|

|

市場調査レポート

商品コード

1790181

衛星サービス市場規模、シェア、動向分析レポート:軌道別、サービス別、タイプ別、最終用途別、地域別、セグメント予測、2025年~2033年Satellite Servicing Market Size, Share & Trends Analysis Report By Orbit (Low Earth Orbit, Medium Earth Orbit, Geostationary Orbit ), By Service, By Type, By End Use, By Region, And Segment Forecasts, 2025 - 2033 |

||||||

カスタマイズ可能

|

|||||||

| 衛星サービス市場規模、シェア、動向分析レポート:軌道別、サービス別、タイプ別、最終用途別、地域別、セグメント予測、2025年~2033年 |

|

出版日: 2025年07月01日

発行: Grand View Research

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

衛星サービス市場の概要

世界の衛星サービス市場規模は、2024年に29億9,610万米ドルと推定され、2033年には70億6,190万米ドルに達すると予測され、2025~2033年のCAGRは10.1%で成長します。市場成長の主要因は、衛星寿命延長需要の高まり、軌道上の老朽衛星数の増加、宇宙インフラへの投資の増加、ロボットサービス技術の進歩、軌道上サービスソリューションの開発です。

市場成長の主要原動力は、軌道上サービス、燃料補給、修理を通じて既存の衛星の寿命と運用効率を延ばす必要性が高まっていることです。特に商業衛星運用者や防衛機関による費用対効果の高い宇宙運用に対する需要の高まりが、自律型やロボット型のサービス技術の開発に拍車をかけています。モジュール型の衛星設計と標準化された保守インターフェースは、衛星保守ミッションのスケーラビリティと実現可能性をさらに向上させており、これが衛星保守産業の拡大を促進すると予想されます。

衛星の運用寿命延長に対する需要の高まりが、衛星保守市場の成長を大きく後押ししています。通信、地球観測、防衛などの用途で打ち上げられる衛星の数が増加するにつれて、軌道上のこれらの資産を保守、補給、アップグレードする必要性が高まっています。衛星整備技術により、事業者は衛星の寿命を延ばし、ミッションコストを削減し、投資収益率を向上させることができます。この動向は、政府と民間宇宙利害関係者の双方を引き付けており、それによって市場の継続的な技術革新が促進されています。

さらに、宇宙の持続可能性とデブリ緩和への注目の高まりが、市場の主要な成長要因となっています。軌道環境はますます混雑しており、廃止された衛星の軌道離脱、資産の再配置、スペースデブリの除去といった軌道上サービスソリューションが重視されるようになっています。衛星サービス産業は、ロボットアーム、自律ドッキング、デブリ回収能力を提供するように進化しています。これらのソリューションは、より安全な宇宙運用を世界の持続可能性目標に合致させ、衛星サービス産業全体の採用を後押ししています。

さらに、自律ロボット工学とAIベースナビゲーションシステムの統合は、衛星サービスミッションの能力に革命をもたらしています。これらの先進技術は、人間の介入なしに、自律的な燃料補給、部品交換、検査作業などの正確でリアルタイムのオペレーションを可能にします。このような複雑な操作を自動化することで、ミッションの成功率を高め、運用上のリスクを低減することができるため、政府機関と民間宇宙プログラムの両方において、衛星整備ソリューションの採用が加速しています。

さらに、衛星メーカー、サービス技術プロバイダ、宇宙機関の間の協力関係が強化され、標準化されたサービス・アーキテクチャーの開発が進んでいます。このようなパートナーシップは、相互運用可能な宇宙機設計、モジュール型サービスインターフェース、サービス運用を合理化するオープンシステムプロトコルにつながります。利害関係者間の技術標準の整合は、より統合されたスケーラブルな衛星サービスエコシステムを育み、最終的に堅調な市場成長を後押ししています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 衛星サービス市場の変数、動向、範囲

