|

市場調査レポート

商品コード

1618862

自動車サイバーセキュリティの世界市場:ソフトウェア定義車両の保護The Global Market for Automotive Cybersecurity: Safeguarding the Software-Defined Vehicle |

||||||

|

|||||||

| 自動車サイバーセキュリティの世界市場:ソフトウェア定義車両の保護 |

|

出版日: 2024年12月20日

発行: VDC Research Group, Inc.

ページ情報: 英文 50 Pages/13 Exhibits; plus 416 Exhibits/Excel

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

自動車業界は、自動車サイバーセキュリティの要件を根本的に変えるソフトウェア定義車両 (SDV) コンセプトへの前例のないシフトを進めています。

本レポートでは、テレマティクスやV2X (Vehicle-to-Everything) 通信、車内決済、車両充電、インフォテインメントシステム機能、オープンソースアーキテクチャ、その他の業界ソフトウェアの取り組みや進歩など、自動車サイバーセキュリティ市場に影響を与える技術や動向の概要を記載しています。また、VDCが継続的に行っている調査対象技術市場との連携活動の一環として、本レポートではVDCの「Voice of the Engineer (エンジニアの声) 」調査から得られたエンドユーザーの知見も紹介しています。最後に、本レポートでは、市場を形成している自動車サイバーセキュリティの主要ベンダー数十社にハイライトを当てています。

インフォグラフィックス

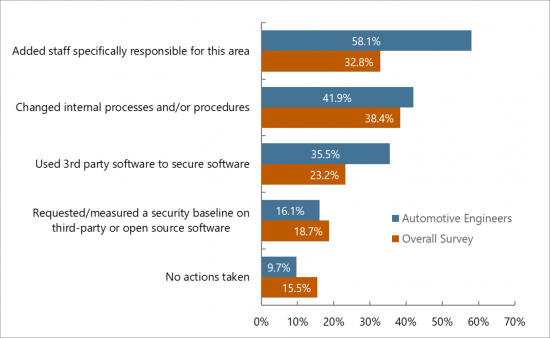

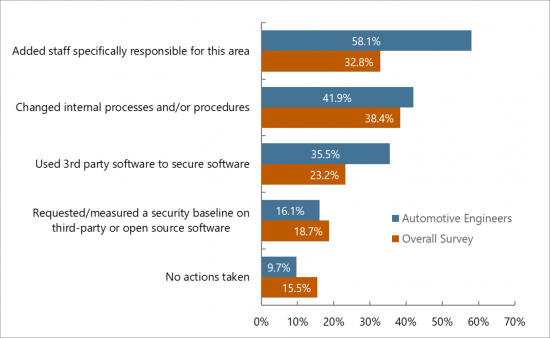

表9:セキュリティ要件に対応して回答組織が取った行動

(回答者の割合、複数回答可)

対応している質問:

- ソフトウェアとコネクティビティの大規模な導入は自動車サイバーセキュリティにどのような影響を与えたか?

- セキュリティソフトウェア、SaaS、プロフェッショナルサービスのうち、どの分野が最も急成長しているか?

- 自動車サイバーセキュリティ規制の将来と、規制の将来を理解することで何が得られるか?

- 2028年まで自動車サイバーセキュリティ市場の成長を牽引する地域はどこか?

- IoTエンジニアと自動車エンジニアはサイバーセキュリティの懸念にどのように対応しているか?

- 自動車サイバーセキュリティ市場を形成しているのはどの企業で、どのようにしているか?

本レポートに掲載されている組織:

|

|

目次

本レポートの内容

取り上げられている質問

本レポートを読むべき人

本レポートに掲載されている組織

エグゼクティブサマリー

- 主な調査結果

イントロダクション

- ソフトウェア定義車両が脆弱性を露呈

- SDVへの移行においてサイバーセキュリティはどのような位置づけとなるか?

