|

|

市場調査レポート

商品コード

1400607

自動運転トラックの世界市場Autonomous Trucks: Global Markets |

||||||

|

|||||||

| 自動運転トラックの世界市場 |

|

出版日: 2023年12月22日

発行: BCC Research

ページ情報: 英文 158 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の自動運転トラックの市場規模は、2023年の33億米ドルから、予測期間中は16.2%のCAGRで推移し、2028年末には69億米ドルを超える規模に成長すると予測されています。

ソフトウェアの部門は2023年の24億米ドルから、16.7%のCAGRで推移し、2028年には51億米ドルに達すると予測されています。また、ハードウェアの部門は2023年の9億1,990万米ドルから、14.9%のCAGRで推移し、2028年には18億米ドルに達すると予測されています。

当レポートでは、世界の自動運転トラックの市場を調査し、市場の定義・概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、技術動向、ESGの展開、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 サマリー・ハイライト

- 市場の見通し

- 市場サマリー

第3章 市場概要

- 概要

- バリューチェーン分析

- PESTEL分析

- 政府の規制

- ポーターのファイブフォース分析

- 自動運転トラック:将来を見据えて

- ロシア・ウクライナ戦争が市場に与える影響

第4章 市場力学

- 概要

- 市場促進要因

- 交通安全と交通規制の改善に対する重要性の高まり

- 自動運転トラックの排出ガス削減と燃費向上

- 技術情勢の改善

- 市場の課題

- 一貫性のない規制の枠組み

- 途上国におけるITと通信インフラの不足

- 市場機会

- コネクテッドインフラの成長

- 高度道路交通システムの開発

第5章 新たな技術と開発

- 概要

- 自動運転トラックの将来の展望

- 自動運転トラックにおける最新技術の応用

- AI

- 機械学習

- 先進運転支援システム

- 光検出・測距

第6章 市場内訳:コンポーネント別

- 概要

- ソフトウェア

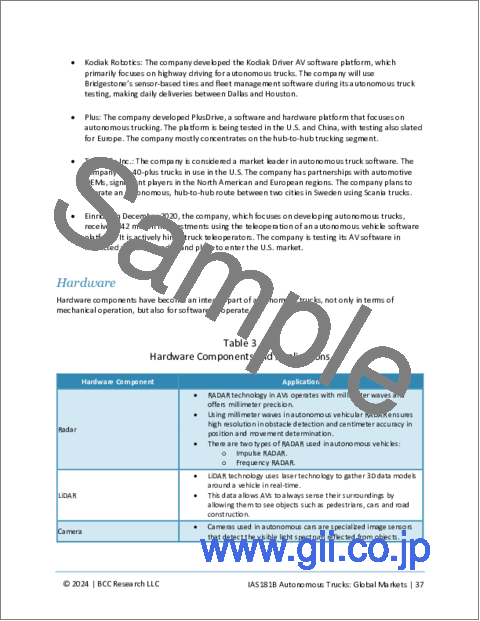

- ハードウェア

第7章 市場内訳:自動レベル別

- 概要

- 半自動型

- 完全自動型

第8章 市場内訳:推進タイプ別

- 概要

- ICエンジン

- 電気

- ハイブリッド

第9章 市場内訳:トラックタイプ別

- 概要

- 小型

- 中型

- 大型

第10章 市場内訳:エンドユーザー別

- 概要

- 物流・輸送

- 製造

- 鉱業

- その他

- 港湾

- 石油・ガス

- 化学薬品

- 農業

- 建設

第11章 市場内訳:地域別

- 概要

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- アジア太平洋

- 中国

- インド

- 日本

- その他の地域

第12章 自動運転トラック業界の持続可能性:ESGの観点

- 自動運転トラック市場における主要なESG問題

- 二酸化炭素排出量/環境への影響

- 動物福祉

- 労働慣行

- 透明性とガバナンス

- 自動運転トラック市場のESGパフォーマンス分析

- 環境面のパフォーマンス

- 社会面のパフォーマンス

- ガバナンス面のパフォーマンス

- 自動運転トラック市場における企業のESGリスク格付けとレベルの現状

- 自動運転トラック市場におけるESGに対する消費者の態度

- 自動運転トラック市場におけるESGの実践

- ケーススタディ

- 環境への取り組み

- 社会への取り組み

- ガバナンスへの取り組み

- 結果

- 投資

- BCCによる総論

第13章 特許分析

- 概要

- 取得済み特許

- 最近取得した特許

第14章 M&A・ベンチャー資金調達の見通し

- M&A分析

- 自動運転トラック市場におけるスタートアップの資金調達

第15章 競合情報

- ベンダー情勢

- 市場シェア分析

- Volvo AB

- Paccar Inc.

- Mercedes-Benz Group AG

- Traton Group

- TuSimple Inc.

- 戦略的分析

第16章 企業プロファイル

- AB VOLVO

- APTIV

- CATERPILLAR

- CONTINENTAL AG

- DENSO CORP.

- EINRIDE

- KODIAK ROBOTICS INC.

- MERCEDES-BENZ GROUP AG

- PACCAR INC.

- ROBERT BOSCH GMBH

- TESLA INC.

- TUSIMPLE HOLDINGS INC.

- WAYMO LLC

第17章 付録:略語

List of Tables

- Summary Table : Global Market for Autonomous Trucks, by Component, Through 2028

- Table 1 : PESTEL Analysis of Autonomous Trucks

- Table 2 : Global Market for Autonomous Trucks, by Component, Through 2028

- Table 3 : Hardware Components and Applications

- Table 4 : Global Market for Autonomous Trucks, by Autonomy, Through 2028

- Table 5 : Global Market for Autonomous Trucks, by Propulsion Type, Through 2028

- Table 6 : Global Market for Autonomous Trucks, by Truck Type, Through 2028

- Table 7 : Global Market for Autonomous Trucks, by End Use, Through 2028

- Table 8 : Global Market for Autonomous Trucks, by Region, Through 2028

- Table 9 : North American Market for Autonomous Trucks, by Country, Through 2028

- Table 10 : North American Market for Autonomous Trucks, by Component, Through 2028

- Table 11 : North American Market for Autonomous Trucks, by Autonomy, Through 2028

- Table 12 : North American Market for Autonomous Trucks, by Propulsion Type, Through 2028

- Table 13 : North American Market for Autonomous Trucks, by Truck Type, Through 2028

- Table 14 : North American Market for Autonomous Trucks, by End Use, Through 2028

- Table 15 : European Market for Autonomous Trucks, by Country, Through 2028

- Table 16 : European Market for Autonomous Trucks, by Component, Through 2028

- Table 17 : European Market for Autonomous Trucks, by Autonomy, Through 2028

- Table 18 : European Market for Autonomous Trucks, by Propulsion Type, Through 2028

- Table 19 : European Market for Autonomous Trucks, by Truck Type, Through 2028

- Table 20 : European Market for Autonomous Trucks, by End Use, Through 2028

- Table 21 : Asia-Pacific Market for Autonomous Trucks, by Country, Through 2028

- Table 22 : Asia-Pacific Market for Autonomous Trucks, by Component, Through 2028

- Table 23 : Asia-Pacific Market for Autonomous Trucks, by Autonomy, Through 2028

- Table 24 : Asia-Pacific Market for Autonomous Trucks, by Propulsion Type, Through 2028

- Table 25 : Asia-Pacific Market for Autonomous Trucks, by Truck Type, Through 2028

