|

|

市場調査レポート

商品コード

1689629

アジア太平洋の輸送試験・検査・認証サービス市場:用途別、製品別、国別 - 分析と予測(2024年~2033年)Asia-Pacific Transportation Testing, Inspection, and Certification Services Market: Focus on Applications, Products, and Country - Analysis and Forecast, 2024-2033 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の輸送試験・検査・認証サービス市場:用途別、製品別、国別 - 分析と予測(2024年~2033年) |

|

出版日: 2025年03月28日

発行: BIS Research

ページ情報: 英文 81 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の輸送試験・検査・認証サービスの市場規模は、2024年に74億5,000万米ドルとなりました。

同市場は10.32%のCAGRで拡大し、2033年には180億4,000万米ドルに達すると予測されています。アジア太平洋における試験・検査・認証(TIC)サービスのニーズは、さまざまな運輸産業で安全性、規制遵守、品質保証への注目が高まっていることが背景にあります。これらのサービスは、部品、インフラ、自動車が厳格な安全・性能要件を満たすことを保証し、信頼性の高い効果的な運行を可能にするために必要です。専門的な試験・認証ソリューションに対する需要は、電気自動車や無人運転車などの最先端技術の採用が進むにつれて、さらに加速しています。また、自動検査機器や検査技術の開発により、精度と業務効率も向上しています。このため、アジア太平洋の鉄道、航空、海運、自動車分野のTICサービス市場は堅調に成長しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2033年 |

| 2024年の評価 | 74億5,000万米ドル |

| 2033年の予測 | 180億4,000万米ドル |

| CAGR | 10.32% |

アジアにおける輸送試験・検査・認証(TIC)サービス市場は、同地域の輸送インフラの成長、迅速な技術改善、安全基準の厳格化により、著しく拡大しています。自動車、部品、インフラが厳しい安全、品質、環境要件を満たすことを保証するために、TICサービスは不可欠です。性能、安全性、規制遵守を保証するため、電気自動車(EV)や自律走行技術の普及に伴い、専門的な試験・認証サービスへのニーズが高まっています。

アジア太平洋では、特に自動車の安全性と排ガス管理に関して、政府の法律が厳しくなっています。こうした法律の結果、自動車、鉄道、海運、航空業界では、包括的な試験・検査手続きがますます必要になっています。さらに、この地域の急速な工業化と都市化によって、信頼性が高く効率的な輸送システムへの需要が高まり、TICサービスの成長にさらに拍車がかかっています。

自動検査技術、AIを活用した分析、遠隔監視システムの開発により、検査手順はより正確かつ効率的になりつつあります。さらに、国際的な自動車輸出の拡大や国境を越えた貿易の増加により、世界基準の遵守が必要となり、TICサービスへの依存度が高まっています。

アジア太平洋がインテリジェントで持続可能な交通インフラへの投資を増やし、同地域全体でより安全でクリーンかつ効果的なモビリティを促進するにつれて、輸送TICサービス市場は徐々に拡大すると予想されます。

当レポートでは、アジア太平洋の輸送試験・検査・認証サービス市場について調査し、市場の概要とともに、用途別、製品別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- ステークホルダー分析

- ビジネス/運用モデル分析

- 市場力学の概要

第2章 地域

- 地域サマリー

- 輸送試験、検査、認証サービス市場(地域別)

- アジア太平洋

- 地域の概要

- 促進要因

- 課題

- 主要な市場参入企業

- 用途

- 製品

- アジア太平洋(国別)

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- UTAC

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market, $Million, 2023, 2027, and 2033

- Figure 2: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023, 2027, and 2033

- Figure 3: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023, 2027, and 2033

- Figure 4: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023, 2027, and 2033

- Figure 5: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023, 2027, and 2033

- Figure 6: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023, 2027, and 2033

- Figure 7: Key Events

- Figure 8: Expenditure on Blockchain Solutions, $Million, 2017-2020

- Figure 9: Supply Chain Analysis of Transportation Testing, Inspection, and Certification Services Market

- Figure 10: Development Process in the Transportation Testing, Inspection, and Certification Services Market

- Figure 11: Impact Analysis of Market Navigating Factors, 2023-2033

- Figure 12: Estimated Percent of Registered Vehicles (by ADAS Feature)

- Figure 13: Region-Wise Electric Car Sales, $Million, 2019-2023

- Figure 14: Region-wise Per-Capita CO2 Emissions, in tonnes per person, 2019-2022

- Figure 15: China Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 16: Japan Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 17: South Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 18: Australia Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 19: Rest-of-Asia-Pacific Transportation Testing, Inspection, and Certification Services Market, $Million, 2023-2033

