|

|

市場調査レポート

商品コード

1832094

フォトマスクの市場規模、シェア、動向、予測:製品、マスクショップタイプ、用途、地域別、2025~2033年Photomask Market Size, Share, Trends and Forecast by Product, Mask Shop Type, Application, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| フォトマスクの市場規模、シェア、動向、予測:製品、マスクショップタイプ、用途、地域別、2025~2033年 |

|

出版日: 2025年10月01日

発行: IMARC

ページ情報: 英文 141 Pages

納期: 2~3営業日

|

概要

フォトマスクの世界市場規模は2024年に51億米ドルとなりました。今後、IMARC Groupは、同市場が2033年までに70億米ドルに達し、2025年から2033年にかけて3.50%のCAGRを示すと予測しています。現在、アジア太平洋地域が市場を独占しており、2024年の市場シェアは36.6%を超えています。フォトマスク市場のシェアは、半導体・集積回路エレクトロニクスおよび自動車産業の高成長、リソグラフィプロセスの継続的な新興国市場の開発、半導体分野のハイテクデバイスに対する産業側の技術革新によって増加しています。

フォトマスク市場は、半導体産業において、様々な電子機器に使用される集積回路(IC)の製造に重要な役割を果たしているため、成長率が高まっています。フォトマスクは、フォトリソグラフィ工程で半導体ウエハー上に複雑な回路パターンを転写するために利用されます。半導体技術の急速な進化に伴い、マイクロエレクトロニクスの進歩、チップの小型化、高性能ICへのニーズの高まりなどを背景に、フォトマスクの需要は急増しています。フォトマスク市場の主な成長要因としては、5G、AI、IoT、自律走行車などの先端技術が挙げられます。これらの技術の消費の増加は、適切に機能し、長期間維持するために、小型化とコンパクトな半導体デバイスを要求します。従って、これらの製品はフォトマスクの需要増加の引き金となります。この成長は、自動車、通信、家電など多様な産業における半導体消費の増加によってさらに促進されます。産業界は半導体デバイスの高性能化と高集積化を求め続けており、フォトマスクはこれらの目標を達成するために不可欠な存在であり続けています。フォトマスクは、半導体製造プロセスの進歩に重要な役割を果たし、家電から自動車、通信に至るまで、さまざまな分野の技術進歩を支え、市場を牽引し続けています。

米国はフォトマスクの主要な地域市場として台頭し、半導体製造産業が米国経済の最重要産業であり続ける中、急速に成長しています。先端半導体デバイスの最大消費国の一つとして、自動車、通信、家電、ヘルスケアなどの分野がフォトマスクの需要を後押ししています。米国は、AI、5G、自律走行車など、高性能半導体やフォトマスクに依存する最先端技術の開発をリードしています。また、Intel、TSMC、Micronといった大手半導体メーカーも米国におけるフォトマスクの需要を後押ししています。また、チップ設計の微細化やプロセスノードの微細化といった動向も、より複雑なフォトマスクを必要とする大きな要因となっています。米国政府が国内半導体製造の強化に取り組んでいることも、フォトマスク業界のさらなる市場拡大環境を生み出しています。

フォトマスク市場動向:

先端半導体デバイスの需要拡大

先端半導体デバイスのニーズの高まりが、フォトマスクの需要を押し上げています。この急増は、モノのインターネット(IoT)、5Gネットワーク、クラウドコンピューティングなど、より強力で効率的な半導体チップを必要とする新興技術に後押しされています。米国商務省の報告書によると、米国における半導体の販売額は2021年に29%増加しました。その理由は、スマートフォンやラップトップ技術から自動車用電子機器や産業機械に至るまで、あらゆるものに使用される高性能チップへの旺盛な需要です。より速く、より小さく、より信頼性の高いチップが求められる用途では、フォトマスクが精密で効率的な半導体製造を可能にします。半導体デバイスのニーズは、AI、エッジコンピューティング、コネクテッドデバイスの採用傾向を通じてさらにエスカレートし、フォトマスクメーカーを市場要求の変化に合わせてイノベーションへと向かわせる。同時に、高いデータトラフィックを伴う5Gインフラの普及が、高性能チップの需要をさらに高める。特に、半導体技術がより小さなノードやより複雑なチップ設計に移行するにつれて、このような先端デバイスへの急激な需要は、フォトマスク市場の拡大に極めて重要な役割を果たし続けるでしょう。

エレクトロニクス産業と自動車産業の急成長

エレクトロニクス産業と自動車産業は大きな勢いを増しています。これは半導体とフォトマスクの需要に直接影響を与えています。世界のエレクトロニクス産業は、技術の進歩、消費者のエレクトロニクス製品に対する需要の増加、IoTやウェアラブル技術の利用拡大などの理由から、著しい成長を遂げています。国際貿易局は、世界のエレクトロニクス産業は2025年までに5兆米ドルの市場価値を超えると予測しており、半導体メーカー、ひいてはフォトマスクメーカーに多くのチャンスをもたらしています。その影響は、電気自動車や自動運転技術を追求する自動車分野にも見られ、そこでは先進的な半導体が求められています。センサー、インフォテインメントシステム、自律走行機能に依存するコネクテッドカーは、より強力なチップの必要性をさらに高めています。こうした動向は、製造に高度なフォトマスクを必要とする複雑な半導体ソリューションの開発につながっています。半導体技術がエレクトロニクスや自動車アプリケーションに統合されるにつれて、フォトマスク市場はこれらの業界のニーズに対応する必要があります。電気自動車用バッテリー、ADAS(先進運転支援システム)、インフォテインメントシステムなどの用途で高性能チップの需要が高まっていることから、フォトマスクメーカーは今後さらに重要な役割を果たすことになるでしょう。

リソグラフィプロセスの技術革新

リソグラフィプロセスにおける技術革新が、フォトマスク市場の動向を形成しています。最も重要な開発のひとつは、極端紫外線(EUV)リソグラフィの導入です。EUVリソグラフィは、半導体製造における重要なステップです。この技術は、より小さな半導体フィーチャをより高い解像度で形成することを可能にし、高度で高性能なデバイスを製造するためのチップを顧客に提供します。International Technology Roadmap for Semiconductorsによると、EUVツールの出荷台数は2020年と比較して2021年には50%増加します。これは、業界におけるこの最先端技術への急速なシフトを示しています。フォトマスク市場は、EUVアプリケーションに最適化されたフォトマスクが、より微細なノードのチップ製造に不可欠となるため、リソグラフィ能力の飛躍的な向上に直接影響を受けます。EUVの採用は、チップ性能の向上、コスト効率の向上、高密度で電力効率の高いデバイスの需要への対応につながります。半導体のノードは5nm以降に微細化しています。そのため、フォトマスクは設計の複雑さとリソグラフィの成功に必要な精度のレベルの向上に対応しなければなりません。EUVの急速な普及ペースとマスク製造技術の進歩は、フォトマスクが半導体製造の重要な一部であり続けることを確実にし、市場をさらに成長させると思われます。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

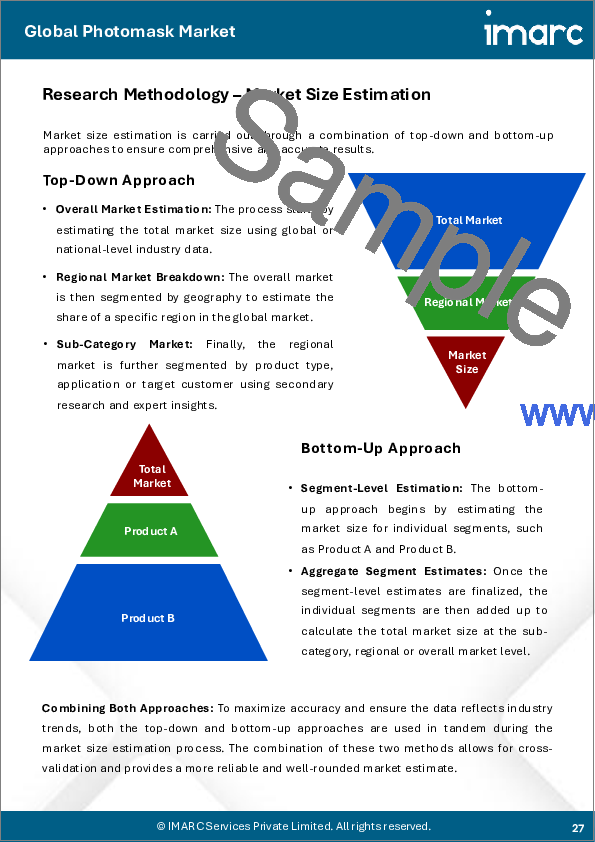

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

第5章 世界のフォトマスク市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:製品別

- レチクル

- マスター

- その他

第7章 市場内訳:マスクショップタイプ別

- 自社内生産型

- 商業販売型

第8章 市場内訳:用途別

- 光学デバイス

- ディスクリートコンポーネント

- ディスプレイ

- MEMS

- その他

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

第10章 SWOT分析

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Advance Reproductions Corp.

- Applied Materials Inc.

- HOYA Corporation

- Infinite Graphics Incorporated

- KLA Corporation

- LG Innotek Co. Ltd

- Mycronic AB(publ)

- Nippon Filcon Co. Ltd.

- Photronics Inc.

- SK-Electronics Co. Ltd.

- Taiwan Mask Corporation

- Toppan Printing Co. Ltd.