|

|

市場調査レポート

商品コード

1806563

セカンドライフEVバッテリー市場:電池タイプ、電池容量、供給源、販売チャネル、用途別-2025-2030年世界予測Second-life EV Batteries Market by Battery Type, Battery Capacity, Source, Sales Channel, Application - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| セカンドライフEVバッテリー市場:電池タイプ、電池容量、供給源、販売チャネル、用途別-2025-2030年世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 192 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

セカンドライフEVバッテリー市場は、2024年には259億2,000万米ドルとなり、2025年には285億2,000万米ドル、CAGR10.60%で成長し、2030年には474億6,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 259億2,000万米ドル |

| 推定年2025 | 285億2,000万米ドル |

| 予測年2030 | 474億6,000万米ドル |

| CAGR(%) | 10.60% |

持続可能なエネルギー・ソリューションとサーキュラー・エコノミー革新の極めて重要な推進力としての電気自動車用二次電池の台頭を明らかにします

電気自動車用二次電池の台頭は、持続可能なエネルギー・ソリューションの探求における画期的な開発です。脱炭素化に向けた世界的な動きが強まる中、各企業は、車載用としては寿命を迎えたもの、据置型用途としては大容量を維持しているバッテリーに潜在的な価値があることを認識し始めています。このシフトは、使用済みバッテリーのリサイクルを延期することで環境への影響を軽減するだけでなく、コスト効率の高い方法でエネルギー安全保障と送電網の回復力を強化します。

EV用セカンドライフバッテリーがいかにエネルギー貯蔵の情勢を変え、複数の業界別脱炭素化を加速しているか

過去10年間で、技術的な大きな進歩が、さまざまな分野でのセカンドライフEVバッテリーの採用を促進しました。バッテリー管理システムと予測分析の進歩により、再利用バッテリーパックの信頼性と安全性が向上し、住宅設備から産業用マイクログリッドまで多様な環境での展開が可能になりました。さらに、モジュール設計と標準化された通信プロトコルの改善により、統合プロセスが合理化され、プロジェクトのタイムラインと運用の複雑さが軽減されています。

米国が新たに導入した関税がEV用セカンドライフバッテリーの貿易力学とグローバルサプライチェーンに与える影響の評価

輸入電池部品と再利用電池モジュールに対する米国の新関税導入は、セカンドライフEVバッテリー分野に課題と機会の両方をもたらしました。これらの関税の発効に伴い、サプライチェーンの関係者は、プロジェクトの実行可能性を維持しながら、コストへの影響を最小限に抑えるために調達戦略を再調整しています。その結果、一部のメーカーは、関税関連の費用を回避し、リードタイムを短縮するために、現地での組み立てや改修の拠点を模索しています。

電池の種類、容量、供給元、チャネルにまたがる多様なセカンドライフEV電池用途を明らかにする市場セグメンテーション洞察の解読

詳細なセグメンテーションにより、バッテリーの化学的性質による性能、展開シナリオ、経済的成果の違いが明らかになります。例えば、リチウムイオンシステムは、その優れたエネルギー密度と長寿命により大きな注目を集め、ニッケル水素ユニットは、特定の据置型アプリケーションに有利な安全性プロファイルを提供します。鉛蓄電池は低コストであるにもかかわらず、重量とスペースの制約が最小限のニッチな役割を果たします。

南北アメリカ、欧州・中東・アフリカ、アジア太平洋の各市場におけるセカンドライフEVバッテリーの異なる機会と課題

セカンドライフEVバッテリーの採用ペースと規模を左右するのは、地域ダイナミックスです。南北アメリカでは、エネルギー回復力に対する強力なインセンティブと再生業者のネットワークの拡大により、パイロット・プロジェクトと商業展開が加速しています。利害関係者は、支持的な政策枠組みと、送電網の安定性向上を目指した官民パートナーシップの拡大から利益を得ています。