- Figure 20: Strategic Initiatives, January 2021-October 2024

- Figure 21: Share of Strategic Initiatives, January 2021-October 2024

- Figure 22: Data Triangulation

- Figure 23: Top-Down and Bottom-Up Approach

- Figure 24: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Competitive Landscape Snapshot

- Table 4: Trends Overview

- Table 5: Key Companies Providing Cybersecurity Testing, Inspection, and Certification Services

- Table 6: Key Functions and Services in the Transportation Testing, Inspection, and Certification (TIC) Value Chain

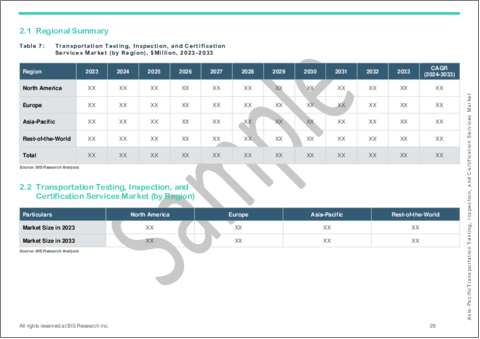

- Table 7: Transportation Testing, Inspection, and Certification Services Market (by Region), $Million, 2023-2033

- Table 8: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 9: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 10: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 11: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 12: Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 13: China Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 14: China Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 15: China Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 16: China Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 17: China Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 18: Japan Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 19: Japan Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 20: Japan Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 21: Japan Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 22: Japan Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 23: South Korea Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 24: South Korea Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 25: South Korea Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 26: South Korea Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 27: South Korea Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 28: Australia Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 29: Australia Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 30: Australia Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 31: Australia Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 32: Australia Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 33: Rest-of-Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Application), $Million, 2023-2033

- Table 34: Rest-of-Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Service Type), $Million, 2023-2033

- Table 35: Rest-of-Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Stage), $Million, 2023-2033

- Table 36: Rest-of-Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Vehicle Type), $Million, 2023-2033

- Table 37: Rest-of-Asia-Pacific Transportation Testing, Inspection, and Certification Services Market (by Propulsion Type), $Million, 2023-2033

- Table 38: Market Share

Introduction to Asia-Pacific Transportation Testing, Inspection, and Certification Services Market

The Asia-Pacific transportation testing, inspection, and certification services market was valued at $7.45 billion in 2024 and is expected to grow at a CAGR of 10.32% and reach $18.04 billion by 2033. The need for testing, inspection, and certification (TIC) services in the Asia-Pacific area is being driven by the increased focus on safety, regulatory compliance, and quality assurance across a variety of transportation industries. These services are necessary to guarantee that components, infrastructure, and automobiles fulfil strict safety and performance requirements, enabling dependable and effective operations. The demand for specialised testing and certification solutions is being further accelerated by the growing adoption of cutting-edge technology, such as electric and driverless cars. Accuracy and operational efficiency are also being improved by developments in automated inspection instruments and testing techniques. This is helping the TIC services market in APAC's rail, aviation, maritime, and automotive sectors to grow steadily.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2033 |

| 2024 Evaluation | $7.45 Billion |

| 2033 Forecast | $18.04 Billion |

| CAGR | 10.32% |

The market for transportation testing, inspection, and certification (TIC) services in Asia is rising significantly due to the region's growing transportation infrastructure, swift technology improvements, and stricter safety standards. In order to guarantee that automobiles, parts, and infrastructure satisfy strict safety, quality, and environmental requirements, TIC services are essential. To ensure performance, safety, and regulatory compliance, there is an increasing need for specialised testing and certification services as electric vehicles (EVs) and autonomous driving technologies gain traction.

Government laws in the APAC region are getting stricter, especially when it comes to car safety and emissions management. Comprehensive testing and inspection procedures are becoming increasingly necessary in the automobile, rail, maritime, and aviation industries as a result of these laws. Additionally, the region's rapid industrialization and urbanization have increased the demand for reliable and efficient transportation systems, further fueling the growth of TIC services.

Testing procedures are becoming more accurate and efficient because to developments in automated inspection technology, AI-powered analytics, and remote monitoring systems. Additionally, the expansion of international automobile exports and the increase of cross-border trade necessitate adherence to global standards, increasing the dependence on TIC services.

The market for transport TIC services is anticipated to expand gradually as APAC makes more investments in intelligent and sustainable transport infrastructure, promoting safer, cleaner, and more effective mobility throughout the region.

Market Segmentation

Segmentation 1: by Application

- Automotive

- Design Validation and Prototyping

- Performance Testing

- Lifecycle Assessment

- Environmental and Compliance Assessment

- Material Testing

- Others

- Rail Transportation

- Rolling Stock Maintenance Inspection and Testing

- Power Supply Testing and Certification Services

- Safety Inspection and Testing

- Others

- Marine Transportation

- Welding Inspection and Testing

- Non-Destructive Testing

- Fire Resistance Testing

- Others

- Air Transportation

- Structural Testing

- Material and Chemicals Testing

- Others

Segmentation 2: by Service Type

- Lab Testing

- Inspection

- Homologation and Certification

Segmentation 3: by Stage

- Pre-Production

- Maintenance and Lifecycle

Segmentation 4: by Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Segmentation 5: by Propulsion Type

- Internal Combustion Engine Vehicles

- Electric Vehicles

Segmentation 6: by Region

- Asia-Pacific: China, Japan, South Korea, Australia, and Rest-of-Asia-Pacific

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different applications of transportation testing, inspection, and certification services on application (automotive, rail transportation, marine transportation, and air transportation), service type (lab testing, inspection, homologation, and certification) by stage (pre-production and maintenance and lifecycle) by vehicle type (passenger vehicles and commercial vehicles), by propulsion (internal combustion engine vehicles and electric vehicles). The market is poised for significant expansion with ongoing technological advancements, increased investments, and growing awareness of the importance of regulatory compliance. Therefore, the transportation testing, inspection, and certification services business is a high-investment and high-revenue generating model.

Growth/Marketing Strategy: The APAC transportation testing, inspection, and certification services market has been growing rapidly. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include product development.

Competitive Strategy: The key players in the APAC transportation testing, inspection, and certification services market analyzed and profiled in the study include professionals with expertise in the automobile and automotive domains. Additionally, a comprehensive competitive landscape such as partnerships, agreements, and collaborations are expected to aid the reader in understanding the untapped revenue pockets in the market.

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Internet of Things (IoT) for Real-Time Testing and Monitoring

- 1.1.2 Use of Blockchain for Data Integrity in Certification

- 1.1.3 Cloud-Based Testing Platforms

- 1.1.4 Cybersecurity and Data Privacy in Testing, Inspection, and Certification Services

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Development Process

- 1.3 Stakeholder Analysis

- 1.4 Business/Operating Model Analysis

- 1.4.1 Subscription-Based Testing, Inspection, and Certification Services

- 1.4.2 Pay-Per-Use and On-Demand Testing, Inspection, and Certification Services Models

- 1.4.3 Cloud-Based Platforms for Real-Time Testing and Inspection

- 1.4.4 Customized and Niche Testing, Inspection, and Certification Services for Specialized Sectors (Such as Autonomous Vehicles)

- 1.4.5 End-to-End Testing, Inspection, and Certification Services Solutions for Integrated Transportation Systems

- 1.5 Market Dynamics Overview

- 1.5.1 Market Drivers

- 1.5.1.1 Rising Demand for Safety and Quality Compliance

- 1.5.1.2 Growth of Electric and Autonomous Vehicle Technologies

- 1.5.1.3 Advancements in Emission Standards and Environmental Regulations

- 1.5.2 Market Restraints

- 1.5.2.1 Complexity of Compliance with Diverse Standards

- 1.5.2.2 High Costs of Advanced Testing Equipment and Technology

- 1.5.3 Market Opportunities

- 1.5.3.1 Expansion of Cybersecurity Testing Services

- 1.5.3.2 Adoption of Digital Twin and Simulation Technologies

- 1.5.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Transportation Testing, Inspection, and Certification Services Market (by Region)

- 2.3 Asia-Pacific

- 2.3.1 Regional Overview

- 2.3.2 Business Drivers

- 2.3.3 Business Challenges

- 2.3.4 Key Market Participants

- 2.3.5 Application

- 2.3.6 Product

- 2.3.7 Asia-Pacific (by Country)

- 2.3.7.1 China

- 2.3.7.1.1 Application

- 2.3.7.1.2 Product

- 2.3.7.2 Japan

- 2.3.7.2.1 Application

- 2.3.7.2.2 Product

- 2.3.7.3 South Korea

- 2.3.7.3.1 Application

- 2.3.7.3.2 Product

- 2.3.7.4 Australia

- 2.3.7.4.1 Application

- 2.3.7.4.2 Product

- 2.3.7.5 Rest-of-Asia-Pacific

- 2.3.7.5.1 Application

- 2.3.7.5.2 Product

- 2.3.7.1 China

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 UTAC

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers/End Users

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.1.7 Market Share, 2023

- 3.2.1 UTAC

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast