|

|

市場調査レポート

商品コード

1807641

ハプティクス技術市場:コンポーネント、技術タイプ、接続性、用途、エンドユーザー別-2025年~2030年世界予測Haptics Technology Market by Component, Technology Type, Connectivity, Application, End User - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ハプティクス技術市場:コンポーネント、技術タイプ、接続性、用途、エンドユーザー別-2025年~2030年世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 195 Pages

納期: 即日から翌営業日

|

概要

ハプティクス技術市場は、2024年には39億7,000万米ドルとなり、2025年にはCAGR 8.66%で43億米ドルに成長し、2030年には65億4,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024年 | 39億7,000万米ドル |

| 推定年2025年 | 43億米ドル |

| 予測年2030年 | 65億4,000万米ドル |

| CAGR(%) | 8.66% |

ハプティクス技術別革命的な感覚的関与が、シームレスなフィードバックによる没入的で具体的なユーザー体験の新時代を切り開く

ハプティクス技術の進化は、デジタルコマンドと物理的知覚のギャップを埋める触覚フィードバックを導入することで、人間とコンピュータの相互作用を再定義しました。アクチュエータ設計、センサーの応答性、ソフトウェア統合における革新は、ユーザーが直感的に感じることができる質感、力、振動をシミュレートするデバイスを可能にしました。より豊かな触感を伝えるこの能力の高まりは、業界を超えた新たなアプリケーションに拍車をかけ、ユーザー体験のパラメーターを再定義しています。

消費者と業界情勢を横断するハプティクス技術の変革を促進する新たな混乱の状況と融合するイノベーション

過去数年間、ハプティクス技術分野は、人工知能と機械学習の触覚フィードバックシステムへの統合に後押しされ、一連の変革的シフトをしてきました。リアルタイムのデータ分析を活用することで、開発者は微妙なユーザーインタラクションに合わせて触覚反応を微調整できるようになり、より自然に感じられるだけでなく、ユーザーのコンテキストに基づいて動的に適応するフィードバックが得られるようになりました。このようなインテリジェンスと触覚の融合は、特にバーチャルコラボレーションや没入型トレーニング環境において、新たなインタラクションモードの可能性を広げています。

予想される関税措置により、2025年に米国内のハプティクス技術産業におけるサプライチェーンの再編成とコスト力学が促進される

米国政府による2025年の新たな関税措置の発表は、ハプティクス技術部門に大きな逆風をもたらしました。高度なアクチュエータや精密センサを含むさまざまな部品を対象としたこれらの関税は、海外生産拠点に依存するメーカーの輸入コストを引き上げる構えです。その結果、かつて低コストのサプライチェーンから利益を得ていた企業は、利益率の低下を緩和し、競争力のある価格設定を維持するために、調達戦略を見直さなければならなくなります。

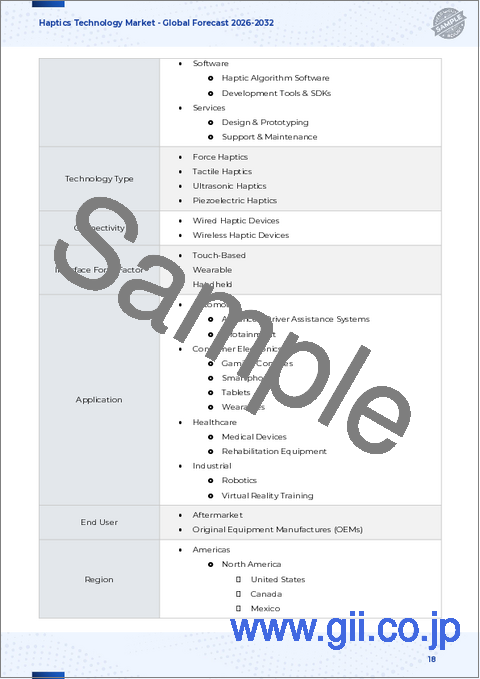

コンポーネント、テクノロジー、コネクティビティ、アプリケーション、エンドユーザのセグメンテーションの包括的な分析が、ハプティクスにおける戦略的機会を明らかにします

コンポーネントのカテゴリを詳細に調べると、アクチュエータ開発が技術革新の最前線にあり、メーカーはより軽量で応答性の高いハプティック素子を作るために電気活性ポリマーを改良していることがわかります。電磁アクチュエータは高精度磁気アクチュエータの恩恵を受け続け、圧電アクチュエータの進歩はきめ細かな振動フィードバックを可能にします。空気圧アクチュエータは、リアルな力覚を与える能力により、医療シミュレータやロボット工学の分野でニッチを開拓しています。これらのアクチュエーターと並んで、洗練されたコントローラーがフィードバックパターンを編成し、モーションディテクター、圧力計、タッチセンシティブオーバーレイなどのセンサーが、ユーザーの入力が触覚反応にシームレスに変換されるようにします。専用ソフトウェアプラットフォームの普及は、システム統合をさらに強化し、コンポーネントの動作を首尾一貫したユーザー体験に統一します。

アメリカ、欧州、中東・アフリカ、アジア太平洋の地域ダイナミクスと採用動向は、ハプティクス技術の成長軌道を浮き彫りにします

南北アメリカでは、ハプティクスは急速な商業展開と研究開発センターの活発なエコシステムによって特徴づけられています。米国は、自動車ADAS(先進運転支援システム)や没入型トレーニングプラットフォームへの触覚フィードバックの統合でリードしており、半導体やソフトウェアサプライヤーの強固なネットワークに支えられています。カナダはヘルスケアのイノベーションに注力しており、触覚を手がかりに患者の回復を促進する斬新なリハビリ機器を生み出しています。ラテンアメリカでは、スマートフォンの普及とデジタル・エンターテインメント・サービスの拡大に後押しされ、モバイル・ゲームとウェアラブル技術の初期段階での採用が進んでいます。