- 市場系統の展望

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 導入の課題

- 衛星サービス市場分析ツール

- 展開分析-ポーター

- PESTEL分析

第4章 衛星サービス市場:軌道別、推定・動向分析

- セグメントダッシュボード

- 衛星サービス市場:軌道変動分析、2024年と2033年

- Windowsシステム

- 低軌道(LEO)

- 中軌道(MEO)

- 静止軌道(GEO)

第5章 衛星サービス市場:サービス別、推定・動向分析

- セグメントダッシュボード

- 衛星サービス市場:サービス変動分析、2024年と2033年

- 能動的デブリ除去(ADR)と軌道調整

- ロボットによるサービス

- 給油

第6章 衛星サービス市場:タイプ別、推定・動向分析

- セグメントダッシュボード

- 衛星サービス市場:タイプ変動分析、2024年と2033年

- 小型衛星(500kg以下)

- 中型衛星(501~1,000kg)

- 大型衛星(1,000kg超)

第7章 衛星サービス市場:最終用途別、推定・動向分析

- セグメントダッシュボード

- 衛星サービス市場:最終用途変動分析、2024年と2033年

- 軍事と政府

- 商用

第8章 衛星サービス市場:地域別、推定・動向分析

- 地域別衛星サービス市場、2024年と2033年

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- ラテンアメリカ

- ブラジル

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第9章 競合情勢

- 企業分類

- 企業の市場ポジショニング

- 企業ヒートマップ分析

- 企業プロファイル/上場企業

- Northrop Grumman

- Maxar Technologies

- Astroscale

- Orbit Fab, Inc.

- Thales Alenia Space

- AIRBUS

- Lockheed Martin Corporation

- ClearSpace

- Altius Space Machines

- Starfish Space.

List of Tables

- Table 1 Satellite Servicing Market Size Estimates & Forecasts 2021 - 2033 (USD Million)

- Table 2 Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 3 Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 4 Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 5 Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

