|

|

市場調査レポート

商品コード

1348228

ミールリプレイスメント市場Meal Replacement Market |

||||||

|

|||||||

| ミールリプレイスメント市場 |

|

出版日: 2023年09月12日

発行: BCC Research

ページ情報: 英文 169 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界のミールリプレイスメントの市場規模は、2022年の125億米ドル、2023年の133億米ドルから、予測期間中は6.7%のCAGRで推移し、2028年には184億米ドルの規模に成長すると予測されています。

地域別で見ると、北米市場が2023年の56億米ドルから、6.3%のCAGRで推移し、2028年には76億米ドルの規模に成長すると予測されています。また、アジア太平洋市場は2023年の39億米ドルから、7.7%のCAGRで推移し、2028年には57億米ドルの規模に成長すると予測されています。

当レポートでは、世界のミールリプレイスメントの市場を調査し、市場および技術の概要、市場影響因子の分析、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、技術および特許の動向、ESGの展開、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 サマリー・ハイライト

第3章 産業概要

- サプライチェーン分析

- 原料および原材料の調達

- 製品製造

- 流通

- 消費者

- 規制状況

- 栄養成分表示

- SWOT分析

第4章 ESG分析

- ESGの重要性

- ミールリプレイスメント業界におけるESGの柱

- 業界のESGパフォーマンス分析

- ケーススタディ

- 今後の動向

- BCCによる総論

第5章 市場力学

- ポーターのファイブフォース分析

- 市場成長推進要因

- 健康意識の高まりによるミールリプレイスメント需要の高まり

- 小分け食品やスナックの需要の高まり

- 植物性のミールリプレイスメントへの需要の高まり

- 肥満と糖尿病の有病率の上昇

- 市場成長抑制要因

- ミールリプレイスメントに対する規制の拡大

- ミールリプレイスメント製品に関する誤解

- ミールリプレイスメント製品のコスト高

- 市場機会

第6章 市場内訳:製品タイプ別

- 粉末

- RTD

- ミールリプレイスメントバー

- その他

第7章 市場内訳:流通チャネル別

- オンライン

- オフライン

- コンビニエンスストア

- ハイパーマーケット/スーパーマーケット

- 専門店

- その他

第8章 市場内訳:地域別

- 世界のミールリプレイスメント市場

- 北米

- 米国

- カナダ

- 欧州

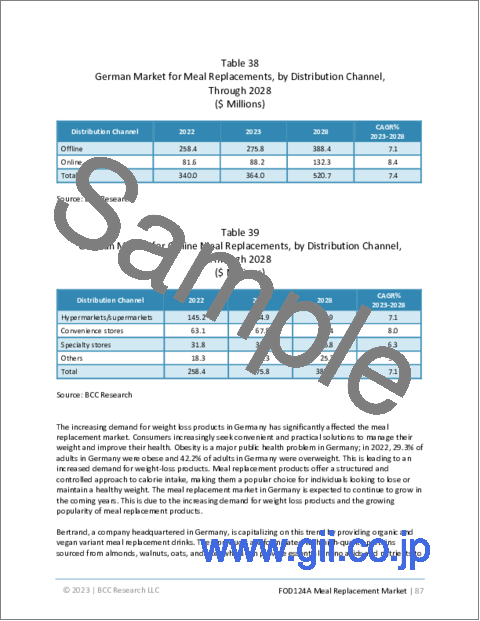

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州地域

- アジア太平洋

- 中国

- 日本

- インド

- その他のアジア太平洋地域

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ地域

- 中東・アフリカ

- 南アフリカ

- UAE

- その他の中東・アフリカ地域

第9章 特許レビュー

第10章 競合情勢

- 市場シェア分析

- 戦略的展開

第11章 企業プロファイル

- ABBOTT LABORATORIES

- AMWAY CORP.

- ATKINS

- GARDEN OF LIFE

- GENERAL MILLS INC.

- GLANBIA PLC

- HEALTHY N FIT INTERNATIONAL INC.

- HERBALIFE INTERNATIONAL OF AMERICA INC.

- HUEL INC.

- KELLOGG CO.

- NESTLE S.A.

- NUTRISYSTEM INC.

- ORGAIN INC.

- SOYLENT

- USANA HEALTH SCIENCES

第12章 付録:頭字語

List of Tables

- Summary Table : Global Market for Meal Replacements, by Region, Through 2028

- Table 1 : Regulatory Requirements for Meal Replacement

- Table 2 : Key Regulations, by Region/Country

- Table 3 : Meal Replacement Product Standards

- Table 4 : Additives Authorized for Meal Replacement

- Table 5 : Net-Zero GHG Commitments, by Major Meal Replacement Companies

- Table 6 : Current Status of ESG in the Meal Replacement: ESG Ranking for 2022

- Table 7 : U.S. Plant-Based Food Sales, by Category, 2022

- Table 8 : Average Prices of Meal Replacement Products and Dietary Supplements

- Table 9 : Global Market for Meal Replacements, by Product Type, Through 2028

- Table 10 : Global Market for Powdered Meal Replacements, by Region, Through 2028

- Table 11 : Global Market for Ready-to-Drink Meal Replacements, by Region, Through 2028

- Table 12 : Global Market for Meal Replacement Bars, by Region, Through 2028

- Table 13 : Global Market for Other Types of Meal Replacements, by Region, Through 2028

- Table 14 : Global Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 15 : Global Market for Online Meal Replacements, by Region, Through 2028

- Table 16 : Global Market for Offline Meal Replacements, by Region, Through 2028

- Table 17 : Global Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 18 : Global Market for Meal Replacements Purchased through Convenience Stores, by Region, Through 2028

- Table 19 : Global Market for Meal Replacements Purchased through Hypermarkets/Supermarkets, by Region, Through 2028

- Table 20 : Global Market for Meal Replacements Purchased through Specialty Stores, by Region, Through 2028

- Table 21 : Global Market for Meal Replacements Purchased through Other Offline Sources, by Region, Through 2028

- Table 22 : Global Market for Meal Replacements, by Region, Through 2028

- Table 23 : North American Market for Meal Replacements, by Country, Through 2028

- Table 24 : North American Market for Meal Replacements, by Product Type, Through 2028

- Table 25 : North American Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 26 : North American Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 27 : U.S. Market for Meal Replacements, by Product Type, Through 2028

- Table 28 : U.S. Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 29 : U.S. Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 30 : Canadian Market for Meal Replacements, by Product Type, Through 2028

- Table 31 : Canadian Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 32 : Canadian Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 33 : European Market for Meal Replacements, by Country, Through 2028

- Table 34 : European Market for Meal Replacements, by Product Type, Through 2028

- Table 35 : European Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 36 : European Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 37 : German Market for Meal Replacements, by Product Type, Through 2028

- Table 38 : German Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 39 : German Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 40 : U.K. Market for Meal Replacements, by Product Type, Through 2028

- Table 41 : U.K. Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 42 : U.K. Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 43 : French Market for Meal Replacements, by Product Type, Through 2028

- Table 44 : French Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 45 : French Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 46 : Italian Market for Meal Replacements, by Product Type, Through 2028

- Table 47 : Italian Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 48 : Italian Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 49 : Rest of Europe Market for Meal Replacements, by Product Type, Through 2028

- Table 50 : Rest of Europe Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 51 : Rest of Europe Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 52 : Asia-Pacific Market for Meal Replacements, by Country, Through 2028

- Table 53 : Asia-Pacific Market for Meal Replacements, by Product Type, Through 2028

- Table 54 : Asia-Pacific Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 55 : Asia-Pacific Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 56 : Chinese Market for Meal Replacements, by Product Type, Through 2028

- Table 57 : Chinese Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 58 : Chinese Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 59 : Japanese Market for Meal Replacements, by Product Type, Through 2028

- Table 60 : Japanese Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 61 : Japanese Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 62 : Indian Market for Meal Replacements, by Product Type, Through 2028

- Table 63 : Indian Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 64 : Indian Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 65 : Rest of Asia Pacific Market for Meal Replacements, by Product Type, Through 2028

- Table 66 : Rest of Asia-Pacific Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 67 : Rest of Asia-Pacific Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 68 : Latin American Market for Meal Replacements, by Country, Through 2028

- Table 69 : Latin American Market for Meal Replacements, by Product Type, Through 2028

- Table 70 : Latin American Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 71 : Latin American Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 72 : Brazilian Market for Meal Replacements, by Product Type, Through 2028

- Table 73 : Brazilian Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 74 : Brazilian Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 75 : Mexican Market for Meal Replacements, by Product Type, Through 2028

- Table 76 : Mexican Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 77 : Mexican Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 78 : Rest of Latin American Market for Meal Replacements, by Product Type, Through 2028

