|

|

市場調査レポート

商品コード

1630511

OTC薬・医療機器・診断製品:世界市場OTC Drugs, Medical Devices and Diagnostics: Global Markets |

||||||

|

|||||||

| OTC薬・医療機器・診断製品:世界市場 |

|

出版日: 2025年01月03日

発行: BCC Research

ページ情報: 英文 139 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のOTC薬・医療機器・診断製品の市場規模は、2024年の2,517億ドルから、予測期間中はCAGR7.4%で推移し、2029年には3,597億ドルに達すると予測されています。

OTC薬の部門は、2024年の1,965億米ドルから、予測期間中はCAGR 6.7%で推移し、2029年には2,717億米ドルに達すると予測されています。OTC機器・診断製品の部門は、2024年の552億ドルから、CAGR 9.8%で推移し、2029年には880億ドルに達すると予測されます。

当レポートでは、世界のOTC薬・医療機器・診断製品の市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場概要

第2章 市場概要

- OTC製品のタイプ

- OTC薬

- ビタミン・ミネラルサプリメント

- OTC医療機器・診断製品

- OTC薬・医療機器・診断製品のメリットとデメリット

- コスト削減分析

- PESTLE分析

- ポーターのファイブフォース分析

- 規制状況

第3章 市場力学

- 市場力学

- 市場促進要因

- 慢性疾患の増加と高齢者人口の拡大

- 健康意識の向上

- 成長するオンライン販売チャネルと遠隔医療プラットフォーム

- 市場抑制要因

- 代替手段の存在

- 市場機会

- 新興経済国

- 市場の課題

- OTC薬と医療機器の誤用と相互作用

- データのプライバシーとセキュリティに関する懸念

第4章 新興技術と開発

- 新興技術

- 先進ドラッグデリバリー

- 先進ウェアラブルセンサー

- AI

- 臨床試験分析

- 臨床試験分析:研究タイプ別

- 臨床試験分析:ステータス別

- 臨床試験分析:フェーズ別

第5章 市場セグメンテーション分析

- セグメンテーションの内訳

- 市場分析:製品別

- OTC薬

- 医薬品

- ビタミン&ミネラルサプリメント

- OTCデバイス・診断製品

- 監視デバイス

- 治療デバイス

- 診断デバイス・キット

- 市場分析:用途別

- 呼吸器疾患

- 胃腸障害

- 整形外科疾患

- 心血管疾患

- 糖尿病

- 皮膚疾患

- 肥満

- 耳鼻咽喉科疾患

- 睡眠障害

- その他

- 地理的内訳

- 市場分析:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第6章 競合情報

- 市場分析

- 戦略分析

第7章 OTC薬・医療機器・診断製品における持続可能性:ESGの観点

- ESGイントロダクション

- OTC医薬品、医療機器、診断における持続可能性:ESGの観点

- 主要なESG問題

- OTC薬・医療機器・診断製品のESGパフォーマンス分析

- BCCによる総論

第8章 付録

- 調査手法

- 出典

- 略語

- 企業プロファイル

- ABBOTT

- BAYER AG

- DSM-FIRMENICH

- HALEON GROUP OF CO.

- KENVUE

- KONINKLIJKE PHILIPS N.V.

- MASIMO

- NESTLE

- PROCTER & GAMBLE

- SANOFI

List of Tables

- Summary Table : Global Market for OTC Drugs, Medical Devices, and Diagnostics, by Product, Through 2029

- Table 1 : Difference between Prescription v/s OTC Pharmaceutical Drugs

- Table 2 : Top OTC Pharmaceutical Drugs in Major Categories

- Table 3 : Top Vitamin and Mineral Supplements in Major Categories

- Table 4 : Top OTC Medical Devices and Diagnostics in Major Categories

- Table 5 : FDA Medical Device Classification

- Table 6 : EU MDR Medical Device Classification

- Table 7 : Asia-Pacific: Regulatory Landscape

- Table 8 : RoW: Regulatory Landscape

- Table 9 : Global: Leading causes of Disease Burden, 2022 v/s 2050

- Table 10 : U.S.: Sufferers Using Only OTC Products, 2019

- Table 11 : Comparison of FDA-Cleared Health Monitoring Watches

- Table 12 : OTC Drugs: Adverse Effects

- Table 13 : OTC Drug Interaction with Disorders

- Table 14 : Clinical Trials in OTC Drugs, Medical Devices, and Diagnostics, by Type of Study, October 2024

- Table 15 : Clinical Trials in OTC Drugs, Medical Devices, and Diagnostics, by Status, October 2024

