|

|

市場調査レポート

商品コード

1647355

工業用バルブ市場- バルブシーリング別、バルブタイプ別、流体タイプ別、コンポーネント別、機能別、材質別、サイズ別、圧力幅別、最終用途産業別、地域別 - 2029年までの予測Industrial Valve Market - Globe, Ball, Butterfly, Plug, Check, Gate, Diaphragm, Safety, Needle, Pinch, & Solenoid Valve, Fluid (Liquid, Gas, Slurry), Actuator (Electric, Pneumatic, Hydraulic), Material (Steel, Aluminum, Nickel) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 工業用バルブ市場- バルブシーリング別、バルブタイプ別、流体タイプ別、コンポーネント別、機能別、材質別、サイズ別、圧力幅別、最終用途産業別、地域別 - 2029年までの予測 |

|

出版日: 2025年01月01日

発行: MarketsandMarkets

ページ情報: 英文 356 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の工業用バルブの市場規模は、2024年に955億8,000万米ドルとなりました。

同市場は、2029年までに1,216億7,000万米ドルに達すると予測され、予測期間中、4.9%のCAGRで拡大すると予想されています。ヘルスケアおよび製薬業界からのバルブ需要の高まり、世界のスマートシティの設立、バルブの状態を監視してシステム障害を予測するための接続ネットワークの急速な展開、新しい発電所の設立と既存の発電所の改修の必要性の高まりは、工業用バルブ市場の主な促進要因です。

| 調査範囲 | |

|---|---|

| 調査対象年数 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 考慮される単位 | 価値(10億米ドル) |

| セグメント | バルブシーリング別、バルブタイプ別、流体タイプ別、コンポーネント別、機能別、材質別、サイズ別、圧力幅別、最終用途産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

業界では、中央制御ステーションを介して調整される自動化バルブと高度な監視技術の導入が進んでいます。制御バルブは拡張データネットワークにリンクできるため、産業プラントの流量と動作状態を簡単に監視できます。たとえば、石油およびガスプラントでは、ネットワーク上のバルブを接続すると分散制御が可能になり、パイプラインネットワークが詰まったり損傷したりした場合にオペレーターが配管とネットワークシステムを再構成して、生産プロセスを停止することなくより安全な作業環境を確保できます。

エネルギーおよび電力部門は、2024年に工業用バルブ市場で2番目に大きなシェアを占めると予想されています。エネルギーおよび電力業界では、増大するエネルギー需要を満たすためにインフラストラクチャを開発する必要性が高まっています。この傾向により、メーカーは業界の要件と標準に準拠した製品を設計および開発できます。特にデジタル機能を備えたバルブは、安全アプリケーションや重要な操作に需要があります。

北米市場は、2023年に第2位の市場シェアを占める見込みです。北米市場を牽引する主な要因としては、自動化用バルブに使用されるアクチュエータの研究開発の増加と、工業プラントにおける安全基準の必要性の高まりが挙げられます。業界レベルでの研究開発により、米国では、エネルギー・電力や化学などさまざまな業界に工業用バルブの用途が広がっています。工業用バルブは、石油・ガス、エネルギー・電力、水・廃水治療業界のコンポーネントとして使用され、システムを通る媒体の流れを調整したり、流れを開始・停止したり、絞ったりして、安全で効率的なプロセス自動化を実現します。

当レポートでは、世界の工業用バルブ市場について調査し、バルブシーリング別、バルブタイプ別、流体タイプ別、コンポーネント別、機能別、材質別、サイズ別、圧力幅別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- 関税、規制、標準分析

- AI/生成AIが工業用バルブ市場に与える影響

第6章 工業用バルブ市場(バルブシーリング別)

- イントロダクション

- ソフトシートバルブ

- メタルシートバルブ

- パッキンシートバルブ

第7章 工業用バルブ市場(バルブタイプ別)

- イントロダクション

- ロータリーバルブ

- リニアバルブ

第8章 工業用バルブ市場(流体タイプ別)

- イントロダクション

- 液体

- ガス

- スラリーバルブ

第9章 工業用バルブ市場(コンポーネント別)

- イントロダクション

- アクチュエータ

- バルブボディ

- その他

第10章 工業用バルブ市場(機能別)

- イントロダクション

- オン/オフバルブ

- コントロールバルブ

第11章 工業用バルブ市場(材質別)

- イントロダクション

- 鋼鉄

- 鋳鉄

- アルミニウム

- 合金ベース

- プラスチック

- その他

第12章 工業用バルブ市場(サイズ別)

- イントロダクション

- 1インチ未満

- 1~6インチ

- 6~25インチ

- 25~50インチ

- 50インチ超

第13章 工業用バルブ市場(圧力幅別)

- イントロダクション

- 50バール未満

- 50~350バール

- 350~700バール

- 700~1000バール

- 1000バール超

第14章 工業用バルブ市場(最終用途産業別)

- イントロダクション

- 石油・ガス

- 水・廃水処理

- エネルギー・電力

- 医薬品

- 食品・飲料

- 化学薬品

- 建築・建設

- 紙・パルプ

- 金属・鉱業

- 農業

- 半導体

- その他

第15章 工業用バルブ市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- 南米

- アフリカ

第16章 競合情勢

- イントロダクション

- 工業用バルブ市場の主要企業が採用している戦略

- 収益分析、2020年~2023年

- 市場シェア分析、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第17章 企業プロファイル

- 主要参入企業

- EMERSON ELECTRIC CO.

- SLB

- FLOWSERVE CORPORATION

- IMI

- CRANE COMPANY

- VALMET

- SPIRAX SARCO LIMITED

- KITZ CORPORATION

- KSB SE & CO. KGAA

- ALFA LAVAL

- CURTISS-WRIGHT CORPORATION

- PARKER HANNIFIN CORP.

- BRAY INTERNATIONAL

- BAKER HUGHES COMPANY

- IDEX

- その他の主要参入企業

- CIRCOR INTERNATIONAL, INC.

- ROTORK

- NEWAY VALVE

- VELAN INC.

- DANFOSS

- GEORG FISCHER LTD.

- SAMSONCONTROLS.NET

- AVK HOLDING A/S

- KLINGER HOLDING

- TRILLIUM FLOW TECHNOLOGIES

- その他の企業

- EBRO ARMATUREN GEBR. BROER GMBH

- VALVITALIA SPA

- GEFA PROCESSTECHNIK GMBH

- AVCON CONTROLS PVT LTD.

- FORBES MARSHALL

- FRENSTAR

- HAM-LET GROUP

- DWYER INSTRUMENTS, LLC

- APOLLO VALVES

- NOVEL VALVES INDIA PVT. LTD

- INDUSTRIAL VALVES

- L&T VALVES LIMITED

第18章 付録

List of Tables

- TABLE 1 INDUSTRIAL VALVES MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 INDUSTRIAL VALVES MARKET: KEY SECONDARY SOURCES

- TABLE 3 INDUSTRIAL VALVES MARKET: SEGMENTS COVERED AND ASSOCIATED RISKS

- TABLE 4 INDUSTRIAL VALVES MARKET: ROLE IN ECOSYSTEM

- TABLE 5 COMPANY-WISE INDICATIVE SELLING PRICE OF INDUSTRIAL VALVES, BY VALVE TYPE, 2023

- TABLE 6 AVERAGE SELLING PRICE OF INDUSTRIAL VALVES OFFERED BY KEY PLAYERS, BY TYPE

- TABLE 7 INDICATIVE SELLING PRICE OF INDUSTRIAL VALVES, BY REGION, 2020-2023

- TABLE 8 INFLUENCE OF STAKEHOLDERS FROM TOP THREE END-USE INDUSTRIES (%)

- TABLE 9 KEY BUYING CRITERIA OF TOP THREE END-USE INDUSTRIES

- TABLE 10 COMBINATION OF EXPERTISE AND TECHNOLOGIES OF GEMCO VALVE AND ATEC VALVE TO PROCESS EXTREME-TEMPERATURE ABRASIVE POWDERS FOR GTI ENERGY

- TABLE 11 NESTLE'S TRANSITION TO HIGH-PERFORMANCE VALVES THROUGH PRECISION AIRLOCK SOLUTIONS

- TABLE 12 CONTINENTAL MILLS TO ENHANCE PRODUCTION EFFICIENCY AND REDUCE MAINTENANCE COSTS

- TABLE 13 ENHANCED EFFICIENCY AND RELIABILITY WITH DIAPHRAGM-TYPE PILOT-OPERATED PRESSURE RELIEF VALVES

- TABLE 14 IMPORT DATA FOR HS CODE 8481, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 15 EXPORT DATA FOR HS CODE 8481, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 16 KEY PATENTS PERTAINING TO INDUSTRIAL VALVES, 2023-2025

- TABLE 17 INDUSTRIAL VALVES MARKET: REGION-WISE KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 TARIFF FOR PRESSURE-REDUCING VALVES (HS CODE 848110)

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 REGULATORY STANDARDS FOLLOWED BY INDUSTRIAL VALVE MANUFACTURERS

- TABLE 24 INDUSTRIAL VALVES MARKET, BY VALVE TYPE, 2020-2023 (USD MILLION)

- TABLE 25 INDUSTRIAL VALVES MARKET, BY VALVE TYPE, 2024-2029 (USD MILLION)

- TABLE 26 ROTARY VALVES: INDUSTRIAL VALVES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 27 ROTARY VALVES: INDUSTRIAL VALVES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 28 ROTARY VALVES: INDUSTRIAL VALVES MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 29 ROTARY VALVES: INDUSTRIAL VALVES MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 30 ROTARY VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2020-2023 (USD MILLION)

- TABLE 31 ROTARY VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024-2029 (USD MILLION)

- TABLE 32 ROTARY VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 33 ROTARY VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 34 BALL VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2020-2023 (USD MILLION)

- TABLE 35 BALL VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024-2029 (USD MILLION)

- TABLE 36 BALL VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 37 BALL VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 38 BUTTERFLY VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2020-2023 (USD MILLION)

- TABLE 39 BUTTERFLY VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024-2029 (USD MILLION)

- TABLE 40 BUTTERFLY VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 41 BUTTERFLY VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 42 PLUG VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2020-2023 (USD MILLION)

- TABLE 43 PLUG VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024-2029 (USD MILLION)

- TABLE 44 PLUG VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 45 PLUG VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

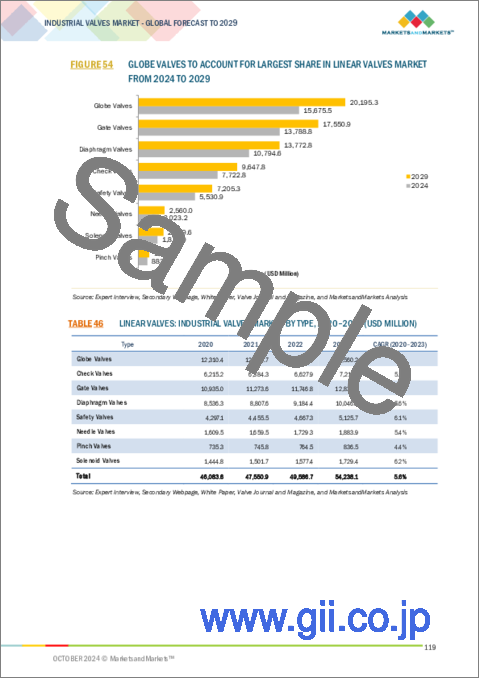

- TABLE 46 LINEAR VALVES: INDUSTRIAL VALVES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 47 LINEAR VALVES: INDUSTRIAL VALVES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 48 LINEAR VALVES: INDUSTRIAL VALVES MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 49 LINEAR VALVES: INDUSTRIAL VALVES MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 50 LINEAR VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2020-2023 (USD MILLION)

- TABLE 51 LINEAR VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024-2029 (USD MILLION)

- TABLE 52 LINEAR VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 53 LINEAR VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 54 GLOBE VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2020-2023 (USD MILLION)

- TABLE 55 GLOBE VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024-2029 (USD MILLION)

- TABLE 56 GLOBE VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 57 GLOBE VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 58 DIAPHRAGM VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2020-2023 (USD MILLION)

- TABLE 59 DIAPHRAGM VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024-2029 (USD MILLION)

- TABLE 60 DIAPHRAGM VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 61 DIAPHRAGM VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 62 GATE VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2020-2023 (USD MILLION)

- TABLE 63 GATE VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024-2029 (USD MILLION)

- TABLE 64 GATE VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 65 GATE VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 66 SAFETY VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2020-2023 (USD MILLION)

- TABLE 67 SAFETY VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024-2029 (USD MILLION)

- TABLE 68 SAFETY VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 69 SAFETY VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 70 CHECK VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2020-2023 (USD MILLION)

- TABLE 71 CHECK VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024-2029 (USD MILLION)

- TABLE 72 CHECK VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 73 CHECK VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 74 NEEDLE VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2020-2023 (USD MILLION)

- TABLE 75 NEEDLE VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024-2029 (USD MILLION)

- TABLE 76 NEEDLE VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 77 NEEDLE VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 78 PINCH VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2020-2023 (USD MILLION)

- TABLE 79 PINCH VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024-2029 (USD MILLION)

- TABLE 80 PINCH VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 81 PINCH VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 82 SOLENOID VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2020-2023 (USD MILLION)

- TABLE 83 SOLENOID VALVES: INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024-2029 (USD MILLION)

- TABLE 84 SOLENOID VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 85 SOLENOID VALVES: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 86 INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2020-2023 (USD MILLION)

- TABLE 87 INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024-2029 (USD MILLION)

- TABLE 88 LIQUID: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 89 LIQUID: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 90 LIQUID: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 91 LIQUID: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 92 GAS: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 93 GAS: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 94 GAS: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 95 GAS: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 96 SLURRY: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 97 SLURRY: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 98 SLURRY: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 99 SLURRY: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 100 INDUSTRIAL VALVES MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 101 INDUSTRIAL VALVES MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 102 ACTUATORS: INDUSTRIAL VALVES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 103 ACTUATORS: INDUSTRIAL VALVES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 104 INDUSTRIAL VALVES MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 105 INDUSTRIAL VALVES MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 106 INDUSTRIAL VALVES MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 107 INDUSTRIAL VALVES MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 108 INDUSTRIAL VALVES MARKET, BY SIZE, 2020-2023 (USD MILLION)

- TABLE 109 INDUSTRIAL VALVES MARKET, BY SIZE, 2024-2029 (USD MILLION)

- TABLE 110 INDUSTRIAL VALVES MARKET, BY PRESSURE RANGE, 2020-2023 (USD MILLION)

- TABLE 111 INDUSTRIAL VALVES MARKET, BY PRESSURE RANGE, 2024-2029 (USD MILLION)

