|

|

市場調査レポート

商品コード

1666219

アフリカの非接触決済の市場規模と予測(2021年~2031年)、地域シェア、動向、成長機会分析:コンポーネント別、決済モード別、業界別、国別Africa Contactless Payments Market Size and Forecast 2021 - 2031, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component, Payment Mode, Industry Verticals and Country |

||||||

|

|||||||

| アフリカの非接触決済の市場規模と予測(2021年~2031年)、地域シェア、動向、成長機会分析:コンポーネント別、決済モード別、業界別、国別 |

|

出版日: 2025年01月15日

発行: The Insight Partners

ページ情報: 英文 95 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アフリカの非接触決済の市場規模は、2023年に7億8,172万米ドルとなり、2031年までには15億3,657万米ドルに達すると予測され、2023年から2031年までのCAGRは8.8%を記録すると推定されます。

アフリカの非接触決済市場は、南アフリカ、エチオピア、エジプト、ナイジェリア、その他アフリカの主要6カ国に区分されます。2023年にはナイジェリアが市場を席巻し、南アフリカとエジプトがそれぞれこれに続きます。ACI Worldwide 2024 Prime Time for Real-Timeレポートによると、ナイジェリアは2022年から2023年にかけてリアルタイムのデジタル取引で54%の成長を記録し、アフリカにおけるリアルタイム決済量と成長のリーダーとしての地位を固めました。2021年3月にナイジェリア銀行間決済システム(NIBSS)が全国即時決済スキーム(NQR)を導入し、相互運用可能なQRコード標準を確立したことは、シームレスな個人間(P2B)および個人間(P2P)決済を可能にする重要な推進力となっています。その結果、ナイジェリアでは2023年に全取引の27.7%をリアルタイム決済が占め、2028年には50.1%増加すると予測されています。リアルタイム決済は、これまでナイジェリアで主流だった現金決済に代わる決済手段として急速に台頭しています。

VisaとDiscovery BankによるSpendTrend23レポートによると、南アフリカは現在、アフリカにおける非接触決済導入の最前線にいます。Visa South Africaのカントリーマネージャーによると、近距離無線通信(NFC)決済の採用は、COVID-19の大流行時に物理的な接触を最小限に抑えるため、当初は勢いがありました。さらに、そのユーザーフレンドリーな性質により、大きな成長を遂げました。政府は、2021年から2022年にかけて、世界全体の対面取引の72%、南アフリカにおけるデジタル取引の50%以上が非接触型であることを強調しました。同支配人によると、南アフリカの消費者の間ではコンタクトレスやモバイル決済の人気が高まっているといいます。

MastercardのNew Payment Index 2022によると、エジプトではより幅広いデジタル決済手段の導入が加速しており、テクノロジーが決済の未来を牽引しています。エジプトでは、デジタルカード、BNPL(Buy Now Pay Later)、オープンバンキングなどのソリューションが認知されるだけでなく、こうしたツールを日常的な取引に取り入れる消費者が増えています。同レポートによると、エジプトの消費者の88%が過去1年間(2021年)に少なくとも1つの新たな決済手段を利用したことがあります。このうち、35%がタップ可能なスマートフォンのモバイルウォレットを、27%がデジタル送金アプリを、24%がQRコードによる支払いを利用しています。さらに、消費者は購入チャネルを拡大しており、音声アシスタントやソーシャルメディア・プラットフォームを通じた取引が増加しています。

業界別では、小売、ホスピタリティ、ヘルスケア、運輸・物流、メディア・エンターテインメント、その他に分類されます。2023年のアフリカの非接触決済市場では、小売セグメントが最大のシェアを占めています。小売業における非接触決済とは、顧客が非接触決済技術を搭載したPOS端末の近くで決済カードやその他の機器をタップすることで取引を行うことができる、安全で便利な決済方法を指します。タップ・アンド・ゴーまたはタップとも呼ばれるこの技術は、1990年代から存在し、その後、世界中の数多くの銀行、クレジットカード会社、加盟店、および小売店を包含するまでに拡大しました。小売業における非接触決済の普及は、この形態の決済を受け入れる加盟店の増加によって促進されており、南アフリカ、ガーナ、カンボジアなどの国では現在、小売店の半数以上が非接触決済を受け入れています。この動向は、非接触型取引を促進するモバイルウォレットアプリやウェアラブルデバイスの利用可能性によって支えられており、この技術の人気の高まりと小売業界への大きな影響の一因となっています。

