth

- TABLE 82 CANADA: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 83 CANADA: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.4 MEXICO

- 11.2.4.1 Increasing demand for chips in consumer electronics and automotive industries to support market growth

- TABLE 84 MEXICO: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 85 MEXICO: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- FIGURE 50 EUROPE: ALD EQUIPMENT MARKET SNAPSHOT

- TABLE 86 EUROPE: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 87 EUROPE: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 88 EUROPE: ALD EQUIPMENT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 89 EUROPE: ALD EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.1 IMPACT OF RECESSION ON ALD EQUIPMENT MARKET IN EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Presence of well-established medical and automotive industries to fuel market growth

- TABLE 90 GERMANY: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 91 GERMANY: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Increasing demand for advanced healthcare solutions to contribute to market growth

- TABLE 92 UK: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 93 UK: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.4 FRANCE

- 11.3.4.1 Highly developed transportation and communication networks to support market growth

- TABLE 94 FRANCE: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 95 FRANCE: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.5 REST OF EUROPE

- TABLE 96 REST OF EUROPE: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 97 REST OF EUROPE: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 51 ASIA PACIFIC: ALD EQUIPMENT MARKET SNAPSHOT

- TABLE 98 ASIA PACIFIC: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: ALD EQUIPMENT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: ALD EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.1 IMPACT OF RECESSION ON ALD EQUIPMENT MARKET IN ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Favorable government initiatives, cost-effective raw materials, and skilled workforce to strengthen semiconductor industry to propel market

- TABLE 102 CHINA: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 103 CHINA: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.3 JAPAN

- 11.4.3.1 Presence of key market players to drive market

- TABLE 104 JAPAN: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 105 JAPAN: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.4 INDIA

- 11.4.4.1 Increasing investments in More than Moore devices to contribute to market growth

- TABLE 106 INDIA: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 107 INDIA: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Advanced manufacturing capabilities of major market players and favorable government initiatives to boost market

- TABLE 108 SOUTH KOREA: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 109 SOUTH KOREA: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 110 REST OF ASIA PACIFIC: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5 ROW

- TABLE 112 ROW: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 113 ROW: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 114 ROW: ALD EQUIPMENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 115 ROW: ALD EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5.1 IMPACT OF RECESSION ON ALD EQUIPMENT MARKET IN ROW

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Enhancement of medical infrastructure and increasing investments in semiconductor industry to drive market

- TABLE 116 MIDDLE EAST & AFRICA: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: ALD EQUIPMENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: ALD EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5.2.2 GCC Countries

- 11.5.2.2.1 Favorable government policies and investments in semiconductor industry to drive market

- 11.5.2.2 GCC Countries

- TABLE 120 GCC COUNTRIES: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 121 GCC COUNTRIES: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.2.3 Rest of Middle East & Africa

- TABLE 122 REST OF MIDDLE EAST & AFRICA: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 123 REST OF MIDDLE EAST & AFRICA: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Growing emphasis on renewable energy to fuel market growth

- TABLE 124 SOUTH AMERICA: ALD EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 125 SOUTH AMERICA: ALD EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 COMPETITIVE OVERVIEW

- TABLE 126 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 52 KEY GROWTH STRATEGIES ADOPTED BY COMPANIES FROM 2019 TO 2023

- 12.2.1 ORGANIC/INORGANIC GROWTH STRATEGIES

- 12.2.2 PRODUCT PORTFOLIO

- 12.2.3 REGIONAL PRESENCE

- 12.2.4 MANUFACTURING FOOTPRINT

- 12.3 MARKET SHARE ANALYSIS, 2022

- TABLE 127 ALD EQUIPMENT MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- 12.4 REVENUE ANALYSIS, 2018-2022

- FIGURE 53 FIVE-YEAR REVENUE ANALYSIS OF MAJOR COMPANIES IN ALD EQUIPMENT MARKET, 2018-2022

- 12.5 COMPANY EVALUATION MATRIX, 2022

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 54 ALD EQUIPMENT MARKET: COMPANY EVALUATION MATRIX, 2022

- 12.5.5 COMPANY FOOTPRINT

- TABLE 128 ALD EQUIPMENT MARKET: OVERALL COMPANY FOOTPRINT

- TABLE 129 ALD EQUIPMENT MARKET: COMPANY FOOTPRINT, BY FILM TYPE

- TABLE 130 ALD EQUIPMENT MARKET: COMPANY FOOTPRINT, BY APPLICATION

- TABLE 131 ALD EQUIPMENT MARKET: COMPANY FOOTPRINT, BY REGION

- 12.6 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 55 ALD EQUIPMENT MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- 12.6.5 COMPETITIVE BENCHMARKING

- TABLE 132 ALD EQUIPMENT MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 133 ALD EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY FILM TYPE

- TABLE 134 ALD EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY APPLICATION

- TABLE 135 ALD EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- 12.7 COMPETITIVE SCENARIOS AND TRENDS

- 12.7.1 PRODUCT LAUNCHES

- TABLE 136 ALD EQUIPMENT MARKET: PRODUCT LAUNCHES, 2019-2023

- 12.7.2 DEALS

- TABLE 137 ALD EQUIPMENT MARKET: DEALS, 2017-2023

- 12.7.3 OTHERS

- TABLE 138 ALD EQUIPMENT MARKET: OTHERS, 2020-2023

13 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 ASM INTERNATIONAL

- TABLE 139 ASM INTERNATIONAL: COMPANY OVERVIEW

- FIGURE 56 ASM INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 140 ASM INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 ASM INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 142 ASM INTERNATIONAL: DEALS

- TABLE 143 ASM INTERNATIONAL: OTHERS

- 13.2.2 APPLIED MATERIALS, INC.

