|

|

市場調査レポート

商品コード

1322933

電気自動車 (EV) 用電池の世界市場Global Electrical Vehicle Battery Market |

||||||

|

|||||||

| 電気自動車 (EV) 用電池の世界市場 |

|

出版日: 2023年08月01日

発行: BCC Research

ページ情報: 英文 302 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界の電気自動車 (EV) 用電池の市場規模は、2023年の664億米ドルから、予測期間中は19.4%のCAGRで推移し、2028年には1,613億米ドルの規模に成長すると予測されています。

地域別でみると、北米地域は、2023年の106億米ドルから、CAGR16.3%で推移し、2028年には226億米ドルに成長すると予測されています。また、アジア太平洋地域は2023年の366億米ドルから、予測期間中はCAGR21.6で推移し、2028年には975億米ドルに成長すると予測されています。

当レポートでは、世界の電気自動車 (EV) 用電池の市場を調査し、市場概要、市場影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、ESGの展開、新興技術と新たな開発、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 サマリー・ハイライト

第3章 市場概要

- EV用電池の進化

- バリューチェーン分析

- 原材料と加工品

- セルコンポーネントの製造

- セル製造

- 電池パックの製造

- EVの製造

- リサイクル

- ポーターのファイブフォースモデル

- COVID-19とウクライナ・ロシア戦争が世界市場に与える影響

第4章 市場力学

- 概要

- 市場促進要因

- 市場抑制要因

- 市場機会

- 市場力学の短期的および長期的影響

第5章 市場内訳:電池タイプ別

- 概要

- リチウムイオン電池・高機能電池

- リチウム電池化学

- リチウムイオン電池の構造

- 先進電池

- 全固体電池

- ナトリウムイオン電池

- ニッケル水素電池

- 鉛蓄電池

第6章 市場内訳:推進タイプ別

- 概要

- BEV

- BEV:市場促進要因

- BEV:主要コンポーネント

- HEV

- HEV:市場促進要因

- HEVのオペレーション

- HEVの主要コンポーネント

- PHEV

- PHEVのオペレーション

- PHEV:市場促進要因

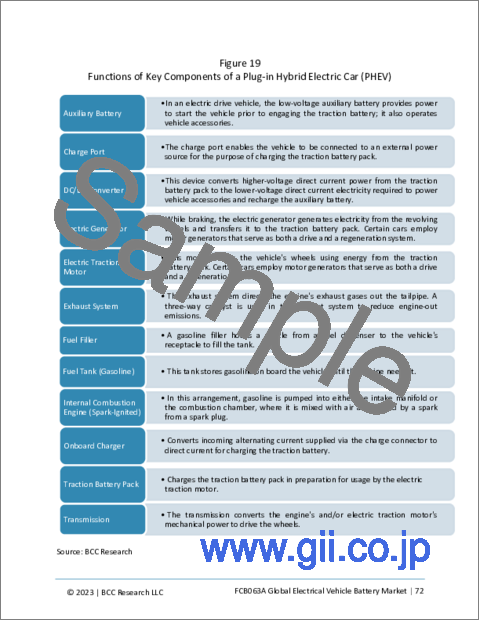

- PHEV:主要コンポーネント

- FCEV

- FCEV:主要コンポーネント

第7章 市場内訳:車両タイプ別

- 概要

- 乗用車

- 乗用車市場:サマリー

- バン

- バス

- 電気バス市場:サマリー

- トラック

- その他の車両

- 二輪車

- オフハイウェイ車両

第8章 市場内訳:ボンディング別

- 概要

- ワイヤーボンディング

- レーザーボンディング

第9章 市場内訳:電池容量別

- 概要

- 50kWh未満

- 50~100kWh

- 100~200kWh

- 200~300kWh

- 300kWh超

第10章 市場内訳:電池形状別

- 概要

- プリズム形

- 円筒形

- パウチ

第11章 市場内訳:材料別

- 概要

- リチウム

- コバルト

- ニッケル

- その他

- マンガン

- 天然黒鉛

第12章 市場内訳:地域別

- 概要

- 北米

- 米国

- カナダ

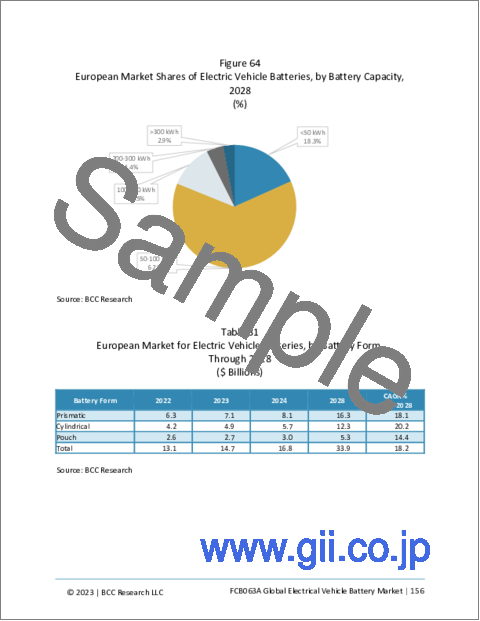

- 欧州

- ドイツ

- フランス

- ノルウェー

- 英国

- その他の欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- その他のアジア太平洋地域

- その他の地域

- 中東・アフリカ

- 南米

第13章 ESGの展開

- 概要

- EV用電池とESGの密接な関係

- EV用電池業界におけるESGの重要性

- ESG目標達成に向けたEV用電池の取り組み

- EV電池製造業者におけるESGの浸透

- EV用電池市場におけるESGの現状

- EV用電池産業によるESGの未来

- ケーススタディ:ESG導入の成功例

- BCCからの総論

第14章 新たな技術と開発

- 現在の市場動向

- エネルギー密度の増加

- コスト削減

- 電池寿命の延長

- 急速充電インフラ

- 持続可能でリサイクル可能な電池

- EV用電池の新たな動向・今後の動向

- 技術的背景

- EV用電池技術の進歩

- 電池寿命の延長

- リサイクルとセカンドライフの用途

- 電池と車両システムの統合

- 持続可能な電池材料

- 提携・協力

第15章 特許分析

- 概要

- 主要特許

第16章 M&A・資金調達の見通し

- M&A分析

- EV用電池のスタートアップによる資金調達

第17章 競合情勢

- 概要

- 市場シェア分析

- 市場戦略の分析

- 合意

- 提携

- 製品の発売

- 拡張

- 投資

- 市場の主な展開

- 合意

- 提携

- 製品の発売

