|

|

市場調査レポート

商品コード

1592689

輸送試験・検査・認証サービス市場の分析・予測 (2024-2033年):用途、製品、EPA 1065規制 (米国) に焦点Transportation Testing, Inspection, and Certification Services Market: Focus on Applications, Products, and EPA 1065 Regulations in the U.S. - Analysis and Forecast, 2024-2033 |

||||||

カスタマイズ可能

|

|||||||

| 輸送試験・検査・認証サービス市場の分析・予測 (2024-2033年):用途、製品、EPA 1065規制 (米国) に焦点 |

|

出版日: 2024年11月19日

発行: BIS Research

ページ情報: 英文 249 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

輸送試験・検査・認証サービスの市場規模は、2023年の344億8,000万米ドルから、予測期間中はCAGR 5.90%で成長し、2033年には617億4,000万米ドルに達すると予測されています。

輸送試験・検査・認証サービスの市場は、さまざまな輸送部門における安全性、規制遵守、品質保証のニーズの高まりにより、大幅な成長を遂げています。これらのサービスは、車両、インフラ、部品が厳格な安全・性能基準を満たしていることを保証し、よりスムーズで信頼性の高い運行をサポートする上で重要な役割を果たしています。輸送システムが電気自動車や自動運転車などの先進技術を取り入れて進化するにつれて、専門的な試験・認証サービスへの需要が高まっています。また、試験手法や自動検査ツールの進歩により精度と効率が向上し、自動車、鉄道、船舶、航空産業での市場導入がさらに進んでいます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024-2033年 |

| 2024年評価 | 368億6,000万米ドル |

| 2033年予測 | 617億4,000万米ドル |

| CAGR | 5.9% |

輸送試験・検査・認証サービス市場は、さまざまな輸送手段において安全性、コンプライアンス、品質を確保するために業界が厳格な基準を採用する中で、急速に拡大しています。車両試験、インフラ検査、部品認証を含むこれらのサービスは、自動運転車、電気自動車、コネクテッドカー技術の進歩が加速するにつれて不可欠なものとなっています。安全性に対する規制要件や消費者の期待が高まる中、信頼性の高い試験・認証サービスへの需要が世界的に高まっています。同市場は、試験方法、自動化、リアルタイムモニタリングツールの革新に加え、自動車、鉄道、船舶、航空の各分野における持続可能な輸送ソリューションのサポートと運用リスクの最小化へのニーズによって、大きな成長を遂げるとみられます。

自動車用途が市場をリード (用途別)

用途別では、自動車部門が市場をリードしており、業界の厳しい安全・品質基準がその原動力となっています。自動車メーカーは、自動車が安全性、排出ガス、性能基準などの規制要件を満たしていることを確認するため、輸送試験・検査・認証サービスへの依存度を高めています。これらの自動車には電池の安全性、ソフトウェアの完全性、センサーの信頼性に関する専門的な試験が必要であることから、電気自動車や自動運転車へのシフトがサービス需要を強めています。さらに、持続可能性と環境コンプライアンスへの注目の高まりも、自動車企業が世界の二酸化炭素削減目標に沿うよう努力しているため、排出ガス試験と認証の必要性を高めています。

サービスタイプ別では、ラボ試験の部門が市場をリードしており、輸送製品の品質、安全性、コンプライアンスを確保する上で不可欠な役割を担っています。ラボ試験は、その精度と極限状態をシミュレートする能力が高く評価され、材料性能、耐久性、安全基準に関する重要な洞察を提供します。このサービスタイプは、製品が市場に出回る前に規制要件や安全要件を満たすために厳格な試験が求められる自動車や航空宇宙産業で特に重要です。

当レポートでは、世界の輸送試験・検査・認証サービスの市場を調査し、業界の動向、技術・特許の動向、法規制環境、市場成長促進要因・抑制要因、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- リアルタイムのテストと監視のためのIoT

- 認証におけるデータ整合性のためのブロックチェーンの使用

- クラウドベースのテストプラットフォーム

- 試験・検査・認証サービスにおけるサイバーセキュリティとデータプライバシー

- サプライチェーンの概要

- バリューチェーン分析

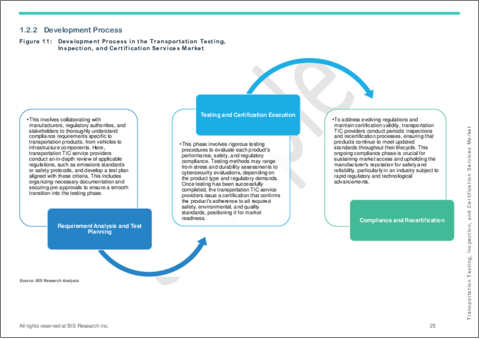

- 開発プロセス

- 研究開発レビュー

- 特許出願動向 (国・企業別)

- 規制状況

- ステークホルダー分析

- 認証基準の概要

- ISO 9001:品質管理システム

- ISO 14001:環境マネジメントシステム

- IATF 16949:自動車品質管理

- AS9100:航空宇宙品質管理

- 国際海事機関 (IMO) 基準

- 欧州連合規制認証

- 航空に関するFAAおよびEASA認証

- ULおよびCE認証

- ビジネスモデル/運用モデルの分析

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 用途

- 用途のセグメンテーション

- 用途の概要

- 輸送試験・検査・認証サービス市場 (用途別)

- 自動車

- 鉄道輸送

- 海上輸送

- 航空輸送

第3章 製品

- 製品セグメンテーション

- 製品概要

- 輸送試験・検査・認証サービス市場 (サービスタイプ別)

- ラボ試験

- 検査

- 認証・認定

- 輸送試験・検査・認証サービス市場 (段階別)

- プリプロダクション

- メンテナンス・ライフサイクル

- 輸送試験・検査・認証サービス市場 (車両タイプ別)

- 乗用車

- 商用車

- 輸送試験・検査・認証サービス市場 (推進タイプ別)

- 内燃機関 (ICE) 車両

- 電気自動車

第4章 地域

- 地域別概要

- 輸送試験・検査・認証サービス市場

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場:競合ベンチマーキングと企業プロファイル

- 次なるフロンティア

- 地理的評価

- Intertek Group plc

- CATARC Europe Testing and Certification GmbH

- CSI S.p.A.

- Belcan

- DEKRA

- Bureau Veritas

- Applus+

- Element Materials Technology

- HORIBA MIRA

- UL LLC

- Eurofins Scientific

- Kiwa

- SGS Societe Generale de Surveillance SA.

- TUV SUD

- UTAC

- FEV Group GmbH

- AVL

- Reinova S.p.a.

- Smithers

- MISTRAS Group

第6章 調査手法

List of Figures

- Figure 1: Transportation Testing, Inspection, and Certification Services Market (by Scenario), $Million, 2023, 2027, and 2033

- Figure 2: Transportation Testing, Inspection, and Certification Services Market (by Region), $Million, 2023, 2027, and 2033

- Figure 3: Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023, 2027, and 2033

- Figure 4: Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023, 2027, and 2033

- Figure 5: Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023, 2027, and 2033

- Figure 6: Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023, 2027, and 2033

- Figure 7: Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023, 2027, and 2033

- Figure 8: Key Events

- Figure 9: Global Expenditure on Blockchain Solutions, $Million, 2017-2020

- Figure 10: Supply Chain Analysis of Transportation Testing, Inspection, and Certification Services Market

- Figure 11: Development Process in the Transportation Testing, Inspection, and Certification Services Market

- Figure 12: Patent Analysis (by Country), January 2021-October 2024

- Figure 13: Patent Analysis (by Company), January 2021-October 2024

- Figure 14: Impact Analysis of Market Navigating Factors, 2023-2033

- Figure 15: Estimated Percent of Registered Vehicles (by ADAS Feature)

- Figure 16: Region-Wise Electric Car Sales, $Million, 2019-2023

- Figure 17: Region-wise Per-Capita CO2 Emissions, in tonnes per person, 2019-2022

- Figure 18: U.S. Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 19: Stakeholders in the Emissions Testing Landscape in the U.S.

- Figure 20: Rest-of-North America Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 21: Germany Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 22: France Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 23: Netherlands Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 24: Denmark Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 25: Sweden Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 26: U.K. Transportation Testing, Inspection, and Certification Services Market, $Million, 2022-2033

- Figure 27: Italy Transportation Testing, Inspection, and Certification Services Market, $Million, 2022-2033

- Figure 28: Poland Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 29: Spain Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 30: Rest-of-Europe Transportation Testing, Inspection, and Certification Services Market, $Million, 2022-2033

- Figure 31: China Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 32: Japan Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 33: South Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 34: Australia Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 35: Rest-of-Asia-Pacific Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 36: U.A.E. Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 37: Brazil Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 38: Others Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 39: Strategic Initiatives, January 2021-October 2024

- Figure 40: Share of Strategic Initiatives, January 2021-October 2024

- Figure 41: Data Triangulation

- Figure 42: Top-Down and Bottom-Up Approach

- Figure 43: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Competitive Landscape Snapshot

- Table 4: Trends Overview

- Table 5: Key Companies Providing Cybersecurity Testing, Inspection, and Certification Services

- Table 6: Key Functions and Services in the Transportation Testing, Inspection, and Certification (TIC) Value Chain

- Table 7: Regulatory Landscape of the Transportation Testing, Inspection, and Certification Services Market

- Table 8: Some of the Key EU Certificates

- Table 10: FAA Certifications

- Table 11: Key Differences between UL and CE Certification

- Table 12: Transportation Testing, Inspection, and Certification Services Market (by Region), $Million, 2023-2033

- Table 13: North America Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 14: North America Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 15: North America Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 16: North America Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 17: North America Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 18: U.S. Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 19: U.S. Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 20: U.S. Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 21: U.S. Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 22: U.S. Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 23: Overview of EPA PART 1065, Engine Testing Procedures

- Table 24: EPA 1065 Engine Testing Market, $Million, 2023-2038

- Table 25: Company Overview

- Table 26: Markey Share of Key Companies

- Table 27: Some of the Past Amendments to EPA Part 1065

- Table 28: Key Committees, Organizations, Industry Associations, and Advocacy Groups Shaping and Influencing EPA 1065 Regulations

- Table 29: Rest-of-North America Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 30: Rest-of-North America Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 31: Rest-of-North America Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 32: Rest-of-North America Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 33: Rest-of-North America Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 34: Europe Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 35: Europe Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 36: Europe Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 37: Europe Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 38: Europe Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 39: Germany Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 40: Germany Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 41: Germany Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 42: Germany Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 43: Germany Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 44: France Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 45: France Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 46: France Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 47: France Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 48: France Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 49: Netherlands Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 50: Netherlands Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 51: Netherlands Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 52: Netherlands Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 53: Netherlands Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 54: Denmark Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 55: Denmark Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 56: Denmark Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 57: Denmark Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 58: Denmark Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 59: Sweden Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 60: Sweden Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 61: Sweden Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 62: Sweden Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 63: Sweden Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 64: U.K. Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 65: U.K. Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 66: U.K. Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 67: U.K. Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 68: U.K. Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 69: Italy Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 70: Italy Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 71: Italy Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 72: Italy Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 73: Italy Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 74: Poland Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 75: Poland Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 76: Poland Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 77: Poland Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 78: Poland Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 79: Spain Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 80: Spain Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 81: Spain Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 82: Spain Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 83: Spain Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 84: Rest-of-Europe Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 85: Rest-of-Europe Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 86: Rest-of-Europe Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 87: Rest-of-Europe Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 88: Rest-of-Europe Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 89: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 90: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 91: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 92: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 93: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 94: China Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 95: China Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 96: China Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 97: China Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 98: China Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 99: Japan Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 100: Japan Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 101: Japan Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 102: Japan Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 103: Japan Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 104: South Korea Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 105: South Korea Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 106: South Korea Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 107: South Korea Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 108: South Korea Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 109: Australia Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 110: Australia Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 111: Australia Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 112: Australia Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 113: Australia Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 114: Rest-of-Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 115: Rest-of-Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 116: Rest-of-Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 117: Rest-of-Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 118: Rest-of-Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 119: Rest-of-the-World Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 120: Rest-of-the-World Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 121: Rest-of-the-World Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 122: Rest-of-the-World Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 123: Rest-of-the-World Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 124: U.A.E. Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 125: U.A.E. Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 126: U.A.E. Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 127: U.A.E. Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 128: U.A.E. Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 129: Brazil Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 130: Brazil Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 131: Brazil Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 132: Brazil Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 133: Brazil Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 134: Others Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 135: Others Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 136: Others Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 137: Others Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 138: Others Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 139: Market Share

Transportation Testing, Inspection, and Certification Services Market Overview

The transportation testing, inspection, and certification services market was valued at $34.48 billion in 2023 and is expected to grow at a CAGR of 5.90% and reach $61.74 billion by 2033. The transportation testing, inspection, and certification services market has been witnessing substantial growth, driven by the rising need for safety, regulatory compliance, and quality assurance across various transportation sectors. These services play a crucial role in ensuring that vehicles, infrastructure, and components meet stringent safety and performance standards, supporting smoother and more reliable operations. As transportation systems evolve to incorporate advanced technologies such as electric and autonomous vehicles, demand for specialized testing and certification services has been increasing. Advancements in testing methodologies and automated inspection tools have also enhanced accuracy and efficiency, further driving market adoption across automotive, rail, maritime, and aviation industries.

Introduction to Transportation Testing, Inspection, and Certification Services

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2033 |

| 2024 Evaluation | $36.86 Billion |

| 2033 Forecast | $61.74 Billion |

| CAGR | 5.9% |

Transportation testing, inspection, and certification services encompass a range of specialized processes designed to ensure the safety, performance, and regulatory compliance of vehicles, infrastructure, and components across the transportation sector. These services involve rigorous testing and evaluation of various parameters such as durability, emissions, fuel efficiency, and structural integrity to verify that transportation assets meet national and international standards. Utilizing advanced testing equipment and inspection technologies, such as non-destructive testing (NDT) methods, automated inspection systems, and real-time monitoring tools, these services provide critical assurance for manufacturers, regulatory bodies, and consumers alike. By identifying potential risks and ensuring operational safety, transportation testing, inspection, and certification services are fundamental to the reliability, efficiency, and sustainability of modern transportation systems across automotive, rail, maritime, and aviation industries.

Market Introduction

The transportation testing, inspection, and certification services market has rapidly expanded as industries adopt rigorous standards to ensure safety, compliance, and quality across various transportation modes. These services, including vehicle testing, infrastructure inspection, and component certification, have become essential as advancements in autonomous, electric, and connected vehicle technologies accelerate. With the increasing regulatory requirements and consumer expectations for safety, the demand for reliable testing and certification services has been growing globally. The market is set to experience significant growth, driven by innovations in testing methods, automation, and real-time monitoring tools, as well as the need to support sustainable transportation solutions and minimize operational risks across automotive, rail, maritime, and aviation sectors.

Industrial Impact

The industrial impact of the transportation testing, inspection, and certification services market extends across the transportation sector alongside advancements in vehicle technology and infrastructure. These services drive innovation in safety standards and compliance, promoting the development of more reliable, efficient, and sustainable transportation systems. As the market grows, it enhances collaboration between technology providers, regulatory bodies, and transportation companies, raising industry standards and fueling advancements in quality and safety. It promotes safer, more efficient transport systems and aligns with global safety and sustainability goals, influencing practices across automotive, rail, maritime, and aviation industries and supporting a more resilient and environmentally responsible transportation ecosystem.

The key players operating in the transportation testing, inspection, and certification services market include Intertek Group plc, CATARC Europe Testing and Certification GmbH, CSI S.p.A., Belcan, DEKRA SE, Bureau Veritas, Applus+, Element Materials Technology, HORIBA MIRA, UL LLC, Eurofins Scientific, Kiwa, SGS Societe Generale de Surveillance SA., TUV SUD, UTAC, FEV Group GmbH, AVL, Reinova S.p.a. and Smithers MISTRAS Group. These companies have been focusing on strategic partnerships, collaborations, and acquisitions to enhance their product offerings and expand their market presence.