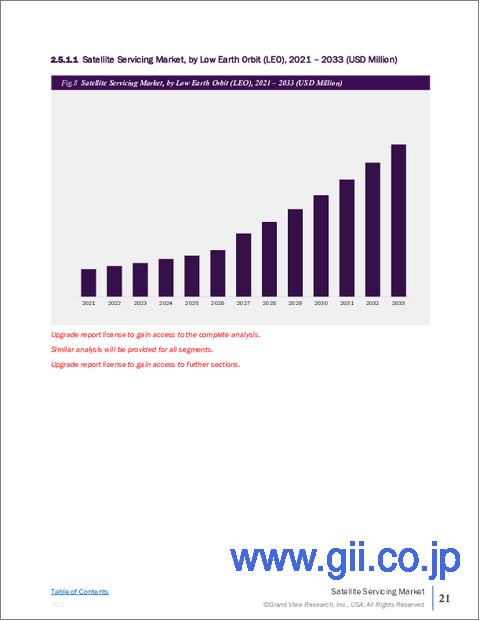

- Table 6 Low Earth Orbit (LEO) Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- Table 7 Medium Earth Orbit (MEO) Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- Table 8 Geostationary Orbit (GEO) Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- Table 9 Active Debris Removal (ADR) and Orbit Adjustment Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- Table 10 Robotic Servicing Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- Table 11 Refueling Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- Table 12 Assembly Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- Table 13 Small Satellites (< 500 Kg) Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- Table 14 Medium Satellites (501- 1000 Kg) Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- Table 15 Large Satellites (>1000 Kg) Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- Table 16 Military & Government Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- Table 17 Commercial Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- Table 18 North America Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 19 North America Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 20 North America Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 21 North America Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 22 U.S. Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 23 U.S. Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 24 U.S. Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 25 U.S. Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 26 Canada Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 27 Canada Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 28 Canada Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 29 Canada Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 30 Mexico Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 31 Mexico Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 32 Mexico Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 33 Mexico Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 34 Europe Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 35 Europe Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 36 Europe Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 37 Europe Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 38 UK Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 39 UK Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 40 UK Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 41 UK Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 42 Germany Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 43 Germany Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 44 Germany Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 45 Germany Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 46 France Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 47 France Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 48 France Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 49 France Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 50 Asia Pacific Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 51 Asia Pacific Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 52 Asia Pacific Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 53 Asia Pacific Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 54 China Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 55 China Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 56 China Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 57 China Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 58 Japan Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 59 Japan Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 60 Japan Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 61 Japan Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 62 India Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 63 India Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 64 India Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 65 India Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 66 South Korea Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 67 South Korea Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 68 South Korea Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 69 South Korea Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 70 Australia Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 71 Australia Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 72 Australia Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 73 Australia Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 74 Latin America Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 75 Latin America Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 76 Latin America Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 77 Latin America Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 78 Brazil Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 79 Brazil Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 80 Brazil Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 81 Brazil Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 82 Middle East & Africa Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 83 Middle East & Africa Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 84 Middle East & Africa Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 85 Middle East & Africa Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 86 Saudi Arabia Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 87 Saudi Arabia Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 88 Saudi Arabia Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 89 Saudi Arabia Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 90 UAE Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 91 UAE Satellite Servicing Market, By Service 2021 - 2033 (USD Million)

- Table 92 UAE Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 93 UAE Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

- Table 94 South Africa Satellite Servicing Market, By Orbit 2021 - 2033 (USD Million)

- Table 95 South Africa Satellite Servicing Market, By Service, 2021 - 2033 (USD Million)

- Table 96 South Africa Satellite Servicing Market, By Type 2021 - 2033 (USD Million)

- Table 97 South Africa Satellite Servicing Market, By End Use 2021 - 2033 (USD Million)

List of Figures

- Fig. 1 Satellite servicing market segmentation

- Fig. 2 Information procurement

- Fig. 3 Data analysis models

- Fig. 4 Market formulation and validation

- Fig. 5 Data validating & publishing

- Fig. 6 Satellite servicing market snapshot

- Fig. 7 Satellite servicing market segment snapshot

- Fig. 8 Satellite servicing market competitive landscape snapshot

- Fig. 9 Market research process

- Fig. 10 Market driver relevance analysis (current & future impact)

- Fig. 11 Market restraint relevance analysis (current & future impact)

- Fig. 12 Satellite servicing market, by orbit, key takeaways

- Fig. 13 Satellite servicing market, by orbit, market share, 2024 & 2033

- Fig. 14 Low earth orbit (LEO) market estimates & forecasts, 2021 - 2033 (USD Million)

- Fig. 15 Medium earth orbit (MEO) market estimates & forecasts, 2021 - 2033 (USD Million)

- Fig. 16 Geostationary orbit (GEO) market estimates & forecasts, 2021 - 2033 (USD Million)

- Fig. 17 Satellite servicing market, by service, key takeaways

- Fig. 18 Satellite servicing market, by service, market share, 2024 & 2033

- Fig. 19 Active debris removal (ADR) and orbit adjustment market estimates & forecasts, 2021 - 2033 (USD Million)

- Fig. 20 Robotic servicing market estimates & forecasts, 2021 - 2033 (USD Million)

- Fig. 21 Refueling market estimates & forecasts, 2021 - 2033 (USD Million)

- Fig. 22 Assembly market estimates & forecasts, 2021 - 2033 (USD Million)

- Fig. 23 Satellite servicing market, by type, key takeaways

- Fig. 24 Satellite servicing market, by type, market share, 2024 & 2033

- Fig. 25 Small satellites (< 500 Kg) market estimates & forecasts, 2021 - 2033 (USD Million)

- Fig. 26 Medium satellites (501- 1000 Kg) market estimates & forecasts, 2021 - 2033 (USD Million)

- Fig. 27 Large satellites (>1000 Kg) market estimates & forecasts, 2021 - 2033 (USD Million)

- Fig. 28 Satellite servicing market, by end use, key takeaways

- Fig. 29 Satellite servicing market, by end use, market share, 2024 & 2033

- Fig. 30 Military & government market estimates & forecasts, 2021 - 2033 (USD Million)

- Fig. 31 Commercial market estimates & forecasts, 2021 - 2033 (USD Million)

- Fig. 32 Regional marketplace: key takeaways

- Fig. 33 North America satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 34 U.S. satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 35 Canada satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 36 Mexico satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 37 Europe satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 38 UK satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 39 Germany satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 40 France satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 41 Asia Pacific satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 42 China satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 43 Japan satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 44 India satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 45 South Korea satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 46 Australia satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 47 Latin America satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 48 Brazil satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 49 Middle East & Africa satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 50 Saudi Arabia satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 51 UAE satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 52 South Africa satellite servicing market estimates & forecast, 2021 - 2033 (USD Million)

- Fig. 53 Key company categorization

- Fig. 54 Strategy framework

Satellite Servicing Market Summary

The global satellite servicing market size was estimated at USD 2,996.1 million in 2024 and is projected to reach USD 7,061.9 million by 2033, growing at a CAGR of 10.1% from 2025 to 2033. Market growth is primarily driven by the rising demand for extending satellite lifespans, the increasing number of aging satellites in orbit, higher investments in space infrastructure, advances in robotic servicing technologies, and the development of on-orbit servicing solutions.

The market growth is primarily driven by the increasing need for extending the lifespan and operational efficiency of existing satellites through in-orbit servicing, refueling, and repairs. The rising demand for cost-effective space operations, especially by commercial satellite operators and defense agencies, is fueling the development of autonomous and robotic servicing technologies. Modular satellite designs and standardized servicing interfaces are further improving the scalability and feasibility of satellite maintenance missions, which is expected to drive the satellite servicing industry expansion.

The rising demand for extending the operational life of satellites is significantly fueling the growth of the satellite servicing market. With the increasing number of satellites being launched for communication, Earth observation, and defense applications, there is a growing need to maintain, refuel, and upgrade these assets in orbit. Satellite servicing technologies enable operators to extend satellite lifespans, reduce mission costs, and improve return on investment. This trend is attracting both government and commercial space stakeholders, thereby driving continuous innovation in the market.

Additionally, the increasing focus on space sustainability and debris mitigation is becoming a major growth driver for the market. The orbital environment becomes increasingly congested, and there is a growing emphasis on in-orbit servicing solutions such as de-orbiting defunct satellites, repositioning assets, and clearing space debris. The satellite servicing industry is evolving to offer robotic arms, autonomous docking, and debris collection capabilities. These solutions ensure safer space operations align with global sustainability goals, boosting adoption across the satellite servicing industry.

Furthermore, the integration of autonomous robotics and AI-based navigation systems is revolutionizing the capabilities of satellite servicing missions. These advanced technologies allow precise, real-time operations such as autonomous refueling, part replacement, and inspection tasks without human intervention. Automating these complex maneuvers enhances mission success rates and reduces operational risks, thereby accelerating the adoption of satellite servicing solutions across both government and commercial space programs.

Moreover, increasing collaboration between satellite manufacturers, servicing technology providers, and space agencies is enhancing the development of standardized servicing architectures. These partnerships lead to interoperable spacecraft designs, modular servicing interfaces, and open-system protocols that streamline servicing operations. The alignment of technical standards across stakeholders is fostering a more integrated and scalable satellite servicing ecosystem, ultimately fueling robust market growth.