- 拡張

- 投資

第18章 企業プロファイル

- BYD CO. LTD.

- CONTEMPORARY AMPEREX TECHNOLOGY LTD. (CATL)

- CHINA LITHIUM BATTERY TECHNOLOGY CO. LTD. (CALB)

- CLARIOSNO

- ENERSYS

- ENVISION AUTOMOTIVE ENERGY SUPPLY CORP. (AESC)

- LG CHEM

- MITSUBISHI CORP.

- MOLICEL

- PANASONIC HOLDINGS CORP.

- SAMSUNG SDI CO. LTD.

- SK ON CO. LTD.

- TOSHIBA CORP.

- VEHICLE ENERGY JAPAN INC.

- PRIMEARTH EV ENERGY CO. LTD.

第19章 付録:頭字語

List of Tables

- Summary Table : Global Market for Electric Vehicle Batteries, by Region, Through 2028

- Table 1 : Raw Material Producing Countries

- Table 2 : Impact of Market Drivers on the Global Market

- Table 3 : Impact of Restraints on the Global Market

- Table 4 : Impact of Challenges on the Global Market

- Table 5 : Impact of Opportunity on the Global Market

- Table 6 : Global Market for Electric Vehicle Batteries, by Type of Battery, Through 2028

- Table 7 : Global Market for Electric Vehicle Batteries, by Type of Propulsion, Through 2028

- Table 8 : Global Market for Electric Vehicle Batteries, by Type of Vehicle, Through 2028

- Table 9 : Consensus, Optimistic, and Pessimistic Scenarios for EV Passenger Vehicles

- Table 10 : Consensus, Optimistic, and Pessimistic Scenarios for the Electric Bus Market

- Table 11 : Consensus, Optimistic, and Pessimistic Scenarios for Electric Scooters

- Table 12 : Global Market for Electric Vehicle Batteries, by Bonding Method, Through 2028

- Table 13 : Global Market for Electric Vehicle Batteries, by Battery Capacity, Through 2028

- Table 14 : Global Market for Electric Vehicle Batteries, by Battery Form, Through 2028

- Table 15 : Global Market for Electric Vehicle Batteries, by Type of Material, Through 2028

- Table 16 : Global Market for Electric Vehicle Batteries, by Region, Through 2028

- Table 17 : North American Market for Electric Vehicle Batteries, by Country, Through 2028

- Table 18 : North American Market for Electric Vehicle Batteries, by Type of Battery, Through 2028

- Table 19 : North American Market for Electric Vehicle Batteries, by Type of Propulsion, Through 2028

- Table 20 : North American Market for Electric Vehicle Batteries, by Type of Vehicle, Through 2028

- Table 21 : North American Market for Electric Vehicle Batteries, by Bonding Method, Through 2028

- Table 22 : North American Market for Electric Vehicle Batteries, by Battery Capacity, Through 2028

- Table 23 : North American Market for Electric Vehicle Batteries, by Battery Form, Through 2028

- Table 24 : North American Market for Electric Vehicle Batteries, by Type of Material, Through 2028

- Table 25 : European Market for Electric Vehicle Batteries, by Country, Through 2028

- Table 26 : European Market for Electric Vehicle Batteries, by Type of Battery, Through 2028

- Table 27 : European Market for Electric Vehicle Batteries, by Type of Propulsion, Through 2028

- Table 28 : European Market for Electric Vehicle Batteries, by Type of Vehicle, Through 2028

- Table 29 : European Market for Electric Vehicle Batteries, by Bonding Method, Through 2028

- Table 30 : European Market for Electric Vehicle Batteries, by Battery Capacity, Through 2028

- Table 31 : European Market for Electric Vehicle Batteries, by Battery Form, Through 2028

- Table 32 : European Market for Electric Vehicle Batteries, by Type of Material, Through 2028

- Table 33 : Asia-Pacific Market for Electric Vehicle Batteries, by Country, Through 2028

- Table 34 : Asia-Pacific Market for Electric Vehicle Batteries, by Type of Battery, Through 2028

- Table 35 : Asia-Pacific Market for Electric Vehicle Batteries, by Type of Propulsion, Through 2028

- Table 36 : Asia-Pacific Market for Electric Vehicle Batteries, by Type of Vehicle, Through 2028

- Table 37 : Asia-Pacific Market for Electric Vehicle Batteries, by Bonding Method, Through 2028

- Table 38 : Asia-Pacific Market for Electric Vehicle Batteries, by Battery Capacity, Through 2028

- Table 39 : Asia-Pacific Market for Electric Vehicle Batteries, by Battery Form, Through 2028

- Table 40 : Asia-Pacific Market for Electric Vehicle Batteries, by Type of Material, Through 2028

- Table 41 : Rest of the World Market for Electric Vehicle Batteries, by Subregion, Through 2028

- Table 42 : Rest of the World Market for Electric Vehicle Batteries, by Type of Battery, Through 2028

- Table 43 : Rest of the World Market for Electric Vehicle Batteries, by Type of Propulsion, Through 2028

- Table 44 : Rest of the World Market for Electric Vehicle Batteries, by Type of Vehicle, Through 2028

- Table 45 : Rest of the World Market for Electric Vehicle Batteries, by Bonding Method, Through 2028

- Table 46 : Rest of the World Market for Electric Vehicle Batteries, by Battery Capacity, Through 2028

- Table 47 : Rest of the World Market for Electric Vehicle Batteries, by Battery Form, Through 2028

- Table 48 : Rest of the World Market for Electric Vehicle Batteries, by Type of Material, Through 2028

- Table 49 : Environmental Factors for the Electric Vehicle Battery Industry

- Table 50 : Social Factors for the Electric Vehicle Battery Industry

- Table 51 : Governance Factors for the Electric Vehicle Battery Industry

- Table 52 : ESG Score for the Market for Electric Vehicle Batteries

- Table 53 : Completed Goals of ESG by EnerSys

- Table 54 : LG Chem's Five Key Sustainability Tasks

- Table 55 : M&A Deals, Global Market for Electric Vehicle Batteries, January 2021-March 2023

- Table 56 : Start-up Funding in Market for Electric Vehicle Batteries, January 2022-April 2023

- Table 57 : Agreements in the Market for Electric Vehicle Batteries, March 2022-May 2023

- Table 58 : Partnerships in the Market for Electric Vehicle Batteries, January 2022-April 2023

- Table 59 : Product Launch Strategies in the Market for Electric Vehicle Batteries, January 2022-April 2023

- Table 60 : Company Expansion Strategies in the Market for Electric Vehicle Batteries, March 2022-May 2023

- Table 61 : Investments in the Market for Electric Vehicle Batteries, July 2022-May 2023

- Table 62 : BYD Co. Ltd.: Recent Developments, 2021 and 2022

- Table 63 : BYD Co. Ltd.: Electric Vehicle Batteries Product Portfolio

- Table 64 : Contemporary Amperex Technology Co. Ltd.: Recent Developments, 2023

- Table 65 : Contemporary Amperex Technology Co. Ltd.: Electric Vehicle Batteries Product Portfolio

- Table 66 : China Aviation Lithium Battery Technology Co. Ltd.: Recent Developments, 2023

- Table 67 : China Aviation Lithium Battery Technology Co. Ltd.: Electric Vehicle Batteries Product Portfolio

- Table 68 : Clarios: Recent Developments, 2022

- Table 69 : Clarios: Electric Vehicle Batteries Product Portfolio

- Table 70 : EnerSys: Annual Revenue, 2021 and 2022

- Table 71 : EnerSys: Recent Developments, 2022

- Table 72 : EnerSys: Electric Vehicle Batteries Product Portfolio

- Table 73 : Envision Aesc Group Ltd.: Recent Developments, 2022

- Table 74 : Envision Aesc Group Ltd.: Electric Vehicle Batteries Product Portfolio

- Table 75 : LG Chem: Annual Revenue, 2021 and 2022

- Table 76 : LG Chem: Recent Developments, 2023

- Table 77 : LG Chem: Electric Vehicle Batteries Product Portfolio

- Table 78 : Mitsubishi Corp.: Annual Revenue, 2021 and 2022

- Table 79 : Mitsubishi Corp.: Recent Developments, 2022 and 2023

- Table 80 : Mitsubishi Corp.: Electric Vehicle Batteries Product Portfolio

- Table 81 : MOLICEL: Recent Developments, 2022

- Table 82 : MOLICEL: Electric Vehicle Batteries Product Portfolio

- Table 83 : Panasonic Holdings Corp.: Annual Revenue, 2021 and 2022

- Table 84 : Panasonic Holdings Corp.: Recent Developments, 2022 and 2023

- Table 85 : Panasonic Holdings Corp.: Electric Vehicle Batteries Product Portfolio

- Table 86 : Samsung SDI Co. Ltd.: Annual Revenue, 2021 and 2022

- Table 87 : Samsung SDI Co. Ltd.: Recent Developments, 2022 and 2023

- Table 88 : Samsung SDI Co. Ltd.: Electric Vehicle Batteries Product Portfolio

- Table 89 : SK on Co. Ltd.: Recent Developments, 2022 and 2023

- Table 90 : SK On Co. Ltd.: Electric Vehicle Batteries Product Portfolio

- Table 91 : Toshiba Corp.: Annual Revenue, 2021 and 2022

- Table 92 : Toshiba Corp.: Recent Developments, 2022 and 2023

- Table 93 : Toshiba Corp.: Electric Vehicle Batteries Product Portfolio

- Table 94 : Vehicle Energy Japan Inc.: Recent Developments, 2022 and 2023

- Table 95 : Vehicle Energy Japan Inc.: Electric Vehicle Batteries Product Portfolio

- Table 96 : Primearth EV Energy Co. Ltd.: Electric Vehicle Batteries Product Portfolio

- Table 97 : Acronyms and Abbreviations Used in This Report

List of Figures

- Summary Figure : Global Market Shares of Electric Vehicle Batteries, by Region, 2022

Figure A : Top-Down and Bottom-Up Approaches to the Global Market for Electric Vehicle Batteries

- Figure 1 : Evolution of Electric Vehicle Batteries

- Figure 2 : Value Chain for EV Battery Market

- Figure 3 : Porter's Five Forces Model for Market for Electric Vehicle Batteries

- Figure 4 : Market Drivers for Electric Vehicle Batteries

- Figure 5 : Market Restraints for Electric Vehicle Batteries

- Figure 6 : Market Challenges for Electric Vehicle Batteries

- Figure 7 : Opportunities in the Market for Electrical Vehicle Batteries

- Figure 8 : Global Market Shares of Electric Vehicle Batteries, by Type of Battery, 2022

- Figure 9 : Global Market Shares of Electric Vehicle Batteries, by Type of Battery, 2028

- Figure 10 : Advantages of Solid-State Batteries

- Figure 11 : Benefits of Sodium-Ion Batteries

- Figure 12 : Global Market Shares of Electric Vehicle Batteries, by Type of Propulsion, 2022

- Figure 13 : Global Market Shares of Electric Vehicle Batteries, by Type of Propulsion, 2028

- Figure 14 : Key Components of a Battery Electric Vehicle (BEV)

- Figure 15 : Function of Key Components of Battery Electric Vehicle (BEV)

- Figure 16 : Key Components of a Hybrid Electric Vehicle (HEV)

- Figure 17 : Functions of Key Components of a Hybrid Electric Vehicle (HEV)

- Figure 18 : Key Components of a Plug-in Hybrid Electric Vehicle (PHEV)

- Figure 19 : Functions of Key Components of a Plug-in Hybrid Electric Car (PHEV)

- Figure 20 : Key Components of a Fuel Cell Electric Vehicle (FCEV)

- Figure 21 : Functions of Key Components of a Fuel Cell Electric Vehicle (FCEV)

- Figure 22 : Global Market Shares of Electric Vehicle Batteries, by Type of Vehicle, 2022

- Figure 23 : Global Market Shares of Electric Vehicle Batteries, by Type of Vehicle, 2028

