|

|

市場調査レポート

商品コード

1661263

屋外広告の市場規模、シェア、動向、予測:タイプ別、セグメント別、地域別、2025年~2033年Outdoor Advertising Market Size, Share, Trends and Forecast by Type, Segment, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 屋外広告の市場規模、シェア、動向、予測:タイプ別、セグメント別、地域別、2025年~2033年 |

|

出版日: 2025年02月10日

発行: IMARC

ページ情報: 英文 146 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

屋外広告の市場の世界市場規模は、2024年に410億米ドルとなった。今後、IMARC Groupは、2033年には679億7,000万米ドルに達し、2025年から2033年にかけて5.72%のCAGRを示すと予測しています。現在、アジアが市場を独占しており、2024年の市場シェアは34.5%を超えます。この地域の市場は、急速な都市化、スマートフォンの普及、デジタル技術の継続的な進歩が主な要因となっています。

屋外広告とは、アウトオブホーム(OOH)広告とも呼ばれ、屋外や公共のスペースで、さまざまな広告媒体やフォーマットを使って、多くの人々に宣伝メッセージを伝えることを指します。ビルボード、交通広告、ストリートファニチャー広告、デジタルディスプレイ、ポスターなど、さまざまな広告フォーマットが含まれます。高い頻度でメッセージに触れることができるため、ブランドリコールやメッセージの定着が強化されます。複数のタッチポイントで一貫したブランド・プレゼンスを提供することで、テレビ(TV)、ラジオ、デジタル・マーケティングなどの他の広告チャネルを補完します。イベント、コンサート、フェスティバル、スポーツイベントなどの宣伝に広く利用されています。

ビルボードへの接近をトリガーとする位置情報ベースのモバイル広告など、モバイル技術と屋外広告の統合は、オフラインとオンラインの広告チャネル間の相乗効果を高めています。これとは別に、視聴者データを分析して広告コンテンツを最適化し、さまざまな属性や時間帯にパーソナライズされたメッセージングを可能にする人工知能(AI)や機械学習(ML)アルゴリズムの利用が増加していることも、市場の成長を後押ししています。さらに、広告主はリアルタイムの気象データを利用して、関連性の高い屋外広告をトリガーするようになっています。さらに、音声起動技術の採用が増加しているため、消費者は音声コマンドを使用して屋外広告に関与できるようになり、よりインタラクティブで便利な体験ができるようになっています。

屋外広告の市場傾向/促進要因:

デジタルトランスフォーメーションとプログラマティック広告

屋外広告業界のデジタルトランスフォーメーションは、良好な市場見通しをもたらす重要な要因の一つです。さらに、デジタル技術とデータ主導の意思決定が屋外広告キャンペーンに統合されたことが、市場の成長を後押ししています。これとは別に、デジタル看板やスクリーンの普及が屋外広告に革命をもたらしています。これらのデジタル・ディスプレイは、リアルタイムで更新可能なダイナミック・コンテンツを提供し、広告主はより魅力的で関連性の高いキャンペーンを行うことができます。さらに、クイックリード(QR)コード、近距離無線通信(NFC)、位置情報技術の開発は、市場にプラスの影響を与えています。さらに、屋外広告スペースの購入と配置を自動化するプログラマティック・プラットフォームの利用が増加していることも、市場を牽引しています。

環境問題の高まり

環境に対する関心の高まりや、広告業界のエコロジカルフットプリントを削減するニーズの高まりも、市場の成長を後押しする大きな要因となっています。さらに、ビルボードや屋外ディスプレイに環境に優しい素材や印刷プロセスの採用が増加していることも、市場の明るい見通しを生み出しています。これらの素材はリサイクル可能で、持続可能なインクを使用しているため、屋外広告キャンペーンの環境への影響を軽減するのに役立っています。これとは別に、LED技術のような、よりエネルギー効率の高いビルボード用照明システムへのシフトが市場の成長を増大させています。LED照明は消費電力が少なく寿命が長いため、運用コストと二酸化炭素排出量を削減できます。