- Table 26 : Asia-Pacific Market for Autonomous Trucks, by End Use, Through 2028

- Table 27 : RoW Market for Autonomous Trucks, by Component, Through 2028

- Table 28 : RoW Market for Autonomous Trucks, by Autonomy, Through 2028

- Table 29 : RoW Market for Autonomous Trucks, by Propulsion Type, Through 2028

- Table 30 : RoW Market for Autonomous Trucks, by Truck Type, Through 2028

- Table 31 : RoW Market for Autonomous Trucks, by End Use, Through 2028

- Table 32 : Environmental ESG Metrics for AB Volvo, 2022

- Table 33 : Social ESG Metrics for AB Volvo, 2022

- Table 34 : Governance ESG Metrics for AB Volvo, 2022

- Table 35 : ESG Risk Ratings of Autonomous Trucks Companies, by Score and Level, 2022

- Table 36 : M&A Deals in the Autonomous Trucks Industry, January 2021 to October 2023

- Table 37 : Startup Funding in Autonomous Trucks, by Date, January 2021 to December 2022

- Table 38 : Autonomous Trucks Vendor Landscape

- Table 39 : Recent Developments in the Autonomous Trucks Market, Jan. 2020 to Oct. 2023

- Table 40 : AB Volvo: Financial Overview, 2022

- Table 41 : AB Volvo: Recent Developments, Oct. 2020 to June 2023

- Table 42 : AB Volvo: Product Portfolio

- Table 43 : Aptiv: Financial Overview, 2022

- Table 44 : Aptiv: Recent Developments, Aug. 2020 to Jan. 2023

- Table 45 : Aptiv: Product Portfolio

- Table 46 : Caterpillar: Financial Overview, 2022

- Table 47 : Caterpillar: Recent Developments, 2021

- Table 48 : Caterpillar: Product Portfolio

- Table 49 : Continental AG: Financial Overview, 2022

- Table 50 : Continental AG: Recent Developments, 2023

- Table 51 : Continental AG: Product Portfolio

- Table 52 : Denso Corp.: Financial Overview, 2021

- Table 53 : Denso Corp.: Recent Developments, 2021

- Table 54 : Denso Corp.: Product Portfolio

- Table 55 : Einride: Recent Developments, 2023

- Table 56 : Einride: Product Portfolio

- Table 57 : Kodiak Robotics Inc.: Recent Developments, 2023

- Table 58 : Kodiak Robotics Inc.: Product Portfolio

- Table 59 : Mercedes-Benz Group AG: Financial Overview, 2021

- Table 60 : Mercedes-Benz Group AG: Recent Developments, Oct. 2020 to July 2021

- Table 61 : Mercedes-Benz Group AG: Product Portfolio

- Table 62 : PACCAR Inc.: Financial Overview, 2022

- Table 63 : PACCAR Inc.: Recent Developments, Sept. 2021 to Jan. 2022

- Table 64 : PACCAR Inc.: Product Portfolio

- Table 65 : Robert Bosch GmbH: Financial Overview, 2021

- Table 66 : Robert Bosch GmbH: Recent Developments, 2023

- Table 67 : Robert Bosch GmbH: Product Portfolio

- Table 68 : Tesla Inc.: Financial Overview, 2022

- Table 69 : Tesla Inc.: Product Portfolio

- Table 70 : TuSimple Holdings Inc.: Financial Overview, 2022

- Table 71 : TuSimple Holdings Inc.: Recent Developments, Dec. 2022 to June 2023

- Table 72 : TuSimple Holdings Inc.: Product Portfolio

- Table 73 : Waymo LLC: Recent Developments, March 2020 to Aug. 2021

- Table 74 : Waymo LLC: Product Benchmarking

- Table 75 : Abbreviations Used in this Report

List of Figures

- Summary Figure : Global Market Share of Autonomous Trucks, by Component, 2022