Market Segmentation

Segmentation 1: by Application

- Automotive

- Design Validation and Prototyping

- Performance Testing

- Lifecycle Assessment

- Environmental and Compliance Assessment

- Material Testing

- Others

- Rail Transportation

- Rolling Stock Maintenance Inspection and Testing

- Power Supply Testing and Certification Services

- Safety Inspection and Testing

- Others

- Marine Transportation

- Welding Inspection and Testing

- Non-Destructive Testing

- Fire Resistance Testing

- Others

- Air Transportation

- Structural Testing

- Material and Chemicals Testing

- Others

Automotive Application to Lead the Market (by Application)

In the transportation testing, inspection, and certification services market, the automotive sector is led by application and driven by the industry's stringent safety and quality standards. Automotive manufacturers increasingly rely on transportation testing, inspection, and certification services to ensure vehicles meet regulatory requirements across safety, emissions, and performance criteria. The shift toward electric and autonomous vehicles has intensified this demand, as these vehicles require specialized testing for battery safety, software integrity, and sensor reliability. Furthermore, the rising focus on sustainability and environmental compliance has amplified the need for emissions testing and certification as automotive companies strive to align with global carbon reduction targets.

Furthermore, the growth in the automotive sector has also been driven by emerging regulations mandating advanced safety features and eco-friendly technologies in vehicles, particularly in regions such as Europe and North America. As vehicle technologies evolve, including advancements in connectivity and automation, the role of transportation testing, inspection, and certification services becomes even more critical, supporting manufacturers in navigating complex compliance landscapes and enhancing product reliability. With the global automotive sector continuing its transformation toward smarter and greener mobility solutions, the demand for transportation testing, inspection, and certification services within this application segment is expected to remain strong, driving market expansion in the coming years.

Segmentation 2: by Service Type

- Lab Testing

- Inspection

- Homologation and Certification

Lab Testing to Lead the Market (by Service Type)

In the transportation testing, inspection, and certification services market, lab testing is led by service type and is driven by its essential role in ensuring the quality, safety, and compliance of transportation products. Lab testing is highly valued for its precision and ability to simulate extreme conditions, providing critical insights into material performance, durability, and safety standards. This service type is especially important in the automotive and aerospace sectors, where rigorous testing is required to meet regulatory and safety requirements before products reach the market.

Moreover, as manufacturers across the transportation industry have been increasingly prioritizing product reliability and regulatory compliance, the reliance on lab testing as a foundational service type in the market is expected to strengthen. The growing complexity of modern transportation technologies further strengthens its leadership, ensuring quality assurance in evolving transportation ecosystems.

Segmentation 3: by Stage

- Pre-Production

- Maintenance and Lifecycle

Pre-Production Stage to Lead the Market (by Stage)

In the transportation testing, inspection, and certification services market, the pre-production stage has emerged as the leading phase, driven by the growing emphasis on early-stage quality assurance, risk mitigation, and regulatory compliance. Pre-production testing is highly valued as it allows manufacturers to identify potential flaws, ensure regulatory alignment, and optimize product designs before mass production begins. This stage is particularly critical in the automotive, aerospace, and rail industries, where stringent safety standards and complex engineering requirements necessitate thorough, upfront evaluation.

Moreover, the importance of pre-production testing is amplified by the increasing complexity of modern transportation systems, which rely on advanced materials, electronics, and software. By addressing compliance and performance issues early, companies can reduce costly recalls and improve product reliability, enhancing their market competitiveness. As regulatory bodies and industry standards continue to push for higher safety and environmental standards, the demand for comprehensive pre-production transportation testing, inspection, and certification services is expected to grow, solidifying this stage's leadership within the market and driving continued expansion.

Segmentation 4: by Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Passenger Vehicles to Lead the Market (by Vehicle Type)

In the transportation testing, inspection, and certification services market, passenger vehicles are led by vehicle type and driven by the high demand for safety, quality, and regulatory compliance across global markets. Passenger vehicles require extensive testing due to the production volume and the diverse regulatory standards they must meet in different regions. This segment is especially prominent in the transportation testing, inspection, and certification services market as consumer expectations for vehicle safety and performance continue to rise, with manufacturers increasingly focusing on advanced features such as autonomous driving, enhanced connectivity, and electric propulsion systems.

Furthermore, the ongoing innovation in passenger vehicle technologies, combined with an emphasis on reducing environmental impact, strengthens the need for comprehensive services. This reliance strengthens passenger vehicles' leadership within the market, making transportation testing, inspection, and certification services a critical component in the lifecycle of vehicle development, from design through to production and market introduction.

Segmentation 5: by Propulsion Type

- Internal Combustion Engine Vehicles

- Electric Vehicles

Internal Combustion Engine Vehicles to Lead the Market (by Propulsion Type)

Internal combustion engine (ICE) vehicles, led by propulsion type, are driven by their widespread presence and established regulatory requirements. Despite the global shift toward electric mobility, ICE vehicles still dominate the automotive landscape, particularly in regions with developing infrastructure for alternative energy sources. The transportation testing, inspection, and certification services market for ICE vehicles has been driven by rigorous emissions testing, safety evaluations, and compliance with evolving environmental standards to reduce carbon footprints and pollutant levels.

Furthermore, as governments worldwide implement stricter emissions regulations, transportation testing, inspection, and certification services for ICE vehicles have been increasingly essential to ensure manufacturers meet compliance and avoid costly penalties. This continued focus on reducing emissions and improving fuel efficiency has solidified ICE vehicles' dominant role within the market, as they require ongoing testing and inspection to adapt to regulatory changes.

