|

|

市場調査レポート

商品コード

1422172

自動車用4D画像レーダー市場:成長、将来展望、競合分析、2023年~2031年Automotive 4D Imaging Radar Market - Growth, Future Prospects and Competitive Analysis, 2023 - 2031 |

||||||

|

|||||||

| 自動車用4D画像レーダー市場:成長、将来展望、競合分析、2023年~2031年 |

|

出版日: 2024年01月12日

発行: Acute Market Reports

ページ情報: 英文 115 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

自動車用4D画像レーダー市場は、センサー技術の進歩、自律走行車の導入拡大、ADAS(先進運転支援システム)の採用拡大に後押しされ、2024年から2032年の予測期間中にCAGR22%で成長すると予測されます。しかし、費用対効果に関する課題が足かせとなっています。セグメンテーション分析では、自動車用4D画像レーダーエコシステム内の多様な力学を反映して、収益とCAGRの面で異なる市場リーダーが明らかになりました。地域別では、アジア太平洋のCAGRが最も高くなると予想される一方、北米は依然として全体の収益に大きく貢献しています。競合情勢は、主要プレイヤーの優位性と、イノベーション、自動化、安全性への戦略的フォーカスを強調し、自動車レーダー技術の未来を形成しています。

市場促進要因

センサー技術の進歩

センサー技術の絶え間ない進歩が自動車用4D画像レーダー市場を牽引しています。Continental AGやBoschなどの企業は、高度なレーダーセンサーの開発に先駆的に取り組み、自動車の知覚能力を高めています。これらの進歩は、4D画像を可能にし、車両の周囲に関する正確でリアルタイムの情報を提供する上で重要な役割を果たしています。この 促進要因の存在は、最新のADAS(先進運転支援システム)や自律走行車にレーダーセンサーが採用されていることからも明らかです。

自律走行車の受け入れ拡大

自律走行車の普及は、4D画像レーダー市場の重要な促進要因です。Velodyne LidarやNVIDIAのような企業は、包括的なセンシング能力で自律走行車に力を与えるソリューションを提供する最前線にいます。その証拠に、自律走行技術への投資が拡大しており、大手自動車メーカーは、正確な知覚、障害物検知、意思決定を可能にする4D画像レーダーシステムを統合しています。自動車産業がより高度な自動運転にシフトするにつれて、先進レーダーシステムの需要は急増し、市場成長を牽引すると予想されます。

ADAS(先進運転支援システム)の採用拡大

ADAS(先進運転支援システム)の採用拡大が、4D画像レーダーの需要を促進しています。AptivやZF Friedrichshafen AGのような企業は、衝突回避、アダプティブ・クルーズ・コントロール、車線逸脱警告などの機能にレーダー技術を組み込んだADASソリューションを提供する主要企業です。その証拠に、最新の自動車にはADASが広く統合されており、レーダーベースのシステムは自動車の安全性を高め、事故を減らす上で重要な役割を果たしています。規制機関が安全基準の強化を推進する中、ADAS搭載車の需要は拡大し、4D画像レーダー市場をさらに押し上げると予想されます。

抑制要因

勢いはある一方で、市場には費用対効果を達成するための課題に関連する顕著な抑制要因があります。4D画像レーダーシステムは複雑で高度な機能を備えているため、製造コストや統合コストが高くなります。一部の自動車メーカーが、4D画像レーダー技術の総合的な費用対効果への懸念から、4D画像レーダーを広く導入することをためらっていることが、この抑制要因の証拠です。最先端機能とコスト効率のバランスを取ることは、市場プレーヤーにとって依然として課題です。

市場セグメンテーション分析

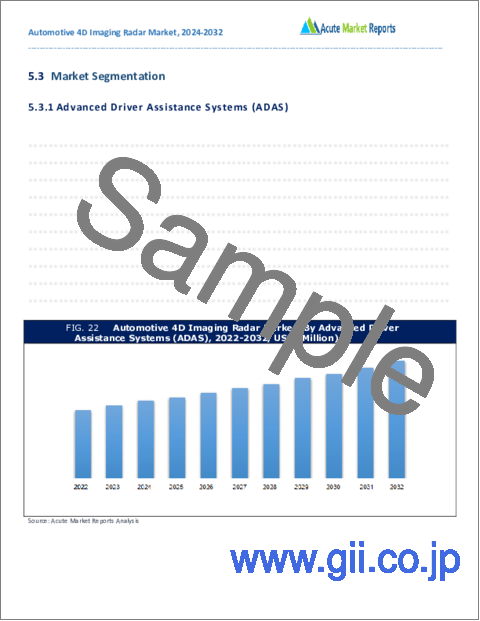

自動化レベル別市場:ADAS(先進運転支援システム)が市場を独占

2023年、自動車用4D画像レーダー市場で最も高い収益を上げたのはADAS(先進運転支援システム)であり、これは 促進要因の安全性向上にレーダー技術が広く採用されていることを反映しています。同時に、予測期間中(2024年~2032年)の年間平均成長率(CAGR)が最も高かったのは自律走行車分野であり、自動運転車への4D画像レーダーの搭載が進んでいることを示しています。

