|

|

市場調査レポート

商品コード

1129233

鉄道用バッテリーの世界市場-2022-2029Global Train Battery Market - 2022-2029 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 鉄道用バッテリーの世界市場-2022-2029 |

|

出版日: 2022年09月29日

発行: DataM Intelligence

ページ情報: 英文 210 Pages

納期: 約2営業日

|

- 全表示

- 概要

- 目次

市場力学

世界各地での自律走行型高速鉄道の普及が、鉄道用バッテリーの需要を高めています。ハイブリッド鉄道システム開発への投資拡大が列車用電池市場を後押し。

世界各地での自律走行型高速鉄道の普及が、鉄道用バッテリーの需要を高めています。

列車の到着、出発、駅間の移動、列車の正確な自動停止、ドアの適時開閉を制御する自動運転システムは、自律走行列車として知られる列車の自動走行プロセスを構成しています。自律走行列車はまだ世界的に普及していませんが、技術の急速な発展により、その用途は確実に広がっています。また、鉄道は、道路輸送に比べ、旅客や長距離貨物の輸送において、中断や故障が少なく、移動時間が短く、信頼性の高い輸送手段であると考えられています。

さらに、鉄道網を維持し、他の交通手段への依存を減らすために、政府は鉄道システムのアップグレードと近代化のための投資予算を増やしています。

しかし、これらの鉄道システムは、高速鉄道や送電線が自律走行する列車に燃料を供給するため、主要なエネルギー消費源とみなされています。そのため、性能を向上させるために、多くの省エネ・蓄電システムが利用されています。例えば、制動エネルギーを電気に変換し、回生ブレーキ技術を使って車内の蓄電システムに蓄えることができます。回生ブレーキ技術を導入することで、インドのデリー地下鉄では約90,04トンの二酸化炭素の排出を止めることができました。

さらに、さまざまな企業が自律走行列車や高速列車用の鉄道用バッテリーの製造に投資しており、予測期間において鉄道用バッテリーのビジネスチャンスを生んでいます。例えば、2022年1月、アルストムとドイツ鉄道(DB)は、アルストム初の完全に承認されたバッテリー列車を乗客を乗せてテストすることにより、気候に優しい鉄道運行の新しい章を開くと発表しました。バッテリー・エレクトリック・マルチプル・ユニット(BEMU)は、1月24日にバーデン=ヴュルテンベルク州で、2月5日にバイエルン州で乗客を乗せた営業運転を開始する予定です。DBの地域交通部門であるDB Regioが、この低公害車を運転します。2022年5月1日までは試験運行を実施します。

鉄道用バッテリーの初期投資額が高いことが市場成長の妨げになっています。

インフラの高コストと政府の予算制限により、メキシコ、インドネシアなど、さまざまな新興経済国での高速列車ネットワークの導入が妨げられています。2021年10月によると、カリフォルニア新幹線の請負業者は、少なくとも別の1,000億米ドルのコスト増を要求していました。米国新幹線プロジェクトは、継続的なコスト上昇と今後数年間に発生する可能性のある関連問題のリスクにより、危険な財政状態にあります。

さらに、鉄道事業者のニーダーバルニマー・アイゼンバーン(NEB)は、欧州投資銀行(EIB)から最大1億724万米ドル(9500万ユーロ)の投資融資を受け、この資金は新しいバッテリー式車両の開発・購入に充てられる予定です。これらの列車は、2024年12月からNEBのディーゼル機関車に取って代わる予定です。ベルリンとポーランド国境を結ぶ東ブランデンブルクの10本の線路については、シーメンスに新型車両Mireo Plus B 31両を発注しています。

英国の高速鉄道は、その高いコストと環境への悪影響から、マンチェスター/リーズ線とバーミンガム線の完成時期がそれぞれ2031年と2040年に延期されたばかりです。また、事業費も当初予算の650億米ドルから1300億米ドルに倍近く膨らんでいます。インドネシアにおける全長150kmの高速鉄道プロジェクトも、同様に2016年に中止されました。このように、新興国ではインフラコストの高さから高速鉄道網の拡大が制限され、鉄道用バッテリーの需要に影響を及ぼすと予想されます。

