|

|

市場調査レポート

商品コード

1597081

北米の衛星推進市場:2031年までの予測 - 地域別分析 - 推進タイプ別、システムタイプ別、用途別、軌道タイプ別North America Satellite Propulsion Market Forecast to 2031 - Regional Analysis - by Propulsion Type, System Type, Application, and Orbit Type |

||||||

|

|||||||

| 北米の衛星推進市場:2031年までの予測 - 地域別分析 - 推進タイプ別、システムタイプ別、用途別、軌道タイプ別 |

|

出版日: 2024年10月17日

発行: The Insight Partners

ページ情報: 英文 93 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

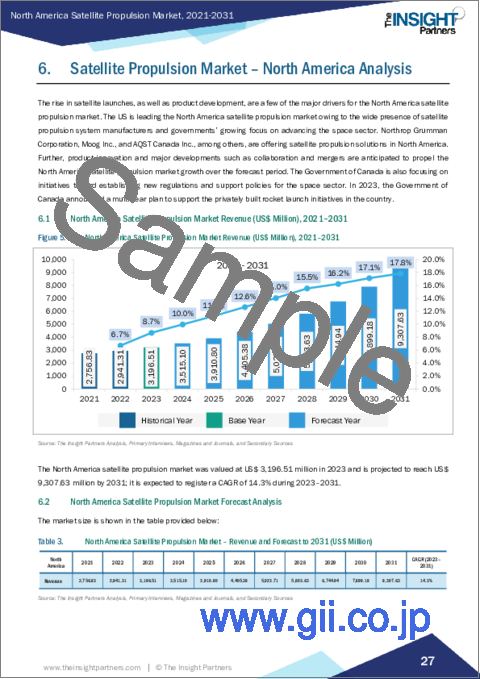

北米の衛星推進市場は、2023年に31億9,651万米ドルとなり、2031年までには93億763万米ドルに達すると予測され、2023年から2031年までのCAGRは14.3%と推定されます。

宇宙着陸船、宇宙船、宇宙タグボート打ち上げへの取り組みが北米の衛星推進市場を後押し

世界の宇宙分野は、地球観測、衛星通信、測位タイミング・ナビゲーションなどのサービス需要の高まりによって牽引されています。宇宙分野は、民間プレイヤーの存在感が高まり、宇宙関連の情報ニーズから生じる需要の高まりを目の当たりにしています。地球低軌道上の小型衛星のコンステレーションは、ニュースペースとして知られるこの動きの主要部分です。2024年2月、月着陸船が月に向けて飛び立ち、米国初の着陸を果たしました。SpaceXも、米国の着陸船が月に向けて飛び立つと同時に、民間の着陸船「オデュッセウス」のファルコン9ロケットを打ち上げました。2024年3月、Blue Originは2025年に月着陸船ブルームーンを打ち上げると発表しました。2024年3月には、SpaceXがスターシップ・ロケットを試験飛行で軌道に打ち上げました。このように、宇宙着陸船、宇宙船、宇宙曳航機への取り組みが増加していることが、衛星推進市場の成長を後押ししています。

北米の衛星推進市場の概要

衛星打ち上げの増加と製品開拓は、北米の衛星推進市場の主要促進要因のいくつかです。米国は、衛星推進システムメーカーが広く存在し、政府が宇宙分野の発展に力を入れるようになっているため、北米の衛星推進市場をリードしています。Northrop Grumman Corporation、Moog Inc.、AQST Canada Inc.などが北米で衛星推進ソリューションを提供しています。さらに、製品の技術革新や提携・合併などの新興市場の開拓が、予測期間中の北米の衛星推進市場の成長を促進すると予想されます。また、カナダ政府は、宇宙分野の新たな規制と支援政策の確立に向けた取り組みに注力しています。2023年、カナダ政府は、同国の民間ロケット打ち上げ構想を支援する複数年計画を発表しました。

北米の衛星推進市場の収益と2031年までの予測(金額)

北米の衛星推進市場のセグメンテーション

北米の衛星推進市場は、推進タイプ、システムタイプ、用途、衛星、軌道タイプ、国に分類されます。

推進タイプに基づき、北米の衛星推進市場は固体推進、コールドガス推進、グリーン推進、電気推進、両極推進に区分されます。2023年の市場シェアは電気推進分野が大きいです。

システムタイプでは、北米の衛星推進市場は単推進剤、二推進剤、電気イオン推進に分類されます。2023年には電気イオン推進分野が最大の市場シェアを占めました。

用途別では、北米の衛星推進市場は、ロケット、宇宙船、衛星、スペースタグ、着陸機に分類されます。2023年に最大の市場シェアを占めたのは民間セグメントです。衛星はさらに500Kg未満、500Kgから1000Kg、1000Kg以上に細分化されます。

軌道タイプでは、北米の衛星推進市場はLEO、MEO、GEO以降に分類されます。2023年にはLEOセグメントが最大の市場シェアを占めています。

国別では、北米の衛星推進市場は米国とカナダに二分されます。2023年の北米の衛星推進市場シェアは米国が独占しました。

Moog Inc、Thales SA、Safran SA、Northrop Grumman Corp、Airbus SE、IHI Corp、ArianeGroupは北米の衛星推進市場で活動する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の衛星推進市場情勢

- ポーターのファイブフォース分析

- エコシステム分析

- コンポーネントメーカー

- 衛星推進システムプロバイダー

- エンドユーザー

- バリューチェーンのベンダー一覧

- 重要考察

- 月着陸推進機の分析

第5章 北米の衛星推進市場:主要市場力学

- 市場促進要因

- 衛星打ち上げ数の増加

- 宇宙着陸船、宇宙船、スペースタグの打ち上げに向けた取り組みの増加

- 戦略的イニシアチブの増加:市場企業別

- 市場抑制要因

- スペースデブリの増加

- 宇宙政策と国際関係の複雑化

- 市場機会

- 衛星コンステレーションの展開

- 衛星打上げロケットに対する戦略的イニシアチブの増加:市場企業別

- 今後の動向

- ライドシェアリングサービスの登場

- 促進要因と抑制要因の影響

第6章 衛星推進市場:北米分析

- 北米の衛星推進市場収益、2021年~2031年

- 北米の衛星推進市場予測分析

第7章 北米の衛星推進市場分析:推進タイプ別

- 固体推進

- コールドガス推進

- グリーン推進

- 電気推進

- アンバイポーラ推進

第8章 北米の衛星推進市場分析:システムタイプ別

- 単推進剤

- バイプロペラント

- 電気イオン推進

第9章 北米の衛星推進市場分析:用途別

- ロケット

- 宇宙船

- 人工衛星

- スペースタグ

- 着陸船

第10章 北米の衛星推進市場分析:軌道タイプ別

- LEO

- MEO・GEO

- Beyond GEO

第11章 北米の衛星推進市場:国別分析

- 北米

- 米国

- カナダ

第12章 競合情勢

- 企業のポジショニングと集中度

第13章 業界情勢

- 市場への取り組み

- 製品開発

第14章 企業プロファイル

- Moog Inc

- Thales SA

- Safran SA

- Northrop Grumman Corp

- Airbus SE

- IHI Corp

- ArianeGroup

第15章 付録

List Of Tables

- Table 1. North America Satellite Propulsion Market Segmentation

- Table 2. List of Vendors

- Table 3. North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Propulsion Type

- Table 5. North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by System Type

- Table 6. North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 7. North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Satellites

- Table 8. North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Orbit Type

- Table 9. North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 10. US Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Propulsion Type

- Table 11. US Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by System Type

- Table 12. US Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 13. US Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Satellites

- Table 14. US Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Orbit Type

- Table 15. Canada Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Propulsion Type

- Table 16. Canada Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by System Type

- Table 17. Canada Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 18. Canada Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Satellites

- Table 19. Canada Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Orbit Type

List Of Figures

- Figure 1. North America Satellite Propulsion Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. North America Satellite Propulsion Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. North America Satellite Propulsion Market Revenue (US$ Million), 2021-2031

- Figure 6. North America Satellite Propulsion Market Share (%) - by Propulsion Type (2023 and 2031)

- Figure 7. Solid Propulsion: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Cold Gas Propulsion: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Green Propulsion: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Electric Propulsion: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Ambipolar Propulsion: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. North America Satellite Propulsion Market Share (%) - by System Type (2023 and 2031)

- Figure 13. Monopropellant: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Bipropellant: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Electric Ion Propulsion: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. North America Satellite Propulsion Market Share (%) - by Application (2023 and 2031)

- Figure 17. Launchers: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Spacecraft: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Satellites: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Space Tugs: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Landers: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. North America Satellite Propulsion Market Share (%) - by Orbit Type (2023 and 2031)

- Figure 23. LEO: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. MEO and GEO: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Beyond GEO: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. North America Satellite Propulsion Market Breakdown, by Key Countries - Revenue (2023) (US$ Million)

- Figure 27. North America Satellite Propulsion Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 28. US Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 29. Canada Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 30. Company Positioning & Concentration

The North America satellite propulsion market was valued at US$ 3,196.51 million in 2023 and is expected to reach US$ 9,307.63 million by 2031; it is estimated to register a CAGR of 14.3% from 2023 to 2031.

Growing Initiatives to Launch Space Landers, Spacecraft, and Space Tugs Fuel North America Satellite Propulsion Market

The global space sector is driven by rising demand from services such as earth observation, satellite communications, and positioning timing and navigation. The space sector is witnessing the growing presence of private players and experiencing heightened demand arising from the need for information related to space. Constellations of small satellites in Low Earth Orbit are a major part of this movement, known as NewSpace. In February 2024, a lunar lander took off for the moon to make the first US landing. SpaceX also launched the private Odysseus lander Falcon 9 rocket as the US lander took off for the moon. In March 2024, Blue Origin announced to launch Blue Moon lunar lander in 2025. In March 2024, SpaceX launched a Starship rocket into orbit on a test flight. Thus, the growing number of initiatives toward space landers, spacecraft, and space tugs propels the growth of the satellite propulsion market.

North America Satellite Propulsion Market Overview

The rise in satellite launches, as well as product development, are a few of the major drivers for the North America satellite propulsion market. The US is leading the North America satellite propulsion market owing to the wide presence of satellite propulsion system manufacturers and governments' growing focus on advancing the space sector. Northrop Grumman Corporation, Moog Inc., and AQST Canada Inc., among others, are offering satellite propulsion solutions in North America. Further, product innovation and major developments such as collaboration and mergers are anticipated to propel the North America satellite propulsion market growth over the forecast period. The Government of Canada is also focusing on initiatives toward establishing new regulations and support policies for the space sector. In 2023, the Government of Canada announced a multi-year plan to support the privately built rocket launch initiatives in the country.

North America Satellite Propulsion Market Revenue and Forecast to 2031 (US$ Million)

North America Satellite Propulsion Market Segmentation

The North America satellite propulsion market is categorized into propulsion type, system type, application, satellites, orbit type, and country.

Based on propulsion type, the North America satellite propulsion market is segmented solid propulsion, cold gas propulsion, green propulsion, electric propulsion, and ambipolar propulsion. The electric propulsion segment held the larger market share in 2023.

In terms of system type, the North America satellite propulsion market is categorized into monopropellant, bipropellant, and electric ion propulsion. The electric ion propulsion segment held the largest market share in 2023.

By application, the North America satellite propulsion market is segmented into launchers, spacecraft, satellites, space tugs, and landers. The private segment held the largest market share in 2023. The satellites is further sub segmented into Below 500 Kg, 500-1000 Kg, Above 1000 Kg.

In terms of orbit type, the North America satellite propulsion market is categorized into LEO, MEO and GEO, and beyond GEO. The LEO segment held the largest market share in 2023.

By country, the North America satellite propulsion market is bifurcated into the US and Canada. The US dominated the North America satellite propulsion market share in 2023.

Moog Inc, Thales SA, Safran SA, Northrop Grumman Corp, Airbus SE, IHI Corp, and ArianeGroup are some of the leading companies operating in the North America satellite propulsion market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Satellite Propulsion Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 Component Manufacturer:

- 4.3.2 Satellite Propulsion System Providers:

- 4.3.3 End User:

- 4.3.4 List of Vendors in the Value Chain

- 4.4 Premium Insights

- 4.4.1 Lunar Lander Propulsion Analysis

5. North America Satellite Propulsion Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Rising Number of Satellite Launches

- 5.1.2 Growing Initiatives to Launch Space Landers, Spacecraft, and Space Tugs

- 5.1.3 Rising Number of Strategic Initiatives by Market Players

- 5.2 Market Restraints

- 5.2.1 Increasing Space Debris

- 5.2.2 Complexity of Space Policy and International Relations

- 5.3 Market Opportunities

- 5.3.1 Deployment of Satellite Constellations

- 5.3.2 Rising Number of Strategic Initiatives for Satellite Launch Vehicles by Market Players

- 5.4 Future Trends

- 5.4.1 Emergence of Ridesharing Services

- 5.5 Impact of Drivers and Restraints:

6. Satellite Propulsion Market - North America Analysis

- 6.1 North America Satellite Propulsion Market Revenue (US$ Million), 2021-2031

- 6.2 North America Satellite Propulsion Market Forecast Analysis

7. North America Satellite Propulsion Market Analysis - by Propulsion Type

- 7.1 Solid Propulsion

- 7.1.1 Overview

- 7.1.2 Solid Propulsion: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Cold Gas Propulsion

- 7.2.1 Overview

- 7.2.2 Cold Gas Propulsion: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Green Propulsion

- 7.3.1 Overview

- 7.3.2 Green Propulsion: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Electric Propulsion

- 7.4.1 Overview

- 7.4.2 Electric Propulsion: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 Ambipolar Propulsion

- 7.5.1 Overview

- 7.5.2 Ambipolar Propulsion: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Satellite Propulsion Market Analysis - by System Type

- 8.1 Monopropellant

- 8.1.1 Overview

- 8.1.2 Monopropellant: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Bipropellant

- 8.2.1 Overview

- 8.2.2 Bipropellant: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Electric Ion Propulsion

- 8.3.1 Overview

- 8.3.2 Electric Ion Propulsion: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Satellite Propulsion Market Analysis - by Application

- 9.1 Launchers

- 9.1.1 Overview

- 9.1.2 Launchers: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Spacecraft

- 9.2.1 Overview

- 9.2.2 Spacecraft: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Satellites

- 9.3.1 Overview

- 9.3.2 Below 500 Kg

- 9.3.3 500-1000 Kg

- 9.3.4 Above 1000 Kg

- 9.3.5 Satellites: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Space Tugs

- 9.4.1 Overview

- 9.4.2 Space Tugs: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Landers

- 9.5.1 Overview

- 9.5.2 Landers: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Satellite Propulsion Market Analysis - by Orbit Type

- 10.1 LEO

- 10.1.1 Overview

- 10.1.2 LEO: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2 MEO and GEO

- 10.2.1 Overview

- 10.2.2 MEO and GEO: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3 Beyond GEO

- 10.3.1 Overview

- 10.3.2 Beyond GEO: North America Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

11. North America Satellite Propulsion Market - Country Analysis

- 11.1 North America

- 11.1.1 North America Satellite Propulsion Market - Revenue and Forecast Analysis - by Country

- 11.1.1.1 North America Satellite Propulsion Market - Revenue and Forecast Analysis - by Country

- 11.1.1.2 US Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.2.1 US Satellite Propulsion Market Breakdown, by Propulsion Type

- 11.1.1.2.2 US Satellite Propulsion Market Breakdown, by System Type

- 11.1.1.2.3 US Satellite Propulsion Market Breakdown, by Application

- 11.1.1.2.3.1 US Satellite Propulsion Market Breakdown, by Satellites

- 11.1.1.2.4 US Satellite Propulsion Market Breakdown, by Orbit Type

- 11.1.1.3 Canada Satellite Propulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.3.1 Canada Satellite Propulsion Market Breakdown, by Propulsion Type

- 11.1.1.3.2 Canada Satellite Propulsion Market Breakdown, by System Type

- 11.1.1.3.3 Canada Satellite Propulsion Market Breakdown, by Application

- 11.1.1.3.3.1.1 Canada Satellite Propulsion Market Breakdown, by Satellites

- 11.1.1.3.4 Canada Satellite Propulsion Market Breakdown, by Orbit Type

- 11.1.1 North America Satellite Propulsion Market - Revenue and Forecast Analysis - by Country

12. Competitive Landscape

- 12.1 Company Positioning & Concentration

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

- 13.3 Product Development

14. Company Profiles

- 14.1 Moog Inc

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Thales SA

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Safran SA

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Northrop Grumman Corp

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Airbus SE

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 IHI Corp

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 ArianeGroup

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners