|

|

市場調査レポート

商品コード

1804688

RTE(調理済み)冷凍食品市場:材料、料理タイプ、包装タイプ、流通チャネル、エンドユーザー別 - 2025年~2030年の世界予測Ready-to-Eat Frozen Food Market by Ingredient, Cuisine Type, Packaging Type, Distribution Channel, End User - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| RTE(調理済み)冷凍食品市場:材料、料理タイプ、包装タイプ、流通チャネル、エンドユーザー別 - 2025年~2030年の世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 199 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

RTE(調理済み)冷凍食品市場の2024年の市場規模は452億米ドルで、2025年には484億8,000万米ドルに成長し、CAGR 7.75%で推移し、2030年までに707億7,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 452億米ドル |

| 推定年2025 | 484億8,000万米ドル |

| 予測年2030 | 707億7,000万米ドル |

| CAGR(%) | 7.75% |

急速に進化する消費者環境におけるRTE(調理済み)冷凍食品の将来を形作る新たな力学と市場勢力

RTE(調理済み)冷凍食品セクターは、技術革新、消費者のライフスタイルの進化、グローバルなサプライ・チェーンの変革という、かつてない合流を経験しています。利便性と時間効率を常に追求する現代の消費者は、最小限の労力で調理できる高品質で栄養価の高い食事を期待しています。この需要の急増は、都市化の傾向、共働き世帯、ワークライフバランス重視の高まりによってさらに推進され、その結果、多忙な個人や家族が、味や健康上の利点に妥協しない信頼できる食事ソリューションを求めるようになっています。

消費者の嗜好に後押しされ、RTE(調理済み)冷凍食品の状況を再定義する変革的変化テクノロジーと持続可能性の必要性

消費者の嗜好は、食事制限、グローバルな風味プロファイル、環境への影響への関心の高まりとともに、オーダーメイドの体験へと劇的にシフトしています。植物性食品や菜食主義者向けのミールソリューションは、健康や持続可能性に対する幅広い関心を反映し、ニッチセグメントを越えて主流商品となっています。これと並行して、急速冷凍、高圧処理、ガス置換包装などの技術が、食感、味、栄養価を大規模に維持するために活用されています。

米国の2025年関税調整が輸入コストに及ぼす遠大な影響の評価サプライチェーンと市場力学

米国が2025年に発動した関税調整により、複数の製品カテゴリー、特に輸入原料や包装部品に依存する製品カテゴリーに大きなコスト圧力がもたらされました。特殊タンパク質、穀物、エキゾチックなスパイスを海外のサプライヤーに依存しているメーカーは、投入コストの増加に直面し、調達戦略の再評価を促しています。これに対して業界各社は、変動する貿易関税の影響を軽減するため、ニアショアリングや国内生産者との戦略的提携を模索しています。

詳細なセグメンテーション分析により、多様な市場セグメントにわたる成分包装の流通チャネルとエンドユーザーの嗜好に関する重要な洞察が明らかになった

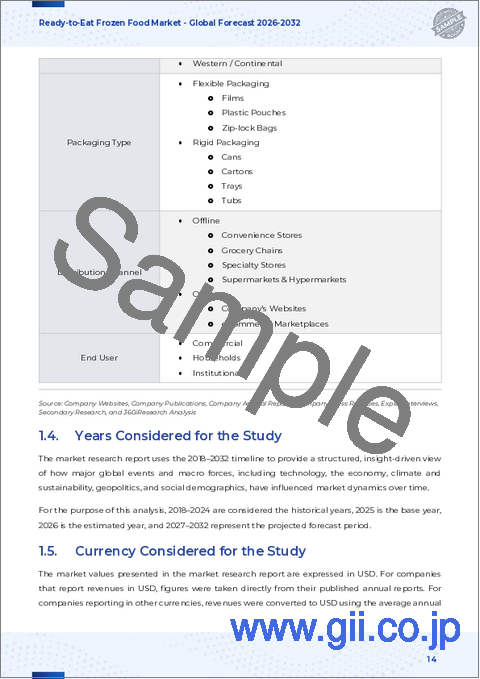

詳細なセグメンテーション分析により、原材料の選択が配合の複雑さ、栄養価の位置づけ、消費者への訴求力に大きな影響を及ぼすことが明らかになりました。ノンベジタリアン、ビーガン、ベジタリアンの各製品を成分別にセグメント化する場合、生産者は異なる味覚プロファイルと健康強調表示に合わせて、調達、加工、マーケティングアプローチを調整する必要があります。同時に、アジア料理、インド料理、ラテンアメリカ料理、中東料理、西洋料理、コンチネンタル料理といった伝統的な料理の種類を検討することで、それぞれのサブカテゴリーにおける消費者の期待や価格への敏感さが浮き彫りになります。

南北アメリカ、欧州、中東・アフリカ、アジア太平洋地域にわたる地域市場の相違と戦略的機会の探求

地理的地域は、消費者行動、規制の枠組み、サプライチェーンのインフラにおいて、それぞれ異なるパターンを示しています。南北アメリカでは、確立されたコールドチェーン・ロジスティクスと成熟した小売ネットワークが迅速な製品流通を可能にする一方、消費者の嗜好の変化が健康志向や利便性を重視した製品のイノベーションを後押ししています。一方、欧州、中東・アフリカでは市場の成熟度がモザイク状に変化しており、西欧ではクリーンラベルや高級惣菜が支持され、中東ではハラール認証やエスニック風の料理への需要が高まっています。

競合情勢の評価は、冷凍食品における主要業界プレイヤーの戦略的取り組みと提携、およびイノベーションのマイルストーンを浮き彫りにします

主要な業界参加者は、新興の消費者層を取り込み、流通網を強化するために、合併、買収、合弁事業を通じて戦略的にポートフォリオを拡大しています。大手多国籍企業数社は、オーガニック、非遺伝子組み換え、アレルゲンフリーの原材料を使用したプレミアム調理済み食品ラインを発表しています。共同製造業者やサードパーティーのロジスティクス・パートナーとのコラボレーションは、生産規模を拡大し、輸送ネットワークを最適化する上で不可欠となっています。

市場競争に打ち勝ち、成長レバーを活用し、持続可能な競合優位性を推進するための、業界リーダーのための実行可能な戦略ガイダンス

業界リーダーは、変動する貿易政策や原材料の入手可能性に適応できる機敏なサプライチェーンの開発を優先すべきです。二重調達フレームワークとニアショアパートナーシップの確立は、関税の影響を軽減し、リードタイムを短縮するのに役立ちます。さらに、賞味期限を延ばし、持続可能性を向上させる先進パッケージング材料への投資は、環境意識の高い消費者の共感を呼び、企業の責任目標をサポートします。

偏りのないマーケット・インテリジェンスを確保するための、専門家別インタビューと厳密な検証プロトコルを含む、堅牢なデータ収集による包括的な調査アプローチ

この調査は、2次データ分析と業界のベテランによる1次洞察を組み合わせた多層的なアプローチを活用しています。イントロダクション、現在の市場力学をマッピングし、主要動向を特定するために、公的提出書類、政府刊行物、評判の高い業界誌を対象とした広範な机上調査を実施しました。その後、サプライチェーンのエグゼクティブ、イノベーション・マネジャー、小売店のバイヤーとの定性的インタビューにより、文脈のニュアンスを提供し、新たな仮説を検証しました。

将来の戦略的意思決定プロセスに情報を提供する、RTE(調理済み)冷凍食品市場の動向の課題と展望の結論的統合

RTE(調理済み)冷凍食品業界は、急速な技術革新、消費者の需要の変化、規制状況の進化を特徴とする重大な岐路に立っています。コスト圧力を緩和し、供給の継続性を確保する上で、多様な調達先と適応性のあるパッケージング・ソリューションによって推進されるオペレーションの弾力性が重要な役割を果たすことになります。同時に、クリーンラベル処方、グローバルなフレーバー体験、食生活のカスタマイズなど、ターゲットを絞った製品の差別化が、ますます混雑するマーケットでのブランド競争力を左右します。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 地元の味を取り入れた植物由来の冷凍食品に対する消費者の嗜好が急増

- 近代的な貿易スーパーマーケットやオンラインプラットフォームを通じた流通チャネルの拡大

- イスラム教徒の消費者向けのハラール認証冷凍調理済み食品の需要増加

- ハイパーマーケットにスマート冷凍庫技術を導入し、商品の視認性を向上

- 地元産の食材を使用することで、国民の誇りをアピールし、地元の農家を支援する

- 健康への懸念の高まりに対応して、低ナトリウム、低脂肪の冷凍食品への移行

- 食品メーカーとeコマース大手のフラッシュセールにおける連携強化

- 冷凍コンビニエンス食品における持続可能かつリサイクル可能な包装ソリューションの採用増加

- マレーシア料理の融合を特徴とする高級な職人手作り冷凍食品の登場

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 RTE(調理済み)冷凍食品市場:材料別

- 非ベジタリアン

- ビーガン

- ベジタリアン

第9章 RTE(調理済み)冷凍食品市場:料理タイプ別

- アジア料理

- インド料理

- ラテンアメリカ料理

- 中東料理

- ウエスタン/ コンチネンタル料理

第10章 RTE(調理済み)冷凍食品市場:包装タイプ別

- 軟質包装

- フィルム

- プラスチックポーチ

- ジップロックバッグ

- 硬質包装

- 缶

- カートン

- トレイ

- タブ

第11章 RTE(調理済み)冷凍食品市場:流通チャネル別

- オフライン

- コンビニエンスストア

- 食料品チェーン

- 専門店

- スーパーマーケットとハイパーマーケット

- オンライン

- 会社のウェブサイト

- 電子商取引マーケットプレイス

第12章 RTE(調理済み)冷凍食品市場:エンドユーザー別

- 商業

- 家庭

- 公共公益機関

第13章 南北アメリカのRTE(調理済み)冷凍食品市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第14章 欧州・中東・アフリカのRTE(調理済み)冷凍食品市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第15章 アジア太平洋地域のRTE(調理済み)冷凍食品市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第16章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Ajinomoto Co., Inc.