- Table 16 : Clinical Trials in OTC Drugs, Medical Devices, and Diagnostics, by Phase, October 2024

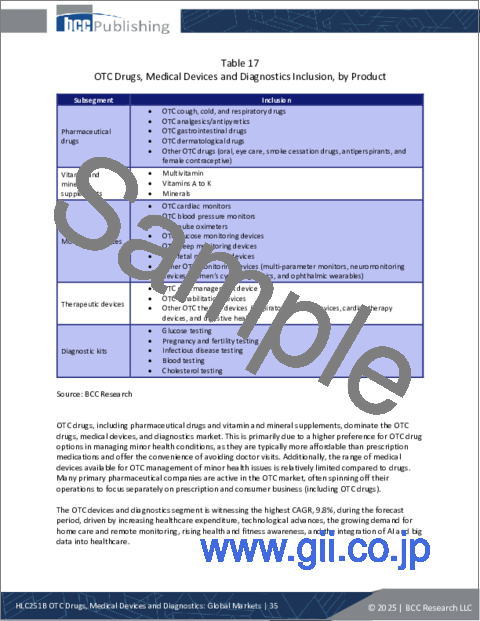

- Table 17 : OTC Drugs, Medical Devices and Diagnostics Inclusion, by Product

- Table 18 : Global Market for OTC Drugs, Medical Devices and Diagnostics, by Product, Through 2029

- Table 19 : Global Market for OTC Drugs, by Region, Through 2029

- Table 20 : Global Market for OTC Drugs, by Type, Through 2029

- Table 21 : Most Common OTC Cough, Cold and Respiratory Drugs

- Table 22 : Most Common OTC Analgesic/Antipyretic

- Table 23 : Most Common OTC Gastrointestinal Drugs

- Table 24 : Most Common OTC Dermatological Drugs

- Table 25 : Key Marketed OTC Pharmaceutical Drugs, by Company

- Table 26 : Global Market for Pharmaceutical Drugs, by Region, Through 2029

- Table 27 : Key Marketed Vitamin and Mineral Supplements, by Company

- Table 28 : Global Market for Vitamin and Mineral Supplements, by Region, Through 2029

- Table 29 : Global Market for OTC Devices and Diagnostics, by Region, Through 2029

- Table 30 : Global Market for OTC Devices and Diagnostics, by Type, Through 2029

- Table 31 : OTC Cardiac Monitoring Devices, by Company

- Table 32 : OTC Blood Pressure Monitoring Devices, by Company

- Table 33 : OTC Pulse Oximeter, by Company

- Table 34 : OTC Glucose Monitoring Devices, by Company

- Table 35 : OTC Sleep Monitoring Devices, by Company

- Table 36 : Fetal Monitoring Devices, by Company

- Table 37 : Global Market for Monitoring Devices, by Region, Through 2029

- Table 38 : Pain Management Devices, by Company

- Table 39 : Rehabilitation Devices, by Company

- Table 40 : Other OTC Devices, by Company

- Table 41 : Global Market for Therapeutic Devices, by Region, Through 2029

- Table 42 : Diagnostic Devices and Kits, by Company

- Table 43 : Global Market for Diagnostic Devices and Kits, by Region, Through 2029

- Table 44 : Global Market for OTC Drugs, Medical Devices, and Diagnostics, by Application, Through 2029

- Table 45 : Global Market for Respiratory Disorders, by Region, Through 2029

- Table 46 : Gastrointestinal Disorders: OTC Drug Management

- Table 47 : Global Market for Gastrointestinal Disorders, by Region, Through 2029

- Table 48 : Global Market for Orthopedic Diseases, by Region, Through 2029

- Table 49 : Global Market for Cardiovascular Diseases, by Region, Through 2029

- Table 50 : Worldwide Diabetes Estimates (20-79 Years), by Region, 2021-2045

- Table 51 : Global Market for Diabetes, by Region, Through 2029

- Table 52 : Global Market for Skin Disorders, by Region, Through 2029

- Table 53 : Global Market for Obesity, by Region, Through 2029

- Table 54 : Global Market for ENT Disorders, by Region, Through 2029

- Table 55 : Global Market for Sleep Disorders, by Region, Through 2029

- Table 56 : Global Market for Other Disorders, by Region, Through 2029

- Table 57 : Global Market for OTC Drugs, Medical Devices, and Diagnostics, by Region, Through 2029

- Table 58 : North American Market for OTC Drugs, Medical Devices, and Diagnostics, by Country, Through 2029

- Table 59 : European Market for OTC Drugs, Medical Devices, and Diagnostics, by Country, Through 2029

