|

|

市場調査レポート

商品コード

1650861

衛星推進市場:エンドユーザー別、推進技術別、プラットフォーム別、システム別、地域別 - 2030年までの予測Satellite Propulsion Market by Platform (Small, Medium, Large), Propulsion (Solid, Liquid, Hybrid, Electric, Solar, Cold Gas), Systems (Hall Effect-Thruster, Bipropellant Thruster, Power Processing), End User and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 衛星推進市場:エンドユーザー別、推進技術別、プラットフォーム別、システム別、地域別 - 2030年までの予測 |

|

出版日: 2025年02月04日

発行: MarketsandMarkets

ページ情報: 英文 232 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

衛星推進の市場規模は、2024年には26億米ドル、2030年には51億9,000万米ドルになると予測され、CAGRは12.2%になる見込みです。

衛星推進市場は、推進技術の進歩によって牽引されています。メーカー各社は、燃料質量を低減し、より多くのペイロード容量を可能にする電気推進など、効率的でコスト効率の高い推進技術の開発に注力しています。さらに、持続可能な推進技術の需要は、環境問題に対応し、規制に適合するグリーン推進技術の開発を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | エンドユーザー別、推進技術別、プラットフォーム別、システム別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

衛星推進市場における商業セグメントは、予測期間中に最高のCAGRで成長すると予想されます。この成長は、遠隔地における衛星ベースのインターネットサービスの需要増加に起因しています。さらに、電気推進などの費用対効果の高い推進技術により、小規模参入企業が手頃な価格で衛星を打ち上げて市場に参入することが可能になります。気候変動の監視、農業、資源マッピング用途での衛星配備の増加も、商業分野の衛星推進市場の成長に寄与しています。

アジア太平洋の衛星推進市場は、2024年から2030年の予測期間中に市場をリードすると予測されています。この地域は宇宙産業が強力に発展しています。アジア太平洋の宇宙産業への投資は近年継続的に増加しています。オーストラリアは、アジア太平洋の衛星推進市場で最も急成長している国です。衛星配備の増加、衛星ベースのインターネット需要の高まり、先進推進技術への需要など、さまざまな要因がこの地域の優位性に寄与しています。

当レポートでは、世界の衛星推進市場について調査し、エンドユーザー別、推進技術別、プラットフォーム別、システム別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 顧客ビジネスに影響を与える動向と混乱

- HSコード

- 規制状況

- ケーススタディ分析

- 主な利害関係者と購入基準

- 2025年~2026年の主な会議とイベント

- 投資と資金調達のシナリオ

- 運用データ

- 衛星推進市場:ビジネスモデル

- 技術ロードマップ

- 部品表

- 総所有コスト

- 生成AIの影響

- マクロ経済見通し

第6章 業界の動向

- イントロダクション

- 技術動向

- 技術分析

- メガトレンドの影響

- サプライチェーン分析

- 特許分析

第7章 衛星推進市場(エンドユーザー別)

- イントロダクション

- 商業

- 政府・民間

- 防衛

第8章 衛星推進市場(推進技術別)

- イントロダクション

- 化学

- 電気

- その他

第9章 衛星推進市場(プラットフォーム別)

- イントロダクション

- 小型

- 中型

- 大型

第10章 衛星推進市場(システム別)

- イントロダクション

- スラスター

- 推進剤供給システム

- 電力処理ユニット

- その他

第11章 衛星推進市場(地域別)

- イントロダクション

- 北米

- PESTLE分析:北米

- 米国

- カナダ

- アジア太平洋

- PESTLE分析:アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- 欧州

- PESTLE分析:欧州

- 英国

- ドイツ

- イタリア

- ロシア

- フランス

- 中東

- PESTLE分析:中東

- 湾岸協力会議

- その他

- 世界のその他の地域

- ラテンアメリカ

- アフリカ

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- NORTHROP GRUMMAN

- SAFRAN

- THALES ALENIA SPACE

- L3HARRIS TECHNOLOGIES, INC.

- AIRBUS

- LOCKHEED MARTIN CORPORATION

- MOOG INC.

- DAWN AEROSPACE

- RAFAEL ADVANCED DEFENSE SYSTEMS

- IHI CORPORATION

- CU AEROSPACE

- EXOTRAIL

- OHB SE

- BUSEK CO. INC.

