|

|

市場調査レポート

商品コード

1808388

工業用酵素市場:タイプ別、ソース別、製剤別、用途別-2025年~2030年の世界予測Industrial Enzymes Market by Type, Source, Formulation, Application - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 工業用酵素市場:タイプ別、ソース別、製剤別、用途別-2025年~2030年の世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 190 Pages

納期: 即日から翌営業日

|

概要

工業用酵素市場は、2024年に78億3,000万米ドルとなり、CAGR7.16%で、2025年には83億6,000万米ドルに成長し、2030年までには118億6,000万米ドルに達すると予測されています。

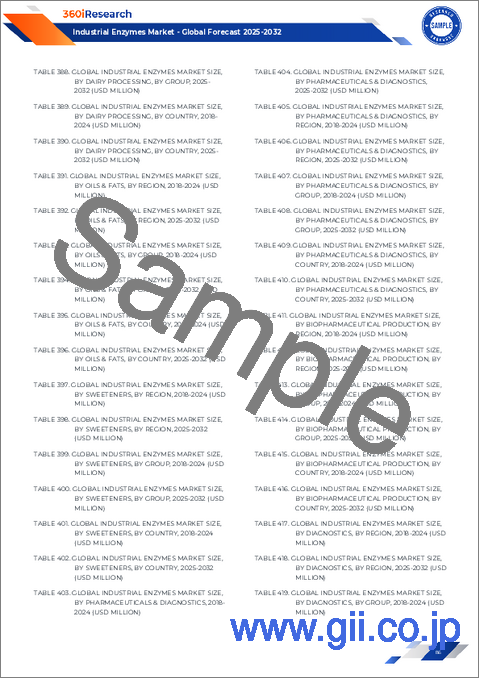

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 78億3,000万米ドル |

| 推定年2025 | 83億6,000万米ドル |

| 予測年2030 | 118億6,000万米ドル |

| CAGR(%) | 7.16% |

工業用酵素がイノベーションと持続可能性を通じて、複数の産業にまたがる世界のバイオプロセスにどのような革命をもたらしているか発見する

工業用酵素セクターは現代のバイオプロセシングの最前線に立ち、食品・飲料製造から繊維製品、廃棄物処理に至るまで、様々な産業のアプリケーションを再構築しています。生化学反応における触媒として、これらのタンパク質は効率を高め、エネルギー消費を削減し、持続可能な操業を可能にします。環境に配慮したソリューションが急務であることから、企業は厳格な環境基準を遵守しながら卓越したオペレーションを実現するために、酵素プロセスにますます注目するようになっています。

工業用酵素のエコシステムにおける急速な革新と普及を促進する、技術的・規制的な原動力を探る

技術的、規制的、市場的な要因の収束によって、工業用酵素の情勢を再定義する変革の波が押し寄せています。第一に、合成生物学的プラットフォームの成熟が、かつてない精度で酵素の発見と最適化を加速しています。CRISPRベースの遺伝子編集やメタゲノム・マイニングなどのツールを活用し、研究者は膨大な微生物の多様性を利用して、特定の産業課題に対処する新規酵素候補を同定しています。このような研究開発投資の急増は、従来のバイオ触媒開発サイクルを凌駕するダイナミックなイノベーションのパイプラインを形成しています。

2025年の米国の関税調整が工業用酵素のサプライチェーンと戦略的調達に及ぼすの広範な影響を検証する

2025年に予定されている米国の関税政策に関する最近の調整は、グローバルな酵素サプライチェーン全体に大きな波及効果をもたらす態勢を整えています。一部の生化学製品に対する輸入関税の引き上げにより、海外の原材料や特殊な酵素の輸入に依存しているメーカーは、調達戦略の再調整を迫られることになります。この再編により、企業はニアショアリングの機会を模索し、サプライヤーの多様化を深めて、コスト上昇や物流の複雑さにさらされるリスクを軽減する必要に迫られています。