Global Satellite Servicing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the satellite servicingmarket report based on orbit, service, type, end use, and region:

- Orbit Outlook (Revenue, USD Million, 2021 - 2033)

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Orbit (GEO)

- Service Outlook (Revenue, USD Million, 2021 - 2033)

- Active Debris Removal (ADR) and Orbit Adjustment

- Robotic Servicing

- Refueling

- Assembly

- Type Outlook (Revenue, USD Million, 2021 - 2033)

- Small Satellites (< 500 Kg)

- Medium Satellites (501- 1000 Kg)

- Large Satellites (>1000 Kg)

- End Use Outlook (Revenue, USD Million, 2021 - 2033)

- Military & Government

- Commercial

- Regional Outlook (Revenue, USD Million, 2021 - 2033)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation and Scope

- 1.2. Market Definitions

- 1.2.1. Information analysis

- 1.2.2. Market formulation & data visualization

- 1.2.3. Data validation & publishing

- 1.3. Research Scope and Assumptions

- 1.3.1. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.3. Competitive Insights

Chapter 3. Satellite Servicing Market Variables, Trends, & Scope

- 3.1. Market Lineage Outlook

- 3.2. Market Dynamics

- 3.2.1. Market Driver Analysis

- 3.2.2. Market Restraint Analysis

- 3.2.3. Deployment Challenge

- 3.3. Satellite Servicing Market Analysis Tools

- 3.3.1. Deployment Analysis - Porter's

- 3.3.1.1. Bargaining power of the suppliers

- 3.3.1.2. Bargaining power of the buyers

- 3.3.1.3. Threats of substitution

- 3.3.1.4. Threats from new entrants

- 3.3.1.5. Competitive rivalry

- 3.3.2. PESTEL Analysis

- 3.3.2.1. Political landscape

- 3.3.2.2. Economic landscape

- 3.3.2.3. Social landscape

- 3.3.2.4. Technological landscape

- 3.3.2.5. Environmental landscape

- 3.3.2.6. Legal landscape

- 3.3.1. Deployment Analysis - Porter's

Chapter 4. Satellite Servicing Market: Orbit Estimates & Trend Analysis

- 4.1. Segment Dashboard

- 4.2. Satellite Servicing Market: Orbit Movement Analysis, 2024 & 2033 (USD Million)

- 4.3. Windows Systems

- 4.3.1. Windows Systems Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

- 4.4. Low Earth Orbit (LEO)

- 4.4.1. Low Earth Orbit (LEO) Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

- 4.5. Medium Earth Orbit (MEO)

- 4.5.1. Medium Earth Orbit (MEO) Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

- 4.6. Geostationary Orbit (GEO)

- 4.6.1. Geostationary Orbit (GEO) Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 5. Satellite Servicing Market: Service Estimates & Trend Analysis

- 5.1. Segment Dashboard

- 5.2. Satellite Servicing Market: Service Movement Analysis, 2024 & 2033 (USD Million)

- 5.3. Active Debris Removal (ADR) and Orbit Adjustment

- 5.3.1. Active Debris Removal (ADR) and Orbit Adjustment Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

- 5.4. Robotic Servicing

- 5.4.1. Robotic Servicing Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

- 5.5. Refueling

- 5.5.1. Refueling Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 6. Satellite Servicing Market: Type Estimates & Trend Analysis

- 6.1. Segment Dashboard

- 6.2. Satellite Servicing Market: Type Movement Analysis, 2024 & 2033 (USD Million)

- 6.3. Small Satellites (< 500 Kg)

- 6.3.1. Small Satellites (< 500 Kg) Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

- 6.4. Medium Satellites (501- 1000 Kg)

- 6.4.1. Medium Satellites (501- 1000 Kg) Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

- 6.5. Large Satellites (>1000 Kg)

- 6.5.1. Large Satellites (>1000 Kg) Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 7. Satellite Servicing Market: End Use Estimates & Trend Analysis

- 7.1. Segment Dashboard

- 7.2. Satellite Servicing Market: End Use Movement Analysis, 2024 & 2033 (USD Million)

- 7.3. Military & Government

- 7.3.1. Military & Government Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

- 7.4. Commercial

- 7.4.1. Commercial Market Revenue Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 8. Satellite Servicing Market: Regional Estimates & Trend Analysis

- 8.1. Satellite Servicing Market by Region, 2024 & 2033

- 8.2. North America

- 8.2.1. North America Satellite Servicing Market Estimates & Forecasts, 2021 - 2033, (USD Million)

- 8.2.2. U.S.