- Figure 1 : Value Chain Analysis of the Market for Autonomous Trucks

- Figure 2 : Porter's Five Forces Analysis of the Autonomous Trucks Industry

- Figure 3 : Future of Autonomous Trucks, 2021

- Figure 4 : Trends in Global Market for Autonomous Trucks

- Figure 5 : Application of Emerging Technologies in Autonomous Trucks

- Figure 6 : Global Market Share of Autonomous Trucks, by Component, 2022

- Figure 7 : Global Market Share of Autonomous Trucks, by Autonomy, 2022

- Figure 8 : Global Market Share of Autonomous Trucks, by Propulsion Type, 2022

- Figure 9 : Global Market Share of Autonomous Trucks, by Truck Type, 2022

- Figure 10 : Global Market Share of Autonomous Trucks, by End Use, 2022

- Figure 11 : Global Market Share of Autonomous Trucks, by Region, 2022

- Figure 12 : North American Market Share of Autonomous Trucks, by Country, 2022

- Figure 13 : North American Market Share of Autonomous Trucks, by Component, 2022

- Figure 14 : North American Market Share of Autonomous Trucks, by Autonomy, 2022

- Figure 15 : North American Market Share of Autonomous Trucks, by Propulsion Type, 2022

- Figure 16 : North American Market Share of Autonomous Trucks, by Truck Type, 2022

- Figure 17 : North American Market Share of Autonomous Trucks, by End Use, 2022

- Figure 18 : European Market Share of Autonomous Trucks, by Country, 2022

- Figure 19 : European Market Share of Autonomous Trucks, by Component, 2022

- Figure 20 : European Market Share of Autonomous Trucks, by Autonomy, 2022

- Figure 21 : European Market Share of Autonomous Trucks, by Propulsion Type, 2022

- Figure 22 : European Market Share of Autonomous Trucks, by Truck Type, 2022

- Figure 23 : European Market Share of Autonomous Trucks, by End Use, 2022

- Figure 24 : Asia-Pacific Market Share of Autonomous Trucks, by Country, 2022

- Figure 25 : Asia-Pacific Market Share of Autonomous Trucks, by Component, 2022

- Figure 26 : Asia-Pacific Market Share of Autonomous Trucks, by Autonomy, 2022

- Figure 27 : Asia-Pacific Market Share of Autonomous Trucks, by Propulsion Type, 2022

- Figure 28 : Asia-Pacific Market Share of Autonomous Trucks, by Truck Type, 2022

- Figure 29 : Asia-Pacific Market Share of Autonomous Trucks, by End Use, 2022

- Figure 30 : RoW Market Share of Autonomous Trucks, by Component, 2022

- Figure 31 : RoW Market Share of Autonomous Trucks, by Autonomy, 2022

- Figure 32 : RoW Market Share of Autonomous Trucks, by Propulsion Type, 2022

- Figure 33 : RoW Market Share of Autonomous Trucks, by Truck Type, 2022

- Figure 34 : RoW Market Share of Autonomous Trucks, by End Use, 2022

- Figure 35 : Autonomous Trucks Patents Published, by Year, 2020-2023*

- Figure 36 : Share of M&A Deals in the Autonomous Trucks Industry, by Region, 2021-2023

- Figure 37 : Startup Fundings in the Autonomous Trucks Market, by Various Rounds, January 2021 to December 2022

- Figure 38 : Global Market Share of Autonomous Trucks, by Major Vendors, 2022

- Figure 39 : Recent Developments in the Autonomous Trucks Market, Strategy Share, January 2020 to October 2023