- BOEING

- ARIANE GROUP LTD

- その他の企業

- ENPULSION GMBH

- THRUSTME

- ORBION SPACE TECHNOLOGY

- VACCO INDUSTRIES

- IENAI SPACE

- BELLATRIX AEROSPACE

- PHASEFOUR

- BENCHMARK SPACE SYSTEMS

- KREIOS SPACE

- MAGDRIVE TECHNOLOGIES

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2023

- TABLE 2 AVERAGE SELLING PRICE, BY REGION, 2020-2023 (USD MILLION)

- TABLE 3 INDICATIVE PRICING ANALYSIS, BY PLATFORM, 2023 (USD MILLION)

- TABLE 4 INDICATIVE PRICING ANALYSIS, BY PROPULSION TECHNOLOGY, 2023 (USD MILLION)

- TABLE 5 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 6 IMPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 7 EXPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 STANDARDS & REGULATIONS RELATED TO SPACE PROPULSION MARKET

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SATELLITE PROPULSION PLATFORMS

- TABLE 15 KEY BUYING CRITERIA FOR END USERS

- TABLE 16 KEY CONFERENCES AND EVENTS, 2025

- TABLE 17 VOLUME ANALYSIS, BY REGION, 2020-2023 (UNITS)

- TABLE 18 VOLUME ANALYSIS, BY REGION, 2024-2030 (UNITS)

- TABLE 19 COMPARISON BETWEEN BUSINESS MODELS

- TABLE 20 BILL OF MATERIALS (BOM) ANALYSIS FOR SATELLITE PROPULSION SYSTEMS

- TABLE 21 BREAKDOWN OF TOTAL COST OF OWNERSHIP FOR SATELLITE PROPULSION PLATFORMS (USD MILLION)

- TABLE 22 AVERAGE TOTAL COST OF OWNERSHIP FOR SATELLITE PROPULSION PLATFORMS (USD MILLION)

- TABLE 23 TYPES OF CUBESATE PROPULSION SYSTEM MODULES

- TABLE 24 OVERVIEW OF HYBRID PROPULSION SYSTEMS

- TABLE 25 COMPARISON BETWEEN GREEN AND HYDRAZINE PROPELLANTS

- TABLE 26 LIST OF MAJOR PATENTS PERTAINING TO SATELLITE PROPULSION SYSTEMS, 2024

- TABLE 27 SATELLITE PROPULSION MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 28 SATELLITE PROPULSION MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 29 FUNDING FOR SPACE LAUNCHES BY COMMERCIAL ORGANIZATIONS, 2019-2021 (USD MILLION)

- TABLE 30 SATELLITE PROPULSION MARKET, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 31 SATELLITE PROPULSION MARKET, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 32 SATELLITE PROPULSION MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 33 SATELLITE PROPULSION MARKET, BY PLATFORM, 2024-2030 (USD MILLION)

- TABLE 34 STARLINK V1.5 SATELLITE SPECIFICATIONS

- TABLE 35 S-CLASS SATELLITE SPECIFICATIONS

- TABLE 36 SMARTLEO AGILE PLATFORM SPECIFICATIONS

- TABLE 37 THALES ALENIA SPACE (TAS)'S SPACEBUS 4000 SATELLITE PLATFORM SPECIFICATIONS

- TABLE 38 BOEING 702X SATELLITE SPECIFICATIONS

- TABLE 39 SATELLITE PROPULSION MARKET, BY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 40 SATELLITE PROPULSION MARKET, BY SYSTEM, 2024-2030 (USD MILLION)

- TABLE 41 ANALYSIS OF SATELLITE PROPULSION MARKET PROPELLANTS

- TABLE 42 SATELLITE PROPULSION MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 43 SATELLITE PROPULSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: SATELLITE PROPULSION MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 45 NORTH AMERICA: SATELLITE PROPULSION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: SATELLITE PROPULSION MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 47 NORTH AMERICA: SATELLITE PROPULSION MARKET, BY PLATFORM, 2024-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: SATELLITE PROPULSION MARKET, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 49 NORTH AMERICA: SATELLITE PROPULSION MARKET, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: SATELLITE PROPULSION MARKET FOR SMALL PLATFORMS, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 51 NORTH AMERICA: SATELLITE PROPULSION MARKET FOR SMALL PLATFORMS, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: SATELLITE PROPULSION MARKET FOR MEDIUM PLATFORMS, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 53 NORTH AMERICA: SATELLITE PROPULSION MARKET FOR MEDIUM PLATFORMS, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: SATELLITE PROPULSION MARKET FOR LARGE PLATFORMS, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 55 NORTH AMERICA: SATELLITE PROPULSION MARKET FOR LARGE PLATFORMS, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 56 ASIA PACIFIC: SATELLITE PROPULSION MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 57 ASIA PACIFIC: SATELLITE PROPULSION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 58 ASIA PACIFIC: SATELLITE PROPULSION MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 59 ASIA PACIFIC: SATELLITE PROPULSION MARKET, BY PLATFORM, 2024-2030 (USD MILLION)

