|

|

市場調査レポート

商品コード

1751636

ファクトリーオートメーションの市場規模、シェア、動向分析レポート:コンポーネント別、技術別、最終用途別、地域別、セグメント予測、2025年~2030年Factory Automation Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Technology (DCS, PLC, SCADA), By End Use, By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| ファクトリーオートメーションの市場規模、シェア、動向分析レポート:コンポーネント別、技術別、最終用途別、地域別、セグメント予測、2025年~2030年 |

|

出版日: 2025年05月21日

発行: Grand View Research

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

ファクトリーオートメーションの市場規模と動向:

世界のファクトリーオートメーション市場規模は、2024年に360億1,000万米ドルと推定され、2025年から2030年にかけてCAGR 11.1%で成長すると予測されています。

この産業の主な原動力は、業務効率化に対する需要の高まり、製造業と産業部門の成長、コスト削減と生産性向上を目的とした自律型プラントと遠隔操作の導入の増加です。

さらに、ファクトリーオートメーションシステムにおける人工知能(AI)と機械学習(ML)の採用拡大が、製造プロセスに革命をもたらし、予知保全、リアルタイムデータ分析、自律的意思決定を可能にし、ダウンタイムを削減し、ファクトリーオートメーション産業の拡大にさらに拍車をかけています。協働ロボット(コボット)の統合が進んでいることも、ファクトリーオートメーション業界の大きな原動力となっています。これはフレキシブルオートメーションへのシフトを反映しており、コボットはダイナミック、小ロット、または多品種の製造タスクにますます使用されるようになっています。企業は、変化する生産需要に迅速に対応するために、コボットのプログラミングの容易さと適応性を活用しています。さらに、作業効率を向上させながら作業員の健康をサポートする安全認証ロボット工学が重視されるようになっており、コボットは次世代スマート工場の中心的な機能となっています。

さらに、エッジコンピューティングは、ファクトリーオートメーション業界における重要なトレンドとして浮上しており、クラウドインフラストラクチャのみに依存するのではなく、センサー、機械、ロボットなどのソースに直接、またはその近くで、より高速なデータ処理を可能にしています。このアプローチは、レイテンシーを大幅に削減し、リアルタイム制御を強化し、時間に敏感な産業環境におけるシステムの信頼性を向上させます。さらに、ローカライズされたAI推論をサポートし、クラウドに常時接続することなくインテリジェントで自律的な意思決定を行うオートメーションシステムを強化します。

さらに、デジタルツインテクノロジーの採用は、ファクトリーオートメーション業界を急速に変革しています。これらの物理的資産の仮想レプリカにより、メーカーは実際の生産を中断することなく、リアルタイムでオペレーションのシミュレーション、変更のテスト、問題の診断を行うことができます。予知保全と性能最適化を可能にすることで、デジタルツインはダウンタイムを削減し、システム効率を高めるのに役立ちます。この動向は、精度と信頼性が重要な航空宇宙、自動車、エネルギーなどの複雑な産業で特に大きな影響を与えます。

さらに、工場ではオートメーション・システムの管理にクラウドベースのプラットフォームを採用する傾向が強まっており、複数の拠点にまたがる集中制御、遠隔監視、データ主導型の洞察が可能になっています。クラウド・ソリューションは、ソフトウェアの迅速な更新、リアルタイムの分析、企業のITシステムとのシームレスな統合をサポートします。このシフトはまた、Automation-as-a-Serviceのような新しいビジネスモデルへの道を開き、製造業者がより少ない資本投資で効率的に業務を拡大できるようにします。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 ファクトリーオートメーション市場の変数、動向、範囲

