|

|

市場調査レポート

商品コード

1567907

アジア太平洋の分散型制御システム:2030年までの市場予測 - 地域分析 - コンポーネント別、産業別Asia Pacific Distributed Control Systems Market Forecast to 2030 - Regional Analysis - by Component (Hardware, Software, and Services) and Industry (Power Generation, Oil and Gas, Pharmaceutical, Food and Beverages, Chemicals, and Others) |

||||||

|

|||||||

| アジア太平洋の分散型制御システム:2030年までの市場予測 - 地域分析 - コンポーネント別、産業別 |

|

出版日: 2024年08月07日

発行: The Insight Partners

ページ情報: 英文 137 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の分散型制御システム市場は、2022年に65億185万米ドルとなり、2030年までには106億4,202万米ドルに達すると予測され、2022年から2030年までのCAGRは6.4%と推定されます。

世界の産業オートメーションの成長がアジア太平洋の分散型制御システム市場を後押し

21世紀は、あらゆる産業分野で競争が激化しています。さまざまな製品を製造するメーカーは、品質、サービス、コスト、市場投入期間などの面で競合他社との激しい競争に直面しています。また、メーカー各社は、製品の需要と供給のバランスを完璧に保つという大きな課題に直面しています。産業用ロボットのような機器の高機能化に伴い、非自動車産業では産業用オートメーションの導入が加速すると予測されています。この成長は、分散型制御システム市場に求められる近代化と変革に起因しています。

機械学習(ML)、モノのインターネット(IoT)、人工知能(Al)などの先端技術の浸透が高まっていることが、産業オートメーションの成長を加速させています。さらに、産業用制御システムの主要企業による製品開発や戦略的イニシアチブの増加が、産業用オートメーションの需要を押し上げています。例えば、2023年10月、Rockwell Automation, Inc.とMicrosoft Corp.は、生成型人工知能(AI)を通じて産業用オートメーションの設計と開発を加速するため、長年の関係を延長すると発表しました。同様に、2023年12月、Rockwell Automation, Inc.は、世界有数のタイヤ製造会社であるMichelinとの協力関係を強化し、Michelinの製造プロセス全体のデジタル革新に注力すると発表しました。さらに、産業オートメーションの拡大、モノのインターネット(IoT)、5G技術は、市場成長に寄与するいくつかの要因です。さらに、コネクテッド・エンタープライズの浸透や、世界中でリアルタイムのデータ分析に対する需要が高まっていることによる製品の大量生産の必要性、パフォーマンスを向上させるための最終用途産業全体での先端技術の統合の高まりが、製造業の自動化動向を促進しています。2023年3月、Samsungはインドのノイダにある携帯電話工場にスマート製造機能を設置し、生産競争力を高めるために投資すると発表しました。

分散型制御システムは、活動の遠隔監視を可能にし、効率向上を確実にすることで、製造部門の成長と生産性を誘導します。製造業における自動化導入の増加は、DCS統合の需要を促進し、分散型制御システム市場を牽引しています。

アジア太平洋の分散型制御システム市場概要

アジア太平洋(APAC)は、中国、インド、日本、韓国、オーストラリアなど、技術に精通した国々が存在する技術的に進歩した地域です。これらの国々は、先端技術に対する驚くべき需要を示しています。経済の絶え間ない成長により、これらの国々の政府や民間組織は、新興経済諸国の先端システムの開発や調達に多額の投資を行っています。エネルギー・電力、自動車、製薬産業、食品・飲料、化学・石油化学セクターは、この地域で最も急成長している産業のひとつです。これらのセクターにおける生産量の増加がDCSの需要増につながっており、これが分散型制御システム市場の主要な触媒となっています。

