|

|

市場調査レポート

商品コード

1738375

送配電機器市場- 世界の産業規模、シェア、動向、機会、予測、セグメント別、製品別、エンドユーザー別、地域別、競合別、2020-2030年Electric Power Transmission and Distribution Equipment Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented, By Product, By End-User, By Region, By Competition, 2020-2030F |

||||||

カスタマイズ可能

|

|||||||

| 送配電機器市場- 世界の産業規模、シェア、動向、機会、予測、セグメント別、製品別、エンドユーザー別、地域別、競合別、2020-2030年 |

|

出版日: 2025年05月30日

発行: TechSci Research

ページ情報: 英文 180 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

送配電機器市場は、2024年に2,005億6,000万米ドルと評価され、2030年には2,828億6,000万米ドルに達し、CAGR 5.74%で拡大すると予測されています。

この市場は、発電所から住宅、商業、工業の各セグメントにわたるエンドユーザーに電力を送配電するインフラの生産と配備に従事する世界の産業です。変圧器、開閉器、遮断器、碍子、リレー、コンデンサー、避雷器、架空・地中送電線などの主要部品が含まれます。送電設備は長距離の高圧電力を扱い、配電設備は消費者への中低圧の供給を管理します。市場の成長には、電力需要の増加、急速な都市化、産業の拡大、送電網インフラの老朽化、再生可能エネルギー源の統合の増加が寄与しています。さらに、スマートグリッドと自動化技術によるデジタル変革が送電網の効率と回復力を高め、最新の送配電機器に新たなビジネスチャンスをもたらしています。

| 市場概要 | |

|---|---|

| 予測期間 | 2026-2030 |

| 市場規模:2024年 | 2,005億6,000万米ドル |

| 市場規模:2030年 | 2,828億6,000万米ドル |

| CAGR:2025年~2030年 | 5.74% |

| 急成長セグメント | スイッチギア |

| 最大市場 | 北米 |

市場促進要因

世界の電力需要の増加と都市化

主な市場課題

インフラの老朽化と近代化の制約

主な市場動向

スマートグリッド技術と高度監視システムの統合

目次

第1章 概要

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 世界の送配電機器市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 製品別(変圧器、配電装置、絶縁体および継手、ケーブルおよび電線)

- エンドユーザー別(エネルギー・公益事業、工業、商業、住宅)

- 地域別

- 企業別(2024)

- 市場マップ

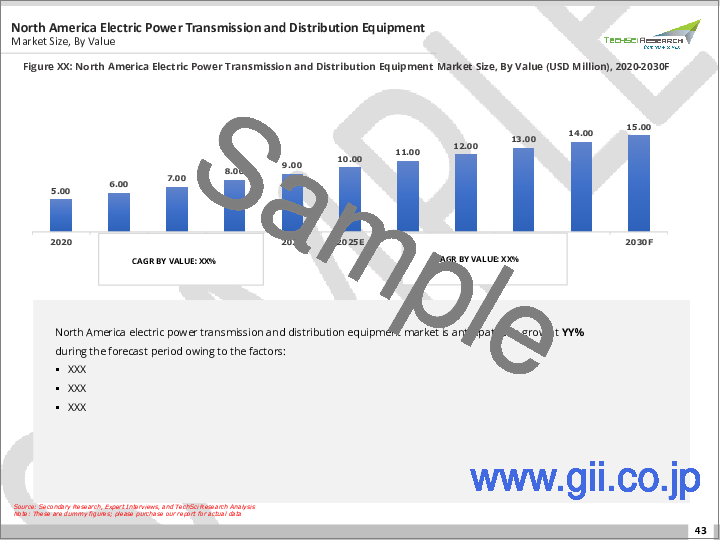

第6章 北米の送配電機器市場展望

- 市場規模・予測

- 市場シェア・予測

- 北米:国別分析

- 米国

- カナダ

- メキシコ

第7章 欧州の送配電機器市場展望

- 市場規模・予測

- 市場シェア・予測

- 欧州:国別分析

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

第8章 アジア太平洋地域の送配電機器市場展望

- 市場規模・予測

- 市場シェア・予測

- アジア太平洋地域:国別分析

- 中国

- インド

- 日本

- 韓国

- オーストラリア

第9章 南米の送配電機器市場展望

- 市場規模・予測

- 市場シェア・予測

- 南米:国別分析

- ブラジル

- アルゼンチン

- コロンビア

第10章 中東・アフリカの送配電機器市場展望

- 市場規模・予測

- 市場シェア・予測

- 中東・アフリカ:国別分析

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- クウェート

- トルコ

第11章 市場力学

- 促進要因

- 課題

第12章 市場動向と発展

- 合併と買収

- 製品上市

- 最近の動向

第13章 企業プロファイル

- ABB Ltd

- Siemens AG

- General Electric Company

- Schneider Electric SE

- Eaton Corporation plc

- Mitsubishi Electric Corporation

- Hyundai Electric & Energy Systems Co., Ltd.

- Crompton Greaves Consumer Electricals Limited

第14章 戦略的提言

第15章 調査会社について・免責事項

The Electric Power Transmission and Distribution Equipment Market was valued at USD 200.56 Billion in 2024 and is projected to reach USD 282.86 Billion by 2030, expanding at a CAGR of 5.74%. This market represents the global industry engaged in producing and deploying infrastructure that transmits and distributes electricity from power generation sites to end-users across residential, commercial, and industrial segments. It includes key components like transformers, switchgear, circuit breakers, insulators, relays, capacitors, arresters, and overhead or underground lines. Transmission equipment handles high-voltage electricity over long distances, while distribution equipment manages the medium to low voltage supply to consumers. Market growth is fueled by rising electricity demand, rapid urbanization, industrial expansion, aging grid infrastructure, and the increasing integration of renewable energy sources. Furthermore, digital transformation through smart grids and automation technologies is enhancing grid efficiency and resilience, creating fresh opportunities for modern transmission and distribution equipment worldwide.

| Market Overview | |

|---|---|

| Forecast Period | 2026-2030 |

| Market Size 2024 | USD 200.56 Billion |

| Market Size 2030 | USD 282.86 Billion |

| CAGR 2025-2030 | 5.74% |

| Fastest Growing Segment | Switchgear |

| Largest Market | North America |

Key Market Drivers

Rising Global Electricity Demand and Urbanization

Global electricity demand is surging due to population growth, expanding industrial activity, and the increasing electrification of homes and businesses. Rapid urbanization, especially in emerging economies, is contributing significantly to higher energy consumption, necessitating the expansion and modernization of transmission and distribution networks. As cities become denser, reliable and efficient power supply becomes crucial to support essential services and infrastructure. According to the International Energy Agency, electricity consumption is projected to rise at double the pace of total energy demand through 2040, further propelling investment in grid infrastructure. Upgrades to aging systems and network expansions are essential to maintain system reliability, especially with the growing adoption of electric vehicles, smart city developments, and digital devices. The deployment of advanced equipment like intelligent transformers and smart switchgear is enabling real-time monitoring, fault detection, and improved system control. In 2024, more than half of the world's population resides in urban areas, and this figure is expected to rise to nearly 70% by 2050, primarily across Asia and Africa, underscoring the critical need for robust and scalable T&D systems.

Key Market Challenges

Aging Infrastructure and Modernization Constraints

A significant challenge in the Electric Power Transmission and Distribution Equipment Market is the widespread presence of outdated infrastructure in developed regions. Many of the systems currently in operation were constructed decades ago and are now experiencing declining efficiency and increased risk of failure. Components such as aged transformers, corroded lines, and obsolete switchgear present reliability issues and are unable to accommodate the demands of modern energy systems or renewable integration. The process of upgrading these legacy systems is expensive and logistically complex, often constrained by limited budgets, regulatory barriers, and societal resistance, particularly in urban and environmentally sensitive areas. Moreover, a lack of standardization and interoperability among existing systems further complicates modernization efforts. These constraints delay the transition to more resilient and intelligent grids, especially as new energy demands and technologies push existing infrastructure to its limits.