- Figure 40 : AB Volvo: Annual Revenue, 2021 and 2022

- Figure 41 : AB Volvo: Revenue Share, by Business Segment, 2022

- Figure 42 : AB Volvo: Revenue Share, by Region, 2022

- Figure 43 : Aptiv: Annual Revenue, 2021 and 2022

- Figure 44 : Aptiv: Revenue Share, by Business Segment, 2022

- Figure 45 : Aptiv: Revenue Share, by Region, 2022

- Figure 46 : Caterpillar: Annual Revenue, 2021 and 2022

- Figure 47 : Caterpillar: Revenue Share, by Business Segment, 2022

- Figure 48 : Caterpillar: Revenue Share, by Region, 2022

- Figure 49 : Continental AG: Annual Revenue, 2021 and 2022

- Figure 50 : Continental AG: Revenue Share, by Business Segment, 2022

- Figure 51 : Continental AG: Revenue Share, by Country/Region, 2022

- Figure 52 : Denso Corp.: Annual Revenue, 2020 and 2021

- Figure 53 : Denso Corp.: Revenue Share, by Business Segment, 2022

- Figure 54 : Denso Corp.: Revenue Share, by Country/Region, 2022

- Figure 55 : Mercedes-Benz Group AG: Annual Revenue, 2020 and 2021

- Figure 56 : Mercedes-Benz Group AG: Revenue Share, by Business Segment, 2022

- Figure 57 : Mercedes-Benz Group AG: Revenue Share, by Region, 2022

- Figure 58 : PACCAR Inc.: Annual Revenue, 2021 and 2022

- Figure 59 : PACCAR Inc.: Revenue Share, by Business Segment, 2022

- Figure 60 : PACCAR Inc.: Revenue Share, by Country/Region, 2022

- Figure 61 : Robert Bosch GmbH: Annual Revenue, 2020 and 2021

- Figure 62 : Robert Bosch GmbH: Revenue Share, by Business Segment, 2022

- Figure 63 : Robert Bosch GmbH: Revenue Share, by Region, 2022

- Figure 64 : Tesla Inc.: Annual Revenue, 2021 and 2022

- Figure 65 : Tesla Inc.: Revenue Share, by Business Segment, 2022

- Figure 66 : Tesla Inc.: Revenue Share, by Country/Region, 2022

- Figure 67 : TuSimple Holdings Inc.: Annual Revenue, 2021 and 2022

Highlights:

The global market for autonomous trucks is expected to grow from $3.3 billion in 2023 to over $6.9 billion by the end of 2028, at a compound annual growth rate (CAGR) of 16.2% during the forecast period of 2023-2028.

The software segment of the global autonomous trucks market is expected to grow from $2.4 billion in 2023 to $5.1 billion by 2028, at a CAGR of 16.7% during the forecast period of 2023-2028.

The hardware segment of the global autonomous trucks market is expected to grow from $919.9 million in 2023 to $1.8 billion by 2028, at a CAGR of 14.9% during the forecast period of 2023-2028.

Report Scope:

This report provides an overview of the global market for autonomous trucks and analyses market trends. Using 2022 as the base year, the report provides estimated market data for the forecast period 2023 through 2028. Revenue forecasts for this period are segmented based on component, autonomy, propulsion type, truck type, end use, and region.

The report also focuses on the major trends and challenges that affect the market and the competitive landscape. It explains the current market trends and provides detailed profiles of the major players and their strategies to enhance their market presence. The report estimates the size of the global autonomous trucks market in 2023 and provides projections of the expected market size through 2028.

Report Includes:

- 40 data tables and 36 additional tables

- An overview of the global market for autonomous trucks

- Analysis of global market trends, featuring historical revenue data for 2022, estimated figures for 2023, as well as forecasts for 2024, 2026 and 2028, including projections for compound annual growth rates (CAGRs) through 2028

- Evaluation of the current market size and revenue growth prospects, accompanied by a market share analysis by component, autonomy, propulsion type, truck type, end use and geographical region

- Coverage of evolving technologies such as automated braking systems, emergency lane assists systems, connectivity systems and navigation systems, and a discussion of their impact on the future of the automobile industry

- Analysis of the current and future market potential and the regulatory framework and reimbursement scenarios

- Review of patents, product pipelines, ESG trends and emerging technologies related to autonomous trucks

- Market share analysis of the key companies and coverage of mergers & acquisitions, joint ventures, collaborations and partnerships, as well as a patent analysis

- Profiles of leading market participants

Table of Contents

Chapter 1 Introduction

- Overview

- Study Goals and Objectives

- Reasons for Doing the Study

- Scope of Report

- What's New in this Update?

- Research Methodology

- Information Sources

- Geographic Breakdown

- Segmentation Breakdown

Chapter 2 Summary and Highlights

- Market Outlook

- Market Summary

Chapter 3 Market Overview

- Overview

- Value Chain Analysis

- PESTEL Analysis

- Government Regulations

- Porter's Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitutes

- Industry Competition

- Autonomous Trucks: Looking Ahead

- The Russia-Ukraine War's Impact on the Market

Chapter 4 Market Dynamics

- Overview

- Market Drivers

- Growing Emphasis on Improved Road Safety and Traffic Control

- Reduced Emissions and Higher Fuel Efficiency of Autonomous Trucks

- Improved Technological Landscape

- Market Challenges

- Inconsistent Regulatory Framework

- Lack of IT and Communication Infrastructure in Developing Nations

- Market Opportunities

- Growth of Connected Infrastructures

- Development of Intelligent Transportation Systems

Chapter 5 Emerging Technologies and Developments

- Overview

- Future Scope of Autonomous Trucks

- Application of Emerging Technologies in Autonomous Trucks

- Artificial Intelligence

- Machine Learning

- Advanced Driver-Assistance System

- Light Detection and Ranging

Chapter 6 Market Breakdown by Component

- Overview

- Software

- Hardware

Chapter 7 Market Breakdown by Autonomy

- Overview

- Semi-Autonomous

- Full Autonomous

Chapter 8 Market Breakdown by Propulsion Type

- Overview

- IC Engines

- Electric

- Hybrid

Chapter 9 Market Breakdown by Truck Type

- Overview

- Light-Duty

- Medium-Duty

- Heavy-Duty

Chapter 10 Market Breakdown by End Use

- Overview

- Logistics and Transportation

- Manufacturing

- Mining

- Other End Use

- Port

- Oil and Gas

- Chemicals

- Agriculture

- Construction

Chapter 11 Market Breakdown by Region

- Overview

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The U.K.

- Germany

- Asia-Pacific

- China

- India

- Japan

- Rest of the World

Chapter 12 Sustainability in Autonomous Trucks Industry: An ESG Perspective

- Key ESG Issues in the Autonomous Trucks Market

- Carbon Footprint/Environmental Impact

- Animal Welfare

- Labor Practices

- Transparency and Governance

- Autonomous Trucks Market ESG Performance Analysis

- Environmental Performance

- Social Performance

- Governance Performance

- Current Status of ESG Risk Ratings and Levels for Companies in the Autonomous Trucks Market

- Consumer Attitudes Towards ESG in the Autonomous Trucks Market

- ESG Practices in the Autonomous Trucks Market

- Case Study

- Environmental Initiatives

- Social Initiatives

- Governance Initiatives

- Outcomes

- Investments

- Concluding Remarks from BCC Research

Chapter 13 Patent Analysis

- Overview

- Granted Patents (2020-2023)

- Recently Awarded Patents

Chapter 14 M&A and Venture Funding Outlook

- Mergers and Acquisitions Analysis

- Startup Fundings in Autonomous Trucks Market

Chapter 15 Competitive Intelligence

- Vendor Landscape

- Market Share Analysis

- Volvo AB

- Paccar Inc.

- Mercedes-Benz Group AG

- Traton Group

- TuSimple Inc.

- Strategic Analysis

Chapter 16 Company Profiles

- AB VOLVO

- APTIV

- CATERPILLAR

- CONTINENTAL AG

- DENSO CORP.

- EINRIDE

- KODIAK ROBOTICS INC.

- MERCEDES-BENZ GROUP AG

- PACCAR INC.

- ROBERT BOSCH GMBH

- TESLA INC.

- TUSIMPLE HOLDINGS INC.

- WAYMO LLC