|

|

市場調査レポート

商品コード

1735438

医療WFM (ワークフォースマネジメント) システムの世界市場Global Healthcare Workforce Management System Market |

||||||

|

|||||||

| 医療WFM (ワークフォースマネジメント) システムの世界市場 |

|

出版日: 2025年05月22日

発行: BCC Research

ページ情報: 英文 141 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の医療WFM (ワークフォースマネジメント) システムの市場規模は、2024年の19億ドルから、2029年末には31億ドルに拡大すると見込まれており、2024年から2029年にかけてのCAGRは10.2%と予測されています。

北米の市場規模は、2024年の7億4,510万ドルから、2029年末には12億ドルに拡大すると見込まれており、同期間のCAGRは9.1%とされています。

アジア太平洋地域の市場規模は、2024年の4億90万ドルから、2029年末には7億1,220万ドルに拡大すると見込まれており、同期間のCAGRは12.2%と予測されています。

当レポートでは、世界の医療WFM (ワークフォースマネジメント) システムの市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場サマリー

- 市場力学と成長要因

- 新興技術

- セグメント分析

- 地域分析

- 結論

第2章 市場概要

- 概要

- イントロダクション:ワークフォースソフトウェア

- 従来のワークフォースソリューションの課題

- 医療WFMのメリット

- 最適なWFMソリューションを選択するための重要な考慮事項

- 医療従事者管理の未来

- ポーターのファイブフォース分析

- マクロ経済要因分析

- 高齢化人口

- 政府の政策と規制

- 労働力不足

第3章 市場力学

- 重要ポイント

- 市場促進要因

- 人材の最適化とモバイルアプリケーションへの需要の高まり

- クラウドベースのソリューションの採用増加

- 医療従事者の効果的な管理による運用コスト効率の実現

- 市場抑制要因

- プライバシーとデータセキュリティに関する懸念

- 複雑な要素をWFMシステムに統合する

- 市場機会

- 競争力の強化

- 従業員エンゲージメントとワークライフバランスの重視

第4章 規制状況

- 概要

第5章 新興技術と特許分析

- 概要

- 新興技術

- AIを活用した予測分析

- 遠隔医療と遠隔ヘルスケアサービスの拡大

- カスタマイズ可能なレポートと分析

- 特許分析

- 主な調査結果

第6章 市場セグメンテーション分析

- セグメンテーションの内訳

- 市場内訳:コンポーネント別

- 重要ポイント

- ソフトウェア

- サービス

- 市場内訳:導入別

- 重要ポイント

- Web/クラウドベースモデル

- オンプレミスモデル

- 市場内訳:組織規模別

- 重要ポイント

- 大規模組織

- 中規模組織

- 小規模組織

- 市場内訳:エンドユーザー別

- 重要ポイント

- 病院

- 介護施設

- 介護付き高齢者用住宅

- 長期ケア施設

- その他

- 地理的内訳

- 市場内訳:地域別

- 重要ポイント

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第7章 競合情報

- 重要ポイント

- 競合情勢

- 主要企業の世界市場シェア

- 主な展開と戦略

- パートナーシップとコラボレーション

- 事業拡大

- 製品の発売、機能強化、拡張

- 買収

- その他

第8章 環境・社会・ガバナンス (ESG) の観点

- ESG:イントロダクション

- 医療WFMにおける持続可能性

- 医療WFMソリューションプロバイダーESG

- 医療WFMシステム市場におけるESGの現状

- BCCによる総論

第9章 付録

- 調査手法

- 参考文献

- 略語

- 企業プロファイル

- ADP INC.

- ATOSS SOFTWARE SE

- CONNECTEAM

- CORNERSTONE

- INFOR

- NICE

- ORACLE

- OSP

- QGENDA LLC.

- RIPPLING PEOPLE CENTER INC.

- RLDATIX

- SAP SE

- SYMPLR

- UKG INC.

- WORKDAY INC.

- 新興スタートアップ企業/市場ディスラプター

List of Tables

- Summary Table : Global Market for Healthcare WFM Systems, by Region, Through 2029

- Table 1 : Porter's Five Forces: Rating Scale

- Table 2 : U.S. Healthcare Data Breaches, by Reporting Entity, 2020-2024

- Table 3 : Major Healthcare Data Breaches in U.S., 2023 and 2024

- Table 4 : Regulatory Scenarios of Healthcare WFM, by Country, 2024

- Table 5 : Notable Published Patents on Healthcare WFM Systems, January 2024-January 2025

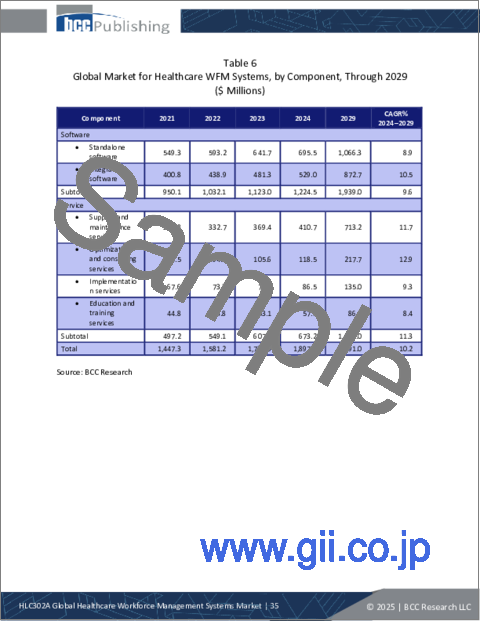

- Table 6 : Global Market for Healthcare WFM Systems, by Component, Through 2029

- Table 7 : Global Market for Healthcare WFM Systems, by Standalone Software, Through 2029

- Table 8 : Leading Players and their Workforce Management Solutions for the Healthcare Sector

- Table 9 : Global Market for Software in Healthcare WFM Systems, by Region, Through 2029

- Table 10 : Global Market for Services in Healthcare WFM Systems, by Region, Through 2029

- Table 11 : Global Market for Healthcare WFM Systems, by Deployment, Through 2029

- Table 12 : Cloud-based Workforce Management Solutions, by Major Players

- Table 13 : Global Market for Web/Cloud Based Deployment of Healthcare WFM Systems, by Region, Through 2029

- Table 14 : Global Market for On-Premises Based Deployment of Healthcare WFM Systems, by Region, Through 2029

- Table 15 : Global Market for Healthcare WFM Systems, by Organization Size, Through 2029

- Table 16 : Global Market for Large Organizations in Healthcare WFM Systems, by Region, Through 2029

- Table 17 : Global Market for Medium Size Organizations in Healthcare WFM Systems, by Region, Through 2029

- Table 18 : Global Market for Small Organizations in Healthcare WFM Systems, by Region, Through 2029

- Table 19 : Global Market for Healthcare WFM Systems, by End User, Through 2029

- Table 20 : Global Market for Hospitals in Healthcare WFM Systems, by Region, Through 2029

- Table 21 : Global Market for Nursing Homes in Healthcare WFM Systems, by Region, Through 2029

- Table 22 : Global Market for Assisted Living Centers in Healthcare WFM Systems, by Region, Through 2029

- Table 23 : Global Market for Long-term Care Facilities in Healthcare WFM Systems, by Region, Through 2029

- Table 24 : Global Market for Other End Users of Healthcare WFM Systems, by Region, Through 2029

- Table 25 : Global Market for Healthcare WFM Systems, by Region, Through 2029

- Table 26 : North American Market for Healthcare WFM Systems, by Country, Through 2029

- Table 27 : North American Market for Healthcare WFM Systems, by Component, Through 2029

- Table 28 : North American Market for Healthcare WFM Systems, by Standalone Software, Through 2029

- Table 29 : North American Market for Healthcare WFM Systems, by Deployment, Through 2029

- Table 30 : North American Market for Healthcare WFM Systems, by Organization Size, Through 2029

- Table 31 : North American Market for Healthcare WFM Systems, by End User, Through 2029

- Table 32 : European Market for Healthcare WFM Systems, by Country, Through 2029

- Table 33 : European Market for Healthcare WFM Systems, by Component, Through 2029

- Table 34 : European Market for Healthcare WFM Systems, by Standalone Software, Through 2029

- Table 35 : European Market for Healthcare WFM Systems, by Deployment, Through 2029

- Table 36 : European Market for Healthcare WFM Systems, by Organization Size, Through 2029

- Table 37 : European Market for Healthcare WFM Systems, by End User, Through 2029

- Table 38 : Asia-Pacific Market for Healthcare WFM Systems, by Country, Through 2029

- Table 39 : Asia-Pacific Market for Healthcare WFM Systems, by Component, Through 2029

- Table 40 : Asia-Pacific Market for Healthcare WFM Systems, by Standalone Software, Through 2029

- Table 41 : Asia-Pacific Market for Healthcare WFM Systems, by Deployment, Through 2029

- Table 42 : Asia-Pacific Market for Healthcare WFM Systems, by Organization Size, Through 2029

- Table 43 : Asia-Pacific Market for Healthcare WFM Systems, by End User, Through 2029

- Table 44 : South American Market for Healthcare WFM Systems, by Country, Through 2029

- Table 45 : South American Market for Healthcare WFM Systems, by Component, Through 2029

- Table 46 : South American Market for Healthcare WFM Systems, by Standalone Software, Through 2029

- Table 47 : South American Market for Healthcare WFM Systems, by Deployment, Through 2029

- Table 48 : South American Market for Healthcare WFM Systems, by Organization Size, Through 2029

- Table 49 : South American Market for Healthcare WFM Systems, by End User, Through 2029

- Table 50 : MEA Market for Healthcare WFM Systems, by Sub-Region, Through 2029

- Table 51 : MEA Market for Healthcare WFM Systems, by Component, Through 2029

- Table 52 : MEA Market for Healthcare WFM Systems, by Standalone Software, Through 2029

- Table 53 : MEA Market for Healthcare WFM Systems, by Deployment, Through 2029

- Table 54 : MEA Market for Healthcare WFM Systems, by Organization Size, Through 2029

- Table 55 : MEA Market for Healthcare WFM Systems, by End User, Through 2029

- Table 56 : Top 5 Providers of Healthcare WFM Software, 2023

- Table 57 : Key Partnerships in the Healthcare WFM System Market, January 2023-December 2024

- Table 58 : Business Expansion Activities in the Healthcare WFM System Market, January 2023-December 2024

- Table 59 : Product Launches, Enhancements, and Expansions in the Healthcare WFM System Market, January 2023-December 2024

- Table 60 : Key Acquisitions in the Healthcare WFM System Market, January 2023-December 2024

- Table 61 : Other Developments in the Healthcare WFM System Market, January 2023-December 2024

- Table 62 : Sustainability Initiatives by Some of the Key Players

- Table 63 : ESG Initiatives by Key Players

- Table 64 : ESG Risk Ratings Metric, by Company, 2024

- Table 65 : Abbreviations Used in the Report

- Table 66 : ADP Inc.: Company Snapshot

- Table 67 : ADP Inc.: Financial Performance, FY 2022 and 2023

- Table 68 : ADP Inc.: Product Portfolio

- Table 69 : ATOSS Software SE: Company Snapshot

- Table 70 : ATOSS Software SE: Financial Performance, FY 2023 and 2024

- Table 71 : ATOSS Software SE: Product Portfolio

- Table 72 : ATOSS Software SE: News/Key Developments, 2023

- Table 73 : Connecteam: Company Snapshot

- Table 74 : Connecteam: Product Portfolio

- Table 75 : Cornerstone: Company Snapshot

- Table 76 : Cornerstone: Product Portfolio

- Table 77 : Cornerstone: News/Key Developments, 2024

- Table 78 : Infor: Company Snapshot

- Table 79 : Infor: Product Portfolio

- Table 80 : Infor: News/Key Developments, 2023

- Table 81 : NICE: Company Snapshot

- Table 82 : NICE: Financial Performance, FY 2022 and 2023

- Table 83 : NICE: Product Portfolio

- Table 84 : Oracle: Company Snapshot

- Table 85 : Oracle: Financial Performance, FY 2022 and 2023

- Table 86 : Oracle: Product Portfolio

- Table 87 : OSP: Company Snapshot

- Table 88 : OSP: Product Portfolio

- Table 89 : QGenda LLC.: Company Snapshot

- Table 90 : QGenda LLC.: Product Portfolio

- Table 91 : Rippling People Center Inc.: Company Snapshot

- Table 92 : Rippling People Center Inc.: Product Portfolio

- Table 93 : Rippling People Center Inc.: News/Key Developments, 2023 and 2024

- Table 94 : RLDatix: Company Snapshot

- Table 95 : RLDatix: Product Portfolio

- Table 96 : RLDatix: News/Key Developments, 2023 and 2024

- Table 97 : SAP SE: Company Snapshot

- Table 98 : SAP SE: Financial Performance, FY 2023 and 2024

- Table 99 : SAP SE: Product Portfolio

- Table 100 : SAP SE: News/Key Developments, 2024

- Table 101 : Symplr: Company Snapshot

- Table 102 : Symplr: Product Portfolio

- Table 103 : Symplr: News/Key Developments, 2023

- Table 104 : UKG Inc.: Company Snapshot

- Table 105 : UKG Inc.: Product Portfolio

- Table 106 : UKG Inc.: News/Key Developments, 2023 and 2024

- Table 107 : Workday Inc.: Company Snapshot

- Table 108 : Workday Inc.: Financial Performance, FY 2022 and 2023

- Table 109 : Workday Inc.: Product Portfolio

- Table 110 : Workday Inc.: News/Key Developments, 2024

- Table 111 : List of a Few Emerging Startups/Market Disruptors

List of Figures

- Summary Figure : Global Market Shares of Healthcare WFM Systems, by Region, 2023

- Figure 1 : Major Workforce Management Solution Components

- Figure 2 : Most Common Traditional Workforce Management Challenges

- Figure 3 : Benefits of Workforce Management

- Figure 4 : Key Considerations for Selecting the Best WFM System

- Figure 5 : Porter's Five Forces Analysis: Global Healthcare WFM Systems Market

- Figure 6 : Market Dynamics of Healthcare WFM Systems

- Figure 7 : Emerging Technologies in WFM Systems

- Figure 8 : AI's Role in Optimizing Hospital Staffing Through Predictive Analytics

- Figure 9 : Global Market Shares of Healthcare WFM Systems, by Component, 2023

- Figure 10 : Global Market Shares of Software in Healthcare WFM Systems, by Region, 2023

- Figure 11 : Global Market Shares of Services in Healthcare WFM Systems, by Region, 2023

- Figure 12 : Global Market Shares of Healthcare WFM Systems, by Deployment, 2023

- Figure 13 : Global Market Shares of Web/Cloud Based Deployment of Healthcare WFM Systems, by Region, 2023

- Figure 14 : Global Market Shares of On-Premises Based Deployment of Healthcare WFM Systems, by Region, 2023

- Figure 15 : Global Market Shares of Healthcare WFM Systems, by Organization Size, 2023

- Figure 16 : Global Market Shares of Large Organizations in Healthcare WFM Systems, by Region, 2023

- Figure 17 : Global Market Shares of Medium Size Organizations in Healthcare WFM Systems, by Region, 2023