- TABLE 60 ASIA PACIFIC: SATELLITE PROPULSION MARKET, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 61 ASIA PACIFIC: SATELLITE PROPULSION MARKET, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 62 ASIA PACIFIC: SATELLITE PROPULSION MARKET FOR SMALL PLATFORMS, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 63 ASIA PACIFIC: SATELLITE PROPULSION MARKET FOR SMALL PLATFORMS, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 64 ASIA PACIFIC: SATELLITE PROPULSION MARKET FOR MEDIUM PLATFORMS, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 65 ASIA PACIFIC: SATELLITE PROPULSION MARKET FOR MEDIUM PLATFORMS, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 66 ASIA PACIFIC: SATELLITE PROPULSION MARKET FOR LARGE PLATFORMS, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 67 ASIA PACIFIC: SATELLITE PROPULSION MARKET FOR LARGE PLATFORMS, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 68 EUROPE: SATELLITE PROPULSION MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 69 EUROPE: SATELLITE PROPULSION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 70 EUROPE: SATELLITE PROPULSION MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 71 EUROPE: SATELLITE PROPULSION MARKET, BY PLATFORM, 2024-2030 (USD MILLION)

- TABLE 72 EUROPE: SATELLITE PROPULSION MARKET, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 73 EUROPE: SATELLITE PROPULSION MARKET, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 74 EUROPE: SATELLITE PROPULSION MARKET FOR SMALL PLATFORMS, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 75 EUROPE: SATELLITE PROPULSION MARKET FOR SMALL PLATFORMS, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 76 EUROPE: SATELLITE PROPULSION MARKET FOR MEDIUM PLATFORMS, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 77 EUROPE: SATELLITE PROPULSION MARKET FOR MEDIUM PLATFORMS, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 78 EUROPE: SATELLITE PROPULSION MARKET FOR LARGE PLATFORMS, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 79 EUROPE: SATELLITE PROPULSION MARKET FOR LARGE PLATFORMS, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 80 MIDDLE EAST: SATELLITE PROPULSION MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 81 MIDDLE EAST: SATELLITE PROPULSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 82 MIDDLE EAST: SATELLITE PROPULSION MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 83 MIDDLE EAST: SATELLITE PROPULSION MARKET, BY PLATFORM, 2024-2030 (USD MILLION)

- TABLE 84 MIDDLE EAST: SATELLITE PROPULSION MARKET, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 85 MIDDLE EAST: SATELLITE PROPULSION MARKET, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 86 MIDDLE EAST: SATELLITE PROPULSION MARKET FOR SMALL PLATFORMS, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 87 MIDDLE EAST: SATELLITE PROPULSION MARKET FOR SMALL PLATFORMS, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 88 MIDDLE EAST: SATELLITE PROPULSION MARKET FOR MEDIUM PLATFORMS, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 89 MIDDLE EAST: SATELLITE PROPULSION MARKET FOR LARGE PLATFORMS, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 90 MIDDLE EAST: SATELLITE PROPULSION MARKET FOR LARGE PLATFORMS, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 91 REST OF THE WORLD: SATELLITE PROPULSION MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 92 REST OF THE WORLD: SATELLITE PROPULSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 93 REST OF THE WORLD: SATELLITE PROPULSION MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 94 REST OF THE WORLD: SATELLITE PROPULSION MARKET, BY PLATFORM, 2024-2030 (USD MILLION)

- TABLE 95 REST OF THE WORLD: SATELLITE PROPULSION MARKET, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 96 REST OF THE WORLD: SATELLITE PROPULSION MARKET, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 97 REST OF THE WORLD: SATELLITE PROPULSION MARKET FOR SMALL PLATFORMS, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 98 REST OF THE WORLD: SATELLITE PROPULSION MARKET FOR SMALL PLATFORMS, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 99 REST OF THE WORLD: SATELLITE PROPULSION MARKET FOR MEDIUM PLATFORMS, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 100 REST OF THE WORLD: SATELLITE PROPULSION MARKET FOR LARGE PLATFORMS, BY PROPULSION TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 101 REST OF THE WORLD: SATELLITE PROPULSION MARKET FOR LARGE PLATFORMS, BY PROPULSION TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 102 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 103 SATELLITE PROPULSION MARKET: DEGREE OF COMPETITION

- TABLE 104 END USER FOOTPRINT

- TABLE 105 PROPULSION TECHNOLOGY FOOTPRINT

- TABLE 106 SYSTEM FOOTPRINT

- TABLE 107 REGION FOOTPRINT

- TABLE 108 LIST OF STARTUPS/SMES

- TABLE 109 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 110 SATELLITE PROPULSION MARKET: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 111 SATELLITE PROPULSION MARKET: OTHER DEVELOPMENTS, JANUARY 2020-DECEMBER 2024

- TABLE 112 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 113 NORTHROP GRUMMAN: PRODUCTS/SOLUTIONS OFFERED

- TABLE 114 NORTHROP GRUMMAN: OTHER DEVELOPMENTS

- TABLE 115 SAFRAN: COMPANY OVERVIEW

- TABLE 116 SAFRAN: PRODUCTS/SOLUTIONS OFFERED

- TABLE 117 SAFRAN: DEALS

- TABLE 118 SAFRAN: OTHER DEVELOPMENTS

- TABLE 119 THALES ALENIA SPACE: COMPANY OVERVIEW

- TABLE 120 THALES ALENIA SPACE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 121 THALES ALENIA SPACE: DEALS

- TABLE 122 THALES ALENIA SPACE: OTHER DEVELOPMENTS

- TABLE 123 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 124 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 125 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 126 AIRBUS: COMPANY OVERVIEW

- TABLE 127 AIRBUS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 128 AIRBUS: OTHER DEVELOPMENTS

- TABLE 129 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 130 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 131 LOCKHEED MARTIN CORPORATION: OTHER DEVELOPMENTS

- TABLE 132 MOOG INC.: COMPANY OVERVIEW

- TABLE 133 MOOG INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 134 MOOG INC.: DEALS

- TABLE 135 MOOG INC.: OTHER DEVELOPMENTS

- TABLE 136 DAWN AEROSPACE: COMPANY OVERVIEW

- TABLE 137 DAWN AEROSPACE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 138 DAWN AEROSPACE: DEALS

- TABLE 139 RAFAEL ADVANCED DEFENSE SYSTEMS: COMPANY OVERVIEW

- TABLE 140 RAFAEL ADVANCED DEFENSE SYSTEMS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 141 IHI CORPORATION: COMPANY OVERVIEW

- TABLE 142 IHI CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 143 CU AEROSPACE: COMPANY OVERVIEW

- TABLE 144 CU AEROSPACE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 145 CU AEROSPACE: OTHER DEVELOPMENTS

- TABLE 146 EXOTRIAL: COMPANY OVERVIEW

- TABLE 147 EXOTRIAL: PRODUCTS/SOLUTIONS OFFERED

- TABLE 148 EXOTRIAL: OTHER DEVELOPMENTS

- TABLE 149 OHB SE: COMPANY OVERVIEW

- TABLE 150 OHB SE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 151 OHB SE: OTHER DEVELOPMENTS

- TABLE 152 BUSEK CO, INC.: COMPANY OVERVIEW

- TABLE 153 BUSEK CO, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 154 BUSEK CO, INC.: OTHER DEVELOPMENTS

- TABLE 155 BOEING: COMPANY OVERVIEW

- TABLE 156 BOEING: PRODUCTS/SOLUTIONS OFFERED

- TABLE 157 ARIANE GROUP LTD: COMPANY OVERVIEW

- TABLE 158 ARIANE GROUP LTD: PRODUCTS/SOLUTIONS OFFERED

- TABLE 159 ARIANE GROUP LTD: OTHER DEVELOPMENTS

- TABLE 160 ENPULSION GMBH: COMPANY OVERVIEW

- TABLE 161 THRUSTME: COMPANY OVERVIEW

- TABLE 162 ORBION SPACE TECHNOLOGY: COMPANY OVERVIEW

- TABLE 163 VACCO INDUSTRIES: COMPANY OVERVIEW

- TABLE 164 IENAI SPACE: COMPANY OVERVIEW

- TABLE 165 BELLATRIX AEROSPACE: COMPANY OVERVIEW

- TABLE 166 PHASEFOUR: COMPANY OVERVIEW

- TABLE 167 BENCHMARK SPACE SYSTEMS: COMPANY OVERVIEW

- TABLE 168 KREIOS SPACE: COMPANY OVERVIEW

- TABLE 169 MAGDRIVE TECHNOLOGIES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN MODEL

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 LARGE PLATFORM SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

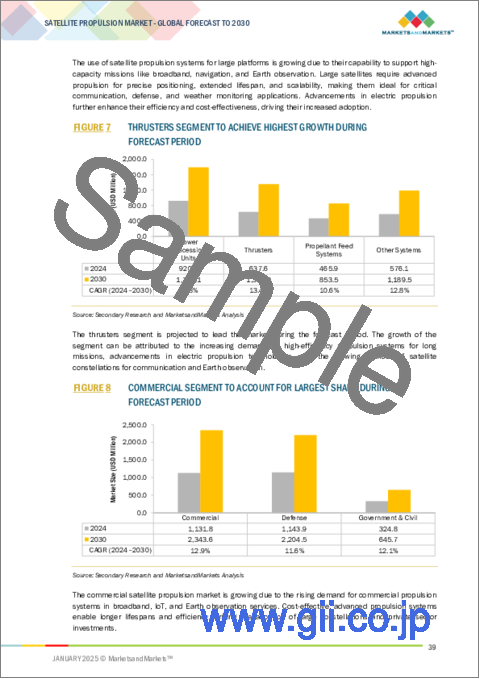

- FIGURE 7 THRUSTERS SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 COMMERCIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO BE LARGEST MARKET IN 2024