- Table 60 : Asia-Pacific Market for OTC Drugs, Medical Devices, and Diagnostics, by Country, Through 2029

- Table 61 : OTC Pharmaceutical Drugs: Market Player Share Analysis, 2023

- Table 62 : OTC Drugs, Medical Devices, and Diagnostics: Recent Strategic Developments, 2022-2024

- Table 63 : ESG Rankings for OTC Drug, Medical Device, and Diagnostics Companies, 2024*

- Table 64 : ESG: Environmental Overview

- Table 65 : ESG: Social Overview

- Table 66 : ESG: Governance Overview

- Table 67 : Report Specific Information Sources

- Table 68 : Abbreviations Used in OTC Drugs, Medical Devices, and Diagnostics Market

- Table 69 : Abbott: Company Snapshot

- Table 70 : Abbott: Financial Performance, FY 2022 and 2023

- Table 71 : Abbott: Product Portfolio

- Table 72 : Abbott: News/Key Developments, 2021-2024

- Table 73 : Bayer AG: Company Snapshot

- Table 74 : Bayer AG: Financial Performance, FY 2022 and 2023

- Table 75 : Bayer AG: Product Portfolio

- Table 76 : DSM-Firmenich: Company Snapshot

- Table 77 : DSM-Firmenich: Financial Performance, FY 2022 and 2023

- Table 78 : DSM-Firmenich: Product Portfolio

- Table 79 : DSM-Firmenich: News/Key Developments, 2023

- Table 80 : Haleon Group of Co.: Company Snapshot

- Table 81 : Haleon Group of Co.: Financial Performance, FY 2022 and 2023

- Table 82 : Haleon Group of Co.: Product Portfolio

- Table 83 : Haleon Group of Co.: News/Key Developments, 2023 and 2024

- Table 84 : Kenvue: Company Snapshot

- Table 85 : Kenvue: Financial Performance, FY 2022 and 2023

- Table 86 : Kenvue: Product Portfolio

- Table 87 : Koninklijke Philips N.V.: Company Snapshot

- Table 88 : Koninklijke Philips N.V.: Financial Performance, FY 2022 and 2023

- Table 89 : Koninklijke Philips N.V.: Product Portfolio

- Table 90 : Masimo: Company Snapshot

- Table 91 : Masimo: Financial Performance, FY 2022 and 2023

- Table 92 : Masimo: Product Portfolio

- Table 93 : Masimo: News/Key Developments, 2024

- Table 94 : Nestle: Company Snapshot

- Table 95 : Nestle: Financial Performance, FY 2022 and 2023

- Table 96 : Nestle: Product Portfolio

- Table 97 : Nestle: News/Key Developments, 2024

- Table 98 : Procter & Gamble: Company Snapshot

- Table 99 : Procter & Gamble: Financial Performance, FY 2022 and 2023

- Table 100 : Procter & Gamble: Product Portfolio

- Table 101 : Sanofi: Company Snapshot

- Table 102 : Sanofi: Financial Performance, FY 2022 and 2023

- Table 103 : Sanofi: Product Portfolio

- Table 104 : Sanofi: News/Key Developments, 2023 and 2024

List of Figures

- Summary Figure : Global Market for OTC Drugs, Medical Devices, and Diagnostics, by Product, 2021-2029

- Figure 1 : Advantages and Disadvantages of OTC Drugs, Medical Devices, and Diagnostics

- Figure 2 : OTC Drugs, Medical Devices, and Diagnostics: PESTLE Analysis

- Figure 3 : Market Dynamics of OTC Drugs, Medical Devices, and Diagnostics

- Figure 4 : Global Population Share Above 65 Years, 2019-2023

- Figure 5 : Security Risk of Wearable

- Figure 6 : Emerging Trends/Technologies in the OTC Drugs, Medical Device and Diagnostics Market

- Figure 7 : Global Market Shares for OTC Drugs, Medical Devices and Diagnostics, by Product, 2023

- Figure 8 : Global Market Shares for OTC Drugs, by Type, 2023

- Figure 9 : Global Market Shares for OTC Devices and Diagnostics, by Type, 2023

- Figure 10 : Global Market Shares for OTC Drugs, Medical Devices, and Diagnostics, by Application, 2023

- Figure 11 : Percentage of Population Aged 65 Years and Above, by Region, 2050

- Figure 12 : Worldwide Diabetes Estimates (20-79 Years), by Region, 2021, 2030 and 2045

- Figure 13 : Global Market Shares for OTC Drugs, Medical Devices, and Diagnostics, by Region, 2023

- Figure 14 : North American Market Shares of OTC Drugs, Medical Devices, and Diagnostics, by Country, 2023

- Figure 15 : U.S. Market for OTC Drugs, Medical Devices, and Diagnostics, 2021-2029

- Figure 16 : Canadian Market for OTC Drugs, Medical Devices, and Diagnostics, 2021-2029

- Figure 17 : European Market Shares of OTC Drugs, Medical Devices, and Diagnostics, by Country, 2023

- Figure 18 : German Market for OTC Drugs, Medical Devices, and Diagnostics, 2021-2029

- Figure 19 : U.K. Market for OTC Drugs, Medical Devices, and Diagnostics, 2021-2029

- Figure 20 : French Market for OTC Drugs, Medical Devices, and Diagnostics, 2021-2029

- Figure 21 : Italian Market for OTC Drugs, Medical Devices, and Diagnostics, 2021-2029

- Figure 22 : Rest of European Market for OTC Drugs, Medical Devices, and Diagnostics, 2021-2029

- Figure 23 : Asia-Pacific Market Shares of OTC Drugs, Medical Devices, and Diagnostics, by Country, 2023

- Figure 24 : Chinese Market for OTC Drugs, Medical Devices, and Diagnostics, 2021-2029

- Figure 25 : Indian Market for OTC Drugs, Medical Devices, and Diagnostics, 2021-2029

- Figure 26 : Japanese Market for OTC Drugs, Medical Devices, and Diagnostics, 2021-2029

- Figure 27 : Rest of Asia-Pacific Market for OTC Drugs, Medical Devices, and Diagnostics, 2021-2029

- Figure 28 : Rest of the World Market for OTC Drugs, Medical Devices, and Diagnostics, 2021-2029

- Figure 29 : Major Vitamin and Mineral Supplements Players

- Figure 30 : Major OTC Medical Device Players

- Figure 31 : ESG Pillars

- Figure 32 : Advantages of ESG for Companies

- Figure 33 : Key ESG Issues in the OTC Drug, Medical Device, and Diagnostics Industry

- Figure 34 : Abbott: Revenue Shares, by Business Unit, FY 2023

- Figure 35 : Abbott: Revenue Shares, by Country/Region, FY 2023

- Figure 36 : Bayer AG: Revenue Shares, by Business Unit, FY 2023

- Figure 37 : Bayer AG: Revenue Shares, by Country/Region, FY 2023

- Figure 38 : DSM-Firmenich: Revenue Shares, by Business Unit, FY 2023

- Figure 39 : DSM-Firmenich: Revenue Shares, by Country/Region, FY 2023

- Figure 40 : Haleon Group of Co.: Revenue Shares, by Business Unit, FY 2023

- Figure 41 : Haleon Group of Co.: Revenue Shares, by Country/Region, FY 2023

- Figure 42 : Kenvue: Revenue Shares, by Business Unit, FY 2023

- Figure 43 : Kenvue: Revenue Shares, by Country/Region, FY 2023

- Figure 44 : Koninklijke Philips N.V.: Revenue Shares, by Business Unit, FY 2023

- Figure 45 : Koninklijke Philips N.V.: Revenue Shares, by Country/Region, FY 2023

- Figure 46 : Masimo: Revenue Shares, by Business Unit, FY 2023

- Figure 47 : Masimo: Revenue Shares, by Country/Region, FY 2023

- Figure 48 : Nestle: Revenue Shares, by Business Unit, FY 2023

- Figure 49 : Nestle: Revenue Shares, by Country/Region, FY 2023

- Figure 50 : Procter & Gamble: Revenue Shares, by Business Unit, FY 2023

- Figure 51 : Procter & Gamble: Revenue Shares, by Country/Region, FY 2023

- Figure 52 : Sanofi: Revenue Shares, by Business Unit, FY 2023

- Figure 53 : Sanofi: Revenue Shares, by Country/ Region, FY 2023

The global market for OTC drugs, medical devices, and diagnostics is estimated to increase from $251.7 billion in 2024 to reach $359.7 billion by 2029, at a compound annual growth rate (CAGR) of 7.4% from 2024 through 2029.

The OTC drugs market for OTC drugs, medical devices, and diagnostics is estimated to increase from $196.5 billion in 2024 to reach $271.7 billion by 2029, at a CAGR of 6.7% from 2024 through 2029.

The OTC devices and diagnostics market for OTC drugs, medical devices, and diagnostics is estimated to increase from $55.2 billion in 2024 to reach $88.0 billion by 2029, at a CAGR of 9.8% from 2024 through 2029.

Report Scope:

The current report provides detailed information and estimates through 2029 and market shares for key market players. It details the market size of OTC drugs, medical devices, and diagnostics based on products and applications. Based on product, OTC drugs, medical devices, and diagnostics are categorized into OTC drugs (pharmaceutical drugs and vitamin and mineral supplements) and OTC devices and diagnostics (monitoring devices, therapeutic devices, and diagnostic devices and kits). Based on application, the report is segmented into respiratory disorders, orthopedic diseases, gastrointestinal disorders, diabetes, obesity, cardiovascular diseases, ENT disorders, skin disorders, sleep disorders, and other disorders.

Report Includes:

- 36 data tables and 69 additional tables

- An up-to-date overview of the global markets for OTC drugs, medical devices and diagnostics

- Analysis of the global market trends, with data from 2021-2023, estimates for 2024, and projections of compound annual growth rates (CAGRs) through 2029

- Evaluation of the current market size and revenue growth prospects, accompanied by a market share analysis by product type, application, and geographic region

- Discussion of how the rise in the number of diseases are creating a constant need for OTC drugs, medical devices, and diagnostics for disease management

- A look at the key market drivers and restraints that will shape the market for OTC drugs, medical devices, and diagnostics over the next five years (2024-2029)

- A discussion on ESG challenges and practices in the industry

- Review of patents issued for OTC drugs, medical devices, and diagnostics

- Assessment of the vendor landscape, including the market shares of leading companies, their product portfolios and financial overviews

- Information on recent mergers, acquisitions, expansions, collaborations, investments, divestments, product launches, and other strategic developments

- Company profiles of major players within the industry, including Haleon Group of Co., Kenvue, Sanofi, and Bayer AG

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

Chapter 2 Market Overview

- Introduction

- Types of OTC Products

- Pharmaceutical OTC Drugs

- Vitamin and Mineral Supplements

- OTC Medical Devices and Diagnostics

- Advantages and Disadvantages of OTC Drugs, Medical Devices, and Diagnostics

- Cost Savings Analysis

- PESTLE Analysis

- Porter's Five Forces Analysis

- Bargaining Power of Buyers: High

- Bargaining Power of Suppliers: Moderate

- Potential of New Entrants to the Market: Moderate

- Competition in the Industry: High

- Threat of Substitutes: Moderate to High

- Regulatory Landscape

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

Chapter 3 Market Dynamics

- Market Dynamics

- Market Drivers

- Growing Prevalence of Chronic Diseases and Expanding Geriatric Populations

- Increasing Health Awareness

- Growing Online Sales Channels and Telehealth Platforms

- Market Restraints

- Presence of Alternative Methods

- Market Opportunities

- Emerging Economies

- Market Challenges

- Misuse and Interactions of OTC Drugs and Medical Devices

- Data Privacy and Security Concerns

Chapter 4 Emerging Technologies and Developments

- Emerging Technologies

- Advanced Drug Delivery

- Advanced Wearable Sensors

- Artificial Intelligence

- Clinical Trials Analysis

- Clinical Trials Analysis by Type of Study

- Clinical Trials Analysis, by Status

- Clinical Trials Analysis, by Phase

Chapter 5 Market Segmentation Analysis

- Segmentation Breakdown

- Market Analysis by Product

- OTC Drugs

- Pharmaceutical Drugs

- Vitamin and Mineral Supplements

- OTC Devices and Diagnostics

- Monitoring Devices

- Therapeutic Devices

- Diagnostic Devices and Kits

- Market Breakdown by Application

- Respiratory Disorders

- Gastrointestinal Disorders

- Orthopedic Diseases

- Cardiovascular Diseases

- Diabetes

- Skin Disorders

- Obesity

- ENT Disorders

- Sleep Disorders

- Other Disorders

- Geographic Breakdown

- Market Analysis by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Chapter 6 Competitive Intelligence

- Market Analysis

- Strategic Analysis

Chapter 7 Sustainability in OTC Drug, Medical Device, and Diagnostics: An ESG Perspective

- Introduction to ESG

- Sustainability in OTC Drug, Medical Device, and Diagnostics: An ESG Perspective

- Key ESG Issues

- OTC Drug, Medical Device, and Diagnostics ESG Performance Analysis

- Concluding Remarks from BCC

Chapter 8 Appendix

- Methodology

- Sources

- Abbreviations

- Company Profiles

- ABBOTT

- BAYER AG

- DSM-FIRMENICH

- HALEON GROUP OF CO.

- KENVUE

- KONINKLIJKE PHILIPS N.V.

- MASIMO

- NESTLE

- PROCTER & GAMBLE

- SANOFI