戦略的提携と技術進歩を通じてセカンドライフEV電池エコシステムのイノベーションを推進する主要利害関係者のプロファイリング

EV用セカンドライフバッテリー分野の主要企業は、戦略的提携、独自の再生技術、多様なサービス提供を通じて差別化を図っています。大手自動車メーカー数社は、エネルギー貯蔵企業と合弁会社を設立し、住宅や商業用マイクログリッド・アプリケーションで使用済みバッテリーを再利用しています。同時に、専門プロバイダーは、スループットを向上させ、一貫したモジュール品質を確保するために、高度な診断ツールと自動分解プロセスを導入しています。

ダイナミックな規制環境の中でリスクを軽減しつつ、セカンドライフEVバッテリーの機会を活用するための業界リーダーにとっての戦略的課題

急速に発展するセカンドライフ・バッテリーの分野を活用するために、業界のリーダーは、市場の信頼と安全性の保証を促進する標準化された試験・認証プロトコルの開発を優先すべきです。自動車メーカーやリサイクル企業との戦略的パートナーシップの確保は、高品質モジュールの安定供給を促進し、自動再生インフラへの投資は、業務効率と拡張性を促進することができます。

セカンドライフEVバッテリー市場を分析し、重要なデータインサイトを検証するために採用した包括的な調査アプローチを示す透明なフレームワーク

本分析を支える調査手法は、1次インタビュー、2次データレビュー、定量的サプライチェーン評価を厳格に組み合わせたものです。多様な視点を捉え、新たな動向を検証するために、相手先商標製品メーカー、再利用施設、エネルギーサービスプロバイダー、規制機関の利害関係者との専門家協議を実施しました。

進化する技術・政策情勢の中で、EV用セカンドライフバッテリー市場の将来の軌跡を描くためのコアとなる知見の統合

セカンドライフEVバッテリー市場は、技術的進歩、政策的支援、持続可能なエネルギーインフラへの緊急の要請によって、変曲点を迎えています。利害関係者がビジネスモデルを洗練させ、協力的なエコシステムを構築するにつれて、再利用バッテリーは住宅、商業、産業、公益事業規模のアプリケーション全体でますます不可欠な役割を担うようになります。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 使用済みEVバッテリーモジュールの残存容量を正確に評価するための診断テストプロトコルの進歩

- 住宅エネルギー貯蔵アプリケーションにおける二次使用リチウムイオン電池のライフサイクル性能劣化モデル

- 都市環境における商用マイクログリッドストレージソリューションに再利用EVバッテリーを統合するための戦略

- 公益事業規模のエネルギープロジェクトにおけるEVバッテリーの再利用導入に対する連邦および州レベルのインセンティブの効果を評価する

- セカンドライフパックを活用した自動車メーカーとエネルギーサービス企業による循環型経済パートナーシップのビジネスモデル

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 セカンドライフEVバッテリー市場:バッテリータイプ別

- 鉛蓄電池

- リチウムイオン

- ニッケル水素

第9章 セカンドライフEVバッテリー市場バッテリー容量別

- 101~200kWh

- 50~100kWh

- 200kWh以上

- 50kWh未満

第10章 セカンドライフEVバッテリー市場:ソース別

- 商用車/ 大型車

- 電気バス

- 乗用車

- 二輪車

第11章 セカンドライフEVバッテリー市場:販売チャネル別

- オフライン

- 直接販売

- 販売代理店

- オンライン

第12章 セカンドライフEVバッテリー市場:用途別

- 商用エネルギー貯蔵

- オフィスビル

- ショッピングモール

- グリッドストレージ

- 産業用エネルギー貯蔵

- データセンター

- 製造工場

- 住宅エネルギー貯蔵

- アパート群

- 個人住宅

- 通信

第13章 南北アメリカのセカンドライフEVバッテリー市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第14章 欧州・中東・アフリカのセカンドライフEVバッテリー市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第15章 アジア太平洋地域のセカンドライフEVバッテリー市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第16章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Connected Energy Ltd.

- RePurpose Energy Inc.

- Bayerische Motoren Werke AG

- BeePlanet Factory

- BYD Company Ltd.

- EcarACCU

- Enel X S.r.l.

- Fortum Oyj

- Hyundai Motor Company

- Li-Cycle Corp.