- 市場系統の見通し

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 導入の課題

- ファクトリーオートメーション市場分析ツール

- 展開分析- ポーター

- PESTEL分析

第4章 ファクトリーオートメーション市場:コンポーネントの推定・動向分析

- セグメントダッシュボード

- ファクトリーオートメーション市場:コンポーネントの変動分析、2024年および2030年

- ハードウェア

- ソフトウェア

- サービス

第5章 ファクトリーオートメーション市場:技術推定・動向分析

- セグメントダッシュボード

- ファクトリーオートメーション市場:技術変動分析、2024年および2030年

- DCS

- PLC

- SCADA

- その他

第6章 ファクトリーオートメーション市場:最終用途の推定・動向分析

- セグメントダッシュボード

- ファクトリーオートメーション市場:最終用途変動分析、2024年および2030年

- 航空宇宙および防衛

- 自動車

- 化学薬品

- エネルギー・公益事業

- 食品・飲料

- ヘルスケア

- 製造業

- 鉱業・金属

- 石油・ガス

- 交通機関

- その他

第7章 地域推定・動向分析

- 地域別ファクトリーオートメーション市場、2024年および2030年

- 北米

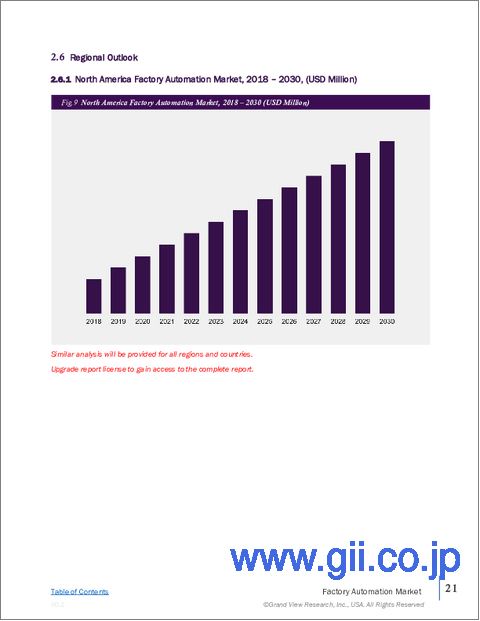

- 北米ファクトリーオートメーション市場の推定と予測、2018年~2030年

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のファクトリーオートメーション市場推計・予測、2018年~2030年

- 英国

- ドイツ

- フランス

- アジア太平洋

- アジア太平洋のファクトリーオートメーション市場推計・予測、2018年~2030年

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- ラテンアメリカ

- ラテンアメリカのファクトリーオートメーション市場推計・予測、2018年~2030年

- ブラジル

- 中東・アフリカ

- 中東・アフリカのファクトリーオートメーション市場推計・予測、2018年~2030年

- サウジアラビア

- 南アフリカ

- アラブ首長国連邦

第8章 競合情勢

- 企業分類

- 企業の市場ポジショニング

- 企業ヒートマップ分析

- 企業プロファイル/上場企業

- ABB Ltd.

- Emerson Electric Co.

- Fuji Electric Co., Ltd.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Omron Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corporation

List of Tables

- Table 1 Factory Automation Market Size Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Table 2 Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 3 Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 4 Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 5 Hardware Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 6 Software Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 7 Services Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 8 DCS Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 9 PLC Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 10 SCADA Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 11 Others Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 12 Aerospace & Defense Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 13 Automotive Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 14 Chemical Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 15 Energy & Utilities Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 16 Food & Beverage Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 17 Healthcare Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 18 Manufacturing Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 19 Mining & Metal Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 20 Oil & Gas Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 21 Transportation Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 22 Others Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- Table 23 North America Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 24 North America Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 25 North America Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 26 U.S. Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 27 U.S. Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 28 U.S. Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 29 Canada Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 30 Canada Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 31 Canada Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 32 Mexico Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 33 Mexico Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 34 Mexico Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 35 Europe Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 36 Europe Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 37 Europe Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 38 UK Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 39 UK Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 40 UK Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 41 Germany Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 42 Germany Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 43 Germany Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 44 France Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 45 France Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 46 France Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 47 Asia Pacific Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 48 Asia Pacific Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 49 Asia Pacific Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 50 China Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 51 China Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 52 China Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 53 Japan Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 54 Japan Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 55 Japan Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 56 India Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 57 India Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 58 India Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 59 South Korea Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 60 South Korea Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 61 South Korea Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 62 Australia Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 63 Australia Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 64 Australia Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 65 Latin America Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 66 Latin America Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 67 Latin America Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 68 Brazil Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 69 Brazil Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 70 Brazil Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 71 Middle East & Africa Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 72 Middle East & Africa Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 73 Middle East & Africa Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 74 Saudi Arabia Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 75 Saudi Arabia Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 76 Saudi Arabia Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 77 UAE Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 78 UAE Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 79 UAE Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

- Table 80 South Africa Factory Automation Market, By Component, 2018 - 2030 (USD Billion)

- Table 81 South Africa Factory Automation Market, By Technology, 2018 - 2030 (USD Billion)

- Table 82 South Africa Factory Automation Market, By End Use, 2018 - 2030 (USD Billion)

List of Figures

- Fig. 1 Factory automation market segmentation

- Fig. 2 Information procurement

- Fig. 3 Data analysis models

- Fig. 4 Market formulation and validation

- Fig. 5 Data validating & publishing

- Fig. 6 Factory automation market snapshot

- Fig. 7 Factory automation market segment snapshot

- Fig. 8 Factory automation market competitive landscape snapshot

- Fig. 9 Market research process

- Fig. 10 Market driver relevance analysis (current & future impact)

- Fig. 11 Market restraint relevance analysis (current & future impact)

- Fig. 12 Factory automation market, by component, key takeaways

- Fig. 13 Factory automation market, by component, market share, 2024 & 2030

- Fig. 14 Hardware market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 15 Software market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 16 Services market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 17 Factory automation market, by technology, key takeaways

- Fig. 18 Factory automation market, by technology, market share, 2024 & 2030

- Fig. 19 DCS market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 20 PLC market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 21 SCADA market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 22 Others market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 23 Factory automation market, by end use, key takeaways

- Fig. 24 Factory automation market, by end use, market share, 2024 & 2030

- Fig. 25 Aerospace & defense market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 26 Automotive market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 27 Chemical market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 28 Energy & utilities market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 29 Food & beverage market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 30 Healthcare market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 31 Manufacturing market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 32 Mining & metal market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 33 Oil & gas market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 34 Transportation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 35 Others market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 36 Regional marketplace: key takeaways

- Fig. 37 North America factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 38 U.S. factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 39 Canada factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 40 Mexico factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 41 Europe factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 42 UK factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 43 Germany factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 44 France factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 45 Asia Pacific factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 46 Japan factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 47 China factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 48 South Korea factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 49 India factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 50 Australia factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 51 Latin America factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 52 Brazil factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 53 MEA factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 54 Saudi Arabia factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 55 South Africa factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 56 UAE factory automation market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 57 Key company categorization

- Fig. 58 Strategy framework

Factory Automation Market Size & Trends:

The global factory automation market size was estimated at USD 36.01 billion in 2024 and is expected to grow at a CAGR of 11.1% from 2025 to 2030. The industry is primarily driven by the rising demand for operational efficiency, the growth of manufacturing and industrial sectors, and the increasing implementation of autonomous plants and remote operations aimed at reducing costs and boosting productivity.

Additionally, the growing adoption of artificial intelligence (AI) and machine learning (ML) in factory automation systems is revolutionizing manufacturing processes, enabling predictive maintenance, real-time data analysis, and autonomous decision-making, and reducing downtime, which is further fueling the factory automation industry expansion. The growing integration of collaborative robots, or cobots, is another major driver in the factory automation industry. This reflects a shift toward flexible automation where cobots are increasingly used for dynamic, short-run, or high-mix manufacturing tasks. Companies are leveraging cobots' ease of programming and adaptability to respond quickly to changing production demands. Moreover, there's a rising emphasis on safety-certified robotics that supports worker wellbeing while improving operational output, making cobots a central feature of next-generation smart factories.

Additionally, edge computing is emerging as a critical trend in the factory automation industry, enabling faster data processing directly or near the source, such as sensors, machines, or robots, instead of relying solely on cloud infrastructure. This approach significantly reduces latency, enhances real-time control, and increases system reliability in time-sensitive industrial environments. Additionally, it supports localized AI inference, empowering automation systems to make intelligent, autonomous decisions without constant cloud connectivity.

Furthermore, the adoption of digital twin technology is rapidly transforming the factory automation industry. These virtual replicas of physical assets allow manufacturers to simulate operations, test changes, and diagnose issues in real time without disrupting actual production. By enabling predictive maintenance and performance optimization, digital twins help reduce downtime and enhance system efficiency. This trend is especially impactful in complex industries such as aerospace, automotive, and energy, where precision and reliability are critical.

Moreover, factories are increasingly turning to cloud-based platforms to manage automation systems, enabling centralized control, remote monitoring, and data-driven insights across multiple sites. Cloud solutions support faster software updates, real-time analytics, and seamless integration with enterprise IT systems. This shift is also paving the way for new business models such as Automation-as-a-Service, allowing manufacturers to scale operations efficiently with lower capital investment, which is expected to further fuel the factory automation industry in the coming years.

Global Factory Automation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global factory automation market report based on component, technology, end use, and region:

- Component (Revenue, USD Billion, 2018 - 2030)

- Hardware

- Software

- Services

- Technology (Revenue, USD Billion, 2018 - 2030)

- DCS

- PLC

- SCADA

- Others

- End Use Outlook (Revenue, USD Billion, 2018 - 2030)

- Aerospace & Defense

- Automotive

- Chemical

- Energy & Utilities

- Food & Beverage

- Healthcare

- Manufacturing

- Mining & Metal

- Oil & Gas

- Transportation

- Others

- Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation and Scope

- 1.2. Market Definitions

- 1.2.1. Information analysis

- 1.2.2. Market formulation & data visualization

- 1.2.3. Data validation & publishing

- 1.3. Research Scope and Assumptions

- 1.3.1. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.3. Competitive Insights

Chapter 3. Factory Automation Market Variables, Trends, & Scope

- 3.1. Market Lineage Outlook

- 3.2. Market Dynamics

- 3.2.1. Market Driver Analysis

- 3.2.2. Market Restraint Analysis

- 3.2.3. Deployment Challenge

- 3.3. Factory Automation Market Analysis Tools

- 3.3.1. Deployment Analysis - Porter's

- 3.3.1.1. Bargaining power of the suppliers

- 3.3.1.2. Bargaining power of the buyers

- 3.3.1.3. Threats of substitution

- 3.3.1.4. Threats from new entrants

- 3.3.1.5. Competitive rivalry

- 3.3.2. PESTEL Analysis

- 3.3.2.1. Political landscape

- 3.3.2.2. Economic landscape

- 3.3.2.3. Social landscape

- 3.3.2.4. Technological landscape

- 3.3.2.5. Environmental landscape

- 3.3.2.6. Legal landscape

- 3.3.1. Deployment Analysis - Porter's

Chapter 4. Factory Automation Market: Component Estimates & Trend Analysis

- 4.1. Segment Dashboard

- 4.2. Factory Automation Market: Component Movement Analysis, 2024 & 2030 (USD Billion)

- 4.3. Hardware

- 4.3.1. Hardware Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 4.4. Software

- 4.4.1. Maintenance and Support Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 4.5. Services

- 4.5.1. Services Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Factory Automation Market: Technology Estimates & Trend Analysis

- 5.1. Segment Dashboard

- 5.2. Factory Automation Market: Technology Movement Analysis, 2024 & 2030 (USD Billion)

- 5.3. DCS

- 5.3.1. DCS Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 5.4. PLC

- 5.4.1. PLC Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 5.5. SCADA

- 5.5.1. SCADA Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 5.6. Others

- 5.6.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Factory Automation Market: End Use Estimates & Trend Analysis

- 6.1. Segment Dashboard

- 6.2. Factory Automation Market: End Use Movement Analysis, 2024 & 2030 (USD Billion)

- 6.3. Aerospace & Defense

- 6.3.1. Aerospace & Defense Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.4. Automotive

- 6.4.1. Automotive Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.5. Chemical

- 6.5.1. Chemical Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.6. Energy & Utilities

- 6.6.1. Energy & Utilities Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.7. Food & Beverage

- 6.7.1. Food & Beverage Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.8. Healthcare

- 6.8.1. Healthcare Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.9. Manufacturing

- 6.9.1. Manufacturing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.10. Mining & Metal

- 6.10.1. Mining & Metal Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.11. Oil & Gas

- 6.11.1. Oil & Gas Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.12. Transportation

- 6.12.1. Transportation Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.13. Others

- 6.13.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Regional Estimates & Trend Analysis

- 7.1. Factory Automation Market by Region, 2024 & 2030

- 7.2. North America

- 7.2.1. North America Factory Automation Market Estimates & Forecasts, 2018 - 2030, (USD Billion)

- 7.2.2. U.S.

- 7.2.2.1. Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.2.3. Canada

- 7.2.3.1. Canada Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.2.4. Mexico

- 7.2.4.1. Mexico Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.3. Europe

- 7.3.1. Europe Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.3.2. UK

- 7.3.2.1. UK Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.3.3. Germany

- 7.3.3.1. Germany Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.3.4. France

- 7.3.4.1. France Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.4. Asia Pacific

- 7.4.1. Asia Pacific Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.4.2. China

- 7.4.2.1. China Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.4.3. Japan

- 7.4.3.1. Japan Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.4.4. India

- 7.4.4.1. India Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.4.5. South Korea

- 7.4.5.1. South Korea Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.4.6. Australia

- 7.4.6.1. Australia Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.5. Latin America

- 7.5.1. Latin America Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.5.2. Brazil

- 7.5.2.1. Brazil Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.6. Middle East and Africa

- 7.6.1. Middle East and Africa Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.6.2. Saudi Arabia

- 7.6.2.1. Saudi Arabia Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.6.3. South Africa

- 7.6.3.1. South Africa Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 7.6.4. UAE

- 7.6.4.1. UAE Factory Automation Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. Competitive Landscape

- 8.1. Company Categorization

- 8.2. Company Market Positioning

- 8.3. Company Heat Map Analysis

- 8.4. Company Profiles/Listing

- 8.4.1. ABB Ltd.

- 8.4.1.1. Participant's Overview

- 8.4.1.2. Financial Performance

- 8.4.1.3. Product Benchmarking

- 8.4.1.4. Strategic Initiatives

- 8.4.2. Emerson Electric Co.

- 8.4.2.1. Participant's Overview

- 8.4.2.2. Financial Performance

- 8.4.2.3. Product Benchmarking

- 8.4.2.4. Strategic Initiatives

- 8.4.3. Fuji Electric Co., Ltd.

- 8.4.3.1. Participant's Overview

- 8.4.3.2. Financial Performance

- 8.4.3.3. Product Benchmarking

- 8.4.3.4. Strategic Initiatives

- 8.4.4. Honeywell International Inc.

- 8.4.4.1. Participant's Overview

- 8.4.4.2. Financial Performance

- 8.4.4.3. Product Benchmarking

- 8.4.4.4. Strategic Initiatives

- 8.4.5. Mitsubishi Electric Corporation

- 8.4.5.1. Participant's Overview

- 8.4.5.2. Financial Performance

- 8.4.5.3. Product Benchmarking

- 8.4.5.4. Strategic Initiatives

- 8.4.6. Omron Corporation

- 8.4.6.1. Participant's Overview

- 8.4.6.2. Financial Performance

- 8.4.6.3. Product Benchmarking

- 8.4.6.4. Strategic Initiatives

- 8.4.7. Rockwell Automation, Inc.

- 8.4.7.1. Participant's Overview

- 8.4.7.2. Financial Performance

- 8.4.7.3. Product Benchmarking

- 8.4.7.4. Strategic Initiatives

- 8.4.8. Schneider Electric SE

- 8.4.8.1. Participant's Overview

- 8.4.8.2. Financial Performance

- 8.4.8.3. Product Benchmarking

- 8.4.8.4. Strategic Initiatives

- 8.4.9. Siemens AG

- 8.4.9.1. Participant's Overview

- 8.4.9.2. Financial Performance

- 8.4.9.3. Product Benchmarking

- 8.4.9.4. Strategic Initiatives

- 8.4.10. Yokogawa Electric Corporation

- 8.4.10.1. Participant's Overview

- 8.4.10.2. Financial Performance

- 8.4.10.3. Product Benchmarking

- 8.4.10.4. Strategic Initiatives

- 8.4.1. ABB Ltd.