範囲別市場:予測期間中、短距離レーダーが市場ポテンシャルを高める

2023年には、短距離レーダーと中・長距離レーダーの両方が市場の収益に大きく貢献しました。しかし、予測期間中、近距離レーダーが最も高いCAGRを示しました。これは、駐車支援や都市部での運転シナリオに不可欠な、近接センシングに優れたレーダーシステムの需要が拡大していることを示しています。

帯域別市場:77GHzから81GHz周波数が市場を独占

2023年には、77GHzから81GHz周波数帯が収益とCAGRの両方でリードし、高解像度イメージングと正確な物体検知に適していることが強調されました。24GHzから24.25GHzと21GHzから26GHzの周波数帯域も収益に貢献しており、異なるアプリケーション要件に対応しています。

アプリケーション別市場衝突回避・自動緊急ブレーキ分野が市場を独占

2023年には、衝突回避・自動緊急ブレーキ分野で最も高い収益とCAGRが観測され、衝突の軽減と車両の安全確保における4D画像レーダーの重要な役割が浮き彫りになった。アダプティブ・クルーズ・コントロール(ACC)、死角検知、車線変更支援も市場収益に大きく貢献しました。

北米が世界のリーダーであり続ける

自動車用4D画像レーダー市場の地理的動向では、アジア太平洋が最もCAGRの高い地域であり、先進自動車技術の急速な採用と自律走行車に対する需要の高まりがその要因となっています。成熟した自動車市場を持つ北米は、売上高寄与率が最も高かったです。こうした動向の背景には、アジア太平洋の急成長する自動車産業と、先進運転支援技術を通じた交通安全向上への継続的な取り組みがあります。

市場競争は予測期間中に激化へ

2023年には、Continental AG、Bosch、Velodyne Lidar、Aptiv、ZF Friedrichshafen AGなどの主要企業が自動車用4D画像レーダー市場で好調な業績を示しました。彼らの主な戦略には、センサー技術の継続的な革新、自律走行ソリューションへの大規模な投資、高度なADAS機能の開発などが含まれます。2023年の収益は過去の実績を示すものであり、予測期間(2024年~2032年)の収益は持続的な成長と市場でのリーダーシップが中心となります。これらの企業はその地位を維持し、進化する市場力学に適応することで、自動車用4D画像レーダー技術の未来を形作る役割を確固たるものにしていくと予想されます。

目次

第1章 序文

- レポート内容

- 報告書の目的

- 対象者

- 主な提供商品

- 市場セグメンテーション

- 調査手法

- フェーズⅠ-二次調査

- フェーズⅡ-一次調査

- フェーズⅢ-有識者レビュー

- 前提条件

- 採用したアプローチ

第2章 エグゼクティブサマリー

- 市場プロファイリング

- 販売およびマーケティング計画

- 市場における重要な結論

- 戦略的な推奨事項

第3章 自動車用4D画像レーダー市場:競合分析

- 主要ベンダーの市場ポジショニング

- ベンダーが採用する戦略

- 主要な産業戦略

- ティア分析:2023 vs 2032

第4章 自動車用4D画像レーダー市場:マクロ分析と市場力学

- イントロダクション

- 世界の自動車用4D画像レーダー市場金額、2022年~2032年

- 市場力学

- 市場促進要因

- 市場抑制要因

- 主な課題

- 主な機会

- 促進要因と抑制要因の影響分析

- シーソー分析

- ポーターのファイブフォースモデル

- サプライヤーパワー

- バイヤーパワー

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

- PESTEL分析

- 政治的情勢

- 経済情勢

- テクノロジーの情勢

- 法的情勢

- 社会的情勢

- ヘプタリシス分析

- ビジネス上の問題の批判的研究:5つの「なぜ?」-根本的原因と関連する解決策の分析

第5章 自動車用4D画像レーダー市場:自動化のレベル別、2022年~2032年

- 市場概要

- 成長・収益分析:2023 vs 2032

- ボリュームと価格の分析、2022年~2032年

- 市場セグメンテーション

- ADAS(先進運転支援システム)(ADAS)

- レベル1(運転支援)

- レベル2(部分自動化)

- レベル2+(高度な部分自動化)

- レベル3(条件付き自動化)

- 自動運転車(AV)

- レベル4(高度な自動化)

- レベル5(完全自動化)

- ADAS(先進運転支援システム)(ADAS)

第6章 自動車用4D画像レーダー市場:範囲別、2022年~2032年

- 市場概要

- 成長・収益分析:2023 vs 2032

- ボリュームと価格の分析、2022年~2032年

- 市場セグメンテーション

- 短距離レーダー

- 中長距離レーダー

第7章 自動車用4D画像レーダー市場:帯域別、2022年~2032年

- 市場概要

- 成長・収益分析:2023 vs 2032

- ボリュームと価格の分析、2022年~2032年

- 市場セグメンテーション

- 24GHz~24.25GHz

- 21GHz~26GHz

- 76GHz~77GHz

- 77GHz~81GHz

第8章 自動車用4D画像レーダー市場:用途別、2022年~2032年

- 市場概要

- 成長・収益分析:2023 vs 2032

- ボリュームと価格の分析、2022年~2032年

- 市場セグメンテーション

- 衝突回避と自動緊急ブレーキ別

- アダプティブクルーズコントロール(ACC)

- 死角検出と車線変更支援

第9章 地域分析

- 市場概要

- マクロ要因と市場への影響:ダッシュボード(2023年)

- 地域をまたいだポーターズファイブフォースモデル:ダッシュボード(2023年)

- 地域にわたるPESTEL要因の影響:ダッシュボード(2023年)

第10章 北米の自動車用4D画像レーダー市場、2022年~2032年

- 市場概要

- 自動車用4D画像レーダー市場:自動化のレベル別、2022年~2032年

- 自動車用4D画像レーダー市場:範囲別、2022年~2032年

- 自動車用4D画像レーダー市場:帯域別、2022年~2032年

- 自動車用4D画像レーダー市場:用途別、2022年~2032年

- 自動車用4D画像レーダー市場:地域別、2022年~2032年

- 北米

- 米国

- カナダ

- その他北米地域

- 北米

第11章 英国と欧州連合の自動車用4D画像レーダー市場、2022年~2032年

- 市場概要

- 自動車用4D画像レーダー市場:自動化のレベル別、2022年~2032年

- 自動車用4D画像レーダー市場:範囲別、2022年~2032年

- 自動車用4D画像レーダー市場:帯域別、2022年~2032年

- 自動車用4D画像レーダー市場:用途別、2022年~2032年

- 自動車用4D画像レーダー市場:地域別、2022年~2032年

- 英国と欧州連合

- 英国

- ドイツ

- スペイン

- イタリア

- フランス

- その他欧州地域

- 英国と欧州連合

第12章 アジア太平洋の自動車用4D画像レーダー市場、2022年~2032年

- 市場概要

- 自動車用4D画像レーダー市場:自動化のレベル別、2022年~2032年

- 自動車用4D画像レーダー市場:範囲別、2022年~2032年

- 自動車用4D画像レーダー市場:帯域別、2022年~2032年

- 自動車用4D画像レーダー市場:用途別、2022年~2032年

- 自動車用4D画像レーダー市場:地域別、2022年~2032年

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋

- アジア太平洋

第13章 ラテンアメリカの自動車用4D画像レーダー市場、2022年~2032年

- 市場概要

- 自動車用4D画像レーダー市場:自動化のレベル別、2022年~2032年

- 自動車用4D画像レーダー市場:範囲別、2022年~2032年

- 自動車用4D画像レーダー市場:帯域別、2022年~2032年

- 自動車用4D画像レーダー市場:用途別、2022年~2032年

- 自動車用4D画像レーダー市場:地域別、2022年~2032年

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ地域

- ラテンアメリカ

第14章 中東・アフリカの自動車用4D画像レーダー市場、2022年~2032年

- 市場概要

- 自動車用4D画像レーダー市場:自動化のレベル別、2022年~2032年

- 自動車用4D画像レーダー市場:範囲別、2022年~2032年

- 自動車用4D画像レーダー市場:帯域別、2022年~2032年

- 自動車用4D画像レーダー市場:用途別、2022年~2032年

- 自動車用4D画像レーダー市場:地域別、2022年~2032年

- 中東・アフリカ

- GCC

- アフリカ

- その他中東・アフリカ地域

- 中東・アフリカ

第15章 企業プロファイル

- Ainstein

- Hyundai Mobis

- Bosch

- Oculii

- Vayyar Imaging

- Texas Instruments

- ZF

- その他の主要企業

List of Tables

- TABLE 1 Global Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 2 Global Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 3 Global Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 4 Global Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 5 Global Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 6 Global Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 7 North America Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 8 North America Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 9 North America Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 10 North America Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 11 North America Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 12 North America Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 13 U.S. Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 14 U.S. Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 15 U.S. Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 16 U.S. Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 17 U.S. Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 18 U.S. Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 19 Canada Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 20 Canada Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 21 Canada Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 22 Canada Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 23 Canada Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 24 Canada Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 25 Rest of North America Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 26 Rest of North America Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 27 Rest of North America Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 28 Rest of North America Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 29 Rest of North America Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 30 Rest of North America Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 31 UK and European Union Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 32 UK and European Union Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 33 UK and European Union Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 34 UK and European Union Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 35 UK and European Union Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 36 UK and European Union Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 37 UK Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 38 UK Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 39 UK Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 40 UK Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 41 UK Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 42 UK Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 43 Germany Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 44 Germany Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 45 Germany Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 46 Germany Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 47 Germany Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 48 Germany Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 49 Spain Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 50 Spain Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 51 Spain Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 52 Spain Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 53 Spain Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 54 Spain Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 55 Italy Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 56 Italy Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 57 Italy Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 58 Italy Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 59 Italy Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 60 Italy Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 61 France Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 62 France Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 63 France Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 64 France Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 65 France Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 66 France Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 67 Rest of Europe Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 68 Rest of Europe Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 69 Rest of Europe Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 70 Rest of Europe Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 71 Rest of Europe Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 72 Rest of Europe Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 73 Asia Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 74 Asia Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 75 Asia Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 76 Asia Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 77 Asia Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 78 Asia Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 79 China Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 80 China Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 81 China Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 82 China Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 83 China Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 84 China Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 85 Japan Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 86 Japan Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 87 Japan Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 88 Japan Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 89 Japan Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 90 Japan Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 91 India Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 92 India Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 93 India Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 94 India Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 95 India Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 96 India Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 97 Australia Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 98 Australia Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 99 Australia Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 100 Australia Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 101 Australia Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 102 Australia Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 103 South Korea Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 104 South Korea Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 105 South Korea Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 106 South Korea Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 107 South Korea Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 108 South Korea Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 109 Latin America Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 110 Latin America Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 111 Latin America Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 112 Latin America Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 113 Latin America Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 114 Latin America Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 115 Brazil Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 116 Brazil Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 117 Brazil Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 118 Brazil Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 119 Brazil Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 120 Brazil Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 121 Mexico Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 122 Mexico Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 123 Mexico Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 124 Mexico Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 125 Mexico Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 126 Mexico Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 127 Rest of Latin America Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 128 Rest of Latin America Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 129 Rest of Latin America Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 130 Rest of Latin America Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 131 Rest of Latin America Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 132 Rest of Latin America Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 133 Middle East and Africa Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 134 Middle East and Africa Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 135 Middle East and Africa Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 136 Middle East and Africa Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 137 Middle East and Africa Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 138 Middle East and Africa Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 139 GCC Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 140 GCC Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 141 GCC Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 142 GCC Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 143 GCC Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 144 GCC Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 145 Africa Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 146 Africa Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 147 Africa Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 148 Africa Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 149 Africa Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 150 Africa Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

- TABLE 151 Rest of Middle East and Africa Automotive 4D Imaging Radar Market By Level of Automation, 2022-2032, USD (Million)

- TABLE 152 Rest of Middle East and Africa Automotive 4D Imaging Radar Market By Advanced Driver Assistance Systems (ADAS), 2022-2032, USD (Million)

TABLE 153 Rest of Middle East and Africa Automotive 4D Imaging Radar Market By Autonomous Vehicles (AV), 2022-2032, USD (Million)

TABLE 154 Rest of Middle East and Africa Automotive 4D Imaging Radar Market By Range, 2022-2032, USD (Million)

- TABLE 155 Rest of Middle East and Africa Automotive 4D Imaging Radar Market By Frequency, 2022-2032, USD (Million)

- TABLE 156 Rest of Middle East and Africa Automotive 4D Imaging Radar Market By Application, 2022-2032, USD (Million)

List of Figures

- FIG. 1 Global Automotive 4D Imaging Radar Market: Market Coverage

- FIG. 2 Research Methodology and Data Sources

- FIG. 3 Market Size Estimation - Top Down & Bottom-Up Approach

- FIG. 4 Global Automotive 4D Imaging Radar Market: Quality Assurance

- FIG. 5 Global Automotive 4D Imaging Radar Market, By Level of Automation, 2023

- FIG. 6 Global Automotive 4D Imaging Radar Market, By Range, 2023

- FIG. 7 Global Automotive 4D Imaging Radar Market, By Frequency, 2023

- FIG. 8 Global Automotive 4D Imaging Radar Market, By Application, 2023

- FIG. 9 Global Automotive 4D Imaging Radar Market, By Geography, 2023

- FIG. 10 Market Geographical Opportunity Matrix - Global Automotive 4D Imaging Radar Market, 2023

FIG. 11Market Positioning of Key Automotive 4D Imaging Radar Market Players, 2023

FIG. 12Global Automotive 4D Imaging Radar Market - Tier Analysis - Percentage of Revenues by Tier Level, 2023 Versus 2032

FIG. 13Porters Five Force Model - Current, Midterm and Long Term Perspective

FIG. 14See Saw Analysis

FIG. 15PETEL Analysis

FIG. 16Key Buying Criteria: Current and Long-Term Perspective

FIG. 17Global Automotive 4D Imaging Radar Market, Scenario Analysis, 2022 to 2032 (US$ Million)

FIG. 18Heptalysis Analysis: Global Automotive 4D Imaging Radar Market

FIG. 19Five Whys Analysis

- FIG. 20 Global Automotive 4D Imaging Radar Market, By Level of Automation, 2023 Vs 2032, %

- FIG. 21 Global Automotive 4D Imaging Radar Market, By Range, 2023 Vs 2032, %

- FIG. 22 Global Automotive 4D Imaging Radar Market, By Frequency, 2023 Vs 2032, %

- FIG. 23 Global Automotive 4D Imaging Radar Market, By Application, 2023 Vs 2032, %

- FIG. 24 U.S. Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 25 Canada Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 26 Rest of North America Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 27 UK Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 28 Germany Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 29 Spain Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 30 Italy Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 31 France Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 32 Rest of Europe Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 33 China Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 34 Japan Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 35 India Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 36 Australia Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 37 South Korea Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 38 Rest of Asia Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 39 Brazil Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 40 Mexico Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 41 Rest of Latin America Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 42 GCC Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 43 Africa Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

- FIG. 44 Rest of Middle East and Africa Automotive 4D Imaging Radar Market (US$ Million), 2022 - 2032

The automotive 4D imaging radar market is expected to grow at a CAGR of 22% during the forecast period of 2024 to 2032, propelled by advancements in sensor technologies, the increasing embrace of autonomous vehicles, and the growing adoption of Advanced Driver Assistance Systems (ADAS). However, challenges related to cost-effectiveness pose a restraint. The segmentation analysis reveals different market leaders in terms of revenue and CAGR, reflecting the diverse dynamics within the automotive 4D imaging radar ecosystem. Geographically, Asia-Pacific is expected to experience the highest CAGR, while North America remains a significant contributor to overall revenue. The competitive landscape underscores the dominance of key players and their strategic focus on innovation, automation, and safety, shaping the future of automotive radar technology.

Key Market Drivers

Advancements in Sensor Technologies

Continuous advancements in sensor technologies are driving the automotive 4D imaging radar market. Companies such as Continental AG and Bosch are pioneering the development of sophisticated radar sensors, enhancing the perception capabilities of vehicles. These advancements play a crucial role in enabling 4D imaging, providing accurate and real-time information about the vehicle's surroundings. Evidence of this driver is evident in the deployment of radar sensors in modern Advanced Driver Assistance Systems (ADAS) and autonomous vehicles, where the ability to precisely detect objects and obstacles is paramount for safe navigation.

Increasing Embrace of Autonomous Vehicles

The increasing embrace of autonomous vehicles is a significant driver for the 4D imaging radar market. Companies like Velodyne Lidar and NVIDIA are at the forefront of providing solutions that empower autonomous vehicles with comprehensive sensing capabilities. The evidence lies in the growing investments in autonomous driving technologies, with major automakers integrating 4D imaging radar systems to enable accurate perception, obstacle detection, and decision-making. As the automotive industry shifts toward higher levels of automation, the demand for advanced radar systems is expected to surge, driving market growth.

Growing Adoption of Advanced Driver Assistance Systems (ADAS)

The growing adoption of Advanced Driver Assistance Systems (ADAS) is fueling the demand for 4D imaging radar. Companies like Aptiv and ZF Friedrichshafen AG are key players in providing ADAS solutions that incorporate radar technology for features such as collision avoidance, adaptive cruise control, and lane departure warning. The evidence is seen in the widespread integration of ADAS in modern vehicles, with radar-based systems playing a critical role in enhancing vehicle safety and reducing accidents. As regulatory bodies push for increased safety standards, the demand for ADAS-equipped vehicles is expected to grow, further boosting the 4D imaging radar market.

Restraint

Despite the positive momentum, the market faces a notable restraint related to the challenges in achieving cost-effectiveness. The complexity and advanced functionalities of 4D imaging radar systems contribute to higher manufacturing and integration costs. Evidence of this restraint can be observed in the hesitancy of some automakers to implement 4D imaging radar widely due to concerns about the overall cost-effectiveness of the technology. Striking a balance between cutting-edge capabilities and cost efficiency remains a challenge for market players.

Market Segmentation Analysis

Market By Level of Automation: Advanced Driver Assistance Systems (ADAS) Dominate the Market

In 2023, the highest revenue in the automotive 4D imaging radar market was generated from Advanced Driver Assistance Systems (ADAS), reflecting the widespread adoption of radar technology in enhancing driver safety. Simultaneously, the highest Compound Annual Growth Rate (CAGR) during the forecast period (2024 to 2032) was observed in the Autonomous Vehicles segment, showcasing the increasing integration of 4D imaging radar in self-driving vehicles.

Market By Range: Short-range Radar to Promise Market Potential during the Forecast Period

In 2023, both Short-range Radar and Medium & Long-Range Radar contributed significantly to the market's revenue. However, during the forecast period, Short-range Radar exhibited the highest CAGR, indicating a growing demand for radar systems that excel nearby sensing, crucial for parking assistance and urban driving scenarios.

Market By Frequency: 77 GHz to 81 GHz frequency Dominates the Market

In 2023, the 77 GHz to 81 GHz frequency band led in both revenue and CAGR, emphasizing its suitability for high-resolution imaging and accurate object detection. The 24 GHz to 24.25 GHz and 21 GHz to 26 GHz frequency bands also contributed to revenue, catering to different application requirements.

Market By Application: Collision Avoidance and Autonomous Emergency Braking segment Dominates the Market

In 2023, the highest revenue and CAGR were observed in the Collision Avoidance and Autonomous Emergency Braking segment, underscoring the critical role of 4D imaging radar in mitigating collisions and ensuring vehicle safety. Adaptive Cruise Control (ACC) Blind Spot Detection and Lane Change Assistance also contributed significantly to market revenue.

North America Remains the Global Leader

The geographic trends in the automotive 4D imaging radar market highlight Asia-Pacific as the region with the highest CAGR, driven by the rapid adoption of advanced automotive technologies and the increasing demand for autonomous vehicles. North America, with its mature automotive market, contributed the highest revenue percent. The reasons for these trends are rooted in Asia-Pacific's burgeoning automotive industry and the continuous efforts to improve road safety through advanced driver assistance technologies.

Market Competition to Intensify during the Forecast Period

In 2023, top players such as Continental AG, Bosch, Velodyne Lidar, Aptiv, and ZF Friedrichshafen AG showcased strong performances in the automotive 4D imaging radar market. Their key strategies included continuous innovation in sensor technologies, significant investments in autonomous driving solutions, and the development of advanced ADAS features. Revenues for 2023 are indicative of past achievements, while expectations for the forecast period (2024 to 2032) revolve around sustained growth and market leadership. These companies are anticipated to maintain their positions and adapt to evolving market dynamics, solidifying their roles in shaping the future of automotive 4D imaging radar technology.

Historical & Forecast Period

This study report represents analysis of each segment from 2021 to 2031 considering 2022 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2023 to 2031.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation ofAutomotive 4D Imaging Radar market are as follows:

- Research and development budgets of manufacturers and government spending

- Revenues of key companies in the market segment

- Number of end users and consumption volume, price and value.

Geographical revenues generate by countries considered in the report:

Micro and macro environment factors that are currently influencing the Automotive 4D Imaging Radar market and their expected impact during the forecast period.

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

Market Segmentation

Level of Automation

- Advanced Driver Assistance Systems (ADAS)

- Level 1 (Driver Assistance)

- Level 2 (Partial Automation)

- Level 2+ (Advanced Partial Automation)

- Level 3 (Conditional Automation)

- Autonomous Vehicles (AV)

- Level 4 (High Automation)

4.3.2.2. Level 5 (Full Automation)

Range

- Short-range Radar

- Medium & Long Range Radar

Frequency

24 GHz to 24.25 GHz

21 GHz to 26 GHz

76 GHz to 77 GHz

77 GHz to 81 GHz

Application

- By Collision Avoidance and Autonomous Emergency Braking

- Adaptive Cruise Control (ACC)

- Blind Spot Detection and Lane Change Assistance

Region Segment (2021-2031; US$ Million)

- North America

- U.S.

- Canada

- Rest of North America

- UK and European Union

- UK

- Germany

- Spain

- Italy

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC

- Africa

- Rest of Middle East and Africa

Key questions answered in this report:

- What are the key micro and macro environmental factors that are impacting the growth of Automotive 4D Imaging Radar market?

- What are the key investment pockets with respect to product segments and geographies currently and during the forecast period?

- Estimated forecast and market projections up to 2031.

- Which segment accounts for the fastest CAGR during the forecast period?

- Which market segment holds a larger market share and why?

- Are low and middle-income economies investing in the Automotive 4D Imaging Radar market?

- Which is the largest regional market for Automotive 4D Imaging Radar market?

- What are the market trends and dynamics in emerging markets such as Asia Pacific, Latin America, and Middle East & Africa?

- Which are the key trends driving Automotive 4D Imaging Radar market growth?

- Who are the key competitors and what are their key strategies to enhance their market presence in the Automotive 4D Imaging Radar market worldwide?

Table of Contents

1. Preface

- 1.1. Report Description

- 1.1.1. Purpose of the Report

- 1.1.2. Target Audience

- 1.1.3. Key Offerings

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.3.1. Phase I - Secondary Research

- 1.3.2. Phase II - Primary Research

- 1.3.3. Phase III - Expert Panel Review

- 1.3.4. Assumptions

- 1.3.5. Approach Adopted

2. Executive Summary

- 2.1. Market Snapshot: Global Automotive 4D Imaging Radar Market

- 2.2. Global Automotive 4D Imaging Radar Market, By Level of Automation, 2023 (US$ Million)

- 2.3. Global Automotive 4D Imaging Radar Market, By Range, 2023 (US$ Million)

- 2.4. Global Automotive 4D Imaging Radar Market, By Frequency, 2023 (US$ Million)

- 2.5. Global Automotive 4D Imaging Radar Market, By Application, 2023 (US$ Million)

- 2.6. Global Automotive 4D Imaging Radar Market, By Geography, 2023 (US$ Million)

- 2.7. Attractive Investment Proposition by Geography, 2023

- 2.8. Key Buying Criteria

- 2.9. Key Case Reports

- 2.10. Scenario Analysis

- 2.10.1. Optimistic estimates and analysis

- 2.10.2. Realistic estimates and analysis

- 2.10.3. Pessimistic estimates and analysis

- 2.11. Market Profiling

- 2.12. Sales and Marketing Plan

- 2.13. Top Market Conclusions

- 2.14. Strategic Recommendations

3. Automotive 4D Imaging Radar Market: Competitive Analysis

- 3.1. Market Positioning of Key Automotive 4D Imaging Radar Market Vendors

- 3.2. Strategies Adopted by Automotive 4D Imaging Radar Market Vendors

- 3.3. Key Industry Strategies

- 3.4. Tier Analysis 2023 Versus 2032

4. Automotive 4D Imaging Radar Market: Macro Analysis & Market Dynamics

- 4.1. Introduction

- 4.2. Global Automotive 4D Imaging Radar Market Value, 2022 - 2032, (US$ Million)

- 4.3. Market Dynamics

- 4.3.1. Market Drivers

- 4.3.2. Market Restraints

- 4.3.3. Key Challenges

- 4.3.4. Key Opportunities

- 4.4. Impact Analysis of Drivers and Restraints

- 4.5. See-Saw Analysis

- 4.6. Porter's Five Force Model

- 4.6.1. Supplier Power

- 4.6.2. Buyer Power

- 4.6.3. Threat Of Substitutes

- 4.6.4. Threat Of New Entrants

- 4.6.5. Competitive Rivalry

- 4.7. PESTEL Analysis

- 4.7.1. Political Landscape

- 4.7.2. Economic Landscape

- 4.7.3. Technology Landscape

- 4.7.4. Legal Landscape

- 4.7.5. Social Landscape

- 4.8. Heptalysis Analysis

- 4.9. Critical Investigation of Business Problems Through Five Whys Root Cause Analysis & Relevant Solutions

5. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 5.1. Market Overview

- 5.2. Growth & Revenue Analysis: 2023 Versus 2032

- 5.3. Volume and Pricing Analysis, 2022-2032

- 5.4. Market Segmentation

- 5.4.1. Advanced Driver Assistance Systems (ADAS)

- 5.4.1.1. Level 1 (Driver Assistance)

- 5.4.1.2. Level 2 (Partial Automation)

- 5.4.1.3. Level 2+ (Advanced Partial Automation)

- 5.4.1.4. Level 3 (Conditional Automation)

- 5.4.2. Autonomous Vehicles (AV)

- 5.4.2.1. Level 4 (High Automation)

- 5.4.2.2. 4.3.2.2. Level 5 (Full Automation)

- 5.4.1. Advanced Driver Assistance Systems (ADAS)

6. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 6.1. Market Overview

- 6.2. Growth & Revenue Analysis: 2023 Versus 2032

- 6.3. Volume and Pricing Analysis, 2022-2032

- 6.4. Market Segmentation

- 6.4.1. Short-range Radar

- 6.4.2. Medium & Long Range Radar

7. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 7.1. Market Overview

- 7.2. Growth & Revenue Analysis: 2023 Versus 2032

- 7.3. Volume and Pricing Analysis, 2022-2032

- 7.4. Market Segmentation

- 7.4.1. 24 GHz to 24.25 GHz

- 7.4.2. 21 GHz to 26 GHz

- 7.4.3. 76 GHz to 77 GHz

- 7.4.4. 77 GHz to 81 GHz

8. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 8.1. Market Overview

- 8.2. Growth & Revenue Analysis: 2023 Versus 2032

- 8.3. Volume and Pricing Analysis, 2022-2032

- 8.4. Market Segmentation

- 8.4.1. By Collision Avoidance and Autonomous Emergency Braking

- 8.4.2. Adaptive Cruise Control (ACC)

- 8.4.3. Blind Spot Detection and Lane Change Assistance

9. Geographic Analysis

- 9.1. Market Overview

- 9.2.Macro Factors versus Market Impact: Dashboard, 2023

- 9.3. Porters Five Force Model Across Geography: Dashboard, 2023

- 9.4. Impact of PESTEL factors Across Geography: Dashboard, 2023

10. North America Automotive 4D Imaging Radar Market, 2022-2032, USD (Million)

- 10.1. Market Overview

- 10.2. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 10.3. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 10.4. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 10.5. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 10.6.Automotive 4D Imaging Radar Market: By Region, 2022-2032, USD (Million)

- 10.6.1.North America

- 10.6.1.1. U.S.

- 10.6.1.1.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 10.6.1.1.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 10.6.1.1.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 10.6.1.1.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 10.6.1.2. Canada

- 10.6.1.2.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 10.6.1.2.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 10.6.1.2.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 10.6.1.2.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 10.6.1.3. Rest of North America

- 10.6.1.3.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 10.6.1.3.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 10.6.1.3.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 10.6.1.3.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 10.6.1.1. U.S.

- 10.6.1.North America

11. UK and European Union Automotive 4D Imaging Radar Market, 2022-2032, USD (Million)

- 11.1. Market Overview

- 11.2. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 11.3. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 11.4. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 11.5. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 11.6.Automotive 4D Imaging Radar Market: By Region, 2022-2032, USD (Million)

- 11.6.1.UK and European Union

- 11.6.1.1. UK

- 11.6.1.1.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 11.6.1.1.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 11.6.1.1.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 11.6.1.1.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 11.6.1.2. Germany

- 11.6.1.2.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 11.6.1.2.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 11.6.1.2.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 11.6.1.2.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 11.6.1.3. Spain

- 11.6.1.3.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 11.6.1.3.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 11.6.1.3.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 11.6.1.3.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 11.6.1.4. Italy

- 11.6.1.4.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 11.6.1.4.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 11.6.1.4.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 11.6.1.4.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 11.6.1.5. France

- 11.6.1.5.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 11.6.1.5.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 11.6.1.5.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 11.6.1.5.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 11.6.1.6. Rest of Europe

- 11.6.1.6.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 11.6.1.6.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 11.6.1.6.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 11.6.1.6.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 11.6.1.1. UK

- 11.6.1.UK and European Union

12. Asia Pacific Automotive 4D Imaging Radar Market, 2022-2032, USD (Million)

- 12.1. Market Overview

- 12.2. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 12.3. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 12.4. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 12.5. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 12.6.Automotive 4D Imaging Radar Market: By Region, 2022-2032, USD (Million)

- 12.6.1.Asia Pacific

- 12.6.1.1. China

- 12.6.1.1.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 12.6.1.1.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 12.6.1.1.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 12.6.1.1.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 12.6.1.2. Japan

- 12.6.1.2.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 12.6.1.2.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 12.6.1.2.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 12.6.1.2.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 12.6.1.3. India

- 12.6.1.3.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 12.6.1.3.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 12.6.1.3.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 12.6.1.3.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 12.6.1.4. Australia

- 12.6.1.4.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 12.6.1.4.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 12.6.1.4.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 12.6.1.4.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 12.6.1.5. South Korea

- 12.6.1.5.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 12.6.1.5.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 12.6.1.5.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 12.6.1.5.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 12.6.1.6. Rest of Asia Pacific

- 12.6.1.6.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 12.6.1.6.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 12.6.1.6.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 12.6.1.6.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 12.6.1.1. China

- 12.6.1.Asia Pacific

13. Latin America Automotive 4D Imaging Radar Market, 2022-2032, USD (Million)

- 13.1. Market Overview

- 13.2. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 13.3. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 13.4. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 13.5. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 13.6.Automotive 4D Imaging Radar Market: By Region, 2022-2032, USD (Million)

- 13.6.1.Latin America

- 13.6.1.1. Brazil

- 13.6.1.1.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 13.6.1.1.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 13.6.1.1.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 13.6.1.1.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 13.6.1.2. Mexico

- 13.6.1.2.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 13.6.1.2.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 13.6.1.2.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 13.6.1.2.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 13.6.1.3. Rest of Latin America

- 13.6.1.3.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 13.6.1.3.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 13.6.1.3.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 13.6.1.3.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 13.6.1.1. Brazil

- 13.6.1.Latin America

14. Middle East and Africa Automotive 4D Imaging Radar Market, 2022-2032, USD (Million)

- 14.1. Market Overview

- 14.2. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 14.3. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 14.4. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 14.5. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 14.6.Automotive 4D Imaging Radar Market: By Region, 2022-2032, USD (Million)

- 14.6.1.Middle East and Africa

- 14.6.1.1. GCC

- 14.6.1.1.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 14.6.1.1.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 14.6.1.1.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 14.6.1.1.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 14.6.1.2. Africa

- 14.6.1.2.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 14.6.1.2.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 14.6.1.2.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 14.6.1.2.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 14.6.1.3. Rest of Middle East and Africa

- 14.6.1.3.1. Automotive 4D Imaging Radar Market: By Level of Automation, 2022-2032, USD (Million)

- 14.6.1.3.2. Automotive 4D Imaging Radar Market: By Range, 2022-2032, USD (Million)

- 14.6.1.3.3. Automotive 4D Imaging Radar Market: By Frequency, 2022-2032, USD (Million)

- 14.6.1.3.4. Automotive 4D Imaging Radar Market: By Application, 2022-2032, USD (Million)

- 14.6.1.1. GCC

- 14.6.1.Middle East and Africa

15. Company Profile

- 15.1. Ainstein

- 15.1.1. Company Overview

- 15.1.2. Financial Performance

- 15.1.3. Product Portfolio

- 15.1.4. Strategic Initiatives

- 15.2. Hyundai Mobis

- 15.2.1. Company Overview

- 15.2.2. Financial Performance

- 15.2.3. Product Portfolio

- 15.2.4. Strategic Initiatives

- 15.3. Bosch

- 15.3.1. Company Overview

- 15.3.2. Financial Performance

- 15.3.3. Product Portfolio

- 15.3.4. Strategic Initiatives

- 15.4. Oculii

- 15.4.1. Company Overview

- 15.4.2. Financial Performance

- 15.4.3. Product Portfolio

- 15.4.4. Strategic Initiatives

- 15.5. Vayyar Imaging

- 15.5.1. Company Overview

- 15.5.2. Financial Performance

- 15.5.3. Product Portfolio

- 15.5.4. Strategic Initiatives

- 15.6. Texas Instruments

- 15.6.1. Company Overview

- 15.6.2. Financial Performance

- 15.6.3. Product Portfolio

- 15.6.4. Strategic Initiatives

- 15.7. ZF

- 15.7.1. Company Overview

- 15.7.2. Financial Performance

- 15.7.3. Product Portfolio

- 15.7.4. Strategic Initiatives

- 15.8. Other Notable Players

- 15.8.1. Company Overview

- 15.8.2. Financial Performance

- 15.8.3. Product Portfolio

- 15.8.4. Strategic Initiatives