- Mercedes-Benz Group AG

- MG Motor

- Moment Energy Inc.

- Nissan Motor Co., Ltd.

- Nunam Technologies India Pvt. Ltd.

- Nuvation Energy

- Proterra, Inc.

- ReJoule Inc.

- Renault Group

- Rivian Automotive, Inc.

- RWE AG

- Second Life EV Batteries Ltd.

- Toyota Motor Corporation

- Zenobe Energy Limited

第17章 リサーチAI

第18章 リサーチ統計

第19章 リサーチコンタクト

第20章 リサーチ記事

第21章 付録

LIST OF FIGURES

- FIGURE 1. SECOND-LIFE EV BATTERIES MARKET RESEARCH PROCESS

- FIGURE 2. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 3. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 4. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 5. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2024 VS 2030 (%)

- FIGURE 6. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2024 VS 2030 (%)

- FIGURE 8. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 9. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2024 VS 2030 (%)

- FIGURE 10. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 11. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2024 VS 2030 (%)

- FIGURE 12. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 13. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2024 VS 2030 (%)

- FIGURE 14. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 15. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 16. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 17. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY STATE, 2024 VS 2030 (%)

- FIGURE 18. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 19. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 20. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 21. ASIA-PACIFIC SECOND-LIFE EV BATTERIES MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 22. ASIA-PACIFIC SECOND-LIFE EV BATTERIES MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 23. SECOND-LIFE EV BATTERIES MARKET SHARE, BY KEY PLAYER, 2024

- FIGURE 24. SECOND-LIFE EV BATTERIES MARKET, FPNV POSITIONING MATRIX, 2024

- FIGURE 25. SECOND-LIFE EV BATTERIES MARKET: RESEARCHAI

- FIGURE 26. SECOND-LIFE EV BATTERIES MARKET: RESEARCHSTATISTICS

- FIGURE 27. SECOND-LIFE EV BATTERIES MARKET: RESEARCHCONTACTS

- FIGURE 28. SECOND-LIFE EV BATTERIES MARKET: RESEARCHARTICLES

LIST OF TABLES

- TABLE 1. SECOND-LIFE EV BATTERIES MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

- TABLE 3. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, 2018-2024 (USD MILLION)

- TABLE 4. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, 2025-2030 (USD MILLION)

- TABLE 5. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 6. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 7. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 8. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 9. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 10. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 11. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY LEAD-ACID, BY REGION, 2018-2024 (USD MILLION)

- TABLE 12. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY LEAD-ACID, BY REGION, 2025-2030 (USD MILLION)

- TABLE 13. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY LITHIUM-ION, BY REGION, 2018-2024 (USD MILLION)

- TABLE 14. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY LITHIUM-ION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 15. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY NICKEL-METAL HYDRIDE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 16. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY NICKEL-METAL HYDRIDE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 17. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2018-2024 (USD MILLION)

- TABLE 18. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 19. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY 101-200 KWH, BY REGION, 2018-2024 (USD MILLION)

- TABLE 20. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY 101-200 KWH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY 50-100 KWH, BY REGION, 2018-2024 (USD MILLION)

- TABLE 22. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY 50-100 KWH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY ABOVE 200 KWH, BY REGION, 2018-2024 (USD MILLION)

- TABLE 24. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY ABOVE 200 KWH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY BELOW 50 KWH, BY REGION, 2018-2024 (USD MILLION)

- TABLE 26. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY BELOW 50 KWH, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 28. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 29. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL VEHICLES / HEAVY-DUTY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 30. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL VEHICLES / HEAVY-DUTY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY ELECTRIC BUSES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 32. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY ELECTRIC BUSES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY PASSENGER CARS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 34. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY PASSENGER CARS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY TWO-WHEELERS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 36. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY TWO-WHEELERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2018-2024 (USD MILLION)

- TABLE 38. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 39. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 40. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY DIRECT SALES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 42. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY DIRECT SALES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY DISTRIBUTORS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 44. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY DISTRIBUTORS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 46. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 47. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY ONLINE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 48. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY ONLINE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 50. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 51. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 52. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFICE BUILDINGS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 54. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFICE BUILDINGS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY SHOPPING MALLS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 56. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY SHOPPING MALLS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 58. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 59. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY GRID STORAGE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 60. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY GRID STORAGE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 62. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY DATA CENTERS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 64. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY DATA CENTERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY MANUFACTURING PLANTS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 66. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY MANUFACTURING PLANTS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 68. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 69. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 70. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY APARTMENT COMPLEXES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 72. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY APARTMENT COMPLEXES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDIVIDUAL HOMES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 74. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDIVIDUAL HOMES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 76. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 77. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY TELECOMMUNICATIONS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 78. GLOBAL SECOND-LIFE EV BATTERIES MARKET SIZE, BY TELECOMMUNICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 80. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 81. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2018-2024 (USD MILLION)

- TABLE 82. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 83. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 84. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 85. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2018-2024 (USD MILLION)

- TABLE 86. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 87. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 88. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 89. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 90. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 92. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 93. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 94. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 95. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 96. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 97. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 98. AMERICAS SECOND-LIFE EV BATTERIES MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 100. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 101. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2018-2024 (USD MILLION)

- TABLE 102. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 103. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 104. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 105. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2018-2024 (USD MILLION)

- TABLE 106. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 107. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 108. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 109. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 110. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 112. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 113. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 114. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 115. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 116. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 117. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY STATE, 2018-2024 (USD MILLION)

- TABLE 118. UNITED STATES SECOND-LIFE EV BATTERIES MARKET SIZE, BY STATE, 2025-2030 (USD MILLION)

- TABLE 119. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 120. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 121. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2018-2024 (USD MILLION)

- TABLE 122. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 123. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 124. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 125. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2018-2024 (USD MILLION)

- TABLE 126. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 127. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 128. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 129. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 130. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 132. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 133. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 134. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 135. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 136. CANADA SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 137. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 138. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 139. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2018-2024 (USD MILLION)

- TABLE 140. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 141. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 142. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 143. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2018-2024 (USD MILLION)

- TABLE 144. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 145. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 146. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 147. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 148. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 150. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 151. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 152. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 153. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 154. MEXICO SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 155. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 156. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 157. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2018-2024 (USD MILLION)

- TABLE 158. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 159. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 160. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 161. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2018-2024 (USD MILLION)

- TABLE 162. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 163. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 164. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 165. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 166. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 167. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 168. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 169. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 170. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 171. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 172. BRAZIL SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 173. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 174. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 175. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2018-2024 (USD MILLION)

- TABLE 176. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 177. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 178. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 179. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2018-2024 (USD MILLION)

- TABLE 180. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 181. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 182. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 183. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 184. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 185. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 186. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 187. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 188. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 189. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 190. ARGENTINA SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 191. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 192. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 193. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2018-2024 (USD MILLION)

- TABLE 194. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 195. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 196. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 197. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2018-2024 (USD MILLION)

- TABLE 198. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 199. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 200. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 201. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 202. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 203. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 204. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 205. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 206. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 207. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 208. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 209. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 210. EUROPE, MIDDLE EAST & AFRICA SECOND-LIFE EV BATTERIES MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 211. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 212. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 213. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2018-2024 (USD MILLION)

- TABLE 214. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 215. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 216. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 217. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2018-2024 (USD MILLION)

- TABLE 218. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 219. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 220. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 221. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 222. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 223. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 224. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 225. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 226. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 227. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 228. UNITED KINGDOM SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 229. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 230. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 231. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2018-2024 (USD MILLION)

- TABLE 232. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 233. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 234. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 235. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2018-2024 (USD MILLION)

- TABLE 236. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 237. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 238. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 239. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 240. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 241. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 242. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 243. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 244. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 245. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 246. GERMANY SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 247. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 248. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 249. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2018-2024 (USD MILLION)

- TABLE 250. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 251. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 252. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 253. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2018-2024 (USD MILLION)

- TABLE 254. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 255. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 256. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 257. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 258. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 259. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 260. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 261. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 262. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 263. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 264. FRANCE SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 265. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 266. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 267. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2018-2024 (USD MILLION)

- TABLE 268. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 269. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 270. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 271. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2018-2024 (USD MILLION)

- TABLE 272. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 273. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 274. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 275. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 276. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 277. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 278. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 279. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 280. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 281. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 282. RUSSIA SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 283. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 284. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 285. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2018-2024 (USD MILLION)

- TABLE 286. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 287. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 288. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 289. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2018-2024 (USD MILLION)

- TABLE 290. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 291. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 292. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 293. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 294. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 295. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 296. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 297. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 298. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 299. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 300. ITALY SECOND-LIFE EV BATTERIES MARKET SIZE, BY RESIDENTIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 301. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 302. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 303. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2018-2024 (USD MILLION)

- TABLE 304. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY BATTERY CAPACITY, 2025-2030 (USD MILLION)

- TABLE 305. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 306. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 307. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2018-2024 (USD MILLION)

- TABLE 308. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 309. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2018-2024 (USD MILLION)

- TABLE 310. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY OFFLINE, 2025-2030 (USD MILLION)

- TABLE 311. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 312. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 313. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 314. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY COMMERCIAL ENERGY STORAGE, 2025-2030 (USD MILLION)

- TABLE 315. SPAIN SECOND-LIFE EV BATTERIES MARKET SIZE, BY INDUSTRIAL ENERGY STORAGE, 2018-2024 (USD MILLION)

- TABLE 316. SPAIN SECOND-LIFE EV BATTERIES MARKET

The Second-life EV Batteries Market was valued at USD 25.92 billion in 2024 and is projected to grow to USD 28.52 billion in 2025, with a CAGR of 10.60%, reaching USD 47.46 billion by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 25.92 billion |

| Estimated Year [2025] | USD 28.52 billion |

| Forecast Year [2030] | USD 47.46 billion |

| CAGR (%) | 10.60% |

Unveiling the Rise of Second-Life Electric Vehicle Batteries as a Pivotal Driver of Sustainable Energy Solutions and Circular Economy Innovations

The emergence of second-life electric vehicle batteries represents a landmark development in the quest for sustainable energy solutions. As the global push toward decarbonization intensifies, organizations have begun to recognize the latent value embedded in batteries that have reached the end of their vehicular life but retain substantial capacity for stationary applications. This shift not only mitigates environmental impact by deferring end-of-life recycling but also bolsters energy security and grid resilience in a cost-effective manner.

By repurposing EV batteries for applications ranging from residential energy storage to grid-scale support, stakeholders can extract additional economic and environmental benefits. In this context, circular economy principles are gaining traction as companies seek to optimize resource utilization and establish new revenue streams. As industry leaders and policymakers align around these shared objectives, second-life battery programs are poised to become a critical component of broader clean energy strategies.

How Second-Life EV Batteries Are Reshaping Energy Storage Landscapes and Accelerating Decarbonization Across Multiple Industry Verticals

Over the past decade, significant technological progress has catalyzed the adoption of second-life EV batteries across multiple sectors. Advancements in battery management systems and predictive analytics have enhanced the reliability and safety of repurposed battery packs, enabling deployment in diverse environments from residential installations to industrial microgrids. Moreover, improvements in modular design and standardized communication protocols have streamlined integration processes, reducing project timelines and operational complexity.

In parallel, regulatory frameworks have evolved to support the second-life value chain, with incentives and guidelines emerging in key markets to accelerate adoption. This combination of innovation and policy support has fostered a marketplace where stakeholders-from automakers to energy service companies-collaborate to unlock the full potential of veteran EV batteries. As a result, the energy storage landscape is undergoing a transformative shift, with repurposed batteries playing an increasingly prominent role in achieving decarbonization goals and enhancing system flexibility.

Assessing the Implications of Newly Introduced United States Tariffs on Second-Life EV Battery Trade Dynamics and Global Supply Chains

The introduction of new United States tariffs on imported battery components and repurposed battery modules has introduced both challenges and opportunities within the second-life EV battery sector. As these levies take effect, supply chain actors are recalibrating sourcing strategies to minimize cost impacts while maintaining project viability. Consequently, some manufacturers are exploring localized assembly and refurbishment hubs to circumvent tariff-related expenses and reduce lead times.

As a result of these trade adjustments, partnerships between domestic integrators and international suppliers are evolving, with an emphasis on compliance, transparency, and logistics optimization. Although short-term disruptions may occur as the market adapts, long-term benefits could materialize through enhanced local capacity and strengthened domestic ecosystems. Stakeholders who proactively engage with tariff mitigation measures and strategic sourcing initiatives will be best positioned to sustain competitive advantage within this dynamic regulatory environment.

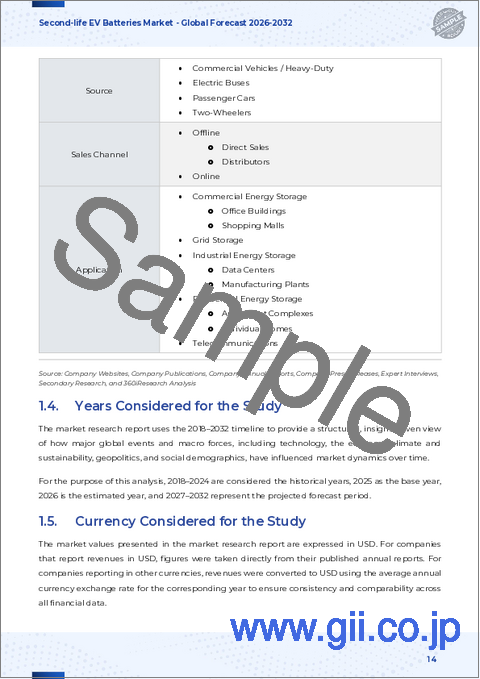

Decoding Market Segmentation Insights to Illuminate Diverse Second-Life EV Battery Applications Across Battery Types, Capacities, Sources, and Channels

Detailed segmentation reveals variations in performance, deployment scenarios, and economic outcomes across battery chemistries. For instance, lithium-ion systems command significant attention due to their superior energy density and longevity, while nickel-metal hydride units offer favorable safety profiles for certain stationary applications. Lead-acid batteries, despite their lower cost, serve niche roles where weight and space constraints are minimal.

Capacity thresholds drive further differentiation, with smaller modules below fifty kilowatt-hours suited to residential installations and telecommunication backup systems, mid-range packs accommodating commercial energy storage needs, and larger units exceeding two hundred kilowatt-hours tailored for grid services and heavy-duty applications. Source-based segmentation underscores unique performance requirements and lifecycle considerations for vehicles such as passenger cars, two-wheelers, electric buses, and heavy-duty commercial fleets. Distribution channels encompass both offline avenues-spanning direct sales agreements and distributor networks-and online platforms that facilitate streamlined procurement. Application-specific insights highlight the versatility of second-life batteries across office complexes, shopping centers, data centers, manufacturing facilities, apartment developments, individual homes, utility-scale storage arrays, and telecommunications sites.

Comparative Regional Perspectives Reveal Distinct Opportunities and Challenges for Second-Life EV Batteries Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in dictating the pace and scale of second-life EV battery adoption. In the Americas, robust incentives for energy resilience and a growing network of refurbishers have accelerated pilot projects and commercial rollouts. Stakeholders benefit from supportive policy frameworks and an expanding array of public-private partnerships aimed at enhancing grid stability.

Across Europe, the Middle East and Africa, stringent decarbonization targets and regulatory mandates have catalyzed investments in second-life programs, particularly in Western Europe's established renewable energy markets. Meanwhile, emerging economies within the region are exploring tailored solutions to address energy access challenges. In the Asia-Pacific basin, high EV penetration rates in countries such as China and Japan have generated substantial volumes of retired battery packs, spurring the development of large-scale repurposing facilities and innovative business models that integrate second-life storage into renewable energy portfolios and microgrid projects.

Profiling Leading Stakeholders Driving Innovation in the Second-Life EV Battery Ecosystem Through Strategic Collaborations and Technological Advancements

Leading companies in the second-life EV battery domain are distinguishing themselves through strategic alliances, proprietary refurbishment technologies, and diversified service offerings. Several major automakers have forged joint ventures with energy storage firms to repurpose retired batteries within residential and commercial microgrid applications. At the same time, specialized providers are deploying advanced diagnostic tools and automated disassembly processes to enhance throughput and ensure consistent module quality.

In addition, technology startups are disrupting traditional value chains by offering turnkey second-life solutions that bundle system integration, financing, and operations support. These entrants leverage software platforms to optimize asset utilization and performance, while established energy companies incorporate second-life storage into broader portfolios spanning grid services, renewable integration, and demand response programs. Collectively, these initiatives are shaping a vibrant ecosystem, driving competitive differentiation and accelerating market maturation.

Strategic Imperatives for Industry Leaders to Capitalize on Second-Life EV Battery Opportunities While Mitigating Risks in a Dynamic Regulatory Environment

To capitalize on the rapidly evolving second-life battery sector, industry leaders should prioritize the development of standardized testing and certification protocols that foster market confidence and safety assurance. Securing strategic partnerships with automotive manufacturers and recycling firms will facilitate a steady supply of high-quality modules, while investments in automated refurbishment infrastructure can drive operational efficiency and scalability.

Furthermore, engaging proactively with regulators and utilities to shape policy frameworks will unlock incentives and streamline project approvals. Companies should also explore innovative financing mechanisms-such as performance-based leasing and energy service agreements-to lower customer entry barriers and promote adoption. By integrating digital monitoring platforms, stakeholders can deliver enhanced asset management and predictive maintenance capabilities, ensuring reliable performance and long-term value realization.

Transparent Framework Outlining the Comprehensive Research Approach Employed to Analyze Second-Life EV Battery Markets and Validate Critical Data Insights

The research methodology underpinning this analysis integrates a rigorous combination of primary interviews, secondary data review, and quantitative supply chain assessments. Expert consultations were conducted with stakeholders across original equipment manufacturers, repurposing facilities, energy service providers, and regulatory bodies to capture diverse perspectives and validate emerging trends.

Complementing these insights, comprehensive desk research was performed using industry reports, academic publications, patent filings, and corporate disclosures. A multi-scenario modeling approach was employed to evaluate potential market trajectories under varying policy, technology, and economic conditions. Data integrity was ensured through triangulation, cross-verifying findings against multiple sources and incorporating feedback loops with domain experts.

Synthesizing Core Insights to Chart the Future Trajectory of the Second-Life EV Battery Market Amidst Evolving Technological and Policy Landscapes

The second-life EV battery market is at an inflection point, driven by technological advancements, supportive policy measures, and the urgent imperative for sustainable energy infrastructure. As stakeholders refine business models and forge collaborative ecosystems, repurposed batteries will assume an increasingly integral role across residential, commercial, industrial, and utility-scale applications.

Looking ahead, continuous innovation in battery management, digitalization, and modular design will be critical to unlocking broader adoption. Companies that align strategic investments with emerging regulations and customer needs are poised to lead the next wave of growth, delivering resilient, cost-effective energy solutions while advancing circular economy objectives.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Market Sizing & Forecasting

5. Market Dynamics

- 5.1. Advances in diagnostic testing protocols to accurately assess residual capacity of retired EV battery modules

- 5.2. Lifecycle performance degradation modeling for second-life lithium-ion batteries in residential energy storage applications

- 5.3. Strategies for integrating repurposed EV batteries into commercial microgrid storage solutions in urban environments

- 5.4. Evaluating the effect of federal and state-level incentives on second-life EV battery adoption in utility-scale energy projects

- 5.5. Business models for circular economy partnerships between automakers and energy service companies using second-life packs

6. Market Insights

- 6.1. Porter's Five Forces Analysis

- 6.2. PESTLE Analysis

7. Cumulative Impact of United States Tariffs 2025

8. Second-life EV Batteries Market, by Battery Type

- 8.1. Introduction

- 8.2. Lead-Acid

- 8.3. Lithium-Ion

- 8.4. Nickel-Metal Hydride

9. Second-life EV Batteries Market, by Battery Capacity

- 9.1. Introduction

- 9.2. 101-200 kWh

- 9.3. 50-100 kWh

- 9.4. Above 200 kWh

- 9.5. Below 50 kWh

10. Second-life EV Batteries Market, by Source

- 10.1. Introduction

- 10.2. Commercial Vehicles / Heavy-Duty

- 10.3. Electric Buses

- 10.4. Passenger Cars

- 10.5. Two-Wheelers

11. Second-life EV Batteries Market, by Sales Channel

- 11.1. Introduction

- 11.2. Offline

- 11.2.1. Direct Sales

- 11.2.2. Distributors

- 11.3. Online

12. Second-life EV Batteries Market, by Application

- 12.1. Introduction

- 12.2. Commercial Energy Storage

- 12.2.1. Office Buildings

- 12.2.2. Shopping Malls

- 12.3. Grid Storage

- 12.4. Industrial Energy Storage

- 12.4.1. Data Centers

- 12.4.2. Manufacturing Plants

- 12.5. Residential Energy Storage

- 12.5.1. Apartment Complexes

- 12.5.2. Individual Homes

- 12.6. Telecommunications

13. Americas Second-life EV Batteries Market

- 13.1. Introduction

- 13.2. United States

- 13.3. Canada

- 13.4. Mexico

- 13.5. Brazil

- 13.6. Argentina

14. Europe, Middle East & Africa Second-life EV Batteries Market

- 14.1. Introduction

- 14.2. United Kingdom

- 14.3. Germany

- 14.4. France

- 14.5. Russia

- 14.6. Italy

- 14.7. Spain

- 14.8. United Arab Emirates

- 14.9. Saudi Arabia

- 14.10. South Africa

- 14.11. Denmark

- 14.12. Netherlands

- 14.13. Qatar

- 14.14. Finland

- 14.15. Sweden

- 14.16. Nigeria

- 14.17. Egypt

- 14.18. Turkey

- 14.19. Israel

- 14.20. Norway

- 14.21. Poland

- 14.22. Switzerland

15. Asia-Pacific Second-life EV Batteries Market

- 15.1. Introduction

- 15.2. China

- 15.3. India

- 15.4. Japan

- 15.5. Australia

- 15.6. South Korea

- 15.7. Indonesia

- 15.8. Thailand

- 15.9. Philippines

- 15.10. Malaysia

- 15.11. Singapore

- 15.12. Vietnam

- 15.13. Taiwan

16. Competitive Landscape

- 16.1. Market Share Analysis, 2024

- 16.2. FPNV Positioning Matrix, 2024

- 16.3. Competitive Analysis

- 16.3.1. Connected Energy Ltd.

- 16.3.2. RePurpose Energy Inc.

- 16.3.3. Bayerische Motoren Werke AG

- 16.3.4. BeePlanet Factory

- 16.3.5. BYD Company Ltd.

- 16.3.6. EcarACCU

- 16.3.7. Enel X S.r.l.

- 16.3.8. Fortum Oyj

- 16.3.9. Hyundai Motor Company

- 16.3.10. Li-Cycle Corp.

- 16.3.11. Mercedes-Benz Group AG

- 16.3.12. MG Motor

- 16.3.13. Moment Energy Inc.

- 16.3.14. Nissan Motor Co., Ltd.

- 16.3.15. Nunam Technologies India Pvt. Ltd.

- 16.3.16. Nuvation Energy

- 16.3.17. Proterra, Inc.

- 16.3.18. ReJoule Inc.

- 16.3.19. Renault Group

- 16.3.20. Rivian Automotive, Inc.

- 16.3.21. RWE AG

- 16.3.22. Second Life EV Batteries Ltd.

- 16.3.23. Toyota Motor Corporation

- 16.3.24. Zenobe Energy Limited