|

|

市場調査レポート

商品コード

1745943

RFB (レドックスフロー電池) による長時間エネルギー貯蔵:グリッド・マイクログリッド・市場・技術 (2025~2045年)Long Duration Energy Storage with Redox Flow Batteries: Grid, Microgrid, Markets, Technology 2025-2045 |

||||||

|

|||||||

| RFB (レドックスフロー電池) による長時間エネルギー貯蔵:グリッド・マイクログリッド・市場・技術 (2025~2045年) |

|

出版日: 2025年06月11日

発行: Zhar Research

ページ情報: 英文 243 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

レドックスフロー電池 (RFB) は、グリッドおよびマイクログリッド向けの長時間エネルギー貯蔵 (LDES) をますます担うようになっています。2025年から2045年にかけて、累計で1,700億ドル以上の事業規模に達する可能性がありますが、その需要は世界各地で多様化・分散化していく見通しです。

2024年のRFBの売上は約10億ドルであり、そのほとんどは短時間用途向けでした。この売上は2045年には約220億ドルに達する可能性があり、その多くがLDES (長時間エネルギー貯蔵) 向けになると見込まれています。これは、市場ニーズとRFB技術の進化によるものです。また、2045年頃には、マイクログリッド向けのRFBによるLDESの売上が主流になる可能性もあります。これらの用途は、今後登場するRFB技術の特性と非常に高い親和性を持つからです。

当レポートでは、RFB (レドックスフロー電池) によるLDES (長時間エネルギー貯蔵) の市場を調査し、RFB技術の概要とロードマップ、市場規模の予測、RFB製造業者のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー・総論

- 目的、LDES、RFB、ハイブリッドRFB

- 調査手法

- 定義、遅延電力の必要性、代替技術

- 8つの主要な結論:RFB市場と業界、10のインフォグラム付き

- インフォグラム:RFBの企業別・技術別の実績と展望

- インフォグラム:2025年のLDES技術の持続時間と供給電力

- RFB 2025-2045が目標とするグリッドLDESとグリッド外LDESの大きく異なるニーズ

- インフォグラム:RFBの将来のビヨンドグリッド用途の例:6G基地局

- RFBの成功と市場におけるギャップ

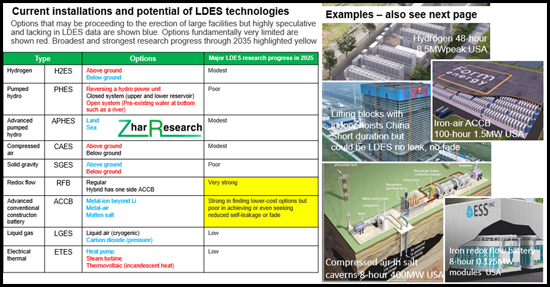

- RFBのコンテキスト:グリッドおよびグリッド外用途の完全なLDESツールキットのインフォグラム

- LDES 2025-2045におけるRFB技術リーダー

- RFB技術に関する19の主要な結論

- RFBロードマップ:市場別・技術別

- 長時間エネルギー貯蔵 (LDES) ロードマップ

- 市場予測:2025-2045年

第2章 LDESのニーズ、設計原則、2025年までの状況

- エネルギーの基礎

- 急速なコスト削減別再生可能エネルギーへの参入:2025年の統計と動向

- 太陽光発電の勝利と間欠性の課題

- LDESの代替ルート

- LDESの定義と選択肢の比較

- グリッドLDESとグリッド外LDESで大きく異なるニーズ

- 2025年の主要プロジェクト

- LDESの障害、代替案、投資環境

- LDESツールキット

- パフォーマンスに関する最新の独立評価:技術別

- LDES用RFBのパラメータ比較表

第3章 RFB (レドックスフロー電池) からLDESへの移行:ニーズ、コスト、化学、メンブレン

- 概要

- 一般:グリッドおよびマイクログリッド向けRFB

- 2030年の6G通信を含むマイクログリッド向けに最適化されたRFB

- 陽極液と陰極液の化学

- より低いLCOS、不燃性、ハイブリッドフォーム、より優れたメンブレンの探求 (インフォグラム)

- 有機および水性RFB設計

- 大規模RFBが実現可能になる

- 活気あるイノベーションのパイプライン

- インフォグラム:RFBの商業的成果と展望

- RFBの研究はLDESへと転換

- LDES向けRFBのSWOT評価

第4章 RFB技術と動向

- RFB技術

- 通常のオプションとハイブリッドオプションのSWOT評価

- 材料別の具体的な設計:バナジウム、鉄およびその変種、ハロゲンベース、有機、マンガン、塩水

第5章 RFB製造業者のプロファイル・分析

- 製造業者の数と市場規模:化学品別

- 45社のRFB企業を8項目で比較:名称、ブランド、技術、技術準備、グリッド外への焦点、LDESへの焦点、コメント

- RFB製造業者のプロファイル

Summary

Redox Flow Batteries RFB increasingly supply Long Duration Energy Storage LDES for grids and microgrids. From 2025-2045, that may total over $170 billion dollars of business cumulatively but fragmenting to serve increasingly varied needs and locations worldwide. It is time for an independent report on that large business opportunity, so we now have the Zhar Research 252-page report, "Long Duration Energy Storage with Redox Flow Batteries: Grid, microgrid, markets, technologies 2025-2045" . This is your detailed guidebook, whether you offer added value materials or complete devices.

Advances in 2025 are very important

Importantly, this new report includes PhD level analysis of the remarkable research and company advances in 2025. See 23 forecast lines 2025-2045, new roadmaps 2025-2045, SWOT reports, comparison tables, infograms and 45 manufacturer profiles with appraisals. Learn how the number of RFB manufacturers will grow up-to and after a future shakeout. Which formats, chemistries, materials and membranes win? What are your potential acquisitions, partners, competitors? What optimum strategies assist you to attain up to $5 billion in yearly RFB LDES sales?

Chapters and their findings

The "Executive summary and conclusions" (50 pages) is sufficient if your time is limited, for here are the basics, eight key conclusions on markets and companies and 19 on technologies. 45 RFB companies are compared in eight columns for each. Many pie charts, three SWOT appraisals and those 23 forecast lines and graphs with explanations make sense of it all. For example, RFB sales were around $1 billion in 2024, mainly for short duration, but sales could be around $22 billion in 2045, mostly as LDES, due to the needs and RFB technologies changing as explained here. RFB LDES value sales for microgrids could dominate by then, because these different requirements are an even better match for emerging RFB capabilities.

Chapter 2. "LDES needs, design principles, situation through 2025" takes 30 pages giving a balanced, independent view embracing the microgrid opportunity as well. You do not suffer figures from manufacturers and trade associations exaggerating the opportunity and concentrating only on grid applications. See why RFB has less competition for microgrid LDES and RFB may even lead that storage market. See escape routes from LDES such as grids widening over time and weather zones and new green generation modes each giving less intermittency. That reduces the need for grid LDES though it will still be substantial.

Chapter 3. "Redox flow batteries RFB pivoting to LDES: needs, costs, chemistries and membranes" (20 pages) gives the big picture on the costs, formats, liquid chemistries and membrane science involved. 2025 advances and potential for improvement are prioritised. The different grid and microgrid solutions are examined.

Chapter 4. "RFB technologies and trends" (37 pages) examines those all-important electrolytes and their matched formats in detail. It compares and interprets the flood of advances, particularly in 2025. The general picture is of most effort, and progress, being with vanadium, iron and zinc-based anolytes and catholytes, variants including combinations with several other metals but there is more. Eliminating flammability is now a given with the aqueous electrolytes and some organic ones. Progress is patchy in eliminating toxigens and toxigen intermediaries and zinc chemistries have considerable research but struggle with commercialisation. Such problems may be your opportunities.

The report closes with the longest chapter. Chapter 5. "RFB manufacturer profiles and analysis" (106 pages) appraises manufacturers and putative manufacturers of RFB including their profiles, technology focus and readiness, strategies, successes and failures. Conclusions are presented in tables, pie charts and forecasts.

Expert opinion

Primary author Dr Peter Harrop, CEO of Zhar Research, says, "As LDES becomes a very large market, pumped hydro and its variants and compressed air underground may serve most grid needs but special situations will favour RFB creating a lesser - but still large - grid opportunity. Green generation off-grid and capable-of-being-off-grid is an even bigger opportunity for RFB because it reads more strongly onto its strengths such as no major earthworks, small footprint when stacked and fast permitting and installation, even safely in cities. Overall, RFB can follow the demand as it moves to longer time of storage and longer duration of subsequent power delivery. It will provide ever larger capacity still with minimal fade and self-leakage, even offering repair and upgrading after deployment. Most alternatives cannot keep up with this, so we strongly urge you to assess these opportunities for both your added-value materials and your capability with structures and product integration".

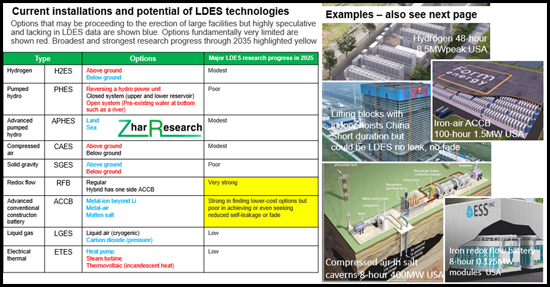

CAPTION: Current installations and potential of LDES technologies showing strong position of RFB. Source, Zhar Research report, "Long Duration Energy Storage with Redox Flow Batteries: Grid, microgrid, markets, technologies 2025-2045".

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report, LDES, RFB and hybrid RFB

- 1.2. Methodology of this analysis

- 1.3. Definitions, need for delayed electricity, escape routes

- 1.4. Eight primary conclusions: RFB markets and industry with ten infograms

- 1.5. Infogram: RFB achievements and aspirations by company and technology 2025-2045

- 1.6. Infogram: Duration hours vs power delivered for LDES technologies in 2025

- 1.7. The very different needs for grid vs beyond-grid LDES targetted by RFB 2025-2045

- 1.8. Infogram: Example of future beyond-grid application of RFB: 6G base stations

- 1.9. RFB success and gaps in its markets

- 1.10. RFB in context: Infogram of complete LDES toolkit for grid and beyond-grid applications

- 1.11. RFB technology leaders for LDES 2025-2045

- 1.11.1. Vanadium RFB gets busy - examples

- 1.11.2. RFB projects without vanadium coming up fast - examples

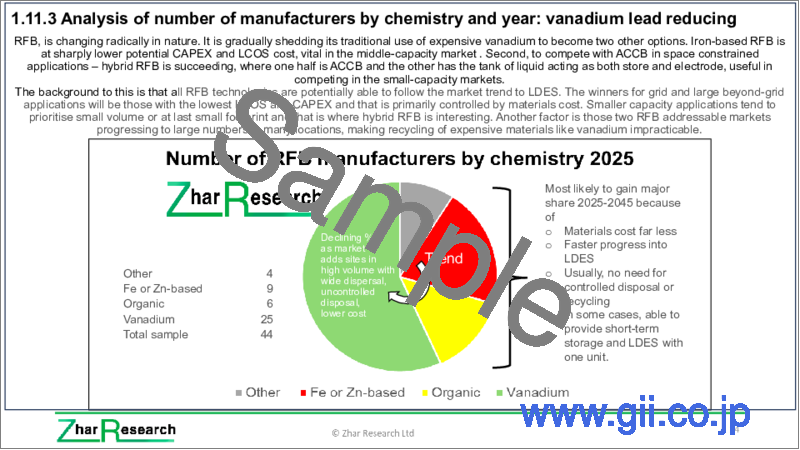

- 1.11.3. Analysis of number of manufacturers by chemistry: vanadium lead reducing

- 1.11.4. Research pipeline analysis: 61 papers from 2024-2025: primary emphasis strongly beyond vanadium

- 1.12. 19 primary conclusions concerning RFB technologies

- 1.12.1. The 19 conclusions

- 1.12.2. Seven RFB key parameters driving volume sales, vanadium vs other 2025-2045

- 1.12.3. 45 RFB companies compared in 8 columns: name, brand, technology, tech. readiness, beyond grid focus, LDES focus, comment

- 1.12.4. SWOT appraisal of regular RFB

- 1.12.5. SWOT appraisal of hybrid RFB

- 1.12.6. SWOT appraisals of vanadium and all-iron RFB against alternatives

- 1.13. RFB roadmap by market and by technology 2025-2045

- 1.14. Long Duration Energy Storage LDES roadmap 2025-2045

- 1.15. Market forecasts 2025-2045 in 23 lines

- 1.15.1. RFB global value market grid vs beyond-grid 2025-2045 table, graph, explanation

- 1.15.2. RFB global value market short term and LDES $ billion 2025-2045 table, graph, explanation

- 1.15.3. Vanadium vs iron vs other RFB value market % 2025-2045 table, graph, explanation

- 1.15.4. Regional share of RFB value market % in four regions and manufacturer numbers 2025-2045

- 1.15.5. LDES total value market showing beyond-grid gaining share 2025-2045

- 1.15.6. LDES value market $ billion in 9 technology categories with explanation 2025-2045

2. LDES needs, design principles, situation through 2025

- 2.1. Energy fundamentals

- 2.2. Racing into renewables with rapid cost reduction: 2025 statistics and trends

- 2.3. Solar winning and the intermittency challenge

- 2.4. Escape routes from LDES

- 2.4.1. General situation

- 2.4.2. Reduction of LDES need by unrelated actions

- 2.4.3. Many options to deliberately reduce the need for LDES

- 2.5. LDES definitions and choices compared

- 2.6. The very different needs for grid vs beyond-grid LDES 2025-2045

- 2.7. Leading projects in 2025 showing leading technology subsets

- 2.7.1. Current LDES situation and trend in need: simplified version

- 2.7.2. Leading projects in 2025 showing detail and leading technology subsets, trend

- 2.8. LDES impediments, alternatives, and investment climate

- 2.9. LDES toolkit

- 2.9.1. Overview

- 2.9.2. LDES choices compared

- 2.9.3. Electrochemical LDES options explained

- 2.10. Latest independent assessments of performance by technology

- 2.11. Parameter comparison table of RFB for LDES

3. Redox flow batteries RFB pivoting to LDES: needs, costs, chemistries, and membranes

- 3.1. Overview

- 3.1.1. General: RFB for grids and microgrids

- 3.1.2. RFB optimised for microgrids including 6G Communications in 2030

- 3.1.3. Chemistries of anolyte and catholyte

- 3.1.4. Quest for lower LCOS, non-flammable, hybrid forms and better membranes (with infogram)

- 3.1.5. Organic and aqueous RFB design

- 3.1.6. Large RFB becoming viable

- 3.1.7. Vibrant pipeline of innovation

- 3.2. Infogram: RFB commercial achievements and aspirations 2025-2045

- 3.3. RFB research pivoting to LDES

- 3.3.1. Overview of RFB and its potential for LDES

- 3.3.2. Lessons from review papers

- 3.3. SWOT appraisal of RFB for LDES

4. RFB technologies and trends

- 4.1. RFB technologies

- 4.1.1. Regular or hybrid, their chemistries and the main ones being commercialised

- 4.1.2. Types of RFB and their design

- 4.1.3. Leading alternative chemistries compared for redox flow batteries RFB including hybrids

- 4.2. SWOT appraisals of regular vs hybrid options

- 4.2.1. SWOT appraisal of regular RFB geometry

- 4.2.2. SWOT appraisal of hybrid RFB

- 4.3. Specific designs by material: vanadium, iron and variants, halogen-based, organic, manganese, salt water 2025, research, 3 SWOT

- 4.3.1. Metal ligand RFB

- 4.3.2. Vanadium RFB design with 15 research advances in 2025 and SWOT

- 4.3.3. All-iron RFB design with research advances in 2025

- 4.3.4. Iron combinations for RFB with research advances in 2025

- 4.3.6. Salt-water to acid-plus-base and back

5. RFB manufacturer profiles and analysis

- 5.1. Number of manufacturers and value market by chemistry 2025-2045

- 5.2. 45 RFB companies compared in 8 columns: name, brand, technology, tech. readiness, beyond-grid focus, LDES focus, comment

- 5.3. Profiles of RFB manufacturers and putative manufacturers in 97 pages