|

|

市場調査レポート

商品コード

1398291

建設業界のエンタープライズICT市場:分析と将来展望:セグメント別(ハードウェア、ソフトウェア、ITサービス)Construction Sector Enterprise ICT Market Analysis and Future Outlook by Segments (Hardware, Software and IT Services) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 建設業界のエンタープライズICT市場:分析と将来展望:セグメント別(ハードウェア、ソフトウェア、ITサービス) |

|

出版日: 2023年12月04日

発行: GlobalData

ページ情報: 英文 54 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

建設業界のICTの市場規模は、主に建設企業のICT予算の成長、5Gネットワークへの投資、建設技術新興企業への投資によって拡大が促進されています。

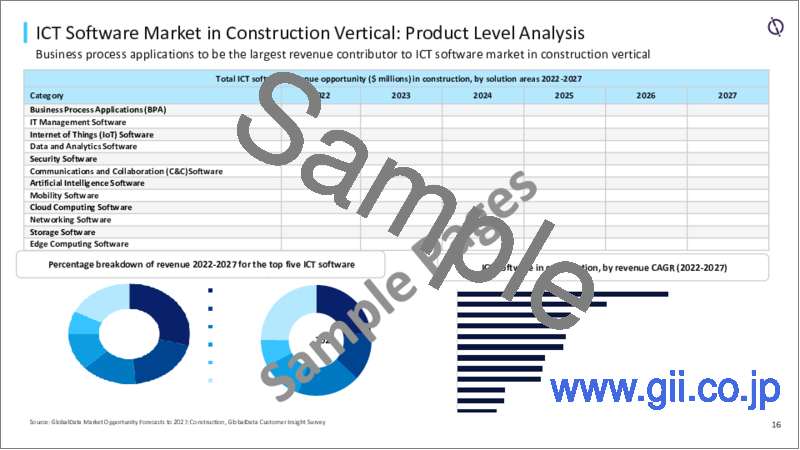

建設業全体のICT市場は、2022年には1,653億米ドルに達し、2022年から2027年にかけてCAGR 11.2%で成長し、2027年には2,814億米ドルに達すると予測されています。建設会社は、高品質の構造物を迅速かつ効率的に建設するために、さまざまなデジタル技術を活用しています。コラボレーション強化とエラー削減のためのビルディングインフォメーションモデリング(BIM)や、設備やプロジェクト進捗のリアルタイムデータを提供するIoT機器など、いくつかの新興技術が建設ライフサイクル全体で利用されています。

クラウドコンピューティングは、セキュリティと俊敏性を確保しながら業務効率を達成するためにクラウドの活用を進める企業や、全国的なデジタルイニシアチブの一環としてクラウドの導入を積極的に推進する政府により、建設業界において最も魅力的な市場と見なすことができます。建設分野におけるクラウドコンピューティングの収益機会は、2022年には241億米ドルに達し、2022年~2027年のCAGRは17.3%で成長すると予測されています。

アジア太平洋の建設業界におけるICTの収益機会は、2022年には713億米ドルに達しました。2022年~2027年のCAGRは12.6%で成長すると予測されています。

当レポートは、建設業界のエンタープライズICT市場について調査し、市場の概要とともに、建設業のエンタープライズICT市場全体の動向と成長要因について詳細に分析しています。また、建設業全体のICT市場に影響を与える市場成長阻害要因についても論じています。18のソリューション分野、セグメント別分析、地域別分析、主要なマクロ経済・規制動向、政府のイニシアティブを網羅し、企業のICT予算配分とICT収益機会に焦点を当てています。また、国内の主要ICTベンダーの簡単なプロファイルも掲載しています。

目次

目次

- 建設業界のエンタープライズICT市場(ハイライト)

- 人口統計調査

- 建設業界におけるICT-市場概要

- 市場力学

- インフラセグメント別のICT市場

- 主要なソリューション分野における企業投資の優先順位

- 主要業種にわたる企業投資の優先順位

企業概要

付録

Abstract

The Construction Enterprise ICT Country Intelligence Report, a new Vertical Intelligence Report by GlobalData, summarizes key findings from GlobalData's ICT Customer Insight Survey carried out in H1-2023 and GlobalData's Market Opportunity Forecasts to 2027: Construction. It reveals an executive-level overview of how the overall ICT budgets and their allocations towards various segments have changed for enterprises in the vertical in 2023 compared to 2022 and ICT revenue opportunity with detailed forecasts of key indicators up to 2027. The report provides detailed analysis of the overall Construction's enterprise ICT market trends and growth drivers based on GlobalData's ICT Customer Insight Survey and GlobalData's Market Opportunity Forecasts. The report also discusses about the market growth inhibitors impacting Construction's overall ICT market. Its sheds focus on enterprise ICT budget allocations and ICT revenue opportunity covering 18 solution areas, segmental analysis, regional analysis, as well as review of key macroeconomic and regulatory trends, and government initiatives. The report also includes a brief profile on some of the key ICT vendors within the country.

The vertical intelligence provides information and insights into ICT budget allocations and ICT revenue opportunity for enterprises in Construction vertical

- Overall enterprise ICT revenue opportunity and ICT budget allocations for enterprises in Construction

- Insights on Construction's enterprise ICT growth drivers and market trends, basis GlobalData's ICT Customer Insight Survey and Market Oppotunity Forecasts to 2027

- Insights on market growth inhibitors impacting Construction's overall ICT market

- Breakdown of enterprise ICT revenue opportunity by solution areas and key regions

- Segmental analysis of Construction's enterprise ICT budget allocations and ICT revenue opportunity - hardware, software and services

- Insights on ICT technology spending priorities of enterprises on key solution areas in Construction

- Company snapshot

Scope

- ICT market growth of construction will be primarily driven growth in ICT budgets of construction companies, investments in 5G networks, and investments in construction tech startups will drive ICT market growth in the construction vertical.

- Construction's overall ICT market was pegged at $165.3 billion in 2022 and is expected to grow at a CAGR of 11.2% during 2022-2027 to reach $281.4 billion in 2027. Construction companies are using various digital technologies to quickly and efficiently build high quality structures. Several emerging technologies are used across the entire construction life cycle including building information modeling (BIM) for enhanced collaboration and error reduction and IoT devices to provide real-time data on equipment and project progress.

- GlobalData's ICT decision makers survey reveals a positive outlook for enterprise ICT spending in construction, with a majority of respondents, about 84% from the country, claiming that there has been an increase in the enterprise ICT budget in 2023 compared to 2022.

- Cloud computing can be regarded as the most attractive market in construction driven by enterprises increasingly leveraging cloud to achieve operational efficiency while ensuring security and agility, and government actively promoting cloud adoption as a part of its nationwide digital initiative. The revenue opportunity for cloud computing in construction was pegged at $24.1 billion in 2022 and is estimated to grow at a CAGR of 17.3% between 2022-2027.

- ICT revenue opportunity in the APAC construction industry was pegged at $71.3 billion in 2022. It is expected to grow a CAGR of 12.6% during 2022-2027.

Reasons to Buy

- This Vertical Intelligence Report is based on GlobalData's IT Customer Insight Survey carried out annually covering key ICT decision makers from enterprises operating in Construction vertical and GlobalData's Market Opportunity Forecasts to 2027, to offer a thorough, forward-looking analysis of Construction's enterprise ICT investment priorities and ICT revenue opportunity market.

- Accompanying GlobalData's IT Customer Insight Survey and Market Opportunity Forecasts to 2027, the report examines the assumptions and drivers behind ongoing and upcoming trends in Construction's enterprise ICT market.

- The report offers a thorough analysis of enterprise ICT investment trends and how it has changed this year compared to previous year.

- The report also presents an analysis of enterprise ICT budget allocations by various spending areas, business functions and product/service categories and how they have changed this year compared to previous years.

- The report also presents an analysis of enterprise ICT revenue opportunity by various solution areas and key regions over the forecast period 2022-2027.

- With more than 50 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

- The report provides insights in a concise format to help executives build proactive and profitable growth strategies.

- The report provides an easily digestible market assessment for decision-makers built around research gathered from the IT decision makers in Construction vertical, which enables executives to quickly get up to speed with the current and emerging trends in enterprise ICT investment priorities.

Table of Contents

Table of Contents

- Enterprise ICT Market in Construction Vertical (Highlights)

- Survey Demographics

- ICT in Construction Vertical - Market Overview

- Market Dynamics

- ICT Market by Infrastructure Segments

- Enterprise Investment Priorities in Key Solution Areas

- Enterprise Investment Priorities Across Key Verticals