データ主導のターゲティングとパーソナライゼーション

データ主導のターゲティングとパーソナライゼーションは、広告主が特定のオーディエンスにメッセージをカスタマイズできるようにすることで、屋外広告の展望を変えつつあります。さらに、多くの広告主は、人口統計、行動、場所などの要素に基づいてターゲットオーディエンスをセグメント化するために、データ分析をますます利用するようになっています。これとは別に、屋外広告におけるビッグデータ分析の統合により、広告主は膨大なデータセットを活用してターゲティング戦略を洗練させ、人の往来が多く消費者との関連性が高いエリアへの的確な広告配置をサポートできるようになっています。さらに、天候、時間帯、視聴者の属性などの要因に基づいてリアルタイムで広告コンテンツを変更するデジタル看板の採用が増加しており、市場にプラスの影響を与えています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 イントロダクション

- 概要

- エグゼクティブサマリー

- 主要業界動向

第4章 世界の広告市場

- 現在と過去の市場動向

- 各種セグメントの実績

- 各地域の実績

- 主要企業とその市場シェア

- 市場予測

第5章 世界の屋外広告市場

- 市場概要

- 現在と過去の市場動向

- COVID-19の影響

- パフォーマンス:地域別

- アジア

- 中国

- 日本

- インド

- 韓国

- その他

- オーストラリア

- オーストラリア

- ニュージーランド

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- エジプト

- 南アフリカ

- その他

- アジア

- 市場内訳:タイプ別

- 伝統的屋外広告の市場

- デジタル屋外広告の市場

- 業績:セグメント別

- ビルボード広告

- 交通広告

- 街路家具広告

- その他

- 市場内訳:産業別

- 市場予測

- 屋外広告の価格モデル

- SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

- バリューチェーン分析

- 調査

- コンテンツ開発

- 広告代理店

- 屋外メディア(看板、公共交通機関、街路設備など)

- 観客

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 新規参入業者の脅威

- 主な課題

第6章 世界の屋外広告市場:競合情勢

- 市場構造

- 主要企業のプロファイル

List of Figures

Figure 5 1: Global: Advertising Market: Sales Value (in Billion USD), 2019-2024

Figure 5 2: Global: Advertising Market: Breakup by Segment (in %), 2024

Figure 5 3: Global: Advertising Market: Regional Breakup by Value (in Billion USD), 2019 and 2024

Figure 5 4: Global: Advertising Market: Regional Breakup (in %), 2024

Figure 5 5: Global: Advertising Market: Share of Key Players (in %), 2024

Figure 5 6: Global: Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 5 7: Global: Advertising Market Forecast: Breakup by Segments (in %), 2033

Figure 5 8: Global: Advertising Market Forecast: Regional Breakup (in %), 2033

Figure 6 1: Global: Outdoor Advertising Market: Sales Value (in Billion USD), 2019-2024

Figure 6 2: Global: Outdoor Advertising Market: Regional Breakup by Value (in %), 2024 and 2033

Figure 6 3: Global: Outdoor Advertising Market: Breakup by Region (in %), 2024

Figure 6 4: Asia: Outdoor Advertising Market: Sales Value (in Billion USD), 2019 and 2024

Figure 6 5: Asia: Outdoor Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 6 6: Australasia: Outdoor Advertising Market: Sales Value (in Billion USD), 2019 and 2024

Figure 6 7: Australasia: Outdoor Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 6 8: Europe: Outdoor Advertising Market: Sales Value (in Billion USD), 2019 and 2024

Figure 6 9: Europe: Outdoor Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 6 10: Latin America: Outdoor Advertising Market: Sales Value (in Billion USD), 2019 and 2024

Figure 6 11: Latin America: Outdoor Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 6 12: Middle East and Africa: Outdoor Advertising Market: Sales Value (in Billion USD), 2019 and 2024

Figure 6 13: Middle East and Africa: Outdoor Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 6 14: Global: Outdoor Advertising Market: Breakup by Type (in %), 2024

Figure 6 15: Global: Traditional Outdoor Advertising Market: Sales Value (in Billion USD), 2019 and 2024