Segmentation 6: by Region

- North America: U.S. and Rest-of-North America

- Europe: Germany, France, Netherlands, Denmark, Sweden, U.K., Poland, Spain, Italy, and Rest-of-Europe

- Asia-Pacific: China, Japan, South Korea, Australia and Rest-of-Asia-Pacific

- Rest-of-the-World: U.A.E., Brazil and Others

Europe is set to lead the transportation testing, inspection, and certification services market, driven by strict regulatory frameworks, advanced infrastructure, and a strong emphasis on safety and sustainability in the transportation sector. Countries such as Germany, France, and the Netherlands have been driving growth in the market with increasing demand for transportation testing, inspection, and certification services across automotive, rail, and aerospace industries. Europe's automotive industry, particularly in electric and autonomous vehicles, has significantly increased the need for these services to ensure compliance with stringent safety and environmental standards. In aerospace, the growing focus on sustainable aviation and the implementation of next-generation technologies have been expanding the scope of testing and certification requirements. Overall, Europe's strong regulatory approach and technology help the region to stay at the forefront of the market, driving innovation in transportation safety, sustainability, and compliance standards. This position is likely to strengthen as Europe's industries continue to adapt to evolving transportation technologies and stringent environmental regulations, ensuring sustainable growth for the transportation testing, inspection, and certification services market.

Recent Developments in the Transportation Testing, Inspection, and Certification Services Market

- In August 2024, TUV Rheinland opened its largest laboratory in China, following a significant investment of over $30.2 million. This facility focuses on testing services across critical sectors such as electronics, photovoltaics, e-mobility, and autonomous driving. Equipped with specialized laboratories, including automotive LiDAR, packaging, and intelligent driving sensing, the hub provides streamlined testing solutions for local industries.

- In August 2023, DEKRA, one of the global leaders in testing, inspection, and certification, partnered with AIShield, a Bosch startup specializing in AI application security, to enhance the security of AI models and systems. This collaboration focuses on developing advanced training, assessment, and protection measures to secure AI systems across industries such as automotive. The partnership addresses the requirements of standards such as the EU AI Act, NIST AI RMF, and MITRE ATLAS, aiming to strengthen AI cyber-resilience and ensure regulatory compliance.

- In July 2023, TUV SUD America Inc. inaugurated its advanced environmental laboratory in the U.S., strengthening its role in electric vehicle (EV) safety and performance testing. This state-of-the-art facility, a $47.5 million investment, is the company's largest laboratory site globally and is equipped for comprehensive EV battery testing, including high-voltage systems, electro-dynamic vibration, and abuse testing. The facility, which supports the country's growing EV ecosystem, is designed with sustainable features, such as the use of clean energy, LED lighting, and locally sourced materials, showcasing TUV SUD's commitment to sustainability.

- In July 2022, DEKRA announced a strategic collaboration with Microsoft to develop digital inspection solutions using the Microsoft Azure Cloud, primarily aimed at enhancing safety in the transport and workplace sectors. This partnership marks a significant advancement for the testing, inspection, and certification industry, allowing DEKRA to incorporate digital tools such as IoT, AI, analytics, and digital twins into its inspection services, thereby improving efficiency and data integrity in safety assessments.

Demand - Drivers, Limitations, and Opportunities

Market Drivers: Rising Demand for Safety and Quality Compliance

The transportation testing, inspection, and certification services market has been witnessing a surge in demand due to increased global emphasis on safety and quality compliance. As transportation technologies evolve with the rise of electric, autonomous, and connected vehicles, there has been a growing need to ensure that these systems meet stringent safety and quality standards. Regulatory bodies implement comprehensive frameworks to address the risks associated with new technologies, driving companies to seek transportation testing, inspection, and certification services to demonstrate compliance and avoid penalties.

Additionally, major companies in the transportation testing, inspection, and certification services market have been emphasizing the increasing importance and benefits of rigorous compliance and quality assurance to meet evolving safety and regulatory standards. For instance, in August 2024, TUV Rheinland opened its largest laboratory in China, following a significant investment of over $30.2 million. This facility focuses on testing services across critical sectors such as electronics, photovoltaics, e-mobility, and autonomous driving. Equipped with specialized laboratories, including automotive LiDAR, packaging, and intelligent driving sensing, the hub provides streamlined testing solutions for local industries. Highlighting TUV Rheinland's commitment to supporting China's technological advancement, this expansion aims to enhance safety, quality, and compliance for various industries.

Market Challenges: Complexity of Compliance with Diverse Global Standards

The complexity of compliance with diverse global standards presents a formidable challenge in the transportation testing, inspection, and certification services market. As countries implement distinct regulations and compliance requirements for transportation safety, emissions, and environmental sustainability, TIC providers face mounting pressure to keep pace with evolving standards. This challenge is heightened by variations in regional safety and environmental norms, particularly as the industry moves toward greater automation and electric transportation solutions. The need to understand, interpret, and apply numerous regulations to various vehicles and equipment strains resources and calls for constant adaptation, making it difficult for TIC providers to maintain efficient and standardized processes across global markets.

In response to the challenge, companies in the sector have been developing solutions to enhance their ability to comply with multiple regulatory frameworks. For instance, TUV SUD expanded its digital compliance capabilities by introducing the universal customer interface (UCI), a centralized platform that empowers clients to manage workflows, track project progress, and submit regulatory application forms online. This platform simplifies the management of complex regulatory data and automates the tracking of changes in legislation, assisting clients in achieving compliance across diverse markets.

Market Opportunities: Expansion of Cybersecurity Testing Services

Cybersecurity testing services present a pivotal opportunity in the transportation testing, inspection, and certification (TIC) services market as connected and automated systems become integral to transportation. Autonomous vehicles, smart rail systems, and digital aviation technologies rely heavily on secure communication and control systems to prevent unauthorized access and ensure data integrity. To meet these security needs and align with regulatory standards, TIC providers have increasingly developed specialized cybersecurity solutions that address risks specific to connected transportation technologies. This expansion positions cybersecurity as a crucial element in the evolution of safe and reliable transportation.