運輸・ロジスティクス業界では、さまざまなサービスにおける決済プロセスを合理化・改善するために、非接触決済の採用が顕著に増加しています。非接触決済は、公共交通機関における通勤客の運賃支払い方法を根本的に変えました。この技術は、公共交通機関の改札口、駐車場の精算端末、道路通行料、バス、地下鉄、電車の切符購入など、交通と物流のさまざまな側面に組み込まれています。交通機関やロジスティクスにおける非接触決済手段の利用は、処理能力の向上、顧客の待ち時間の短縮、より効率的でユーザーフレンドリーな決済体験の確立など、いくつかの大きな利点をもたらします。

Visa、Mastercard、IBA Group、Giesecke+Devrient GmbH、IDEMIA、CityCard Technology Ltd、EcoCash、Ingenico、Nedbank Ltd、Sudo Africa, Incは、この市場調査で紹介するアフリカの非接触決済市場の主要企業です。

アフリカの非接触決済市場全体の規模は、一次情報と二次情報の両方を用いて算出されています。徹底的な二次調査は、アフリカの非接触決済市場規模に関連する質的・量的情報を得るために、社内外の情報源を用いて実施しました。また、このプロセスは、すべての市場セグメントに関する市場の概要と予測を得るのに役立ちます。また、データを検証し、分析的洞察を得るために、業界関係者に複数の一次インタビューを実施しました。このプロセスには、副社長、市場開拓マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家と、アフリカの非接触決済市場を専門とする評価専門家、研究アナリスト、キーオピニオンリーダーなどの外部コンサルタントが参加しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 アフリカの非接触決済市場情勢

- PEST分析

- エコシステム分析

- ハードウェア・プロバイダー

- ソリューション・サービス・プロバイダー

- 物流・サプライチェーン管理プロバイダー

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 アフリカの非接触決済市場:主要市場力学

- アフリカの非接触決済市場-主要市場力学

- 市場促進要因

- デジタル決済を推進する政府のイニシアチブの増加

- 非接触決済の効率性と費用対効果

- 市場抑制要因

- 潜在的なセキュリティ上の懸念と限界

- 市場機会

- 非接触決済の技術的進歩

- IoTを組み込んだ非接触決済

- 今後の動向

- 音声照合確認による音声ベース決済

- 促進要因と抑制要因の影響

第6章 アフリカの非接触決済市場分析

- アフリカの非接触決済市場収益、2021年~2031年

- アフリカの非接触決済市場予測と分析

第7章 アフリカの非接触決済市場分析:コンポーネント別

- ハードウェア

- ソフトウェア

- サービス

第8章 アフリカの非接触決済市場分析:決済モード別

- スマートフォン

- スマートカード

- POS端末

- その他

第9章 アフリカの非接触決済市場分析:業界別

- 小売

- 運輸・物流

- ホスピタリティ

- ヘルスケア

- メディア・エンターテイメント

- その他

第10章 アフリカの非接触決済市場:国別分析

- アフリカ

- ナイジェリア

- 南アフリカ

- エジプト

- エチオピア

- その他のアフリカ

第11章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

- 製品開発

第13章 企業プロファイル

- Nedbank Group Ltd

- Econet Wireless(Private)Limited

- IBA Group a.s.

- Sudo Africa, Inc.

- Thales SA

- Ingenico Group SA

- Giesecke+Devrient GmbH

- IDEMIA France SAS

- Visa Inc

- Mastercard Inc

第14章 付録

List Of Tables

- Table 1. Africa Contactless Payments Market Segmentation

- Table 2. List of Vendors

- Table 3. Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 5. Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Payment Mode

- Table 6. Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Industry Verticals

- Table 7. Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 8. Nigeria: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 9. Nigeria: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Payment Mode

- Table 10. Nigeria: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Industry Verticals

- Table 11. South Africa: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 12. South Africa: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Payment Mode

- Table 13. South Africa: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Industry Verticals

- Table 14. Egypt: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 15. Egypt: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Payment Mode

- Table 16. Egypt: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Industry Verticals

- Table 17. Ethiopia: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 18. Ethiopia: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Payment Mode

- Table 19. Ethiopia: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Industry Verticals

- Table 20. Rest of Africa: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 21. Rest of Africa: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Payment Mode

- Table 22. Rest of Africa: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million) - by Industry Verticals

- Table 23. Company Positioning & Concentration

- Table 24. List of Abbreviation

List Of Figures

- Figure 1. Africa Contactless Payments Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Africa Contactless Payments Market Revenue (US$ Million), 2021-2031

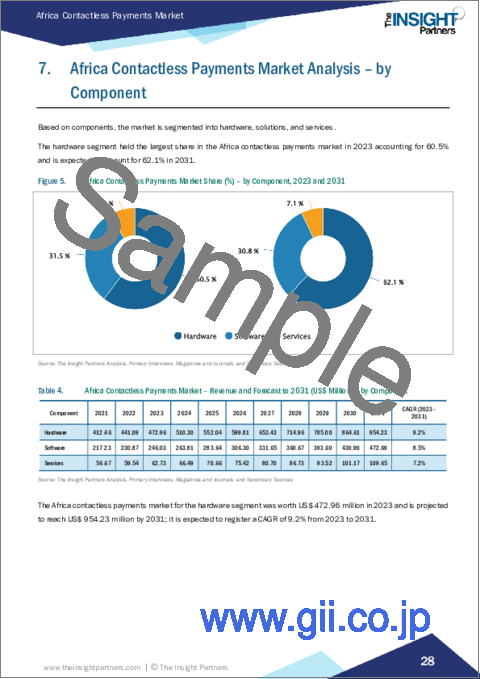

- Figure 5. Africa Contactless Payments Market Share (%) - by Component, 2023 and 2031

- Figure 6. Hardware: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Software: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Services: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Africa Contactless Payments Market Share (%) - by Payment Mode, 2023 and 2031

- Figure 10. Smartphones: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Smart Cards: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. POS Terminals: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Others: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Africa Contactless Payments Market Share (%) - by Industry Verticals, 2023 and 2031

- Figure 15. Retail: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Transportation and Logistics: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Hospitality: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Healthcare: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Media and Entertainment: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Others: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Africa Contactless Payments Market Breakdown by Key Countries, 2023 and 2031 (%)

- Figure 22. Nigeria: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. South Africa: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Egypt: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Ethiopia: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Rest of Africa: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Heat Map Analysis by Key Players

The Africa contactless payments market size was valued at US$ 781.72 million in 2023 and is expected to reach US$ 1536.57 million by 2031; it is estimated to record a CAGR of 8.8% from 2023 to 2031.

The Africa contactless payments market is segmented into six major countries- South Africa, Ethiopia, Egypt, Nigeria, and the Rest of Africa. Nigeria dominated the market in 2023, followed by South Africa and Egypt, respectively. As per the ACI Worldwide 2024 Prime Time for Real-Time report, Nigeria registered a 54% growth in real-time digital transactions between 2022 and 2023, solidifying its position as the leader in Africa for real-time payment volume and growth. The introduction of the National Instant Payment Scheme (NQR) by the Nigeria Inter-Bank Settlement System (NIBSS) in March 2021, which established an interoperable QR-code standard, is a key driver in enabling seamless Person-to-Business (P2B) and Person-to-Person (P2P) payments. As a result, real-time payments accounted for 27.7% of all transactions in Nigeria in 2023, projected to rise by 50.1% by 2028. Real-time payments are rapidly emerging as a viable alternative to cash, which has been a dominant payment method historically in the country

As per the SpendTrend23 report by Visa and Discovery Bank, South Africa is currently at the forefront of embracing contactless payments in Africa. According to the Country Manager for Visa South Africa, the adoption of near-field communication (NFC) payments initially gained momentum during the COVID-19 pandemic to minimize physical contact. Moreover, it has experienced significant growth due to its user-friendly nature. The Government highlighted that during 2021-2022, 72% of all in-person transactions globally and over 50% of digital transactions in South Africa were contactless. According to the manager, contactless and mobile payments are increasingly becoming popular among consumers in South Africa.

According to Mastercard's New Payment Index 2022, the adoption of a wider range of digital payment methods is accelerating in Egypt, with technology driving the future of payments. Beyond awareness of solutions such as digital cards, Buy Now Pay Later (BNPL), and open banking, consumers in Egypt are increasingly incorporating these tools into their daily transactions. The report reveals that 88% of consumers in Egypt have utilized at least one emerging payment method in the past year i.e. 2021. Out of this, 35% used tappable smartphone mobile wallets, 27% used digital money transfer apps, and 24% made payments via QR codes. Additionally, consumers are expanding their purchase channels, increasingly making transactions through voice assistants and social media platforms.

Based on industry vertical, the market is categorized into retail, hospitality, healthcare, transportation & logistics, media & entertainment, and others. The retail segment held the largest share in the Africa contactless payments market in 2023. Contactless payment in retail refers to a secure and convenient payment method that enables customers to conduct transactions by tapping a payment card or another device near a point-of-sale terminal equipped with contactless payment technology. This technology, also known as tap-and-go or tap, has been in existence since the 1990s and has since expanded to encompass numerous banks, credit card companies, merchants, and retailers worldwide. The widespread adoption of contactless payment in retail has been facilitated by the increasing number of merchants accepting this form of payment, with over half of retailers in countries such as South Africa, Ghana, and Cambodia currently accepting contactless payments. This trend is supported by the availability of mobile wallet apps and wearable devices that facilitate contactless transactions, contributing to the technology's growing popularity and profound impact on the retail industry.

Within transportation and logistics, there has been a notable rise in the adoption of contactless payment methods for streamlining and improving the payment process across a range of services. Contactless payments have fundamentally transformed the way commuters handle fare payments in public transportation. This technology has been integrated into various facets of transportation and logistics, encompassing public transportation turnstiles, parking garage checkout terminals, road tolls, and the purchase of tickets for buses, subways, and trains. The utilization of contactless payment methods in transportation and logistics yields several significant advantages, including increased throughput, decreased customer waiting times, and the establishment of a more efficient and user-friendly payment experience.

Visa, Mastercard, IBA Group, Giesecke + Devrient GmbH, IDEMIA, CityCard Technology Ltd, EcoCash, Ingenico, Nedbank Ltd, and Sudo Africa, Inc are among the key Africa contactless payments market players that are profiled in this market study.

The overall Africa contactless payments market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the Africa contactless payments market size. The process also helps obtain an overview and forecast of the market with respect to all the market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. This process includes industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the Africa contactless payments market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Africa Contactless Payments Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 Hardware Providers

- 4.3.2 Solution and Service Providers

- 4.3.3 Logistics and Supply Chain Management Providers

- 4.3.4 End Users

- 4.3.5 List of Vendors in the Value Chain

5. Africa Contactless Payments Market - Key Market Dynamics

- 5.1 Africa Contactless Payments Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increase in Government Initiatives to Promote Digital Payments

- 5.2.2 Efficiency and Cost-Effectiveness of Contactless Payments

- 5.3 Market Restraints

- 5.3.1 Potential Security Concerns and Limitations

- 5.4 Market Opportunities

- 5.4.1 Technological Advancements in Contactless Payments

- 5.4.2 IoT-Embedded Contactless Payment

- 5.5 Future Trends

- 5.5.1 Voice-Based Payments with Voice Match Confirmation

- 5.6 Impact of Drivers and Restraints:

6. Africa Contactless Payments Market Analysis

- 6.1 Africa Contactless Payments Market Revenue (US$ Million), 2021-2031

- 6.2 Africa Contactless Payments Market Forecast and Analysis

7. Africa Contactless Payments Market Analysis - by Component

- 7.1 Hardware

- 7.1.1 Overview

- 7.1.2 Hardware: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Software

- 7.2.1 Overview

- 7.2.2 Software: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Services

- 7.3.1 Overview

- 7.3.2 Services: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

8. Africa Contactless Payments Market Analysis - by Payment Mode

- 8.1 Smartphones

- 8.1.1 Overview

- 8.1.2 Smartphones: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Smart Cards

- 8.2.1 Overview

- 8.2.2 Smart Cards: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 POS Terminals

- 8.3.1 Overview

- 8.3.2 POS Terminals: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Others

- 8.4.1 Overview

- 8.4.2 Others: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

9. Africa Contactless Payments Market Analysis - by Industry Verticals

- 9.1 Retail

- 9.1.1 Overview

- 9.1.2 Retail: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Transportation and Logistics

- 9.2.1 Overview

- 9.2.2 Transportation and Logistics: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Hospitality

- 9.3.1 Overview

- 9.3.2 Hospitality: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Healthcare

- 9.4.1 Overview

- 9.4.2 Healthcare: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Media and Entertainment

- 9.5.1 Overview

- 9.5.2 Media and Entertainment: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

10. Africa Contactless Payments Market - Country Analysis

- 10.1 Africa

- 10.1.1 Africa Contactless Payments Market Breakdown by Countries

- 10.1.2 Africa Contactless Payments Market Revenue and Forecast and Analysis - by Country

- 10.1.2.1 Africa Contactless Payments Market Revenue and Forecast and Analysis - by Country

- 10.1.2.2 Nigeria: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.2.1 Nigeria: Africa Contactless Payments Market Breakdown by Component

- 10.1.2.2.2 Nigeria: Africa Contactless Payments Market Breakdown by Payment Mode

- 10.1.2.2.3 Nigeria: Africa Contactless Payments Market Breakdown by Industry Verticals

- 10.1.2.3 South Africa: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.3.1 South Africa: Africa Contactless Payments Market Breakdown by Component

- 10.1.2.3.2 South Africa: Africa Contactless Payments Market Breakdown by Payment Mode

- 10.1.2.3.3 South Africa: Africa Contactless Payments Market Breakdown by Industry Verticals

- 10.1.2.4 Egypt: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.4.1 Egypt: Africa Contactless Payments Market Breakdown by Component

- 10.1.2.4.2 Egypt: Africa Contactless Payments Market Breakdown by Payment Mode

- 10.1.2.4.3 Egypt: Africa Contactless Payments Market Breakdown by Industry Verticals

- 10.1.2.5 Ethiopia: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.5.1 Ethiopia: Africa Contactless Payments Market Breakdown by Component

- 10.1.2.5.2 Ethiopia: Africa Contactless Payments Market Breakdown by Payment Mode

- 10.1.2.5.3 Ethiopia: Africa Contactless Payments Market Breakdown by Industry Verticals

- 10.1.2.6 Rest of Africa: Africa Contactless Payments Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.6.1 Rest of Africa: Africa Contactless Payments Market Breakdown by Component

- 10.1.2.6.2 Rest of Africa: Africa Contactless Payments Market Breakdown by Payment Mode

- 10.1.2.6.3 Rest of Africa: Africa Contactless Payments Market Breakdown by Industry Verticals

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product Development

13. Company Profiles

- 13.1 Nedbank Group Ltd

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Econet Wireless (Private) Limited

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 IBA Group a.s.

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Sudo Africa, Inc.

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Thales SA

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Ingenico Group SA

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Giesecke+Devrient GmbH

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 IDEMIA France SAS

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Visa Inc

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Mastercard Inc

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 Word Index

- 14.2 About the Insight Partners