Figure 6 16: Global: Traditional Outdoor Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 6 17: Global: Digital Outdoor Advertising Market: Sales Value (in Billion USD), 2019 and 2024

Figure 6 18: Global: Digital Outdoor Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 6 19: Global: Outdoor Advertising Market: Breakup by Segment (in %), 2024

Figure 6 20: Global: Billboard Advertising Market: Sales Value (in Billion USD), 2019 and 2024

Figure 6 21: Global: Billboard Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 6 22: Global: Transport Advertising Market: Sales Value (in Billion USD), 2019 and 2024

Figure 6 23: Global: Transport Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 6 24: Global: Street Furniture Advertising Market: Sales Value (in Billion USD), 2019 and 2024

Figure 6 25: Global: Street Furniture Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 6 26: Global: Others Advertising Market: Sales Value (in Billion USD), 2019 and 2024

Figure 6 27: Global: Others Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 6 28: Global: Outdoor Advertising Market: Breakup by Industry (in %), 2024

Figure 6 29: Global: Outdoor Advertising Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 6 30: Global: Outdoor Advertising Market Forecast: Breakup by Region (in %), 2033

Figure 6 31: Global: Outdoor Advertising Market Forecast: Breakup by Segment (in %), 2033

Figure 6 32: Global: Outdoor Advertising Market: SWOT Analysis

Figure 6 33: Global: Outdoor Advertising Market: Value Chain Analysis

Figure 6 34: Global: Outdoor Advertising Market: Porter's Five Forces Analysis

List of Tables

Table 3 1: Global: Advertising Market: Performance of Various Segments, (in Billion USD), 2019-2024

Table 3 2: Global: Advertising Market Forecast: Performance of Various Segments, (in Billion USD), 2025-2033

The global outdoor advertising market size was valued at USD 41.00 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 67.97 Billion by 2033, exhibiting a CAGR of 5.72% from 2025-2033. Asia currently dominates the market, holding a market share of over 34.5% in 2024. The market in the region is primarily driven by rapid urbanization, widespread smartphone penetration, and continuous advancements in digital technology.

Outdoor advertising, also known as out-of-home (OOH) advertising, refers to the practice of using various advertising media and formats to convey promotional messages to a wide audience in outdoor or public spaces. It encompasses various advertising formats, including billboards, transit ads, street furniture ads, digital displays, and posters. It offers high frequency exposure to messages, which reinforces brand recall and message retention. It complements other advertising channels, such as television (TV), radio, and digital marketing, by providing a consistent brand presence across multiple touchpoints. It is widely used for promoting events, concerts, festivals, and sporting events.

The integration of mobile technologies with outdoor advertising, such as location-based mobile ads triggered by proximity to billboards, is enhancing the synergy between offline and online advertising channels. Apart from this, the increasing use of artificial intelligence (AI) and machine learning (ML) algorithms to analyze audience data and optimize ad content and enable personalized messaging for different demographics and times of day, is favoring the market growth. In addition, advertisers are using real-time weather data to trigger relevant outdoor ads. Furthermore, the rising adoption of voice-activated technology is enabling consumers to engage with outdoor ads using voice commands and creating a more interactive and convenient experience.

Outdoor Advertising Market Trends/Drivers:

Digital transformation and programmatic advertising

The digital transformation of the outdoor advertising industry represents one of the key factors offering a favorable market outlook. Additionally, the integration of digital technology and data-driven decision-making into outdoor advertising campaigns is favoring the market growth. Apart from this, the widespread adoption of digital billboards and screens is revolutionizing outdoor advertising. These digital displays offer dynamic content that can be updated in real-time and enable advertisers to create more engaging and relevant campaigns. Furthermore, the development of quick read (QR) codes, near-field communication (NFC), and location-based technologies is influencing the market positively. Moreover, the increasing use of programmatic platforms to automate the buying and placement of outdoor ad space is driving the market.