COVID-19の影響分析

COVID-19の大流行により、鉄道輸送に悪影響が及び、鉄道車両の運行が減少し、鉄道用バッテリーメーカーに損失が発生しています。各社は2022年現在、稼働率を下げて生産を再開しており、需要に応じて生産調整が行われると思われます。中国などの大国が病気の蔓延を食い止めるために鎖国状態を続けているため、鉄道用バッテリーメーカーはサプライチェーンに支障をきたすと見ています。

さらに、調査対象のすべての国で、鉄道や公共交通機関の利用が減少しています。3月22日には、インドですべての鉄道の運行が中止されました。米国、カナダ、オーストラリア、英国は、交通がまだ動いている国の中で、都市部の公共交通機関が最も激減している国です。香港、韓国、スウェーデンは、封鎖されていないため、交通機関の利用減はより緩やかです。また、香港や韓国はSARSの流行を経験しているため、パンデミックに備えた公共交通機関の整備がなされています。このように、鉄道業界への直接的な影響により、鉄道用バッテリーの市場需要が減少し、業界の直接的な障害となっています。

しかし、市場の成長状況の改善は、予測期間内に以前の鉄道用バッテリーの勢いを再構築することが期待されます。

世界の鉄道用バッテリー市場レポートは、約77の市場データ表、80の図と210ページの構成で提供しています。

目次

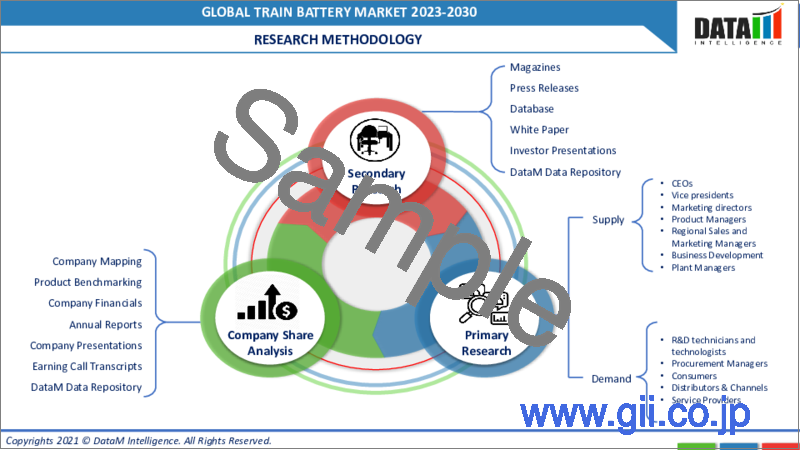

第1章 鉄道用バッテリーの世界市場の調査手法と範囲

- 調査手法

- 調査目的・調査範囲

第2章 鉄道用バッテリーの世界市場-市場の定義と概要

第3章 鉄道用バッテリーの世界市場-エグゼクティブサマリー

- 電池別市場内訳

- 鉄道別市場内訳

- 技術別市場内訳

- 機関車別市場内訳

- エンドユーザー別市場内訳

- 地域別市場内訳

第4章 鉄道用バッテリーの世界市場-市場力学

- 市場インパクトファクター

- 促進要因

- 世界各地での自律走行型高速鉄道の普及が、鉄道用バッテリーの需要を拡大。

- ハイブリッド鉄道システム開発への投資拡大が列車用電池市場を後押し

- 阻害要因

- 鉄道用バッテリーの初期投資が高く、市場成長の妨げになります。

- 市場機会

- 影響分析

- 促進要因

第5章 鉄道用バッテリーの世界市場-産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格設定分析

- 規制分析

第6章 鉄道用バッテリーの世界市場-COVID-19分析

- COVID-19の市場分析

- COVID-19以前の市場シナリオ

- COVID-19の現在の市場シナリオ

- COVID-19以降、または将来のシナリオ

- COVID-19の中での価格ダイナミクス

- 需要-供給スペクトラム

- パンデミック時の市場に関連する政府の取り組み

- メーカーの戦略的な取り組み

- まとめ

第7章 鉄道用バッテリーの世界市場-バッテリー別

- 鉛蓄電池

- ニッケルカドミウム電池

- リチウムイオン電池

第8章 鉄道用バッテリーの世界市場-列車別

- 自律走行型電車

- ハイブリッド機関車

- 完全バッテリー駆動電車

第9章 鉄道用バッテリーの世界市場-技術別

- 従来型鉛蓄電池

- バルブ制御鉛蓄電池

- ポケットプレート型ニッケル水素電池

- ファイバー/PNE型ニッケル水素電池

- ゲルチューブラー鉛蓄電池

- シンター/PNEニッケル水素電池

- リチウムイオン電池

第10章 鉄道用バッテリーの世界市場- 機関車別

- ディーゼル機関車

- DMUs

- 電気自動車

- メトロ

- 高速鉄道

- 電気機関車

- 軽便鉄道・路面電車・モノレール

- その他

第11章 鉄道用バッテリーの世界市場-アプリケーション別

- スターターバッテリー

- 補助バッテリ(HVAC、ドア、インフォテインメント)

第12章 鉄道用バッテリーの世界市場-地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ地域

第13章 鉄道用バッテリーの世界市場- 競争情勢

- 競合シナリオ

- 市況/シェア分析

- 合併・買収の分析

第14章 鉄道用バッテリーの世界市場-企業プロファイル

- GS Yuasa Corporation

- 企業概要

- エンドユーザー向けポートフォリオと説明

- 主なハイライト

- 財務概要

- AEG Power Solutions

- ENERSYS

- East Penn Manufacturing Company

- China SHOTO

- THE Furukawa Battery CO., LTD

- Coslight India Telecom Pvt. Ltd

- Hunan Fengri Power & Electric CO. LTD

- Amara Raja Batteries

- IDEX Corporation

第15章 鉄道用バッテリーの世界市場-重要考察

第16章 鉄道用バッテリーの世界市場-DataM

Market Overview

The Train Battery Market reached US$ XX million in 2021 and is expected to record significant growth by reaching up to US$ XX million by 2029, growing at a CAGR of 5.10% during the forecast period (2022-2029).