- Table 79 : Rest of Latin American Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 80 : Rest of Latin American Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 81 : Middle East and African Market for Meal Replacements, by Country, Through 2028

- Table 82 : Middle East and African Market for Meal Replacements, by Product Type, Through 2028

- Table 83 : Middle East and African Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 84 : Middle East and African Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 85 : South African Market for Meal Replacements, by Product Type, Through 2028

- Table 86 : South African Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 87 : South African Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 88 : UAE Market for Meal Replacements, by Product Type, Through 2028

- Table 89 : UAE Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 90 : UAE Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 91 : Rest of the Middle East and African Market for Meal Replacements, by Product Type, Through 2028

- Table 92 : Rest of the Middle East and African Market for Meal Replacements, by Distribution Channel, Through 2028

- Table 93 : Rest of the Middle East and African Market for Offline Meal Replacements, by Distribution Channel, Through 2028

- Table 94 : Patents on Meal Replacements, 2020-2023

- Table 95 : Strategic Developments, 2018-2022

- Table 96 : Abbott Laboratories: Financials, 2022

- Table 97 : Abbott Laboratories: Product Portfolio

- Table 98 : Abbott Laboratories: News, 2022

- Table 99 : Amway: Product Portfolio

- Table 100 : Atkins: Product Portfolio

- Table 101 : Atkins: News, 2022

- Table 102 : Garden of Life: Product Portfolio

- Table 103 : General Mills Inc.: Financials, 2022

- Table 104 : General Mills Inc.: Product Portfolio

- Table 105 : Glanbia PLC: Financials, 2022

- Table 106 : Glanbia PLC: Product Portfolio

- Table 107 : Glanbia PLC: News, 2018

- Table 108 : Healthy 'N Fit International Inc.: Product Portfolio

- Table 109 : Herbalife Nutrition Ltd.: Financials, 2022

- Table 110 : Herbalife Nutrition Ltd.: Product Portfolio

- Table 111 : Herbalife Nutrition Ltd.: News, 2019-2021

- Table 112 : Huel Inc.: Product Portfolio

- Table 113 : Huel Inc.: News, 2022

- Table 114 : Kellogg Co.: Financials, 2022

- Table 115 : Kellogg Co.: Product Portfolio

- Table 116 : Kellogg Co.: News, 2022

- Table 117 : Nestle S.A.: Financials, 2022

- Table 118 : Nestle S.A.: Product Portfolio

- Table 119 : Nestle S.A.: News, 2023

- Table 120 : Nutrisystem Inc.: Product Portfolio

- Table 121 : Nutrisystem Inc.: News, 2021

- Table 122 : Orgain Inc.: Product Portfolio

- Table 123 : Orgain Inc.: News, 2022

- Table 124 : Soylent: Product Portfolio

- Table 125 : Soylent: News, 2023

- Table 126 : USANA Health Sciences: Product Portfolio

- Table 127 : Acronyms Used in This Report

List of Figures

- Summary Figure : Global Market for Meal Replacements, by Region, 2022-2028

Figure A : Research Methodology for Global Meal Replacement

- Figure 1 : Macro- and Micronutrient Composition of Meal Replacement

- Figure 2 : Supply Chain of Meal Replacement

- Figure 3 : SWOT Analysis of Meal Replacement

- Figure 4 : General Mills Inc.: ESG Issues

- Figure 5 : Porter's Five Forces Analysis for Meal Replacement

- Figure 6 : Common Restrictions for Meal Replacement

- Figure 7 : Global Global Market Shares of Meal Replacements, by Product Type, 2022

- Figure 8 : Global Market Shares of Powdered Meal Replacements, by Region, 2022

- Figure 9 : Global Market Shares of Ready-to-Drink Meal Replacements, by Region, 2022

- Figure 10 : Global Market for Market Shares of Meal Replacement Bars, by Region, 2022

- Figure 11 : Global Market Shares of Other Types of Meal Replacements, by Region, 2022

- Figure 12 : Global Global Market Shares of Meal Replacements, by Distribution Channel, 2022

- Figure 13 : Global Market Shares of Online Meal Replacements, by Region, 2022

- Figure 14 : Global Market Shares of Offline Meal Replacements, by Region, 2022

- Figure 15 : Global Market Shares of Meal Replacements Purchased through Convenience Stores, by Region, 2022

- Figure 16 : Global Market Shares of Meal Replacements Purchased through Hypermarkets/Supermarkets, by Region, 2022