- TABLE 112 INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 113 INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 114 OIL & GAS: INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 115 OIL & GAS: INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 116 OIL & GAS: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 117 OIL & GAS: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 118 OIL & GAS: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 119 OIL & GAS: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 120 WATER & WASTEWATER TREATMENT: INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 121 WATER & WASTEWATER TREATMENT: INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 122 WATER & WASTEWATER TREATMENT: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 123 WATER & WASTEWATER TREATMENT: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 124 WATER & WASTEWATER TREATMENT: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 125 WATER & WASTEWATER TREATMENT: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 126 ENERGY & POWER: INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 127 ENERGY & POWER: INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 128 ENERGY & POWER: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 129 ENERGY & POWER: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 130 ENERGY & POWER: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 131 ENERGY & POWER: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 132 PHARMACEUTICAL: INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 133 PHARMACEUTICAL: INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 134 PHARMACEUTICAL: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 135 PHARMACEUTICAL: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 136 PHARMACEUTICAL: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 137 PHARMACEUTICAL: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 138 FOOD & BEVERAGE: INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 139 FOOD & BEVERAGE: INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 140 FOOD & BEVERAGE: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 141 FOOD & BEVERAGE: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 142 FOOD & BEVERAGE: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 143 FOOD & BEVERAGE: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 144 CHEMICAL: INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 145 CHEMICAL: INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 146 CHEMICAL: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 147 CHEMICAL: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 148 CHEMICAL: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 149 CHEMICAL: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 150 BUILDING & CONSTRUCTION: INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 151 BUILDING & CONSTRUCTION: INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 152 BUILDING & CONSTRUCTION: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 153 BUILDING & CONSTRUCTION: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 154 BUILDING & CONSTRUCTION: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 155 BUILDING & CONSTRUCTION: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 156 PAPER & PULP: INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 157 PAPER & PULP: INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 158 PAPER & PULP: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 159 PAPER & PULP: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 160 PAPER & PULP: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 161 PAPER & PULP: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 162 METAL & MINING: INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 163 METAL & MINING: INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 164 METAL & MINING: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 165 METAL & MINING: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 166 METAL & MINING: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 167 METAL & MINING: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 168 AGRICULTURE: INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 169 AGRICULTURE: INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 170 AGRICULTURE: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 171 AGRICULTURE: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 172 AGRICULTURE: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 173 AGRICULTURE: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 174 SEMICONDUCTOR: INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 175 SEMICONDUCTOR: INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 176 SEMICONDUCTOR: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 177 SEMICONDUCTOR: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 178 SEMICONDUCTOR: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 179 SEMICONDUCTOR: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 180 OTHER END-USE INDUSTRIES: INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 181 OTHER END-USE INDUSTRIES: INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 182 OTHER END-USE INDUSTRIES: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2020-2023 (USD MILLION)

- TABLE 183 OTHER END-USE INDUSTRIES: INDUSTRIAL VALVES MARKET, BY ROTARY VALVE, 2024-2029 (USD MILLION)

- TABLE 184 OTHER END-USE INDUSTRIES: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2020-2023 (USD MILLION)

- TABLE 185 OTHER END-USE INDUSTRIES: INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024-2029 (USD MILLION)

- TABLE 186 INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 187 INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 188 SHIPMENTS: INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 189 SHIPMENTS: INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 190 NORTH AMERICA: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 191 NORTH AMERICA: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 192 NORTH AMERICA: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 193 NORTH AMERICA: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 194 EUROPE: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 195 EUROPE: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 196 EUROPE: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 197 EUROPE: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 198 ASIA PACIFIC: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 199 ASIA PACIFIC: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 200 ASIA PACIFIC: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 201 ASIA PACIFIC: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 202 REST OF THE WORLD: INDUSTRIAL VALVES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 203 REST OF THE WORLD: INDUSTRIAL VALVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 204 REST OF THE WORLD: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 205 REST OF THE WORLD: INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 206 MIDDLE EAST: INDUSTRIAL VALVES MARKET, COUNTRY, 2020-2023 (USD MILLION)

- TABLE 207 MIDDLE EAST: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 208 INDUSTRIAL VALVES MARKET: MAJOR STRATEGIES DEPLOYED BY KEY PLAYERS

- TABLE 209 INDUSTRIAL VALVES MARKET: DEGREE OF COMPETITION

- TABLE 210 INDUSTRIAL VALVES MARKET: VALVE TYPE FOOTPRINT

- TABLE 211 INDUSTRIAL VALVES MARKET: FLUID TYPE FOOTPRINT

- TABLE 212 INDUSTRIAL VALVES MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 213 INDUSTRIAL VALVES MARKET: REGION FOOTPRINT

- TABLE 214 INDUSTRIAL VALVES MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 215 INDUSTRIAL VALVES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, BY TYPE

- TABLE 216 INDUSTRIAL VALVES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, BY FLUID TYPE

- TABLE 217 INDUSTRIAL VALVES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, BY END-USE INDUSTRY

- TABLE 218 INDUSTRIAL VALVES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, BY REGION

- TABLE 219 INDUSTRIAL VALVES MARKET: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2024

- TABLE 220 INDUSTRIAL VALVES MARKET: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 221 INDUSTRIAL VALVES MARKET: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 222 INDUSTRIAL VALVES MARKET: OTHER DEVELOPMENTS, JANUARY 2021-DECEMBER 2024

- TABLE 223 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 224 EMERSON ELECTRIC CO.: PRODUCTS OFFERED

- TABLE 225 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 226 SLB: COMPANY OVERVIEW

- TABLE 227 SLB: PRODUCTS OFFERED

- TABLE 228 SLB: EXPANSIONS

- TABLE 229 FLOWSERVE CORPORATION: COMPANY OVERVIEW

- TABLE 230 FLOWSERVE CORPORATION: PRODUCTS OFFERED

- TABLE 231 FLOWSERVE CORPORATION: PRODUCT LAUNCHES

- TABLE 232 FLOWSERVE CORPORATION: DEALS

- TABLE 233 FLOWSERVE CORPORATION: OTHER DEVELOPMENTS

- TABLE 234 IMI: COMPANY OVERVIEW

- TABLE 235 IMI: PRODUCTS OFFERED

- TABLE 236 IMI: PRODUCT LAUNCHES

- TABLE 237 IMI: EXPANSIONS

- TABLE 238 CRANE COMPANY: COMPANY OVERVIEW

- TABLE 239 CRANE COMPANY: PRODUCTS OFFERED

- TABLE 240 CRANE COMPANY: DEALS

- TABLE 241 CRANE COMPANY: EXPANSIONS

- TABLE 242 VALMET: COMPANY OVERVIEW

- TABLE 243 VALMET: PRODUCTS OFFERED

- TABLE 244 VALMET: DEALS

- TABLE 245 SPIRAX SARCO LIMITED: COMPANY OVERVIEW

- TABLE 246 SPIRAX SARCO LIMITED: PRODUCTS OFFERED

- TABLE 247 SPIRAX SARCO LIMITED: DEALS

- TABLE 248 KITZ CORPORATION: COMPANY OVERVIEW

- TABLE 249 KITZ CORPORATION: PRODUCTS OFFERED

- TABLE 250 KITZ CORPORATION: PRODUCT LAUNCHES

- TABLE 251 KITZ CORPORATION: DEALS

- TABLE 252 KITZ CORPORATION: EXPANSIONS

- TABLE 253 KSB SE & CO. KGAA: COMPANY OVERVIEW

- TABLE 254 KSB SE & CO. KGAA: PRODUCTS OFFERED

- TABLE 255 KSB SE & CO. KGAA: PRODUCT LAUNCHES

- TABLE 256 KSB SE & CO. KGAA: EXPANSIONS

- TABLE 257 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 258 ALFA LAVAL: PRODUCTS OFFERED

- TABLE 259 ALFA LAVAL: DEALS

- TABLE 260 ALFA LAVAL: OTHER DEVELOPMENTS

- TABLE 261 CURTISS-WRIGHT CORPORATION: COMPANY OVERVIEW

- TABLE 262 CURTISS-WRIGHT CORPORATION: PRODUCTS OFFERED

- TABLE 263 PARKER HANNIFIN CORP.: COMPANY OVERVIEW

- TABLE 264 PARKER HANNIFIN CORP.: PRODUCTS OFFERED

- TABLE 265 PARKER HANNIFIN CORP.: PRODUCT LAUNCHES

- TABLE 266 PARKER HANNIFIN CORP.: DEALS

- TABLE 267 BRAY INTERNATIONAL: COMPANY OVERVIEW

- TABLE 268 BRAY INTERNATIONAL: PRODUCTS OFFERED

- TABLE 269 BRAY INTERNATIONAL: DEALS

- TABLE 270 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- TABLE 271 BAKER HUGHES COMPANY: PRODUCTS OFFERED

- TABLE 272 IDEX: COMPANY OVERVIEW

- TABLE 273 IDEX: PRODUCTS OFFERED

- TABLE 274 IDEX: DEALS

- TABLE 275 CIRCOR INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 276 ROTORK: COMPANY OVERVIEW

- TABLE 277 NEWAY VALVE: COMPANY OVERVIEW

- TABLE 278 VELAN INC.: COMPANY OVERVIEW

- TABLE 279 DANFOSS: COMPANY OVERVIEW

- TABLE 280 GEORG FISCHER LTD.: COMPANY OVERVIEW

- TABLE 281 SAMSONCONTROLS.NET: COMPANY OVERVIEW

- TABLE 282 AVK HOLDING A/S: COMPANY OVERVIEW

- TABLE 283 KLINGER HOLDING: COMPANY OVERVIEW

- TABLE 284 TRILLIUM FLOW TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 285 EBRO ARMATUREN GEBR. BROER GMBH: COMPANY OVERVIEW

- TABLE 286 VALVITALIA SPA: COMPANY OVERVIEW

- TABLE 287 GEFA PROCESSTECHNIK GMBH: COMPANY OVERVIEW

- TABLE 288 AVCON CONTROLS PVT LTD.: COMPANY OVERVIEW

- TABLE 289 FORBES MARSHALL: COMPANY OVERVIEW

- TABLE 290 FRENSTAR: COMPANY OVERVIEW

- TABLE 291 HAM-LET GROUP: COMPANY OVERVIEW

- TABLE 292 DWYER INSTRUMENTS, LLC: COMPANY OVERVIEW

- TABLE 293 APOLLO VALVES: COMPANY OVERVIEW

- TABLE 294 NOVEL VALVES INDIA PVT. LTD: COMPANY OVERVIEW

- TABLE 295 INDUSTRIAL VALVES: COMPANY OVERVIEW

- TABLE 296 L&T VALVES LIMITED: COMPANY OVERVIEW

List of Figures

- FIGURE 1 INDUSTRIAL VALVES MARKET: SEGMENTS CONSIDERED

- FIGURE 2 INDUSTRIAL VALVES MARKET: YEARS CONSIDERED

- FIGURE 3 INDUSTRIAL VALVES MARKET: RESEARCH DESIGN

- FIGURE 4 INDUSTRIAL VALVES MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 INDUSTRIAL VALVES MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 6 INDUSTRIAL VALVES MARKET: KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 INDUSTRIAL VALVES MARKET: PRIMARY AND SECONDARY RESEARCH APPROACH

- FIGURE 8 INDUSTRIAL VALVES MARKET: KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 9 INDUSTRIAL VALVES MARKET: MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 10 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 11 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 12 INDUSTRIAL VALVES MARKET: DATA TRIANGULATION

- FIGURE 13 INDUSTRIAL VALVES MARKET: STUDY ASSUMPTIONS

- FIGURE 14 BALL VALVES TO RECORD HIGHEST CAGR BETWEEN 2024 AND 2029

- FIGURE 15 LIQUID VALVES TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 16 ACTUATORS TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 CONTROL VALVES TO RECORD HIGHEST GROWTH RATE FROM 2024 TO 2029

- FIGURE 18 1"-6" TO DOMINATE INDUSTRIAL VALVES MARKET DURING STUDY PERIOD

- FIGURE 19 OIL & GAS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 20 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR BETWEEN 2024 AND 2029

- FIGURE 21 RAPID INDUSTRIALIZATION IN EMERGING ECONOMIES TO DRIVE MARKET

- FIGURE 22 GLOBE VALVES TO CAPTURE LARGEST MARKET SHARE IN 2029

- FIGURE 23 LIQUID SEGMENT TO DOMINATE INDUSTRIAL VALVES MARKET DURING FORECAST PERIOD

- FIGURE 24 <50 BAR VALVES TO COMMAND LARGEST MARKET SHARE IN 2029

- FIGURE 25 PLASTIC VALVES TO GROW AT HIGHEST CAGR DURING STUDY PERIOD

- FIGURE 26 CHEMICAL INDUSTRY TO REGISTER HIGHEST GROWTH RATE BETWEEN 2024 AND 2029

- FIGURE 27 SOUTH KOREA TO REGISTER HIGHEST CAGR DURING STUDY PERIOD

- FIGURE 28 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 29 INDUSTRIAL VALVES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 30 INDUSTRIAL VALVES MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 31 INDUSTRIAL VALVES MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 32 INDUSTRIAL VALVES MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 33 INDUSTRIAL VALVES MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 34 INDUSTRIAL VALVES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 35 INDUSTRIAL VALVES MARKET: MANUFACTURING ECOSYSTEM

- FIGURE 36 INDUSTRIAL VALVES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 37 INDUSTRIAL VALVES MARKET: FUNDING AND NUMBER OF DEALS, 2020-2024

- FIGURE 38 AVERAGE SELLING PRICE OF INDUSTRIAL VALVES, 2020-2023

- FIGURE 39 AVERAGE SELLING PRICE OF INDUSTRIAL VALVES OFFERED BY KEY PLAYERS, BY TYPE (USD)

- FIGURE 40 INDICATIVE PRICE TREND OF INDUSTRIAL VALVES OFFERED BY KEY PLAYERS, BY REGION, 2020-2023 (USD)

- FIGURE 41 INDUSTRIAL VALVES MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 42 INDUSTRIAL VALVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 43 INFLUENCE OF KEY STAKEHOLDERS FROM TOP THREE END-USE INDUSTRIES

- FIGURE 44 KEY BUYING CRITERIA OF TOP THREE END-USE INDUSTRIES

- FIGURE 45 IMPORT DATA FOR HS CODE 8481, BY COUNTRY, 2019-2024 (USD MILLION)

- FIGURE 46 EXPORT DATA FOR HS CODE 8481, BY COUNTRY, 2019-2024 (USD MILLION)

- FIGURE 47 LIST OF MAJOR PATENTS FOR INDUSTRIAL VALVES MARKET, 2015-2024

- FIGURE 48 AI USE CASES IN INDUSTRIAL VALVES MARKET

- FIGURE 49 INDUSTRIAL VALVES MARKET, BY VALVE SEALING

- FIGURE 50 SOFT SEATED VALVES ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 51 INDUSTRIAL VALVES MARKET, BY VALVE TYPE

- FIGURE 52 LINEAR VALVES TO COMMAND HIGHER CAGR DURING STUDY PERIOD

- FIGURE 53 BALL VALVES TO COMMAND LARGEST SHARE IN ROTARY VALVES MARKET DURING FORECAST PERIOD

- FIGURE 54 GLOBE VALVES TO ACCOUNT FOR LARGEST SHARE IN LINEAR VALVES MARKET FROM 2024 TO 2029

- FIGURE 55 INDUSTRIAL VALVES MARKET, BY FLUID TYPE

- FIGURE 56 LIQUID VALVES TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 57 INDUSTRIAL VALVES MARKET, BY COMPONENT

- FIGURE 58 ACTUATORS TO COMMAND LARGEST MARKET SHARE IN 2029

- FIGURE 59 INDUSTRIAL VALVES MARKET, BY FUNCTION

- FIGURE 60 ON/OFF VALVES TO DOMINATE MARKET DURING STUDY PERIOD

- FIGURE 61 INDUSTRIAL VALVES MARKET, BY MATERIAL

- FIGURE 62 STEEL TO HOLD LARGEST MARKET SHARE FROM 2024 TO 2029

- FIGURE 63 INDUSTRIAL VALVES MARKET, BY SIZE

- FIGURE 64 >1"-6" SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 65 INDUSTRIAL VALVES MARKET, BY PRESSURE RANGE

- FIGURE 66 <50 BAR SEGMENT TO COMMAND LARGEST MARKET SHARE DURING STUDY PERIOD

- FIGURE 67 INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY

- FIGURE 68 OIL & GAS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 69 INDUSTRIAL VALVES MARKET, BY REGION

- FIGURE 70 ASIA PACIFIC INDUSTRIAL VALVES MARKET TO REGISTER HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 71 NORTH AMERICA: INDUSTRIAL VALVES MARKET SNAPSHOT

- FIGURE 72 EUROPE: INDUSTRIAL VALVES MARKET SNAPSHOT

- FIGURE 73 ASIA PACIFIC: INDUSTRIAL VALVES MARKET SNAPSHOT

- FIGURE 74 REST OF THE WORLD: INDUSTRIAL VALVES MARKET SNAPSHOT

- FIGURE 75 INDUSTRIAL VALVES MARKET: REVENUE ANALYSIS OF KEY PLAYERS (2020-2023)

- FIGURE 76 INDUSTRIAL VALVES MARKET: SHARE OF KEY PLAYERS (2023)

- FIGURE 77 INDUSTRIAL VALVES MARKET: COMPANY VALUATION

- FIGURE 78 INDUSTRIAL VALVES MARKET: FINANCIAL METRICS (EV/EBITDA)

- FIGURE 79 INDUSTRIAL VALVES MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS FOR KEY PLAYERS

- FIGURE 80 INDUSTRIAL VALVES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 81 INDUSTRIAL VALVES MARKET: COMPANY FOOTPRINT

- FIGURE 82 INDUSTRIAL VALVES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 83 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 84 SLB: COMPANY SNAPSHOT

- FIGURE 85 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

- FIGURE 86 IMI: COMPANY SNAPSHOT

- FIGURE 87 CRANE COMPANY: COMPANY SNAPSHOT

- FIGURE 88 VALMET: COMPANY SNAPSHOT

- FIGURE 89 SPIRAX SARCO LIMITED: COMPANY SNAPSHOT

- FIGURE 90 KITZ CORPORATION: COMPANY SNAPSHOT

- FIGURE 91 KSB SE & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 92 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 93 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- FIGURE 94 PARKER HANNIFIN CORP.: COMPANY SNAPSHOT

- FIGURE 95 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

- FIGURE 96 IDEX: COMPANY SNAPSHOT

The global Industrial Valve market was valued at USD 95.58 billion in 2024 and is projected to reach USD 121.67 billion by 2029; it is expected to register a CAGR of 4.9% during the forecast period. The rising demand for valves from the healthcare and pharmaceutical industries, the establishment of smart cities globally, the rapid deployment of connected networks to monitor valve conditions and predict system failure, and the increasing need to establish new power plants and revamp existing ones are the key driving factors for the industrial valves market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By technology, industry, and region |

| Regions covered | North America, Europe, APAC, RoW |

"Control valve segment is expected to grow at the highest CAGR during the forecast period."

The industry is moving toward adopting automated valves and sophisticated monitoring technologies coordinated through a central control station. Control valves can be linked to an extended data network, enabling them to easily monitor an industrial plant's flow rates and operating conditions. For instance, in an oil & gas plant, connecting valves on a network allows distributed control, which enables operators to reconfigure piping and networking systems in the case of a blockage or damage to the pipeline network and ensures a safer working environment without stopping the production process.

"Energy & power segment is likely to hold the second largest market in 2024."

The energy & Power segment is expected to hold the second-largest share of the Industrial Valve market in 2024. The energy & power industry is witnessing a strong need to develop infrastructure to meet the growing energy demand. This trend allows manufacturers to design and develop their products adhering to industry requirements and standards. Valves, specifically with digital capabilities, are in demand for safety applications and critical operations.

"The North America segment to Hold second Largest market share in 2023"

The market in North America is to hold the second-largest market share in 2023. Key factor driving the North American market include increased R&D on actuators utilized in valves for automation and the increasing need for safety standards in industrial plants. R&D at the industry level is broadening the scope of industrial valve applications into the different industries, namely energy & power and chemical, within the US. Industrial valves are used as components in oil & gas, energy & power, and water & wastewater treatment industries to regulate the flow of the media through a system, to start and stop the flow, or to throttle it, ensuring safe and efficient process automation.

Breakdown of primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 40%, Tier 2 - 35%, Tier 3 - 25%

- By Designation- C-level Executives - 45%, Directors - 35%, Others - 20%

- By Region-North America - 30%, Europe - 25%, Asia Pacific - 40%, RoW - 5%

The Industrial Valve market is dominated by a few globally established players such as Emerson Electric Co. (US), SLB (US), Flowserve Corporation (US), IMI (UK), Valmet (Finland), Spirax Sarco Limited (UK), Crane Company (US), Kitz Corporation (Japan), KSB SE & CO. KGAA (Germany), Alfa Laval (Sweden), Curtiss-Wright Corporation (US), Parker Hannifin Corporation (US), Bray International (US), Baker Hughes Company (US), IDEX Corporation (US). The study includes an in-depth competitive analysis of these key players in the Industrial Valve market and their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the Industrial Valve market and forecasts by valve type, Component, Material, Function, fluid Type, Size, pressure range, industry, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed market view across four main regions-North America, Europe, Asia Pacific, and RoW. A supply chain analysis has been included in the report, along with the key players and their competitive analysis of the Industrial Valve ecosystem.

Key Benefits to Buy the Report:

- Analysis of key drivers (Rising demand for valves from healthcare and pharmaceutical industries, Increasing need to establish new power plants and revamp existing ones, Rapid deployment of connected networks to monitor valve conditions and predict system failure, and Shifting focus of process industries toward adoption of automation solutions). Restraint (High capital investment and low-profit margin due to varying valve standards across regions, Customer dissatisfaction owing to higher lead time and late order delivery ), Opportunity (Integration of industrial valves with IIoT and Industry 4.0, Rising demand for AI-integrated valves for intelligent water supply, and Increasing adoption of smart valves as replacement for outdated valves ), Challenges (Focus of valve manufacturers on acquisitions affecting profit margins and cash flow, Fierce competition owing to reduced product differentiation).

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the Industrial Valve market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Industrial Valve market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the Industrial Valve market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players Emerson Electric Co. (US), SLB (US), Flowserve Corporation (US), IMI (UK), Valmet (Finland), Spirax Sarco Limited (UK), Crane Company (US), Kitz Corporation (Japan), KSB SE & CO. KGAA (Germany), Alfa Laval (Sweden), Curtiss-Wright Corporation (US), Parker Hannifin Corporation (US), Bray International (US), Baker Hughes Company (US), IDEX Corporation (US) among others in the Industrial Valve market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 SEGMENTS CONSIDERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 MARKET STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for arriving at market size using bottom-up approach

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for arriving at market size using top-down approach

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 STUDY ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN INDUSTRIAL VALVES MARKET

- 4.2 INDUSTRIAL VALVES MARKET, BY LINEAR VALVE, 2024 VS. 2029 (USD MILLION)

- 4.3 INDUSTRIAL VALVES MARKET, BY FLUID TYPE, 2024 VS. 2029 (USD MILLION)

- 4.4 INDUSTRIAL VALVES MARKET, BY PRESSURE RANGE, 2024 VS. 2029 (USD MILLION)

- 4.5 INDUSTRIAL VALVES MARKET, BY MATERIAL, 2024 VS. 2029 (USD MILLION)

- 4.6 INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY, 2024 VS. 2029 (USD MILLION)

- 4.7 INDUSTRIAL VALVES MARKET, BY COUNTRY, 2024 VS. 2029

- 4.8 INDUSTRIAL VALVES MARKET, BY REGION, 2024 VS. 2029 (USD MILLION)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand from pharmaceutical industries

- 5.2.1.2 Increasing need to establish new power plants and revamp existing ones

- 5.2.1.3 Growing use of connected networks and smart industrial valves

- 5.2.1.4 Inclusion of automation solutions in process industries

- 5.2.1.5 Establishment of smart cities

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital investments and low-profit margins

- 5.2.2.2 Customer dissatisfaction due to longer lead time and late order delivery

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of industrial valves with IIoT and Industry 4.0

- 5.2.3.2 Rising demand for AI-integrated valves for intelligent water supply

- 5.2.3.3 Use of 3D printing technique in industrial valves

- 5.2.3.4 Increasing number of refineries and petrochemical and chemical plants

- 5.2.3.5 Shifting focus of valve manufacturers toward better maintenance and aftermarket services

- 5.2.3.6 Increasing adoption of smart valves as replacement for outdated valves

- 5.2.4 CHALLENGES

- 5.2.4.1 Reduction in competitive rivalry and disruptions in market hierarchy

- 5.2.4.2 Fierce market competition and influence of local valve manufacturers

- 5.2.4.3 Unplanned plant downtime due to valve malfunctioning

- 5.2.4.4 High cost of valve manufacturing

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 PRICING ANALYSIS

- 5.6.1 COMPANY-WISE INDICATIVE SELLING PRICE OF INDUSTRIAL VALVES, BY VALVE TYPE

- 5.6.2 AVERAGE SELLING PRICE OF INDUSTRIAL VALVES, 2020-2023

- 5.6.3 AVERAGE SELLING PRICE OF INDUSTRIAL VALVES OFFERED BY KEY PLAYERS, BY TYPE

- 5.6.4 INDICATIVE PRICE TREND OF INDUSTRIAL VALVES, BY REGION

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Industrial internet of things (IIoT)

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Digitalization and artificial intelligence

- 5.8.3 COMPLEMENTARY TECHNOLOGIES

- 5.8.3.1 Valve condition monitoring

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 BARGAINING POWER OF SUPPLIERS

- 5.9.2 BARGAINING POWER OF BUYERS

- 5.9.3 THREAT OF NEW ENTRANTS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 KEY BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA FOR HS CODE 8481

- 5.12.2 EXPORT DATA FOR HS CODE 8481

- 5.13 PATENT ANALYSIS

- 5.13.1 LIST OF MAJOR PATENTS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 TARIFF, REGULATION, AND STANDARD ANALYSIS

- 5.15.1 TARIFF FOR PRESSURE-REDUCING VALVES

- 5.15.2 REGULATIONS AND STANDARDS

- 5.15.2.1 Regulatory bodies, government agencies, and other organizations

- 5.15.2.2 Regulatory standards

- 5.16 IMPACT OF AI/GEN AI ON INDUSTRIAL VALVES MARKET

- 5.16.1 AI-SPECIFIC USE CASES

- 5.16.2 FUTURE OF GENERATIVE AI IN VALVE ECOSYSTEM

6 INDUSTRIAL VALVES MARKET, BY VALVE SEALING

- 6.1 INTRODUCTION

- 6.2 SOFT SEATED VALVES

- 6.2.1 COST-EFFECTIVENESS AND ZERO LEAKAGE TO PROPEL MARKET DEMAND

- 6.3 METAL SEATED VALVES

- 6.3.1 INCREASED DURABILITY IN HIGH-TEMPERATURE, HIGH-PRESSURE, AND CORROSIVE ENVIRONMENTS TO BOOST MARKET GROWTH

- 6.4 PACKING SEATED VALVES

- 6.4.1 BETTER ADAPTABILITY, VERSATILITY, AND FLEXIBILITY TO SPUR MARKET GROWTH

7 INDUSTRIAL VALVES MARKET, BY VALVE TYPE

- 7.1 INTRODUCTION

- 7.2 ROTARY VALVES

- 7.2.1 BALL VALVES

- 7.2.1.1 Tight sealing and low operating torque to drive demand

- 7.2.1.2 Trunnion-mounted ball valves

- 7.2.1.3 Floating ball valves

- 7.2.1.4 Rising stem ball valves

- 7.2.2 BUTTERFLY VALVES

- 7.2.2.1 Cost-effectiveness and compact design to boost market growth

- 7.2.2.2 Zero-offset butterfly valves

- 7.2.2.3 Double-offset butterfly valves

- 7.2.2.4 Triple-offset butterfly valves

- 7.2.3 PLUG VALVES

- 7.2.3.1 Easy sealing and isolation to boost adoption in wastewater treatment plants

- 7.2.1 BALL VALVES

- 7.3 LINEAR VALVES

- 7.3.1 GLOBE VALVES

- 7.3.1.1 Use in high-pressure systems to support segmental growth

- 7.3.2 DIAPHRAGM VALVES

- 7.3.2.1 Ability to handle corrosive fluids, fibrous slurries, and radioactive fluids to aid market growth

- 7.3.3 GATE VALVES

- 7.3.3.1 Easy flow of media to boost demand in oil & gas and petrochemical applications

- 7.3.3.2 Standard plate gate valves

- 7.3.3.3 Wedge-type gate valves

- 7.3.3.4 Knife gate valves

- 7.3.4 SAFETY VALVES

- 7.3.4.1 Rising demand from oil & gas, energy & power, and chemical industries to propel segmental growth

- 7.3.5 CHECK VALVES

- 7.3.5.1 Ability to prevent reversal pipeline flow to stimulate demand for check valves

- 7.3.6 NEEDLE VALVES

- 7.3.6.1 Needle valves to offer precise flow control in oil & gas, pharmaceuticals, and water industries

- 7.3.7 PINCH VALVES

- 7.3.7.1 Pinch valves to offer reliable flow control for abrasive materials in mining and water treatment industries

- 7.3.8 SOLENOID VALVES

- 7.3.8.1 High demand for efficient fluid control systems to augment market growth

- 7.3.1 GLOBE VALVES

8 INDUSTRIAL VALVES MARKET, BY FLUID TYPE

- 8.1 INTRODUCTION

- 8.2 LIQUID

- 8.2.1 NEED FOR EFFECTIVE WATER TREATMENT AND WASTEWATER MANAGEMENT TO SUPPORT MARKET GROWTH

- 8.2.2 WATER VALVES

- 8.2.3 OIL VALVES

- 8.2.4 CHEMICAL VALVES

- 8.3 GAS

- 8.3.1 ADVANCED GAS VALVE SYSTEMS TO ENHANCE SAFETY AND PERFORMANCE IN INDUSTRIAL APPLICATIONS

- 8.3.2 NATURAL GAS

- 8.3.2.1 Natural gases to boost demand for industrial valves in extraction and distribution

- 8.3.2.2 Methane

- 8.3.2.3 Ethane

- 8.3.2.4 Propane

- 8.3.3 COMPRESSED AIR

- 8.3.3.1 Demand for compressed air valves to increase with automation and industrial processes

- 8.3.4 INDUSTRIAL GAS

- 8.3.4.1 Demand for industrial gas valves to rise with increased energy needs and improved safety regulations

- 8.3.4.2 Hydrogen

- 8.3.4.2.1 Increased adoption of clean energy and expansion of hydrogen infrastructure to aid segment growth

- 8.3.4.3 Nitrogen

- 8.3.4.3.1 Increased need for industrial applications to spur segment growth

- 8.3.4.4 Oxygen

- 8.3.4.4.1 Increasing urbanization and infrastructure development to fuel segment growth

- 8.3.4.5 Other industrial gases

- 8.4 SLURRY VALVES

- 8.4.1 ABILITY TO HANDLE CORROSIVE FLUIDS AND FIBROUS SLURRIES TO PROPEL MARKET DEMAND

- 8.4.2 CEMENT

- 8.4.3 SLUDGE

9 INDUSTRIAL VALVES MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 ACTUATORS

- 9.2.1 REDUCED MAINTENANCE COST, INCREASED UPTIME, AND ENHANCED PLANT SAFETY TO DRIVE DEMAND

- 9.2.2 PNEUMATIC ACTUATORS

- 9.2.2.1 Greater focus on automation, energy efficiency, and cost-effectiveness to drive market

- 9.2.2.2 Diaphragm actuators

- 9.2.2.3 Piston actuators

- 9.2.3 ELECTRIC ACTUATORS

- 9.2.3.1 Wide use in water and wastewater treatment and chemical plants to boost segmental growth

- 9.2.4 HYDRAULIC ACTUATORS

- 9.2.4.1 Integration of hydraulic actuators in HVAC, fire protection, and irrigation systems to propel growth

- 9.3 VALVE BODIES

- 9.3.1 IMPROVED CORROSION RESISTANCE AND ENHANCED CHEMICAL COMPATIBILITY TO FUEL SEGMENT GROWTH

- 9.4 OTHER COMPONENTS

10 INDUSTRIAL VALVES MARKET, BY FUNCTION

- 10.1 INTRODUCTION

- 10.2 ON/OFF VALVES

- 10.2.1 INCREASING USE IN THROTTLING APPLICATIONS TO DRIVE MARKET

- 10.3 CONTROL VALVES

- 10.3.1 NEED TO CONTROL TEMPERATURE, FLOW, AND PRESSURE IN INDUSTRIAL PROCESSES TO FAVOR MARKET GROWTH

- 10.3.2 MODULATING VALVES

- 10.3.3 POSITION-CONTROLLED VALVES

- 10.3.3.1 Quarter-turn valves

- 10.3.3.2 Multi-turn valves

11 INDUSTRIAL VALVES MARKET, BY MATERIAL

- 11.1 INTRODUCTION

- 11.2 STEEL

- 11.2.1 RESISTANCE TO STRESS CORROSION CRACKING TO DRIVE ADOPTION IN NATURAL GAS SECTOR

- 11.3 CAST IRON

- 11.3.1 GROWING ADOPTION IN WATER AND WASTEWATER TREATMENT FACILITIES TO BOOST MARKET DEMAND

- 11.4 ALUMINUM

- 11.4.1 LIGHTWEIGHT AND LOW-DENSITY MATERIAL TO BE USED IN AEROSPACE AND AUTOMOBILE INDUSTRY

- 11.5 ALLOY-BASED

- 11.5.1 EFFECTIVE ROLE IN MANAGING HIGH PRESSURE, TEMPERATURE, AND CORROSION IN PRODUCTION PROCESS TO FUEL MARKET GROWTH

- 11.5.2 NICKEL-ALUMINUM

- 11.5.3 NICKEL-CHROMIUM

- 11.6 PLASTIC

- 11.6.1 HIGH DURABILITY AND ENHANCED CORROSION RESISTANCE TO DRIVE DEMAND

- 11.7 OTHER MATERIALS

- 11.7.1 BRONZE

- 11.7.2 BRASS

12 INDUSTRIAL VALVES MARKET, BY SIZE

- 12.1 INTRODUCTION

- 12.2 <1"

- 12.2.1 INCREASING NEED FOR COMPACT AND EFFECTIVE TECHNOLOGIES TO DRIVE MARKET

- 12.3 1"-6"

- 12.3.1 COMPACT SIZE TO INCREASE ADOPTION IN OIL & GAS AND CHEMICAL INDUSTRIES

- 12.4 6"-25"

- 12.4.1 INCREASING ADOPTION IN OIL & GAS TO CREATE OPPORTUNITIES FOR VALVE PROVIDERS

- 12.5 25"-50"

- 12.5.1 GROWING NEED FOR FUNCTIONAL VALVES IN HIGH-TEMPERATURE AND HIGH-PRESSURE ENVIRONMENTS TO PROPEL MARKET GROWTH

- 12.6 >50"

- 12.6.1 INCREASED ADOPTION OF HIGH-CAPACITY SYSTEMS TO BOOST MARKET DEMAND

13 INDUSTRIAL VALVES MARKET, BY PRESSURE RANGE

- 13.1 INTRODUCTION

- 13.2 <50 BAR

- 13.2.1 INCREASING NEED FOR < 50 BAR VALVES FOR HVAC CONTROL TO DRIVE MARKET

- 13.3 >50 TO 350 BAR

- 13.3.1 RISING FOCUS ON SMART MANUFACTURING PROCESSES TO ENCOURAGE MARKET GROWTH

- 13.4 >350 TO 700 BAR

- 13.4.1 RISING DEMAND FOR HIGH-PRESSURE PROCESSES IN CHEMICAL AND PHARMACEUTICAL INDUSTRIES TO DRIVE MARKET

- 13.5 >700 TO 1000 BAR

- 13.5.1 GROWING NEED FOR FUNCTIONAL VALVES IN HIGH-PRESSURE ENVIRONMENT TO PROPEL MARKET GROWTH

- 13.6 >1000 BAR

- 13.6.1 ADVANCEMENTS IN HIGH-PERFORMANCE AND PRECISION MANUFACTURING TO DRIVE DEMAND

14 INDUSTRIAL VALVES MARKET, BY END-USE INDUSTRY

- 14.1 INTRODUCTION

- 14.2 OIL & GAS

- 14.2.1 RISING DEMAND IN TRANSPORTATION SECTOR TO FOSTER MARKET GROWTH

- 14.2.2 UPSTREAM

- 14.2.3 MIDSTREAM

- 14.2.4 DOWNSTREAM

- 14.3 WATER & WASTEWATER TREATMENT

- 14.3.1 HIGH INVESTMENTS IN ESTABLISHING WATER TREATMENT PLANTS TO PROPEL MARKET GROWTH

- 14.3.2 WATER DISTRIBUTION SYSTEMS

- 14.3.3 DESALINATION UNITS

- 14.4 ENERGY & POWER

- 14.4.1 INCREASING ENERGY DEMAND IN EMERGING ECONOMIES TO BOOST MARKET

- 14.4.2 CONVENTIONAL POWER PLANTS

- 14.4.3 RENEWABLE ENERGY PLANTS

- 14.5 PHARMACEUTICAL

- 14.5.1 AUTOMATION IN PHARMA COMPANIES TO REDUCE DRUG SHORTAGE AND INCREASE DEMAND FOR INDUSTRIAL VALVES

- 14.5.2 STERILIZATION PROCESS

- 14.5.3 PACKAGING & FILLING

- 14.6 FOOD & BEVERAGE

- 14.6.1 NEED FOR LEAKPROOF AND CLEAN CONTAINERS TO AUGMENT MARKET GROWTH

- 14.6.2 BEVERAGE PRODUCTION

- 14.6.3 DAIRY PRODUCTION

- 14.7 CHEMICAL

- 14.7.1 VALVES IN CHEMICAL INDUSTRY TO REDUCE EMISSIONS, INCREASE PLANT SAFETY, AND PROTECT ENVIRONMENT

- 14.7.2 BATCH PROCESSING

- 14.7.3 FILTRATION PROCESS

- 14.8 BUILDING & CONSTRUCTION

- 14.8.1 INCREASING INFRASTRUCTURAL INVESTMENTS AND GROWING FOCUS ON BETTER SAFETY STANDARDS TO AID MARKET GROWTH

- 14.8.2 HVAC APPLICATION

- 14.8.3 FIRE PROTECTION

- 14.9 PAPER & PULP

- 14.9.1 NEED TO PRODUCE HIGH-QUALITY PRODUCTS WITH LESS ENERGY CONSUMPTION TO INCREASE DEMAND FOR VALVES

- 14.9.2 PAPER FORMATION

- 14.9.3 BLENDING

- 14.10 METAL & MINING

- 14.10.1 INDUSTRIAL VALVES IN MINING OPERATIONS TO HELP SELF-DIAGNOSE PLANTS AND ENSURE EFFICIENT OPERATIONS

- 14.10.2 HYDROMETALLURGY

- 14.10.3 CONVEYOR SYSTEMS

- 14.11 AGRICULTURE

- 14.11.1 RISING USE OF INDUSTRIAL VALVES IN IRRIGATION APPLICATIONS TO SPUR DEMAND

- 14.11.2 SPRINKLER SYSTEMS

- 14.11.3 WATER STORAGE TANKS

- 14.12 SEMICONDUCTOR

- 14.12.1 RISING DEMAND FOR SEMICONDUCTOR CHIPS FROM ELECTRONICS AND AUTOMOBILE MANUFACTURING COMPANIES TO DRIVE MARKET

- 14.12.2 WAFER PROCESSING

- 14.12.3 VACUUM SYSTEMS

- 14.13 OTHER END-USE INDUSTRIES

15 INDUSTRIAL VALVES MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 15.2.2 US

- 15.2.2.1 US to command largest share in North American industrial valves market during study period

- 15.2.3 CANADA

- 15.2.3.1 Favorable government policies and developed mining industry to propel market growth

- 15.2.4 MEXICO

- 15.2.4.1 Thriving semiconductor industry and availability of cheap labor to boost market growth

- 15.3 EUROPE

- 15.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 15.3.2 UK

- 15.3.2.1 Strong regulatory framework and developed pharmaceutical industry to drive market

- 15.3.3 GERMANY

- 15.3.3.1 Rising adoption of industrial valves by process industries to stimulate market growth

- 15.3.4 FRANCE

- 15.3.4.1 Focus on renewable energy development to drive demand for industrial valves

- 15.3.5 ITALY

- 15.3.5.1 Increasing investments in refurbishing and retrofitting water & wastewater treatment plants to support market growth

- 15.3.6 REST OF EUROPE

- 15.4 ASIA PACIFIC

- 15.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 15.4.2 CHINA

- 15.4.2.1 Developed industrial base and increased medical needs to augment market growth

- 15.4.3 JAPAN

- 15.4.3.1 Increasing focus on renewable energy projects to boost requirement for industrial valves

- 15.4.4 SOUTH KOREA

- 15.4.4.1 Growing focus on developing hydrogen industry to propel market growth

- 15.4.5 INDIA

- 15.4.5.1 Increasing investments in oil & gas and manufacturing sectors to stimulate market growth

- 15.4.6 REST OF ASIA PACIFIC

- 15.5 REST OF THE WORLD

- 15.5.1 MACROECONOMIC OUTLOOK FOR REST OF THE WORLD

- 15.5.2 MIDDLE EAST

- 15.5.2.1 Booming oil & gas and chemical industries to increase demand for industrial valves

- 15.5.2.2 GCC Countries

- 15.5.2.2.1 Rising investments in oil & gas, petrochemical, and water management sectors to aid market growth

- 15.5.3 SOUTH AMERICA

- 15.5.3.1 Increasing FDI and rising per capita income to aid market growth

- 15.5.4 AFRICA

- 15.5.4.1 Increasing investments for better water management infrastructure to generate market opportunities

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 STRATEGIES ADOPTED BY KEY PLAYERS IN INDUSTRIAL VALVES MARKET

- 16.3 REVENUE ANALYSIS, 2020-2023

- 16.4 MARKET SHARE ANALYSIS, 2023

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 16.7.5.1 Company footprint

- 16.7.5.2 Valve type footprint

- 16.7.5.3 Fluid type footprint

- 16.7.5.4 End-use industry footprint

- 16.7.5.5 Region footprint

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 16.8.5.1 Detailed list of key startups/SMEs

- 16.8.5.2 Competitive benchmarking of key startups/SMEs

- 16.8.5.2.1 Competitive benchmarking, by type

- 16.8.5.2.2 Competitive benchmarking, by fluid type

- 16.8.5.2.3 Competitive benchmarking, by end-use industry

- 16.8.5.2.4 Competitive benchmarking, by region

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 EXPANSIONS

- 16.9.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 EMERSON ELECTRIC CO.

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths/Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses/Competitive threats

- 17.1.2 SLB

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Expansions

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths/Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses/Competitive threats

- 17.1.3 FLOWSERVE CORPORATION

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches

- 17.1.3.3.2 Deals

- 17.1.3.3.3 Other developments

- 17.1.3.4 MnM View

- 17.1.3.4.1 Key strengths/Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses/Competitive threats

- 17.1.4 IMI

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.3.2 Expansions

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths/Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses/Competitive threats

- 17.1.5 CRANE COMPANY

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Deals

- 17.1.5.3.2 Expansions

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths/Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses/Competitive threats

- 17.1.6 VALMET

- 17.1.6.1 Business overview

- 17.1.6.2 Products offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Deals

- 17.1.7 SPIRAX SARCO LIMITED

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Deals

- 17.1.8 KITZ CORPORATION

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches

- 17.1.8.3.2 Deals

- 17.1.8.3.3 Expansions

- 17.1.9 KSB SE & CO. KGAA

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches

- 17.1.9.3.2 Expansions

- 17.1.10 ALFA LAVAL

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Deals

- 17.1.10.3.2 Other developments

- 17.1.11 CURTISS-WRIGHT CORPORATION

- 17.1.11.1 Business overview

- 17.1.11.2 Products offered

- 17.1.12 PARKER HANNIFIN CORP.

- 17.1.12.1 Business overview

- 17.1.12.2 Products offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Product launches

- 17.1.12.3.2 Deals

- 17.1.13 BRAY INTERNATIONAL

- 17.1.13.1 Business overview

- 17.1.13.2 Products offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Deals

- 17.1.14 BAKER HUGHES COMPANY

- 17.1.14.1 Business overview

- 17.1.14.2 Products offered

- 17.1.15 IDEX

- 17.1.15.1 Business overview

- 17.1.15.2 Products offered

- 17.1.15.3 Recent developments

- 17.1.15.3.1 Deals

- 17.1.1 EMERSON ELECTRIC CO.

- 17.2 OTHER KEY PLAYERS

- 17.2.1 CIRCOR INTERNATIONAL, INC.

- 17.2.2 ROTORK

- 17.2.3 NEWAY VALVE

- 17.2.4 VELAN INC.

- 17.2.5 DANFOSS

- 17.2.6 GEORG FISCHER LTD.

- 17.2.7 SAMSONCONTROLS.NET

- 17.2.8 AVK HOLDING A/S

- 17.2.9 KLINGER HOLDING

- 17.2.10 TRILLIUM FLOW TECHNOLOGIES

- 17.3 OTHER PLAYERS

- 17.3.1 EBRO ARMATUREN GEBR. BROER GMBH

- 17.3.2 VALVITALIA SPA

- 17.3.3 GEFA PROCESSTECHNIK GMBH

- 17.3.4 AVCON CONTROLS PVT LTD.

- 17.3.5 FORBES MARSHALL

- 17.3.6 FRENSTAR

- 17.3.7 HAM-LET GROUP

- 17.3.8 DWYER INSTRUMENTS, LLC

- 17.3.9 APOLLO VALVES

- 17.3.10 NOVEL VALVES INDIA PVT. LTD

- 17.3.11 INDUSTRIAL VALVES

- 17.3.12 L&T VALVES LIMITED

18 APPENDIX

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS