|

|

市場調査レポート

商品コード

1752402

リチウムイオン電池の世界市場:電池タイプ別、用途別、地域別 - 2033年までの予測Lithium-ion Battery Market by Battery Type, Cell Type, Capacity, Energy Storage Consumer Electronics, Medical - Global Forecast to 2033 |

||||||

カスタマイズ可能

|

|||||||

| リチウムイオン電池の世界市場:電池タイプ別、用途別、地域別 - 2033年までの予測 |

|

出版日: 2025年06月17日

発行: MarketsandMarkets

ページ情報: 英文 321 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のリチウムイオン電池の市場規模は、10.3%のCAGRで拡大し、2025年の1,946億6,000万米ドルから2033年には4,263億7,000万米ドルに成長すると予測されています。

市場成長の原動力となるのは、輸送、産業、エネルギーの各分野で加速する電動化へのシフトと、電池性能、エネルギー密度、充電効率の継続的な進歩です。電気自動車の採用が増加し、送電網の安定と産業運営を支える高性能エネルギー貯蔵システムの必要性が、主要な成長促進要因となっています。バッテリー管理システムの強化と製造プロセスの革新は、安全性、コスト最適化、ライフサイクル性能の向上に寄与しています。さらに、地域密着型のバッテリーサプライチェーンを構築し、大規模なバッテリー生産を支援するための政府支援イニシアティブが、バリューチェーン全体への投資を後押ししています。産業界が持続可能性、効率性、エネルギー回復力を優先する中、リチウムイオン電池の需要は、多様な最終用途で大幅に増加する見通しです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2033年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2033年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 電池タイプ別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

リチウムニッケルマンガンコバルト(NMC)電池は、その高いエネルギー密度、長いサイクル寿命、強い熱安定性により、リチウムイオン電池市場で大きく成長すると予測されています。これらの電池は性能とコストの最適なバランスを保ち、電気自動車、電動工具、医療機器、産業機器に理想的です。コバルト含有量を削減するための継続的な努力は、手頃な価格を高め、持続可能性への懸念に対処しています。コンパクトなフォームファクターで信頼性の高い大容量の電力を供給できるコバルトは、自動車やエネルギー貯蔵システムでの利用拡大を支えています。業界が軽量、高効率、長寿命のエネルギーソリューションを優先する中、NMC電池は汎用性と拡張性のある選択肢として台頭しており、進化する電池情勢における中核技術としての地位を強化しています。

エネルギー貯蔵は、信頼性が高く、柔軟性があり、コスト効率の高いエネルギーソリューションに対する需要の高まりに後押しされ、リチウムイオン電池市場で最も急成長する見通しです。増加する送電網の不安定性、ピーク負荷管理における課題、中断のないバックアップ電源の重要な必要性は、公益事業や産業部門全体でリチウムイオン電池蓄電システムの大規模な展開に拍車をかけています。これらのシステムは、低需要時に余剰電力を貯蔵し、ピーク消費時に供給することで最適化されたエネルギー管理を可能にし、運用コストの削減とグリッドの回復力強化に貢献します。リチウムイオン電池固有の拡張性、高速応答時間、長寿命により、メーター前とメーター裏の両方に最適です。グリッド近代化、再生可能エネルギー統合、スマート・インフラへの投資の加速が採用を後押し。エネルギー貯蔵が電力システムの変革にますます中心的な役割を果たすようになるにつれ、リチウムイオン電池は、世界中で持続可能で効率的なエネルギー管理を可能にする上で極めて重要な役割を果たし続けるとみられています。

アジア太平洋は、電気自動車の急速な普及と再生可能エネルギープロジェクトへの大規模な投資により、予測期間中にリチウムイオン電池市場で最も高いCAGRを記録すると予想されます。中国、インド、日本、韓国などの主要国は、電池の製造能力と技術力を積極的に拡大しています。クリーンエネルギーとエネルギー貯蔵ソリューションを支援する政府のインセンティブは、市場の成長をさらに加速させる。さらに、この地域は、確立されたサプライチェーン、豊富な原材料の入手可能性、進行中のインフラ整備の恩恵を受けています。さらに、この地域ではリチウムイオン電池の製造が盛んであるため、コストを最小限に抑えることができ、採用率は上昇傾向にあります。これらの要因が相まって、アジア太平洋地域はリチウムイオン電池技術の世界の需要と技術革新をリードし、今後数年間は同市場における支配的な地域となることが予想されます。

当レポートでは、世界のリチウムイオン電池市場について調査し、電池タイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 価格分析

- リチウムイオン電池業界に関する重要な洞察

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- 規制状況

- 生成AI/AIの影響

- 2025年の米国関税の影響

第6章 リチウムイオン電池に使用される材料

- イントロダクション

- カソード

- アノード

- 電解質

- セパレーター

- 集電装置

- その他の材料

第7章 リチウムイオン電池市場(電池タイプ別)

- イントロダクション

- NMC

- LFP

- LCO

- LTO

- LMO

- NCA

第8章 リチウムイオン電池市場(用途別)

- イントロダクション

- 電気自動車

- エネルギー貯蔵

- 工業

- 家電

- 医療

- その他

第9章 リチウムイオン電池市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年~2024年

- 収益分析、2021年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- LG ENERGY SOLUTION

- SAMSUNG SDI

- PANASONIC HOLDINGS CORPORATION

- BYD COMPANY LTD.

- CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

- BAK POWER

- CALB

- CLARIOS

- ENERSYS

- EVE ENERGY CO., LTD.

- GOTION

- GS YUASA CORPORATION

- MITSUBISHI ELECTRIC CORPORATION

- SK INNOVATION CO., LTD.

- TESLA

- TOSHIBA CORPORATION

- SUNWODA ELECTRONIC CO., LTD.

- VARTA AG

- その他の企業

- AESC GROUP LTD.

- AMPEREX TECHNOLOGY LIMITED

- AMPRIUS TECHNOLOGIES

- ENOVIX CORPORATION

- FARASIS ENERGY(GANZHOU)CO., LTD.

- GROUP14 TECHNOLOGIES, INC.

- IPOWER BATTERIES PRIVATE LIMITED

- LECLANCHE SA

- LITHIUMWERKS

- LYTEN, INC.

- NEXTECH BATTERIES

- PPBC(POLYPLUS BATTERY COMPANY)

- SAFT

- SILA NANOTECHNOLOGIES INC.

- SOLAREDGE

第12章 付録

List of Tables

- TABLE 1 LITHIUM-ION BATTERY MARKET: RISK ANALYSIS

- TABLE 2 LIST OF UPCOMING GLOBAL BESS PROJECTS

- TABLE 3 LIST OF COMPANIES WITNESSED BANKRUPTCY IN LITHIUM-ION BATTERY MARKET

- TABLE 4 LITHIUM-ION BATTERY ECOSYSTEM ANALYSIS

- TABLE 5 PRICING RANGE OF LITHIUM-ION BATTERY PACKS OFFERED BY KEY PLAYERS, 2024

- TABLE 6 AVERAGE SELLING PRICE TREND OF LFP AND NMC BATTERIES, 2021-2024 (USD/KWH)

- TABLE 7 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, BY REGION, 2021-2024 (USD/KWH)

- TABLE 8 LITHIUM PRODUCTION, BY COUNTRY, 2023

- TABLE 9 LARGEST OPERATIONAL GIGAFACTORIES WORLDWIDE

- TABLE 10 UPCOMING GIGAFACTORIES WORLDWIDE

- TABLE 11 LARGEST PE/VC-BACKED INVESTMENTS IN BATTERY ENERGY STORAGE SYSTEMS ANNOUNCED IN 2024

- TABLE 12 LITHIUM-ION BATTERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 14 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 15 IMPORT DATA FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 16 EXPORT DATA FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 17 LITHIUM-ION BATTERY MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2021-2024

- TABLE 18 LITHIUM-ION BATTERY MARKET: LIST OF KEY CONFERENCES AND EVENTS

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 STANDARDS

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR LITHIUM-ION BATTERY MARKET

- TABLE 26 EXPECTED CHANGE IN PRICES AND ANTICIPATED IMPACT ON APPLICATIONS MARKET DUE TO TARIFF

- TABLE 27 KEY MATERIALS USED IN LITHIUM-ION BATTERY COMPONENTS

- TABLE 28 COMPARISON OF LITHIUM-ION BATTERY TYPES BASED ON DIFFERENT PARAMETERS

- TABLE 29 LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD BILLION)

- TABLE 30 LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2033 (USD BILLION)

- TABLE 31 NMC: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 32 NMC: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2025-2033 (USD BILLION)

- TABLE 33 NMC: LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 34 NMC: LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2033 (USD BILLION)

- TABLE 35 LFP: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 36 LFP: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2025-2033 (USD BILLION)

- TABLE 37 LFP: LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 38 LFP: LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2033 (USD BILLION)

- TABLE 39 LCO: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 40 LCO: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2025-2033 (USD BILLION)

- TABLE 41 LCO: LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 42 LCO: LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2033 (USD BILLION)

- TABLE 43 LTO: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 44 LTO: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2025-2033 (USD BILLION)

- TABLE 45 LTO: LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 46 LTO: LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2033 (USD BILLION)

- TABLE 47 LMO: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 48 LMO: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2025-2033 (USD BILLION)

- TABLE 49 LMO: LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 50 LMO: LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2033 (USD BILLION)

- TABLE 51 NCA: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 52 NCA: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2025-2033 (USD BILLION)

- TABLE 53 NCA: LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 54 NCA: LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2033 (USD BILLION)

- TABLE 55 LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 56 LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2025-2033 (USD BILLION)

- TABLE 57 EVS: LITHIUM-ION BATTERY MARKET, BY INSTALLED CAPACITY, 2021-2024 (GWH)

- TABLE 58 EVS: LITHIUM-ION BATTERY MARKET, BY INSTALLED CAPACITY, 2025-2033 (GWH)

- TABLE 59 EVS: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2021-2024 (USD BILLION)

- TABLE 60 EVS: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2025-2033 (USD BILLION)

- TABLE 61 EVS: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD BILLION)

- TABLE 62 EVS: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2033 (USD BILLION)

- TABLE 63 BATTERY TYPE/FORM USED BY OEMS, BY EV MODEL, 2025-2026

- TABLE 64 BATTERY FORMS: ADVANTAGES AND DISADVANTAGES

- TABLE 65 EVS: LITHIUM-ION BATTERY MARKET, BY BATTERY FORM, 2021-2024 (USD BILLION)

- TABLE 66 EVS: LITHIUM-ION BATTERY MARKET, BY BATTERY FORM, 2025-2033 (USD BILLION)

- TABLE 67 EVS : LITHIUM-ION BATTERY MARKET, BY VEHICLE TYPE, 2021-2024 (GWH)

- TABLE 68 EVS: LITHIUM-ION BATTERY MARKET, BY VEHICLE TYPE, 2025-2033 (GWH)

- TABLE 69 EVS: LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 70 EVS: LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2033 (USD BILLION)

- TABLE 71 EVS: LITHIUM-ION BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 72 EVS: LITHIUM-ION BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2033 (USD BILLION)

- TABLE 73 EVS: LITHIUM-ION BATTERY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 74 EVS: LITHIUM-ION BATTERY MARKET IN EUROPE, BY COUNTRY, 2025-2033 (USD BILLION)

- TABLE 75 EVS: LITHIUM-ION BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 76 EVS: LITHIUM-ION BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2033 (USD BILLION)

- TABLE 77 EVS: LITHIUM-ION BATTERY MARKET IN ROW, BY REGION, 2021-2024 (USD BILLION)

- TABLE 78 EVS: LITHIUM-ION BATTERY MARKET IN ROW, BY REGION, 2025-2033 (USD BILLION)

- TABLE 79 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY INSTALLED CAPACITY, 2021-2024 (GWH)

- TABLE 80 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY INSTALLED CAPACITY, 2025-2033 (GWH)

- TABLE 81 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2021-2024 (USD BILLION)

- TABLE 82 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2025-2033 (USD BILLION)

- TABLE 83 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD BILLION)

- TABLE 84 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2033 (USD BILLION)

- TABLE 85 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY CONNECTION TYPE, 2021-2024 (USD BILLION)

- TABLE 86 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY CONNECTION TYPE, 2025-2033 (USD BILLION)

- TABLE 87 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY END USE, 2021-2024 (USD BILLION)

- TABLE 88 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY END USE, 2025-2033 (USD BILLION)

- TABLE 89 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 90 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2033 (USD BILLION)

- TABLE 91 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 92 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2033 (USD BILLION)

- TABLE 93 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 94 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET IN EUROPE, BY COUNTRY, 2025-2033 (USD BILLION)

- TABLE 95 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 96 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2033 (USD BILLION)

- TABLE 97 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET IN ROW, BY REGION, 2021-2024 (USD BILLION)

- TABLE 98 ENERGY STORAGE: LITHIUM-ION BATTERY MARKET IN ROW, BY REGION, 2025-2033 (USD BILLION)

- TABLE 99 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 100 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2025-2033 (USD MILLION)

- TABLE 101 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 102 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2033 (USD MILLION)

- TABLE 103 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 INDUSTRIAL: LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 105 INDUSTRIAL: LITHIUM-ION BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 INDUSTRIAL: LITHIUM-ION BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 107 INDUSTRIAL: LITHIUM-ION BATTERY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 108 INDUSTRIAL: LITHIUM-ION BATTERY MARKET IN EUROPE, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 109 INDUSTRIAL: LITHIUM-ION BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 INDUSTRIAL: LITHIUM-ION BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 111 INDUSTRIAL: LITHIUM-ION BATTERY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 INDUSTRIAL: LITHIUM-ION BATTERY MARKET IN ROW, BY REGION, 2025-2033 (USD MILLION)

- TABLE 113 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY PRODUCT TYPE, 2021-2024 (USD BILLION)

- TABLE 114 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY PRODUCT TYPE, 2025-2033 (USD BILLION)

- TABLE 115 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2021-2024 (USD BILLION)

- TABLE 116 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2025-2033 (USD BILLION)

- TABLE 117 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD BILLION)

- TABLE 118 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2033 (USD BILLION)

- TABLE 119 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 120 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2033 (USD BILLION)

- TABLE 121 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 122 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2033 (USD BILLION)

- TABLE 123 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 124 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET IN EUROPE, BY COUNTRY, 2025-2033 (USD BILLION)

- TABLE 125 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 126 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2033 (USD BILLION)

- TABLE 127 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET IN ROW, BY REGION, 2021-2024 (USD BILLION)

- TABLE 128 CONSUMER ELECTRONICS: LITHIUM-ION BATTERY MARKET IN ROW, BY REGION, 2025-2033 (USD BILLION)

- TABLE 129 MEDICAL: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2021-2024 (USD MILLION)

- TABLE 130 MEDICAL: LITHIUM-ION BATTERY MARKET, BY BATTERY CAPACITY, 2025-2033 (USD MILLION)

- TABLE 131 MEDICAL: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 132 MEDICAL: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2033 (USD MILLION)

- TABLE 133 MEDICAL: LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 134 MEDICAL: LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 135 MEDICAL: LITHIUM-ION BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 136 MEDICAL: LITHIUM-ION BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 137 MEDICAL: LITHIUM-ION BATTERY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 MEDICAL: LITHIUM-ION BATTERY MARKET IN EUROPE, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 139 MEDICAL: LITHIUM-ION BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 MEDICAL: LITHIUM-ION BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 141 MEDICAL: LITHIUM-ION BATTERY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 142 MEDICAL: LITHIUM-ION BATTERY MARKET IN ROW, BY REGION, 2025-2033 (USD MILLION)

- TABLE 143 OTHER APPLICATIONS: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 144 OTHER APPLICATIONS: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2033 (USD MILLION)

- TABLE 145 OTHER APPLICATIONS: LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 146 OTHER APPLICATIONS: LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 147 OTHER APPLICATIONS: LITHIUM-ION BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 148 OTHER APPLICATIONS: LITHIUM-ION BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 149 OTHER APPLICATIONS: LITHIUM-ION BATTERY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 150 OTHER APPLICATIONS: LITHIUM-ION BATTERY MARKET IN EUROPE, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 151 OTHER APPLICATIONS: LITHIUM-ION BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 152 OTHER APPLICATIONS: LITHIUM-ION BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 153 OTHER APPLICATIONS: LITHIUM-ION BATTERY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 154 OTHER APPLICATIONS: LITHIUM-ION BATTERY MARKET IN ROW, BY REGION, 2025-2033 (USD MILLION)

- TABLE 155 LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 156 LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2033 (USD BILLION)

- TABLE 157 NORTH AMERICA: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 158 NORTH AMERICA: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2025-2033 (USD BILLION)

- TABLE 159 NORTH AMERICA: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD BILLION)

- TABLE 160 NORTH AMERICA: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2033 (USD BILLION)

- TABLE 161 NORTH AMERICA: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 162 NORTH AMERICA: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2025-2033 (USD BILLION)

- TABLE 163 EUROPE: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 164 EUROPE: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2025-2033 (USD BILLION)

- TABLE 165 EUROPE: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD BILLION)

- TABLE 166 EUROPE: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2033 (USD BILLION)

- TABLE 167 EUROPE: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 168 EUROPE: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2025-2033 (USD BILLION)

- TABLE 169 ASIA PACIFIC: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 170 ASIA PACIFIC: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2025-2033 (USD BILLION)

- TABLE 171 ASIA PACIFIC: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD BILLION)

- TABLE 172 ASIA PACIFIC: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2033 (USD BILLION)

- TABLE 173 ASIA PACIFIC: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2021-2024 (USD BILLION)

- TABLE 174 ASIA PACIFIC: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2025-2033 (USD BILLION)

- TABLE 175 ROW: LITHIUM-ION BATTERY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 176 ROW: LITHIUM-ION BATTERY MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 177 ROW: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2021-2024 (USD MILLION)

- TABLE 178 ROW: LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE, 2025-2033 (USD MILLION)

- TABLE 179 ROW: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 180 ROW: LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2025-2033 (USD MILLION)

- TABLE 181 MIDDLE EAST: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 182 MIDDLE EAST: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 183 AFRICA: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 184 AFRICA: LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 185 LITHIUM-ION BATTERY MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 186 LITHIUM-ION BATTERY MARKET: DEGREE OF COMPETITION, 2024

- TABLE 187 LITHIUM-ION BATTERY MARKET: DEGREE OF COMPETITION FOR EVS APPLICATIONS, 2024

- TABLE 188 LITHIUM-ION BATTERY MARKET: REGION FOOTPRINT

- TABLE 189 LITHIUM-ION BATTERY MARKET: BATTERY TYPE FOOTPRINT

- TABLE 190 LITHIUM-ION BATTERY MARKET: APPLICATION FOOTPRINT

- TABLE 191 LITHIUM-ION BATTERY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 192 LITHIUM-ION BATTERY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 193 LITHIUM-ION BATTERY MARKET: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 194 LITHIUM-ION BATTERY MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 195 LITHIUM-ION BATTERY MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 196 LITHIUM-ION BATTERY MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 197 LG ENERGY SOLUTION: COMPANY OVERVIEW

- TABLE 198 LG ENERGY SOLUTION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 LG ENERGY SOLUTION: PRODUCT LAUNCHES

- TABLE 200 LG ENERGY SOLUTION: DEALS

- TABLE 201 LG ENERGY SOLUTION: EXPANSIONS

- TABLE 202 SAMSUNG SDI: COMPANY OVERVIEW

- TABLE 203 SAMSUNG SDI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 SAMSUNG SDI: DEALS

- TABLE 205 SAMSUNG SDI: EXPANSIONS

- TABLE 206 SAMSUNG SDI: OTHER DEVELOPMENTS

- TABLE 207 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 208 PANASONIC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 PANASONIC HOLDINGS CORPORATION: DEALS

- TABLE 210 PANASONIC HOLDINGS CORPORATION: EXPANSIONS

- TABLE 211 PANASONIC HOLDINGS CORPORATION: OTHER DEVELOPMENTS

- TABLE 212 BYD COMPANY LTD.: COMPANY OVERVIEW

- TABLE 213 BYD COMPANY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 BYD COMPANY LTD.: DEALS

- TABLE 215 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: COMPANY OVERVIEW

- TABLE 216 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: PRODUCT LAUNCHES

- TABLE 218 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: DEALS

- TABLE 219 BAK POWER: COMPANY OVERVIEW

- TABLE 220 BAK POWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 BAK POWER: PRODUCT LAUNCHES

- TABLE 222 BAK POWER: EXPANSIONS

- TABLE 223 CALB: COMPANY OVERVIEW

- TABLE 224 CALB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 CALB: PRODUCT LAUNCHES

- TABLE 226 CLARIOS: COMPANY OVERVIEW

- TABLE 227 CLARIOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 ENERSYS: COMPANY OVERVIEW

- TABLE 229 ENERSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 ENERSYS: DEALS

- TABLE 231 ENERSYS: EXPANSIONS

- TABLE 232 EVE ENERGY CO., LTD.: COMPANY OVERVIEW

- TABLE 233 EVE ENERGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 EVE ENERGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 235 EVE ENERGY CO., LTD.: DEALS

- TABLE 236 GOTION: COMPANY OVERVIEW

- TABLE 237 GOTION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 GOTION: DEALS

- TABLE 239 GS YUASA CORPORATION: COMPANY OVERVIEW

- TABLE 240 GS YUASA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 GS YUASA CORPORATION: DEALS

- TABLE 242 GS YUASA CORPORATION: OTHER DEVELOPMENTS

- TABLE 243 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 244 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 SK INNOVATION CO., LTD.: COMPANY OVERVIEW

- TABLE 246 SK INNOVATION CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 SK INNOVATION CO., LTD.: DEALS

- TABLE 248 TESLA: COMPANY OVERVIEW

- TABLE 249 TESLA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 TESLA: DEVELOPMENTS

- TABLE 251 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 252 TOSHIBA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 TOSHIBA CORPORATION: PRODUCT LAUNCHES

- TABLE 254 TOSHIBA CORPORATION: DEALS

- TABLE 255 SUNWODA ELECTRONIC CO., LTD.: COMPANY OVERVIEW

- TABLE 256 SUNWODA ELECTRONIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 SUNWODA ELECTRONIC CO., LTD.: DEALS

- TABLE 258 VARTA AG: COMPANY OVERVIEW

- TABLE 259 VARTA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 LITHIUM-ION BATTERY MARKET SEGMENTATION

- FIGURE 2 LITHIUM-ION BATTERY MARKET: RESEARCH DESIGN

- FIGURE 3 LITHIUM-ION BATTERY MARKET: RESEARCH APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR LITHIUM-ION BATTERY MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ASSUMPTIONS

- FIGURE 9 LITHIUM-ION BATTERY MARKET, 2021-2033

- FIGURE 10 LFP BATTERY TYPE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2033

- FIGURE 11 ENERGY STORAGE SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO LEAD GLOBAL LITHIUM-ION BATTERY MARKET DURING FORECAST PERIOD

- FIGURE 13 RISING SALES OF BATTERY-OPERATED ELECTRIC VEHICLES GLOBALLY TO DRIVE MARKET

- FIGURE 14 EVS SEGMENT TO DOMINATE MARKET, BY APPLICATION, IN 2033

- FIGURE 15 HISTORICAL AND PROJECTED DATA ON BATTERY CAPACITY INSTALLATIONS WORLDWIDE, 2021-2033

- FIGURE 16 EVS SEGMENT AND CHINA TO HOLD LARGEST SHARE OF LITHIUM-ION BATTERY MARKET IN ASIA PACIFIC IN 2033

- FIGURE 17 INDIA TO RECORD HIGHEST CAGR IN GLOBAL LITHIUM-ION BATTERY BETWEEN 2025 AND 2033

- FIGURE 18 LITHIUM-ION BATTERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 ELECTRIC CAR SALES, 2018-2024

- FIGURE 20 LITHIUM-ION BATTERY MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 21 LITHIUM-ION BATTERY MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 22 LITHIUM-ION BATTERY MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 23 LITHIUM-ION BATTERY MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 24 LITHIUM-ION BATTERY VALUE CHAIN ANALYSIS

- FIGURE 25 KEY PLAYERS IN LITHIUM-ION BATTERY ECOSYSTEM

- FIGURE 26 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, 2021-2033

- FIGURE 27 AVERAGE SELLING PRICE TREND OF LFP AND NMC BATTERIES, 2021-2024

- FIGURE 28 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, BY REGION, 2021-2024

- FIGURE 29 LITHIUM-ION BATTERY MANUFACTURING CAPACITY OF DIFFERENT COUNTRIES, 2022 VS. 2025 VS. 2030

- FIGURE 30 TRENDS/DISRUPTIONS INFLUENCING PLAYERS IN LITHIUM-ION BATTERY MARKET

- FIGURE 31 GLOBAL EV BATTERY INVESTMENT AND VC FUNDING SCENARIO, 2018-2024

- FIGURE 32 GLOBAL INVESTMENT AND PE/VC FUNDING SCENARIO FOR BATTERY ENERGY STORAGE SYSTEMS, 2020-2024

- FIGURE 33 LITHIUM-ION BATTERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 36 IMPORT SCENARIO FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 37 EXPORT SCENARIO FOR HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 38 LITHIUM-ION BATTERY MARKET: PATENT ANALYSIS, 2014-2024

- FIGURE 39 KEY AI USE CASES IN LITHIUM-ION BATTERY MARKET

- FIGURE 40 LITHIUM-ION BATTERY MARKET, BY TYPE

- FIGURE 41 LFP SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 PERFORMANCE PARAMETERS OF NMC BATTERIES

- FIGURE 43 PERFORMANCE PARAMETERS OF LFP BATTERIES

- FIGURE 44 PERFORMANCE PARAMETERS OF LCO BATTERIES

- FIGURE 45 PERFORMANCE PARAMETERS OF LTO BATTERIES

- FIGURE 46 PERFORMANCE PARAMETERS OF LMO BATTERIES

- FIGURE 47 PERFORMANCE PARAMETERS OF NCA BATTERIES

- FIGURE 48 LITHIUM-ION BATTERY MARKET, BY APPLICATION

- FIGURE 49 EVS SEGMENT TO HOLD PROMINENT MARKET SHARE IN 2033

- FIGURE 50 LITHIUM-ION BATTERY MARKET, BY REGION

- FIGURE 51 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL LITHIUM-ION BATTERY MARKET DURING FORECAST PERIOD

- FIGURE 52 ASIA PACIFIC TO RECORD HIGHEST CAGR FROM 2025 TO 2033

- FIGURE 53 NORTH AMERICA: LITHIUM-ION BATTERY MARKET SNAPSHOT

- FIGURE 54 US HELD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2024

- FIGURE 55 EUROPE: LITHIUM-ION BATTERY MARKET SNAPSHOT

- FIGURE 56 UK TO RECORD HIGHEST CAGR IN EUROPEAN LITHIUM-ION BATTERY MARKET DURING FORECAST PERIOD

- FIGURE 57 ASIA PACIFIC: LITHIUM-ION BATTERY MARKET SNAPSHOT

- FIGURE 58 CHINA TO CAPTURE LARGEST SHARE OF ASIA PACIFIC MARKET IN 2033

- FIGURE 59 EMERGING BATTERY POWERHOUSES: INDIA'S GIGAFACTORY MAP

- FIGURE 60 MIDDLE EAST TO EMERGE AS FASTEST-GROWING REGION IN LITHIUM-ION BATTERY MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 61 LITHIUM-ION BATTERY MARKET: REVENUE ANALYSIS, 2021-2024

- FIGURE 62 LITHIUM-ION BATTERY MARKET SHARE ANALYSIS, 2024

- FIGURE 63 COMPANY VALUATION

- FIGURE 64 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 65 BRAND COMPARISON

- FIGURE 66 LITHIUM-ION BATTERY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 67 LITHIUM-ION MARKET: COMPANY FOOTPRINT

- FIGURE 68 LITHIUM-ION BATTERY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 69 LITHIUM BATTERY STARTUP LANDSCAPE

- FIGURE 70 LG ENERGY SOLUTION: COMPANY SNAPSHOT

- FIGURE 71 SAMSUNG SDI: COMPANY SNAPSHOT

- FIGURE 72 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 73 BYD COMPANY LTD.: COMPANY SNAPSHOT

- FIGURE 74 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: COMPANY SNAPSHOT

- FIGURE 75 CALB: COMPANY SNAPSHOT

- FIGURE 76 ENERSYS: COMPANY SNAPSHOT

- FIGURE 77 EVE ENERGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 78 GOTION: COMPANY SNAPSHOT

- FIGURE 79 GS YUASA CORPORATION: COMPANY SNAPSHOT

- FIGURE 80 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 81 SK INNOVATION CO., LTD.: COMPANY SNAPSHOT

- FIGURE 82 TESLA: COMPANY SNAPSHOT

- FIGURE 83 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- FIGURE 84 SUNWODA ELECTRONIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 85 VARTA AG: COMPANY SNAPSHOT

With a CAGR of 10.3%, the global lithium-ion battery market is projected to grow from USD 194.66 billion in 2025 to USD 426.37 billion by 2033. Market growth will be driven by the accelerating shift toward electrification across transportation, industrial, and energy sectors, coupled with ongoing advancements in battery performance, energy density, and charging efficiency. Increasing adoption of electric vehicles and the need for high-performance energy storage systems to support grid stability and industrial operations are key growth drivers. Enhanced battery management systems and innovations in manufacturing processes contribute to improved safety, cost optimization, and lifecycle performance. Additionally, government-backed initiatives to build localized battery supply chains and support large-scale battery production fuel investment across the value chain. As industries prioritize sustainability, efficiency, and energy resilience, the demand for lithium-ion batteries is poised to rise significantly across diverse end-use applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Units Considered | Value (USD Billion) |

| Segments | By Battery Type, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Growing adoption of NMC batteries to support lithium-ion battery market growth"

Lithium nickel manganese cobalt (NMC) batteries are projected to grow significantly in the lithium-ion battery market, driven by their high energy density, long cycle life, and strong thermal stability. These batteries strike an optimal balance of performance and cost, making them ideal for electric vehicles, power tools, medical devices, and industrial equipment. Ongoing efforts to reduce cobalt content are enhancing affordability and addressing sustainability concerns. Their ability to deliver reliable, high-capacity power in compact form factors supports their expanding use across automotive and energy storage systems. As industries prioritize lightweight, efficient, and long-lasting energy solutions, NMC batteries are emerging as a versatile and scalable option, reinforcing their position as a core technology in the evolving battery landscape.

"Rising energy storage demand fuels expansion of lithium-ion battery market"

Energy storage is poised to be the fastest-growing application in the lithium-ion battery market, driven by escalating demand for reliable, flexible, and cost-efficient energy solutions. Increasing grid instability, challenges in peak load management, and the critical need for uninterrupted backup power fuel the large-scale deployment of lithium-ion battery storage systems across utilities and industrial sectors. These systems enable optimized energy management by storing excess power during low-demand periods and delivering it during peak consumption, which helps reduce operational costs and strengthen grid resilience. The inherent scalability, rapid response times, and long service life of lithium-ion batteries make them ideal for both front-of-the-meter and behind-the-meter applications. Accelerated investments in grid modernization, renewable energy integration, and smart infrastructure boost adoption. As energy storage becomes increasingly central to the transformation of power systems, lithium-ion batteries will continue to play a pivotal role in enabling sustainable and efficient energy management worldwide.

" Expanding EV adoption and renewable investments to drive Asia Pacific's dominance in lithium-ion battery market"

The Asia Pacific region is expected to register the highest CAGR in the lithium-ion battery market during the forecast period, fueled by rapid growth in electric vehicle adoption and significant investments in renewable energy projects. Leading countries such as China, India, Japan, and South Korea are aggressively expanding their battery manufacturing capacities and technological capabilities. Government incentives supporting clean energy and energy storage solutions further accelerate market growth. Additionally, the region benefits from a well-established supply chain, abundant raw material availability, and ongoing infrastructure development. Moreover, as this region undertakes major manufacturing of Li-ion batteries, the adoption rate has seen an upward trend due to the cost minimization of these batteries. These factors collectively position Asia Pacific to lead global demand and innovation in lithium-ion battery technologies, making it the dominant region in the market over the coming years.

Breakdown of primaries

A variety of executives from key organizations operating in the lithium-ion battery market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 -52%, Tier 2 - 31%, and Tier 3 - 17%

- By Designation: Directors - 31%, C-level Executives - 47%, and Others - 22%

- By Region: North America - 35%, Europe - 21%, Asia Pacific - 37%, and RoW - 7%

Note: Three tiers of companies are defined based on their total revenue as of 2024: tier 3 = revenue less than USD 500 million; tier 2 = revenue between USD 500 million and USD 5 billion; and tier 1 = revenue more than USD 5 billion. Other designations include sales, marketing, and product managers.

Major players profiled in this report are as follows: LG Energy Solution (South Korea), Samsung SDI (South Korea), Panasonic Holdings Corporation (Japan), BYD Company Ltd. (China), Contemporary Amperex Technology Co., Limited (China), BAK Power (China), CALB (China), CLARIOS (US), EnerSys (US), EVE Energy Co., Ltd. (China), Gotion, Inc. (China), GS Yuasa Corporation (Japan), Mitsubishi Electric Corporation (Japan), SK Innovation Co., Ltd. (South Korea), Tesla (US), Toshiba Corporation (Japan), Sunwoda Electronic Co., Ltd. (China), VARTA AG (Germany), AESC GROUP LTD. (Japan), Amperex Technology Limited (China), Amprius Technologies (US), Enovix Corporation (US), Farasis Energy (GanZhou) Co., Ltd. (China), Group14 Technologies, Inc. (US), Ipower Batteries Private Limited (India), Leclanche SA (Switzerland), LITHIUMWERKS (Netherlands), Lyten, Inc. (US), NexTech Batteries (US), PolyPlus Battery Company (US), Saft (France), Sila Nanotechnologies, Inc. (US) and SolarEdge (Israel). These leading companies possess a wide portfolio of products, establishing a prominent presence in established as well as emerging markets.

The study provides a detailed competitive analysis of these key players in the lithium-ion battery market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report segments the lithium-ion battery market based on battery type, application, and region. The battery type segment includes lithium nickel manganese cobalt oxide (NMC), lithium iron phosphate (LFP), lithium cobalt oxide (LCO), lithium titanate oxide (LTO), lithium manganese oxide (LMO), and lithium nickel cobalt aluminum oxide (NCA). The application segment comprises electric vehicles (EVs), energy storage, industrial, consumer electronics, medical, and other applications, which include aerospace, marine, and telecommunications. The market has been segmented into four regions: North America, Asia Pacific, Europe, and Rest of the World (RoW).

Reasons to Buy the Report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the lithium-ion battery market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

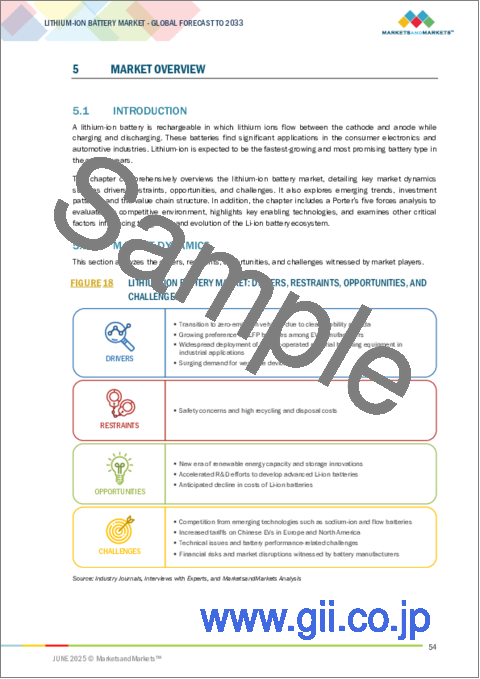

- Analysis of key Drivers (Shift toward zero-emission vehicles due to clean mobility agenda, growing preference for LFP batteries among electric vehicle manufacturers, widespread adoption of battery-operated material handling equipment is in industrial applications, growing adoption of wearable devices), Restraints (Safety concerns and high recycling and disposal costs), Opportunities (new era of renewable energy capacity and storage innovations, accelerated R&D efforts to advance lithium-ion battery technologies, significant decline in costs of Li-ion batteries), and Challenges (Competition from emerging technologies such as sodium-ion and flow batteries, increased tariffs on Chinese EVs in Europe and North America, technical issues and battery performance-related challenges, managing financial risks and market disruptions witnessed by global battery manufacturers) influencing the growth of the lithium-ion battery market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the lithium-ion battery market

- Market Development: Comprehensive information about lucrative markets by analyzing the lithium-ion battery market across varied regions

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the lithium-ion battery market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Contemporary Amperex Technology Co., Limited. (China), LG Energy Solution (South Korea), Panasonic Holdings Corporation (Japan), BYD Company Ltd. (China), and Samsung SDI (South Korea), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key primary interview participants

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.1.3.5 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.1.1 Estimation of market size using top-down approach

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Estimation of market size using bottom-up approach

- 2.2.1 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LITHIUM-ION BATTERY MARKET

- 4.2 LITHIUM-ION BATTERY MARKET, BY APPLICATION

- 4.3 LITHIUM-ION BATTERY MARKET, BY INSTALLED CAPACITY

- 4.4 LITHIUM-ION BATTERY MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- 4.5 LITHIUM-ION BATTERY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Transition to zero-emission vehicles due to clean mobility agenda

- 5.2.1.2 Growing preference for LFP batteries among EV manufacturers

- 5.2.1.3 Widespread deployment of battery-operated material handling equipment in industrial applications

- 5.2.1.4 Surging demand for wearable devices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Safety concerns and high recycling and disposal costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 New era of renewable energy capacity and storage innovations

- 5.2.3.2 Accelerated R&D efforts to develop advanced Li-ion batteries

- 5.2.3.3 Anticipated decline in costs of Li-ion batteries

- 5.2.4 CHALLENGES

- 5.2.4.1 Competition from emerging technologies such as sodium-ion and flow batteries

- 5.2.4.2 Increased tariffs on Chinese EVs in Europe and North America

- 5.2.4.3 Technical issues and battery performance-related challenges

- 5.2.4.4 Financial risks and market disruptions witnessed by battery manufacturers

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, 2021-2033

- 5.5.2 PRICING RANGE OF LITHIUM-ION BATTERY PACKS, BY KEY PLAYER, 2024

- 5.5.3 AVERAGE SELLING PRICE TREND OF LFP AND NMC BATTERIES, 2021-2024

- 5.5.4 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, BY REGION, 2021-2024

- 5.6 KEY INSIGHTS RELATED TO LITHIUM-ION BATTERY INDUSTRY

- 5.6.1 TOP LITHIUM-PRODUCING COUNTRIES

- 5.6.2 LITHIUM-ION BATTERY MANUFACTURING CAPACITY, BY COUNTRY, 2022 VS. 2025 VS. 2030

- 5.6.3 LIST OF CURRENTLY OPERATIONAL AND UPCOMING GIGAFACTORIES

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Lithium-sulfur batteries

- 5.9.1.2 Lithium-silicon batteries

- 5.9.1.3 Solid-state batteries

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Flow batteries

- 5.9.2.1.1 Vanadium flow batteries

- 5.9.2.1.2 Zinc-bromine flow batteries

- 5.9.2.2 Zinc batteries

- 5.9.2.2.1 Nickel-zinc batteries

- 5.9.2.2.2 Zinc-ion batteries

- 5.9.2.3 Sodium-ion batteries

- 5.9.2.4 Liquid-metal batteries

- 5.9.2.1 Flow batteries

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 Battery management systems

- 5.9.3.2 Energy management system

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 BARGAINING POWER OF SUPPLIERS

- 5.10.2 BARGAINING POWER OF BUYERS

- 5.10.3 THREAT OF NEW ENTRANTS

- 5.10.4 THREAT OF SUBSTITUTES

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 TOYOTA MATERIAL HANDLING HELPS REDUCE EQUIPMENT DOWNTIME BY REPLACING LEAD-ACID BATTERIES WITH LITHIUM-ION TECHNOLOGY

- 5.12.2 LITHION'S LIFEPO4 U-CHARGE BATTERY MODULES ALLOW MEDICAL EQUIPMENT MANUFACTURER INCREASE EFFICIENCY AND RELIABILITY OF MEDICAL DEVICES

- 5.12.3 EV MANUFACTURER ACHIEVES ENHANCED SAFETY AND IMPROVED RUN TIME BY REPLACING NIMH BATTERIES WITH LITHION'S LIFEPO4 BATTERY MODULES

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 850650)

- 5.13.2 EXPORT SCENARIO (HS CODE 850650)

- 5.14 PATENT ANALYSIS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 STANDARDS

- 5.17 IMPACT OF GEN AI/AI

- 5.17.1 INTRODUCTION

- 5.17.2 IMPACT OF AI ON LITHIUM-ION BATTERY MARKET

- 5.17.3 TOP USE CASES AND MARKET POTENTIAL

- 5.18 IMPACT OF 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON APPLICATIONS

6 MATERIALS USED IN LITHIUM-ION BATTERIES

- 6.1 INTRODUCTION

- 6.2 CATHODE

- 6.2.1 CATHODE MATERIALS FOR LITHIUM-ION BATTERIES

- 6.2.1.1 Lithium iron phosphate

- 6.2.1.2 Lithium cobalt oxide

- 6.2.1.3 Lithium nickel manganese cobalt

- 6.2.1.4 Lithium nickel cobalt aluminum oxide

- 6.2.1.5 Lithium manganese oxide

- 6.2.1 CATHODE MATERIALS FOR LITHIUM-ION BATTERIES

- 6.3 ANODE

- 6.3.1 ANODE MATERIALS FOR LITHIUM-ION BATTERIES

- 6.3.1.1 Natural graphite

- 6.3.1.2 Artificial graphite

- 6.3.1.3 Other anode materials

- 6.3.1 ANODE MATERIALS FOR LITHIUM-ION BATTERIES

- 6.4 ELECTROLYTE

- 6.5 SEPARATOR

- 6.6 CURRENT COLLECTOR

- 6.7 OTHER MATERIALS

7 LITHIUM-ION BATTERY MARKET, BY BATTERY TYPE

- 7.1 INTRODUCTION

- 7.2 NMC

- 7.2.1 LOWER SELF-HEATING RATE TO ACCELERATE ADOPTION

- 7.3 LFP

- 7.3.1 LONG LIFESPAN AND LOW MAINTENANCE REQUIREMENTS TO BOOST DEMAND

- 7.4 LCO

- 7.4.1 RISING USE IN PORTABLE ELECTRONICS TO DRIVE MARKET

- 7.5 LTO

- 7.5.1 HIGH SECURITY AND STABILITY DUE TO LOW OPERATING VOLTAGE TO BOOST DEMAND

- 7.6 LMO

- 7.6.1 ENHANCED THERMAL STABILITY AND SAFETY TO ACCELERATE ADOPTION

- 7.7 NCA

- 7.7.1 POWER AND AUTOMOTIVE INDUSTRIES TO CONTRIBUTE MOST TO MARKET GROWTH

8 LITHIUM-ION BATTERY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 EVS

- 8.2.1 GROWING ADOPTION OF ELECTRIC VEHICLES TO DRIVE MARKET

- 8.2.2 BY BATTERY CAPACITY

- 8.2.2.1 Below 50 kWh

- 8.2.2.1.1 Increasing consumer awareness regarding zero-emission transportation to boost demand

- 8.2.2.2 50-100 kWh

- 8.2.2.2.1 Rising demand for SUVs and electric vans to fuel segmental growth

- 8.2.2.3 Above 100 kWh

- 8.2.2.3.1 Growing use of high-capacity batteries in heavy-duty and industrial vehicles and commercial EVs to support market growth

- 8.2.2.1 Below 50 kWh

- 8.2.3 BY BATTERY TYPE

- 8.2.4 BY BATTERY FORM

- 8.2.4.1 Prismatic

- 8.2.4.1.1 Excellence in thermal management and long cycle lift to accelerate demand by EV manufacturers

- 8.2.4.2 Pouch

- 8.2.4.2.1 High power output and adaptability to varying vehicle architectures and designs to boost demand

- 8.2.4.3 Cylindrical

- 8.2.4.3.1 High energy density, effective thermal management, and ease of integration within battery packs to spur demand

- 8.2.4.1 Prismatic

- 8.2.5 BY VEHICLE TYPE

- 8.2.5.1 Passenger cars

- 8.2.5.1.1 Rising investments in electrification of transportation sector to support market growth

- 8.2.5.2 Vans/Light trucks

- 8.2.5.2.1 Government incentives for clean transportation to create lucrative opportunities

- 8.2.5.3 Medium & heavy trucks

- 8.2.5.3.1 Transition to sustainable logistics to fuel market growth

- 8.2.5.4 Buses

- 8.2.5.4.1 Increasing deployment of electric buses in urban areas to contribute to market growth

- 8.2.5.5 Off-highway vehicles

- 8.2.5.5.1 Tightening emission regulations and sustainability targets to spike demand

- 8.2.5.1 Passenger cars

- 8.2.6 BY REGION

- 8.3 ENERGY STORAGE

- 8.3.1 GROWING IMPLEMENTATION OF LI-ON BATTERIES IN RESIDENTIAL AND GRID-SCALE ENERGY STORAGE APPLICATIONS TO DRIVE MARKET

- 8.3.2 BY BATTERY CAPACITY

- 8.3.2.1 Below 30 kWh

- 8.3.2.1.1 Need for reliable backup power by homeowners to stimulate demand

- 8.3.2.2 30 kWh-10 MWh

- 8.3.2.2.1 Integration of renewable energy into commercial facilities and industrial plants to boost adoption

- 8.3.2.3 Above 10 MWh

- 8.3.2.3.1 Transition toward cleaner energy mix to create growth opportunities

- 8.3.2.1 Below 30 kWh

- 8.3.3 BY BATTERY TYPE

- 8.3.4 BY CONNECTION TYPE

- 8.3.5 BY END USE

- 8.3.5.1 Residential

- 8.3.5.1.1 Growing interest in residential battery storage for cost reduction and sustainable living to spike demand

- 8.3.5.2 Commercial & industrial

- 8.3.5.2.1 Surging use of UPS in data centers, factories, and hospitals to fuel market growth

- 8.3.5.3 Utilities

- 8.3.5.3.1 Increasing reliance of utility operators on energy storage systems to ensure reliable power supply to drive market

- 8.3.5.1 Residential

- 8.3.6 BY REGION

- 8.4 INDUSTRIAL

- 8.4.1 INCREASING DEPLOYMENT OF ELECTRIFIED SYSTEMS SUPPORTING AUTOMATED OPERATIONS TO PROPEL MARKET

- 8.4.2 BY TYPE

- 8.4.2.1 Material handling equipment

- 8.4.2.2 Mining equipment

- 8.4.2.3 Low-speed electric vehicles

- 8.4.2.4 Industrial tools

- 8.4.3 BY BATTERY CAPACITY

- 8.4.3.1 Below 50 kWh

- 8.4.3.1.1 Increasing deployment of LSEVs in warehouses, campuses, and manufacturing facilities to fuel segmental growth

- 8.4.3.2 50-100 kWh

- 8.4.3.2.1 Ability to fast charge and support multi-shift operations to increase adoption

- 8.4.3.3 Above 100 kWh

- 8.4.3.3.1 Excellence in meeting high energy demands and performing operations for extended hours to foster segmental growth

- 8.4.3.1 Below 50 kWh

- 8.4.4 BATTERY TYPE

- 8.4.5 BY REGION

- 8.5 CONSUMER ELECTRONICS

- 8.5.1 LONG LIFESPAN, HIGH ENERGY DENSITY, LOW SELF-DISCHARGE RATE TO INCREASE INTEGRATION INTO ELECTRONIC DEVICES

- 8.5.2 BY PRODUCT TYPE

- 8.5.2.1 Smartphones

- 8.5.2.1.1 Compact design and ability to support fast charging to boost adoption

- 8.5.2.2 Laptops & tablets

- 8.5.2.2.1 Prolonged runtime capability to support video streaming, gaming, and remote work tasks with fast-charging capabilities to stimulate demand

- 8.5.2.3 Wearables

- 8.5.2.3.1 Capacity to support extending wearable functionality to stimulate segmental growth

- 8.5.2.1 Smartphones

- 8.5.3 BY BATTERY CAPACITY

- 8.5.3.1 Below 10 Wh

- 8.5.3.1.1 Rising demand for ultra-portable devices, such as wireless earbuds, fitness trackers, smartwatches, to fuel segmental growth

- 8.5.3.2 10-30 Wh

- 8.5.3.2.1 Ability to meet prolonged usage and moderate energy requirements to foster segmental growth

- 8.5.3.3 Above 30 Wh

- 8.5.3.3.1 Surging demand for laptops, high-performance tablets, and portable speakers to accelerate market growth

- 8.5.3.1 Below 10 Wh

- 8.5.4 BY BATTERY TYPE

- 8.5.5 BY REGION

- 8.6 MEDICAL

- 8.6.1 ESCALATING NEED FOR RELIABLE POWER SUPPLY FOR LIFE-SAVING DEVICES TO FACILITATE ADOPTION

- 8.6.2 BY DEVICE TYPE

- 8.6.2.1 Portable & diagnostic devices

- 8.6.2.2 Wearable & implantable devices

- 8.6.3 BY BATTERY CAPACITY

- 8.6.3.1 Below 10 Wh

- 8.6.3.1.1 Rising use of pacemakers, neurostimulators, and continuous glucose monitors to drive market

- 8.6.3.2 10-50 Wh

- 8.6.3.2.1 Ability to support functions requiring intermittent higher power draws to stimulate demand

- 8.6.3.3 Above 50 Wh

- 8.6.3.3.1 Escalating requirement for portable ventilators, mobile imaging systems, and surgical power tools to contribute to segmental growth

- 8.6.3.1 Below 10 Wh

- 8.6.4 BY BATTERY TYPE

- 8.6.5 BY REGION

- 8.7 OTHER APPLICATIONS

- 8.7.1 TELECOMMUNICATIONS

- 8.7.1.1 Higher power density, faster charging times, longer lifespan, and minimal maintenance features to drive adoption

- 8.7.2 MARINE

- 8.7.2.1 Ability to resist high discharge currents, mechanical shocks, and vibrations to spur demand

- 8.7.3 AEROSPACE

- 8.7.3.1 Greater emphasis of aerospace companies on minimizing aircraft weight and maximizing power to accelerate demand

- 8.7.4 BY BATTERY TYPE

- 8.7.5 BY REGION

- 8.7.1 TELECOMMUNICATIONS

9 LITHIUM-ION BATTERY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Public-private alliances for clean energy future to expedite demand

- 9.2.3 CANADA

- 9.2.3.1 Abundance of cobalt, lithium, and nickel materials to create lucrative opportunities for battery providers

- 9.2.4 MEXICO

- 9.2.4.1 Increasing investments in lithium-ion battery production to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Clean energy goals to fuel battery demand

- 9.3.3 UK

- 9.3.3.1 Rising focus on generating electricity using renewables to foster market growth

- 9.3.4 FRANCE

- 9.3.4.1 Government-backed expansion of lithium and EV battery ecosystem to support market growth

- 9.3.5 ITALY

- 9.3.5.1 Government incentives promoting use of EVs to contribute to market growth

- 9.3.6 SPAIN

- 9.3.6.1 Push for clean mobility and clean energy to boost demand

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Strategic dominance in battery supply chain and EV manufacturing to accelerate market growth

- 9.4.3 JAPAN

- 9.4.3.1 Strong presence of major lithium-ion manufacturers to support market growth

- 9.4.4 INDIA

- 9.4.4.1 Lithium discoveries and rising EV adoption to unlock new opportunities

- 9.4.4.2 Recent strategic developments accelerating India's lithium-ion battery market growth

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Investment in advanced battery technologies to fuel market expansion

- 9.4.6 AUSTRALIA

- 9.4.6.1 Growing demand for cleaner and more affordable transportation to fuel market growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 ROW

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Bahrain

- 9.5.2.1.1 Economic diversification and clean energy initiatives to propel market

- 9.5.2.2 Kuwait

- 9.5.2.2.1 Vision 2035 and clean energy investments to support market growth

- 9.5.2.3 Oman

- 9.5.2.3.1 National Energy Strategy and clean mobility goals to unlock market potential

- 9.5.2.4 Qatar

- 9.5.2.4.1 E-mobility and smart energy initiatives under National Vision 2030 to foster market growth

- 9.5.2.5 Saudi Arabia

- 9.5.2.5.1 Heavy investments in EV manufacturing and renewable energy projects to drive market

- 9.5.2.6 UAE

- 9.5.2.6.1 Energy Strategy 2050 and gigascale storage initiative to create growth opportunities

- 9.5.2.7 Rest of Middle East

- 9.5.2.1 Bahrain

- 9.5.3 AFRICA

- 9.5.3.1 South Africa

- 9.5.3.1.1 Deployment of solar energy and demand for battery storage to drive market

- 9.5.3.2 Other African countries

- 9.5.3.1 South Africa

- 9.5.4 SOUTH AMERICA

- 9.5.4.1 Attractive destination for lithium-ion battery manufacturers to propel market

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 10.3 REVENUE ANALYSIS, 2021-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.4.1 OVERALL LITHIUM-ION BATTERY MARKET SHARE ANALYSIS

- 10.4.2 LITHIUM-ION BATTERY MARKET SHARE ANALYSIS FOR EV APPLICATION, BY INSTALLED CAPACITY

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Battery type footprint

- 10.7.5.4 Application footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.8.6 STARTUP LANDSCAPE ACROSS KEY SEGMENTS OF LITHIUM BATTERY VALUE CHAIN

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 LG ENERGY SOLUTION

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 SAMSUNG SDI

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 PANASONIC HOLDINGS CORPORATION

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.3.2 Expansions

- 11.1.3.3.3 Other developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 BYD COMPANY LTD.

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 BAK POWER

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Expansions

- 11.1.7 CALB

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.8 CLARIOS

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.9 ENERSYS

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.3.2 Expansions

- 11.1.10 EVE ENERGY CO., LTD.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Deals

- 11.1.11 GOTION

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.12 GS YUASA CORPORATION

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Deals

- 11.1.12.3.2 Other developments

- 11.1.13 MITSUBISHI ELECTRIC CORPORATION

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.14 SK INNOVATION CO., LTD.

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Deals

- 11.1.15 TESLA

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Developments

- 11.1.16 TOSHIBA CORPORATION

- 11.1.16.1 Business overview

- 11.1.16.2 Products/Solutions/Services offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Product launches

- 11.1.16.3.2 Deals

- 11.1.17 SUNWODA ELECTRONIC CO., LTD.

- 11.1.17.1 Business overview

- 11.1.17.2 Products/Solutions/Services offered

- 11.1.17.3 Recent developments

- 11.1.17.3.1 Deals

- 11.1.18 VARTA AG

- 11.1.18.1 Business overview

- 11.1.18.2 Products/Solutions/Services offered

- 11.1.1 LG ENERGY SOLUTION

- 11.2 OTHER PLAYERS

- 11.2.1 AESC GROUP LTD.

- 11.2.2 AMPEREX TECHNOLOGY LIMITED

- 11.2.3 AMPRIUS TECHNOLOGIES

- 11.2.4 ENOVIX CORPORATION

- 11.2.5 FARASIS ENERGY(GANZHOU)CO., LTD.

- 11.2.6 GROUP14 TECHNOLOGIES, INC.

- 11.2.7 IPOWER BATTERIES PRIVATE LIMITED

- 11.2.8 LECLANCHE SA

- 11.2.9 LITHIUMWERKS

- 11.2.10 LYTEN, INC.

- 11.2.11 NEXTECH BATTERIES

- 11.2.12 PPBC (POLYPLUS BATTERY COMPANY)

- 11.2.13 SAFT

- 11.2.14 SILA NANOTECHNOLOGIES INC.

- 11.2.15 SOLAREDGE

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS