|

|

市場調査レポート

商品コード

1390185

世界の植物性食品市場:2023年~2030年Global Plant-Based Foods Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 世界の植物性食品市場:2023年~2030年 |

|

出版日: 2023年12月05日

発行: DataM Intelligence

ページ情報: 英文 186 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

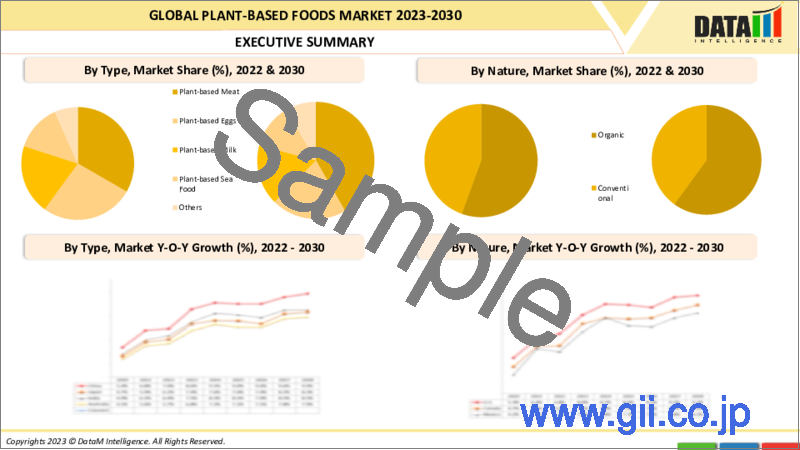

世界の植物性食品市場は、2022年に112億米ドルに達し、2023年から2030年の予測期間中にCAGR 12.2%で成長し、2030年までには281億米ドルに達すると予測されています。

世界の植物性食品市場は長年にわたって著しい成長と変貌を遂げており、植物性食品生活に関連する健康上の利点に関する意識の高まり、革新的な製品の発売の増加、菜食主義者の人口増加が市場成長の原動力になると予想されます。

さらに、これらの製品に対する需要が増加しているため、メーカーは革新的な高品質の製品を発売しています。例えば、2023年3月、インドのオルト・ミート・ブランドWakao Foodsは、ジャックフルーツを53%使用した植物性コンチネンタル・バーガー・パティの新製品を発売しました。この製品は食物繊維とタンパク質が豊富で、スパイスも入っており、プルプルした肉の食感を模倣しています。従って、このような製品は市場成長の拡大に役立ちます。

植物性の食肉セグメントは世界市場で最大のシェアを占めており、同様に北米地域は世界の植物性食品市場で支配的な力を維持しています。したがって、この地域は世界の植物性食品市場の牽引役となっています。

ダイナミクス

植物性の食事に関連する健康上の利点に関する意識の高まり

消費者は健康志向を高め、動物性食品に代わるものを求めるようになっています。植物性食品には必須栄養素やミネラルが豊富に含まれているため、植物性食品の需要が高まっています。

さらに、消費者が菜食主義に移行しているため、植物性食品の需要が増加しています。例えば、世界動物基金の報告書によると、世界には約8,800万人の菜食主義者がおり、これは幅広い用途での菜食主義食品の採用率を高めるのに役立つ可能性があります。

革新的な製品発表の増加

ヴィーガンおよび植物性食品の需要が高まるにつれて、食品会社やその他の研究開発は、伝統的な肉の味、食感、および全体的な食体験を忠実に模倣した新しい植物性製品を積極的に革新・導入しており、これは植物性食品の人気を高めるのに役立ちます。

例えば、2023年5月、Two Handsは韓国の有名なヴィーガン食肉ブランドであるUNLIMEATと提携し、UNLIMEATのヴィーガンソーセージを発売し、多様な選好に応える植物性の選択肢を提供するためにメニューを拡大しました。従って、このような製品は市場の成長拡大に役立つと思われます。

高い製品コスト

植物性食品のコストが高く、従来の食肉と比較して植物性食肉のコストが高いことが、予測期間における市場成長の妨げになると予想されます。例えば、植物性ミルクは従来のミルクの2倍のコストがかかります。製造コストと原材料の収集コストは市場成長の妨げになると思われます。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 植物性の食事に関連する健康上の利点に関する意識の高まり

- 革新的な製品上市の増加

- 抑制要因

- 高い製品コスト

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- 特許分析

第6章 COVID-19分析

第7章 タイプ別

- 植物性食肉

- 鶏肉

- 牛肉

- ラム

- ハム

- ソーセージ

- その他

- 植物性卵

- 植物性牛乳

- 植物性海産物

- 魚製品

- エビ製品

- カニ製品

- その他

- その他

第8章 由来別

- オーガニック

- コンベンショナル

第9章 原材料別

- 豆腐

- 大豆

- セイタン

- 小麦グルテン

- ジャガイモでんぷん

- エンドウ豆プロテイン

- レンズ豆

- 亜麻仁

- アクアファバ

- ゴマ

- その他

第10章 流通チャネル別

- スーパーマーケットとハイパーマーケット

- コンビニエンスストア

- オンラインストア

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Ingredion Inc.

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Omni Foods

- Greenleaf Foods, SPC.

- Aqua Cultured Foods

- Beyond Meat Inc.

- Impossible Foods Inc.

- Atlantic Natural Foods LLC

- Umiami

- Pacific Foods

- Danone SA

第14章 付録

Overview

Global Plant-based Food Market reached US$ 11.2 billion in 2022 and is expected to reach US$ 28.1 billion by 2030, growing with a CAGR of 12.2% during the forecast period 2023-2030.

The global plant-based food market has witnessed significant growth and transformations over the years, an increase in awareness about the health benefits associated with plant-based diets, an increase in innovative product launches, and an increase in the vegan population are expected to drive the market growth.

Furthermore, as the demand for these products is increasing, manufacturers are launching innovative high-quality products. For instance, in in March 2023, Indian alt-meat brand Wakao Foods launched a new product the plant-based Continental Burger Patty, made from 53% jackfruit. This product is rich in fiber and protein, and also contains spices, and mimics the texture of pulled meat. Hence, such products can help in increasing the market growth.

The plant-based meat segment holds the maximum share of the global market, similarly the North- American region remains the dominant force in the global plant-based food market, as there are more than 15.5 Million vegans in the US. Hence, it can help in driving the global plant-based food market.

Dynamics

Increase in Awareness about the Health Benefits Associated with Plant-Based Diets

Consumers are becoming more health-conscious, seeking alternatives to animal-based products, which has increased the demand for plant-based foods, as these are rich in essential nutrients, and minerals, also plant-based diets are often lower in saturated fats, which reduces the risk of heart disease.

Furthermore, the demand for plant-based foods products is increasing as consumers are shifting to veganism, for instance, according to the World Animal Foundation report there Are approximately 88 million vegans in the world, and this can help in increasing the adoption rate for vegan foods for wide applications.

Increase in Innovative Product Launches

As the demand for vegan and plant-based foods is increasing, Food companies and other research and developments have been actively innovating and introducing new plant-based products that closely mimic the taste, texture, and overall eating experience of traditional meat, which can help in increasing the popularity of plant-based foods.

Furthermore, many manufacturing companies are also launching products to expand their market growth, for instance, in May 2023, Two Hands partnered with UNLIMEAT, a renowned vegan meat brand from Korea, and Two Hands company launched a UNLIMEAT's vegan sausage, expanding their menu to offer plant-based options that cater to diverse tastes. Hence, such products can help in increasing the market growth.

High Product Cost

The high cost of plant-based foods, and the high cost of plant-based meat when compared to traditional meat is expected to hinder the market growth in the forecast period. For instance, plant-based milk costs twice the amount of traditional milk. The manufacturing costs and the collection costs of raw materials would hamper the market growth.

Segment Analysis

The global plant-based food market is segmented based on type, nature, ingredients, distribution channel, and region.

Increase in Demand for Alternatives of Animal-based Products

Plant-based meat segment holds the maximum share in the global plant-based foods market, due to the increased number of vegan populations globally and also the availability of a range of products. According to the report by the National Institute of Health in 2022, plant-based substitutes were the most favored meat alternatives, >90% of consumers would consume them.

Furthermore, as the demand for this plant-based meat is increasing, manufacturers are highly investing in this product. For instance, in September 2023, Novozymes company launched a Vertera ProBite, a solution set to advance the plant-based meat industry. The vertera probite is an enzyme MTGase, which is designed to enhance the texture of plant-based products. Hence, such product launches can help in increasing the market growth.

Geographical Penetration

High Plant-based Food Market and Product Launches

North America is expected to hold a dominant position in the market share. This is due to the increase in the vegan population, the increase in the number of plant-based food product launches in the region, and also the availability of a number of products of customer demands is expected to hold the region in the dominant position in the market share.

Also, the region has a high vegan population, for instance, according to the World Animal Foundation's most recent data for 2023, there are more than 15.5 Million vegans in the US. Also, the plant-based food market is increasing in this region, for instance, according to the Plant-based Food Association report it is estimated that U.S. retail sales of plant-based foods continue to increase, growing 6.2% in 2021 bringing the total plant-based market value to $7.4 billion

Additionally, the increase in the number of product launches is also expected to drive the market growth. For instance, In September 2021, Impossible Foods launched a plant-based chicken nugget substitute in the US. Furthermore, In May 2023, Beyond Meat Inc. launched the Beyond Smashable Burger which delivers everything consumers crave with the added nutritional and environmental benefits of plant-based meat.

Competitive Landscape

The major global players in the market include: Ingredion Inc., Omni Foods, Greenleaf Foods, SPC., Aqua Cultured Foods, Beyond Meat Inc., Impossible Foods Inc., Atlantic Natural Foods LLC, Umiami, Pacific Foods, and Danone SA.

COVID-19 Impact Analysis

The pandemic had a positive impact on the global plant-based foods market, many people started adopting plant-based foods due to an increase in health consciousness, which increased the adoption rate and demand for the development of new products, Hence, it can lead to an increase in global plant-based foods market growth.

By Type

- Plant-based Meat

- Chicken

- Beef

- Lamb

- Ham

- Sausage

- Others

- Plant-based Eggs

- Plant-based Milk

- Plant-based Sea Food

- Fish Products

- Prawn and Shrimp Products

- Crab Products

- Others

- Others

By Nature

- Organic

- Conventional

By Ingredients

- Tofu

- Soy

- Seitan

- Wheat Gluten

- Potato Starch

- Pea Protein

- Lentils

- Flax Seeds

- Aquafaba

- Sesame

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In May 2023, Wicked Kitchen, a 100% plant-based, flavor-forward global food brand acquired Current Foods, an alt-protein startup that provides plant-based seafood to food service and fine dining locations in the U.S. and Europe.

- In August 2023, Plant-based frozen foods processor Alpha Foods acquired LiveKindly Collective (LKC), this acquisition helped to boost the growth, particularly in product innovation in a segment often accused of stagnant, standardized development around patty and nugget formats.

Why Purchase the Report?

- To visualize the global plant-based food market segmentation based on type, nature, ingredients, distribution channel, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of plant-based food market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global plant-based food market report would provide approximately 69 tables, 76 figures and 186 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Nature

- 3.3. Snippet by Ingredients

- 3.4. Snippet by Distribution Channel

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increase in Awareness about the health benefits associated with plant-based diets

- 4.1.1.2. Increase in Innovative Product Launches

- 4.1.2. Restraints

- 4.1.2.1. High Product Cost

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Patent Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Plant-based Meat*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.2.3. Chicken

- 7.2.4. Beef

- 7.2.5. Lamb

- 7.2.6. Ham

- 7.2.7. Sausage

- 7.2.8. Others

- 7.3. Plant-based Eggs

- 7.4. Plant-based Milk

- 7.5. Plant-based Sea Food

- 7.5.1. Fish Products

- 7.5.2. Prawn and Shrimp Products

- 7.5.3. Crab Products

- 7.5.4. Others

- 7.6. Others

8. By Nature

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Nature

- 8.1.2. Market Attractiveness Index, By Nature

- 8.2. Organic*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Conventional

9. By Ingredients

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredients

- 9.1.2. Market Attractiveness Index, By Ingredients

- 9.2. Tofu*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Soy

- 9.4. Seitan

- 9.5. Wheat Gluten

- 9.6. Potato Starch

- 9.7. Pea Protein

- 9.8. Lentils

- 9.9. Flax Seeds

- 9.10. Aquafaba

- 9.11. Sesame

- 9.12. Others

10. By Distribution Channel

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 10.1.2. Market Attractiveness Index, By Distribution Channel

- 10.2. Supermarkets and Hypermarkets*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Convenience Stores

- 10.4. Online Stores

- 10.5. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Nature

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredients

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Nature

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredients

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Nature

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredients

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Nature

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredients

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Nature

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredients

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Ingredion Inc.*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Omni Foods

- 13.3. Greenleaf Foods, SPC.

- 13.4. Aqua Cultured Foods

- 13.5. Beyond Meat Inc.

- 13.6. Impossible Foods Inc.

- 13.7. Atlantic Natural Foods LLC

- 13.8. Umiami

- 13.9. Pacific Foods

- 13.10. Danone SA

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us