A train battery is used to supply power to the coaches when the train is stationary or moving slowly. In engines and coaches, rolling stock batteries are utilized for auxiliary systems, lighting and locomotive starting. Railroad crossings, signal towers and signaling systems all employ stationary batteries as emergency backup power. Additionally, batteries are employed to meet the electricity needs of traveling passengers, including those for light, fans, air conditioning and other small appliances. Therefore, battery capacity, resilience, dependability and performance are crucial for successful battery use.

Furthermore, to ensure the proper functioning of the train batteries and their features, batteries are sent to the railway workshop after a fixed period set by the railway authority. By performing further testing, these functionalities are guaranteed. The discharge procedure is one of the performance tests used to evaluate a battery's reliability and capacity.

The demand for high-speed trains rises along with the demand for comfortable, luxurious trains, energy-efficient transportation systems and population growth and urbanization are boosting the market growth opportunities for train batteries. Additionally, introducing high-speed trains in developing nations is anticipated to open up prospects for the market to grow to a greater level through the development of hybrid rail systems and significantly more autonomous trains.

Market Dynamics

Growing autonomous and high-speed trains in various parts of the world have escalated the demand for the train battery market. Growing investments in developing hybrid rail systems boost the train battery market.

Growing autonomous and high-speed trains in various parts of the world have escalated the demand for the train battery market.

An automated train driving system that controls train arrival, departure, movement between stations, the precise and automatic halting of trains and timely opening and closing of doors makes up the automated train travel process known as autonomous trains. Although autonomous trains have not yet become widely used on the global market, their applications are steadily expanding due to the rapid development of technology. Additionally, railways are thought to be a more reliable and effective means of transportation for passengers and long-distance freight with less interruptions and failures, lowering the traveling time compared to road transportation.

Furthermore, to sustain the railway network and reduce reliance on other forms of transportation, the government has boosted its investment budget for upgrading and modernizing the railway system.

