|

|

市場調査レポート

商品コード

1696239

易剥離性接着剤の世界市場:2025年~2032年Global De-bondable Adhesives Market - 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 易剥離性接着剤の世界市場:2025年~2032年 |

|

出版日: 2025年03月25日

発行: DataM Intelligence

ページ情報: 英文 180 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

世界の易剥離性接着剤の市場規模は、2024年に4億2,000万米ドルに達し、2032年には8億米ドルに達すると予測され、予測期間の2025年~2032年のCAGRは8.52%となる見込みです。

易剥離性接着剤市場は、さまざまな産業で持続可能で再加工可能な接着ソリューションの需要が増加しているため、大幅に拡大しています。これらの接着剤は、エレクトロニクス、自動車、建築、医療用途で広く利用されており、基材を損傷することなく簡単に分解できるという利点を提供しています。リサイクル可能性、修理可能性、材料回収への注目の高まりが、市場の成長を後押ししています。

循環型経済原則へのシフトにより、材料の回収とリサイクルが容易な易剥離性接着剤の需要が増加しています。エレクトロニクスや自動車などの業界では、厳しい環境規制を遵守するため、これらの接着剤を採用するケースが増えています。

軽量素材やモジュール式アセンブリへの注目が高まる中、自動車業界や航空宇宙業界では、パネル接着、内装アセンブリ、部品修理などの用途に易剥離性接着剤の採用が進んでいます。この採用は、持続可能性とメンテナンスの容易性を高めます。

循環型経済と持続可能な製品ライフサイクルを重視する傾向が強まっていることが、易剥離性接着剤市場の主な促進要因となっています。産業界は廃棄物の削減と材料のリサイクル可能性の向上に注力しており、その結果、可逆性接着剤の採用が増加しています。特にエレクトロニクス分野では、これらの接着剤を活用して部品を簡単に分解し、電子廃棄物を削減しています。

同様に、自動車産業は、軽量モジュール設計のためにこれらの接着剤を採用し、修理可能性と持続可能性を向上させています。欧州環境庁によると、循環型経済への取り組みにより、2030年までに産業界の材料需要を20%削減できる可能性があり、市場成長をさらに促進します。

易剥離性接着剤はその長所にもかかわらず、研究開発コストの高さやエンドユーザーの認知度の低さといった課題に直面しています。制御された剥離メカニズムを持つスマート接着剤の開発には、高度な材料科学と革新的なエンジニアリングが必要であり、製造コストが上昇します。

さらに、従来の接着剤に依存している業界は、その用途や性能上の利点に馴染みがないため、剥離可能な代替品の採用をためらう可能性があります。特に中小企業は、こうした高度な接着ソリューションへの切り替えに伴う高いコストを正当化することが難しく、市場拡大を抑制する可能性があります。

当レポートでは、世界の易剥離性接着剤市場について調査し、市場の概要とともに、タイプ別、組成別、形態別、最終用途産業別、地域別動向、競合情勢、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 調査手法と範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 抑制要因

- 機会

- 影響分析

第5章 業界分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- バリューチェーン分析

- 価格分析

- 規制およびコンプライアンス分析

- AIと自動化の影響分析

- 研究開発とイノベーション分析

- 持続可能性とグリーンテクノロジー分析

- 技術ロードマップ

- 特許情勢

- DMIオピニオン

第6章 タイプ別

- 熱剥離型接着剤

- UV/光剥離型接着剤

- 化学剥離型接着剤

- 電気剥離型接着剤

- その他

第7章 組成別

- 反応性

- 非反応性

- ハイブリッド

第8章 形態別

- 液体接着剤

- フィルム接着剤

- ペースト接着剤

第9章 最終用途産業別

- 電子・電気

- 自動車

- ヘルスケア・医療

- 航空宇宙・防衛

- 建設

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市場ポジショニング/シェア分析

- 合併と買収の分析

第12章 企業プロファイル

- Henkel AG &Co. KGaA

- 3M Company

- Flanders Make

- Conagen, Inc.

- ATSP Innovations

第13章 付録

Global de-bondable adhesives market reached US$0.42 billion in 2024 and is expected to reach US$0.80 billion by 2032, growing at a CAGR of 8.52% during the forecast period 2025-2032.

The de-bondable adhesives market is expanding significantly due to the increasing demand for sustainable and reworkable bonding solutions across various industries. These adhesives are widely utilized in electronics, automotive, construction, and medical applications, offering the advantage of easy disassembly without damaging substrates. The rising focus on recyclability, repairability, and material recovery is fueling market growth.

De-bondable Adhesives Trends

The shift towards circular economy principles has increased the demand for de-bondable adhesives that facilitate easy material recovery and recycling. Industries such as electronics and automotive are increasingly incorporating these adhesives to comply with stringent environmental regulations.

With the increasing focus on lightweight materials and modular assembly, the automotive and aerospace industries are adopting de-bondable adhesives for applications such as panel bonding, interior assembly, and component repair. This adoption enhances sustainability and ease of maintenance.

Dynamic

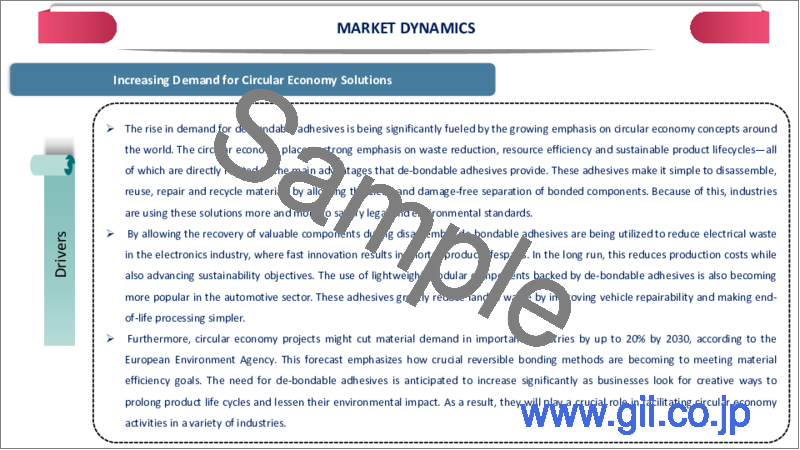

Driver: Increasing Demand for Circular Economy Solutions

The growing emphasis on a circular economy and sustainable product life cycles is a major driver for the de-bondable adhesives market. Industries are focusing on reducing waste and enhancing the recyclability of materials, leading to increased adoption of reversible adhesives. The electronics sector, in particular, is leveraging these adhesives for easy disassembly of components, thereby reducing electronic waste.

Similarly, the automotive industry is adopting these adhesives for lightweight modular designs, improving repairability and sustainability. According to the European Environment Agency, the circular economy initiatives could reduce material demand in industries by 20% by 2030, further propelling market growth.

Restraint: High Development Costs and Limited Awareness

Despite their advantages, de-bondable adhesives face challenges related to high research and development costs and limited awareness among end-users. The development of smart adhesives with controlled debonding mechanisms requires advanced material science and innovative engineering, increasing production costs.

Additionally, industries that rely on traditional adhesives may be hesitant to adopt de-bondable alternatives due to unfamiliarity with their applications and performance benefits. Small and medium enterprises, in particular, may find it difficult to justify the higher costs associated with switching to these advanced bonding solutions, thereby restraining market expansion.

Segment Analysis

The global de-bondable adhesives market is segmented based on type, composition, form, end-use industry, and region.

The electronics and electrical applications segment holds the largest share in the global de-bondable adhesives market, driven by increasing demand for miniaturization, flexible electronics, and reworkable components. These adhesives are widely used in chip packaging, printed circuit boards (PCBs), display panels, and semiconductor assembly, allowing manufacturers to perform repairs and modifications efficiently.

Additionally, with the rising adoption of 5G technology, demand for high-frequency PCBs and optoelectronic devices is escalating, further propelling market growth. Leading electronic manufacturers, including Apple, Samsung, and Intel, are investing in advanced bonding solutions to enhance device performance and sustainability. Similarly, in semiconductor manufacturing, de-bondable adhesives facilitate wafer handling, chip stacking, and die-attach processes, improving yield and reducing material waste.

Geographical Penetration

Rapid Industrialization Drives the Market in the Asia-Pacific Region.

The Asia-Pacific region dominates the global de-bondable adhesives market, driven by rapid industrialization, expanding electronics manufacturing, and increasing government support for sustainable solutions. Countries such as China, Japan, South Korea, and India are witnessing high demand for adhesives in consumer electronics, automotive, and semiconductor industries. Meanwhile, India's rising automotive and electronics sectors, supported by government initiatives like "Make in India" and PLI schemes, are fostering the adoption of de-bondable adhesives in EV battery assembly and consumer gadgets.

China, the world's largest electronics producer, accounts for over 35% of global semiconductor manufacturing. The Chinese government's "Made in China 2025" initiative is accelerating the adoption of advanced adhesives in flexible electronics and microelectronics production. Japan and South Korea, home to leading electronics giants like Sony, Panasonic, Samsung, and LG, are investing heavily in reworkable adhesives for OLED displays, foldable devices, and high-performance computing components.

Competitive Landscape

The major players in the market include Henkel AG & Co. KGaA, 3M Company, Flanders Make, Conagen, Inc., and ATSP Innovations.

By Type

- Thermally De-bondable Adhesives

- UV/Photo-Debondable Adhesives

- Chemically De-bondable Adhesives

- Electrically De-bondable Adhesives

- Others

By Composition

- Reactive

- Non-reactive

- Hybrid

By Form

- Liquid Adhesives

- Film Adhesives

- Paste Adhesives

By End-Use Industry

- Electronics and Electrical

- Automotive

- Healthcare and Medical

- Aerospace and Defense

- Construction

- Others

By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

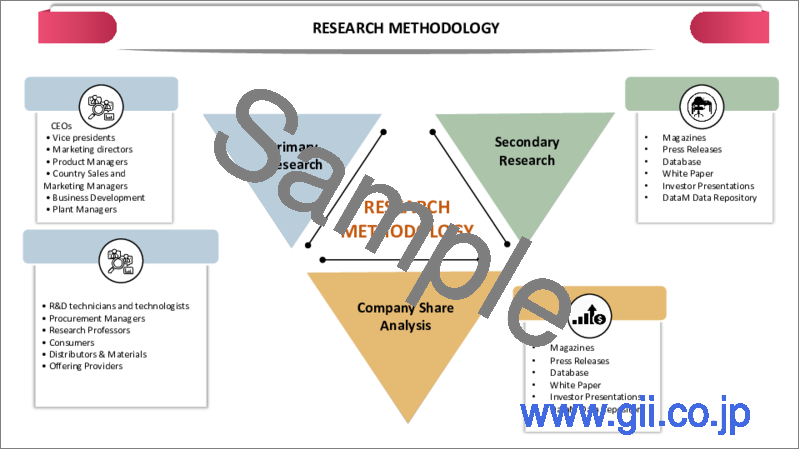

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Composition

- 3.3. Snippet by Form

- 3.4. Snippet by End-Use Industry

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Demand for Reworkable and Recyclable Adhesives

- 4.1.2. Restraints

- 4.1.2.1. High Cost and Performance Limitations

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Value Chain Analysis

- 5.4. Pricing Analysis

- 5.5. Regulatory and Compliance Analysis

- 5.6. AI & Automation Impact Analysis

- 5.7. R&D and Innovation Analysis

- 5.8. Sustainability & Green Technology Analysis

- 5.9. Technology Roadmap

- 5.10. Patent Landscape

- 5.11. DMI Opinion

6. By Type

- 6.1. Introduction

- 6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 6.1.2. Market Attractiveness Index, By Type

- 6.2. Thermally De-bondable Adhesives*

- 6.2.1. Introduction

- 6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 6.3. UV/Photo-De-bondable Adhesives

- 6.4. Chemically De-bondable Adhesives

- 6.5. Electrically De-bondable Adhesives

- 6.6. Others

7. By Composition

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Composition

- 7.1.2. Market Attractiveness Index, By Composition

- 7.2. Reactive*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Non-reactive

- 7.4. Hybrid

8. By Form

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 8.1.2. Market Attractiveness Index, By Form

- 8.2. Liquid Adhesives*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Film Adhesives

- 8.4. Paste Adhesives

9. By End-Use Industry

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-Use Industry

- 9.1.2. Market Attractiveness Index, By End-Use Industry

- 9.2. Electronics and Electrical*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Automotive

- 9.4. Healthcare and Medical

- 9.5. Aerospace and Defense

- 9.6. Construction

- 9.7. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Composition

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-Use Industry

- 10.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.7.1. US

- 10.2.7.2. Canada

- 10.2.7.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Composition

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-Use

- 10.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.7.1. Germany

- 10.3.7.2. UK

- 10.3.7.3. France

- 10.3.7.4. Italy

- 10.3.7.5. Spain

- 10.3.7.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Key Region-Specific Dynamics

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Composition

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-Use

- 10.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.8.1. Brazil

- 10.4.8.2. Argentina

- 10.4.8.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Composition

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-Use

- 10.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.7.1. China

- 10.5.7.2. India

- 10.5.7.3. Japan

- 10.5.7.4. Australia

- 10.5.7.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Composition

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-Use

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Henkel AG & Co. KGaA*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. 3M Company

- 12.3. Flanders Make

- 12.4. Conagen, Inc.

- 12.5. ATSP Innovations

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us