- 8.2.2.1. Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.2.3. Canada

- 8.2.3.1. Canada Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.2.4. Mexico

- 8.2.4.1. Mexico Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.3. Europe

- 8.3.1. Europe Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.3.2. UK

- 8.3.2.1. UK Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.3.3. Germany

- 8.3.3.1. Germany Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.3.4. France

- 8.3.4.1. France Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.4. Asia Pacific

- 8.4.1. Asia Pacific Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.4.2. China

- 8.4.2.1. China Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.4.3. Japan

- 8.4.3.1. Japan Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.4.4. India

- 8.4.4.1. India Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.4.5. South Korea

- 8.4.5.1. South Korea Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.4.6. Australia

- 8.4.6.1. Australia Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.5. Latin America

- 8.5.1. Latin America Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.5.2. Brazil

- 8.5.2.1. Brazil Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.6. Middle East and Africa

- 8.6.1. Middle East and Africa Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.6.2. Saudi Arabia

- 8.6.2.1. Saudi Arabia Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.6.3. UAE

- 8.6.3.1. UAE Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

- 8.6.4. South Africa

- 8.6.4.1. South Africa Satellite Servicing Market Estimates and Forecasts, 2021 - 2033 (USD Million)

Chapter 9. Competitive Landscape

- 9.1. Company Categorization

- 9.2. Company Market Positioning

- 9.3. Company Heat Map Analysis

- 9.4. Company Profiles/Listing

- 9.4.1. Northrop Grumman

- 9.4.1.1. Participant's Overview

- 9.4.1.2. Financial Performance

- 9.4.1.3. Service Benchmarking

- 9.4.1.4. Strategic Initiatives

- 9.4.2. Maxar Technologies

- 9.4.2.1. Participant's Overview

- 9.4.2.2. Financial Performance

- 9.4.2.3. Service Benchmarking

- 9.4.2.4. Strategic Initiatives

- 9.4.3. Astroscale

- 9.4.3.1. Participant's Overview

- 9.4.3.2. Financial Performance

- 9.4.3.3. Service Benchmarking

- 9.4.3.4. Strategic Initiatives

- 9.4.4. Orbit Fab, Inc.

- 9.4.4.1. Participant's Overview

- 9.4.4.2. Financial Performance

- 9.4.4.3. Service Benchmarking

- 9.4.4.4. Strategic Initiatives

- 9.4.5. Thales Alenia Space

- 9.4.5.1. Participant's Overview

- 9.4.5.2. Financial Performance

- 9.4.5.3. Service Benchmarking

- 9.4.5.4. Strategic Initiatives

- 9.4.6. AIRBUS

- 9.4.6.1. Participant's Overview

- 9.4.6.2. Financial Performance

- 9.4.6.3. Service Benchmarking

- 9.4.6.4. Strategic Initiatives

- 9.4.7. Lockheed Martin Corporation.

- 9.4.7.1. Participant's Overview

- 9.4.7.2. Financial Performance

- 9.4.7.3. Service Benchmarking

- 9.4.7.4. Strategic Initiatives

- 9.4.8. ClearSpace

- 9.4.8.1. Participant's Overview

- 9.4.8.2. Financial Performance

- 9.4.8.3. Service Benchmarking

- 9.4.8.4. Strategic Initiatives

- 9.4.9. Altius Space Machines

- 9.4.9.1. Participant's Overview

- 9.4.9.2. Financial Performance

- 9.4.9.3. Service Benchmarking

- 9.4.9.4. Strategic Initiatives

- 9.4.10. Starfish Space.

- 9.4.10.1. Participant's Overview

- 9.4.10.2. Financial Performance

- 9.4.10.3. Service Benchmarking

- 9.4.10.4. Strategic Initiatives

- 9.4.1. Northrop Grumman