Growing environmental concerns

The growing environmental concerns and the rising need to reduce the ecological footprint of the advertising industry is another major factor propelling the market growth. Additionally, the increasing adoption of eco-friendly materials and printing processes for billboards and outdoor displays is creating a positive market outlook. These materials are recyclable and use sustainable inks, which helps in reducing the environmental impact of outdoor advertising campaigns. Apart from this, the shift towards more energy-efficient lighting systems for billboards, such as LED technology is augmenting the market growth. LED lights consume less energy and have a longer lifespan, reducing operational costs and carbon emissions.

Data-driven targeting and personalization

Data-driven targeting and personalization are transforming the outdoor advertising landscape by allowing advertisers to tailor their messages to specific audiences. Additionally, many advertisers are increasingly using data analytics to segment their target audience based on factors like demographics, behavior, and location. Apart from this, the integration of big data analytics in outdoor advertising is allowing advertisers to tap into vast datasets to refine their targeting strategies and support precise ad placement in areas with high foot traffic and consumer relevance. Furthermore, the rising adoption of digital billboards to change ad content in real-time based on factors like weather conditions, time of day, and audience demographics is positively influencing the market.

Outdoor Advertising Industry Segmentation:

Breakup by Type:

Outdoor Advertising Market

- Traditional Outdoor Advertising

- Digital Outdoor Advertising

Traditional outdoor advertising encompasses conventional forms of outdoor ad displays that have been a staple in the industry for decades. This category includes static billboards, transit ads, posters, and physical street furniture ads. These ads typically rely on printed graphics and are static in nature, meaning their content remains fixed until manually replaced.

Digital advertising includes digital billboards, electronic transit displays, and interactive street furniture ads. These ads leverage digital screens and technologies to deliver dynamic and interactive content. Additionally, it provides flexibility, which enables advertisers to create highly engaging and contextually relevant campaigns. Apart from this, it aligns well with the evolving expectations of consumers for more interactive and personalized advertising experiences.

Breakup by Segment:

- Billboard Advertising

- Transport Advertising

- Street Furniture Advertising

- Others

Billboard advertising dominates the market

Billboard advertising involves large, eye-catching displays that are strategically placed along highways, major roads, and urban areas to capture the attention of a broad audience. Billboard ads are highly visible and serve as effective branding tools, conveying messages and promotions to commuters and pedestrians alike. Apart from this, they are non-intrusive, allowing consumers to engage with advertising messages at their own discretion. Furthermore, they offer a cost-effective solution as they require a one-time production cost and ongoing rental fees, which makes them a more budget-friendly choice for advertisers. Furthermore, the development of advanced tools like geolocation data and traffic patterns analysis provides advertisers with valuable insights into the reach and impact of their billboard campaigns.

Breakup by Region:

Outdoor Advertising Market

- Asia

- China

- Japan

- India

- South Korea

- Others

- Australasia

- Australia

- New Zealand

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Others

Asia exhibits a clear dominance, accounting for the largest outdoor advertising market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia (China, Japan, India, South Korea, and others); Australasia (Australia, New Zealand, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa (Saudi Arabia, UAE, Egypt, South Africa, and others) According to the report, Asia accounted for the largest market share as the region is home to a vast and diverse population, comprising numerous countries with varying cultures, languages, and demographics. This diversity provides lucrative opportunities to target a wide array of consumer segments through billboards, transit ads, and street furniture advertising. Additionally, rapid urbanization, increasing population, and the reliance on public and sharing commute are strengthening the growth of the market. Apart from this, many companies in the Asia Pacific region are utilizing outdoor advertising to drive online traffic and sales. Moreover, governing authorities of various countries in the region are providing support through investments in infrastructure, transportation networks, and public spaces.

Competitive Landscape:

Outdoor advertising companies are emphasizing eco-friendly advertising solutions, such as using sustainable materials for billboards and adopting energy-efficient lighting. Apart from this, they are focusing on location scouting and research to identify high-traffic areas and key demographics for optimal ad placement. Furthermore, they are developing innovative ways to engage the audience, such as QR code integration, social media integration, and mobile apps for interactive experiences. Moreover, they are adopting new technologies like augmented reality (AR) and location-based targeting to enhance the impact of outdoor advertising. Besides this, they are forming strategic collaborations with property owners, municipalities, and transportation companies to secure prime advertising locations and ensure compliance with local regulations.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Key Questions Answered in This Report

- 1.How big is the outdoor advertising market?

- 2.What is the future outlook of the outdoor advertising market?

- 3.What are the key factors driving the outdoor advertising market?

- 4.Which region accounts for the largest outdoor advertising market share?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

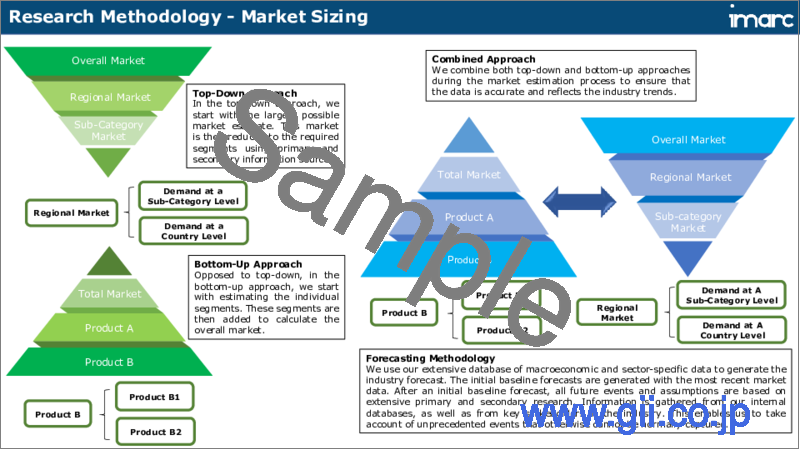

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Introduction

- 3.1 Overview

- 3.2 Executive Summary

- 3.3 Key Industry Trends

4 Global Advertising Market

- 4.1 Current and Historical Market Trends

- 4.2 Performance of Various Segments

- 4.3 Performance of Various Regions

- 4.4 Key Players and their Market Shares

- 4.5 Market Forecast

5 Global Outdoor Advertising Market

- 5.1 Market Overview

- 5.2 Current and Historical Market Trends

- 5.3 Impact of COVID-19

- 5.4 Performance by Region

- 5.4.1 Asia

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 Others

- 5.4.2 Australasia

- 5.4.2.1 Australia

- 5.4.2.2 New Zealand

- 5.4.2.3 Others

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Others

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 Others

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 UAE

- 5.4.5.3 Egypt

- 5.4.5.4 South Africa

- 5.4.5.5 Others

- 5.4.1 Asia

- 5.5 Market Breakup by Type

- 5.5.1 Traditional Outdoor Advertising Market

- 5.5.2 Digital Outdoor Advertising Market

- 5.6 Performance by Segment

- 5.6.1 Billboard Advertising

- 5.6.2 Transport Advertising

- 5.6.3 Street Furniture Advertising

- 5.6.4 Others

- 5.7 Market Breakup by Industry

- 5.8 Market Forecast

- 5.9 Outdoor Advertising Pricing Models

- 5.10 SWOT Analysis

- 5.10.1 Overview

- 5.10.2 Strengths

- 5.10.3 Weaknesses

- 5.10.4 Opportunities

- 5.10.5 Threats

- 5.11 Value Chain Analysis

- 5.11.1 Research

- 5.11.2 Content Development

- 5.11.3 Advertising Agencies

- 5.11.4 Outdoor Media (Billboards, Public Transport, Street Furniture, etc.)

- 5.11.5 Audience

- 5.12 Porters Five Forces Analysis

- 5.12.1 Bargaining Power of Suppliers

- 5.12.2 Bargaining Power of Buyers

- 5.12.3 Threat of Substitutes

- 5.12.4 Competitive Rivalry

- 5.12.5 Threat of New Entrants

- 5.13 Key Challenges

6 Global Outdoor Advertising Market: Competitive Landscape

- 6.1 Market Structure

- 6.2 Profiles of Leading Players