酵素タイプ、ソース、製剤、用途にまたがる包括的なセグメンテーションの洞察から、戦略的ポートフォリオと開発の選択を導く

セグメンテーションを深く掘り下げると、的を絞った投資と製品開発の指針となる、微妙な洞察が見えてきます。酵素タイプ別では、アミラーゼ、セルラーゼ、インベルターゼ、キシラナーゼなどの炭水化物分解酵素は、デンプンの変換、バイオマスの糖化、甘味料の生産に対応し、バイオ燃料から食品・飲料までの産業に燃料を供給します。一方、カタラーゼ、ラッカーゼ、ペルオキシダーゼなどの酸化還元酵素は、漂白、脱色、汚染物質除去などの用途を可能にします。一方、DNAポリメラーゼ、DNアーゼ、RNAポリメラーゼ、RNアーゼを含むポリメラーゼとヌクレアーゼは、分子診断学とバイオ医薬品製造の進歩を促進し、エンドプロテアーゼとエキソプロテアーゼに分類されるプロテアーゼは、動物飼料と皮革加工におけるタンパク質加水分解プロセスを強化します。

酵素産業の成長軌道を形成する南北アメリカ、欧州、中東・アフリカ、アジア太平洋における需要ダイナミクスの地域差の分析

世界の酵素業界では、地域によって投資の優先順位や提携モデルが変化しています。南北アメリカでは、北米の製薬、食品加工、バイオ燃料セクターによる旺盛なエンドユーザー需要が、多国籍サプライヤーと現地のバイオ製造施設との連携を促進しています。中南米市場では、農作物の収量を高め、家畜の栄養状態を最適化する取り組みに支えられ、農業用酵素と飼料用酵素への関心が高まっています。一方、欧州、中東・アフリカでは、多様な規制が存在します。西欧の厳しい環境基準は、紙パルプ、洗剤、繊維製品における環境に優しい酵素プロセスの採用を加速させています。欧州連合(EU)域内の規制調和への取り組みは、国境を越えた貿易を促進していますが、現地の承認を調整する複雑さは依然として残っています。中東・アフリカでは、インフラ投資と水不足への懸念から、廃水処理と資源効率の高い酵素アプリケーションへの需要が高まっています。

戦略的パートナーシップと市場差別化を通じて、確立されたリーダーと機敏なイノベーターがどのように酵素技術を前進させているかを評価する

競争の舞台は、漸進的なイノベーションと画期的な酵素技術の両方を推進する企業によって特徴付けられています。既存企業は、微生物株ライブラリーや独自の酵素ポートフォリオを拡大する戦略的買収を通じて、パイプラインを強化し続けています。学術機関との共同研究提携は、特定の産業部門に合わせた新規酵素クラスの開発に拍車をかけています。同時に、機敏なバイオテクノロジー新興企業は、俊敏なR&Dフレームワークとデジタル・スクリーニング・プラットフォームを活用して製品上市を迅速に進め、特化したニッチを切り拓いています。このような二本立ての状況は、規模を重視する既存企業と、創造的破壊を志向する課題への課題者とのバランスを育んでいます。

市場リーダーシップと持続的成長を強化するために、的を絞った研究開発、サプライチェーンの強靭化、サービス主導の戦略を実施する

業界のリーダーは、促進要因を活用し、市場でのポジショニングを強化するために、多方面からのアプローチを優先すべきです。第一に、企業はAI主導のタンパク質設計と自動化を組み込んだ酵素工学プラットフォームへの投資を強化し、探索期間の短縮と開発コストの削減を図る必要があります。これと並行して、エンドユーザーとの共同イノベーション・ハブを確立することで、迅速なフィードバック・ループが促進され、新しい生体触媒が現実のプロセスの制約や性能ベンチマークに確実に対応できるようになります。

主要な酵素市場に関する洞察の基礎となる、1次インタビュー、2次調査とシナリオプランニングを組み合わせた厳密な調査フレームワークの理解

この分析では、一次情報と二次情報を組み合わせた構造化された調査フレームワークを採用し、正確性と網羅性を確保しました。1次調査には、酵素メーカー、エンドユーザー、規制機関の業界幹部、技術専門家、調達スペシャリストへの詳細なインタビューが含まれます。これらの対話から、進化する性能要件、商業的導入の障壁、戦略的優先事項に関する洞察が得られました。併せて2次調査では、技術動向と政策開発を検証するために、査読付き学術誌、特許出願、業界ホワイトペーパー、規制当局の出版物を系統的にレビューしました。

技術革新、レジリエンス、持続可能性が工業用酵素市場のリーダーシップをどのように推進するかを強調する戦略的課題と将来展望をまとめる

工業用酵素市場は、技術革新、進化する規制圧力、変化する取引力学によって大きな変革期を迎えています。工学的に設計されたバイオ触媒は、優れたプロセス効率と持続可能性の利点を提供し、さまざまな産業で広範な採用を促しています。同時に、地政学的な発展と関税の調整によってサプライチェーンが再構築され、利害関係者は調達戦略に弾力性と柔軟性を取り入れる必要に迫られています。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 新たな産業応用を可能にする酵素工学における技術的進歩

- 製品品質の向上のため、繊維および皮革加工における酵素の使用が増加

- バイオベースの洗剤酵素の需要増加が環境に優しい洗浄ソリューションを推進

- 食品・飲料加工における酵素の利用拡大で効率向上

- 過酷な産業環境での使用に適した耐熱性・耐酸性酵素の開発

- バイオ燃料のバイオマス変換効率を向上させるテーラーメイド酵素製剤の拡大

- 酵素メーカーと製薬会社の戦略的パートナーシップがバイオ触媒の採用を促進

- 海洋由来酵素の革新により、食品加工や栄養補助食品の新たな用途が開拓

- 酵素工学における人工知能の統合によるプロセス最適化の加速

- グリーンバイオ触媒の開発を形作る酵素の安全性と持続可能性に焦点を当てた規制

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響、2025年

第8章 工業用酵素市場:タイプ別

- 炭水化物分解酵素

- アミラーゼ

- セルラーゼ

- インベルターゼ

- キシラナーゼ

- リパーゼ

- 細菌リパーゼ

- 真菌リパーゼ

- 酸化還元酵素

- カタラーゼ

- ラッカーゼ

- ペルオキシダーゼ

- ポリメラーゼとヌクレアーゼ

- DNAポリメラーゼ

- DNase

- RNAポリメラーゼ

- RNases

- プロテアーゼ

- エンドプロテアーゼ

- エキソプロテアーゼ

第9章 工業用酵素市場:ソース別

- 動物

- 牛

- 豚

- 反芻動物

- 微生物

- 細菌性

- 真菌

- 酵母

- 植物

- 果物と野菜

- 種子と穀物

第10章 工業用酵素市場:製剤別

- 固定化

- 吸着

- 共有結合

- カプセル化

- 捕捉

- 液体

- 水溶液

- 濃縮物

- 粉末

- フリーズドライ

- スプレー乾燥

第11章 工業用酵素市場:用途別

- 農業

- 種子処理

- サイレージ添加剤

- 動物飼料

- 養殖業

- 家禽

- 反芻動物

- 豚

- バイオ燃料

- バイオディーゼル

- バイオエタノール

- 洗剤

- 食器洗い

- 産業・公共機関

- 洗濯洗剤

- 食品・飲料

- ベーキング

- 醸造

- 乳製品加工

- 果物と野菜の加工

- 砂糖加工

- 医薬品・診断

- バイオ医薬品製造

- 診断

- 医薬品の処方

- パルプ・紙

- 脱墨

- パルプ漂白

- サイズ

- 繊維

- デニム仕上げ

- 繊維加工

- 衣服仕上げ

- 廃棄物治療

- 固形廃棄物の堆肥化

- 廃水

第12章 南北アメリカの工業用酵素市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第13章 欧州、中東・アフリカの工業用酵素市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第14章 アジア太平洋の工業用酵素市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第15章 競合情勢

- 市場シェア分析、2024年

- FPNVポジショニングマトリックス、2024年

- 競合分析

- AB Enzymes GmbH

- Kerry Group plc

- Codexis, Inc.

- International Flavors & Fragrances Inc.

- BASF SE

- Novozymes A/S

- Advanced Enzyme Technologies Limited

- Evonik Industries AG

- Chr. Hansen Holding A/S

- Amano Enzyme Inc.

- Associated British Foods PLC

- BRAIN Biotech AG

- Creative Enzymes

- Denykem Ltd.

- DSM-Firmenich AG

- DuPont de Nemours, Inc

- Dyadic International, Inc.

- Enzymatic Deinking Technologies, LLC

- Enzyme Development Corporation

- Enzyme Solutions, Inc.

- Enzyme Supplies Limited

- Koninklijke DSM N.V.

- Lesaffre International, SAS

- Neogen Corporation

- Novus International, Inc.

- Roquette Freres

- Roquette Freres

- Sunson Industry Group Co., Ltd.

- Tex Biosciences(P)Ltd.