|

|

市場調査レポート

商品コード

1871065

長期エネルギー貯蔵 (LDES) の概要:技術・材料・プロジェクト・企業・研究の進展 (2025-2026年)・代替案・市場動向 (2026-2046年)Long Duration Energy Storage (LDES) Overview: Technologies, Materials, Projects, Companies, Research Advances in 2025-2026, Escape Routes, Markets 2026-2046 |

||||||

|

|||||||

| 長期エネルギー貯蔵 (LDES) の概要:技術・材料・プロジェクト・企業・研究の進展 (2025-2026年)・代替案・市場動向 (2026-2046年) |

|

出版日: 2025年10月31日

発行: Zhar Research

ページ情報: 英文 560 Pages

納期: 即日から翌営業日

|

概要

長期間エネルギー貯蔵 (LDES) は、風力・太陽光発電の間欠性を補うためにますます重要性を増しています。また、その他のグリーン電力オプションが停止する時間帯を補完する用途としても有用です。一部の支持者は、LDESに数兆ドル規模の投資が必要だと訴えていますが、エスケープルート (代替案)・投資回収・現実的な遅延を考慮するとどうでしょうか?

当レポートでは、2026年から2046年までの23本の詳細な予測ライン、3本のロードマップを提示することでその答えを示します。特に重要なのは、2025年から2026年にかけての研究開発と企業動向を詳細に分析している点です。その結果として、今後20年間でLDESによる低コストなグリーン電力供給を実現するには約1兆ドルが必要となり、一方で、より広範な気象条件や時間帯をカバーする送電網・連系線の拡充など、代替案も次第に活性化していくことが示されています。

目次

第1章 エグゼクティブサマリーと結論

- 本レポートの目的と独自の範囲

- 調査手法

- 電化とLDESの定義、ニーズ、候補者に関する主要な結論

- LDESパラメータと計算に関する重要な結論

- 主な結論:グリッド、マイクログリッド、代替案のためのLDES

- LDESの実際のタイプと提案されたタイプ、ゴールドスタンダード

- 19列・10技術別の潜在的なLDES性能

- 現在の設備と潜在的設備の例

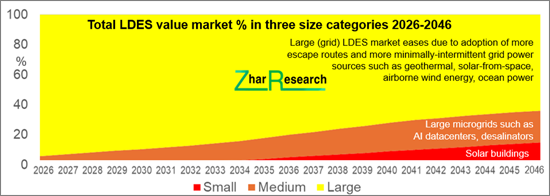

- LDESの3つのサイズ区分と、それぞれの2026-2046年の技術優位性

- 技術別に見た設置可能サイト数 (2026-2046年)

- 技術別のLDES必要量の計算とその示唆

- 現在および将来のLDESの持続時間と供給可能電力

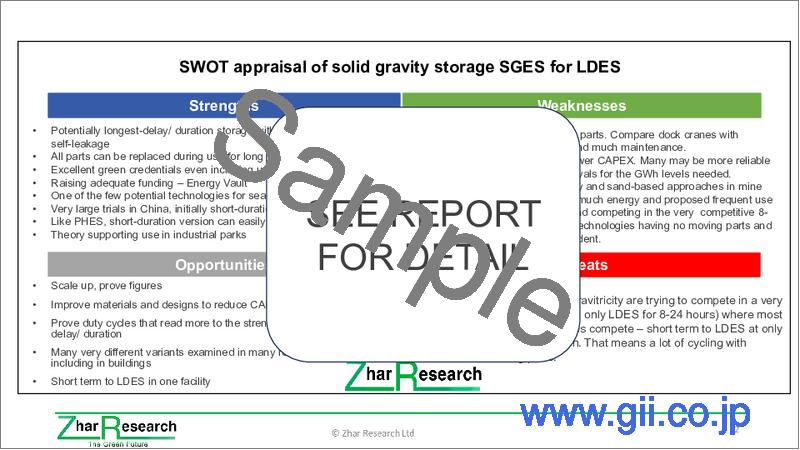

- 2026-2046年の重要な9つのLDES技術のSWOT分析

- 注目企業、企業と技術ごとの投資動向、重要地域

- 長時間エネルギー貯蔵 (LDES) ロードマップ

- 2026-2046年の市場予測 (23本の予測ライン、グラフ、解説)

第2章 LDESの必要性と設計原則

- エネルギーの基礎

- 再エネへの急速な移行とコスト急減 (2025年統計と傾向)

- 太陽光発電の優勢と間欠性の課題

- 風力/太陽光の割合の増加とコスト低下に伴う長時間LDES採用の拡大

- LDESの定義とニーズ

- LDESメトリクス

- 2025-2026年のLDESプロジェクト (主要技術サブセット)

- LDESの障害、代替案、投資環境

- LDESツールキット

- 技術別のパフォーマンスに関する最新の独立評価

- 8時間以上の長時間に弱い電池

- 非グリッドLDESの詳細分析レポート

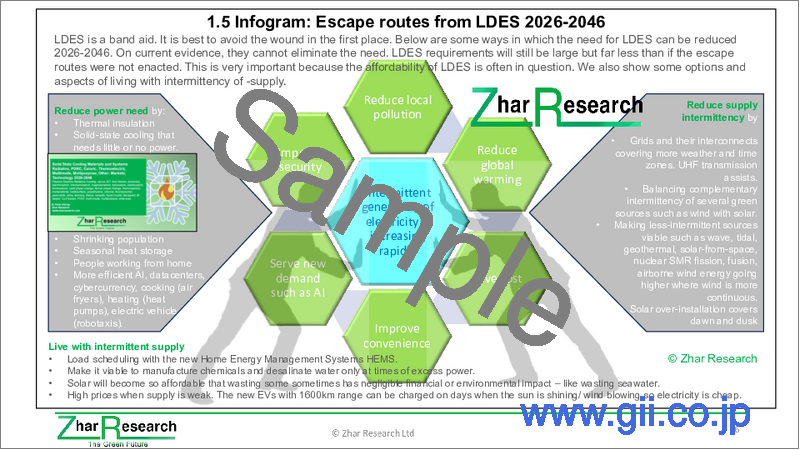

第3章 LDESの代替案

- 概況

- インフォグラム:13のエスケープルート (2026-2046年)

- 世界の例:デンマーク、シンガポール、中国、アメリカ

- 風力、太陽光、LDESを必要としないオプションの設備利用率

- 2025年のLDES代替案に関する広範な調査

- 2025年の断続的電力供給に対応する家庭用エネルギーマネジメント (HEMS) の研究

第4章 揚水発電:従来型PHES

- 概要

- 2025年までの研究の進歩と可能性の見通し

- 世界中のプロジェクトと計画

- 経済性

- 政策提言

- 従来型PHESのパラメータ評価

- 従来型PHESのSWOT評価

第5章 先進揚水発電 (APHES)

- 概要

- 鉱山跡地の利用

- 加圧地下:Quidnet Energy USA

- 重い流体を使い丘陵を活用:RheEnergise UK

- 海水や塩水の利用

- Sizeable Energy (イタリア) 、StEnSea (ドイツ) 、Ocean Grazer (オランダ)

- ハイブリッド技術:2024年と2025年の研究の進歩

- 2024年と2025年の研究の進歩

- APHESのSWOT評価

第6章 圧縮空気 (CAES)

- 概要 (2025年の研究進展含む)

- 供給不足による参入企業の急増

- CAESの市場ポジショニング

- LDESにおけるCAESのSWOT評価とパラメータ比較

- CAES技術オプション

- CAESプロジェクト、サブシステムメーカー、研究 (2025年~)

- 企業別の進展プロファイルとZhar Researchによる評価

- ALCAES Switzerland

- APEX CAES USA

- Augwind Energy Israel

- Keep Energy Systems UK formerly Cheesecake

- Corre Energy Netherlands

- Huaneng Group China

- Hydrostor Canada

- LiGE Pty South Africa

- Storelectric UK

- Terrastor Energy Corporation USA

第7章 レドックスフロー電池 (RFB)

- 概要

- LDES向けに研究がシフト

- 2026-2046年におけるLDES向けRFBの成功

- SWOT分析とパラメーター比較 (RFB for LDES)

- 45社のRFB企業を8項目で比較 (名称、ブランド、技術、成熟度、非グリッド焦点、LDES焦点、コメント)

- RFB技術 (2025年までの研究含む)

- 材料別の具体的な設計:バナジウム、鉄およびその変種、その他の金属配位子、ハロゲンベース、有機、マンガン、2025年の研究、3つのSWOT評価

- RFBメーカープロファイル

第8章 固体重力エネルギー貯蔵 (SGES)

- 概要 (2025年研究含む)

- ARES USA

- Energy Vault スイス、米国、中国、インドのライセンシー

- Gravitricity

- Green Gravity Australia

- SinkFloatSolutions France

第9章 高度従来型建設電池 (ACCB)

- 概要

- 8社のACCBメーカーを8項目で比較

- パラメーター評価とSWOT (ACCB for LDES)

- 金属空気電池

- 高温電池

- Inlyte、Altris、HiNa、Tiamat、Natron、Faradionなどの金属イオン電池

- ニッケル水素電池:EnerVenue USAのSWOT

第10章 液化ガスエネルギー貯蔵 (LGES):液体空気 (LAES) またはCO2

- 概要

- LAES LDES

- 液体および圧縮二酸化炭素LDES

第11章 遅延電力のための熱エネルギー貯蔵 (ETES)

- 2025年の概要と研究の進展

- 2025年と2024年の研究の進歩

- 失敗の教訓:Siemens Gamesa, Azelio, Steisdal, Lumenion

- 熱機関アプローチの進展:Echogen USA

- 極端な温度と光電変換の利用

- 一つのプラントから遅延熱と電力を販売

第12章 水素およびその他の化学中間体 (LDES)

- 2025-2026年の研究の進捗状況の概要

- LDESにおける水素貯蔵パラメータの評価

- LDESにおける水素、メタン、アンモニアのSWOT評価

- 数少ない実際のプロジェクト

- 計算上、H2ESは季節間貯蔵のみで最適 (将来的に必要)

- データ不足により別結論となる研究も存在

- LDESシステムにおける水素貯蔵の候補技術