- Figure 17 : Global Market Shares of Meal Replacements Purchased through Specialty Stores, by Region, 2022

- Figure 18 : Global Market Shares of Meal Replacements Purchased through Other Offline Sources, by Region, 2022

- Figure 19 : Global Global Market Shares of Meal Replacements, by Region, 2022

- Figure 20 : North American Market Shares of Meal Replacements, by Country, 2022

- Figure 21 : European Market Shares of Meal Replacements, by Country, 2022

- Figure 22 : Asia-Pacific Market Shares of Meal Replacements, by Country, 2022

- Figure 23 : New Product Launches of High/Added Protein RTDs in Asia-Pacific

- Figure 24 : Latin American Market Shares of Meal Replacements, by Country, 2022

- Figure 25 : Middle East and African Market Shares of Meal Replacements, by Country, 2022

- Figure 26 : Patents Published and Applications, 2019-2023*

- Figure 27 : Share of Patents Granted, by Country, 2019-2023*

- Figure 28 : Share of Patents Granted, by Applicant, 2019-2023*

- Figure 29 : Global Shares of Major Players in the Market for Meal Replacements, 2022

- Figure 30 : Share of Strategic Developments, by Type, 2018-2022

- Figure 31 : Abbott Laboratories: Financials, 2021 and 2022

- Figure 32 : Abbott Laboratories: Revenue Shares, by Region/Country, 2022

- Figure 33 : Abbott Laboratories: Revenue Shares, by Business Unit, 2022

- Figure 34 : General Mills Inc.: Financials, 2021 and 2022

- Figure 35 : General Mills Inc.: Revenue Shares, by Region/Country, 2022

- Figure 36 : General Mills Inc.: Revenue Shares, by Business Unit, 2022

- Figure 37 : Glanbia PLC: Financials, 2021 and 2022

- Figure 38 : Glanbia PLC: Revenue Shares, by Region, 2022

- Figure 39 : Glanbia PLC: Revenue Shares, by Business Unit, 2022

- Figure 40 : Herbalife Nutrition Ltd.: Financials, 2021 and 2022

- Figure 41 : Herbalife Nutrition Ltd.: Revenue Shares, by Region/Country, 2022

- Figure 42 : Herbalife Nutrition Ltd.: Revenue Shares, by Business Unit, 2022

- Figure 43 : Kellogg Co.: Annual Revenue, 2021 and 2022

- Figure 44 : Kellogg Co.: Revenue Shares, by Region, 2022

- Figure 45 : Kellogg Co.: Revenue Shares, by Business Unit, 2022

- Figure 46 : Nestle S.A.: Financials, 2021 and 2022

- Figure 47 : Nestle S.A.: Revenue Shares, by Region, 2022

- Figure 48 : Nestle S.A.: Revenue Shares, by Business Unit, 2022

Highlights:

The global meal replacements market should reach $18.4 billion by 2028 from $13.3 billion in 2023 at a compound annual growth rate (CAGR) of 6.7% for the forecast period of 2023 to 2028. And in 2022 (base year), the market was $12.5 billion.

North American meal replacements market is expected to grow from $5.6 billion in 2023 to $7.6 billion in 2028 at a CAGR of 6.3% for the forecast period of 2023 to 2028.

Asia-Pacific meal replacements market is expected to grow from $3.9 billion in 2023 to $5.7 billion in 2028 at a CAGR of 7.7% for the forecast period of 2023 to 2028.

Report Scope:

The report provided an updated review of the global meal replacement market, focusing on its product type and distribution channel. Definitive and detailed estimates and forecasts of the worldwide meal replacement market are provided, followed by a detailed analysis of regions, countries, and manufacturers.

The global meal replacement market by product type is segmented into powder, ready-to-drink, meal replacement bar, and others. The market is segmented by distribution channel, including online and offline.

The market size and estimations are provided in terms of value (U.S. $ millions), considering 2022 as a base year, and the market forecast is provided from 2023 to 2028. Regional-level market sizes based on product type and distribution channels are provided.

The report also discusses the major players across each regional meal replacement market. Further, it explains the global meal replacement market's primary drivers, regional dynamics, and current trends across the industry. The report concludes with a detailed focus on the vendor landscape and includes complete profiles of the major players in the market.

Report Includes:

- 93 data tables and 35 additional tables

- An overview of the current and future global markets for meal replacement

- Analyses of the global market trends, with historical market revenue data (sales figures) for 2022, estimates for 2023, and projections of compound annual growth rates (CAGRs) through 2028

- Estimation of the actual market size and revenue forecast for global meal replacement market, and corresponding market share analysis based on product, distribution/sales channel, and region

- In-depth information (facts and figures) concerning market growth drivers, opportunities and challenges, current trends, products, regulations, and new industries related to meal replacement

- Holistic review of the impact of Covid-19 and the Russia-Ukraine war on meal replacement market

- A look at the manufacturers and other market participants involved in the meal replacement market, and analyze the structure of this industry (e.g., market shares, concentration and recent merger and acquisition (M&A) activity)

- Understanding of the importance of ESG in meal replacement market, consumer attitudes towards sustainability, risks and opportunity assessment, and ESG practices followed by different types of companies, manufacturers and other industry participants

- Analysis of the company competitive landscape of major stakeholder companies based on their recent developments, key financials and segmental revenues, and operational integration

- Profile descriptions of the leading market players in the market of the industry, including Abbott Laboratories, General Mills Inc., Herbalife Nutrition Ltd., Kellogg Co. and Nestle S.A.

Table of Contents

Chapter 1 Introduction

- Study Goals and Objectives

- Reasons for Doing This Study

- Scope of Report

- Methodology

- Information Sources

- Geographic Breakdown

Chapter 2 Summary and Highlights

- Market Outlook

- Summary

Chapter 3 Industry Overview

- Introduction

- Supply Chain Analysis

- Ingredient Sourcing/Raw Material Procurement

- Product Manufacturing

- Distribution

- Consumers

- Regulatory Landscape

- Labeling for Nutrient Content Declaration: Meal Replacements

- SWOT Analysis of Meal Replacement

- Strengths

- Weakness

- Opportunities

- Threats

Chapter 4 ESG Analysis

- Importance of ESG

- ESG Pillars in Meal Replacement Industry

- Industry ESG Performance Analysis

- Case Study

- Future Trends

- Concluding Remarks from BCC

Chapter 5 Market Dynamics

- Porter's Five Forces Analysis

- Threat of New Entrants: Low

- Bargaining Power of Buyers: Moderate

- Bargaining Power of Suppliers: Moderate

- Threat of Substitutes: High

- Competitive Rivalry: High

- Market Growth Drivers

- Increasing Health Awareness Drives the Demand for Meal Replacement

- Rising Demand for Small-Portion Food and Snacking

- Growing Demand for Plant-Based Meal Replacement

- Growing Prevalence of Obesity and Diabetes

- Market Restrains

- Growing Regulations for Meal Replacement

- Misconception About Meal Replacement Products

- Higher Cost of Meal Replacement Products

- Market Opportunities

Chapter 6 Market Breakdown by Product Type

- Introduction

- Powder

- Ready to Drink

- Meal Replacement Bars

- Others

Chapter 7 Market Breakdown by Distribution Channel

- Introduction

- Online

- Offline

- Convenience Stores

- Hypermarkets/Supermarkets

- Specialty Stores

- Others

Chapter 8 Market Breakdown by Region

- Global Market for Meal Replacements

- North American Market for Meal Replacements by Country

- United States

- Canada

- European Market for Meal Replacements by Country

- Germany

- United Kingdom

- France

- Italy

- Rest of Europe

- Asia-Pacific Market for Meal Replacements by Country

- China

- Japan

- India

- Rest of Asia-Pacific

- Latin American Market for Meal Replacements by Country

- Brazil

- Mexico

- Rest of Latin America

- Middle East and African Market for Meal Replacements by Country

- South Africa

- United Arab Emirates

- Rest of the Middle East and Africa

Chapter 9 Patent Review

Chapter 10 Competitive Landscape

- Market Share Analysis

- Strategic Developments

Chapter 11 Company Profiles

- ABBOTT LABORATORIES

- AMWAY CORP.

- ATKINS

- GARDEN OF LIFE

- GENERAL MILLS INC.

- GLANBIA PLC

- HEALTHY N FIT INTERNATIONAL INC.

- HERBALIFE INTERNATIONAL OF AMERICA INC.

- HUEL INC.

- KELLOGG CO.

- NESTLE S.A.

- NUTRISYSTEM INC.

- ORGAIN INC.

- SOYLENT

- USANA HEALTH SCIENCES