Key Market Trends

Integration of Smart Grid Technologies and Advanced Monitoring Systems

A prominent trend shaping the Electric Power Transmission and Distribution Equipment Market is the integration of smart grid technologies and digital monitoring systems. These innovations are transforming traditional grids into intelligent networks capable of real-time data analysis, automated responses, and enhanced efficiency. Technologies such as smart meters, SCADA (Supervisory Control and Data Acquisition), IoT-enabled sensors, and advanced communication protocols allow utilities to optimize grid operations, detect and resolve faults rapidly, and improve load balancing. The integration of Geographic Information Systems (GIS) and digital twin models is further enhancing asset management and grid planning. These developments are particularly crucial as intermittent renewable sources like solar and wind become more prevalent. Smart T&D systems enable dynamic adjustments and distributed energy resource management, ensuring reliability in the face of changing energy flows. Governments worldwide are investing in grid modernization as part of broader energy transition and sustainability initiatives, accelerating the adoption of intelligent T&D solutions.

Key Market Players

- ABB Ltd

- Siemens AG

- General Electric Company

- Schneider Electric SE

- Eaton Corporation plc

- Mitsubishi Electric Corporation

- Hyundai Electric & Energy Systems Co., Ltd.

- Crompton Greaves Consumer Electricals Limited

Report Scope:

In this report, the Global Electric Power Transmission and Distribution Equipment Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Electric Power Transmission and Distribution Equipment Market, By Product:

- Transformer

- Switchgear

- Insulators & Fittings

- Cables & Lines

Electric Power Transmission and Distribution Equipment Market, By End-User:

- Energy & Utilities

- Industrial

- Commercial

- Residential

Electric Power Transmission and Distribution Equipment Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Electric Power Transmission and Distribution Equipment Market.

Available Customizations:

Global Electric Power Transmission and Distribution Equipment Market report with the given Market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional Market players (up to five).

Table of Contents

1. Product Overview

- 1.1. Market Definition

- 1.2. Scope of the Market

- 1.2.1. Markets Covered

- 1.2.2. Years Considered for Study

- 1.3. Key Market Segmentations

2. Research Methodology

- 2.1. Objective of the Study

- 2.2. Baseline Methodology

- 2.3. Formulation of the Scope

- 2.4. Assumptions and Limitations

- 2.5. Sources of Research

- 2.5.1. Secondary Research

- 2.5.2. Primary Research

- 2.6. Approach for the Market Study

- 2.6.1. The Bottom-Up Approach

- 2.6.2. The Top-Down Approach

- 2.7. Methodology Followed for Calculation of Market Size & Market Shares

- 2.8. Forecasting Methodology

- 2.8.1. Data Triangulation & Validation

3. Executive Summary

- 3.1. Overview of the Market

- 3.2. Overview of Key Market Segmentations

- 3.3. Overview of Key Market Players

- 3.4. Overview of Key Regions/Countries

- 3.5. Overview of Market Drivers, Challenges, and Trends

4. Voice of Customer

5. Global Electric Power Transmission and Distribution Equipment Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. Market Share & Forecast

- 5.2.1. By Product (Transformer, Switchgear, Insulators & Fittings, Cables & Lines)

- 5.2.2. By End-User (Energy & Utilities, Industrial, Commercial, Residential)

- 5.2.3. By Region

- 5.3. By Company (2024)

- 5.4. Market Map

6. North America Electric Power Transmission and Distribution Equipment Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Product

- 6.2.2. By End-User

- 6.2.3. By Country

- 6.3. North America: Country Analysis

- 6.3.1. United States Electric Power Transmission and Distribution Equipment Market Outlook

- 6.3.1.1. Market Size & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.2. Market Share & Forecast

- 6.3.1.2.1. By Product

- 6.3.1.2.2. By End-User

- 6.3.1.1. Market Size & Forecast

- 6.3.2. Canada Electric Power Transmission and Distribution Equipment Market Outlook

- 6.3.2.1. Market Size & Forecast

- 6.3.2.1.1. By Value

- 6.3.2.2. Market Share & Forecast

- 6.3.2.2.1. By Product

- 6.3.2.2.2. By End-User

- 6.3.2.1. Market Size & Forecast

- 6.3.3. Mexico Electric Power Transmission and Distribution Equipment Market Outlook

- 6.3.3.1. Market Size & Forecast

- 6.3.3.1.1. By Value

- 6.3.3.2. Market Share & Forecast

- 6.3.3.2.1. By Product

- 6.3.3.2.2. By End-User

- 6.3.3.1. Market Size & Forecast

- 6.3.1. United States Electric Power Transmission and Distribution Equipment Market Outlook

7. Europe Electric Power Transmission and Distribution Equipment Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Product

- 7.2.2. By End-User

- 7.2.3. By Country

- 7.3. Europe: Country Analysis

- 7.3.1. Germany Electric Power Transmission and Distribution Equipment Market Outlook

- 7.3.1.1. Market Size & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share & Forecast

- 7.3.1.2.1. By Product

- 7.3.1.2.2. By End-User

- 7.3.1.1. Market Size & Forecast

- 7.3.2. United Kingdom Electric Power Transmission and Distribution Equipment Market Outlook

- 7.3.2.1. Market Size & Forecast

- 7.3.2.1.1. By Value

- 7.3.2.2. Market Share & Forecast

- 7.3.2.2.1. By Product

- 7.3.2.2.2. By End-User

- 7.3.2.1. Market Size & Forecast

- 7.3.3. Italy Electric Power Transmission and Distribution Equipment Market Outlook

- 7.3.3.1. Market Size & Forecast

- 7.3.3.1.1. By Value

- 7.3.3.2. Market Share & Forecast

- 7.3.3.2.1. By Product

- 7.3.3.2.2. By End-User

- 7.3.3.1. Market Size & Forecast

- 7.3.4. France Electric Power Transmission and Distribution Equipment Market Outlook

- 7.3.4.1. Market Size & Forecast

- 7.3.4.1.1. By Value

- 7.3.4.2. Market Share & Forecast

- 7.3.4.2.1. By Product

- 7.3.4.2.2. By End-User

- 7.3.4.1. Market Size & Forecast

- 7.3.5. Spain Electric Power Transmission and Distribution Equipment Market Outlook

- 7.3.5.1. Market Size & Forecast

- 7.3.5.1.1. By Value

- 7.3.5.2. Market Share & Forecast

- 7.3.5.2.1. By Product

- 7.3.5.2.2. By End-User

- 7.3.5.1. Market Size & Forecast

- 7.3.1. Germany Electric Power Transmission and Distribution Equipment Market Outlook

8. Asia-Pacific Electric Power Transmission and Distribution Equipment Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Product

- 8.2.2. By End-User

- 8.2.3. By Country

- 8.3. Asia-Pacific: Country Analysis

- 8.3.1. China Electric Power Transmission and Distribution Equipment Market Outlook

- 8.3.1.1. Market Size & Forecast

- 8.3.1.1.1. By Value

- 8.3.1.2. Market Share & Forecast

- 8.3.1.2.1. By Product

- 8.3.1.2.2. By End-User

- 8.3.1.1. Market Size & Forecast

- 8.3.2. India Electric Power Transmission and Distribution Equipment Market Outlook

- 8.3.2.1. Market Size & Forecast

- 8.3.2.1.1. By Value

- 8.3.2.2. Market Share & Forecast

- 8.3.2.2.1. By Product

- 8.3.2.2.2. By End-User

- 8.3.2.1. Market Size & Forecast

- 8.3.3. Japan Electric Power Transmission and Distribution Equipment Market Outlook

- 8.3.3.1. Market Size & Forecast

- 8.3.3.1.1. By Value

- 8.3.3.2. Market Share & Forecast

- 8.3.3.2.1. By Product

- 8.3.3.2.2. By End-User

- 8.3.3.1. Market Size & Forecast

- 8.3.4. South Korea Electric Power Transmission and Distribution Equipment Market Outlook

- 8.3.4.1. Market Size & Forecast

- 8.3.4.1.1. By Value

- 8.3.4.2. Market Share & Forecast

- 8.3.4.2.1. By Product

- 8.3.4.2.2. By End-User

- 8.3.4.1. Market Size & Forecast

- 8.3.5. Australia Electric Power Transmission and Distribution Equipment Market Outlook

- 8.3.5.1. Market Size & Forecast

- 8.3.5.1.1. By Value

- 8.3.5.2. Market Share & Forecast

- 8.3.5.2.1. By Product

- 8.3.5.2.2. By End-User

- 8.3.5.1. Market Size & Forecast

- 8.3.1. China Electric Power Transmission and Distribution Equipment Market Outlook

9. South America Electric Power Transmission and Distribution Equipment Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Product

- 9.2.2. By End-User

- 9.2.3. By Country

- 9.3. South America: Country Analysis

- 9.3.1. Brazil Electric Power Transmission and Distribution Equipment Market Outlook

- 9.3.1.1. Market Size & Forecast

- 9.3.1.1.1. By Value

- 9.3.1.2. Market Share & Forecast

- 9.3.1.2.1. By Product

- 9.3.1.2.2. By End-User

- 9.3.1.1. Market Size & Forecast

- 9.3.2. Argentina Electric Power Transmission and Distribution Equipment Market Outlook

- 9.3.2.1. Market Size & Forecast

- 9.3.2.1.1. By Value

- 9.3.2.2. Market Share & Forecast

- 9.3.2.2.1. By Product

- 9.3.2.2.2. By End-User

- 9.3.2.1. Market Size & Forecast

- 9.3.3. Colombia Electric Power Transmission and Distribution Equipment Market Outlook

- 9.3.3.1. Market Size & Forecast

- 9.3.3.1.1. By Value

- 9.3.3.2. Market Share & Forecast

- 9.3.3.2.1. By Product

- 9.3.3.2.2. By End-User

- 9.3.3.1. Market Size & Forecast

- 9.3.1. Brazil Electric Power Transmission and Distribution Equipment Market Outlook

10. Middle East and Africa Electric Power Transmission and Distribution Equipment Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Product

- 10.2.2. By End-User

- 10.2.3. By Country

- 10.3. Middle East and Africa: Country Analysis

- 10.3.1. South Africa Electric Power Transmission and Distribution Equipment Market Outlook

- 10.3.1.1. Market Size & Forecast

- 10.3.1.1.1. By Value

- 10.3.1.2. Market Share & Forecast

- 10.3.1.2.1. By Product

- 10.3.1.2.2. By End-User

- 10.3.1.1. Market Size & Forecast

- 10.3.2. Saudi Arabia Electric Power Transmission and Distribution Equipment Market Outlook

- 10.3.2.1. Market Size & Forecast

- 10.3.2.1.1. By Value

- 10.3.2.2. Market Share & Forecast

- 10.3.2.2.1. By Product

- 10.3.2.2.2. By End-User

- 10.3.2.1. Market Size & Forecast

- 10.3.3. UAE Electric Power Transmission and Distribution Equipment Market Outlook

- 10.3.3.1. Market Size & Forecast

- 10.3.3.1.1. By Value

- 10.3.3.2. Market Share & Forecast

- 10.3.3.2.1. By Product

- 10.3.3.2.2. By End-User

- 10.3.3.1. Market Size & Forecast

- 10.3.4. Kuwait Electric Power Transmission and Distribution Equipment Market Outlook

- 10.3.4.1. Market Size & Forecast

- 10.3.4.1.1. By Value

- 10.3.4.2. Market Share & Forecast

- 10.3.4.2.1. By Product

- 10.3.4.2.2. By End-User

- 10.3.4.1. Market Size & Forecast

- 10.3.5. Turkey Electric Power Transmission and Distribution Equipment Market Outlook

- 10.3.5.1. Market Size & Forecast

- 10.3.5.1.1. By Value

- 10.3.5.2. Market Share & Forecast

- 10.3.5.2.1. By Product

- 10.3.5.2.2. By End-User

- 10.3.5.1. Market Size & Forecast

- 10.3.1. South Africa Electric Power Transmission and Distribution Equipment Market Outlook

11. Market Dynamics

- 11.1. Drivers

- 11.2. Challenges

12. Market Trends & Developments

- 12.1. Merger & Acquisition (If Any)

- 12.2. Product Launches (If Any)

- 12.3. Recent Developments

13. Company Profiles

- 13.1. ABB Ltd

- 13.1.1. Business Overview

- 13.1.2. Key Revenue and Financials

- 13.1.3. Recent Developments

- 13.1.4. Key Personnel/Key Contact Person

- 13.1.5. Key Product/Services Offered

- 13.2. Siemens AG

- 13.3. General Electric Company

- 13.4. Schneider Electric SE

- 13.5. Eaton Corporation plc

- 13.6. Mitsubishi Electric Corporation

- 13.7. Hyundai Electric & Energy Systems Co., Ltd.

- 13.8. Crompton Greaves Consumer Electricals Limited