中国は技術的にAPACで最も成熟した市場であり、引き続きこの地域を支配しています。化学・石油化学産業の継続的な成長は、中国の分散型制御システム市場の主要な促進要因です。中国の化学企業は、より多くのDCSの導入に取り組んでいます。例えば、2022年11月、中国のWanhua Chemical Groupは、化学プラントのオペレーションをデジタル化すると発表しました。このプラントでは、スマート端末がFieldComm Groupの技術を経由して分散型制御システム(DCS)や安全計装システム(SIS)に接続されています。そして、スマート端末は、インテリジェント機器管理プラットフォームを使用することで、最大限の管理と制御効率を達成することができます。さらに、ABBのFreelance DCSは、中国最大のソーダ灰生産会社が海洋化学産業チェーンを拡大し、地域経済と化学産業を後押しするのに役立っています。これは主に、化学・石油化学プラントには複数の入出力(I/O)ポイントがあり、すべてのI/Oポイントを人間の干渉を受けながら監視・制御することは難しいという事実に関係しています。

さらに、新たな産業インフラの建設は、政治、環境、法律、経済などさまざまな要因によって制限されています。しかし、DCSを装備したインフラは継続的な運用が要求されるため、アジア太平洋ではサービスプロバイダーに対する需要が急増しており、これが最終的にアジア太平洋の分散型制御システム市場を押し上げています。

アジア太平洋の分散型制御システム市場の収益と2030年までの予測(金額)

アジア太平洋の分散型制御システム市場のセグメンテーション

アジア太平洋の分散型制御システム市場は、コンポーネント、産業、国に基づいてセグメント化されます。

コンポーネントに基づき、アジア太平洋の分散型制御システム市場はハードウェア、ソフトウェア、サービスに区分されます。2022年にはハードウェアセグメントが最大のシェアを占めています。

産業別では、アジア太平洋の分散型制御システム市場は、発電、石油・ガス、製薬、食品・飲料、化学、その他に区分されます。石油・ガスセグメントが2022年に最大シェアを占めました。

国別では、アジア太平洋の分散型制御システム市場は、オーストラリア、中国、インド、日本、韓国、その他アジア太平洋に分類されます。中国が2022年のアジア太平洋の分散型制御システム市場を独占しました。

Honeywell International Inc、General Electric Co、ABB Ltd、Yokogawa Electric Corp、Toshiba Corp、Siemens AG、Emerson Electric Co、NovaTech LLC、Schneider Electric SE、Rockwell Automation Incは、アジア太平洋の分散型制御システム市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 アジア太平洋の分散型制御システム市場情勢

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 アジア太平洋の分散型制御システム市場:主要市場力学

- 市場促進要因

- 世界の産業オートメーションの成長

- 電力・エネルギー分野の成長

- 石油・ガス産業からの需要増加

- 市場抑制要因

- 高額な設備投資

- サイバー攻撃に対する脆弱性

- 市場機会

- 新しい製造施設の建設

- DCSのアーキテクチャ開発

- 今後の動向

- 新技術の統合

- 促進要因と抑制要因の影響

第6章 分散型制御システム市場:アジア太平洋市場分析

- アジア太平洋の分散型制御システム市場収益、2022年~2030年

- アジア太平洋の分散型制御システム市場予測分析

第7章 アジア太平洋の分散型制御システム市場分析:コンポーネント別

- ハードウェア

- ソフトウェア

- サービス

第8章 アジア太平洋の分散型制御システム市場分析:産業別

- 石油・ガス

- 発電

- 化学

- 食品・飲料

- 製薬

- その他

第9章 アジア太平洋の分散型制御システム市場:国別分析

- アジア太平洋

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋

第10章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第11章 業界情勢

- 市場イニシアティブ

- 新製品開発

第12章 企業プロファイル

- Honeywell International Inc

- General Electric Co

- ABB Ltd

- Yokogawa Electric Corp

- Toshiba Corp

- Siemens AG

- Emerson Electric Co

- NovaTech LLC

- Schneider Electric SE

- Rockwell Automation Inc

第13章 付録

List Of Tables

- Table 1. Asia Pacific Distributed Control Systems Market Segmentation

- Table 2. Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Table 3. Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Component

- Table 4. Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million) - by Industry

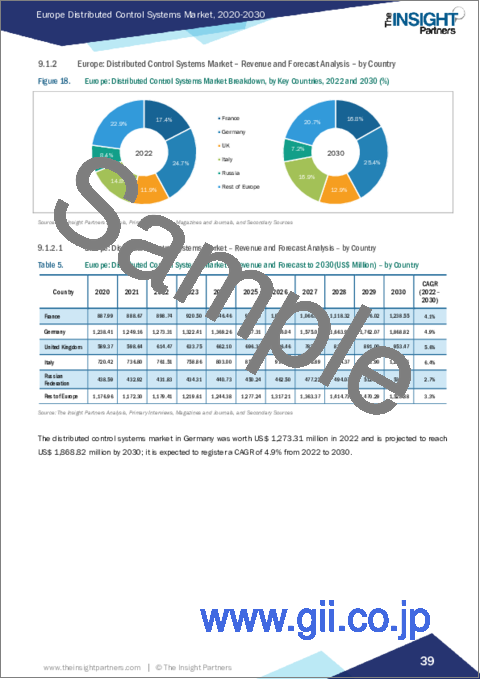

- Table 5. Asia Pacific: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million) - by Country

- Table 6. Australia: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 7. Australia: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million) - by Industry

- Table 8. China: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 9. China: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million) - by Industry

- Table 10. India: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 11. India: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million) - by Industry

- Table 12. Japan: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 13. Japan: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million) - by Industry

- Table 14. South Korea: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 15. South Korea: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million) - by Industry

- Table 16. Rest of Asia Pacific: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million) - by Component

- Table 17. Rest of Asia Pacific: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million) - by Industry

- Table 18. Company Positioning & Concentration

- Table 19. List of Abbreviation

List Of Figures

- Figure 1. Asia Pacific Distributed Control Systems Market Segmentation, by Country

- Figure 2. Ecosystem: Distributed Control Systems Market

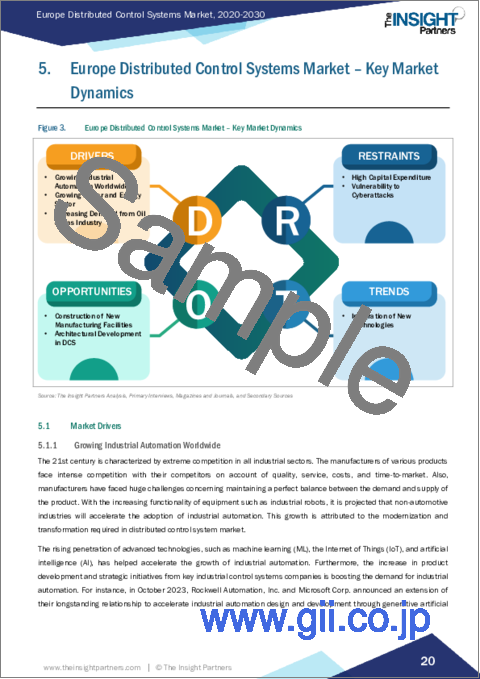

- Figure 3. Asia Pacific Distributed Control Systems Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Asia Pacific Distributed Control Systems Market Revenue (US$ Million), 2022-2030

- Figure 6. Asia Pacific Distributed Control Systems Market Share (%) - by Component (2022 and 2030)

- Figure 7. Hardware: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Software: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Services: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Asia Pacific Distributed Control Systems Market Share (%) - by Industry (2022 and 2030)

- Figure 11. Oil and Gas: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Power Generation: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Chemicals: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Food and Beverages: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Pharmaceutical: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Others: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Asia Pacific Distributed Control Systems Market- Revenue and Forecast to 2030(US$ Million)

- Figure 18. Asia Pacific: Distributed Control Systems Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 19. Australia: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million)

- Figure 20. China: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million)

- Figure 21. India: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million)

- Figure 22. Japan: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million)

- Figure 23. South Korea: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million)

- Figure 24. Rest of Asia Pacific: Distributed Control Systems Market - Revenue and Forecast to 2030(US$ Million)

- Figure 25. Heat Map Analysis By Key Players

The Asia Pacific distributed control systems market was valued at US$ 6,501.85 million in 2022 and is expected to reach US$ 10,642.02 million by 2030; it is estimated to register at a CAGR of 6.4% from 2022 to 2030.

Growing Industrial Automation Worldwide Boosts Asia Pacific Distributed Control Systems Market

The 21st century is characterized by extreme competition in all industrial sectors. The manufacturers of various products face intense competition with their competitors on account of quality, service, costs, and time-to-market. Also, manufacturers have faced huge challenges concerning maintaining a perfect balance between the demand and supply of the product. With the increasing functionality of equipment such as industrial robots, it is projected that non-automotive industries will accelerate the adoption of industrial automation. This growth is attributed to the modernization and transformation required in distributed control system market.

The rising penetration of advanced technologies, such as machine learning (ML), the Internet of Things (IoT), and artificial intelligence (Al), has helped accelerate the growth of industrial automation. Furthermore, the increase in product development and strategic initiatives from key industrial control systems companies is boosting the demand for industrial automation. For instance, in October 2023, Rockwell Automation, Inc. and Microsoft Corp. announced an extension of their longstanding relationship to accelerate industrial automation design and development through generative artificial intelligence (AI). Similarly, in December 2023, Rockwell Automation, Inc. announced that it strengthened its collaboration with Michelin, one of the world's leading tires manufacturing company, focusing on digital innovation across Michelin's manufacturing processes. Further, the growing industrial automation, the Internet of Things (IoT), and the 5G technology are a few factors contributing to market growth. Moreover, the penetration of connected enterprises and the need for mass manufacturing of products due to the growing demand for real-time data analysis across the globe and the rising integration of advanced technologies across end-use industries to improve performance are promoting automation trends in manufacturing. In March 2023, Samsung announced that it would invest in setting up smart manufacturing capabilities at its mobile phone plant in Noida, India, to make production more competitive.

The distributed control system enables remote monitoring of activities and ensures efficiency enhancement, thereby inducing growth and productivity in the manufacturing sector. The increasing adoption of automation in the manufacturing industry propels the demand for DCS integration, driving the distributed control system market.

Asia Pacific Distributed Control Systems Market Overview

Asia Pacific (APAC) is a technologically advancing region with tech-savvy countries, including China, India, Japan, South Korea, and Australia. These countries showcase an astonishing demand for advanced technologies. Owing to the constant growth in their economies, their governments and private organizations are investing significantly higher amounts in developing and procuring advanced systems. Energy & power, automotive, and pharmaceutical industries and food & beverages and chemicals & petrochemicals sectors are among the fastest-growing industries in the region. The growing production in these sectors is leading to an increased demand for DCS, which is the key catalyzer for the distributed control systems market.

China is the most mature market in the APAC in terms of technologies, and it continues to dominate the region. The continuous growth in the chemicals & petrochemicals industry is the key driving factor for the distributed control systems market in China. Chinese chemical companies are engaged in implementing higher numbers of DCS. For instance, in November 2022, China's Wanhua Chemical Group announced that they are digitizing the operations in their chemical plant. In the plant, smart terminals are connected to the distributed control system (DCS) or safety instrumented system (SIS) via FieldComm Group technology. Smart terminals can then achieve maximum management and control efficiency by using the intelligent equipment management platform. In addition, ABB's Freelance DCS is helping China's largest soda ash producer increase its marine chemical industrial chain and boost the local economy and chemical industry. This majorly pertains to the fact that the chemical and petrochemical plants have multiple input/output (I/O) points, and monitoring and controlling every I/O point with human interference is difficult.

In addition, the construction of new industrial infrastructure is limited by various factors, including political, environmental, legal, and economic parameters. However, the infrastructures outfitted with DCS demand continuous operation, and due to this, the demand for service providers is surging in the region, which is ultimately boosting the distributed control systems market in Asia-Pacific.

Asia Pacific Distributed Control Systems Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Distributed Control Systems Market Segmentation

The Asia Pacific distributed control systems market is segmented based on component, industry, and country.

Based on component, the Asia Pacific distributed control systems market is segmented into hardware, software, and services. The hardware segment held the largest share in 2022.

In terms of industry, the Asia Pacific distributed control systems market is segmented into power generation, oil and gas, pharmaceutical, food and beverages, chemicals, and others. The oil and gas segment held the largest share in 2022.

Based on country, the Asia Pacific distributed control systems market is categorized into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific distributed control systems market in 2022.

Honeywell International Inc, General Electric Co, ABB Ltd, Yokogawa Electric Corp, Toshiba Corp, Siemens AG, Emerson Electric Co, NovaTech LLC, Schneider Electric SE, and Rockwell Automation Inc are some of the leading companies operating in the Asia Pacific distributed control systems market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Distributed Control Systems Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 List of Vendors in the Value Chain:

5. Asia Pacific Distributed Control Systems Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Industrial Automation Worldwide

- 5.1.2 Growing Power and Energy Sector

- 5.1.3 Increasing Demand from Oil & Gas Industry

- 5.2 Market Restraints

- 5.2.1 High Capital Expenditure

- 5.2.2 Vulnerability to Cyberattacks

- 5.3 Market Opportunities

- 5.3.1 Construction of New Manufacturing Facilities

- 5.3.2 Architectural Development in DCS

- 5.4 Future Trends

- 5.4.1 Integration of New Technologies

- 5.5 Impact of Drivers and Restraints:

6. Distributed Control Systems Market - Asia Pacific Market Analysis

- 6.1 Asia Pacific Distributed Control Systems Market Revenue (US$ Million), 2022-2030

- 6.2 Asia Pacific Distributed Control Systems Market Forecast Analysis

7. Asia Pacific Distributed Control Systems Market Analysis - by Component

- 7.1 Hardware

- 7.1.1 Overview

- 7.1.2 Hardware: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Software

- 7.2.1 Overview

- 7.2.2 Software: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Services

- 7.3.1 Overview

- 7.3.2 Services: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

8. Asia Pacific Distributed Control Systems Market Analysis - by Industry

- 8.1 Oil and Gas

- 8.1.1 Overview

- 8.1.2 Oil and Gas: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Power Generation

- 8.2.1 Overview

- 8.2.2 Power Generation: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Chemicals

- 8.3.1 Overview

- 8.3.2 Chemicals: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Food and Beverages

- 8.4.1 Overview

- 8.4.2 Food and Beverages: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Pharmaceutical

- 8.5.1 Overview

- 8.5.2 Pharmaceutical: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others: Asia Pacific Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

9. Asia Pacific Distributed Control Systems Market -Country Analysis

- 9.1 Asia Pacific

- 9.1.1 Asia Pacific Distributed Control Systems Market Overview

- 9.1.2 Asia Pacific: Distributed Control Systems Market - Revenue and Forecast Analysis - by Country

- 9.1.2.1 Asia Pacific: Distributed Control Systems Market - Revenue and Forecast Analysis - by Country

- 9.1.2.2 Australia: Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.2.2.1 Australia: Distributed Control Systems Market Breakdown, by Component

- 9.1.2.2.2 Australia: Distributed Control Systems Market Breakdown, by Industry

- 9.1.2.3 China: Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.2.3.1 China: Distributed Control Systems Market Breakdown, by Component

- 9.1.2.3.2 China: Distributed Control Systems Market Breakdown, by Industry

- 9.1.2.4 India: Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.2.4.1 India: Distributed Control Systems Market Breakdown, by Component

- 9.1.2.4.2 India: Distributed Control Systems Market Breakdown, by Industry

- 9.1.2.5 Japan: Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.2.5.1 Japan: Distributed Control Systems Market Breakdown, by Component

- 9.1.2.5.2 Japan: Distributed Control Systems Market Breakdown, by Industry

- 9.1.2.6 South Korea: Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.2.6.1 South Korea: Distributed Control Systems Market Breakdown, by Component

- 9.1.2.6.2 South Korea: Distributed Control Systems Market Breakdown, by Industry

- 9.1.2.7 Rest of Asia Pacific: Distributed Control Systems Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.2.7.1 Rest of Asia Pacific: Distributed Control Systems Market Breakdown, by Component

- 9.1.2.7.2 Rest of Asia Pacific: Distributed Control Systems Market Breakdown, by Industry

10. Competitive Landscape

- 10.1 Heat Map Analysis By Key Players

- 10.2 Company Positioning & Concentration

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 New Product Development

12. Company Profiles

- 12.1 Honeywell International Inc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 General Electric Co

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 ABB Ltd

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Yokogawa Electric Corp

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Toshiba Corp

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Siemens AG

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Emerson Electric Co

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 NovaTech LLC

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Schneider Electric SE

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Rockwell Automation Inc

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners

- 13.2 Word Index