|

|

市場調査レポート

商品コード

1385628

乾燥野菜の世界市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2031年)- タイプ別、性質別、最終用途別、形態別、流通チャネル別、地域別Dehydrated Vegetables Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2031 - By Product, Technology, Grade, Application, End-user, Region: (North America, Europe, Asia Pacific, Latin America and Middle East and Africa) |

||||||

|

|||||||

| 乾燥野菜の世界市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2031年)- タイプ別、性質別、最終用途別、形態別、流通チャネル別、地域別 |

|

出版日: 2023年11月14日

発行: Fairfield Market Research

ページ情報: 英文 350 Pages

納期: 2~5営業日

|

全表示

- 概要

- 目次

世界の乾燥野菜の市場規模は、2024年に850億米ドルになるとみられ、CAGR9.94%という驚異的なスピードで急増すると予測されており、2031年末には1,650億米ドルに達する見込みです。世界の乾燥野菜の売上、低水分含量を特徴とする乾燥野菜は、食品産業における数多くの利点と用途により人気を集めています。

乾燥野菜は、空気乾燥、真空乾燥、凍結乾燥など様々な脱水技術によって製造され、生鮮野菜から約90~95%の水分を効果的に除去します。これらの技術により、野菜の保存期間が長くなり、様々な料理用途の貴重な資源となります。

健康的な間食傾向の高まりは、乾燥野菜市場の重要な促進要因です。健康志向の高まりに伴い、乾燥野菜は健康的な間食の選択肢として認知されつつあり、コレステロールの多い食品やジャンクフードに関連する肥満や心血管疾患への懸念に対処しています。より健康的な食品への嗜好がこの市場の成長を促進すると予想されます。

RFID(Radio-Frequency Identification)技術の採用は、サプライチェーン管理の効率を高めています。RFIDタグは詳細な製品情報を保存し、顧客のチェックアウトプロセスを合理化し、小売業者と消費者の時間を短縮します。この技術は、商品タグ付けにますます普及しており、全体的なショッピング体験を向上させています。

乾燥野菜は、凍結乾燥、風乾、真空乾燥などの高度な生産技術により、保存期間が長くなっています。これらの工程で水分が除去されるため、微生物の繁殖が防がれ、製品寿命が延びる。保存期間の延長により、乾燥野菜は消費者にとって貴重な選択肢となっています。

多忙なライフスタイルと厳しい労働文化が、加工されたレディトゥイートへの需要を促進しています。乾燥野菜は、味と栄養を提供しながら調理時間を節約する上で重要な役割を果たしています。さまざまな種類があり、多様な消費者の嗜好に対応しています。

当レポートでは、世界の乾燥野菜市場について調査し、市場の概要とともに、タイプ別、性質別、最終用途別、形態別、流通チャネル別、地域別動向、および市場に参入する企業の競合動向などを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 市場概要

- 市場の定義とセグメンテーション

- 市場力学

- バリューチェーン分析

- ポーターのファイブフォース分析

- COVID-19の影響分析

- ウクライナとロシアの紛争の影響

- 経済概要

- PESTLE分析

第3章 世界の乾燥野菜市場の見通し、2018年~2031年

- 世界の乾燥野菜市場の見通し、タイプ別、金額別(10億米ドル)、2018年~2031年

- 世界の乾燥野菜市場の見通し、性質別、金額(10億米ドル)、2018年~2031年

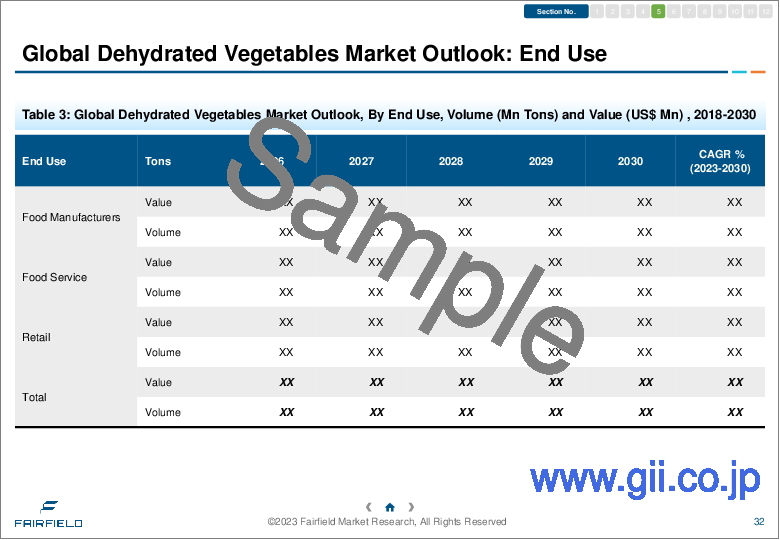

- 世界の乾燥野菜市場の見通し、最終用途別、金額(10億米ドル)、2018年~2031年

- 世界の乾燥野菜市場の見通し、形態別、金額別(10億米ドル)、2018年~2031年

- 世界の乾燥野菜市場の見通し、流通チャネル別、金額(10億米ドル)、2018年~2031年

- 世界の乾燥野菜市場の見通し、地域別、金額(10億米ドル)、2018年~2031年

第4章 北米の乾燥野菜市場の見通し、2018年~2031年

第5章 欧州の乾燥野菜市場の見通し、2018年~2031年

第6章 アジア太平洋の乾燥野菜市場の見通し、2018年~2031年

第7章 ラテンアメリカの乾燥野菜市場の見通し、2018年~2031年

第8章 中東・アフリカの乾燥野菜市場の見通し、2018年~2031年

第9章 競合情勢

- 最終用途別と性質別のヒートマップ

- メーカーと性質別ヒートマップ

- 企業の市場シェア分析、2023年

- 競争力ダッシュボード

- 企業プロファイル

- Olam International

- Naturex S.A.

- Symrise AG

- Mercer Foods, LLC

- BC Foods, Inc.

- Harmony House Foods, Inc

- Natural Dehydrated Vegetables Pvt. Ltd

- Real Dehydrated Pvt Ltd

- Green Rootz

- Silva International, Inc

- Van Drunen Farms

- Kissan Foods

- Rosun Groups

- Mevive International Food Ingredients

- Catz International B.V.

- KAN Phytochemicals Pvt.Ltd.

- Del-Val Food Ingredients

- Xinghua Lianfu Food Co.,Ltd

- Alpspure Lifesciences Private Limited

第10章 付録

Increasing Health Consciousness and Technology Adoption Drive Growth

The global dehydrated vegetables market culminating in a valuation of US$ 85 billion in 2024, is poised for even more significant expansion. According to a study by Fairfield Market Research, sales of dehydrated vegetables worldwide are expected to surge at an impressive 9.94% CAGR, reaching a substantial market size of US$ 165 billion by the end of 2031. Dehydrated vegetables, characterized by their low moisture content, are gaining popularity due to their numerous benefits and applications in the food industry.

Dehydrated Vegetables: A Nutritional and Technological Marvel

Dehydrated vegetables are produced through various dehydration techniques such as air drying, vacuum drying, and freeze drying, effectively removing approximately 90-95% of moisture content from fresh vegetables. These techniques ensure a longer shelf life for the vegetables, making them a valuable resource for various culinary applications.

Key Market Trends Driving Demand

Growing Healthy Snacking Trend: The rising trend of healthy snacking is a significant driver for the dehydrated vegetables market. As health-consciousness increases, dehydrated vegetables are gaining recognition as a healthy snacking option, addressing concerns about obesity and cardiovascular issues associated with cholesterol-rich and junk foods. The preference for healthier food products is expected to fuel the growth of this market.

Adoption of RFID Technology: The adoption of Radio-Frequency Identification (RFID) technology is enhancing supply chain management efficiency. RFID tags store detailed product information, streamlining the checkout process for customers and reducing retailer and consumer time. This technology is becoming increasingly popular for product tagging, improving the overall shopping experience.

Long Shelf Life of Dehydrated Vegetables: Dehydrated vegetables offer a longer shelf life due to advanced production technologies, including freeze-drying, air drying, and vacuum drying. These processes remove moisture, preventing the growth of microorganisms and ensuring extended product life. The extended shelf life makes dehydrated vegetables a valuable option for consumers.

Rise in Demand for Processed Food: Busy lifestyles and demanding work cultures are driving the demand for processed and ready-to-eat meals. Dehydrated vegetables play a crucial role in saving preparation time while providing flavor and nutrition. They are available in various varieties, catering to diverse consumer preferences.

Country-wise Market Insights

India: Emerging as a Lucrative Market India accounts for over 12% of global dehydrated vegetable consumption, with vacuum drying technology being a major contributor. Drum drying technology is projected to experience the fastest growth, with an estimated CAGR of 10.2%. India's prominence in emerging economies is driving this market.

United States: High Demand for Dehydrated Vegetable Products North America, with the United States at the forefront, holds nearly 9% of the global market share. The U.S. alone represents about 55% of the North American market. Food manufacturers are the primary consumers, contributing to the growth of the dehydrated vegetable market in the country.

Competitive Landscape

Dehydrated vegetable processors are expanding production capacities and embracing new technologies to meet the growing demand from the food processing, foodservice, and household sectors. Companies are continuously innovating to cater to evolving consumer preferences.

Key Companies Leading the Dehydrated Vegetables Market:

- Olam International

- Naturex S.A.

- Symrise AG

- Mercer Foods, LLC

- BC Foods, Inc.

- Harmony House Foods, Inc

- Natural Dehydrated Vegetables Pvt. Ltd

- Real Dehydrated Pvt Ltd

- Green Rootz

- Silva International, Inc

- Van Drunen Farms

- Kissan Foods

- Rosun Groups

- Mevive International Food Ingredients

- Catz International B.V.

- KAN Phytochemicals Pvt.Ltd.

- Del-Val Food Ingredients

- Xinghua Lianfu Food Co.,Ltd

- Alpspure Lifesciences Private Limited

- DMH Ingredients

Dehydrated Vegetables Industry Research Segmentation

By Type:

- Carrot

- Onions

- Potatoes

- Broccoli

- Beans

- Peas

- Cabbage

- Mushrooms

- Tomatoes

- Other Types

By Nature:

- Organic

- Conventional

By End Use:

- Food Processing Industry

- Snacks & Savory

- Ready-to-eat Meal

- Salads, Dressings & Sauces

- Others

- Foodservice Industry

- Retail/Household

By Form:

- Slices/Cubes

- Powder

By Distribution Channel:

- Business to Business

- Business to Consumer

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

By Region:

- North America

- Latin America

- Europe

- South Asia & Pacific

- East Asia

- Middle East & Africa

Table of Contents

1. Executive Summary

- 1.1. Global Dehydrated Vegetables Market Snapshot

- 1.2. Future Projections

- 1.3. Key Market Trends

- 1.4. Regional Snapshot, by Value, 2023

- 1.5. Analyst Recommendations

2. Market Overview

- 2.1. Market Definitions and Segmentations

- 2.2. Market Dynamics

- 2.2.1. Drivers

- 2.2.2. Restraints

- 2.2.3. Market Opportunities

- 2.3. Value Chain Analysis

- 2.4. Porter's Five Forces Analysis

- 2.5. COVID-19 Impact Analysis

- 2.5.1. Supply

- 2.5.2. Demand

- 2.6. Impact of Ukraine-Russia Conflict

- 2.7. Economic Overview

- 2.7.1. World Economic Projections

- 2.8. PESTLE Analysis

3. Global Dehydrated Vegetables Market Outlook, 2018 - 2031

- 3.1. Global Dehydrated Vegetables Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

- 3.1.1. Key Highlights

- 3.1.1.1. Carrot

- 3.1.1.2. Onions

- 3.1.1.3. Potatoes

- 3.1.1.4. Broccoli

- 3.1.1.5. Beans

- 3.1.1.6. Peas

- 3.1.1.7. Cabbage

- 3.1.1.8. Mushroom

- 3.1.1.9. Tomato

- 3.1.1.10. Others types

- 3.1.1. Key Highlights

- 3.2. Global Dehydrated Vegetables Market Outlook, by Nature, Value (US$ Bn), 2018 - 2031

- 3.2.1. Key Highlights

- 3.2.1.1. Organic

- 3.2.1.2. Conventional

- 3.2.1. Key Highlights

- 3.3. Global Dehydrated Vegetables Market Outlook, by End Use, Value (US$ Bn), 2018 - 2031

- 3.3.1. Key Highlights

- 3.3.1.1. Food Processing Industry

- 3.3.1.1.1. Snacks & Savory

- 3.3.1.1.2. Ready to eat Meal

- 3.3.1.1.3. Salads, dressing & Sauces

- 3.3.1.1.4. Others

- 3.3.1.2. Food service Industry

- 3.3.1.3. Retails/Household

- 3.3.1.1. Food Processing Industry

- 3.3.1. Key Highlights

- 3.4. Global Dehydrated Vegetables Market Outlook, by Form, Value (US$ Bn), 2018 - 2031

- 3.4.1. Key Highlights

- 3.4.1.1. Slices/Cubes

- 3.4.1.2. Powder

- 3.4.1. Key Highlights

- 3.5. Global Dehydrated Vegetables Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 3.5.1. Key Highlights

- 3.5.1.1. Business to Business

- 3.5.1.2. Business to Consumers

- 3.5.1.2.1. Hypermarket/Supermarket

- 3.5.1.2.2. Convenience Store

- 3.5.1.2.3. Speciality Store

- 3.5.1.2.4. Online Retails

- 3.5.1. Key Highlights

- 3.6. Global Dehydrated Vegetables Market Outlook, by Region, Value (US$ Bn), 2018 - 2031

- 3.6.1. Key Highlights

- 3.6.1.1. North America

- 3.6.1.2. Europe

- 3.6.1.3. Asia Pacific

- 3.6.1.4. Latin America

- 3.6.1.5. Middle East & Africa

- 3.6.1. Key Highlights

4. North America Dehydrated Vegetables Market Outlook, 2018 - 2031

- 4.1. North America Dehydrated Vegetables Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

- 4.1.1. Key Highlights

- 4.1.1.1. Carrot

- 4.1.1.2. Onions

- 4.1.1.3. Potatoes

- 4.1.1.4. Broccoli

- 4.1.1.5. Beans

- 4.1.1.6. Peas

- 4.1.1.7. Cabbage

- 4.1.1.8. Mushroom

- 4.1.1.9. Tomato

- 4.1.1.10. Others types

- 4.1.1. Key Highlights

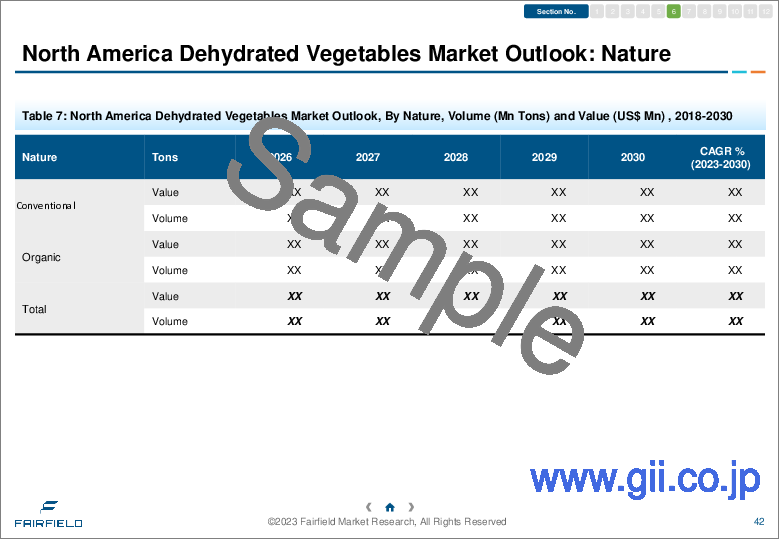

- 4.2. North America Dehydrated Vegetables Market Outlook, by Nature, Value (US$ Bn), 2018 - 2031

- 4.2.1. Key Highlights

- 4.2.1.1. Organic

- 4.2.1.2. Conventional

- 4.2.1. Key Highlights

- 4.3. North America Dehydrated Vegetables Market Outlook, by End Use, Value (US$ Bn), 2018 - 2031

- 4.3.1. Key Highlights

- 4.3.1.1. Food Processing Industry

- 4.3.1.1.1. Snacks & Savory

- 4.3.1.1.2. Ready to eat Meal

- 4.3.1.1.3. Salads, dressing & Sauces

- 4.3.1.1.4. Others

- 4.3.1.2. Food service Industry

- 4.3.1.3. Retails/Household

- 4.3.1.1. Food Processing Industry

- 4.3.1. Key Highlights

- 4.4. North America Dehydrated Vegetables Market Outlook, by Form, Value (US$ Bn), 2018 - 2031

- 4.4.1. Key Highlights

- 4.4.1.1. Slices/Cubes

- 4.4.1.2. Powder

- 4.4.1. Key Highlights

- 4.5. North America Dehydrated Vegetables Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 4.5.1. Key Highlights

- 4.5.1.1. Business to Business

- 4.5.1.2. Business to Consumers

- 4.5.1.2.1. Hypermarket/Supermarket

- 4.5.1.2.2. Convenience Store

- 4.5.1.2.3. Speciality Store

- 4.5.1.2.4. Online Retails

- 4.5.2. BPS Analysis/Market Attractiveness Analysis

- 4.5.1. Key Highlights

- 4.6. North America Dehydrated Vegetables Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

- 4.6.1. Key Highlights

- 4.6.1.1. U.S. Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 4.6.1.2. U.S. Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 4.6.1.3. U.S. Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 4.6.1.4. U.S. Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 4.6.1.5. U.S. Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 4.6.1.6. Canada Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 4.6.1.7. Canada Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 4.6.1.8. Canada Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 4.6.1.9. Canada Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 4.6.1.10. Canada Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 4.6.2. BPS Analysis/Market Attractiveness Analysis

- 4.6.1. Key Highlights

5. Europe Dehydrated Vegetables Market Outlook, 2018 - 2031

- 5.1. Europe Dehydrated Vegetables Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

- 5.1.1. Key Highlights

- 5.1.1.1. Carrot

- 5.1.1.2. Onions

- 5.1.1.3. Potatoes

- 5.1.1.4. Broccoli

- 5.1.1.5. Beans

- 5.1.1.6. Peas

- 5.1.1.7. Cabbage

- 5.1.1.8. Mushroom

- 5.1.1.9. Tomato

- 5.1.1.10. Others types

- 5.1.1. Key Highlights

- 5.2. Europe Dehydrated Vegetables Market Outlook, by Nature, Value (US$ Bn), 2018 - 2031

- 5.2.1. Key Highlights

- 5.2.1.1. Organic

- 5.2.1.2. Conventional

- 5.2.1. Key Highlights

- 5.3. Europe Dehydrated Vegetables Market Outlook, by End Use, Value (US$ Bn), 2018 - 2031

- 5.3.1. Key Highlights

- 5.3.1.1. Food Processing Industry

- 5.3.1.1.1. Snacks & Savory

- 5.3.1.1.2. Ready to eat Meal

- 5.3.1.1.3. Salads, dressing & Sauces

- 5.3.1.1.4. Others

- 5.3.1.2. Food service Industry

- 5.3.1.3. Retails/Household

- 5.3.1.1. Food Processing Industry

- 5.3.1. Key Highlights

- 5.4. Europe Dehydrated Vegetables Market Outlook, by Form, Value (US$ Bn), 2018 - 2031

- 5.4.1. Key Highlights

- 5.4.1.1. Slices/Cubes

- 5.4.1.2. Powder

- 5.4.1. Key Highlights

- 5.5. Europe Dehydrated Vegetables Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 5.5.1. Key Highlights

- 5.5.1.1. Business to Business

- 5.5.1.2. Business to Consumers

- 5.5.1.2.1. Hypermarket/Supermarket

- 5.5.1.2.2. Convenience Store

- 5.5.1.2.3. Speciality Store

- 5.5.1.2.4. Online Retails

- 5.5.2. BPS Analysis/Market Attractiveness Analysis

- 5.5.1. Key Highlights

- 5.6. Europe Dehydrated Vegetables Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

- 5.6.1. Key Highlights

- 5.6.1.1. Germany Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 5.6.1.2. Germany Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 5.6.1.3. Germany Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 5.6.1.4. Germany Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 5.6.1.5. Germany Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 5.6.1.6. U.K. Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 5.6.1.7. U.K. Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 5.6.1.8. U.K. Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 5.6.1.9. U.K. Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 5.6.1.10. U.K. Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 5.6.1.11. France Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 5.6.1.12. France Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 5.6.1.13. France Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 5.6.1.14. France Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 5.6.1.15. France Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 5.6.1.16. Italy Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 5.6.1.17. Italy Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 5.6.1.18. Italy Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 5.6.1.19. Italy Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 5.6.1.20. Italy Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 5.6.1.21. Turkey Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 5.6.1.22. Turkey Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 5.6.1.23. Turkey Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 5.6.1.24. Turkey Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 5.6.1.25. Turkey Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 5.6.1.26. Russia Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 5.6.1.27. Russia Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 5.6.1.28. Russia Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 5.6.1.29. Russia Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 5.6.1.30. Russia Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 5.6.1.31. Rest of Europe Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 5.6.1.32. Rest of Europe Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 5.6.1.33. Rest of Europe Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 5.6.1.34. Rest of Europe Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 5.6.1.35. Rest of Europe Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 5.6.2. BPS Analysis/Market Attractiveness Analysis

- 5.6.1. Key Highlights

6. Asia Pacific Dehydrated Vegetables Market Outlook, 2018 - 2031

- 6.1. Asia Pacific Dehydrated Vegetables Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

- 6.1.1. Key Highlights

- 6.1.1.1. Carrot

- 6.1.1.2. Onions

- 6.1.1.3. Potatoes

- 6.1.1.4. Broccoli

- 6.1.1.5. Beans

- 6.1.1.6. Peas

- 6.1.1.7. Cabbage

- 6.1.1.8. Mushroom

- 6.1.1.9. Tomato

- 6.1.1.10. Others types

- 6.1.1. Key Highlights

- 6.2. Asia Pacific Dehydrated Vegetables Market Outlook, by Nature, Value (US$ Bn), 2018 - 2031

- 6.2.1. Key Highlights

- 6.2.1.1. Organic

- 6.2.1.2. Conventional

- 6.2.1. Key Highlights

- 6.3. Asia Pacific Dehydrated Vegetables Market Outlook, by End Use, Value (US$ Bn), 2018 - 2031

- 6.3.1. Key Highlights

- 6.3.1.1. Food Processing Industry

- 6.3.1.1.1. Snacks & Savory

- 6.3.1.1.2. Ready to eat Meal

- 6.3.1.1.3. Salads, dressing & Sauces

- 6.3.1.1.4. Others

- 6.3.1.2. Food service Industry

- 6.3.1.3. Retails/Household

- 6.3.1.1. Food Processing Industry

- 6.3.1. Key Highlights

- 6.4. Asia Pacific Dehydrated Vegetables Market Outlook, by Form, Value (US$ Bn), 2018 - 2031

- 6.4.1. Key Highlights

- 6.4.1.1. Slices/Cubes

- 6.4.1.2. Powder

- 6.4.1. Key Highlights

- 6.5. Asia Pacific Dehydrated Vegetables Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 6.5.1. Key Highlights

- 6.5.1.1. Business to Business

- 6.5.1.2. Business to Consumers

- 6.5.1.2.1. Hypermarket/Supermarket

- 6.5.1.2.2. Convenience Store

- 6.5.1.2.3. Speciality Store

- 6.5.1.2.4. Online Retails

- 6.5.2. BPS Analysis/Market Attractiveness Analysis

- 6.5.1. Key Highlights

- 6.6. Asia Pacific Dehydrated Vegetables Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

- 6.6.1. Key Highlights

- 6.6.1.1. China Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 6.6.1.2. China Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 6.6.1.3. China Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 6.6.1.4. China Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 6.6.1.5. China Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 6.6.1.6. Japan Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 6.6.1.7. Japan Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 6.6.1.8. Japan Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 6.6.1.9. Japan Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 6.6.1.10. Japan Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 6.6.1.11. South Korea Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 6.6.1.12. South Korea Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 6.6.1.13. South Korea Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 6.6.1.14. South Korea Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 6.6.1.15. South Korea Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 6.6.1.16. India Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 6.6.1.17. India Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 6.6.1.18. India Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 6.6.1.19. India Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 6.6.1.20. India Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 6.6.1.21. Southeast Asia Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 6.6.1.22. Southeast Asia Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 6.6.1.23. Southeast Asia Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 6.6.1.24. Southeast Asia Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 6.6.1.25. Southeast Asia Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 6.6.1.26. Rest of Asia Pacific Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 6.6.1.27. Rest of Asia Pacific Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 6.6.1.28. Rest of Asia Pacific Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 6.6.1.29. Rest of Asia Pacific Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 6.6.1.30. Rest of Asia Pacific Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 6.6.2. BPS Analysis/Market Attractiveness Analysis

- 6.6.1. Key Highlights

7. Latin America Dehydrated Vegetables Market Outlook, 2018 - 2031

- 7.1. Latin America Dehydrated Vegetables Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

- 7.1.1. Key Highlights

- 7.1.1.1. Carrot

- 7.1.1.2. Onions

- 7.1.1.3. Potatoes

- 7.1.1.4. Broccoli

- 7.1.1.5. Beans

- 7.1.1.6. Peas

- 7.1.1.7. Cabbage

- 7.1.1.8. Mushroom

- 7.1.1.9. Tomato

- 7.1.1.10. Others types

- 7.1.1. Key Highlights

- 7.2. Latin America Dehydrated Vegetables Market Outlook, by Nature, Value (US$ Bn), 2018 - 2031

- 7.2.1.1. Organic

- 7.2.1.2. Conventional

- 7.3. Latin America Dehydrated Vegetables Market Outlook, by End Use, Value (US$ Bn), 2018 - 2031

- 7.3.1. Key Highlights

- 7.3.1.1. Food Processing Industry

- 7.3.1.1.1. Snacks & Savory

- 7.3.1.1.2. Ready to eat Meal

- 7.3.1.1.3. Salads, dressing & Sauces

- 7.3.1.1.4. Others

- 7.3.1.2. Food service Industry

- 7.3.1.3. Retails/Household

- 7.3.1.1. Food Processing Industry

- 7.3.1. Key Highlights

- 7.4. Latin America Dehydrated Vegetables Market Outlook, by Form, Value (US$ Bn), 2018 - 2031

- 7.4.1. Key Highlights

- 7.4.1.1. Slices/Cubes

- 7.4.1.2. Powder

- 7.4.1. Key Highlights

- 7.5. Latin America Dehydrated Vegetables Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 7.5.1. Key Highlights

- 7.5.1.1. Business to Business

- 7.5.1.2. Business to Consumers

- 7.5.1.2.1. Hypermarket/Supermarket

- 7.5.1.2.2. Convenience Store

- 7.5.1.2.3. Speciality Store

- 7.5.1.2.4. Online Retails

- 7.5.2. BPS Analysis/Market Attractiveness Analysis

- 7.5.1. Key Highlights

- 7.6. Latin America Dehydrated Vegetables Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

- 7.6.1. Key Highlights

- 7.6.1.1. Brazil Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 7.6.1.2. Brazil Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 7.6.1.3. Brazil Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 7.6.1.4. Brazil Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 7.6.1.5. Brazil Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 7.6.1.6. Mexico Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 7.6.1.7. Mexico Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 7.6.1.8. Mexico Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 7.6.1.9. Mexico Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 7.6.1.10. Mexico Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 7.6.1.11. Argentina Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 7.6.1.12. Argentina Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 7.6.1.13. Argentina Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 7.6.1.14. Argentina Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 7.6.1.15. Argentina Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 7.6.1.16. Rest of Latin America Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 7.6.1.17. Rest of Latin America Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 7.6.1.18. Rest of Latin America Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 7.6.1.19. Rest of Latin America Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 7.6.1.20. Rest of Latin America Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 7.6.2. BPS Analysis/Market Attractiveness Analysis

- 7.6.1. Key Highlights

8. Middle East & Africa Dehydrated Vegetables Market Outlook, 2018 - 2031

- 8.1. Middle East & Africa Dehydrated Vegetables Market Outlook, by Type, Value (US$ Bn), 2018 - 2031

- 8.1.1. Key Highlights

- 8.1.1.1. Carrot

- 8.1.1.2. Onions

- 8.1.1.3. Potatoes

- 8.1.1.4. Broccoli

- 8.1.1.5. Beans

- 8.1.1.6. Peas

- 8.1.1.7. Cabbage

- 8.1.1.8. Mushroom

- 8.1.1.9. Tomato

- 8.1.1.10. Others types

- 8.1.1. Key Highlights

- 8.2. Middle East & Africa Dehydrated Vegetables Market Outlook, by Nature, Value (US$ Bn), 2018 - 2031

- 8.2.1. Key Highlights

- 8.2.1.1. Organic

- 8.2.1.2. Conventional

- 8.2.1. Key Highlights

- 8.3. Middle East & Africa Dehydrated Vegetables Market Outlook, by End Use, Value (US$ Bn), 2018 - 2031

- 8.3.1. Key Highlights

- 8.3.1.1. Food Processing Industry

- 8.3.1.1.1. Snacks & Savory

- 8.3.1.1.2. Ready to eat Meal

- 8.3.1.1.3. Salads, dressing & Sauces

- 8.3.1.1.4. Others

- 8.3.1.2. Food service Industry

- 8.3.1.3. Retails/Household

- 8.3.1.1. Food Processing Industry

- 8.3.1. Key Highlights

- 8.4. Middle East & Africa Dehydrated Vegetables Market Outlook, by Form, Value (US$ Bn), 2018 - 2031

- 8.4.1. Key Highlights

- 8.4.1.1. Slices/Cubes

- 8.4.1.2. Powder

- 8.4.1. Key Highlights

- 8.5. Middle East & Africa Dehydrated Vegetables Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 8.5.1. Key Highlights

- 8.5.1.1. Business to Business

- 8.5.1.2. Business to Consumers

- 8.5.1.2.1. Hypermarket/Supermarket

- 8.5.1.2.2. Convenience Store

- 8.5.1.2.3. Speciality Store

- 8.5.1.2.4. Online Retails

- 8.5.2. BPS Analysis/Market Attractiveness Analysis

- 8.5.1. Key Highlights

- 8.6. Middle East & Africa Dehydrated Vegetables Market Outlook, by Country, Value (US$ Bn), 2018 - 2031

- 8.6.1. Key Highlights

- 8.6.1.1. GCC Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 8.6.1.2. GCC Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 8.6.1.3. GCC Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 8.6.1.4. GCC Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 8.6.1.5. GCC Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 8.6.1.6. South Africa Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 8.6.1.7. South Africa Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 8.6.1.8. South Africa Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 8.6.1.9. South Africa Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 8.6.1.10. South Africa Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 8.6.1.11. Egypt Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 8.6.1.12. Egypt Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 8.6.1.13. Egypt Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 8.6.1.14. Egypt Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 8.6.1.15. Egypt Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 8.6.1.16. Nigeria Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 8.6.1.17. Nigeria Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 8.6.1.18. Nigeria Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 8.6.1.19. Nigeria Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 8.6.1.20. Nigeria Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 8.6.1.21. Rest of Middle East & Africa Dehydrated Vegetables Market by Type, Value (US$ Bn), 2018 - 2031

- 8.6.1.22. Rest of Middle East & Africa Dehydrated Vegetables Market by Nature, Value (US$ Bn), 2018 - 2031

- 8.6.1.23. Rest of Middle East & Africa Dehydrated Vegetables Market by End Use, Value (US$ Bn), 2018 - 2031

- 8.6.1.24. Rest of Middle East & Africa Dehydrated Vegetables Market by Form, Value (US$ Bn), 2018 - 2031

- 8.6.1.25. Rest of Middle East & Africa Dehydrated Vegetables Market by Distribution Channel, Value (US$ Bn), 2018 - 2031

- 8.6.2. BPS Analysis/Market Attractiveness Analysis

- 8.6.1. Key Highlights

9. Competitive Landscape

- 9.1. By End Use vs by Nature Heat map

- 9.2. Manufacturer vs by Nature Heat map

- 9.3. Company Market Share Analysis, 2023

- 9.4. Competitive Dashboard

- 9.5. Company Profiles

- 9.5.1. Olam International

- 9.5.1.1. Company Overview

- 9.5.1.2. Product Portfolio

- 9.5.1.3. Financial Overview

- 9.5.1.4. Business Strategies and Development

- 9.5.2. Naturex S.A.

- 9.5.2.1. Company Overview

- 9.5.2.2. Product Portfolio

- 9.5.2.3. Financial Overview

- 9.5.2.4. Business Strategies and Development

- 9.5.3. Symrise AG

- 9.5.3.1. Company Overview

- 9.5.3.2. Product Portfolio

- 9.5.3.3. Financial Overview

- 9.5.3.4. Business Strategies and Development

- 9.5.4. Mercer Foods, LLC

- 9.5.4.1. Company Overview

- 9.5.4.2. Product Portfolio

- 9.5.4.3. Financial Overview

- 9.5.4.4. Business Strategies and Development

- 9.5.5. BC Foods, Inc.

- 9.5.5.1. Company Overview

- 9.5.5.2. Product Portfolio

- 9.5.5.3. Financial Overview

- 9.5.5.4. Business Strategies and Development

- 9.5.6. Harmony House Foods, Inc

- 9.5.6.1. Company Overview

- 9.5.6.2. Product Portfolio

- 9.5.6.3. Financial Overview

- 9.5.6.4. Business Strategies and Development

- 9.5.7. Natural Dehydrated Vegetables Pvt. Ltd

- 9.5.7.1. Company Overview

- 9.5.7.2. Product Portfolio

- 9.5.7.3. Financial Overview

- 9.5.7.4. Business Strategies and Development

- 9.5.8. Real Dehydrated Pvt Ltd

- 9.5.8.1. Company Overview

- 9.5.8.2. Product Portfolio

- 9.5.8.3. Financial Overview

- 9.5.8.4. Business Strategies and Development

- 9.5.9. Green Rootz

- 9.5.9.1. Company Overview

- 9.5.9.2. Product Portfolio

- 9.5.9.3. Financial Overview

- 9.5.9.4. Business Strategies and Development

- 9.5.10. Silva International, Inc

- 9.5.10.1. Company Overview

- 9.5.10.2. Product Portfolio

- 9.5.10.3. Financial Overview

- 9.5.10.4. Business Strategies and Development

- 9.5.11. Van Drunen Farms

- 9.5.11.1. Company Overview

- 9.5.11.2. Product Portfolio

- 9.5.11.3. Financial Overview

- 9.5.11.4. Business Strategies and Development

- 9.5.12. Kissan Foods

- 9.5.12.1. Company Overview

- 9.5.12.2. Product Portfolio

- 9.5.12.3. Financial Overview

- 9.5.12.4. Business Strategies and Development

- 9.5.13. Rosun Groups

- 9.5.13.1. Company Overview

- 9.5.13.2. Product Portfolio

- 9.5.13.3. Financial Overview

- 9.5.13.4. Business Strategies and Development

- 9.5.14. Mevive International Food Ingredients

- 9.5.14.1. Company Overview

- 9.5.14.2. Product Portfolio

- 9.5.14.3. Financial Overview

- 9.5.14.4. Business Strategies and Development

- 9.5.15. Catz International B.V.

- 9.5.15.1. Company Overview

- 9.5.15.2. Product Portfolio

- 9.5.15.3. Financial Overview

- 9.5.15.4. Business Strategies and Development

- 9.5.16. KAN Phytochemicals Pvt.Ltd.

- 9.5.16.1. Company Overview

- 9.5.16.2. Product Portfolio

- 9.5.16.3. Financial Overview

- 9.5.16.4. Business Strategies and Development

- 9.5.17. Del-Val Food Ingredients

- 9.5.17.1. Company Overview

- 9.5.17.2. Product Portfolio

- 9.5.17.3. Financial Overview

- 9.5.17.4. Business Strategies and Development

- 9.5.18. Xinghua Lianfu Food Co.,Ltd

- 9.5.18.1. Company Overview

- 9.5.18.2. Product Portfolio

- 9.5.18.3. Financial Overview

- 9.5.18.4. Business Strategies and Development

- 9.5.19. Alpspure Lifesciences Private Limited

- 9.5.19.1. Company Overview

- 9.5.19.2. Product Portfolio

- 9.5.19.3. Financial Overview

- 9.5.19.4. Business Strategies and Development

- 9.5.1. Olam International

10. Appendix

- 10.1. Research Methodology

- 10.2. Report Assumptions

- 10.3. Acronyms and Abbreviations