|

|

市場調査レポート

商品コード

1597109

欧州のイベントロジスティクス市場の将来予測 (2031年まで) - 地域別分析:種類別、エンドユーザー別Europe Event Logistics Market Forecast to 2031 - Regional Analysis - by Type and End User |

||||||

|

|||||||

| 欧州のイベントロジスティクス市場の将来予測 (2031年まで) - 地域別分析:種類別、エンドユーザー別 |

|

出版日: 2024年10月17日

発行: The Insight Partners

ページ情報: 英文 152 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州のイベントロジスティクス市場は、2023年に291億3,197万米ドルと評価され、2031年には463億3,674万米ドルに達すると予測され、2023年から2031年までのCAGRは6.0%と推定されます。

主要企業による戦略的イニシアチブの増加が欧州のイベントロジスティクス市場を牽引

欧州イベントロジスティクス市場で事業を展開する主要企業には、DSV A/S、CH Robinson、KUEHNE+NAGEL、CEVA Logistics、DB SCHENKER、DHL International GmbH、FedEx、UPS、XPO Logistics, Inc.、GEODISなどがあります。これらの企業は市場で競争力を維持するために、M&A、契約、パートナーシップなど様々な戦略を採用しています。以下に、そうした戦略の例をいくつか挙げます:

2024年3月、Kuehne+Nagel社World Sailingと3年間のロジスティクス・パートナーシップを締結しました。このパートナーシップを通じて、Kuehne + Nagelは、セーリング用具、ボート、その他のワールドセーリング公認イベントに不可欠なリソースの輸送を管理することを目指しています。2024年1月、Kuehne+NagelはClarion Eventsと提携しました。このパートナーシップのもと、同社は公式世界ロジスティクスパートナーとなり、Clarion Eventsグループの展示会のカーボンフットプリントを削減するとともに、イベント業界に新たな基準を設定することを目標に掲げています。2023年3月、DHLは国際ボブスレー・スケルトン連盟 (IBSF) と提携しました。このパートナーシップを通じて、DHLはIBSFがスケルトンそり、レーシングヘルメット、スピードスーツ、ショルダーパッド、スパイクシューズなどのスポーツ・マーケティング用品の使用を含む世界選手権に関連するロジスティクス需要を満たすための支援を目指しました。このように、主要企業による取り組み件数の増加が、欧州のイベントロジスティクス市場の成長を後押ししています。

欧州のイベントロジスティクス市場の概要

欧州のイベントロジスティクス市場規模は、主にKuehne+Nagel、DHL、DEKRA、GEODIS、HEED-Logistics、Hamburg Messe+Congress、Target Motivation、Sport & Events Logistics Srl、Genius Eventi Srl、WES Logistics、Event Logistics Team srlなど、多数のイベントロジスティクス企業の存在によって支えられています。これらのベンダーは、この地域の企業イベント/見本市、スポーツイベント、メディア・エンターテイメントイベントから発生する需要に常に対応しています。上記のイベントロジスティクスベンダーのうち、DHL、GEODIS、Kuehne+Nagelのようないくつかの企業は、世界中の物流業界のトップ企業であり、欧州地域はイベントロジスティクス業界にとってもう一つの大きな地域となっています。

欧州のイベントロジスティクス市場の収益と2031年までの予測 (単位:100万米ドル)

欧州のイベントロジスティクス市場のセグメンテーション

欧州のイベントロジスティクス市場は、種類別・エンドユーザー別・国別に分類されます。

種類別では、欧州イベントロジスティクス市場は、在庫管理、配送管理、貨物輸送、パレット・梱包サービス、その他に区分されます。2023年には、貨物輸送セグメントが最大の市場シェアを占めています。

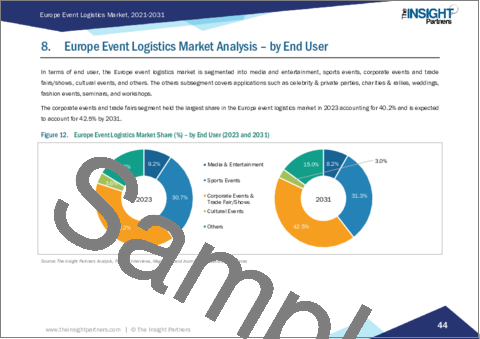

エンドユーザー別では、欧州イベントロジスティクス市場はメディア・エンターテインメント、スポーツイベント、企業イベント・見本市、文化イベント、その他に分類されます。2023年には、企業イベント・見本市分野が最大の市場シェアを占めています。

国別では、欧州のイベントロジスティクス市場はドイツ、フランス、イタリア、英国、ロシア、その他欧州に区分されます。2023年の欧州イベントロジスティクス市場シェアはドイツが独占。

C H Robinson Worldwide Inc、CEVA Logistics AG、DB Schenker、Deutsche Post AG、DSV AS、FedEx Corp、GEODIS SA、Kuehne+Nagel International AG、United Parcel Service Inc、XPO Incなどが、欧州のイベントロジスティクス市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 欧州のイベントロジスティクス市場の情勢

- エコシステム分析

- 技術プロバイダー

- イベントロジスティクスサービス業者

- エンドユーザー

- アフターマーケット・ロジスティクス

第5章 欧州のイベントロジスティクス市場:主な市場力学

- 市場促進要因

- イベント産業の成長

- 主要企業による戦略的イニシアチブの高まり

- 市場抑制要因

- 新興国における十分なインフラ整備の不足

- サプライチェーンの混乱と地政学的緊張

- 市場機会

- 持続可能なソリューションの採用増加

- 今後の動向

- 成長する建設・再生可能エネルギー産業における企業展示会・イベントの増加

- 促進要因と抑制要因の影響

第6章 欧州のイベントロジスティクス市場の分析

- 欧州のイベントロジスティクス市場の収益 (2021~2031年)

- 欧州のイベントロジスティクス市場の予測分析

第7章 欧州のイベントロジスティクス市場の分析:種類別

- 在庫管理

- 配送管理

- 貨物輸送

- パレット・梱包サービス

- その他

第8章 欧州のイベントロジスティクス市場の分析:エンドユーザー別

- メディア・エンターテインメント

- スポーツイベント

- 企業イベント・見本市

- 文化イベント

- その他

第9章 欧州イベントロジスティクス市場:国別分析

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- その他

第10章 競合情勢

- 企業のポジショニングと集中度

第11章 業界情勢

- 市場イニシアティブ

- 企業合併・買収 (M&A)

第12章 企業プロファイル

- Kuehne+Nagel International AG

- CEVA Logistics AG

- DB Schenker

- FedEx Corp

- United Parcel Service, Inc.

- XPO, Inc.

- GEODIS SA

- DSV A/S

- C. H. Robinson Worldwide, Inc.

- Deutsche Post AG

第13章 付録

List Of Tables

- Table 1. Europe Event Logistics Market Segmentation

- Table 2. Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Table 3. Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 4. Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 5. Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 6. Germany: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 7. Germany: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 8. France: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 9. France: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 10. Italy: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 11. Italy: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 12. United Kingdom: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 13. United Kingdom: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 14. Russia: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 15. Russia: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 16. Rest of Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 17. Rest of Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million) - by End User

List Of Figures

- Figure 1. Europe Event Logistics Market Segmentation, by Country

- Figure 2. Ecosystem Analysis

- Figure 3. Europe Event Logistics Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Europe Event Logistics Market Revenue (US$ Million), 2021-2031

- Figure 6. Europe Event Logistics Market Share (%) - by Type (2023 and 2031)

- Figure 7. Inventory Management: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Delivery Management: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Freight Forwarding: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Pallets & Packaging Services: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Others: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Europe Event Logistics Market Share (%) - by End User (2023 and 2031)

- Figure 13. Media & Entertainment: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Sports Events: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Corporate Events & Trade Fairs: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Cultural Events: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Others: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Europe Event Logistics Market, by Key Countries - Revenue (2023) (US$ million)

- Figure 19. Europe Event Logistics Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 20. Germany: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. France: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Italy: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. United Kingdom: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Russia: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Rest of Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Company Positioning & Concentration

The Europe event logistics market was valued at US$ 29,131.97 million in 2023 and is expected to reach US$ 46,336.74 million by 2031; it is estimated to register a CAGR of 6.0% from 2023 to 2031.

Rise in Strategic Initiatives by Key Players Drives Europe Event Logistics Market

Key players operating in the Europe event logistics market include DSV A/S; CH Robinson; KUEHNE + NAGEL; CEVA Logistics; DB SCHENKER; DHL International GmbH; FedEx; UPS; XPO Logistics, Inc.; and GEODIS; among others. These players are adopting various strategies to stay competitive in the market, which include mergers & acquisitions, contract agreements, and partnerships, among others. A few examples of such strategies are mentioned below:

In March 2024, Kuehne + Nagel signed a three-year logistics partnership with World Sailing. Through this partnership, Kuehne + Nagel aims to control the transportation of sailing equipment, boats, and other essential resources for World Sailing-authorized events. In January 2024, Kuehne + Nagel partnered with Clarion Events. Under this partnership, the company has set a target to become the official global logistics partner and reduce the carbon footprint of the Clarion Events Group's exhibitions while setting new standards for the events industry. In March 2023, DHL partnered with the International Bobsleigh and Skeleton Federation (IBSF). Through this partnership, DHL aimed at helping IBSF fulfill logistics demands associated with the World Championships, including the use of sports and marketing equipment such as skeleton sled, racing helmet, speed suit, shoulder pads, spiked shoes, and other equipment. Thus, the rise in the number of initiatives by the key players fuels the Europe event logistics market growth.

Europe Event Logistics Market Overview

The European event logistics market size is mainly supported by the presence of large number of event logistics companies such as Kuehne+Nagel, DHL, DEKRA, GEODIS, HEED-Logistics, Hamburg Messe + Congress, Target Motivation, Sport & Events Logistics Srl, Genius Eventi Srl, WES Logistics, and Event Logistics Team srl. These vendors are constantly catering to the demand generated from corporate events/trade fairs, sport events, media & entertainment events in the region. Among the mentioned event logistics vendors, some of the companies such as DHL, GEODIS, and Kuehne+Nagel are top companies in the logistics industry worldwide which makes the European region another big region for event logistics industry.

Europe Event Logistics Market Revenue and Forecast to 2031 (US$ Million)

Europe Event Logistics Market Segmentation

The Europe event logistics market is categorized into type, end user, and country.

Based on type, the Europe event logistics market is segmented inventory management, delivery management, freight forwarding, pallets and packaging services, and others. The freight forwarding segment held the largest market share in 2023.

In terms of end user, the Europe event logistics market is categorized into media and entertainment, sports events, corporate events and trade fairs, cultural events, and others. The corporate events and trade fairs segment held the largest market share in 2023.

By country, the Europe event logistics market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. Germany dominated the Europe event logistics market share in 2023.

C H Robinson Worldwide Inc, CEVA Logistics AG, DB Schenker, Deutsche Post AG, DSV AS, FedEx Corp, GEODIS SA, Kuehne + Nagel International AG, United Parcel Service Inc, and XPO Inc are some of the leading companies operating in the Europe event logistics market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Europe Event Logistics Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 Technology Providers

- 4.2.2 Event Logistics Service Providers

- 4.2.3 End User

- 4.2.4 Aftermarket Logistics

5. Europe Event Logistics Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growth of Events Industry

- 5.1.2 Rise in Strategic Initiatives by Key Players

- 5.2 Market Restraints

- 5.2.1 Lack of Adequate Infrastructure Development in Developing Economies

- 5.2.2 Disruptions in Supply Chain and Geopolitical Tensions

- 5.3 Market Opportunities

- 5.3.1 Increasing Adoption of Sustainable Solutions

- 5.4 Future Trends

- 5.4.1 Rise in Corporate Exhibition/Events in Growing Construction and Renewable Energy Industry

- 5.5 Impact of Drivers and Restraints:

6. Event Logistics Market - Europe Analysis

- 6.1 Overview

- 6.2 Europe Event Logistics Market Revenue (US$ Million), 2021-2031

- 6.3 Europe Event Logistics Market Forecast Analysis

7. Europe Event Logistics Market Analysis - by Type

- 7.1 Inventory Management

- 7.1.1 Overview

- 7.1.2 Inventory Management: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Delivery Management

- 7.2.1 Overview

- 7.2.2 Delivery Management: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Freight Forwarding

- 7.3.1 Overview

- 7.3.2 Freight Forwarding: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Pallets & Packaging Services

- 7.4.1 Overview

- 7.4.2 Pallets & Packaging Services: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

8. Europe Event Logistics Market Analysis - by End User

- 8.1 Media & Entertainment

- 8.1.1 Overview

- 8.1.2 Media & Entertainment: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Sports Events

- 8.2.1 Overview

- 8.2.2 Sports Events: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Corporate Events & Trade Fairs

- 8.3.1 Overview

- 8.3.2 Corporate Events & Trade Fairs: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Cultural Events

- 8.4.1 Overview

- 8.4.2 Cultural Events: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Others

- 8.5.1 Overview

- 8.5.2 Others: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

9. Europe Event Logistics Market - Country Analysis

- 9.1 Overview

- 9.1.1 Europe Event Logistics Market Breakdown, by Key Countries, 2023 and 2031 (%)

- 9.1.1.1 Europe Event Logistics Market - Revenue and Forecast Analysis - by Country

- 9.1.1.2 Germany: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.2.1 Germany: Europe Event Logistics Market Breakdown, by Type

- 9.1.1.2.2 Germany: Europe Event Logistics Market Breakdown, by End User

- 9.1.1.3 France: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.3.1 France: Europe Event Logistics Market Breakdown, by Type

- 9.1.1.3.2 France: Europe Event Logistics Market Breakdown, by End User

- 9.1.1.4 Italy: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.4.1 Italy: Europe Event Logistics Market Breakdown, by Type

- 9.1.1.4.2 Italy: Europe Event Logistics Market Breakdown, by End User

- 9.1.1.5 United Kingdom: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.5.1 United Kingdom: Europe Event Logistics Market Breakdown, by Type

- 9.1.1.5.2 United Kingdom: Europe Event Logistics Market Breakdown, by End User

- 9.1.1.6 Russia: Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.6.1 Russia: Europe Event Logistics Market Breakdown, by Type

- 9.1.1.6.2 Russia: Europe Event Logistics Market Breakdown, by End User

- 9.1.1.7 Rest of Europe Event Logistics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.7.1 Rest of Europe Event Logistics Market Breakdown, by Type

- 9.1.1.7.2 Rest of Europe Event Logistics Market Breakdown, by End User

- 9.1.1 Europe Event Logistics Market Breakdown, by Key Countries, 2023 and 2031 (%)

10. Competitive Landscape

- 10.1 Company Positioning & Concentration

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Mergers & Acquisitions

12. Company Profiles

- 12.1 Kuehne + Nagel International AG

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 CEVA Logistics AG

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 DB Schenker

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 FedEx Corp

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 United Parcel Service, Inc.

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 XPO, Inc.

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 GEODIS SA

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 DSV A/S

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 C. H. Robinson Worldwide, Inc.

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Deutsche Post AG

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners