|

|

市場調査レポート

商品コード

1808674

エシカルファッション市場:製品タイプ別、タイプ別、材料別、使用場面別、流通チャネル別、エンドユーザー別 - 世界予測、2025年~2030年Ethical Fashion Market by Product Type, Type, Material, Usage Occasion, Distribution Channel, End-users - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| エシカルファッション市場:製品タイプ別、タイプ別、材料別、使用場面別、流通チャネル別、エンドユーザー別 - 世界予測、2025年~2030年 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 185 Pages

納期: 即日から翌営業日

|

概要

エシカルファッション市場は、2024年には80億7,000万米ドルとなり、2025年には85億8,000万米ドル、CAGR6.50%で成長し、2030年には117億8,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 80億7,000万米ドル |

| 推定年2025 | 85億8,000万米ドル |

| 予測年2030 | 117億8,000万米ドル |

| CAGR(%) | 6.50% |

急速に進化する市場情勢の中で、消費者の嗜好と業界イノベーションを形成するエシカルファッションの勢いを発見する

消費者、ブランド、規制当局がサプライ・チェーン全体の説明責任をますます求めるようになり、エシカル・ファッション分野は世界的な話題に急浮上しています。かつてはニッチな関心事であったものが、戦略的な必須事項へと発展し、製品デザインからコーポレート・ガバナンスに至るまで、あらゆるものに影響を与えています。持続可能性の指標が重要な業績指標となる中、本イントロダクションは、アパレル、アクセサリー、フットウェアの各分野において、倫理的配慮がいかに競争上の差別化を支えているかを理解するための舞台を提供します。

持続可能な材料の革新からサーキュラーエコノミー(循環型経済)のコラボレーションまで、エシカルファッションの採用を加速させる重要な変化を世界中で解明

過去5年間で、エシカルファッションのパラダイムを再定義する根本的な変化が起こり、エシカルファッションは憧れの理想から経営の優先事項へと押し上げられました。材料科学の進歩は、オーガニックコットンや麻などの天然材料へのアクセスを民主化し、再生ポリエステルやデッドストックの再利用は、繊維廃棄物に対するスケーラブルな解決策として登場しました。並行して、フェアトレードや動物虐待のない生産に焦点を当てた認証制度は、透明性と説明責任を高め、バリューチェーン全体にわたる協力関係を誘発しました。

2025年、米国の関税政策がエシカルファッションのサプライチェーンと世界的な市場アクセスに及ぼす遠大な影響を検証

2025年、米国の繊維・アパレル輸入関税の改定は、エシカルファッションの利害関係者にとって、調達戦略を見直す緊急性を高めています。完成品と主要原材料に対する関税の引き上げは、国際的なサプライチェーン全体に波及するコスト圧力をもたらし、ブランドは従来の製造拠点を再考し、貿易関連費用がより低い地域の代替品を評価するよう促しています。

製品タイプ、タイプ、材料、使用場面、流通チャネル、エンドユーザーにおける多様な市場セグメンテーション力学に関する詳細な洞察

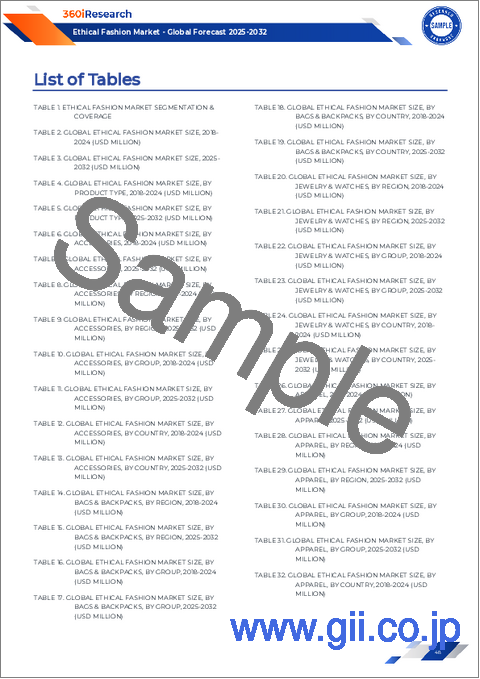

エシカルファッション市場は、それぞれ独自のイノベーション促進要因、消費者の期待、小売のダイナミクスによって定義された、異なる製品柱の相互作用で構成されています。アクセサリーは職人技の新境地を開拓し、アパレル・ブランドは綿、麻、リネンなどの天然材料とリサイクル・ポリエステルの混紡に多額の投資を行い、性能と持続可能性の両方の基準を満たしています。フットウェアブランドは、デッドストックの材料を活用して廃棄物を最小限に抑え、同時にエコ意識の高いバイヤーに支持されるオーダーメイドのデザイン能力を高めています。

南北アメリカ、欧州、中東・アフリカ、アジア太平洋地域の各市場におけるエシカルファッション導入に影響を与える戦略的地域変動

エシカル・ファッションの勢いは、規制環境、文化的態度、インフラ能力によって形成される世界各地域で異なる様相を呈しています。アメリカ大陸では、成熟市場と新興市場が混在し、北米の小売企業がサプライヤーにESGコンプライアンスを義務付ける一方、ラテンアメリカの生産者は地元産コットンと土着の職人技術を活用して付加価値セグメントを獲得しています。ニアショアリングとサプライヤーの多様化に対するこの地域的な注目は、サプライチェーンの強靭性を強化し、国内のエシカルブランドにチャンスをもたらしています。

イノベーション、サステナビリティ、消費者エンゲージメント戦略を推進するエシカルファッションの主要ブランドのプロファイルを通じて、競合情勢を分析

エシカルファッションの競合は、持続可能性をビジネスモデルのあらゆる糸にシームレスに統合する先駆的ブランドによって織り成されています。伝統的な老舗ブランドは、再生可能な材料を使って従来のサプライチェーンを改修し、既存の規模を活かして単価を下げながら、動物虐待のない厳格な基準を維持しています。同時に、デジタル・ネイティブ・ブランドは、追跡可能な生産データを消費者に直接提供し、製品ライフサイクルを延長するクローズド・ループ・リサイクル・イニシアチブを展開することで、従来の小売チャネルを破壊しています。

持続可能なパフォーマンスを強化するための、業界リーダー向け実行可能な戦略の実施、エシカルファッションにおける市場の差別化と長期的成長の実現

業界のリーダーは、材料革新のパイプラインを統合し、競争力のある価格帯で優れた性能を提供する次世代の天然繊維やリサイクル繊維に研究開発投資を振り向けることを優先すべきです。川上のサプライヤーと戦略的パートナーシップを確立することで、ブランドは倫理的に認証された原材料への優先的なアクセスを確保し、進化する消費者の期待に沿った処方を共同開発することができます。同様に重要なのは、統合されたデジタル・トレーサビリティ・プラットフォームを展開することで、すべての衣料品をその出自にまつわるストーリーにつなげ、ブランドの信頼を育み、新たな規制への準拠を促進することができます。

市場検証のための定性的専門家インタビュー、定量的データ分析、包括的二次情報を組み合わせた厳密な調査手法を理解

本レポートの調査結果は、質的および量的な厳密さを融合させた方法論的枠組みに裏打ちされています。調査プロセスは、主要なエシカルファッション市場において、経営幹部、サプライチェーンマネージャー、サステナビリティの専門家に実施した一連の綿密なインタビューから始まりました。これらの専門家の洞察は、包括的な文脈と正確性を確保するために、公開されている企業責任の開示、貿易政策文書、持続可能性認証データと三角比較されました。

エシカルファッションの未来を形成し、利害関係者にとって有益な意思決定の指針となる戦略的インペラティブを強調する主なハイライト

サマリー:エシカルファッションは、持続可能性へのコミットメントが競争上の優位性と経営上の強靭性をもたらす、極めて重要な変曲点に立っています。材料の革新、透明性のある調達、循環型ビジネスモデルの融合は、アパレル、アクセサリー、フットウェアにおける価値創造を再定義しつつあります。利害関係者は、進化する関税状況、地域ごとの規制状況、消費者の優先順位の変化などを乗り越えて、成長機会をつかみ、市場でのリーダーシップを確固たるものにしなければならないです。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 倫理的な調達のためにブロックチェーンを活用した透明性ソリューションを導入する高級ファッションブランド

- ファストファッション小売業者は、繊維廃棄物ゼロを実現するために閉ループリサイクルモデルを導入

- 植物由来の皮革代替品の出現が持続可能なファッション材料の革新を推進

- ソーシャルメディア主導の消費者運動により、ブランドは倫理的な労働慣行に責任を負う

- 新興市場における倫理的な職人技を促進するための高級ブランドと社会的企業のコラボレーション

- ファッション業界の透明性を確保し、グリーンウォッシングを削減するためのデジタル製品パスポートの導入

- パイロットプロジェクトを超えた、拡張可能な繊維リサイクルおよびアップサイクル技術への投資の急増

- ネットゼロ目標を達成するために、世界中のアパレルメーカーにカーボンニュートラルなサプライチェーン戦略を導入

- 不道徳な労働違反をリアルタイムで検出するAI駆動型サプライチェーン監視の拡大

- 中古および再生高級アパレルの循環型経済マーケットプレイスの導入拡大

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 エシカルファッション市場:製品タイプ別

- アクセサリー

- アパレル

- フットウェア

第9章 エシカルファッション市場:タイプ別

- クルエルティフリー

- エコフレンドリー

- フェアトレード

第10章 エシカルファッション市場:材料別

- 天然生地

- コットン

- 麻

- リネン

- リサイクル生地

- デッドストック

- リサイクルポリエステル

第11章 エシカルファッション市場:使用場面別

- ビジネスウェア

- カジュアルウェア

- 特別な機会

第12章 エシカルファッション市場:流通チャネル別

- オフライン

- オンライン

第13章 エシカルファッション市場:エンドユーザー別

- 子供

- 男性

- 女性

第14章 南北アメリカのエシカルファッション市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第15章 欧州・中東・アフリカのエシカルファッション市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第16章 アジア太平洋地域のエシカルファッション市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第17章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Patagonia, Inc.

- Wear Pact, LLC

- Ashuhari

- Issey Miyake Inc.

- Koraru LLC

- Oblekt

- United by Blue

- Turtledove London

- Thought Clothing UK

- Ten Tree International Inc.

- Stella McCartney LTD

- Psylo Fashion

- People Tree Ltd

- Outland Denim Australia

- Nudie Jeans Co.

- LVMH Group

- Little Yellow Bird Ltd

- Kowtow Clothing Ltd

- Kettlewell Colours Ltd.

- Hanes Australia Pty Ltd

- Girlfriend Collective LLC

- Frugi Limited

- Eileen Fisher, Inc.

- Bassike LLC

- Amour Vert, Inc.

- Aditya Birla Group

- The Reformation Inc.

- Ninety Percent Ltd

- The Fashion Pact