- Figure 18 : Global Market Shares of Small Organizations in Healthcare WFM Systems, by Region, 2023

- Figure 19 : Global Market Shares of Healthcare WFM Systems, by End User, 2023

- Figure 20 : Global Market Shares of Hospitals in Healthcare WFM Systems, by Region, 2023

- Figure 21 : Global Market Shares of Nursing Homes in Healthcare WFM Systems, by Region, 2023

- Figure 22 : Global Market Shares of Assisted Living Centers in Healthcare WFM Systems, by Region, 2023

- Figure 23 : Global Market Shares of Long-term Care Facilities in Healthcare WFM Systems, by Region, 2023

- Figure 24 : Global Market Shares of Other End Users of Healthcare WFM Systems, by Region, 2023

- Figure 25 : Global Market Shares of Healthcare WFM Systems, by Region, 2023

- Figure 26 : Company Share Analysis of the Healthcare WFM System Market, 2023

- Figure 27 : Snapshot of the ESG Pillars

- Figure 28 : ADP Inc.: Revenue Share, by Business Segment, FY 2023

- Figure 29 : ADP Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 30 : ATOSS Software SE: Revenue Share, by Business Segment, FY 2024

- Figure 31 : ATOSS Software SE: Revenue Share, by Country/Region, FY 2024

- Figure 32 : NICE: Revenue Share, by Business Segment, FY 2023

- Figure 33 : NICE: Revenue Share, by Country/Region, FY 2023

- Figure 34 : Oracle: Revenue Share, by Business Segment, FY 2023

- Figure 35 : Oracle: Revenue Share, by Country/Region, FY 2023

- Figure 36 : SAP SE: Revenue Share, by Business Segment, FY 2024

- Figure 37 : SAP SE: Revenue Share, by Country/Region, FY 2024

- Figure 38 : Workday Inc.: Revenue Share, by Business Segment, FY 2023

- Figure 39 : Workday Inc.: Revenue Share, by Country/Region, FY 2023

The global market for healthcare workforce management (WFM) systems is expected to grow from $1.9 billion in 2024 to $3.1 billion by the end of 2029, at a compound annual growth rate (CAGR) of 10.2% from 2024 to 2029.

The North American market for healthcare WFM systems is expected to grow from $745.1 million in 2024 to $1.2 billion by the end of 2029, at a CAGR of 9.1% from 2024 to 2029.

The Asia-Pacific market for healthcare WFM systems is expected to grow from $400.9 million in 2024 to $712.2 million by the end of 2029, at a CAGR of 12.2% from 2024 to 2029.

Report Scope

This report provides an overview of the global healthcare workforce management system market and analyzes its trends. The report includes global revenue ($ millions), with 2023 as the base year, estimates for 2024, and forecasts through 2029. The market is segmented based on components, deployment, organization size, end user, and region. The regions covered in this study include North America, Europe, Asia-Pacific, South America, and the Middle East and Africa, with a focus on major countries in these regions.

The report focuses on the significant driving trends and challenges that affect the market and vendor landscape. It analyzes environmental, social, and corporate governance (ESG) developments and discusses patents and emerging technologies related to the market.

The report concludes with an analysis of the competitive landscape, which provides the ranking/share of key players in the global healthcare workforce management system market. It also has a dedicated section of company profiles that covers details of leading key market players.

Report Includes

- 56 data tables and 56 additional tables

- An overview of the current and future global market for healthcare workforce management (WFM) systems

- An analysis of global market trends, with market revenue data from 2021 to 2023, estimates for 2024, and projected CAGRs through 2029

- Estimates of the size and revenue prospects of the global market, along with a market share analysis by component, deployment, organization size, end user and region

- Facts and figures pertaining to market dynamics, technological advances, regulations, and the impact of macroeconomic factors

- Analysis of market opportunities with a review of Porter's Five Forces and a value chain analysis taking into consideration the prevailing micro- and macro environmental factors

- Discussion of the importance of ESG in the market for healthcare workforce management systems, consumer attitudes towards sustainability, an assessment of risks and opportunities, ratings and matrices, and ESG practices in the industry

- Analysis of relevant patents, with emphasis on emerging technologies and new developments in healthcare workforce management systems

- Analysis of the industry structure, including companies' market shares and rankings, strategic alliances, M&A activity and a venture funding outlook

- Profiles of the leading companies, including Oracle, ADP Inc., SAP SE, ATOSS Software SE and Workday Inc.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of the Report

- Market Summary

- Market Dynamics and Growth Factors

- Emerging Technologies

- Segmental Analysis

- Regional Analysis

- Conclusion

Chapter 2 Market Overview

- Overview

- Introduction: Workforce Management Software

- Challenges of Traditional Workforce Management Solutions

- Benefits of Healthcare WFM

- Key Considerations for Choosing the Best WFM Solution

- The Future of Healthcare Workforce Management

- Porter's Five Forces Analysis

- Threat of New Entrants (Moderate to High)

- Bargaining Power of Suppliers (Moderate)

- Bargaining Power of Buyers (High)

- Threat of Substitutes (Low to Moderate)

- Level of Competitiveness (High)

- Macroeconomic Factors Analysis

- Aging Population

- Government Policies and Regulations

- Workforce Shortages

Chapter 3 Market Dynamics

- Key Takeaways

- Market Drivers

- Growing Demand for Workforce Optimization and Mobile Applications

- Increasing Adoption of Cloud-based Solutions

- Achieving Operational Cost-Efficiency Through Effective Management of Healthcare Workforce

- Market Restraints

- Privacy and Data Security Concerns

- Integrating Complexities with the WFM System

- Market Opportunities

- Growing Competitiveness

- Emphasis on Employee Engagement and Work-Life Balance

Chapter 4 Regulatory Landscape

- Overview

Chapter 5 Emerging Technologies and Patent Analysis

- Overview

- Emerging Technologies

- AI-Powered Predictive Analytics

- Expansion of Telehealth and Remote Healthcare Services

- Customizable Reporting and Analytics

- Patent Analysis

- Key Findings

Chapter 6 Market Segmentation Analysis

- Segmentation Breakdown

- Market Breakdown, by Component

- Key Takeaways

- Software

- Service

- Market Breakdown, by Deployment

- Key Takeaways

- Web/Cloud-Based Model

- On-Premises Model

- Market Breakdown, by Organization Size

- Key Takeaways

- Large Organizations

- Medium Organizations

- Small Organizations

- Market Breakdown, by End User

- Key Takeaways

- Hospitals

- Nursing Homes

- Assisted Living Centers

- Long-term Care Facilities

- Others

- Geographical Breakdown

- Market Breakdown, by Region

- Key Takeaways

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

Chapter 7 Competitive Intelligence

- Key Takeaways

- Competitive Landscape

- Global Market Shares of Leading Companies

- Key Developments and Strategies

- Partnerships and Collaborations

- Business Expansions

- Product Launches, Enhancements, and Expansions

- Acquisitions

- Other Developments

Chapter 8 Environmental, Social and Governance (ESG) Perspective

- Introduction to ESG

- Sustainability in Healthcare WFM

- Healthcare WFM Solution Providers ESG

- Status of ESG in the Healthcare Workforce Management System Market

- Concluding Remarks from BCC Research

Chapter 9 Appendix

- Research Methodology

- References

- Abbreviations

- Company Profiles

- ADP INC.

- ATOSS SOFTWARE SE

- CONNECTEAM

- CORNERSTONE

- INFOR

- NICE

- ORACLE

- OSP

- QGENDA LLC.

- RIPPLING PEOPLE CENTER INC.

- RLDATIX

- SAP SE

- SYMPLR

- UKG INC.

- WORKDAY INC.

- Emerging Start-ups/Market Disruptors