However, these railway systems are regarded as major energy consumers since high-speed and power lines typically fuel autonomous trains. As a result, many energy-saving and storage systems are used to increase performance. For instance, braking energy is converted into electricity and stored onboard energy storage systems using regenerative braking techniques. By implementing regenerative braking technology, the Delhi metro system in India could stop the discharge of around 90,04 tonnes of carbon dioxide.

Furthermore, various companies are investing in building train batteries for autonomous and high-speed trains, creating opportunities for the train battery in the forecast period. For instance, in January 2022, Alstom and Deutsche Bahn (DB) announced to opening of a new chapter in climate-friendly rail operations by putting Alstom's first fully approved battery train to the test with passengers onboard. The Battery Electric Multiple Unit (BEMU) will start revenue operation with passengers on January 24 in Baden-Wurttemberg and February 5 in Bavaria. The regional transport division of DB, DB Regio, will drive the low-emission vehicle. Until May 1, 2022, the test operation will be in effect.

The high initial investment in train batteries hurdles market growth.

The high cost of infrastructure and budget restrictions on the government has hampered the adoption of high-speed train networks in different rising economies, such as Mexico, Indonesia, etc. According to October 2021, the California bullet train's contractors had requested cost increases of at least another billion dollars. The US$100 billion project is in hazard assessment financial shape due to ongoing cost rises and the risk that related issues may show over the coming years.

Furthermore, The railway operator Niederbarnimer Eisenbahn (NEB) will get an investment loan from the European Investment Bank (EIB) for up to US$107.24 million (€95 million), which will be used to develop and buy new battery-powered trains. These trains will replace the NEB's diesel locomotives beginning in December 2024. For the ten East Brandenburg tracks that connect Berlin with the Polish border, the business has made an order with Siemens for 31 new Mireo Plus B trains.

Due to the project's high cost and negative environmental impact, UK's high-speed rail line's completion dates for the Manchester/Leeds and Birmingham branches have recently been pushed back to 2031 and 2040, respectively. The project's projected cost has also nearly doubled from its initial budget of US$ 65 billion to US$ 130 billion. A 150 km long high-speed train project in Indonesia was similarly halted in 2016. As a result, it is anticipated that the high infrastructure cost will limit the expansion of the high-speed train network in emerging economies, impacting the demand for train batteries.

COVID-19 Impact Analysis

The COVID-19 pandemic has adversely affected rail transport, reducing rolling stock operations and losses for train battery manufacturers. Companies have resumed production as of 2022 with decreased capacity utilization and production will likely be adjusted in response to demand. As big nations like China continue to be under a state of lockdown to stop the disease's spread, train battery producers see interruptions in their supply chains.

Furthermore, all the countries in the study have seen a decline in rail and public transportation use. On March 22, all rail service in India was canceled. U.S., Canada, Australia and UK are the nations where public transit in urban areas has decreased most dramatically among those where traffic is still moving. Because these nations were not put under lockdown, transit usage declines have been more muted in Hong Kong, South Korea and Sweden. Furthermore, having experienced SARS epidemics, Hong Kong and South Korea have established pandemic-preparedness public transportation procedures. Thus, the direct impact on the railway industry has reduced the train battery market demand, directly hampering the industry.

However, improving market growth conditions are expected to rebuild the previous train battery momentum in the forecast period.

Segment Analysis

The global train battery market can be segmented on battery, train, technology, locomotive, application and region.

Due to improved high power density and lower maintenance costs than lead-acid batteries, Ni-Cd battery producers have significant growth prospects

The global train battery market based on the battery is segmented into lead-acid battery, nickel-cadmium battery and lithium-ion battery. Out of the mentioned battery, the nickel-cadmium battery holds a dominating position in the global train battery market. Due to improved high power density and lower maintenance costs than lead-acid batteries, battery producers have significant growth prospects. Nickel-cadmium batteries outperform conventional batteries on variable loads and across various temperatures.

Furthermore, the nickel-cadmium battery is extremely dependable and requires less maintenance than conventional batteries. Ni-Cd batteries offer very high performance in rail applications like the emergency braking of metros and fast trains and the starting of diesel locomotives.

