|

市場調査レポート

商品コード

1745945

欧州のオフィス家具市場The European Market for Office Furniture |

||||||

|

|||||||

| 欧州のオフィス家具市場 |

|

出版日: 2025年06月11日

発行: CSIL Centre for Industrial Studies

ページ情報: 英文 281 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

欧州のオフィス家具の市場規模は現在95億ユーロを超え、ここ2年間は輸入の好調な推移により、一定の安定性を示しています。欧州内での主要な消費国は、ドイツ、イギリス、フランスです。

時間の経過とともに、オフィス家具の世界は境界があいまいになりつつあります。働き方のパラダイムの変化、高さ調節可能デスク、電話ブース、防音ポッドなど、製品の技術的特性の進化、家庭環境からの影響が相まって、イノベーションへの強い推進力が生まれ、この分野は数年前の従来の概念から根本的に変革されつつあります。

当レポートは、欧州のオフィス家具の市場について、2019年から2024年までの30カ国の生産額、市場動向、国際貿易などを幅広く分析し、製品セグメント、流通チャネル、業界に影響を与える主要動向、新たな需要促進要因などについて概説しています。欧州の市場予測や2025年と2026年の市場発展予測も掲載しています。また、欧州のオフィス家具最大手企業の業績と市場シェアを調査し、欧州のオフィス家具の競合情勢も分析しています。

対象企業

対象企業

|

|

|

ハイライト

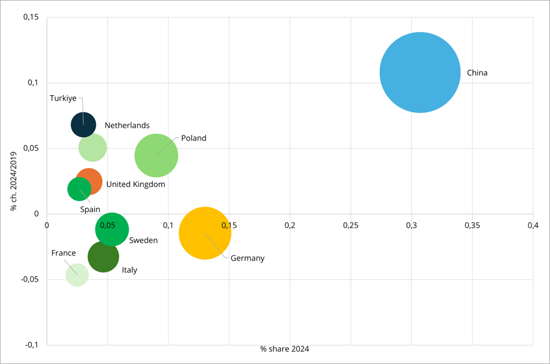

欧州オフィス家具。輸入上位国 (2019-2024年)

2024年のユーロ・シェア, 2024/2019年の変化率

出所CSIL

目次 (要約)

調査手法、定義および注釈

エグゼクティブサマリー:欧州のオフィス家具産業を牽引する主要要因

第1章 市場シナリオ:国別の動向、製品タイプ、数値

- 国別の市場動向と数値:オフィス家具の生産額と価格、消費量、国際貿易

- 需要の牽引因子

- 欧州の主要グループとその市場シェア

- 現在の動向・市場予測

第2章 業績:地域・国別の基本データとマクロ経済指標

- 北欧 (デンマーク、フィンランド、ノルウェー、スウェーデン)

- 西欧 (ベルギー、フランス、アイルランド、オランダ、英国)

- 中欧 (DACH:オーストリア、ドイツ、スイス)

- 南欧 (ギリシャ、イタリア、ポルトガル、スペイン)

- 中東欧 (ブルガリア、クロアチア、キプロス、チェコ共和国、エストニア、ハンガリー、リトアニア、ラトビア、マルタ、ポーランド、ルーマニア、スロベニア、スロバキア)

第3章 オフィス家具の国際貿易

- 貿易収支:セグメント別

- 輸出:国・セグメント別

- 欧州以外の目的地

- 輸入:国・セグメント別

- 主要供給国

第4章 供給構造と製品セグメント

- 製品セグメント:欧州および一部の国におけるオフィス家具:セグメント別

- オフィス用座席:生産額 (タイプ・カバー別)・供給量 (タイプ別)

- 作業用デスク:生産額・供給量 ( 自立型・パネルベース別)

- エグゼクティブ家具:生産額

- ファイリングシステム:生産額

- 壁、パーティション、音響製品:生産額・供給量 (タイプ別)

- 会議室および共用エリアの家具:生産額 (タイプ別)

焦点

- 欧州の電話ブースと音響ポッド

- 欧州における高さ調節可能なテーブル (HAT)

- 雇用と投資活動

- 持続可能性と再利用

第5章 市場と流通:流通チャネル別のオフィス家具販売

- 欧州における回転椅子:販売数とブランドポジショニング

第6章 競合情勢

- 主要製造業者の売上と市場シェア:製品カテゴリー別

- 主要製造業者の売上と市場シェア:主要市場別

付録1:国際貿易表

付録2:掲載企業リスト

The CSIL Report "The European Market for Office Furniture" offers an extensive analysis of the office furniture market in Europe with production values, market trends, and international trade from 2019 to 2024 for 30 countries, outlining product segments, distribution channels, key trends impacting the industry, and emerging demand drivers. Market forecasts and expected developments in Europe are provided for the years 2025 and 2026. The research report also examines the largest office furniture companies in Europe, their performance and market share, to analyse the European office furniture competitive landscape.

MARKET EVOLUTION AND FIGURES BY COUNTRY

The report provides office furniture demand drivers, production and price trends, macroeconomic indicators, workforce statistics, and 2019-2024 values of office furniture production, consumption, imports, and exports and 2025 and 2026 office furniture consumption forecasts for Europe as a whole and by country.

The international trade of office furniture is thoroughly examined, providing a breakdown of European office furniture imports and exports by country and product type (office furniture and office seating), alongside key trading partners.

COMPETITION: KEY PLAYERS IN THE EUROPEAN OFFICE FURNITURE SECTOR

The study presents sales data and market shares (including trends), significant events in the competitive landscape, and mergers and acquisitions involving the leading European office furniture manufacturers.

Sales of the largest European office furniture manufacturers and their market share are provided on both a country level and for specific sub-segments, with brief profiles of selected firms.

Extra-European business: Office furniture sales Extra-EU and Russia, Middle East, Asia Pacific, North America, Central-South America, and Africa are provided for a sample of European companies.

Additionally, the report includes the addresses of around 300 office furniture companies.

SUPPLY STRUCTURE, TYPES OF PRODUCTS AND TRENDS

European office furniture production is broken down by type of products (Seating, Operative Desking, Partitions / Acoustic Filing / Storage, Communal Areas, and Executive Furniture). For each one, the report includes production values for the time series 2019-2024. The values of Office furniture by segment are also provided for selected countries (Germany, Italy, France, the United Kingdom, Sweden, Spain, Poland, and the Czech Republic)

- Office Seating: production values, breakdown by type and by covering and supply by type in a sample of companies with a FOCUS ON: Swivel Chairs. A detailed analysis of office seating volumes and brand positioning. Brand positioning by average net price and total units sold are given on a European level. The number and the performance of swivel chairs sold in the time series 2020-2024 are also provided for the major countries (Germany, France, United Kingdom, Italy, Spain, Poland, and Sweden). Values include both products manufactured in Europe and products imported from extra-European countries.

- Operative Desking: production values, the breakdown between freestanding and panel-based desking, and supply by freestanding and panel-based desking in a sample of companies, with a FOCUS ON: Height Adjustable Tables (HAT) , production of sit-standing desks by the main country/region (Scandinavia, DACH, Benelux, Italy, France, United Kingdom, Spain & Portugal, Poland, Other) and breakdown of desking supply between fixed and height adjustable, in a sample of companies.

- Executive Furniture: production values.

- Filing Systems: production values, breakdown by type, and supply by type in a sample of companies

- Walls, Partitions and Acoustic Products: production values, partition walls by type, supply by type in a sample of companies, with a FOCUS ON: Phone Booths and Acoustic Pods, values of production of phone booths and acoustic pods, values of consumption of phone booths and acoustic pods by country/region, phone booths and acoustic pods by kind, average list prices.

- Furniture for Meeting Rooms and Communal Areas: production values and breakdown by type.

MARKET AND DISTRIBUTION

The analysis of office furniture distribution channels covers Direct sales, Specialist dealers, Non-specialists, and E-commerce, with the incidence in the major European markets. A breakdown of office furniture sales by distribution channel is available for the top companies.

GEOGRAPHICAL COVERAGE:

- Northern Europe: Denmark (DK), Finland (FI), Norway (NO), and Sweden (SE);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL), and the United Kingdom (UK). Unless otherwise specified, figures for Belgium include those for Luxembourg;

- Central Europe (DACH): Germany (DE), Austria (AT), and Switzerland (CH);

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT), and Spain (ES);

- Central-Eastern Europe: Poland (PL), Czech Republic (CZ), Slovakia (SK), Hungary (HU) and Romania (RO), Slovenia (SL), Croatia (HR), Bulgaria (BG), Cyprus (CY), Malta (MT), Estonia (EE), Latvia (LV), Lithuania (LT)

The CSIL report "The European Market for Office Furniture" aims to answer to the following questions, to better understand the current state and future outlook of the relevant sector:

- What is the European Office Furniture market size?