- Figure 24 : EV Passenger Car Market Drivers

- Figure 25 : Electric Bus Market Drivers

- Figure 26 : Electric Scooter Market Drivers

- Figure 27 : Global Market Shares of Electric Vehicle Batteries by Bonding Method, 2022

- Figure 28 : Global Market Shares of Electric Vehicle Batteries, by Bonding Method, 2028

- Figure 29 : Global Market Shares of Electric Vehicle Batteries, by Battery Capacity, 2022

- Figure 30 : Global Market Shares of Electric Vehicle Batteries, by Battery Capacity, 2028

- Figure 31 : Global Market Shares of Electric Vehicle Batteries by Battery Form, 2022

- Figure 32 : Global Market Shares of Electric Vehicle Batteries, by Battery Form, 2028

- Figure 33 : Global Market Shares of Electric Vehicle Batteries, by Type of Material, 2022

- Figure 34 : Global Market Shares of Electric Vehicle Batteries, by Type of Material, 2028

- Figure 35 : Global Market Shares of Electric Vehicle Batteries, by Region, 2022

- Figure 36 : Global Market Shares of Electric Vehicle Batteries, by Region, 2028

- Figure 37 : North American Market Shares of Electric Vehicle Batteries, by Country, 2022

- Figure 38 : North American Market Shares of Electric Vehicle Batteries, by Country, 2028

- Figure 39 : North American Market Shares of Electric Vehicle Batteries, by Type of Battery, 2022

- Figure 40 : North American Market Shares of Electric Vehicle Batteries, by Type of Battery, 2028

- Figure 41 : North American Market Shares of Electric Vehicle Batteries, by Type of Propulsion, 2022

- Figure 42 : North American Market Shares of Electric Vehicle Batteries, by Type of Propulsion, 2028

- Figure 43 : North American Market Shares of Electric Vehicle Batteries, by Type of Vehicle, 2022

- Figure 44 : North American Market Shares of Electric Vehicle Batteries, by Type of Vehicle, 2028

- Figure 45 : North American Market Shares of Electric Vehicle Batteries, by Bonding Method, 2022

- Figure 46 : North American Market Shares of Electric Vehicle Batteries, by Bonding Method, 2028

- Figure 47 : North American Market Shares of Electric Vehicle Batteries, by Battery Capacity, 2022

- Figure 48 : North American Market Shares of Electric Vehicle Batteries, by Battery Capacity, 2028

- Figure 49 : North American Market Shares of Electric Vehicle Batteries, by Battery Form, 2022

- Figure 50 : North American Market Shares of Electric Vehicle Batteries, by Battery Form, 2028

- Figure 51 : North American Market Shares of Electric Vehicle Batteries, by Type of Material, 2022

- Figure 52 : North American Market Shares of Electric Vehicle Batteries, by Type of Material, 2028

- Figure 53 : European Market Shares of Electric Vehicle Batteries, by Country, 2022

- Figure 54 : European Market Shares of Electric Vehicle Batteries, by Country, 2028

- Figure 55 : European Market Shares of Electric Vehicle Batteries, by Type of Battery, 2022

- Figure 56 : European Market Shares of Electric Vehicle Batteries, by Type of Battery, 2028

- Figure 57 : European Market Shares of Electric Vehicle Batteries, by Type of Propulsion, 2022

- Figure 58 : European Market Shares of Electric Vehicle Batteries, by Type of Propulsion, 2028

- Figure 59 : European Market Shares of Electric Vehicle Batteries, by Type of Vehicle, 2022

- Figure 60 : European Market Shares of Electric Vehicle Batteries, by Type of Vehicle, 2028

- Figure 61 : European Market Shares of Electric Vehicle Batteries, by Bonding Method, 2022

- Figure 62 : European Market Shares of Electric Vehicle Batteries, by Bonding Method, 2028

- Figure 63 : European Market Shares of Electric Vehicle Batteries, by Battery Capacity, 2022

- Figure 64 : European Market Shares of Electric Vehicle Batteries, by Battery Capacity, 2028

- Figure 65 : European Market Shares of Electric Vehicle Batteries, by Battery Form, 2022

- Figure 66 : European Market Shares of Electric Vehicle Batteries, by Battery Form, 2028

- Figure 67 : European Market Shares of Electric Vehicle Batteries, by Type of Material, 2022

- Figure 68 : European Market Shares of Electric Vehicle Batteries, by Type of Material, 2028

- Figure 69 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Country, 2022

- Figure 70 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Country, 2028

- Figure 71 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Type of Battery, 2022

- Figure 72 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Type of Battery, 2028

- Figure 73 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Type of Propulsion, 2022

- Figure 74 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Type of Propulsion, 2028

- Figure 75 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Type of Vehicle, 2022

- Figure 76 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Type of Vehicle, 2028

- Figure 77 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Bonding Method, 2022

- Figure 78 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Bonding Method, 2028

- Figure 79 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Battery Capacity, 2022

- Figure 80 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Battery Capacity, 2028

- Figure 81 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Battery Form, 2022

- Figure 82 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Battery Form, 2028

- Figure 83 : Asia-Pacific Market Shares of Electric Vehicle Batteries by Type of Material, 2022

- Figure 84 : Asia-Pacific Market Shares of Electric Vehicle Batteries, by Type of Material, 2028

- Figure 85 : Rest of the World Market Shares of Electric Vehicle Batteries, by Subregion, 2022

- Figure 86 : Rest of the World Market Shares of Electric Vehicle Batteries, by Subregion, 2028

- Figure 87 : Rest of the World Market Shares of Electric Vehicle Batteries, by Type of Battery, 2022

- Figure 88 : Rest of the World Market Shares of Electric Vehicle Batteries, by Type of Battery, 2028

- Figure 89 : Rest of the World Market Shares of Electric Vehicle Batteries, by Type of Propulsion, 2022

- Figure 90 : Rest of the World Market Shares of Electric Vehicle Batteries, by Type of Propulsion, 2028

- Figure 91 : Rest of the World Market Shares of Electric Vehicle Batteries, by Type of Vehicle, 2022

- Figure 92 : Rest of the World Market Shares of Electric Vehicle Batteries, by Type of Vehicle, 2028

- Figure 93 : Rest of the World Market Shares of Electric Vehicle Batteries, by Bonding Method, 2022

- Figure 94 : Rest of the World Market Shares of Electric Vehicle Batteries, by Bonding Method, 2028

- Figure 95 : Rest of the World Market Shares of Electric Vehicle Batteries, by Battery Capacity, 2022

- Figure 96 : Rest of the World Market Shares of Electric Vehicle Batteries, by Battery Capacity, 2028

- Figure 97 : Rest of the World Market Shares of Electric Vehicle Batteries, by Battery Form, 2022

- Figure 98 : Rest of the World Market Shares of Electric Vehicle Batteries, by Battery Form, 2028

- Figure 99 : Rest of the World Market Shares of Electric Vehicle Batteries, by Type of Material, 2022

- Figure 100 : Rest of the World Market Shares of Electric Vehicle Batteries, by Type of Material, 2028

- Figure 101 : Factors in the Linkage between Electric Vehicle Batteries and ESG

- Figure 102 : Current Trends in the Market for Electric Vehicle Batteries

- Figure 103 : Product Life Cycle of Battery Technology

- Figure 104 : Emerging Trends in the Market for Electric Vehicle Batteries

- Figure 105 : Share of Patents Issued on Electric Vehicle Batteries Technology, by Company, 2022

- Figure 106 : Distribution Share of M&A in Electric Vehicle Batteries, by Region, 2021-2023

- Figure 107 : Start-up Funding in Electric Vehicle Batteries, by Amount Raised, 2022 and 2023

- Figure 108 : Distribution Share of Start-up Funding Amount, by Various Rounds, 2022 and 2023

- Figure 109 : Global Market Shares of Electric Vehicle Batteries, by Company, 2022

- Figure 110 : Share of Strategies Used in the Market for Electric Vehicle Batteries, 2022

- Figure 111 : BYD Co. Ltd.: Revenue Share, by Business Unit, 2021

- Figure 112 : BYD Co. Ltd.: Revenue Share, by Region, 2021

- Figure 113 : Contemporary Amperex Technology Co. Ltd.: Revenue Share, by Business Unit, 2022

- Figure 114 : Contemporary Amperex Technology Co. Ltd.: Revenue Share, by Region, 2022

- Figure 115 : EnerSys: Annual Revenue, 2021 and 2022

- Figure 116 : EnerSys: Revenue Share, by Business Unit, 2022

- Figure 117 : LG Chem: Annual Revenue, 2021 and 2022

- Figure 118 : LG Chem: Revenue Share, by Business Unit, 2022

- Figure 119 : LG Chem: Revenue Share, by Region, 2022

- Figure 120 : Mitsubishi Corp.: Annual Revenue, 2021 and 2022

- Figure 121 : Mitsubishi Corp.: Revenue Share, by Business Unit, 2022

- Figure 122 : Mitsubishi Corp.: Revenue Share, by Region/Country, 2022

- Figure 123 : Panasonic Holdings Corp.: Annual Revenue, 2021 and 2022

- Figure 124 : Panasonic Holdings Corp.: Revenue Share, by Business Unit, 2022

- Figure 125 : Panasonic Holdings Corp.: Revenue Share, by Region/Country, 2022

- Figure 126 : Samsung SDI Co. Ltd.: Annual Revenue, 2021 and 2022

- Figure 127 : Samsung SDI Co. Ltd.: Revenue Share, by Business Unit, 2022

- Figure 128 : Samsung SDI Co. Ltd.: Revenue Share, by Region/Country, 2022

- Figure 129 : Toshiba Corp.: Annual Revenue, 2021 and 2022

- Figure 130 : Toshiba Corp.: Revenue Share, by Business Unit, 2022

- Figure 131 : Toshiba Corp.: Revenue Share, by Region/Country, 2022

Highlights:

The global electric vehicle batteries market should reach $161.3 billion by 2028 from $66.4 billion in 2023 at a compound annual growth rate (CAGR) of 19.4% for the forecast period of 2023 to 2028.

North American electric vehicle batteries market is expected to grow from $10.6 billion in 2023 to $22.6 billion in 2028 at a CAGR of 16.3% for the forecast period of 2023 to 2028.

Asia-Pacific electric vehicle batteries market is expected to grow from $36.6 billion in 2023 to $97.5 billion in 2028 at a CAGR of 21.6% for the forecast period of 2023 to 2028.

Report Scope:

This report provides an analysis of the global market for electric vehicle batteries. Using 2022 as the base year, the report provides estimated market data for 2023 through 2028. This report also offers insights on drivers and opportunities for the market, which were gathered through primary and secondary research. It also covers various market factors, including COVID-19 impact, the Russia-Ukraine war, Porter's five forces, use case analysis, and the regulatory landscape.

The report has been prepared in a simple, easy-to-understand format, with some tables and charts/figures. The report's scope includes a detailed study of global and regional markets for battery type, propulsion, vehicle type, method, battery capacity, battery form, and material type. The qualitative and quantitative data of all segments are provided in the report. The report examines each segment, determines its current market size, and estimates its future market size with compound annual growth rates (CAGR).

The report also provides detailed profiles of the significant electric vehicle battery players and their strategies to enhance their market presence. The report also includes a competitive landscape chapter that discusses the market ecosystem of the top electric vehicle battery provider in 2022.

Report Includes:

- 47 data tables and 51 additional tables

- An overview of the global markets for electrical vehicle battery

- Estimation of market size and analyses of global market trends, with data from 2022, estimates for 2023 and 2024, and projections of compound annual growth rates (CAGRs) through 2028

- Highlights of the market potential and characterization of electrical vehicle battery market by battery type, propulsion, vehicle type, method, battery capacity, battery form, material type and region

- Insights into government initiatives, laws, and incentives to encourage electric vehicle usage and information on significant improvements in battery chemistry, materials, and manufacturing techniques

- Description of gigafactories, the companies who run them and discussion on how they help in improving battery production capacity resulting in low cost and easy availability of EV batteries

- Coverage of emerging technologies and developments of the industry

- Evaluation of key industry acquisitions and strategic alliances and market share analysis of the leading suppliers of the industry

- Profiles of the key companies of the industry, including BYD Co. Ltd., LG Chem, Mitsubishi Corp., Panasonic Holdings Corp. and Toshiba Corp.

Table of Contents

Chapter 1 Introduction

- Overview

- Study Goals and Objectives

- Reasons for Doing This Study

- Scope of Report

- Methodology

- Information Sources

- Geographic Breakdown

Chapter 2 Summary and Highlights

- Market Overview

Chapter 3 Market Overview

- Introduction

- Evolution of Electric Vehicle Batteries

- Value Chain AnalysisValue Chain Analysis

- Raw and Processed Materials

- Cell Component Manufacturing

- Cell Manufacturing

- Battery Pack Manufacturing

- Electric Vehicles Manufacturing

- Recycling

- Porter's Five Forces Model

- Supplier Power

- Buyer Power

- Threat of New Entrants

- Threat of Substitute

- Competitive Rivalry

- Impact of COVID-19 and Ukraine-Russia War on the Global Market

- COVID-19 Impact

- Impact of the Russia-Ukraine War

Chapter 4 Market Dynamics

- Overview

- Key Market Drivers

- Increase in Demand for Electric Vehicles (HEVs, PHEVs, Pure EVs, and FCEVs)

- Cost Reductions for EV Batteries

- Growing Demand for Clean Energy

- Reduction of Carbon Emissions

- Market Restraints

- High Capital Cost for Electric Vehicles Compared to Conventional ICE Vehicles

- Inadequate Electric Vehicle Charging Infrastructure

- Key Challenges in the Market for Electric Vehicle Batteries

- Battery Capacity is Limited

- Inadequate Uniformity of Electric Vehicle Charging Infrastructure

- Market Opportunities

- Government Efforts Relating to Electric Vehicles

- Government Agencies are Promoting the Establishment of Electric Charging Stations

- To Feed the Market, Researchers are Developing Wireless EV Charging Technologies for On-the-Go Charging

- Short-Term and Long-Term Impact of Market Dynamics

Chapter 5 Market Breakdown by Type of Battery

- Overview

- Lithium-Ion Batteries and Advanced Batteries

- Lithium Battery Chemistry

- Construction of Lithium-Ion Batteries

- Advance Battery

- Solid-State Batteries

- Sodium-Ion Battery

- Nickel-Metal Hydride Batteries

- Lead-Acid Batteries

Chapter 6 Market Breakdown by Type of Propulsion

- Overview

- Battery Electric Vehicle (BEV)

- Market Drivers for Battery Electric Vehicles

- Key Components of Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Market Drivers for Hybrid Electric Vehicles

- Operation of Hybrid Electric Vehicles

- Key Components of a Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Operation of Plug-in Hybrid Electric Vehicles

- Market Drivers for Plug-in Hybrid Electric Vehicle

- Key Components of a Plug-in Hybrid Electric Car (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

- Key Components of a Fuel Cell Electric Vehicle (FCEV)

Chapter 7 Market Breakdown by Type of Vehicle

- Overview

- Passenger Cars

- Passenger Vehicle Market Summary

- Vans

- Bus

- Electric Bus Market Summary

- Truck

- Other Types of Vehicles

- Two-Wheeler

- Off-Highway Vehicle

Chapter 8 Market Breakdown by Bonding Method

- Overview

- Wire Bonding

- Laser Bonding

Chapter 9 Market Breakdown by Battery Capacity

- Overview

- <50 kWh

- 50-100 kWh

- 100-200 kWh

- 200-300 kWh

- >300 kWh

Chapter 10 Market Breakdown by Battery Form

- Overview

- Prismatic

- Cylindrical

- Pouch

Chapter 11 Market Breakdown by Type of Material

- Overview

- Lithium

- Cobalt

- Nickel

- Other Types of Materials

- Manganese

- Natural Graphite

Chapter 12 Market Breakdown by Region

- Overview

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Norway

- U.K.

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- Rest of the World

- Middle East and Africa

- South America

Chapter 13 ESG Development

- Overview

- Electric Vehicle Batteries and ESG are Closely Related

- Importance of ESG in the Electric Vehicle Battery Industry

- Approach by Electric Vehicle Batteries to Achieve ESG Goals

- ESG Penetration for EV Battery Manufactures

- Current Status of ESG in the Market for Electric Vehicle Batteries

- Future of ESG with Electric Vehicle Battery Industry

- Case Study: Examples of Successful Implementation of ESG

- Concluding Remarks from BCC

Chapter 14 Emerging Technologies and Developments

- Introduction

- Current Market Trends

- Increased Energy Density

- Cost Reduction

- Extended Battery Life

- Fast-Charging Infrastructure

- Sustainable and Recyclable Batteries

- Emerging and Upcoming Trends in Electric Vehicle Batteries

- Technological Background

- Advancements in Electric Vehicle Batteries Technology

- Longer Battery Lifespan

- Recycling and Second-Life Applications

- Integration of Battery and Vehicle Systems

- Sustainable Battery Materials

- Collaborations and Partnerships

Chapter 15 Patent Analysis

- Overview

- Key Patents

Chapter 16 M&A and Funding Outlook

- M&A Analysis

- Start-up Funding in Electric Vehicle Batteries

Chapter 17 Competitive Landscape

- Overview

- Market Share Analysis

- Market Strategy Analysis for Electric Vehicle Batteries

- Agreements

- Partnerships

- Product Launches

- Expansions

- Investments

- Key Market Developments

- Agreement

- Partnership

- Product Launch

- Expansion

- Investment

Chapter 18 Company Profiles

- BYD CO. LTD.

- CONTEMPORARY AMPEREX TECHNOLOGY LTD. (CATL)

- CHINA LITHIUM BATTERY TECHNOLOGY CO. LTD. (CALB)

- CLARIOSNO

- ENERSYS

- ENVISION AUTOMOTIVE ENERGY SUPPLY CORP. (AESC)

- LG CHEM

- MITSUBISHI CORP.

- MOLICEL

- PANASONIC HOLDINGS CORP.

- SAMSUNG SDI CO. LTD.

- SK ON CO. LTD.

- TOSHIBA CORP.

- VEHICLE ENERGY JAPAN INC.

- PRIMEARTH EV ENERGY CO. LTD.