世界のハプティクス技術エコシステムでイノベーション、パートナーシップ、競合差別化を推進する業界大手企業

業界をリードする複数の企業が、的を絞った投資や戦略的提携を通じてハプティクス技術の将来を形成しています。大手電子機器メーカーは、独自のハプティックエンジンをフラッグシップデバイスに組み込み、グローバルな流通網を活用して普及を加速させています。同時に、専門的な新興企業は、相手先商標製品メーカーやソフトウェア開発者のための統合を簡素化するモジュラー・ハプティック・キットを開発することで、ニッチな機会を確保しています。この競合情勢では、特許ポートフォリオの厚みと、シームレスなハードウェアとソフトウェアの融合を実現する能力が、トップランナーと新興の競合企業を差別化しています。

新たなハプティクス技術の動向と市場機会を活用するための業界リーダーへの戦略的必須事項と戦術的推奨事項

業界のリーダーは、高解像度フィードバックとエネルギー効率のバランスをとり、進化するデバイスの携帯性要件を満たす柔軟なアクチュエータ技術の開発を優先すべきです。人工知能をハプティック制御システムに統合することで、リアルタイムの適応型フィードバックを実現し、ユーザーエンゲージメントを高め、混雑した市場での差別化を促進することができます。モジュラープラットフォームアーキテクチャを採用することで、企業は市場投入までの時間を短縮し、多様なハードウェア構成間でのシームレスな統合を促進することができます。

一次情報、二次情報、データ検証プロトコルを統合した厳密な調査手法により、堅牢なハプティクス技術に関する洞察を得ることができます

この調査は、業界幹部、製品開発者、および学術研究者との1次インタビューを組み合わせた厳密な調査手法を活用し、技術の進歩と市場力学に関する生の視点を捉えています。このような綿密な対話により、ユーザーの要求、技術革新のロードマップ、および複数の部門にわたる投資決定を促す戦略的要請に関する定性的な洞察が得られます。

ハプティクス技術領域における戦略的重要事項、成長触媒、将来の方向性を強調する調査結果の包括的な統合

ハプティクス技術領域は、アクチュエータとセンサ設計のブレークスルー、人工知能の融合、ユーザ体験における触覚フィードバックへの評価の高まりによって、変曲点に立っています。米国で近々予定されている関税措置はコスト圧力をもたらす一方で、サプライチェーンの多様化と国内製造イニシアティブを促進します。これらの要因が相まって、企業が製品開発や市場開拓にどのように取り組むかが大きく変わりつつあります。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- スマートグラスに正確な触覚フィードバックを可能にするウェアラブル超音波触覚モジュールの採用

- 産業用ロボット向け低遅延ワイヤレス触覚通信プロトコルの進歩

- 遠隔手術シミュレータ用高解像度マルチチャンネル触覚ディスプレイの開発

- 仮想現実におけるユーザー体験を最適化するAI駆動型適応型触覚フィードバックシステム

- 高度な圧電微細構造によるプログラム可能な触覚テクスチャのカスタマイズ

- ゲームコントローラにリアルなフォースフィードバックを実現する電気活性ポリマーアクチュエータの統合

- 義肢制御を強化する触覚センサーを組み込んだソフトロボティクスの進歩

- 遠隔コラボレーションのための磁気粘性流体ベースの触覚手袋の導入が増加

- 先進的な自動車制御インターフェースにおける空中フィードバックのための触覚超音波アレイの採用

- 触覚技術に人工知能(AI)を活用した戦略的パートナーシップにより、ビジネスの生産性と市場シェアを向上

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025年

第8章 ハプティクス技術市場:コンポーネント別

- アクチュエータ

- 電気活性ポリマー

- 電磁アクチュエータ

- 圧電アクチュエータ

- 空気圧アクチュエータ

- コントローラー

- センサー

- モーションセンサー

- 圧力センサー

- タッチセンサー

- ソフトウェア

第9章 ハプティクス技術市場:技術タイプ別

- フォースハプティクス

- 触覚ハプティクス

第10章 ハプティクス技術市場:接続性別

- 有線触覚デバイス

- ワイヤレス触覚デバイス

第11章 ハプティクス技術市場:用途別

- 自動車

- ADAS(先進運転支援システム)

- インフォテインメント

- 家電

- ゲーム機

- スマートフォン

- タブレット

- ウェアラブル

- ヘルスケア

- 医療機器

- リハビリテーション機器

- 産業

- ロボット工学

- バーチャルリアリティトレーニング

第12章 ハプティクス技術市場:エンドユーザー別

- アフターマーケット

- OEM

第13章 南北アメリカのハプティクス技術市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第14章 欧州・中東・アフリカのハプティクス技術市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第15章 アジア太平洋のハプティクス技術市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第16章 競合情勢

- 市場シェア分析, 2024年

- FPNVポジショニングマトリックス, 2024年

- 競合分析

- Texas Instruments Inc.

- Johnson Electric Holdings Limited

- 3D Systems, Inc.

- Microchip Technology Inc.

- Force Dimension

- HAPTION SA

- Immersion Corporation

- TDK Corporation

- Samsung Electronics Co., Ltd.

- Tanvas, Inc.

- Ultraleap Limited

- Tactical Haptics, Inc.

- HaptX Inc.

- D-BOX Technologies Inc.

- Boreas Technologies Inc.

- Interhaptics by Razer Inc.

- Elara Systems, Inc.

- Vibra Nova

- Sony Corporation

- Nokia Corporation

- Merkel Haptic Systems Pvt Ltd.

- KEMET by Yageo Corporation

- Meta Platforms, Inc

- Analog Devices, Inc.