- TABLE 144 APPLIED MATERIALS, INC.: COMPANY OVERVIEW

- FIGURE 57 APPLIED MATERIALS, INC.: COMPANY SNAPSHOT

- TABLE 145 APPLIED MATERIALS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 APPLIED MATERIALS, INC.: PRODUCT LAUNCHES

- TABLE 147 APPLIED MATERIALS, INC.: DEALS

- TABLE 148 APPLIED MATERIALS, INC.: OTHERS

- 13.2.3 TOKYO ELECTRON LIMITED.

- TABLE 149 TOKYO ELECTRON LIMITED.: COMPANY OVERVIEW

- FIGURE 58 TOKYO ELECTRON LIMITED.: COMPANY SNAPSHOT

- TABLE 150 TOKYO ELECTRON LIMITED.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 TOKYO ELECTRON LIMITED.: OTHERS

- 13.2.4 LAM RESEARCH CORPORATION.

- TABLE 152 LAM RESEARCH CORPORATION.: BUSINESS OVERVIEW

- FIGURE 59 LAM RESEARCH CORPORATION.: COMPANY SNAPSHOT

- TABLE 153 LAM RESEARCH CORPORATION.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 LAM RESEARCH CORPORATION.: PRODUCT LAUNCHES

- TABLE 155 LAM RESEARCH CORPORATION.: OTHERS

- 13.2.5 VEECO INSTRUMENTS INC.

- TABLE 156 VEECO INSTRUMENTS INC.: COMPANY OVERVIEW

- FIGURE 60 VEECO INSTRUMENTS INC.: COMPANY SNAPSHOT

- TABLE 157 VEECO INSTRUMENTS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 VEECO INSTRUMENTS INC.: DEALS

- 13.2.6 KURT J. LESKER COMPANY

- TABLE 159 KURT J. LESKER COMPANY: COMPANY OVERVIEW

- TABLE 160 KURT J. LESKER COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 KURT J. LESKER COMPANY: DEALS

- TABLE 162 KURT J. LESKER COMPANY: OTHERS

- 13.2.7 OPTORUN CO., LTD.

- TABLE 163 OPTORUN CO., LTD.: COMPANY OVERVIEW

- FIGURE 61 OPTORUN CO., LTD.: COMPANY SNAPSHOT

- TABLE 164 OPTORUN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 OPTORUN CO., LTD.: PRODUCT LAUNCHES

- TABLE 166 OPTORUN CO., LTD.: DEALS

- TABLE 167 OPTORUN CO., LTD.: OTHERS

- 13.2.8 CVD EQUIPMENT CORPORATION

- TABLE 168 CVD EQUIPMENT CORPORATION: COMPANY OVERVIEW

- FIGURE 62 CVD EQUIPMENT CORPORATION: COMPANY SNAPSHOT

- TABLE 169 CVD EQUIPMENT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 CVD EQUIPMENT CORPORATION: DEALS

- 13.2.9 EUGENE TECHNOLOGY CO. LTD.

- TABLE 171 EUGENE TECHNOLOGY CO. LTD.: COMPANY OVERVIEW

- FIGURE 63 EUGENE TECHNOLOGY CO. LTD.: COMPANY SNAPSHOT

- TABLE 172 EUGENE TECHNOLOGY CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 EUGENE TECHNOLOGY CO. LTD.: PRODUCT LAUNCHES

- TABLE 174 EUGENE TECHNOLOGY CO. LTD.: DEALS

- 13.2.10 BENEQ

- TABLE 175 BENEQ: COMPANY OVERVIEW

- TABLE 176 BENEQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 BENEQ: PRODUCT LAUNCHES

- TABLE 178 BENEQ: DEALS

- TABLE 179 BENEQ: OTHERS

- 13.3 OTHER PLAYERS

- 13.3.1 ANRIC TECHNOLOGIES.

- 13.3.2 FORGE NANO INC.

- 13.3.3 WONIK IPS.

- 13.3.4 ENCAPSULIX

- 13.3.5 SENTECH INSTRUMENTS GMBH

- 13.3.6 TEMPRESS

- 13.3.7 NCD CO., LTD.

- 13.3.8 JIANGSU MICROGUIDE NANOTECHNOLOGY CO., LTD.

- 13.3.9 NAURA

- 13.3.10 CN1 CO., LTD.

- 13.3.11 SHOWA SHINKU CO., LTD.

- 13.3.12 LEVITECH

- 13.3.13 NANO-MASTER, INC.

- 13.3.14 SAMCO INC.

- 13.3.15 ARRADIANCE LLC

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS