|

|

市場調査レポート

商品コード

1581328

RCSビジネスメッセージングの世界市場:2024-2029年Global RCS Business Messaging Market: 2024-2029 |

||||||

|

|||||||

| RCSビジネスメッセージングの世界市場:2024-2029年 |

|

出版日: 2024年11月04日

発行: Juniper Research Ltd

ページ情報: 英文

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

RCSビジネスメッセージングのトラフィックは2025年に50%成長を示す見通し

| 主要統計 | |

|---|---|

| 2024年の総収益: | 18億米ドル |

| 2029年の総収益: | 87億米ドル |

| 2024~2029年の市場成長率: | 370% |

| 予測期間: | 2024-2029年 |

当調査レポートでは、RCS (リッチコミュニケーションサービス) ビジネスメッセージングの市場を調査し、Appleの市場参入が今後2年間の成長にどのような影響を与えるかを中心に、同成長市場を牽引する主要要因について包括的かつ洞察に満ちた分析を行っています。本レポートにより、ネットワーク事業者やメッセージングベンダーのステークホルダーは、市場の成長に影響を与える主な要因や、来年の主な投資機会を理解することができます。

当レポートには、RCSビジネスメッセージングの導入と今後の成長に関する市場予測へのアクセス、最新の市場動向と機会に焦点を当てた詳細な調査、RCSメッセージングの主要企業の分析を含む競合リーダーボードなどが含まれています。

主な特徴

- 市場力学:RCSビジネスメッセージング市場の展望に関する詳細な洞察を提供し、Appleの市場参入の影響など、今後の市場成長の主な促進要因を評価します。来年のRCSビジネスメッセージングの成長に影響を与える主要要因として、Google Jibeによる事業者のオンボード化、ブランド検証プロセス、サードパーティのOTTメッセージングプラットフォームとの競合などを取り上げています。また、認証、トランザクション、プロモーション、会話など、さまざまなメッセージングタイプを調査し、それぞれの主な機会を検証しています。さらに、60カ国の市場機会を評価し、メッセージングベンダーにとって来年注目すべき国を特定する国別準備度指標も含まれています。

- 主な要点と戦略的提言RCSビジネスメッセージング市場における主な発展機会、業界動向、知見を詳細に分析し、ステークホルダーに対する主要な戦略的提言を掲載しています。

- ベンチマーク業界予測:RCSビジネスメッセージングの市場規模と予測には、年間送信総数と収益の5年予測が含まれます。また、収益を課金モデル別に分割しており、課金モデルには、メッセージごとの課金、セッションベース、アクセスベース、コールツーアクションベースの課金モデルが含まれます。同予測では、RCSビジネスメッセージングのトラフィックを4つの主要使用事例に分類している:

- 認証

- 会話

- プロモーション

- トランザクション

サンプル

市場データ・予測:PDFレポート:

市場動向・戦略:レポート:

市場データ・予測

当調査スイートには、54の表と24,000を超えるデータポイントの市場予測データ一式へのアクセスが含まれています。調査スイートの指標には以下が含まれます:

- RCSビジネスメッセージの総数:

- 認証

- トランザクション

- プロモーション

- 会話

- RCSビジネスメッセージの総収益:課金モデル別

- メッセージごとの課金(シングルRCS/ベーシックRCS)

- セッションベース

- アクセスベース

- コールツーアクションベース

Juniper Research Interactive Forecast Excelには以下の機能があります:

- 統計分析:データ期間中の全地域・国について表示される特定の指標を検索できるのが特長です。グラフは簡単に変更でき、クリップボードへのエクスポートも可能です。

- 国別データツール:このツールでは、予測期間中のすべての主要地域と国の指標を見ることができます。検索バーで表示される指標を絞り込むことができます。

- 国別比較ツール:ユーザーは国を選択し、特定の国についてそれぞれを比較することができます。このツールにはグラフをエクスポートする機能が含まれています。

- What-if分析:5つのインタラクティブなシナリオを通じて、ユーザーは予測の前提条件と比較することができます。

目次

市場動向・戦略

第1章 主要動向・戦略的推奨事項

- 主要動向

- 戦略的推奨事項

第2章 将来の市場見通し

- RCSビジネスメッセージング:イントロダクション

- 今後の市場の見通し

- 市場促進要因

- 市場の課題

- RCSの利用事例

- 認証・検証

- リマインダー・通知

- プロモーションメッセージ

- 会話ベースの利用事例

- RCS収益化

- メッセージごとの課金

- セッションベース

- コールツーアクションベース

- アクセスベース

第3章 RCSビジネスメッセージ詐欺の将来

- RCSビジネスメッセージングにおける詐欺:将来的な影響

第4章 国別準備指数

- RCSビジネスメッセージング:国別準備指数

- 重点市場

- 成長市場

- 飽和市場

- 新興国市場

競合リーダーボード

第1章 Juniper Research:競合リーダーボード

第2章 ベンダープロファイル

- RCSビジネスメッセージング:企業プロファイル

- Cisco Webex

- CM.com

- Comviva

- Esendex

- GMS (Global Message Services)

- Gupshup

- Infobip

- Interop Technologies

- LINK Mobility

- Messaggio

- Route Mobile

- Sinch

- Soprano Design

- Syniverse

- Tata Communications

- Twilio

- Vonage

- Juniper Researchリーダーボード評価手法

- 制限と解釈

データ・予測:目次

第1章 重要ポイント・市場予測

- RCSビジネスメッセージング市場の概要と将来の展望

- 予測手法

- RCS対応加入者

- RCSアクティブ加入者

- 送信されたRCSビジネスメッセージ数

- RCSビジネスメッセージング収益

第2章 収益化モデル:メッセージごとの課金

- 収益化:メッセージごとの課金

- 予測手法

- メッセージごとの課金で収益化されたRCSビジネスメッセージの数

- メッセージごとの課金で収益化されたRCSビジネスメッセージの収益

第3章 収益化モデル:セッションベース

- 収益化:セッションベース

- 予測手法

- セッションベースで収益化されたRCSビジネスメッセージの数

- セッションベースで収益化されたRCSビジネスメッセージの収益

第4章 その他の収益化モデル

- 収益化:その他

- 予測手法

- その他の手法で収益化されたRCSビジネスメッセージの数

- その他の手法で収益化されたRCSビジネスメッセージの収益

'RCS Business Messaging Traffic to Grow 50% in 2025'

| KEY STATISTICS | |

|---|---|

| Total revenue in 2024: | 1.8bn |

| Total revenue in 2029: | $8.7bn |

| Market growth 2024-2029: | 370% |

| Forecast period: | 2024-2029 |

Overview

Our latest "RCS (Rich Communication Services) Business Messaging" research suite comprises comprehensive and insightful analysis of key factors driving this advancing market, with focus on how Apple's entrance into the market will impact growth over the next two years. The report enables stakeholders from network operators and messaging vendors to understand the major factors influencing growth in the market, and where the key investment opportunities are for RCS business messaging next year.

The RCS business messaging market report includes several different options that can be purchased separately, including access to a market forecast of the adoption and future growth of the RCS business messaging market; a detailed study highlighting the latest market trends and opportunities, and a Competitor Leaderboard document containing an analysis of the major players in the RCS messaging space. The coverage can also be purchased as a full research suite, containing all of these elements, and including a substantial discount.

The study provides a critical tool for stakeholders in the telecoms industry for navigating this rapidly growing market; allowing vendors to shape their future strategy with RCS business messaging monetisation, and capitalise on emerging opportunities as RCS takes off in markets where Apple has a high market share. Its extensive coverage makes this RCS business messaging market analysis research suite an incredibly valuable resource for examining the future of this market as it reaches an inflection point.

Key Features

- Market Dynamics: Provides detailed insight into the outlook of the RCS business messaging market; assessing the key drivers to future market growth, including the impact of Apple's entrance into the market. It addresses the key factors that will impact the growth of RCS business messaging next year, including operator onboarding with Google Jibe, the brand verification process, and competition from third-party OTT (over-the-top) messaging platforms. The research also explores the different messaging types, including authentication, transactional, promotional, and conversational, and examines the key opportunities for each. Moreover, it includes a Country Readiness Index, which assesses the market opportunities across 60 countries, identifying the countries which must be of focus for messaging vendors next year.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities, industry trends and findings within the RCS business messaging market; accompanied by key strategic recommendations for stakeholders.

- Benchmark Industry Forecasts: The market size and forecasts for RCS business messaging include 5-year forecasts for total number of RCS business messages sent per annum, and total revenue from RCS business messaging. It also splits RCS business messaging revenue by billing model, including the pay-per-message, session-based, access-based and call-to-action-based billing model. The forecast breaks down RCS business messaging traffic into four key use cases:

- Authentication

- Conversational

- Promotional

- Transactional

- Juniper Research Competitor Leaderboard: Key industry player capability and capacity assessment for 17 RCS Business Messaging vendors, via the Juniper Research Competitor Leaderboard.

SAMPLE VIEW

Market Data & Forecasts PDF Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations and a walk-through of the forecasts.

Market Trends & Strategies Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasts

The market-leading research suite for the RCS Business Messaging market includes access to the full set of market forecast data of 54 tables and over 24,000 datapoints. Metrics in the research suite include:

- Total Number of RCS Business Messages, split into:

- Authentication

- Transactional

- Promotional

- Conversational

- Total Revenue from RCS Business Messages, split by billing model:

- Pay-per-message (Single RCS/ Basic RCS)

- Session-based

- Access-based

- Call-to-action-based

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all key regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select countries and compare each of them for specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via five interactive scenarios.

Market Trends & Strategies Report

This market study examines the "RCS Business Messaging" landscape in detail, assessing the impact of Apple supporting RCS on the growth of RCS business messaging in 2025. The report delivers an in-depth analysis of the strategic opportunities for vendors; addressing key challenges impacting future growth, and how stakeholders must navigate these to maximise growth of the RCS business messaging market next year.

It also evaluates country level opportunities for RCS business messaging growth via Juniper Research's Country Readiness Index, identifying the key markets that messaging vendors should focus on next year.

Competitor Leaderboard Report

This RCS business messaging market study includes a Competitor Leaderboard report, which provides detailed evaluation and market positioning of 17 RCS business messaging vendors. The vendors are positioned as established leaders, leading challengers or disruptors and challengers based on product and capability assessments.

Juniper Research Competitor Leaderboard for RCS Business Messaging, including key players:

|

|

Interop Technologies:

|

|

This document is centred around the Juniper Research Competitor Leaderboard; a vendor positioning tool that provides an at-a-glance view of the competitive landscape in a market, backed by a robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Trends & Strategic Recommendations

- 1.1. Key Trends

- 1.2. Strategic Recommendations

2. Future Market Outlook

- 2.1. Introduction to RCS Business Messaging

- Figure 2.1: SMS vs RCS: Key Features & Capabilities

- 2.2. Future Market Outlook

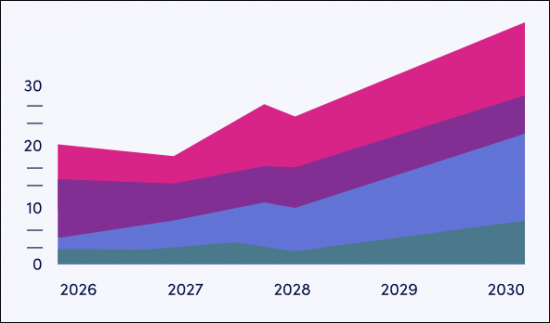

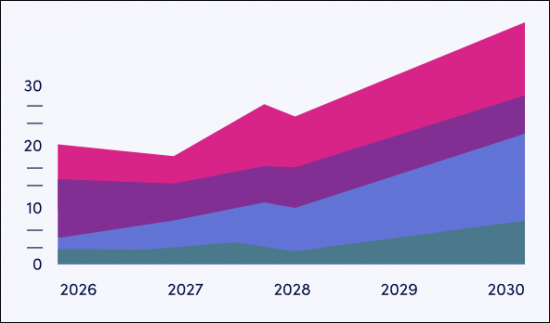

- Figure 2.2: Total Revenue from RCS Business Messaging ($m), 2024-2029, Split by 8 Key Regions

- 2.2.1. Market Drivers

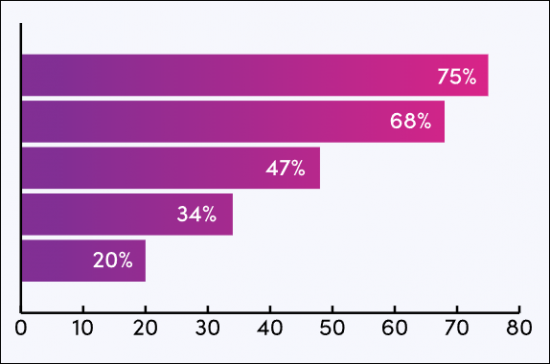

- i. Apple's Launch of RCS in iOS 18 Update

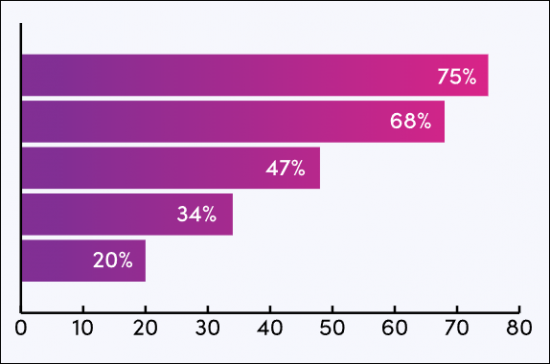

- Figure 2.3: Proportion of Mobile Subscribers Which Were RCS-capable in 2023 Key Markets (%)

- Figure 2.4: Total Number of RCS-Capable Subscribers in the US (m), 2023 vs 2024

- ii. Basic RCS Messages

- iii. Increased Demand for Conversational Use Cases

- i. Apple's Launch of RCS in iOS 18 Update

- 2.2.2. Market Challenges

- i. Brand Verification Process

- ii. Competition from OTT Messaging Platforms

- iii. Fraud

- iv. Unity Amongst Operators

- 2.3. RCS Use Cases

- 2.3.1. Authentication & Verification

- Figure 2.5: Example of a Verification Message

- i. Strengths

- ii. Weaknesses

- iii. Opportunities

- iv. Threats

- 2.3.2. Reminders & Notifications

- Figure 2.6: Example of a Transactional Message

- i. Strengths

- ii. Weaknesses

- iii. Opportunities

- iv. Threats

- Figure 2.6: Example of a Transactional Message

- 2.3.3. Promotional Messages

- Figure 2.7: Example Promotional RCS Business Message

- i. Strengths

- ii. Weaknesses

- iii. Opportunities

- iv. Threats

- Figure 2.7: Example Promotional RCS Business Message

- 2.3.4. Conversational-based Use Cases

- Figure 2.8: Example RCS Conversation

- i. Strengths

- ii. Weaknesses

- iii. Opportunities

- iv. Threats

- Figure 2.8: Example RCS Conversation

- 2.3.1. Authentication & Verification

- 2.4. RCS Monetisation

- 2.4.1. Pay-per-message

- 2.4.2. Session-based

- 2.4.3. Call-to-action

- 2.4.4. Access-based

3. Future of RCS Business Messaging Fraud

- 3.1. Future Impact of Fraud on RCS Business Messaging

- Table 3.1: The Role of RCS in Preventing Types of Fraud Observed Over SMS

- 3.1.1. Emerging Types of Messaging Fraud

4. Country Readiness Index

- 4.1. RCS Business Messaging Country Readiness Index

- Figure 4.1: Countries in Each Region

- Table 4.2: Juniper Research RCS Business Messaging Country Readiness Index: Scoring Criteria

- Table 4.4: RCS Business Messaging Country Readiness Index: Market Segments37

- 4.2. Focus Markets

- 4.2.1. High Acceptance of A2P SMS Will Increase Transition Rate to RCS Business Messaging

- Figure 4.5: Average A2P SMS Message per Mobile Subscriber per Month in 2024 for Key Markets: US, Canada & France

- 4.2.2. Lack of Competition from OTT Messaging Players Will Create Demand for an Alternative Rich Media Messaging Channel

- Figure 4.6: Penetration of OTT Messaging vs RCS Messaging in France in 2024 (%)

- 4.2.3. ROI for RCS Business Messaging to Enterprises

- Figure 4.7: Average Revenue per RCS business message in Key Markets in 2024 ($)

- 4.2.4. Support for Chatbots Will Create Demand for Conversational Use Cases

- 4.2.1. High Acceptance of A2P SMS Will Increase Transition Rate to RCS Business Messaging

- 4.3. Growth Markets

- 4.3.1. A High Smartphone Penetration Will Create High Opportunity for Future Growth

- Figure 4.8: Smartphone Penetration in Key Growth Markets (%)

- 4.3.2. Successful Implementation of RCS to Date Will Encourage Adoption by Other Brands

- 4.3.1. A High Smartphone Penetration Will Create High Opportunity for Future Growth

- 4.4. Saturated Markets

- 4.4.1. Several Factors Create a Low Demand for RCS Business Messaging

- 4.5. Developing Markets

- 4.5.1. Low Smartphone Penetration Resulting in Low Reach of RCS

- Figure 4.9: Average Smartphone Penetration in Focus and Developing Markets

- 4.5.2. Low Mobile Messaging Acceptance

- Figure 4.10: Average A2P SMS Sent per Mobile Subscriber in Key Developing Markets in 2024

- Table 4.11: Juniper Research Country Readiness Index Heatmap: North America

- Table 4.12: Juniper Research Country Readiness Index Heatmap: Latin America

- Table 4.13: Juniper Research Country Readiness Index Heatmap: West Europe

- Table 4.14: Juniper Research Country Readiness Index Heatmap: Central & East Europe

- Table 4.15: Juniper Research Country Readiness Index Heatmap: Far East & China

- Table 4.16: Juniper Research Country Readiness Index Heatmap: Indian Subcontinent

- Table 4.17: Juniper Research Country Readiness Index Heatmap: Rest of Asia Pacific

- Table 4.18: Juniper Research Country Readiness Index Heatmap: Africa & Middle East

- 4.5.1. Low Smartphone Penetration Resulting in Low Reach of RCS

Competitor Leaderboard

1. Juniper Research Competitor Leaderboard

- 1.1. Why Read This Report

- Table 1.1: Juniper Research Leaderboard: RCS Business Messaging Vendors Included & Product Portfolio

- Figure 1.2: Juniper Research Competitor Leaderboard: RCS Business Messaging Vendors

- Table 1.3: Juniper Research Leaderboard: RCS Business Messaging Vendors & Positioning

2. Vendor Profiles

- 2.1. RCS Business Messaging: Company Profiles

- 2.1.1. Cisco Webex

- i. Corporate Information

- Table 2.1: Cisco's Key Acquisitions, 2023 - Present

- Table 2.2: Cisco's Selected Financial Information ($bn), 2021-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Recommendations

- i. Corporate Information

- 2.1.2. CM.com

- i. Corporate Information

- Table 2.3: Acquisitions Made by CM.com, 2021-Present

- Table 2.4: CM.com's Select Financial Information (Euro-m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partners

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate Information

- 2.1.3. Comviva

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Recommendations

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.4. Esendex

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.5. GMS (Global Message Services)

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partners

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.6. Gupshup

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.7. Infobip

- i. Corporate Information

- Table 2.5: Infobip's Acquisitions - April 2021 to Present

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate Information

- 2.1.8. Interop Technologies

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partners

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.9. LINK Mobility

- i. Corporate Information

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.10. Messaggio

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partners

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths and Strategic Opportunities

- 2.1.11. Route Mobile

- i. Corporate

- Table 2.6: Route Mobile's Financial Information (Indian Rupee Cr), FY 2021-22 - FY 2023-

- ii. Geographical Spread

- iii. Key Clients & Strategic Partners

- iv. High-level View of Offerings

- Figure 2.8: Route Mobile RBM Managed Services Overview

- i. Corporate

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.12. Sinch

- i. Corporate

- Table 2.9: Sinch's Most Recent Acquisitions, 2020-2021

- Table 2.10: Sinch's Select Financial Information (SEKm), 2022-2023

- Table 2.9: Sinch's Most Recent Acquisitions, 2020-2021

- ii. Geographical Spread

- iii. Key Clients & Strategic Partners

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.13. Soprano Design

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partners

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.14. Syniverse

- i. Corporate

- ii. Geographical Spread

- iii. Key Customers & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.15. Tata Communications

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.16. Twilio

- i. Corporate Information

- Table 2.13: Twilio's Acquisitions Nov 2019-Dec 2023

- Table 2.14: Twilio's Revenue Information 2021-Present

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate Information

- 2.1.17. Vonage

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.1. Cisco Webex

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.3. Limitations & Interpretations

Data & Forecasting Table of Contents

1. Key Takeaways & Market Forecasts

- 1.1. RCS Business Messaging Market Summary & Future Outlook

- 1.1.1. RCS Business Messaging Market Summary Forecast Methodology

- Figure 1.1: Forecast Methodology: RCS Business Messaging Market Summary

- 1.1.2. RCS-Capable Subscribers

- Figure & Table 1.2: Total Number of RCS-capable Subscribers (m), Split by 8 Key Regions, 2023-2029

- 1.1.3. RCS Active Subscribers

- Figure & Table 1.3: Total Number of RCS Active Subscribers (m), Split by 8 Key Regions, 2023-2029

- 1.1.4. Number of RCS Business Messages Sent

- Figure & Table 1.4: Total Number of RCS Business Messages (m), Split by Type Message, 2023-2029

- 1.1.5. RCS Business Messaging Revenue

- Figure & Table 1.5: Total Revenue from RCS Business Messaging Traffic ($m), Split by 8 Key Regions, 2023-2029

- 1.1.1. RCS Business Messaging Market Summary Forecast Methodology

2. Price-Per-Message Monetisation

- 2.1. Price-per-message Monetisation

- 2.1.1. Price-per-message Forecast Methodology

- Figure 2.1: 2.1.1. Price-per-Message Forecast Methodology

- 2.1.2. Number of RCS Business Messages Monetised by Pay-per-message

- Figure & Table 2.2: Total Number of RCS Business Messages Monetised by the Pay-per-message Model (m), Split by Basic and Single RCS Message, 2024-2029

- 2.1.3. Revenue from RCS Business Messages Monetised by the Pay-per-message Model

- Figure & Table 2.3: Total Revenue from RCS Business Messaging Monetised via the Pay-per-message Model ($m), Split by 8 Key Regions, 2023-2029

- 2.1.1. Price-per-message Forecast Methodology

3. Session-based Monetisation Model

- 3.1. Session-based Monetisation Model

- 3.1.1. Session-based Monetisation Forecast Methodology

- Figure 3.1: Session-based Monetisation Model Forecast Methodology

- 3.1.2. Number of RCS Business Messages Monetised by the Session-based Model

- Figure & Table 3.2: Total Number of RCS Business Messages that are Monetised via the Session-based Model (m), Split by 8 Key Regions, 2023-2029

- 3.1.3. Revenue from Session-based Monetisation

- Figure & Table 3.3: Total Revenue from RCS Business Messaging Sessions ($m), Split by 8 Key Regions, 2023-2029

- 3.1.1. Session-based Monetisation Forecast Methodology

4. Other Monetisation Models

- 4.1. Other RCS Business Messaging Monetisation Models

- 4.1.1. Other RCS Business Messaging Monetisation Models Forecast Methodology

- Figure 4.1: Access-based Monetisation Model Forecast Methodology

- Figure 4.2: CTA Monetisation Model Forecast Methodology

- 4.1.2. Number of RCS Business Messages Monetised by Other Models

- Figure & Table 4.3: Total Number of RCS Business Messages Delivered via Other Monetisation Models (m), Split by the Access-based & CTA Models, 2023-2029

- 4.1.3. Revenue from Other Monetisation Models

- Figure & Table 4.4: Total Revenue from Other RCS Business Messaging Monetisation Models ($m), Split out by the Access-based and CTA Models, 2023-2029

- 4.1.1. Other RCS Business Messaging Monetisation Models Forecast Methodology