|

|

市場調査レポート

商品コード

1397426

光ファイバーケーブルの世界市場:国・地域別の分析・予測 (2023-2032年)Fiber Optic Cable Market - A Global and Regional Analysis: Focus on Country and Region - Analysis and Forecast, 2023-2032 |

||||||

カスタマイズ可能

|

|||||||

| 光ファイバーケーブルの世界市場:国・地域別の分析・予測 (2023-2032年) |

|

出版日: 2023年12月19日

発行: BIS Research

ページ情報: 英文 98 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

光ファイバーケーブルの市場規模は、2022年の146億1,000万米ドルから、予測期間中は10.70%のCAGRで推移し、2032年には430億2,000万米ドルの規模に成長すると予測されています。

同市場の主な促進要因は、5G技術の普及です。通信事業者による5Gネットワークの世界的展開により、大容量かつ低遅延の要件をサポートできる通信インフラに対する需要が急増しています。

光ファイバーケーブル市場は、技術の進歩、インターネット接続の拡大、5Gネットワークの展開、データセンターの要件などを背景に、高速データ伝送に対する需要の急増に対応するために進化しています。大容量のデータを迅速に伝送できることで知られる光ファイバーケーブルは、セルタワーやデータセンターなどの重要なエレメントのサポートに不可欠であり、シームレスで効率的な5G通信を保証します。

スマートデバイスの普及、IoT用途の拡大、各種産業でのデジタル化の拡大によるインターネット接続の急増も光ファイバーケーブルの需要を拡大させています。比類のない速度と信頼性で知られるこれらのケーブルは、家庭、企業、公共スペースにおける堅牢な通信ネットワークに不可欠です。クラウドコンピューティングとビッグデータアナリティクスで加速するデータセンターの需要の高まりは、高度な光ファイバーソリューションの必要性をさらに高めています。これを受けて、市場では高密度波長分割多重 (DWDM) やコヒーレント光学などの技術革新が見られ、データ伝送容量が向上しています。さらに、業界では持続可能性を重視し、環境に優しい光ファイバーケーブルが開発されています。環境への配慮が重要になる中で、持続可能な光ファイバーソリューションの採用が市場の将来を形成すると予想されています。

当レポートでは、世界の光ファイバーケーブルの市場を調査し、市場の背景・概要、市場成長への各種影響因子の分析、エコシステム・進行中のプログラム、市場規模の推移・予測、地域/主要国別の詳細分析、主要企業の分析などをまとめています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2032年 |

| 2023年評価 | 172億4,000万米ドル |

| 2032年予測 | 430億2,000万米ドル |

| CAGR | 10.7% |

需要:促進要因と制約

需要促進要因

- 持続可能なケーブル製品に対する需要の増加

- インターネット利用とデータトラフィックの増加

- スマートシティ開発への取り組み

- 自動車産業の成長

市場の制約

- ワイヤレスシステムの急成長

- 他のケーブルと比べた光ファイバーケーブルの脆弱性と低い柔軟性

- 光ファイバーケーブルの限られた電力伝送

主要企業:

|

|

その他の関連企業:

|

|

目次

エグゼクティブサマリー

調査範囲

第1章 市場

- 業界の展望

- 動向:現在と未来

- サプライチェーン分析

- エコシステム/進行中のプログラム

- 規制機関

- 政府のプログラム

- 研究機関・大学によるプログラム

- 主要企業の持続可能な取り組み

- 事業力学

- 事業促進要因

- 事業上の課題

- 事業機会

第2章 地域

- 北米

- 市場

- 北米:国レベルの分析

- 欧州

- 市場

- 欧州:国レベルの分析

- アジア太平洋と日本

- 市場

- アジア太平洋と日本:国レベルの分析

- 中東・アフリカ

- 市場

- 中東・アフリカ:国レベルの分析

- その他の地域

- 市場

第3章 市場:企業プロファイル

- 企業プロファイル

- Belden Inc.

- Finolex Cables Ltd

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- LS Cable & System Ltd.

- Sumitomo Electric Industries, Ltd.

- RS Components Ltd

- Amphenol Corporation

- HUBER+SUHNER AG

第4章 調査手法

List of Figures

- Figure 1: Fiber Optic Cable Market Overview, $Billion, 2022-2032

- Figure 2: Fiber Optic Cable Market Overview, Thousand Tons, 2022-2032

- Figure 3: Global Fiber Optic Cable Market (by Region), $Billion, 2022

- Figure 4: Global Fiber Optic Cable Market (by Region), Thousand Tons, 2022

- Figure 5: Fiber Optic Cable Market Coverage (by Region)

- Figure 6: Fiber Optic Cable Market Coverage (by Priority Countries)

- Figure 7: Fiber Optic Cable Supply Chain

- Figure 8: Factors Influencing the Production of Wires and Cables

- Figure 9: Business Dynamics for the Fiber Optic Cable Market

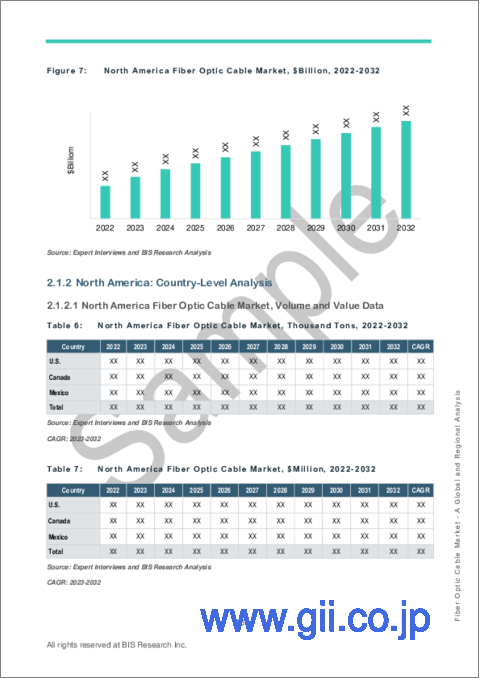

- Figure 10: North America Fiber Optic Cable Market, Thousand Tons, 2022-2032

- Figure 11: North America Fiber Optic Cable Market, $Billion, 2022-2032

- Figure 12: Europe Fiber Optic Cable Market, Thousand Tons, 2022-2032

- Figure 13: Europe Fiber Optic Cable Market, $Billion, 2022-2032

- Figure 14: Asia-Pacific and Japan Fiber Optic Cable Market, Thousand Tons, 2022-2032

- Figure 15: Asia-Pacific and Japan Fiber Optic Cable Market, $Billion, 2022-2032

- Figure 16: Middle East and Africa Fiber Optic Cable Market, Thousand Tons, 2022-2032

- Figure 17: Middle East and Africa Fiber Optic Cable Market, $Billion, 2022-2032

- Figure 18: Rest-of-the-World Fiber Optic Cable Market, Thousand Tons, 2022-2032

- Figure 19: Rest-of-the-World Fiber Optic Cable Market, $Billion, 2022-2032

- Figure 20: Belden Inc.: R&D Expenditure, $Million, 2020-2022

- Figure 21: Fujikura Ltd.: R&D Expenditure, $Million, 2020-2022

- Figure 22: LS Cable & System Ltd.: R&D Expenditure, $Million, 2020-2022

- Figure 23: Sumitomo Electric Industries, Ltd.: R&D Expenditure, $Billion, 2020-2022

- Figure 24: Amphenol Corporation: R&D Expenditure, $Million, 2020-2022

- Figure 25: HUBER+SUHNER AG: R&D Expenditure, $Million, 2020-2022

- Figure 26: Data Triangulation

- Figure 27: Top-Down and Bottom-Up Approach

List of Tables

- Table 1: Developments in the Fiber Optics Industry

- Table 2: Regulatory Bodies

- Table 3: Government Programs

- Table 4: Programs by Research Institutions and Universities

- Table 5: Sustainable Initiatives of Key Players

- Table 6: Developments in the Fiber Optics Industry

- Table 7: North America Fiber Optic Cable Market, Thousand Tons, 2022-2032

- Table 8: North America Fiber Optic Cable Market, $Million, 2022-2032

- Table 9: Europe Fiber Optic Cable Market, Thousand Tons, 2022-2032

- Table 10: Europe Fiber Optic Cable Market, $Million, 2022-2032

- Table 11: Asia-Pacific and Japan Fiber Optic Cable Market, Thousand Tons, 2022-2032

- Table 12: Asia-Pacific and Japan Fiber Optic Cable Market, $Million, 2022-2032

- Table 13: Middle East and Africa Fiber Optic Cable Market, Thousand Tons, 2022-2032

- Table 14: Middle East and Africa Fiber Optic Cable Market, $Million, 2022-2032

“The Global Fiber Optic Cable Market Expected to Reach $43.02 Billion by 2032.”

Fiber Optic Cable Market Overview

The fiber optic cable market was valued at $14.61 billion in 2022, and it is expected to grow at a CAGR of 10.70% and reach $43.02 billion by 2032. A key driver of the fiber optic cable market is the widespread adoption of 5G technology. The global deployment of 5G networks by telecommunications operators has led to a surge in demand for communication infrastructure that can support high-capacity and low-latency requirements.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2032 |

| 2023 Evaluation | $17.24 Billion |

| 2032 Forecast | $43.02 Billion |

| CAGR | 10.7% |

The fiber optic cable market is evolving to meet the surging demand for high-speed data transmission, driven by technological advancements, expanding internet connectivity, 5G network deployment, and data center requirements. Renowned for their capacity to transmit large data volumes swiftly, fiber optic cables are integral in supporting critical elements such as cell towers and data centers, ensuring seamless and efficient 5G communication.

The surge in internet connectivity, driven by the proliferation of smart devices, IoT applications, and digitalization across industries, fuels the demand for fiber optic cable. These cables, known for unmatched speed and reliability, are vital for robust communication networks in homes, businesses, and public spaces. The escalating demand for data centers, fueled by cloud computing and big data analytics, further intensifies the need for advanced fiber optic solutions. In response, the market witnessed innovations such as dense wavelength division multiplexing (DWDM) and coherent optics, enhancing data transmission capacity. Additionally, the industry's emphasis on sustainability leads to eco-friendly fiber optic cables, aligning with the telecommunications sector's eco-conscious shift. As environmental considerations gain importance, the adoption of sustainable fiber optic solutions is expected to shape the market's future.

However, the fiber optic cable market faces certain challenges. The significant initial investment required to deploy fiber optics networks can act as a deterrent to entry into certain regions and organizations. Additionally, the existing legacy infrastructure, primarily reliant on copper cables, presents a hurdle for the widespread adoption of fiber optics. Effectively addressing these challenges necessitates strategic planning, collaborative efforts among stakeholders, and continual investments in network infrastructure.

Furthermore, the fiber optic cable industry is experiencing robust growth driven by the need for high-speed, reliable, and scalable communication networks. The intersection of factors such as the adoption of 5G, increasing demands for internet connectivity, expansion of data centers, and ongoing technological innovations positions fiber optics as a crucial facilitator of the ongoing digital transformation across various industries. As the pursuit of faster and more efficient data transmission intensifies, the fiber optic cable market is poised for sustained expansion, steering the evolution of communication infrastructure.

Impact:

The fiber optic cables market is crucial for high-speed, reliable communication networks, witnessing substantial growth. With the increasing adoption of 5G, rising demands for internet connectivity, emerging 6G ecosystem, and ongoing technological advancements, fiber optics play a pivotal role in driving digital transformation across industries. The market is expected to experience continued growth, reflecting the evolving landscape of communication infrastructure.

Market Segmentation:

Segmentation 1: by Region

- North America

- Europe

- Asia-Pacific and Japan

- Middle East and Africa

- Rest-of-the-World

The Asia-Pacific and Japan region is witnessing robust growth in the fiber optic cable market, which is propelled by several pivotal factors. The increasing demand for high-speed internet connectivity, swift urbanization, and widespread deployment of 5G networks play significant roles. Governments and businesses in these regions are making substantial investments to enhance communication infrastructure, aligning with the evolving requirements of digitalization. Moreover, the growth has been amplified by the region's dedication to technological advancement, creating a favorable environment for the expansion of fiber optic networks.

Recent Developments in the Fiber Optic Cable Market

- In November 2023, China, in collaboration with Tsinghua University, China Mobile, Huawei Technologies, and Cernet Corporation, launched the world's fastest internet connectivity services. This network connected Beijing, Wuhan, and Guangzhou through an extensive optical fiber cabling infrastructure, showcasing the capability to transmit data at a remarkable speed of 1.2 terabits (equivalent to 1,200 gigabits) per second.

- In April 2023, STL Tech announced the development of its thinnest optical fiber, a 180-micron optical fiber. This fiber would allow for the lowest widths in cables while maintaining the highest fiber density to enable high-speed data transmission.

- In January 2023, Prysmian S.p.A. launched an 864-fiber version of the Sirocco HD micro-duct cable. The newly launched cable squeezes 864 fibers into a diameter of 11.0 mm, producing a fiber density of 9.1 fibers per square millimeter. The fiber cable can be installed into a 13-mm duct.

Demand - Drivers and Limitations

Following are the demand drivers for the fiber optic cable market:

- Increase in Demand for Sustainable Cable Products

- Increased Internet Usage and Data Traffic

- Initiatives for Smart City Development

- Growth in Automotive Industry

Following are the limitations of the fiber optic cable market:

- Rapid Growth of Wireless Systems

- Fragility and Low Flexibility of Fiber Optic Cables Compared to Other Cables

- Limited Power Transmission in Fiber Optic Cables

How can this report add value to an organization?

Product/Innovation Strategy: The product strategy helps the readers understand the different aftermarket solutions provided by the industry participants.

Growth/Marketing Strategy: The fiber optic cable market is growing at a significant pace and holds enormous opportunities for market players. Some of the strategies covered in this segment are product launches, partnerships, collaborations, business expansions, and investments. The companies' preferred strategy has been product launches, partnerships, and collaborations to strengthen their positions in the global fiber optic cable market.

Competitive Strategy: The key players in the fiber optic cable ecosystem analyzed and profiled in the study include fiber optic cable manufacturers, raw material suppliers, and wholesalers and distributors. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and regional presence.

Some of the prominent names in this market are:

|

|

Other related companies in the fiber optic cable ecosystem are:

|

|

Companies that are not a part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope of the Study

1. Markets

- 1.1. Industry Outlook

- 1.1.1. Trends: Current and Future

- 1.1.1.1. Increased Demand for High-Speed Internet

- 1.1.1.2. Increase in Fiber-to-the-Home (FTTH) Deployments and Growth of Internet of Things (IoT)

- 1.1.1.3. Growth in Use of Automation and the Rise of Robotics

- 1.1.2. Supply Chain Analysis

- 1.1.2.1. Sourcing Raw Material

- 1.1.2.2. Production

- 1.1.2.3. Transportation

- 1.1.2.4. Product Customization

- 1.1.2.5. End User

- 1.1.1. Trends: Current and Future

- 1.2. Ecosystem/Ongoing Programs

- 1.2.1. Regulatory Bodies

- 1.2.2. Government Programs

- 1.2.3. Programs by Research Institutions and Universities

- 1.2.4. Sustainable Initiatives of Key Players

- 1.3. Business Dynamics

- 1.3.1. Business Drivers

- 1.3.1.1. Increase in Demand for Sustainable Cable Products

- 1.3.1.2. Increased Internet Usage and Data Traffic

- 1.3.1.3. Initiatives for Smart City Development

- 1.3.1.4. Growth in Automotive Industry

- 1.3.2. Business Challenges

- 1.3.2.1. Rapid Growth of Wireless Systems

- 1.3.2.2. Fragility and Low Flexibility of Fiber Optic Cables Compared to Other Cables

- 1.3.2.3. Limited Power Transmission in Fiber Optic Cables

- 1.3.3. Business Opportunities

- 1.3.3.1. Increasing Investments in the 5G/6G Communication Networks

- 1.3.3.2. Expansion of Subsea Fiber Optic Cable Projects

- 1.3.3.3. Growth in Demand for Internet Usage, Data Centers, and Cloud Computing

- 1.3.1. Business Drivers

2. Region

- 2.1. North America

- 2.1.1. Market

- 2.1.1.1. Key Manufacturers/Suppliers in North America

- 2.1.1.2. Business Challenges

- 2.1.1.3. Business Drivers

- 2.1.1.4. North America Fiber Optic Cable Market, Volume and Value Data

- 2.1.2. North America: Country-Level Analysis

- 2.1.2.1. North America Fiber Optic Cable Market, Volume and Value Data

- 2.1.1. Market

- 2.2. Europe

- 2.2.1. Markets

- 2.2.1.1. Key Manufacturers/Suppliers in Europe

- 2.2.1.2. Business Challenges

- 2.2.1.3. Business Drivers

- 2.2.1.4. Europe Fiber Optic Cable Market, Volume and Value Data

- 2.2.2. Europe: Country-Level Analysis

- 2.2.2.1. Europe Fiber Optic Cable Market, Volume and Value Data

- 2.2.1. Markets

- 2.3. Asia-Pacific and Japan

- 2.3.1. Markets

- 2.3.1.1. Key Manufacturers/Suppliers in Asia-Pacific and Japan

- 2.3.1.2. Business Challenges

- 2.3.1.3. Business Drivers

- 2.3.1.4. Asia-Pacific and Japan Fiber Optic Cable Market, Volume and Value Data

- 2.3.2. Asia-Pacific and Japan: Country-Level Analysis

- 2.3.2.1. Asia-Pacific and Japan Fiber Optic Cable Market, Volume and Value Data

- 2.3.1. Markets

- 2.4. Middle East and Africa

- 2.4.1. Markets

- 2.4.1.1. Key Manufacturers/Suppliers in Middle East and Africa

- 2.4.1.2. Business Challenges

- 2.4.1.3. Business Drivers

- 2.4.1.4. Middle East and Africa Fiber Optic Cable Market, Volume and Value Data

- 2.4.2. Middle East and Africa: Country-Level Analysis

- 2.4.2.1. Middle East and Africa Fiber Optic Cable Market, Volume and Value Data

- 2.4.1. Markets

- 2.5. Rest-of-the-World

- 2.5.1. Markets

- 2.5.1.1. Key Manufacturers/Suppliers in Rest-of-the-World

- 2.5.1.2. Business Challenges

- 2.5.1.3. Business Drivers

- 2.5.1.4. Rest-of-the-World Fiber Optic Cable Market, Volume and Value Data

- 2.5.1. Markets

3. Markets - Company Profiles

- 3.1. Company Profiles

- 3.1.1. Belden Inc.

- 3.1.1.1. Company Overview

- 3.1.1.1.1. Role of Belden Inc. in the Fiber Optic Cable Market

- 3.1.1.1.2. Product Portfolio

- 3.1.1.1.3. Production Sites

- 3.1.1.2. Business Strategies

- 3.1.1.2.1. Belden Inc.: Product Development

- 3.1.1.3. Corporate Strategies

- 3.1.1.3.1. Belden Inc.: Mergers and Acquisitions

- 3.1.1.3.2. Belden Inc.: Partnerships and Joint Ventures

- 3.1.1.4. R&D Analysis

- 3.1.1.5. Analyst View

- 3.1.1.1. Company Overview

- 3.1.2. Finolex Cables Ltd

- 3.1.2.1. Company Overview

- 3.1.2.1.1. Role of Finolex Cables Ltd in the Fiber Optic Cable Market

- 3.1.2.1.2. Product Portfolio

- 3.1.2.1.3. Production Sites

- 3.1.2.2. Business Strategies

- 3.1.2.2.1. Finolex Cables Ltd: Market Development

- 3.1.2.3. Analyst View

- 3.1.2.1. Company Overview

- 3.1.3. Fujikura Ltd.

- 3.1.3.1. Company Overview

- 3.1.3.1.1. Role of Fujikura Ltd. in the Fiber Optic Cable Market

- 3.1.3.1.2. Product Portfolio

- 3.1.3.1.3. Production Sites

- 3.1.3.2. Business Strategies

- 3.1.3.2.1. Fujikura Ltd.: Product Development

- 3.1.3.3. R&D Analysis

- 3.1.3.4. Analyst View

- 3.1.3.1. Company Overview

- 3.1.4. Furukawa Electric Co., Ltd.

- 3.1.4.1. Company Overview

- 3.1.4.1.1. Role of Furukawa Electric Co., Ltd. in the Fiber Optic Cable Market

- 3.1.4.1.2. Product Portfolio

- 3.1.4.1.3. Production Sites

- 3.1.4.2. Corporate Strategies

- 3.1.4.2.1. Furukawa Electric Co., Ltd.: Sponsorships and Social Engagements

- 3.1.4.3. Analyst View

- 3.1.4.1. Company Overview

- 3.1.5. LS Cable & System Ltd.

- 3.1.5.1. Company Overview

- 3.1.5.1.1. Role of LS Cable & System Ltd. in the Fiber Optic Cable Market

- 3.1.5.1.2. Product Portfolio

- 3.1.5.1.3. Production Sites

- 3.1.5.2. Business Strategies

- 3.1.5.2.1. LS Cable & System Ltd.: Product Development

- 3.1.5.2.2. LS Cable & System Ltd.: Market Development

- 3.1.5.3. Corporate Strategies

- 3.1.5.3.1. LS Cable & System Ltd.: Mergers and Acquisitions

- 3.1.5.3.2. LS Cable & System Ltd.: Sponsorships and Social Engagements

- 3.1.5.4. R&D Analysis

- 3.1.5.5. Analyst View

- 3.1.5.1. Company Overview

- 3.1.6. Sumitomo Electric Industries, Ltd.

- 3.1.6.1. Company Overview

- 3.1.6.1.1. Role of Sumitomo Electric Industries, Ltd. in the Fiber Optic Cable Market

- 3.1.6.1.2. Product Portfolio

- 3.1.6.1.3. Production Sites

- 3.1.6.2. Business Strategies

- 3.1.6.2.1. Sumitomo Electric Industries, Ltd.: Product Development

- 3.1.6.3. Corporate Strategies

- 3.1.6.3.1. Sumitomo Electric Industries, Ltd.: Partnerships and Joint Ventures

- 3.1.6.3.2. Sumitomo Electric Industries, Ltd.: Collaborations and Alliances

- 3.1.6.4. R&D Analysis

- 3.1.6.5. Analyst View

- 3.1.6.1. Company Overview

- 3.1.7. RS Components Ltd

- 3.1.7.1. Company Overview

- 3.1.7.1.1. Role of RS Components Ltd in the Fiber Optic Cable Market

- 3.1.7.1.2. Product Portfolio

- 3.1.7.2. Corporate Strategies

- 3.1.7.2.1. RS Components Ltd: Mergers and Acquisitions

- 3.1.7.2.2. RS Components Ltd: Partnerships and Joint Ventures

- 3.1.7.3. Analyst View

- 3.1.7.1. Company Overview

- 3.1.8. Amphenol Corporation

- 3.1.8.1. Company Overview

- 3.1.8.1.1. Role of Amphenol Corporation in the Fiber Optic Cable Market

- 3.1.8.1.2. Product Portfolio

- 3.1.8.1.3. Production Sites

- 3.1.8.2. Corporate Strategies

- 3.1.8.2.1. Amphenol Corporation: Mergers and Acquisitions

- 3.1.8.3. R&D Analysis

- 3.1.8.4. Analyst View

- 3.1.8.1. Company Overview

- 3.1.9. HUBER+SUHNER AG

- 3.1.9.1. Company Overview

- 3.1.9.1.1. Role of HUBER+SUHNER AG in the Fiber Optic Cable Market

- 3.1.9.1.2. Product Portfolio

- 3.1.9.1.3. Production Sites

- 3.1.9.2. Corporate Strategies

- 3.1.9.2.1. HUBER+SUHNER AG: Mergers and Acquisitions

- 3.1.9.2.2. HUBER+SUHNER AG: Partnerships and Joint Ventures

- 3.1.9.3. R&D Analysis

- 3.1.9.4. Analyst View

- 3.1.9.1. Company Overview

- 3.1.1. Belden Inc.

4. Research Methodology

- 4.1. Data Sources

- 4.1.1. Primary Data Sources

- 4.1.2. Secondary Data Sources

- 4.1.3. Data Triangulation

- 4.2. Market Estimation and Forecast

- 4.2.1. Factors for Data Prediction and Modeling