- Bellisio Foods, Inc.

- BRF S.A.

- Campbell Soup Company

- CP Malaysia

- EB Frozen Food Sdn Bhd

- General Mills Inc.

- Grupo Bimbo

- Iceland Foods Ltd.

- JBS S.A.

- Kawan Food Manufacturing Sdn Bhd

- Kellogg Company

- Kidfresh

- Maruha Nichiro

- McCain Foods Limited

- Nestle S.A

- Nissin Foods Co., Inc.

- OOB Organic

- Simplot Global Food, LLC

- TANVI FOODS LTD.

- The Kraft Heinz Company

- Tyson Foods Inc.

- Unilever PLC

- Vandemoortele NV

- Wawona Frozen Foods

第17章 リサーチAI

第18章 リサーチ統計

第19章 リサーチコンタクト

第20章 リサーチ記事

第21章 付録

LIST OF FIGURES

- FIGURE 1. READY-TO-EAT FROZEN FOOD MARKET RESEARCH PROCESS

- FIGURE 2. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 3. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 4. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 5. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2024 VS 2030 (%)

- FIGURE 6. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2024 VS 2030 (%)

- FIGURE 8. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 9. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2024 VS 2030 (%)

- FIGURE 10. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 11. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2024 VS 2030 (%)

- FIGURE 12. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 13. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2024 VS 2030 (%)

- FIGURE 14. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 15. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 16. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 17. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY STATE, 2024 VS 2030 (%)

- FIGURE 18. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 19. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 20. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 21. ASIA-PACIFIC READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 22. ASIA-PACIFIC READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 23. READY-TO-EAT FROZEN FOOD MARKET SHARE, BY KEY PLAYER, 2024

- FIGURE 24. READY-TO-EAT FROZEN FOOD MARKET, FPNV POSITIONING MATRIX, 2024

- FIGURE 25. READY-TO-EAT FROZEN FOOD MARKET: RESEARCHAI

- FIGURE 26. READY-TO-EAT FROZEN FOOD MARKET: RESEARCHSTATISTICS

- FIGURE 27. READY-TO-EAT FROZEN FOOD MARKET: RESEARCHCONTACTS

- FIGURE 28. READY-TO-EAT FROZEN FOOD MARKET: RESEARCHARTICLES

LIST OF TABLES

- TABLE 1. READY-TO-EAT FROZEN FOOD MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

- TABLE 3. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, 2018-2024 (USD MILLION)

- TABLE 4. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, 2025-2030 (USD MILLION)

- TABLE 5. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 6. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 7. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 8. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 9. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 10. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 11. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY NON-VEGETARIAN, BY REGION, 2018-2024 (USD MILLION)

- TABLE 12. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY NON-VEGETARIAN, BY REGION, 2025-2030 (USD MILLION)

- TABLE 13. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY VEGAN, BY REGION, 2018-2024 (USD MILLION)

- TABLE 14. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY VEGAN, BY REGION, 2025-2030 (USD MILLION)

- TABLE 15. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY VEGETARIAN, BY REGION, 2018-2024 (USD MILLION)

- TABLE 16. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY VEGETARIAN, BY REGION, 2025-2030 (USD MILLION)

- TABLE 17. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION)

- TABLE 18. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2025-2030 (USD MILLION)

- TABLE 19. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ASIAN, BY REGION, 2018-2024 (USD MILLION)

- TABLE 20. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ASIAN, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INDIAN, BY REGION, 2018-2024 (USD MILLION)

- TABLE 22. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INDIAN, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY LATIN AMERICAN, BY REGION, 2018-2024 (USD MILLION)

- TABLE 24. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY LATIN AMERICAN, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY MIDDLE EASTERN, BY REGION, 2018-2024 (USD MILLION)

- TABLE 26. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY MIDDLE EASTERN, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY WESTERN / CONTINENTAL, BY REGION, 2018-2024 (USD MILLION)

- TABLE 28. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY WESTERN / CONTINENTAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2018-2024 (USD MILLION)

- TABLE 30. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 31. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, BY REGION, 2018-2024 (USD MILLION)

- TABLE 32. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FILMS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 34. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FILMS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PLASTIC POUCHES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 36. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PLASTIC POUCHES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ZIP-LOCK BAGS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 38. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ZIP-LOCK BAGS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2018-2024 (USD MILLION)

- TABLE 40. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2025-2030 (USD MILLION)

- TABLE 41. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, BY REGION, 2018-2024 (USD MILLION)

- TABLE 42. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CANS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 44. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CANS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CARTONS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 46. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CARTONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY TRAYS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 48. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY TRAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY TUBS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 50. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY TUBS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2018-2024 (USD MILLION)

- TABLE 52. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2025-2030 (USD MILLION)

- TABLE 53. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 54. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 55. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 56. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CONVENIENCE STORES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 58. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CONVENIENCE STORES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY GROCERY CHAINS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 60. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY GROCERY CHAINS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY SPECIALTY STORES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 62. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY SPECIALTY STORES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY SUPERMARKETS & HYPERMARKETS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 64. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY SUPERMARKETS & HYPERMARKETS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 66. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 67. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 68. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COMPANY'S WEBSITES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 70. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COMPANY'S WEBSITES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ECOMMERCE MARKETPLACES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 72. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ECOMMERCE MARKETPLACES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 74. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 75. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 76. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 77. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COMMERCIAL, BY REGION, 2018-2024 (USD MILLION)

- TABLE 78. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COMMERCIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY HOUSEHOLDS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 80. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY HOUSEHOLDS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INSTITUTIONAL, BY REGION, 2018-2024 (USD MILLION)

- TABLE 82. GLOBAL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INSTITUTIONAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 84. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 85. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION)

- TABLE 86. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2025-2030 (USD MILLION)

- TABLE 87. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2018-2024 (USD MILLION)

- TABLE 88. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 89. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2018-2024 (USD MILLION)

- TABLE 90. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2025-2030 (USD MILLION)

- TABLE 91. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2018-2024 (USD MILLION)

- TABLE 92. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2025-2030 (USD MILLION)

- TABLE 93. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 94. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 95. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 96. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 97. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 98. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 99. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 100. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 101. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 102. AMERICAS READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 104. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 105. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION)

- TABLE 106. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2025-2030 (USD MILLION)

- TABLE 107. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2018-2024 (USD MILLION)

- TABLE 108. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 109. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2018-2024 (USD MILLION)

- TABLE 110. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2025-2030 (USD MILLION)

- TABLE 111. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2018-2024 (USD MILLION)

- TABLE 112. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2025-2030 (USD MILLION)

- TABLE 113. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 114. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 115. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 116. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 117. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 118. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 119. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 120. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 121. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY STATE, 2018-2024 (USD MILLION)

- TABLE 122. UNITED STATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY STATE, 2025-2030 (USD MILLION)

- TABLE 123. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 124. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 125. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION)

- TABLE 126. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2025-2030 (USD MILLION)

- TABLE 127. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2018-2024 (USD MILLION)

- TABLE 128. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 129. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2018-2024 (USD MILLION)

- TABLE 130. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2025-2030 (USD MILLION)

- TABLE 131. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2018-2024 (USD MILLION)

- TABLE 132. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2025-2030 (USD MILLION)

- TABLE 133. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 134. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 135. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 136. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 137. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 138. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 139. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 140. CANADA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 141. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 142. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 143. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION)

- TABLE 144. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2025-2030 (USD MILLION)

- TABLE 145. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2018-2024 (USD MILLION)

- TABLE 146. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 147. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2018-2024 (USD MILLION)

- TABLE 148. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2025-2030 (USD MILLION)

- TABLE 149. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2018-2024 (USD MILLION)

- TABLE 150. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2025-2030 (USD MILLION)

- TABLE 151. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 152. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 153. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 154. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 155. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 156. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 157. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 158. MEXICO READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 159. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 160. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 161. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION)

- TABLE 162. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2025-2030 (USD MILLION)

- TABLE 163. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2018-2024 (USD MILLION)

- TABLE 164. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 165. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2018-2024 (USD MILLION)

- TABLE 166. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2025-2030 (USD MILLION)

- TABLE 167. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2018-2024 (USD MILLION)

- TABLE 168. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2025-2030 (USD MILLION)

- TABLE 169. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 170. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 171. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 172. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 173. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 174. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 175. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 176. BRAZIL READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 177. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 178. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 179. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION)

- TABLE 180. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2025-2030 (USD MILLION)

- TABLE 181. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2018-2024 (USD MILLION)

- TABLE 182. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 183. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2018-2024 (USD MILLION)

- TABLE 184. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2025-2030 (USD MILLION)

- TABLE 185. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2018-2024 (USD MILLION)

- TABLE 186. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2025-2030 (USD MILLION)

- TABLE 187. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 188. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 189. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 190. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 191. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 192. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 193. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 194. ARGENTINA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 195. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 196. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 197. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION)

- TABLE 198. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2025-2030 (USD MILLION)

- TABLE 199. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2018-2024 (USD MILLION)

- TABLE 200. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 201. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2018-2024 (USD MILLION)

- TABLE 202. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2025-2030 (USD MILLION)

- TABLE 203. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2018-2024 (USD MILLION)

- TABLE 204. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2025-2030 (USD MILLION)

- TABLE 205. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 206. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 207. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 208. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 209. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 210. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 211. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 212. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 213. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 214. EUROPE, MIDDLE EAST & AFRICA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 215. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 216. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 217. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION)

- TABLE 218. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2025-2030 (USD MILLION)

- TABLE 219. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2018-2024 (USD MILLION)

- TABLE 220. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 221. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2018-2024 (USD MILLION)

- TABLE 222. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2025-2030 (USD MILLION)

- TABLE 223. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2018-2024 (USD MILLION)

- TABLE 224. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2025-2030 (USD MILLION)

- TABLE 225. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 226. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 227. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 228. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 229. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 230. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 231. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 232. UNITED KINGDOM READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 233. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 234. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 235. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION)

- TABLE 236. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2025-2030 (USD MILLION)

- TABLE 237. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2018-2024 (USD MILLION)

- TABLE 238. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 239. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2018-2024 (USD MILLION)

- TABLE 240. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2025-2030 (USD MILLION)

- TABLE 241. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2018-2024 (USD MILLION)

- TABLE 242. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2025-2030 (USD MILLION)

- TABLE 243. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 244. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 245. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 246. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 247. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 248. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 249. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 250. GERMANY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 251. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 252. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 253. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION)

- TABLE 254. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2025-2030 (USD MILLION)

- TABLE 255. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2018-2024 (USD MILLION)

- TABLE 256. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 257. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2018-2024 (USD MILLION)

- TABLE 258. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2025-2030 (USD MILLION)

- TABLE 259. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2018-2024 (USD MILLION)

- TABLE 260. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2025-2030 (USD MILLION)

- TABLE 261. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 262. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 263. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 264. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 265. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 266. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 267. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 268. FRANCE READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 269. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 270. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 271. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION)

- TABLE 272. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2025-2030 (USD MILLION)

- TABLE 273. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2018-2024 (USD MILLION)

- TABLE 274. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 275. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2018-2024 (USD MILLION)

- TABLE 276. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2025-2030 (USD MILLION)

- TABLE 277. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2018-2024 (USD MILLION)

- TABLE 278. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2025-2030 (USD MILLION)

- TABLE 279. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 280. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 281. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 282. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 283. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 284. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 285. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 286. RUSSIA READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 287. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 288. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 289. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION)

- TABLE 290. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2025-2030 (USD MILLION)

- TABLE 291. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2018-2024 (USD MILLION)

- TABLE 292. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 293. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2018-2024 (USD MILLION)

- TABLE 294. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2025-2030 (USD MILLION)

- TABLE 295. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2018-2024 (USD MILLION)

- TABLE 296. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2025-2030 (USD MILLION)

- TABLE 297. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 298. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 299. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 300. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 301. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 302. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 303. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 304. ITALY READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 305. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 306. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 307. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION)

- TABLE 308. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2025-2030 (USD MILLION)

- TABLE 309. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2018-2024 (USD MILLION)

- TABLE 310. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 311. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2018-2024 (USD MILLION)

- TABLE 312. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY FLEXIBLE PACKAGING, 2025-2030 (USD MILLION)

- TABLE 313. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2018-2024 (USD MILLION)

- TABLE 314. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY RIGID PACKAGING, 2025-2030 (USD MILLION)

- TABLE 315. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 316. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 317. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 318. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 319. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 320. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 321. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 322. SPAIN READY-TO-EAT FROZEN FOOD MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 323. UNITED ARAB EMIRATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2018-2024 (USD MILLION)

- TABLE 324. UNITED ARAB EMIRATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 325. UNITED ARAB EMIRATES READY-TO-EAT FROZEN FOOD MARKET SIZE, BY CUISINE TYPE, 2018-2024 (USD MILLION

The Ready-to-Eat Frozen Food Market was valued at USD 45.20 billion in 2024 and is projected to grow to USD 48.48 billion in 2025, with a CAGR of 7.75%, reaching USD 70.77 billion by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 45.20 billion |

| Estimated Year [2025] | USD 48.48 billion |

| Forecast Year [2030] | USD 70.77 billion |

| CAGR (%) | 7.75% |

Emerging Dynamics and Market Forces Shaping the Future of Ready-to-Eat Frozen Food in a Rapidly Evolving Consumer Environment

The ready-to-eat frozen food sector is experiencing an unprecedented confluence of technological innovation, evolving consumer lifestyles, and global supply chain transformations. Constantly driven by the pursuit of convenience and time efficiency, modern consumers expect high-quality, nutritious meals that can be prepared with minimal effort. This surge in demand is further propelled by urbanization trends, dual-income households, and a growing emphasis on work-life balance, resulting in busy individuals and families seeking reliable meal solutions that do not compromise on taste or health benefits.

Moreover, advancements in freezing technologies and packaging innovations have expanded the range of products that can be preserved without significant nutrient degradation or loss of flavor. Consequently, manufacturers are introducing a diverse portfolio of offerings-from gourmet entrees to plant-based alternatives-that cater to a wide spectrum of dietary preferences. As the industry grows more competitive, players are prioritizing product differentiation through proprietary recipes, sustainable sourcing, and clean-label formulations. These dynamics underscore a pivotal moment in which the sector must balance rapid innovation with operational efficiency to remain resilient and responsive to consumer expectations.

Transformational Shifts Redefining the Ready-to-Eat Frozen Food Landscape Driven by Consumer Preferences Technology and Sustainability Imperatives

Consumer preferences are shifting dramatically toward tailored experiences, with a heightened focus on dietary restrictions, global flavor profiles, and environmental impact. Plant-based entrees and vegan-friendly meal solutions have moved beyond niche segments to become mainstream offerings, reflecting broader health and sustainability concerns. In parallel, technologies such as flash-freezing, high-pressure processing, and modified atmosphere packaging are being leveraged to preserve texture, taste, and nutritional value at scale.

Additionally, digitization across the supply chain and direct-to-consumer platforms is redefining how products are marketed, ordered, and delivered. E-commerce marketplaces and subscription meal services are gaining ground by providing personalized recommendations and seamless fulfillment, thereby driving experimentation and brand loyalty. Sustainability imperatives are also emerging as transformative factors: manufacturers are exploring recyclable packaging solutions and carbon-reduction strategies to align with corporate social responsibility objectives. Through these converging trends, the ready-to-eat frozen food landscape is being reshaped by a blend of consumer-centric innovation and operational agility.

Assessing the Far-Reaching Consequences of the United States' 2025 Tariff Adjustments on Import Costs Supply Chains and Market Dynamics

The tariff adjustments enacted by the United States in 2025 have introduced significant cost pressures across multiple product categories, particularly those relying on imported ingredients and packaging components. Manufacturers who depend on overseas suppliers for specialty proteins, grains, and exotic spices have encountered increased input expenses, prompting a reevaluation of sourcing strategies. In response, industry players are exploring nearshoring and strategic partnerships with domestic producers to mitigate exposure to fluctuating trade duties.

Furthermore, the ripple effects of higher tariffs extend to packaging materials, where rigid containers and flexible films imported from key manufacturing hubs face elevated import levies. This has stimulated investment in local production capacities, encouraging collaboration with regional converters. In parallel, logistics providers are adapting their networks to optimize cross-border transit and warehousing solutions, seeking to balance cost efficiency with delivery speed. Collectively, these developments underscore the importance of supply chain resilience and diversified procurement as essential levers for maintaining competitive pricing and ensuring uninterrupted product availability.

In-Depth Segmentation Analysis Reveals Critical Insights into Ingredients Packaging Distribution Channels and End User Preferences Across Diverse Market Segments

An in-depth segmentation analysis reveals that ingredient choices exert a profound influence on formulation complexity, nutritional positioning, and consumer appeal. When segmenting by ingredient across non-vegetarian, vegan, and vegetarian offerings, producers must tailor sourcing, processing, and marketing approaches to align with distinct taste profiles and health claims. Concurrently, examining cuisine type across Asian, Indian, Latin American, Middle Eastern, and Western or continental traditions highlights unique consumer expectations and price sensitivities in each subcategory.

Packaging formats also play a critical role in product differentiation and shelf stability. The use of flexible films, plastic pouches, and zip-lock bags supports convenience and portion control, while rigid designs such as cans, cartons, trays, and tubs reinforce premium positioning and ease of heating. Moreover, distribution channels ranging from offline channels like convenience stores, grocery chains, specialty outlets, and supermarkets or hypermarkets to online platforms including company websites and e-commerce marketplaces create varied touchpoints for consumer interaction. Finally, the end-user segmentation among commercial establishments, households, and institutional buyers underscores the necessity of customizing volume offerings, pricing structures, and service levels to meet the specific demands of each buyer cohort.

Regional Market Divergence and Strategic Opportunities Explored Across the Americas Europe Middle East Africa and Asia-Pacific Territories

Geographic regions present distinct patterns in consumer behavior, regulatory frameworks, and supply chain infrastructure. In the Americas, established cold-chain logistics and mature retail networks enable rapid product distribution, while shifting consumer preferences drive innovation in health-oriented and convenience-focused offerings. Meanwhile, Europe, the Middle East, and Africa exhibit a mosaic of market maturity levels, with Western Europe championing clean-label and premium ready meals, the Middle East demonstrating growing demand for Halal-certified and ethnically inspired dishes, and Africa emerging as an opportunity zone for basic frozen staples supported by improving infrastructure.

Across the Asia-Pacific region, dynamic urbanization and rising disposable incomes are fostering adoption of both local and international culinary experiences in frozen form. Investments in cold storage facilities and last-mile delivery are accelerating market penetration in urban centers, while rural areas remain underserved. Regulatory differences-such as stringent food safety standards in developed markets and evolving guidelines in emerging economies-further influence product formulation, labeling practices, and packaging requirements, shaping regional go-to-market strategies and partnership models.

Competitive Landscape Evaluation Highlighting Key Industry Players Their Strategic Initiatives Collaborations and Innovation Milestones in Frozen Food

Key industry participants are strategically expanding their portfolios through mergers, acquisitions, and joint ventures to capture emerging consumer segments and enhance distribution reach. Several leading multinationals have introduced premium ready-to-eat lines featuring organic, non-GMO, and allergen-free ingredients, while regional specialists leverage local sourcing alliances to deliver authentic flavor profiles. Collaboration with co-manufacturers and third-party logistics partners has become instrumental in scaling production and optimizing transportation networks.

In addition, R&D investments are accelerating product innovation pipelines, with companies focusing on clean-label preservatives, novel proteins, and advanced freezing technologies. Strategic alliances between ingredient suppliers, packaging innovators, and foodservice operators are also emerging, aimed at creating integrated value chains that enhance quality control and reduce time to market. As competitive intensity grows, brand differentiation through targeted marketing campaigns, loyalty programs, and digital engagement will remain essential for maintaining consumer mind share and driving repeat purchase behavior.

Actionable Strategic Guidance for Industry Leaders to Navigate Market Disruptions Capitalize on Growth Levers and Drive Sustainable Competitive Advantage

Industry leaders should prioritize the development of agile supply chains that can adapt to fluctuating trade policies and raw material availability. Establishing dual sourcing frameworks and nearshore partnerships will help mitigate tariff exposure and reduce lead times. Furthermore, investing in advanced packaging materials that extend shelf life and improve sustainability credentials will resonate with environmentally conscious consumers and support corporate responsibility goals.

On the go-to-market front, companies must leverage omnichannel strategies that integrate offline retail experiences with digital touchpoints. Personalized promotions, subscription models, and direct-to-consumer platforms can deepen customer relationships while providing data-driven insights into purchasing behavior. At the same time, fostering cross-industry collaborations-such as co-branding with nutritional experts or technology providers-can unlock unique value propositions. Finally, continuous monitoring of regulatory developments and proactive engagement with policymakers will ensure compliance and help shape favorable trade and safety standards.

Comprehensive Research Approach Incorporating Robust Data Collection Expert Interviews and Rigorous Validation Protocols to Ensure Unbiased Market Intelligence

This research leverages a multi-tiered approach combining secondary data analysis with primary insights from industry veterans. Initially, extensive desk research was conducted across public filings, government publications, and reputable trade journals to map current market dynamics and identify key trends. Subsequently, qualitative interviews with supply chain executives, innovation managers, and retail buyers provided contextual nuance and validated emerging hypotheses.

Quantitative data inputs were cross-verified through triangulation methods, ensuring consistency and accuracy. Advanced analytical tools were utilized to assess tariff impact scenarios, segmentation overlaps, and regional performance metrics. A rigorous review process involving peer validation and expert panel discussions was implemented to eliminate bias and enhance the reliability of findings. This methodology ensures that conclusions are grounded in robust evidence, delivering actionable insights for strategic decision makers.

Conclusive Synthesis of Ready-to-Eat Frozen Food Market Trends Challenges and Prospects Informing Future Strategic Decision Making Processes

The ready-to-eat frozen food industry stands at a critical juncture characterized by rapid innovation, shifting consumer demands, and evolving regulatory landscapes. Operational resilience, driven by diversified sourcing and adaptive packaging solutions, will be instrumental in mitigating cost pressures and ensuring supply continuity. At the same time, targeted product differentiation-spanning clean-label formulations, global flavor experiences, and dietary customization-will determine brand competitiveness in an increasingly crowded marketplace.