- FIGURE 10 INCREASING DEMAND FOR ADVANCED SATELLITE PROPULSION TECHNOLOGIES TO DRIVE MARKET

- FIGURE 11 DEFENSE SEGMENT TO LEAD MARKET IN 2024

- FIGURE 12 ELECTRIC SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 13 CANADA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 14 SATELLITE PROPULSION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 AVERAGE SELLING PRICE, BY REGION, 2020-2023 (USD MILLION)

- FIGURE 16 INDICATIVE PRICING ANALYSIS, BY PLATFORM, 2023 (USD MILLION)

- FIGURE 17 INDICATIVE PRICING ANALYSIS, BY PROPULSION TECHNOLOGY, 2023 (USD MILLION)

- FIGURE 18 VALUE CHAIN ANALYSIS

- FIGURE 19 ECOSYSTEM ANALYSIS

- FIGURE 20 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 IMPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 22 EXPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SATELLITE PROPULSION PLATFORMS

- FIGURE 24 KEY BUYING CRITERIA FOR END USERS

- FIGURE 25 INVESTMENTS AND FUNDING SCENARIO, 2020-2024 (USD BILLION)

- FIGURE 26 SATELLITE PROPULSION MARKET: COMPARISON BETWEEN BUSINESS MODEL PROVIDERS

- FIGURE 27 TECHNOLOGY ROADMAP OF SATELLITE PROPULSION SYSTEMS

- FIGURE 28 EVOLUTION OF SATELLITE PROPULSION TECHNOLOGIES

- FIGURE 29 EMERGING TRENDS IN SATELLITE PROPULSION MARKET

- FIGURE 30 BILL OF MATERIALS (BOM) FOR SATELLITE PROPULSION SYSTEMS

- FIGURE 31 BREAKDOWN OF TOTAL COST OF OWNERSHIP FOR SATELITE PROPULSION SYSTEMS

- FIGURE 32 AVERAGE TOTAL COST OF OWNERSHIP FOR SATELLITE PROPULSION PLATFORMS (USD MILLION)

- FIGURE 33 ADOPTION OF AI IN SATELLITE INDUSTRY

- FIGURE 34 AI IN SPACE: ADOPTION TRENDS, BY KEY COUNTRY

- FIGURE 35 IMPACT OF AI ON SATELLITE PLATFORMS

- FIGURE 36 IMPACT OF AI ON SATELLITE PROPULSION MARKET

- FIGURE 37 TECHNOLOGY TRENDS IN SATELLITE PROPULSION MARKET

- FIGURE 38 SUPPLY CHAIN ANALYSIS

- FIGURE 39 LIST OF MAJOR PATENTS RELATED TO SATELLITE PROPULSION SYSTEMS

- FIGURE 40 COMMERCIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 41 ELECTRIC SEGMENT TO LEAD MARKET DURING BY 2030

- FIGURE 42 LARGE SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2030

- FIGURE 43 THRUSTERS SEGMENT TO GROW AT HIGHEST CAGR BY 2030

- FIGURE 44 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE IN 2024

- FIGURE 45 NORTH AMERICA: SATELLITE PROPULSION MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: SATELLITE PROPULSION MARKET SNAPSHOT

- FIGURE 47 EUROPE: SATELLITE PROPULSION MARKET SNAPSHOT

- FIGURE 48 MIDDLE EAST: SATELLITE PROPULSION MARKET SNAPSHOT

- FIGURE 49 REST OF THE WORLD: SATELLITE PROPULSION MARKET SNAPSHOT

- FIGURE 50 REVENUE ANALYSIS OF TOP FOUR PLAYERS, 2020-2023 (USD MILLION)

- FIGURE 51 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 52 SATELLITE PROPULSION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 53 COMPANY FOOTPRINT

- FIGURE 54 SATELLITE PROPULSION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 55 VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 56 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

- FIGURE 57 BRAND/PRODUCT COMPARISON

- FIGURE 58 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 59 SAFRAN: COMPANY SNAPSHOT

- FIGURE 60 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 61 AIRBUS: COMPANY SNAPSHOT

- FIGURE 62 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 MOOG INC.: COMPANY SNAPSHOT

- FIGURE 64 IHI CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 OHB SE: COMPANY SNAPSHOT

- FIGURE 66 BOEING: COMPANY SNAPSHOT

The Satellite Propulsion market is estimated in terms of market size to be USD 2.60 billion in 2024 to USD 5.19 billion by 2030, at a CAGR of 12.2%. The satellite propulsion market is driven by the increasing advancemnts in propulsion technology. Manufacturers are focusing on developing efficient and cost effective propulsion technologies such as electric propulsion, which lower the fuel mass and allows more payload capacity. Additionally, the demand for sustainable propulsion technology drives the development of green propulsion which addresses environmental concerns and comply with regulations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Platform, System, Propulsion Technology, End User and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The Commercial segment will account for the largest market share in the Satellite Propulsion market during the forecast period."

The Commercial segment in satellite propulsion market is expected to grow at highest CAGR during the forecast period. This growth is attributed to the increasing demand for satellite based internet services in remote areas. Additionally, cost-effective propulsion technologies such as electric propulsion, enables small players to enter the market with affordable satellite launch. The increasing deployment of satellites for monitoring climate change, agriculture and resource mapping applications also contributing the growth of satellite propulsion market for commercial segment.

"The Asia Pacific market is estimated to lead the market."

The Asia Pacific Satellite Propulsion market is expected to lead the market during the forecast period of 2024-2030. The region has a strong and developed space industry in place. Investment in the space industry in Asia Pacific has increased continuously in recent years. Australia is the fastest-growing country in the Asia Pacific Satellite Propulsion market. Various factors, like increasing satellite deployment, rising demand for satellite based internet, demand for advanced propulsion technologies contribute to the region's dominance.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- By Designation: C Level-35%; Directors-25%; and Others-40%

- By Region: North America-20%; Europe-25%; Asia Pacific-35%; Middle East-10%; RoW-10%

Northrop Grumman (US), Safran SA (France), Thales Alenia Space (France), L3Harris Technologies, Inc. (US), and Airbus (France) are some of the leading players operating in the Satellite Propulsion market.

Research Coverage

The study covers the Satellite Propulsion market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on propulsion, capacity, operation, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report:

This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Satellite Propulsion market and its subsegments. The report covers the entire ecosystem of the Satellite Propulsion market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and factors, such as increasing launch of satellites for communication and earth observation services, increase in public-private partnerships for development of satellite propulsion could contribute to an increase in the Satellite Propulsion market.

- Product Development/Innovation: In-depth analysis of product innovation/development by companies across various region.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Satellite Propulsion market across varied regions.

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in Satellite Propulsion market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Northrop Grumman (US), Safran SA (France), Thales Alenia Space (France), L3Harris Technologies, Inc. (US), and Airbus (France) among others in the Satellite Propulsion market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE FACTORS

- 2.2.3 SUPPLY-SIDE FACTORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology (demand side)

- 2.3.1.2 Market size estimation: US satellite propulsion market

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SATELLITE PROPULSION MARKET

- 4.2 SATELLITE PROPULSION MARKET, BY END USER

- 4.3 SATELLITE PROPULSION MARKET, BY PROPULSION TECHNOLOGY

- 4.4 SATELLITE PROPULSION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in satellite launches for communication and Earth observation services

- 5.2.1.2 Increased adoption of electric propulsion systems for efficiency and longevity of satellites

- 5.2.1.3 Miniaturization of propulsion systems for CubeSats and nanosatellites

- 5.2.1.4 Increase in public-private partnerships to develop satellite propulsion technology

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory restrictions on toxic propellants

- 5.2.2.2 Complex and stringent government policies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of advanced thruster technologies

- 5.2.3.2 Increased investments by government agencies for space sustainability

- 5.2.4 CHALLENGES

- 5.2.4.1 Thermal management issues

- 5.2.4.2 Supply chain management issues

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE, BY REGION

- 5.3.2 INDICATIVE PRICING ANALYSIS, BY PLATFORM

- 5.3.3 INDICATIVE PRICING ANALYSIS, BY PROPULSION TECHNOLOGY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 HS CODES

- 5.7.1 IMPORT SCENARIO (HS CODE 880260)

- 5.7.2 EXPORT SCENARIO (HS CODE 880260)

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 REGULATORY FRAMEWORK

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 THRUSTME (FRANCE) HELPED CHINESE SATELLITE COMPANY PERFORM SIGNIFICANT ORBITAL MANEUVERS

- 5.9.2 NASA'S GREEN PROPELLANT INFUSION MISSION (GPIM) SUCCESSFULLY DEMONSTRATED NEW PROPELLANT'S CAPABILITIES IN SPACE

- 5.9.3 NANOAVIONICS (US) PROVIDED GREEN MONOPROPELLANT MICROTHRUSTER PROPULSION SYSTEM FOR LITUANICASAT-2

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 INVESTMENTS AND FUNDING SCENARIO

- 5.13 OPERATIONAL DATA

- 5.14 SATELLITE PROPULSION MARKET: BUSINESS MODELS

- 5.15 TECHNOLOGY ROADMAP

- 5.16 BILL OF MATERIALS

- 5.17 TOTAL COST OF OWNERSHIP

- 5.18 IMPACT OF GENERATIVE AI

- 5.18.1 INTRODUCTION

- 5.18.2 ADOPTION OF AI IN SPACE BY KEY COUNTRIES

- 5.18.3 IMPACT OF AI ON SPACE INDUSTRY: USE CASES

- 5.18.4 IMPACT OF AI ON SATELLITE PROPULSION MARKET

- 5.19 MACROECONOMIC OUTLOOK

- 5.19.1 INTRODUCTION

- 5.19.2 NORTH AMERICA

- 5.19.3 EUROPE

- 5.19.4 ASIA PACIFIC

- 5.19.5 MIDDLE EAST

- 5.19.6 LATIN AMERICA & AFRICA

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 ADVANCED ELECTRIC THRUSTERS

- 6.2.2 IONIC LIQUID ELECTROSPRAY SYSTEMS

- 6.2.3 CUBESAT PROPULSION MODULES

- 6.2.4 HYBRID PROPULSION

- 6.2.5 GREEN PROPELLANT TECHNOLOGY

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 KEY TECHNOLOGIES

- 6.3.1.1 Solar sail propulsion

- 6.3.1.2 Resistojet propulsion

- 6.3.2 COMPLEMENTARY TECHNOLOGIES

- 6.3.2.1 Propellant-less electrodynamic tethers

- 6.3.2.2 Cryogenic propellant storage and handling

- 6.3.1 KEY TECHNOLOGIES

- 6.4 IMPACT OF MEGATRENDS

- 6.4.1 ADDITIVE MANUFACTURING

- 6.4.2 MICRO PROPULSION

- 6.4.3 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 6.5 SUPPLY CHAIN ANALYSIS

- 6.6 PATENT ANALYSIS

7 SATELLITE PROPULSION MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.2 COMMERCIAL

- 7.2.1 INCREASING COMMERCIAL APPLICATIONS OF SATELLITES TO DRIVE GROWTH

- 7.3 GOVERNMENT & CIVIL

- 7.3.1 INCREASED FUNDING FROM GOVERNMENTS TO BOOST ADVANCEMENTS IN SATELLITE PROPULSION SYSTEMS

- 7.4 DEFENSE

- 7.4.1 SATELLITE PROPULSION SYSTEMS ENABLE RELIABILE, SECURE, AND ADAPTABLE SATELLITE OPERATIONS

8 SATELLITE PROPULSION MARKET, BY PROPULSION TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 CHEMICAL

- 8.2.1 CHEMICAL PROPULSION SYSTEMS ARE KNOWN FOR THEIR HIGH SPECIFIC IMPULSE (ISP) AND ABILITY TO DELIVER SIGNIFICANT THRUST

- 8.2.2 SOLID

- 8.2.3 LIQUID

- 8.2.4 HYBRID

- 8.3 ELECTRIC

- 8.3.1 ELECTRIC PROPULSION TECHNOLOGY OFFERS HIGH EFFICIENCY AND LOW THRUST

- 8.3.2 ELECTROTHERMAL

- 8.3.3 ELECTROMAGNETIC

- 8.3.4 ELECTROSTATIC

- 8.4 OTHER TECHNOLOGIES

- 8.4.1 SOLAR

- 8.4.2 TETHER

- 8.4.3 COLD & WARM GAS

9 SATELLITE PROPULSION MARKET, BY PLATFORM

- 9.1 INTRODUCTION

- 9.2 SMALL

- 9.2.1 RAPID DEPLOYMENT OF SATELLITES IN INTERPLANETARY MISSIONS TO DRIVE GROWTH

- 9.3 MEDIUM

- 9.3.1 MEDIUM SATELLITES INTEGRATE BIPROPELLANT CHEMICAL SYSTEMS FOR LAUNCHES AND ELECTRIC PROPULSION FOR IN-ORBIT MANEUVERS

- 9.4 LARGE

- 9.4.1 LARGE SATELLITES REQUIRE PROPULSION SYSTEMS TO ACHIEVE PRECISE ORBIT INSERTION

10 SATELLITE PROPULSION MARKET, BY SYSTEM

- 10.1 INTRODUCTION

- 10.2 THRUSTERS

- 10.2.1 INCREASING DEMAND FOR EFFICIENT PROPULSION SYSTEMS FOR EXTENDED MISSIONS TO DRIVE GROWTH

- 10.2.2 CHEMICAL

- 10.2.2.1 Monopropellant

- 10.2.2.2 Bipropellant

- 10.2.3 NON-CHEMICAL

- 10.2.3.1 Cold & warm gas

- 10.2.3.2 Electric

- 10.2.3.2.1 Hall-effect thrusters

- 10.2.3.2.2 Ion thrusters

- 10.2.3.2.3 Pulsed plasma thrusters

- 10.2.3.2.4 Others

- 10.3 PROPELLANT FEED SYSTEMS

- 10.3.1 PROPELLANT FEED SYSTEMS ARE USED FOR AUXILIARY PROPULSION APPLICATIONS REQUIRING LOW SYSTEM PRESSURE

- 10.3.2 SENSORS

- 10.3.3 FILTERS

- 10.3.4 VALVES

- 10.3.5 PUMPS

- 10.3.6 PRESSURE REGULATORS

- 10.3.7 FUEL TANKS

- 10.3.8 OTHERS

- 10.4 POWER PROCESSING UNITS

- 10.4.1 NEED FOR RELIABLE POWER SUPPLY IN SPACE OPERATIONS TO DRIVE GROWTH

- 10.5 OTHER SYSTEMS

11 SATELLITE PROPULSION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 PESTLE ANALYSIS: NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Presence of key manufacturers and space agencies to drive market growth

- 11.2.3 CANADA

- 11.2.3.1 Increasing government support to lead market growth

- 11.3 ASIA PACIFIC

- 11.3.1 PESTLE ANALYSIS: ASIA PACIFIC

- 11.3.2 CHINA

- 11.3.2.1 Modernization and presence of prominent players

- 11.3.3 INDIA

- 11.3.3.1 Rise in government initiatives to lead market

- 11.3.4 JAPAN

- 11.3.4.1 Government support and technological developments to boost growth

- 11.3.5 SOUTH KOREA

- 11.3.5.1 Modernization programs to increase fuel efficiency to drive growth

- 11.3.6 AUSTRALIA

- 11.3.6.1 Rapid technological advancements in satellite industry to boost growth

- 11.4 EUROPE

- 11.4.1 PESTLE ANALYSIS: EUROPE

- 11.4.2 UK

- 11.4.2.1 Development of advanced satellite propulsion systems to boost market

- 11.4.3 GERMANY

- 11.4.3.1 Innovations and significant contributions from research institutions and corporations to drive market

- 11.4.4 ITALY

- 11.4.4.1 Collaboration between academia and major companies to boost growth

- 11.4.5 RUSSIA

- 11.4.5.1 Increase in space projects and satellite launches to spur growth

- 11.4.6 FRANCE

- 11.4.6.1 Focus on space exploration and satellite technologies to boost growth

- 11.5 MIDDLE EAST

- 11.5.1 PESTLE ANALYSIS: MIDDLE EAST

- 11.5.2 GCC

- 11.5.2.1 UAE

- 11.5.2.1.1 Need to enhance satellite propulsion capabilities to drive growth

- 11.5.2.2 Saudi Arabia

- 11.5.2.2.1 Increasing investments and partnerships between satellite manufacturers to drive market

- 11.5.2.1 UAE

- 11.5.3 REST OF MIDDLE EAST

- 11.6 REST OF THE WORLD

- 11.6.1 LATIN AMERICA

- 11.6.1.1 Rapid adoption of electric propulsion technology to drive market

- 11.6.2 AFRICA

- 11.6.2.1 Increasing investments in space industry to drive market

- 11.6.1 LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 DEALS

- 12.9.2 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 NORTHROP GRUMMAN

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SAFRAN

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 THALES ALENIA SPACE

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 L3HARRIS TECHNOLOGIES, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 AIRBUS

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 LOCKHEED MARTIN CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Other developments

- 13.1.7 MOOG INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Other developments

- 13.1.8 DAWN AEROSPACE

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 RAFAEL ADVANCED DEFENSE SYSTEMS

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions offered

- 13.1.10 IHI CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions offered

- 13.1.11 CU AEROSPACE

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Other developments

- 13.1.12 EXOTRAIL

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Other developments

- 13.1.13 OHB SE

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Other developments

- 13.1.14 BUSEK CO. INC.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Other developments

- 13.1.15 BOEING

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions offered

- 13.1.16 ARIANE GROUP LTD

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Other developments

- 13.1.1 NORTHROP GRUMMAN

- 13.2 OTHER PLAYERS

- 13.2.1 ENPULSION GMBH

- 13.2.2 THRUSTME

- 13.2.3 ORBION SPACE TECHNOLOGY

- 13.2.4 VACCO INDUSTRIES

- 13.2.5 IENAI SPACE

- 13.2.6 BELLATRIX AEROSPACE

- 13.2.7 PHASEFOUR

- 13.2.8 BENCHMARK SPACE SYSTEMS

- 13.2.9 KREIOS SPACE

- 13.2.10 MAGDRIVE TECHNOLOGIES

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS