|

|

市場調査レポート

商品コード

1372584

植物性油脂の世界市場-2023年~2030年Global Plant-Based Fats Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 植物性油脂の世界市場-2023年~2030年 |

|

出版日: 2023年10月18日

発行: DataM Intelligence

ページ情報: 英文 212 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界の植物性油脂市場は2022年に708億米ドルに達し、2030年には2,589億米ドルに達すると予測され、予測期間2023~2030年のCAGRは17.6%で成長します。

食事から動物性食品を減らすか除去することを優先する植物ベースの食生活を取り入れる人が増えるにつれて、業界は拡大しています。そのため、同市場は、こうした食生活を実践する個人にとって極めて重要な要素となっています。同時に消費者は、環境に関する知識や関心の高まりから、生態系への影響を減らし、畜産に関する倫理的問題を解決するために、植物性油脂を選ぶようになっています。

食品を通じて、植物性油脂の市場は活気に満ちており、着実に拡大しています。より持続可能で倫理的な食品の選択肢を求める世界中の消費者からの需要の高まりが、予測期間中の市場成長の主な促進要因です。種子、ナッツ、ココナッツを原料とする数多くの植物性食品の人気が高まっています。

同様に、北米は植物性油脂市場を独占し、1/3以上の最大市場シェアを獲得しています。北米では、植物性油脂がより入手しやすくなっています。ファーストフードチェーン、健康食品専門店、一般的な食料品店などで頻繁に入手できるようになっています。植物性油脂の普及により、消費者が植物性油脂を料理に取り入れるのがより便利になっています。

力学

食生活動向と健康志向

WHO報告書2022によると、CVDと総称される心臓・血管疾患には、心臓弁膜症や脳血管疾患が含まれます。CVDによる死亡者5人のうち4人以上が脳卒中や心臓発作によるもので、70歳未満ではその30%が早期に死亡しています。

植物性脂肪は、心臓病や糖尿病などの慢性疾患を管理・予防するための食事計画に組み込まれています。特定の健康問題に取り組む健康志向の消費者は、症状管理への全体的なアプローチの一環として植物性油脂に注目しています。

健康志向の消費者は、食品表示の透明性や成分表の清潔さを優先することが多いです。植物性油脂は、透明でクリーンなラベルの選択肢とみなされ、摂取するものを理解し管理したいと願う消費者の共感を呼んでいます。健康とウェルネスの動向に起因する需要は、食品業界の大幅な製品革新に拍車をかけています。

消費者はますます健康的な食習慣を優先するようになっており、これは脂肪の消費パターンに顕著な変化をもたらしています。歴史的に、飽和脂肪酸とトランス脂肪酸は植物由来の製品において重要な位置を占めていました。しかし、これらの脂肪と心臓病をはじめとする様々な健康リスクとの関連性が科学的調査で立証されるにつれ、消費者はより健康志向の代替品を積極的に求めるようになっています。このような食生活嗜好の変化は、極めて重要な市場促進要因となっています。

植物ベースの食事への嗜好の高まり

消費者は菜食主義へとシフトしており、これが市場成長を牽引しています。World Animal Foundationの2023年調査の統計によると、世界中で約8,800万人が菜食主義者です。これは、80億人を超える世界人口の約1.1%に相当します。植物性油脂とヴィーガンを謳った飲食品の年間平均発売数は、2018年から2021年の間に世界でそれぞれ21%と58%増加しました。

Vegoconomistの調査によると、英国では15歳から40歳までのビーガンが少なくとも538万人おり、人口の45%を占めています。10年前と比較すると、約300%増加していることになります。企業は、この市場ニーズを満たすために、動物性脂肪の生産から植物性脂肪食品に切り替えています。顧客が自社製品に求めるものを提供することで、これらの企業はさらなる顧客を引き寄せています。

味と食感の課題

植物性油脂市場は、従来の動物性脂肪の味と食感を再現するための絶え間ない探求に直面しています。植物性油脂製品は大幅に進歩しているが、完全に一致させることは依然として複雑な課題です。例えば、バターのクリーミーさ、ペストリーにおけるラードのフレーク感、肉料理における動物性油脂のとろけるような食感を再現することは、植物性代替油脂にとって困難です。

このような味や食感の制限は、特に動物性油脂の独特な特性に慣れている消費者を落胆させる可能性があります。シェフやパン職人など、料理の専門家もまた、植物性油脂をレシピに適合させる際に課題に直面し、最終的な料理に一貫性がなくなったり、品質が損なわれたりします。植物性油脂の感覚を改善するための広範な研究開発が続けられているが、あらゆる調理用途において動物性油脂と同等にすることは依然として大きな課題であり、市場の成長を制限しています。

規制と表示の複雑さ

植物性油脂市場は、規制と表示の複雑さと闘っています。何が「植物性油脂」であるかの定義と規制は複雑で、製品のラベリングや主張に食い違いが生じる可能性があります。こうした齟齬は、十分な情報に基づいた選択を求める消費者の間に混乱を生じさせる可能性があります。例えば、特定の植物性代替バターを「バター」と表示することは、法的紛争や乳業業界からの反発を引き起こし、市場拡大の障害となる可能性があります。

さらに、地域や国によって表示に関する規制や基準が異なるため、世界な展開を目指すメーカーにとっては問題が複雑になる可能性があります。こうした規制上の課題を克服し、表示要件を確実に遵守することは、資源集約的であり、市場拡大の妨げになりかねないです。

植物性油脂の需要が高まり続ける中、規制を標準化し、消費者にわかりやすい明確な表示を実施することは、植物性油脂製品に対する信頼と信用を醸成するために不可欠です。このような規制や表示の複雑さに対処することは、植物性油脂の市場での長期的な成功と受容に不可欠です。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 食生活動向と健康志向

- 植物性食品への嗜好の高まり

- 抑制要因

- 味と食感の課題

- 規制と表示の複雑さ

- 機会

- 影響分析

- 促進要因

第5章 業界分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMI意見

第6章 COVID-19分析

第7章 タイプ別

- 飽和

- 不飽和

- トランス

第8章 供給源別

- ひまわり

- ココナッツ

- 大豆

- キャノーラ

- 落花生

- パームカーネル

- その他

第9章 用途別

- スナック・コンビニエンス食品

- サラダドレッシング

- 調理・フライ

- ベーキング

- 栄養補助食品

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他のアジア太平洋

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Cargill, Inc.

- ADM

- Wilmar International Limited

- Bunge Limited

- IOI Group

- AAK AB

- Fuji Oil Holdings Inc.

- United Plantations Berhad

- Avena Foods Limited

- EFKO Group

第13章 付録

Overview

Global Plant-Based Fats Market reached US$ 70.8 billion in 2022 and is expected to reach US$ 258.9 billion by 2030, growing with a CAGR of 17.6% during the forecast period 2023-2030.

As more people embrace plant-based diets that prioritise cutting back on or eliminating animal products from their diets, the industry is expanding. Thus, the market has emerged as a crucial element for individuals who are dedicated to following these dietary options. At the same time, consumers are choosing plant-based fats in order to reduce their ecological impact and solve ethical issues related to animal agriculture due to increased environmental knowledge and concerns.

Throughout the food, there is a vibrant and steadily expanding market for plant-based fats. The increasing demand from consumers across the World for more sustainable and ethical food options is the main driving factor of the market growth during the forecast period. Numerous plant-based foods, sourced from seeds, nuts and coconuts, are increasingly becoming popular.

Similarly, North America dominates the plant-based fats market, capturing the largest market share of over 1/3rd. In North America, plant-based fats have grown more readily accessible. They are frequently available at fast-food chains, specialty health food stores, and standard grocery stores. This is now more convenient for consumers to incorporate plant-based fats into their cuisines due to their prevalent availability.

Dynamics

Dietary Trends and Health Consciousness

According to WHO Report 2022, Cardiac and vascular diseases collectively known to as CVD include valvular heart illness, and cerebrovascular disease. A stroke or heart attack constitute over four of each five deaths of CVD, and thirty percent of these fatalities occur prematurely for individuals under the age of 70.

Plant-based fats have been integrated into dietary plans for individuals managing and preventing chronic conditions like heart disease or diabetes. Health-conscious consumers dealing with specific health concerns have turned to plant-based fats as a part of their holistic approach to condition management.

Health-conscious consumers frequently prioritize transparency in food labeling and cleaner ingredient lists. Plant-based fats are viewed as a transparent and clean-label choice, resonating with individuals who wish to comprehend and govern what they ingest. The demand stemming from health and wellness trends has spurred substantial product innovation in the food industry.

Consumers are increasingly prioritizing healthier eating habits, which has instigated a noteworthy transformation in fat consumption patterns. Historically, saturated and trans fats held a prominent place in plant-based products. However, with scientific research establishing links between these fats and various health risks, including heart disease, consumers are actively seeking more health-conscious alternatives. This alteration in dietary preferences serves as a pivotal market driver.

Increasing Preferences for Plant-Based Diets

Consumers are shifting towards vegan diets, which is driving the market growth. Around 88 million people around the world identify as vegans, according to statistics from the World Animal Foundation's 2023 study. That represents roughly 1.1% of the world's population, which is over 8 billion people. The average yearly growth of food and beverage launches with plant-based fats and vegan claims climbed by 21% and 58%, respectively, globally between 2018 and 2021.

In the U.K, there are at least 5,38,000 vegans between the ages of 15 and 40, accounting for 45% of the population, according to a Vegoconomist survey. Compared to the preceding ten years, this indicates a rise of around 300 percent. Companies switch from producing animal fat to plant-based fat foods in order to satisfy this market need. By giving customers what they want from their products, these companies draw in additional customers.

Taste and Texture Challenges

The plant-based fats market faces a constant quest to replicate the taste and texture of traditional animal-based fats. Although plant-based products have made substantial advancements, achieving an exact match remains a complex undertaking. For instance, replicating the creaminess of butter, the flakiness of lard in pastries, and the melt-in-the-mouth texture of animal fats in meat dishes poses difficulties for plant-based alternatives.

These taste and texture limitations can discourage consumers, especially those accustomed to the unique attributes of animal fats. Culinary professionals, including chefs and bakers, also encounter challenges when adapting plant-based fats to their recipes, leading to inconsistencies and quality compromises in the final dishes. Extensive research and development efforts continue to improve the sensory experience of plant-based fats, but achieving parity with animal fats across all culinary applications remains a significant challenge, limiting market growth.

Regulatory and Labeling Complexities

The plant-based fats market contends with regulatory and labeling complexities. Defining and regulating what qualifies as "plant-based fat" can be intricate, leading to discrepancies in product labeling and claims. These discrepancies can create confusion among consumers seeking to make informed choices. For instance, labeling certain plant-based butter alternatives as "butter" can trigger legal disputes and opposition from the dairy industry, posing obstacles to market expansion.

Furthermore, varying labeling regulations and standards across regions and countries can complicate matters for manufacturers looking to expand globally. Navigating these regulatory challenges and ensuring adherence to labeling requirements can be resource-intensive and may hinder market expansion efforts.

As the demand for plant-based fats continues to rise, standardizing regulations and implementing clear, consumer-friendly labeling practices are essential to foster trust and confidence in these products. Addressing these regulatory and labeling complexities is vital for the long-term success and acceptance of plant-based fats in the market.

Segment Analysis

The global plant-based fats market is segmented based on type, source, application and region.

Increased Demand for Sunflower-based Fats

The sunflower segment held 35.5% of the global market share. Sunflower-based fats, like sunflower oil, present an allergen-friendly alternative. They are naturally devoid of common allergens like nuts and soy, making them suitable for individuals with food allergies or sensitivities. This allergen-friendly attribute has broadened the appeal of sunflower-based fats in the market.

Sunflower-based fats have found a niche in the creation of plant-based meat and dairy substitutes. These fats are harnessed to replicate the desirable textures and mouthfeel of traditional animal-based products, aiding manufacturers in recreating the sensory experiences consumers are familiar with. Food producers are actively engaged in innovation to craft an array of sunflower-based fat products that closely mimic the taste and functionality of traditional animal-based fats.

These products include margarine, salad dressings, and spreads. Such innovations facilitate the adoption of sunflower-based fats in consumers' daily culinary endeavors. In May 2022, in a survey by Consumer VOICE (Voluntary Organisation in the Interest of Consumer Education) to evaluate the safety and quality of edible oils sold in the nation.

Gemini, the flagship brand of Cargill and the market leader in the edible oil category in Maharashtra, was ranked as the best quality sunflower oil brand in India. Based on the results of a laboratory study on 23 sunflower brands assessed on 20 quality indicators in accordance with Agmark, FSSAI (Food Safety & Standards Authority of India) laws, Gemini sunflower oil, which had less percentage of saturated fat was ranked first in terms of quality.

Geographical Penetration

Demand for Specialty Fat Products in North America

The North America plant-based fats market held the largest market share of 40.3% in 2022 in the Plant-based fats market analysis. A growing number of individuals are searching for healthier substitutes for conventional animal-based fats as they become more health conscious. Since they typically have higher quantities of smaller amounts of less appealing fatty acids and beneficial unsaturated fats, fats derived from plants are increasingly accepted owing to their healthier lipid content.

In accordance with recent studies, the rate of American deaths due to cardiovascular diseases related to being overweight surged thrice between 1999 and 2022. Obesity remains a significant planetary health burden and a key risk factor for cardiovascular disease. In the meantime, 42% of Americans have been affected, up almost 10%, according to American Heart Association data for 2023. To reduce the possibility of diseases like heart disease, obesity, and some forms of carcinoma, individuals are turning to these plant-based lipids.

There is growing awareness of how eating habits affect the environment. Because traditional animal husbandry emits more greenhouse gases, more water, and more land is used, and this is commonly accepted to have a greater ecological imprint. Because of this, many North American customers are moving to plant-based fats in an attempt to lessen their impact on the environment.

Competitive Landscape

The major global players in the market include: Cargill, Inc., ADM, Bunge Limited, Wilmar International, IOI Group, AAK AB, Fuji Oil Holdings Inc., United Plantations Berhad, Avena Foods Limited and EFKO Group.

COVID-19 Impact Analysis

The plant-based fats market experienced significant repercussions from the COVID-19 pandemic, with both immediate and long-term effects. In the early stages of the crisis, there was a surge in demand for essential goods, including plant-based cooking oils, due to consumer stockpiling. Home cooking became the norm, driving up the market for plant-based fats. However, supply chain disruptions, labor shortages, and logistical challenges had adverse consequences on production and distribution.

With the evolving pandemic, health-conscious consumers increasingly turned to plant-based fats that aligned with their dietary and nutritional requirements, further boosting market demand. Market players adapted by promoting health attributes and expanding their presence on e-commerce platforms to cater to changing consumer preferences.

Russia-Ukraine War Impact Analysis

The conflict between Russia and Ukraine significantly impacted the plant-based fats market, particularly in relation to global supply chains and trade dynamics. Ukraine is a major producer of sunflower oil, a prominent plant-based cooking oil. The war disrupted sunflower oil production and exports, causing fluctuations in global oil prices.

The geopolitical turmoil and its effect on sunflower oil supply exposed the vulnerability of the global plant-based fats market to geopolitical factors and the risks associated with relying on a single supplier. In response, the market began exploring alternative sources for crucial ingredients and oils to mitigate these risks and enhance supply chain resilience.

Moreover, the geopolitical instability resulting from the Russia-Ukraine conflict had implications for commodity markets and currency exchange rates, affecting the overall cost structure of the plant-based fats market. Fluctuating exchange rates and geopolitical uncertainties added to the market's complexity.

By Type

- Saturated

- Unsaturated

- Trans

By Source

- Sunflower

- Coconut

- Soybean

- Canola

- Groundnut

- Palm Kernel

- Others

By Application

- Snacks and Convenience Foods

- Salad Dressings

- Cooking and Frying

- Baking

- Nutritional Supplements

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In March 2023, OleoPro, the first ingredient launched from food tech startup Shiru, is powered by artificial intelligence. OleoPro is a plant-based fat made of unsaturated oil and plant proteins. OleoPro may reduce saturated fats in plant-based products by 90%, brown when cooked, and maintain its form at room temperature. It also gives plant-based applications a juicy mouthfeel.

- In November 2022, Hong Kong-based Omni Foods introduced their exclusive line of vegan fat, OmniNanoTM. Through an emulsification process including water and oil, they can imitate animal fat in plant-based meat substitutes. The juiciness, flavor, and texture of Omni's plant-based meats are said to be enhanced by the added fat.

- In January 2022, CP Foods and American company Lypid collaborated to create better-tasting plant-based beef. Lypid's vegan fat will create a better experience for consumers. Lypid is the creator of "vegan fat," a brand of fats that mimic the flavour of conventional meats by using oils derived from plants. The texture, melting point, and oil content of the vegan oils are identical to those of animal fats.

Why Purchase the Report?

- To visualize the global plant-based fats market segmentation based on type, source, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of plant-based fats market-level with all segments.

- The PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

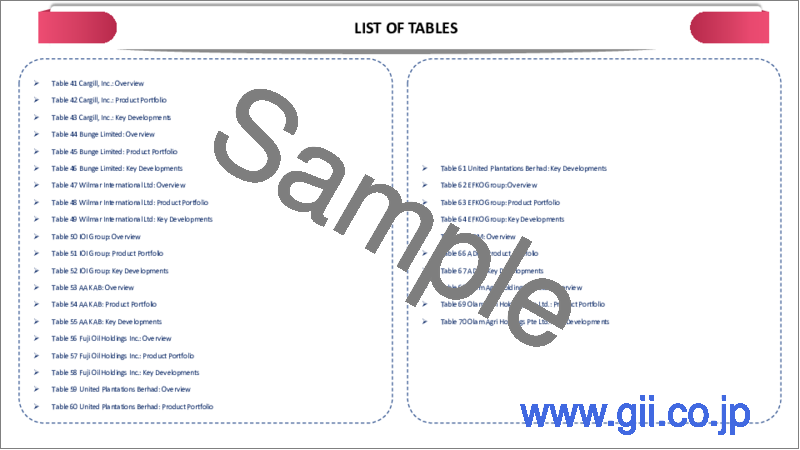

The global plant-based fats market report would provide approximately 64 tables, 61 figures and 212 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet By Type

- 3.2. Snippet By Source

- 3.3. Snippet By Application

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Dietary Trends and Health Consciousness

- 4.1.1.2. Increasing Preferences for Plant-Based Diets

- 4.1.2. Restraints

- 4.1.2.1. Taste and Texture Challenges

- 4.1.2.2. Regulatory and Labeling Complexities

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers' Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By type

- 7.2. Saturated*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Unsaturated

- 7.4. Trans

8. By Source

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 8.1.2. Market Attractiveness Index, By Source

- 8.2. Sunflower*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Coconut

- 8.4. Soybean

- 8.5. Canola

- 8.6. Groundnut

- 8.7. Palm Kernel

- 8.8. Others

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Snack and Convenience Foods*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Salad Dressings

- 9.4. Cooking and Frying

- 9.5. Baking

- 9.6. Nutritional Supplements

- 9.7. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Russia

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Cargill, Inc.

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. ADM

- 12.3. Wilmar International Limited

- 12.4. Bunge Limited

- 12.5. IOI Group

- 12.6. AAK AB

- 12.7. Fuji Oil Holdings Inc.

- 12.8. United Plantations Berhad

- 12.9. Avena Foods Limited

- 12.10. EFKO Group

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us