Looking ahead, companies that integrate sustainable practices and leverage data-driven consumer insights will be best positioned to capture emerging opportunities. Collaboration across the value chain, from ingredient suppliers to logistics partners, will accelerate time to market and enhance product quality. Ultimately, the strategic choices made today will shape the industry's trajectory, influencing its capacity to deliver convenient, nutritious, and environmentally responsible meal solutions.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Market Sizing & Forecasting

5. Market Dynamics

- 5.1. Surge in consumer preference for plant-based ready-to-eat frozen meals with local flavors

- 5.2. Expansion of distribution channels through modern trade supermarkets and online platforms

- 5.3. Growing demand for halal-certified frozen ready-to-eat meals catering to Muslim consumers

- 5.4. Integration of smart freezer technology in hypermarkets for improved product visibility

- 5.5. Use of locally sourced ingredients to appeal to national pride and support local farmers

- 5.6. Shift toward low-sodium and low-fat frozen meals responding to rising health concerns

- 5.7. Increased collaboration between food manufacturers and e-commerce giants for flash sales

- 5.8. Rising adoption of sustainable and recyclable packaging solutions in frozen convenience foods

- 5.9. Emergence of premium artisanal frozen meal offerings featuring fusion of Malaysian cuisines

6. Market Insights

- 6.1. Porter's Five Forces Analysis

- 6.2. PESTLE Analysis

7. Cumulative Impact of United States Tariffs 2025

8. Ready-to-Eat Frozen Food Market, by Ingredient

- 8.1. Introduction

- 8.2. Non-Vegetarian

- 8.3. Vegan

- 8.4. Vegetarian

9. Ready-to-Eat Frozen Food Market, by Cuisine Type

- 9.1. Introduction

- 9.2. Asian

- 9.3. Indian

- 9.4. Latin American

- 9.5. Middle Eastern

- 9.6. Western / Continental

10. Ready-to-Eat Frozen Food Market, by Packaging Type

- 10.1. Introduction

- 10.2. Flexible Packaging

- 10.2.1. Films

- 10.2.2. Plastic Pouches

- 10.2.3. Zip-lock Bags

- 10.3. Rigid Packaging

- 10.3.1. Cans

- 10.3.2. Cartons

- 10.3.3. Trays

- 10.3.4. Tubs

11. Ready-to-Eat Frozen Food Market, by Distribution Channel

- 11.1. Introduction

- 11.2. Offline

- 11.2.1. Convenience Stores

- 11.2.2. Grocery Chains

- 11.2.3. Specialty Stores

- 11.2.4. Supermarkets & Hypermarkets

- 11.3. Online

- 11.3.1. Company's Websites

- 11.3.2. eCommerce Marketplaces

12. Ready-to-Eat Frozen Food Market, by End User

- 12.1. Introduction

- 12.2. Commercial

- 12.3. Households

- 12.4. Institutional

13. Americas Ready-to-Eat Frozen Food Market

- 13.1. Introduction

- 13.2. United States

- 13.3. Canada

- 13.4. Mexico

- 13.5. Brazil

- 13.6. Argentina

14. Europe, Middle East & Africa Ready-to-Eat Frozen Food Market

- 14.1. Introduction

- 14.2. United Kingdom

- 14.3. Germany

- 14.4. France

- 14.5. Russia

- 14.6. Italy

- 14.7. Spain

- 14.8. United Arab Emirates

- 14.9. Saudi Arabia

- 14.10. South Africa

- 14.11. Denmark

- 14.12. Netherlands

- 14.13. Qatar

- 14.14. Finland

- 14.15. Sweden

- 14.16. Nigeria

- 14.17. Egypt

- 14.18. Turkey

- 14.19. Israel

- 14.20. Norway

- 14.21. Poland

- 14.22. Switzerland

15. Asia-Pacific Ready-to-Eat Frozen Food Market

- 15.1. Introduction

- 15.2. China

- 15.3. India

- 15.4. Japan

- 15.5. Australia

- 15.6. South Korea

- 15.7. Indonesia

- 15.8. Thailand

- 15.9. Philippines

- 15.10. Malaysia

- 15.11. Singapore

- 15.12. Vietnam

- 15.13. Taiwan

16. Competitive Landscape

- 16.1. Market Share Analysis, 2024

- 16.2. FPNV Positioning Matrix, 2024

- 16.3. Competitive Analysis

- 16.3.1. Ajinomoto Co., Inc.

- 16.3.2. Bellisio Foods, Inc.

- 16.3.3. BRF S.A.

- 16.3.4. Campbell Soup Company

- 16.3.5. CP Malaysia

- 16.3.6. EB Frozen Food Sdn Bhd

- 16.3.7. General Mills Inc.

- 16.3.8. Grupo Bimbo

- 16.3.9. Iceland Foods Ltd.

- 16.3.10. JBS S.A.

- 16.3.11. Kawan Food Manufacturing Sdn Bhd

- 16.3.12. Kellogg Company

- 16.3.13. Kidfresh

- 16.3.14. Maruha Nichiro

- 16.3.15. McCain Foods Limited

- 16.3.16. Nestle S.A

- 16.3.17. Nissin Foods Co., Inc.

- 16.3.18. OOB Organic

- 16.3.19. Simplot Global Food, LLC

- 16.3.20. TANVI FOODS LTD.

- 16.3.21. The Kraft Heinz Company

- 16.3.22. Tyson Foods Inc.

- 16.3.23. Unilever PLC

- 16.3.24. Vandemoortele NV

- 16.3.25. Wawona Frozen Foods