- What are the main trends in the European office furniture market?

- What are the market forecasts for office furniture in Europe for 2025 and 2026?

- What are the leading office furniture manufacturers in Europe and their performance?

- How is office furniture distribution structured in the European market?

- Which types of office furniture are most in demand in Europe?

Selected companies

Among the considered companies:

|

|

|

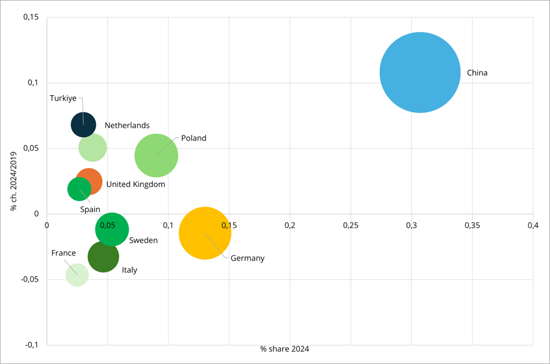

Highlights:

Europe. Office Furniture. Top countries of origin of imports, 2019-2024.

Million EUR and shares 2024, % changes 2024/2019

Source: CSIL

The European market for office furniture currently exceeds a value of EUR 9.5 billion, showing a certain stability over the last two years as a result of the positive trend of imports. Leading consuming countries within Europe are Germany, the United Kingdom, and France.

Over time, the world of office furniture has assumed increasingly blurred boundaries. The change in working paradigms, the evolution of the technical characteristics of products (i.e, HAT height adjustable desks, phone booths, and acoustic pods), and the contaminations coming from the home environment have generated a push towards innovation that has radically transformed this sector from the traditional concepts of a few years ago.

TABLE OF CONTENTS (ABSTRACT)

METHODOLOGY, DEFINITIONS AND NOTES

EXECUTIVE SUMMARY: KEY FACTORS DRIVING THE OFFICE FURNITURE INDUSTRY IN EUROPE

1. MARKET SCENARIO: Trends, product types and figures by country

- 1.1. Market evolution and figures by country 2019-2024: Office furniture production values and prices, consumption and international trade

- 1.2. Demand drivers

- 1.3. Leading groups in Europe and their market shares

- 1.4. Current trends and market forecasts for 2025 and 2026

2. BUSINESS PERFORMANCE: Basic data e and macroeconomic indicators by region and by country

- 2.1. Northern Europe (Denmark, Finland, Norway and Sweden)

- 2.2. Western Europe (Belgium, France, Ireland, Netherlands, the UK)

- 2.3. Central Europe (DACH: Austria, Germany, Switzerland)

- 2.4. Southern Europe (Greece, Italy, Portugal, Spain)

- 2.5. Central-Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovenia, Slovakia)

3. THE INTERNATIONAL TRADE OF OFFICE FURNITURE

- 3.1. Trade balance by segment

- 3.2. Exports: by country and segments

- 3.3. Extra-European destinations

- 3.4. Imports: by country and segments

- 3.5. Leading supplying countries

4. SUPPLY STRUCTURE AND PRODUCT SEGMENTS

- 4.1. Product segments: Office furniture by segment in Europe and in selected countries

- Office seating: production values, breakdown by type and covering and supply by type in a sample of companies

- Operative desking: production values, freestanding and panel-based desking, supply by freestanding and panel-based desking in a sample of companies

- Executive furniture: production values

- Filing systems: production values, breakdown by type, supply by type in a sample of companies

- Walls, partitions and acoustic products: production values, partition walls by type, supply by type in a sample of companies

- Furniture for meeting rooms and communal areas: production values and breakdown by type

FOCUS ON

- 4.2. Phone booths and acoustic pods in Europe: values of production of phone booths and acoustic pods, phone booths and acoustic pods by kind, average list prices, a sample of brands and products by year of launch, and price segment.

- 4.3. Height Adjustable Tables (HAT) in Europe: production of sit-standing desks by the main country/region and breakdown of desking supply between fixed and height adjustable, in a sample of companies

- 4.4. Employment and investment activity

- 4.5. Sustainability and reuse

5. MARKET AND DISTRIBUTION: Office furniture Sales by distribution channel

- 5.1. Swivel chairs in Europe: volumes and brand positioning

6. THE COMPETITIVE LANDSCAPE

- Sales and market shares of the leading manufacturers by product category

- Sales and market shares of the leading manufacturers by major markets