The main applications of the battery include diesel engine starting and power backup. The batteries offer various advantages such as short duration, high peak discharges, low maintenance (2 years without topping up with water), long life: of more than 15 years, high reliability, wide operating temperature range and excellent changeability. The advantages mentioned above by Ni-Cd accelerate the market growth in the train batteries business.

Geographical Analysis

Growing rail network and increased government investment in the transportation sector of Asia-Pacific boost the market share for train batteries in the region

Due to the construction of rail networks in nations like China, Japan, India and South Korea, Asia-Pacific is thought to have the largest and fastest-growing market. Furthermore, the market's expansion in this region can be attributed to the region's rapid infrastructure development, increased government investment in the transportation sector and ongoing and upcoming projects in various nations. Emerging economies such as India and China, where the number of subway line installations are expanding quickly relative to other countries in the region, dominate Asia-Pacific market. The market for automatic trains is primarily driven in the region by advancements in automation and consumer desire for safe and effective transportation.

Additionally, China and India have some of the largest rail systems in the world. China had a track length of more than 250,000 km in 2019, India had a track length of over 100,000 km, Japan had a track length of about 28,000 km and South Korea had a track length of roughly 4,000 km. Passenger trains are the most popular form of transportation in India, China and South Korea, although, in Japan, high-speed railroads and metro trains are preferred. The need for batteries is growing due to the increased demand for properly equipped train sets.

Competitive Landscape

The train battery market is highly competitive with the presence of local and global companies. Some prime companies contributing to the market's growth are GS Yuasa Corporation., AEG Power Solutions, ENERSYS, East Penn Manufacturing Company, China SHOTO, Sunlight, THE Furukawa Battery CO., LTD., Coslight India Telecom Pvt. Ltd., Saft, Hunan Fengri Power & Electric CO. LTD., Amara Raja Batteries and others.

The major companies are adopting several growth strategies such as acquisitions, product launches and collaborations, contributing to the market growth of train battery globally.

- For instance, In 2022, ABB won orders worth US$80 million from Stadler for energy-efficient traction and high-performance battery technologies for high-capacity commuter trains. Many of these trains would improve Spain's short-distance transportation system, which now transports over a million commuting passengers daily between some of the country's main cities, including Madrid and Barcelona. Additionally, new locomotive traction equipment is included in the orders.

DMS Technologies Pvt. Ltd

Overview: GS Yuasa Corporation is a Japanese company specializing in the development and production of lead-acid and lithium-ion batteries, used in trains, automobiles, motorcycles and other areas, including aerospace and defense applications. The company was established in 2004 and had a capital stock of 10 billion by 2021.

Product Portfolio:

- Alkaline(Ni-Cd) Batteries for Railway Vehicles: The company offers Nid-Cd batteries for railway application which is used as UPS, an emergency power source, for trains, lighting for trains, ships and equipment, telecommunication, transportable and solar cells.

Key Development

- In 2018, GS Yuasa Corporation announced delivery of E3 Solution System, a regenerative power storage system offering an output of 1,000kW, to West Japan Railway Company. The system is a single unit made of a converter coupled with lithium-ion batteries and can charge and discharge a maximum power of up to 1,000kW.

Why Purchase the Report?

- Visualize the train battery market segmentation by battery, train, technology, locomotive, application and region, highlighting key commercial assets and players.

- Identify commercial opportunities in the train battery market by analyzing trends and co-development deals.

- Excel data sheet with thousands of train battery market-level 4/5 segmentation data points.

- PDF report with the most relevant analysis cogently put together after exhaustive qualitative interviews and in-depth market study.

- Product mapping in excel for the key product of all major market players

The global train battery market report would provide approximately 77 market data tables, 80 figures and 210 pages.

Target Audience 2022

- Service Providers/ Buyers

- Industry Investors/Investment Bankers

- Education & Research Institutes

- Research Professionals

- Emerging Companies

- Manufacturers

- Logistics companies

- Distributors

Table of Contents

1. Global Train Battery Market Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Global Train Battery Market - Market Definition and Overview

3. Global Train Battery Market - Executive Summary

- 3.1. Market Snippet by Battery

- 3.2. Market Snippet by Train

- 3.3. Market Snippet by Technology

- 3.4. Market Snippet by Locomotive

- 3.5. Market Snippet by End-User

- 3.6. Market Snippet by Region

4. Global Train Battery Market-Market Dynamics

- 4.1. Market Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing autonomous and high-speed trains in various parts of the world have escalated the demand for the train battery market.

- 4.1.1.2. Growing investments in developing hybrid rail systems boost the train battery market.

- 4.1.2. Restraints

- 4.1.2.1. The high initial investment in train battery hurdles the market growth

- 4.1.3. Opportunity

- 4.1.3.1. XX

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Global Train Battery Market - Industry Analysis

- 5.1. Porter's Five Forces Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. Global Train Battery Market - COVID-19 Analysis

- 6.1. Analysis of COVID-19 on the Market

- 6.1.1. Before COVID-19 Market Scenario

- 6.1.2. Present COVID-19 Market Scenario

- 6.1.3. After COVID-19 or Future Scenario

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. Global Train Battery Market - By Battery

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 7.1.2. Market Attractiveness Index, By Battery

- 7.2. Lead Acid Battery

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Nickel Cadmium Battery

- 7.4. Lithium-Ion Battery

8. Global Train Battery Market - By Train

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Train

- 8.1.2. Market Attractiveness Index, By Train

- 8.2. Autonomous Trains

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Hybrid Locomotives

- 8.4. Fully Battery Operated Trains

9. Global Train Battery Market - By Technology

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 9.1.2. Market Attractiveness Index, By Technology

- 9.2. Conventional Lead Acid Battery*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Valve Regulated Lead Acid Battery

- 9.4. Pocket Plate Ni-Cd Battery

- 9.5. Fiber/PNE Ni-Cd Battery

- 9.6. Gel Tubular Lead Acid Battery

- 9.7. Sinter/PNE Ni-Cd Battery

- 9.8. Lithium-Ion Battery

10. Global Train Battery Market - By Locomotive

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By locomotive

- 10.1.2. Market Attractiveness Index, By Locomotive

- 10.2. Diesel Locomotives

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. DMUs

- 10.4. EMUs

- 10.5. Metros

- 10.6. High-speed Trains

- 10.7. Electric Locomotives

- 10.8. Light Trains/Trams/Monorails

- 10.9. Others

11. Global Train Battery Market - By Application

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.1.2. Market Attractiveness Index, By Application

- 11.2. Starter Battery

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Auxiliary Battery (HVAC, Doors, Infotainment)

12. Global Train Battery Market - By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Train

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By locomotive

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1. U.S.

- 12.2.8.2. Canada

- 12.2.8.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Train

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By locomotive

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1. Germany

- 12.3.8.2. UK

- 12.3.8.3. France

- 12.3.8.4. Italy

- 12.3.8.5. Spain

- 12.3.8.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Train

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By locomotive

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1. Brazil

- 12.4.8.2. Argentina

- 12.4.8.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Train

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By locomotive

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1. China

- 12.5.8.2. India

- 12.5.8.3. Japan

- 12.5.8.4. South Korea

- 12.5.8.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Train

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By locomotive

- 12.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

13. Global Train Battery Market - Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Positioning/Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Global Train Battery Market- Company Profiles

- 14.1. GS Yuasa Corporation

- 14.1.1. Company Overview

- 14.1.2. End-User Portfolio and Description

- 14.1.3. Key Highlights

- 14.1.4. Financial Overview

- 14.2. AEG Power Solutions

- 14.3. ENERSYS

- 14.4. East Penn Manufacturing Company

- 14.5. China SHOTO

- 14.6. THE Furukawa Battery CO., LTD

- 14.7. Coslight India Telecom Pvt. Ltd

- 14.8. Hunan Fengri Power & Electric CO. LTD

- 14.9. Amara Raja Batteries

- 14.10. IDEX Corporation

LIST NOT EXHAUSTIVE

15. Global Train Battery Market - Premium Insights

16. Global Train Battery Market - DataM

- 16.1. Appendix

- 16.2. About Us and Services

- 16.3. Contact Us