|

|

市場調査レポート

商品コード

1513712

非食肉原料市場- 世界および地域別分析:最終用途別、由来別、原料タイプ別、地域別 - 分析と予測(2024年~2034年)Non-meat Ingredients Market - A Global and Regional Analysis: Focus on End-use Application, Source, Ingredients Type, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 非食肉原料市場- 世界および地域別分析:最終用途別、由来別、原料タイプ別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年07月17日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

非食肉原料の市場規模は、より健康的で持続可能な食品オプションに対する消費者の嗜好の進化に牽引され、力強い成長を遂げています。

この市場には、植物性タンパク質、澱粉、繊維、天然着色料など、食肉製品の栄養プロファイル、食感、味を向上させるために使用される幅広い原料が含まれます。楽観的シナリオを考慮すると、2024年の市場規模は427億3,000万米ドルと見込まれ、CAGR 4.53%で成長し、2034年には665億3,000万米ドルに達すると予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年評価 | 427億3,000万米ドル |

| 2034年予測 | 665億3,000万米ドル |

| CAGR | 4.53% |

こうした原材料の需要は、消費者が身近で原材料の少ない食品を求めるクリーンラベル製品の動向の高まりによってさらに高まっています。健康意識が高まり、味や食感に妥協することなく肉の消費量を減らす食生活を選ぶ消費者が増えるにつれて、非肉原材料市場は大きく拡大する態勢にあります。この成長を支えているのは、食品加工における技術革新と、植物由来の食生活への志向の高まりであり、食品産業における投資と開発の重要な分野となっています。

香味料分野は、いくつかの要因から非食肉原料市場の成長をリードしています。消費者の感覚体験の向上に対する需要は、特に世界の料理動向が人気を集めるにつれて、多様でエキゾチックな風味の必要性を高めています。また、健康志向の動向に合わせて、香料はメーカーが塩分、脂肪分、糖分を過剰に添加することなく、より美味しい製品を提供することを可能にし、より健康的なライフスタイルの選択をサポートします。

さらに、クリーンラベル運動は天然香味料の使用を促進し、消費者はシンプルでわかりやすい原材料を使用した製品を好むようになっています。さらに、世界化によって消費者の味覚の幅が広がり、多様な嗜好に対応するためにより多様な風味プロファイルが必要とされています。最後に、食品開発における継続的な技術革新は、ユニークな風味の組み合わせの探求を促し、メーカーが製品を差別化し、新たな市場セグメントを展開するのに役立っています。こうした動向は総体的に香料需要を押し上げ、この分野の市場成長を促進する要因となっています。

当レポートでは、世界の非食肉原料市場について調査し、市場の概要とともに、最終用途別、由来別、原料タイプ別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 非食肉原料市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- 非食肉原料市場(最終用途別)

第3章 非食肉原料市場(製品別)

- 製品セグメンテーション

- 製品概要

- 非食肉原料市場(由来別)

- 非食肉原料市場(原料タイプ別)

第4章 非食肉原料市場(地域別)

- 非食肉原料市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- BASF SE

- Kerry Group plc.

- ADM

- Cargill, Incorporated

- Ingredion

- International Flavors & Fragrances Inc.

- DSM

- Mosaic Foods

- Roquette Freres

- Wenda Ingredients

- Fiberstar, Inc.

- SMScor.

- Palsgaard

- Advanced Food Systems

- Nestle

- その他

第6章 調査手法

Introduction to Non-meat Ingredients Market

The non-meat ingredients market is experiencing robust growth driven by evolving consumer preferences towards healthier and more sustainable food options. This market includes a wide range of ingredients such as plant proteins, starches, fibers, and natural colorants that are used to enhance the nutritional profile, texture, and taste of meat products. Considering the optimistic scenario the market is valued at $42.73 Billion in 2024 and is expected to grow at a CAGR of 4.53% to reach $66.53 Billion by 2034.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $42.73 Billion |

| 2034 Forecast | $66.53 Billion |

| CAGR | 4.53% |

The demand for these ingredients is further fueled by the rising trend of clean label products, where consumers seek food items with familiar and fewer ingredients. As health awareness increases and more consumers opt for dietary choices that reduce meat consumption without compromising on taste or texture, the non-meat ingredients market is poised for significant expansion. This growth is supported by technological innovations in food processing and a growing inclination towards plant-based diets, making it a critical area for investment and deveopment in the food industry.

The flavoring agents segment is leading the growth in the non-meat ingredients market due to several factors. Consumer demand for enhanced sensory experiences drives the need for diverse and exotic flavors, particularly as global culinary trends gain popularity. In line with health and wellness trends, flavoring agents also allow manufacturers to offer tastier products without the addition of excess salt, fat, or sugar, supporting healthier lifestyle choices.

Furthermore, the clean label movement promotes the use of natural flavoring agents, as consumers increasingly prefer products with simple, recognizable ingredients. Additionally, globalization has broadened consumer palates, necessitating a wider variety of flavor profiles to meet diverse tastes and preferences. Finally, ongoing innovation in food product development encourages the exploration of unique flavor combinations, helping manufacturers differentiate their offerings and tap into new market segments. These trends collectively boost the demand for flavoring agents, making them a key driver of market growth in this sector.

Based on end-use application, the market has been segmented into fresh meat, processed and cured meat, marinated and seasoned meat, ready-to-eat meat products, and others. Based on source, the market has been segmented into chemical substances, plant origin, and animal origin. Based on ingredients type, the market has been segmented into binders extenders, fillers, flavoring agents, coloring agents, preservatives, salt, texturing agents, and others.

North America leads the non-meat ingredients market, largely due to its high consumption of meat and the well-established meat processing industry. The region has a strong culture of innovation and substantial investment in food technology, which drives the development and adoption of new non-meat ingredients. Coupled with this is the significant consumer shift towards healthier eating habits and demand for clean label products, which emphasizes natural and recognizable ingredients. These trends are strongly supported by the region's robust regulatory framework that encourages transparency and safety in food products.

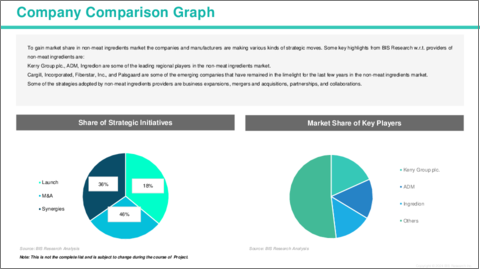

The competitive landscape of the non-meat ingredients market is increasingly dynamic, characterized by the presence of both established players and innovative startups. Key companies are continuously enhancing their product portfolios with a focus on natural, organic, and sustainable ingredients, catering to the growing consumer demand for healthier and environmentally friendly alternatives. Strategic partnerships, acquisitions, and expansions are prevalent strategies to leverage technological advancements and expand market reach. This sector is also witnessing a surge in research and development investments aimed at improving the sensory qualities and nutritional profiles of non-meat products, which is crucial for appealing to a broader consumer base that includes not only vegans and vegetarians but also flexitarians seeking to reduce meat consumption. This competitive intensity reflects the market's substantial growth potential and its importance in the broader shift towards sustainable eating habits.

Market Segmentation:

Segmentation 1: by End-use Application

- Fresh Meat

- Processed and Cured Meat

- Marinated and Seasoned Meat

- Ready-to-eat Meat Products

- Others

Segmentation 2: by Source

- Chemical Substances

- Plant Origin

- Animal Origin

Segmentation 3: by Ingredients Type

- Binders Extenders

- Fillers

- Flavoring Agents

- Coloring Agents

- Preservatives

- Salt

- Texturing Agents

- Others

Segmentation 4: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this report add value to an organization?

Product/Innovation Strategy: The global non-meat ingredients market has been extensively segmented based on various categories, such as end-use application, source, and ingredients type. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: A detailed competitive benchmarking of the players operating in the global non-meat ingredients market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some of the prominent companies in this market are:

- BASF SE

- Kerry Group plc.

- ADM

- Cargill, Incorporated

- Ingredion

- International Flavors & Fragrances Inc.

- Advanced Food Systems

Key Questions Answered in this Report:

- What are the main factors driving the demand for non-meat ingredients market?

- What are the major patents filed by the companies active in the non-meat ingredients market?

- Who are the key players in the non-meat ingredients market, and what are their respective market shares?

- What partnerships or collaborations are prominent among stakeholders in the non-meat ingredients market?

- What are the strategies adopted by the key companies to gain a competitive edge in non-meat ingredients market?

- What is the futuristic outlook for the non-meat ingredients market in terms of growth potential?

- What is the current estimation of the non-meat ingredients market and what growth trajectory is projected from 2024 to 2034?

- Which application, and product segment is expected to lead the market over the forecast period (2024-2034)?

- What could be the impact of growing end-use industries in the non-meat ingredients market?

- Which regions demonstrate the highest adoption rates for non-meat ingredients market, and what factors contribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Non-meat Ingredients Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Non-meat Ingredients Market (by End-use Application)

- 2.3.1 Fresh Meat

- 2.3.2 Processed and Cured Meat

- 2.3.3 Marinated and Seasoned Meat

- 2.3.4 Ready-to-eat Meat Products

- 2.3.5 Others

3. Non-meat Ingredients Market (by Products)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Non-meat Ingredients Market (by Source)

- 3.3.1 Chemical Substances

- 3.3.2 Plant Origin

- 3.3.3 Animal Origin

- 3.4 Non-meat Ingredients Market (Ingredients Type)

- 3.4.1 Binders Extenders

- 3.4.2 Fillers

- 3.4.3 Flavoring Agents

- 3.4.4 Coloring Agents

- 3.4.5 Preservatives

- 3.4.6 Salt

- 3.4.7 Texturing Agents

- 3.4.8 Others

4. Non-meat Ingredients Market (by Region)

- 4.1 Non-meat Ingredients Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Mexico

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Rest-of-Europe

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 South Korea

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 Rest-of-Asia-Pacific

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 South America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 BASF SE

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 Kerry Group plc.

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 ADM

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 Cargill, Incorporated

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 Ingredion

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 International Flavors & Fragrances Inc.

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 DSM

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 Mosaic Foods

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 Roquette Freres

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 Wenda Ingredients

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 Fiberstar, Inc.

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 SMScor.

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 Palsgaard

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 Advanced Food Systems

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 Nestle

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.16 Other Key Players

- 5.2.1 BASF SE