- V2X接続

- 車内決済

- 車両充電

- アプリとAPI

- AIの役割

- オープンソースとオープンアーキテクチャ

- 製品情勢

世界市場の概要

- 自動車サイバーセキュリティ製品の分類

成長を促す規制

- WP.29規則155および156

- ISO/SAE 21434

- 米国の規制

- 中国のGB 44495-2024およびGB 44496-2024

- インドのAISC AIS-189およびAIS-190

地域分析

業界コンソーシアムと標準化団体

- ASRG

- AUTO-ISAC

- COVESA

- digital.auto initiative

- Eclipse SDV

- eSync Alliance

- MIPI Alliance

- Uptane

ベンダー情勢

- ベンダープロファイル

- BlackBerry QNX

- Block Harbor

- Bosch / ETAS

- Continental / Elektrobit / PlaxidityX

- Green Hills Software

- Integrity Security Services

- Irdeto

- Karamba Security

- Kaspersky

- HARMAN

- Sonatus

- Thales

- VicOne

- Upstream

- Vector

エンドユーザーの洞察

- セキュリティ要件への業界の適応

- ベンダー情勢はイノベーションを後押し

- 組み込みセキュリティソフトウェア、ハードウェア、FOTAの実装

- 自動車技術の未来

著者について

VDC Researchについて

図表リスト*

Inside this Report

The automotive industry is undergoing an unprecedented shift toward the software-defined vehicle (SDV) concept that is fundamentally changing the requirements for automotive cybersecurity. This report includes an overview of technologies and trends that influence the automotive cybersecurity market, including telematics and vehicle-to- everything (V2X) communication, payment by car, vehicle charging, infotainment system capabilities, open source architectures, and other industry software initiatives and advancements. As part of VDC's continued efforts to engage with the technology markets we research, this report includes end user insights from VDC's "Voice of the Engineer" survey. Lastly, this report highlights dozens of key automotive cybersecurity vendors that are shaping the market.

INFOGRAPHICS

Exhibit 9: Actions Taken by Respondents Organization

in Response to Security Requirements

(Percentage of Respondents, Multiple Responses Permitted)

What Questions are Addressed?

- How has the mass introduction of software and connectivity affected automotive cybersecurity?

- Which segment is growing the fastest - Security software, Security-as-a-service or Professional services?

- What is the future of automotive cybersecurity regulations and what can be gained by understanding the future of regulations?

- Which geographic regions are driving growth in the automotive cybersecurity market through 2028?

- How are IoT engineers and automotive engineers responding to cybersecurity concerns?

- Which firms are shaping the automotive cybersecurity market and how are they doing it?

Who Should Read this Report?

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and product strategy leaders

- Channel management and channel strategy leaders

Organizations Listed in this Report:

|

|

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

Introduction

- Software-Defined Vehicles Expose Vulnerabilities

- Where does Cybersecurity Fit in the Transition to the SDV?

- V2X Connectivity

- In-Car Payments

- Vehicle Charging

- Apps and APIs

- The Role of Artificial Intelligence

- Open Source and Open Architecture

- Product Landscape

Global Market Overview

- Automotive Cybersecurity Product Segmentation

- Product Segmentations within the Automotive Cybersecurity Market

Regulations Driving Growth

- WP.29 Regulations 155 and 156

- ISO/SAE 21434

- Regulations in the United States

- China GB 44495-2024 and GB 44496-2024

- India AISC AIS-189 and AIS-190

Regional Analysis

Industry Consortia and Standards Organizations

- ASRG

- AUTO-ISAC

- COVESA

- digital.auto initiative

- Eclipse SDV

- eSync Alliance

- MIPI Alliance

- Uptane

Vendor Landscape

- Vendor Profiles

- BlackBerry QNX

- Block Harbor

- Bosch / ETAS

- Continental / Elektrobit / PlaxidityX

- Green Hills Software

- Integrity Security Services

- Irdeto

- Karamba Security

- Kaspersky

- HARMAN

- Sonatus

- Thales

- VicOne

- Upstream

- Vector

End User Insights

- Industry Adaptation to Security Requirements

- Vendor Landscape Favors Innovation

- Diminishing Influence of Established Tech and System Integrators

- Implementation of Embedded Security Software, Hardware, and FOTA

- The Future of Automotive Technology

About the Authors

About VDC Research

List of Exhibits*

- Exhibit 1 Biggest Obstacle to the Development and Growth of the Connected/Software-Defined Vehicle Industry

- Exhibit 2: Current Concerns About AI-generated Software Code

- Exhibit 3: Sample Table of Vendors Offering Automotive Cybersecurity Solutions

- Exhibit 4: Global Revenue of Automotive Cybersecurity Software and Services

- Exhibit 5: Global Revenue for Automotive Cybersecurity Software and Services by Product Category

- Exhibit 6: Global Revenue for Automotive Cybersecurity and Software, 2023 to 2028, Share by Product Category

- Exhibit 7: Global Revenue for Automotive Cybersecurity Software and Services by Region

- Exhibit 8: Global Revenue of Automotive Cybersecurity Software & Services by Geographic

- Exhibit 9: Actions Taken by Respondents Organization in Response to Security Requirements

- Exhibit 10: Current Major Competition in the Software-defined Space

- Exhibit 11: Use of Embedded Security Software, Hardware, & Firmware-Over-the-Air Updating in Current Automotive Projects vs. Overall IoT Projects

- Exhibit 12: Technologies Automotive Respondent's Organization is Most Interested in and/or Building for Future Customers

*This report also includes access to 416 Exhibits from our 2024 Voice of the Engineer Survey.