In a strategic move to enhance its cybersecurity capabilities, Bureau Veritas acquired Security Innovation Inc., a U.S.-based firm specializing in software security, in July 2024. This acquisition aligns with Bureau Veritas's LEAP 28 strategy to grow in the cybersecurity sector and strengthen its presence in North America. Security Innovation Inc. provides software security consulting, secure software development lifecycle (SDLC) advisory, and training. This adds significant expertise in cybersecurity testing and AI capabilities to Bureau Veritas's global offerings. Additionally, this acquisition is expected to benefit both Bureau Veritas's customers and Security Innovation's clients, expanding services in software security across private and public sectors and reinforcing Bureau Veritas's role in cybersecurity innovation within the testing, inspection, and certification services market. The transaction is anticipated to establish a new cybersecurity hub in the U.S. with potential global scalability.

How can this Report add value to an Organization?

Product/Innovation Strategy: The product segment helps the reader understand the different applications of transportation testing, inspection, and certification services on application (automotive, rail transportation, marine transportation, and air transportation), service type (lab testing, inspection, homologation, and certification) by stage (pre-production and maintenance and lifecycle) by vehicle type (passenger vehicles and commercial vehicles), by propulsion (internal combustion engine vehicles and electric vehicles). The market is poised for significant expansion with ongoing technological advancements, increased investments, and growing awareness of the importance of regulatory compliance. Therefore, the transportation testing, inspection, and certification services business is a high-investment and high-revenue generating model.

Growth/Marketing Strategy: The transportation testing, inspection, and certification services market has been growing rapidly. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include product development.

Competitive Strategy: The key players in the transportation testing, inspection, and certification services market analyzed and profiled in the study include professionals with expertise in the automobile and automotive domains. Additionally, a comprehensive competitive landscape such as partnerships, agreements, and collaborations are expected to aid the reader in understanding the untapped revenue pockets in the market.

Research Methodology

Factors for Data Prediction and Modelling

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate has been taken from the historical exchange rate of the Oanda website.

- Nearly all the recent developments from January 2021 to November 2024 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major technological breakthroughs.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the transportation testing, inspection, and certification services market.

The market engineering process involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the transportation testing, inspection, and certification services market and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study of the transportation testing, inspection, and certification services market involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the aforementioned data sources, the study has been undertaken with the help of other data sources and websites, such as EPA.

Secondary research was done in order to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies profiled in the transportation testing, inspection, and certification services market have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- Intertek Group plc

- CATARC Europe Testing and Certification GmbH

- CSI S.p.A.

- Belcan

- DEKRA

- Bureau Veritas

- Applus+

- Element Materials Technology

- HORIBA MIRA

- UL LLC

- Eurofins Scientific

- Kiwa

- SGS Societe Generale de Surveillance SA.

- TUV SUD

- UTAC

- FEV Group GmbH

- AVL

- Reinova S.p.A.

- Smithers

- MISTRAS Group

Companies that are not a part of the pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Internet of Things (IoT) for Real-Time Testing and Monitoring

- 1.1.2 Use of Blockchain for Data Integrity in Certification

- 1.1.3 Cloud-Based Testing Platforms

- 1.1.4 Cybersecurity and Data Privacy in Testing, Inspection, and Certification Services

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Development Process

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country, by Company)

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.6 Certification Standards Overview

- 1.6.1 ISO 9001: Quality Management Systems

- 1.6.2 ISO 14001: Environmental Management Systems

- 1.6.3 IATF 16949: Automotive Quality Management

- 1.6.4 AS9100: Aerospace Quality Management

- 1.6.5 International Maritime Organization (IMO) Standards

- 1.6.6 European Union Regulatory Certifications

- 1.6.7 FAA and EASA Certifications for Aviation

- 1.6.8 UL and CE Certifications

- 1.7 Business/Operating Model Analysis

- 1.7.1 Subscription-Based Testing, Inspection, and Certification Services

- 1.7.2 Pay-Per-Use and On-Demand Testing, Inspection, and Certification Services Models

- 1.7.3 Cloud-Based Platforms for Real-Time Testing and Inspection

- 1.7.4 Customized and Niche Testing, Inspection, and Certification Services for Specialized Sectors (Such as Autonomous Vehicles)

- 1.7.5 End-to-End Testing, Inspection, and Certification Services Solutions for Integrated Transportation Systems

- 1.8 Market Dynamics Overview

- 1.8.1 Market Drivers

- 1.8.1.1 Rising Demand for Safety and Quality Compliance

- 1.8.1.2 Growth of Electric and Autonomous Vehicle Technologies

- 1.8.1.3 Advancements in Emission Standards and Environmental Regulations

- 1.8.2 Market Restraints

- 1.8.2.1 Complexity of Compliance with Diverse Global Standards

- 1.8.2.2 High Costs of Advanced Testing Equipment and Technology

- 1.8.3 Market Opportunities

- 1.8.3.1 Expansion of Cybersecurity Testing Services

- 1.8.3.2 Adoption of Digital Twin and Simulation Technologies

- 1.8.1 Market Drivers

2 Application

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Transportation Testing, Inspection, and Certification Services Market (by Application)

- 2.3.1 Automotive

- 2.3.1.1 Design Validation and Prototyping

- 2.3.1.2 Performance Testing

- 2.3.1.3 Lifecycle Assessment

- 2.3.1.4 Environmental and Compliance Assessment

- 2.3.1.5 Material Testing

- 2.3.1.6 Others

- 2.3.2 Rail Transportation

- 2.3.2.1 Rolling Stock Maintenance Inspection and Testing

- 2.3.2.2 Power Supply Testing and Certification Services

- 2.3.2.3 Safety Inspection and Testing

- 2.3.2.4 Others

- 2.3.3 Marine Transportation

- 2.3.3.1 Welding Inspection and Testing

- 2.3.3.2 Non-Destructive Testing

- 2.3.3.3 Fire Resistance Testing

- 2.3.3.4 Others

- 2.3.4 Air Transportation

- 2.3.4.1 Structural Testing

- 2.3.4.1.1 Non-Destructive Testing

- 2.3.4.1.2 Accelerated Stress Testing (AST)

- 2.3.4.1.3 Mechanical Testing

- 2.3.4.1.4 Others

- 2.3.4.2 Material and Chemicals Testing

- 2.3.4.3 Others

- 2.3.4.1 Structural Testing

- 2.3.1 Automotive

3 Products

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Transportation Testing, Inspection, and Certification Services Market (by Service Type)

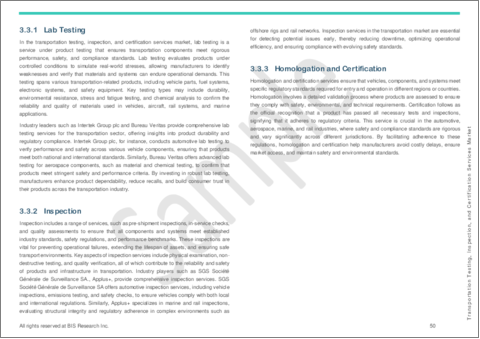

- 3.3.1 Lab Testing

- 3.3.2 Inspection

- 3.3.3 Homologation and Certification

- 3.4 Transportation Testing, Inspection, and Certification Services Market (by Stage)

- 3.4.1 Pre-Production

- 3.4.2 Maintenance and Lifecycle

- 3.5 Transportation, Inspection, and Certification Services Market (by Vehicle Type)

- 3.5.1 Passenger Vehicles

- 3.5.2 Commercial Vehicles

- 3.6 Transportation, Inspection, and Certification Services Market (by Propulsion Type)

- 3.6.1 Internal Combustion Engine (ICE) Vehicles

- 3.6.2 Electric Vehicles

4 Regions

- 4.1 Regional Summary

- 4.2 Transportation Testing, Inspection, and Certification Services Market (by Region)

- 4.3 North America

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Key Market Participants

- 4.3.5 Application

- 4.3.6 Product

- 4.3.7 North America (by Country)

- 4.3.7.1 U.S.

- 4.3.7.1.1 Application

- 4.3.7.1.2 Product

- 4.3.7.1.3 Focus on EPA 1065 Engine Testing in the U.S.

- 4.3.7.1.3.1 Current Regulatory Requirements for EPA 1065 Testing

- 4.3.7.1.3.2 Key Trends in EPA 1065

- 4.3.7.1.3.3 Potential Regulatory Changes due to Political and Policy Shifts

- 4.3.7.1.3.3.1 Impact of Upcoming 2024 U.S. Presidential Election on EPA 1065

- 4.3.7.1.3.3.2 Influence of Climate Change Policies on Future Regulation

- 4.3.7.1.3.4 EPA 1065 Engine Testing Market Size and Compound Annual Growth Rate (CAGR) Analysis, 2023 - 2028

- 4.3.7.1.3.5 Key Competitor Analysis

- 4.3.7.1.3.5.1 Overview of Key Players

- 4.3.7.1.3.5.2 Market Share Estimates of Key Players

- 4.3.7.1.3.6 End-User Analysis: Effects on Primary End Customers by EPA 1065 Regulations

- 4.3.7.1.3.6.1 Light Passenger Vehicles

- 4.3.7.1.3.6.2 Heavy Trucks

- 4.3.7.1.3.6.3 Agricultural Machinery

- 4.3.7.1.3.6.4 Military Land Systems

- 4.3.7.1.3.7 Analysis of Anticipated or Proposed Changes to EPA 1065 Specifications

- 4.3.7.1.3.7.1 Technological Advancements in Testing Methods

- 4.3.7.1.3.8 Major Committees/Organizations Influencing Decisions in the EPA 1065 and Emissions Testing Regulations

- 4.3.7.1.3.8.1 Key Stakeholders in the Emissions Testing Regulatory Landscape

- 4.3.7.1.3.8.2 List of Leading Committees, Organizations, Industry Associations, and Lobbying Groups Shaping and Influencing EPA 1065 Regulations

- 4.3.7.2 Rest-of-North America

- 4.3.7.2.1 Application

- 4.3.7.2.2 Product

- 4.3.7.1 U.S.

- 4.4 Europe

- 4.4.1 Regional Overview

- 4.4.2 Business Drivers

- 4.4.3 Business Challenges

- 4.4.4 Key Market Participants

- 4.4.5 Application

- 4.4.6 Product

- 4.4.7 Europe (by Country)

- 4.4.7.1 Germany

- 4.4.7.1.1 Application

- 4.4.7.1.2 Product

- 4.4.7.2 France

- 4.4.7.2.1 Application

- 4.4.7.2.2 Product

- 4.4.7.3 Netherlands

- 4.4.7.3.1 Application

- 4.4.7.3.2 Product

- 4.4.7.4 Denmark

- 4.4.7.4.1 Application

- 4.4.7.4.2 Product

- 4.4.7.5 Sweden

- 4.4.7.5.1 Application

- 4.4.7.5.2 Product

- 4.4.7.6 U.K.

- 4.4.7.6.1 Application

- 4.4.7.6.2 Product

- 4.4.7.7 Italy

- 4.4.7.7.1 Application

- 4.4.7.7.2 Product

- 4.4.7.8 Poland

- 4.4.7.8.1 Application

- 4.4.7.8.2 Product

- 4.4.7.9 Spain

- 4.4.7.9.1 Application

- 4.4.7.9.2 Product

- 4.4.7.10 Rest-of-Europe

- 4.4.7.10.1 Application

- 4.4.7.10.2 Product

- 4.4.7.1 Germany

- 4.5 Asia-Pacific

- 4.5.1 Regional Overview

- 4.5.2 Business Drivers

- 4.5.3 Business Challenges

- 4.5.4 Key Market Participants

- 4.5.5 Application

- 4.5.6 Product

- 4.5.7 Asia-Pacific (by Country)

- 4.5.7.1 China

- 4.5.7.1.1 Application

- 4.5.7.1.2 Product

- 4.5.7.2 Japan

- 4.5.7.2.1 Application

- 4.5.7.2.2 Product

- 4.5.7.3 South Korea

- 4.5.7.3.1 Application

- 4.5.7.3.2 Product

- 4.5.7.4 Australia

- 4.5.7.4.1 Application

- 4.5.7.4.2 Product

- 4.5.7.5 Rest-of-Asia-Pacific

- 4.5.7.5.1 Application

- 4.5.7.5.2 Product

- 4.5.7.1 China

- 4.6 Rest-of-the-World

- 4.6.1 Regional Overview

- 4.6.2 Business Drivers

- 4.6.3 Business Challenges

- 4.6.4 Key Market Participants

- 4.6.5 Application

- 4.6.6 Product

- 4.6.7 Rest-of-the-World (by Country)

- 4.6.7.1 U.A.E.

- 4.6.7.1.1 Application

- 4.6.7.1.2 Product

- 4.6.7.2 Brazil

- 4.6.7.2.1 Application

- 4.6.7.2.2 Product

- 4.6.7.3 Others

- 4.6.7.3.1 Application

- 4.6.7.3.2 Product

- 4.6.7.1 U.A.E.

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 Intertek Group plc

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers/End Users

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share, 2023

- 5.2.2 CATARC Europe Testing and Certification GmbH

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers/End Users

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share, 2023

- 5.2.3 CSI S.p.A.

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers/End Users

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share, 2023

- 5.2.4 Belcan

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers/End Users

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share, 2023

- 5.2.5 DEKRA

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers/End Users

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share, 2023

- 5.2.6 Bureau Veritas

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers/End Users

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share, 2023

- 5.2.7 Applus+

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers/End Users

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share, 2023

- 5.2.8 Element Materials Technology

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers/End Users

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share, 2023

- 5.2.9 HORIBA MIRA

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers/End Users

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share, 2023

- 5.2.10 UL LLC

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers/End Users

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share, 2023

- 5.2.11 Eurofins Scientific

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers/End Users

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share, 2023

- 5.2.12 Kiwa

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers/End Users

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share, 2023

- 5.2.13 SGS Societe Generale de Surveillance SA.

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers/End Users

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share, 2023

- 5.2.14 TUV SUD

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers/End Users

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share, 2023

- 5.2.15 UTAC

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers/End Users

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share, 2023

- 5.2.16 FEV Group GmbH

- 5.2.16.1 Overview

- 5.2.16.2 Top Products/Product Portfolio

- 5.2.16.3 Top Competitors

- 5.2.16.4 Target Customers/End Users

- 5.2.16.5 Key Personnel

- 5.2.16.6 Analyst View

- 5.2.16.7 Market Share, 2023

- 5.2.17 AVL

- 5.2.17.1 Overview

- 5.2.17.2 Top Products/Product Portfolio

- 5.2.17.3 Top Competitors

- 5.2.17.4 Target Customers/End Users

- 5.2.17.5 Key Personnel

- 5.2.17.6 Analyst View

- 5.2.17.7 Market Share, 2023

- 5.2.18 Reinova S.p.a.

- 5.2.18.1 Overview

- 5.2.18.2 Top Products/Product Portfolio

- 5.2.18.3 Top Competitors

- 5.2.18.4 Target Customers/End Users

- 5.2.18.5 Key Personnel

- 5.2.18.6 Analyst View

- 5.2.18.7 Market Share, 2023

- 5.2.19 Smithers

- 5.2.19.1 Overview

- 5.2.19.2 Top Products/Product Portfolio

- 5.2.19.3 Top Competitors

- 5.2.19.4 Target Customers/End Users

- 5.2.19.5 Key Personnel

- 5.2.19.6 Analyst View

- 5.2.19.7 Market Share, 2023

- 5.2.20 MISTRAS Group

- 5.2.20.1 Overview

- 5.2.20.2 Top Products/Product Portfolio

- 5.2.20.3 Top Competitors

- 5.2.20.4 Target Customers/End Users

- 5.2.20.5 Key Personnel

- 5.2.20.6 Analyst View

- 5.2.20.7 Market Share, 2023

- 5.2.1 Intertek Group plc

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast