|

|

市場調査レポート

商品コード

1494479

北米の軍事用アンテナ:2030年市場予測- 地域別分析- タイプ、周波数、プラットフォーム、用途別North America Military Antenna Market Forecast to 2030 - Regional Analysis - by Type, Frequency, Platform, and Application |

||||||

|

|||||||

| 北米の軍事用アンテナ:2030年市場予測- 地域別分析- タイプ、周波数、プラットフォーム、用途別 |

|

出版日: 2024年04月05日

発行: The Insight Partners

ページ情報: 英文 104 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

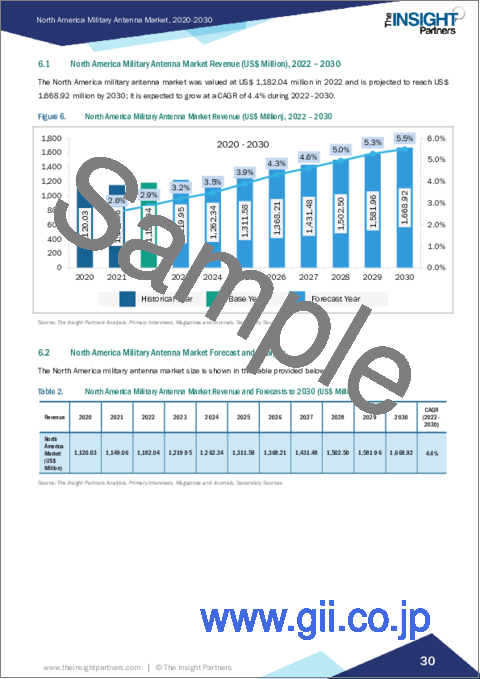

北米の軍事用アンテナ市場は、2022年に11億8,204万米ドルと評価され、2030年には16億6,892万米ドルに達すると予測され、2022年から2030年までのCAGRは4.4%を記録すると予測されています。

国防費の急増が北米の軍事用アンテナ市場を牽引

進化する現代の戦争シナリオは、世界中の様々な国の政府に、それぞれの防衛と軍事力に対して多額の資金と財政援助を割り当てざるを得なくさせています。国防予算の配分は、軍や軍隊が国内外の開発者から強化された技術や装備を入手することを支援しています。一方、国防予算配分の増加により、軍事用車両や陸軍車両のアップグレードは増加傾向にあります。さらに、政府支出の増加は、国家安全保障部隊の強化に政府が注力していることを示しています。先進的な監視、通信、ナビゲーション機器、砲兵、武装、車両などで軍事・国境警備部隊を強化する必要性が高まっているため、世界中の軍隊が先進技術の調達に多額の投資を行うことに注力しています。国防軍は、非戦闘および戦闘作戦のための新技術の獲得に絶えず傾倒しており、世界の軍事費をさらに押し上げています。ストックホルム国際平和研究所(SIPRI)によると、2022年の世界の軍事費は2兆1,480億米ドルに増加し、2021年から3.5%増加しました。米国、中国、インド、ロシア、サウジアラビアが2022年の支出国トップ5であり、世界の支出額の63%を占めました。

軍事費の増加は、高距離アンテナ、高度通信装置、無人車両、レーダー、ミサイル探知システム、監視・ナビゲーション・システムといった高度な戦争技術の取り込みを促します。さらに、高い軍事予算は、各国が既存の航空防衛、地上防衛、海軍防衛システムの進歩やアップグレードのために資源を割り当てることを支援します。これには、ハイエンドのアンテナを組み込むことで、時代遅れで成熟した通信、監視、ナビゲーション・システムを、より先進的で高性能なものに強化または交換することが含まれます。例えば、2022年にはViasat Inc.が大口径アンテナを発表し、商品化しました。このアンテナは、米国や他の宇宙を利用する国々に、将来の国防総省プロジェクトのために、改良された宇宙から地上への通信を提供することができます。2023年、ワシントンを拠点とするネットワーキング・ソリューション企業のカンビウム・ネットワークスは、米国陸軍協会年次総会・博覧会(Association of the United States Army Annual Meeting and Exposition 2023)において、先進的なアンテナを搭載した新しいPTP 700ビーム・ステアリング室外機のデモンストレーションを行う予定です。さらに2023年、宇宙軍は増え続ける軍事衛星を軌道上で管理するため、米国海洋大気庁(NOAA)と協力。宇宙軍は今後、軍事衛星のミッションにNOAAアンテナを使用することが予想されます。さらに、2023年10月、Keysight Technologies, Inc.は、フェーズドアレイ・アンテナ・コントロール&キャリブレーション・ソリューションを発表しました。このソリューションは、衛星通信用途に特化したアクティブな電子走査アレイを製造する衛星設計者が、検証時に設計を適切にテストできるようにするものです。このソリューションは、アクティブアンテナアレイ部品の周波数を向上させることで、信号指向精度を高めます。先進的な軍事用車両は軍事用アンテナの主要な応用分野であるため、軍事費の増加が北米の軍事用アンテナ市場の成長を後押ししています。

北米の軍事用アンテナ市場概要

軍事用アンテナは、監視、通信、テレメトリ、ナビゲーション、電子戦のために、海軍、航空、地上などのすべての防衛プラットフォームで主に使用されています。現代の戦場要件に対応する高度な通信システムに対するニーズの高まりが、北米における軍事用アンテナの需要を押し上げています。SATCOMとして知られる空中無線通信のための衛星の統合が進んでいることも、北米諸国の軍事用アンテナ需要を押し上げる大きな要因となっています。不安定な地政学的シナリオの可能性が高まっていることも、高度な地上ベースの軍事用アンテナのニーズが高まっている主な要因の1つです。北米の軍事用アンテナ市場は米国がリースしており、カナダ、メキシコがそれに続いています。2020年、北米は防衛活動に8,097億米ドルを費やし、2021年には約8,358億米ドルに達しました。2022年には軍事費は9,123億米ドルに達します。米国は最も軍事費の高い国の一つです。国防費の予算が増加していることは、安全保障の必要性の高まりに対応するため、同国が国防部門の強化に重点を置き、注力していることを示しています。国防費には、運用・保守、調達、研究開発、試験・評価、軍事要員などの分野が含まれます。北米では、軍事用機の総数は2023年時点で14144機です。また、海軍艦艇の総数は2023年には466隻となります。米国が243隻、メキシコが186隻、カナダが21隻です。フリゲート、コルベット、駆逐艦、空母、潜水艦が主な艦艇の種類です。また、72隻が就役しました。軍事用アンテナは、この種の艦船の通信、信号伝達、航行のための主要部品のひとつです。このように、艦艇における高度な通信とナビゲーションシステムの用途の増加は、北米の軍事用アンテナの需要を後押ししています。

北米の軍事用アンテナ市場の収益と2030年までの予測(金額)

北米の軍事用アンテナ市場セグメンテーション

北米の軍事用アンテナ市場は、タイプ、周波数、プラットフォーム、用途、国に基づいてセグメント化されます。

タイプ別では、北米の軍事用アンテナ市場は、開口部アンテナ、ダイポールアンテナ、進行波アンテナ、モノポールアンテナ、ループアンテナ、アレイアンテナ、その他に区分されます。2022年にはダイポールアンテナセグメントが最大のシェアを占めました。

周波数別では、北米の軍事用アンテナ市場は高周波、超高周波、極超短波に区分されます。高周波数セグメントが2022年に最大のシェアを占めました。

プラットフォーム別では、北米の軍事用アンテナ市場は海軍、陸軍、空軍に区分されます。2022年には地上セグメントが最大のシェアを占めています。

用途別では、北米の軍事用アンテナ市場は通信、テレメトリ、電子戦、監視、ナビゲーションに分類されます。通信セグメントが2022年に最大のシェアを占めました。

国別では、北米の軍事用アンテナ市場は米国、カナダ、メキシコに区分されます。2022年の北米の軍事用アンテナ市場は米国が支配。

BAE Systems Plc、Comrod Communication AS、Hascall-Denke Corp、L3Harris Technologies Inc、Lockheed Martin Corp、MTI Wireless Edge Ltd、Raytheon Technologies Corp、Rohde and Schwarz GmbH and Co KG、Thales SAは、北米の軍事用アンテナ市場で事業展開している大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の軍事用アンテナ市場情勢

- ポーターズ分析

- エコシステム分析

- 原材料サプライヤー

- 軍事用アンテナメーカー

- エンドユーザー

第5章 北米の軍事用アンテナ市場:主要産業力学

- 北米の軍事用アンテナ市場- 主要産業力学

- 市場促進要因

- 防衛費の急増

- 電子制御フェーズドアレイアンテナの統合の増加

- 不安定な地政学的シナリオと近代的戦争技術の出現による事件の増加

- 軍事用アンテナ供給契約の増加

- 市場抑制要因

- 新興諸国における軍事用アンテナ製造施設の数の制限

- ジャミング技術による脅威

- 市場機会

- 防衛通信システム用超小型アンテナの開発

- 無人航空機(UAV)通信システムの開発

- 今後の動向

- 対策システムの展開

- 促進要因と抑制要因の影響

第6章 軍事用アンテナ市場:北米市場分析

- 北米の軍事用アンテナ市場収益、2022年~2030年

- 北米の軍事用アンテナ市場の予測と分析

第7章 北米の軍事用アンテナ市場分析:2030年までの予測‐タイプ別

- 開口部アンテナ

- ダイポールアンテナ

- 進行波アンテナ

- モノポールアンテナ

- ループアンテナ

- アレイアンテナ

- その他

第8章 北米の軍事用アンテナ市場分析:2030年までの予測‐周波数

- 高周波

- 超高周波

- 極超短波

第9章 北米の軍事用アンテナ市場の分析:2030年までの予測‐プラットフォーム別

- 陸軍

- 空軍

- 海軍

第10章 北米の軍事用アンテナ市場の分析:2030年までの予測‐用途

- 通信

- テレメトリ

- 電子戦

- 監視市場

- ナビゲーション

第11章 北米の軍事用アンテナ市場:国別分析

- 米国

- カナダ

- メキシコ

第12章 競合情勢

- 企業のポジショニングと集中度

第13章 業界情勢

- 市場への取り組み

- 新製品開発

- 合併と買収

第14章 企業プロファイル

- Thales SA

- Comrod Communication AS

- L3Harris Technologies Inc

- Hascall-Denke Corp

- Lockheed Martin Corp

- MTI Wireless Edge Ltd

- Raytheon Technologies Corp

- Rohde and Schwarz GmbH and Co KG

- BAE Systems Plc

第15章 付録

List Of Tables

- Table 1. North America Military Antenna Market Segmentation

- Table 2. North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Million)

- Table 3. North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Million) - Type

- Table 4. North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Million) - Frequency

- Table 5. North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Million) - Platform

- Table 6. North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Million) - Application

- Table 7. US: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn) - By Type

- Table 8. US: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn) - By Frequency

- Table 9. US: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn) - By Platform

- Table 10. US: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn) - By Application

- Table 11. Canada: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn) - By Type

- Table 12. Canada: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn) - By Frequency

- Table 13. Canada: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn) - By Platform

- Table 14. Canada: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn) - By Application

- Table 15. Mexico: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn) - By Type

- Table 16. Mexico: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn) - By Frequency

- Table 17. Mexico: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn) - By Platform

- Table 18. Mexico: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn) - By Application

List Of Figures

- Figure 1. North America Military Antenna Market Segmentation, By Country

- Figure 2. PORTER'S Analysis

- Figure 3. Ecosystem: North America Military Antenna Market

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. North America Military Antenna Market Breakdown by Country, 2022 and 2030 (%)

- Figure 6. North America Military Antenna Market Revenue (US$ Million), 2022 - 2030

- Figure 7. North America Military Antenna Market Share (%) - Type, 2022 and 2030

- Figure 8. Aperture Antennas Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 9. Dipole Antennas Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 10. Travelling Wave Antennas Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 11. Monopole Antennas Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 12. Loop Antennas Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 13. Array Antennas Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 14. Others Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 15. North America Military Antenna Market Share (%) - Frequency, 2022 and 2030

- Figure 16. High Frequency Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 17. Very High Frequency Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 18. Ultra-High Frequency Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 19. North America Military Antenna Market Share (%) - Platform, 2022 and 2030

- Figure 20. Ground Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 21. Airborne Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 22. Marine Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 23. North America Military Antenna Market Share (%) - Application, 2022 and 2030

- Figure 24. Communication Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 25. Telemetry Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 26. Electronic Warfare Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 27. Surveillance Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 28. Navigation Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 29. North America Military Antenna Market Breakdown by Country - Revenue (2022) (US$ Million)

- Figure 30. North America Military Antenna Market Breakdown by Country (2022 and 2030)

- Figure 31. US: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 32. Canada: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 33. Mexico: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 34. Company Positioning & Concentration

The North America military antenna market was valued at US$ 1,182.04 million in 2022 and is expected to reach US$ 1,668.92 million by 2030; it is estimated to record a CAGR of 4.4% from 2022 to 2030.

Surging Defense Expenditure Drives North America Military Antenna Market

The evolving modern warfare scenario has compelled governments of various countries across the globe to assign significant funds and financial aid toward respective defense and military forces. The defense budget allocation supports army and military forces to obtain enhanced technologies and equipment from domestic or international developers. On the other hand, military and army vehicle upgrades are on the rise owing to growing defense budget allocation. Furthermore, the increasing governmental expenditure showcases the government's focus on strengthening national security forces. There is an increased need to reinforce military and border security forces with advanced surveillance, communication, navigation equipment, artilleries, armaments, and vehicles, among others; hence, military forces across the globe are focusing on investing significant amounts in procuring advanced technologies. Defense forces' constant inclination to acquire new technologies for noncombat and combat operations further boosts military expenditure worldwide. As per the Stockholm International Peace Research Institute (SIPRI), global military expenditure increased to US$ 2,148 billion in 2022, representing a 3.5% increase from 2021. The US, China, India, Russia, and Saudi Arabia were the top five spenders in 2022, which accounted for 63% of the global expenditure.

Increasing military expenditure encourages the incorporation of advanced warfare technologies such as high-range antennas, advanced communication devices, unmanned vehicles, radars, missile detection systems, and surveillance and navigation systems. In addition, a high military budget supports countries in assigning resources for the advancement and upgradation of their existing air, ground-based, and naval defense systems. This comprises enhancing or replacing outdated and mature communication, surveillance, and navigation systems with more advanced and capable ones by incorporating high-end antennas. For instance, in 2022, Viasat Inc. introduced and commercialized its large-aperture antennas, which can deliver the US and other spacefaring countries with improved space-to-ground communications for future Department of Defense projects. In 2023, Cambium Networks, a Washington-based networking solution company, is anticipated to demonstrate its new PTP 700 beam-steering outdoor unit equipped with an advanced antenna at the Association of the United States Army Annual Meeting and Exposition 2023. In addition, in 2023, the Space Force collaborated with the National Oceanic and Atmospheric Administration (NOAA) to manage the growing number of military satellites in orbit. Space Force is anticipated to use NOAA Antennas for its military satellite missions in upcoming projects. Moreover, in October 2023, Keysight Technologies, Inc. launched the Phased Array Antenna Control and Calibration solution that facilitates satellite designers fabricating active, electronically scanned arrays specifically for satellite communications applications to test their designs in time of validation properly. The solution increases signal-pointing accuracy by enhancing the frequency of active antenna array components. As advanced army vehicles are a major application area of military antennas, the increase in military expenditure boosts the North America military antenna market growth.

North America Military Antenna Market Overview

Military antennas are majorly used in all defense platforms, such as naval, airborne, and ground-based, for surveillance, communication, telemetry, navigation, and electronic warfare. The growing need for advanced communication systems to cater to modern battlefield requirements is boosting the demand for military antennas in North America. The growing integration of satellite for airborne radio telecommunication, which is known as SATCOM, is another major factor boosting the demand for military antennas in North American countries. Growing possibilities of unstable geopolitical scenarios are also one of the key factors that resulted in the growing need for advanced ground-based military antennas. The US is leasing the market for military antennas in North America, followed by Canada and Mexico. In 2020, North America spent US$ 809.7 billion on defense activities, and in 2021, it reached approximately US$ 835.8 billion. In 2022, the military expenditure reached to US$ 912.3 billion. The US is one of the highest military spending countries. The growing budget for defense expenditure indicates the country's focus and emphasis on advancing the defense sector to meet the growing need for security. The defense expenditure covers sections such as operation and maintenance, procurement, research, and development, testing and evaluation, and military personnel. In North America, the total number of military aircraft fleet accounted for 14144 as of 2023. In addition, the total number of naval vessels accounted to be 466 in 2023. The US accounted for 243 units of navy vessels, followed by Mexico, which accounted for 186 units, and Canada had 21 units. Frigates, corvettes, destroyers, aircraft carriers, and submarines were the major types of naval vessels. Also, 72 units of naval vessel orders were commissioned. The growing number of naval vessel orders are one of the prime opportunity areas for military antennas, which are one of the major parts of these kind of ships for communication, signal transfer, and navigation. Thus, the rising application of advanced communication and navigation systems in naval vessels is also boosting the demand for military antennas in North America.

North America Military Antenna Market Revenue and Forecast to 2030 (US$ Million)

North America Military Antenna Market Segmentation

The North America military antenna market is segmented based on type, frequency, platform, application, and country.

Based on type, the North America military antenna market is segmented into aperture antennas, dipole antennas, travelling wave antennas, monopole antennas, loop antennas, array antennas, and others. The dipole antennas segment held the largest share in 2022.

By frequency, the North America military antenna market is segmented into high frequency, very high frequency, and ultra-high frequency. The high frequency segment held the largest share in 2022.

By platform, the North America military antenna market is segmented into marine, ground, and airborne. The ground segment held the largest share in 2022.

In terms of application, the North America military antenna market is categorized into communication, telemetry, electronic warfare, surveillance, and navigation. The communication segment held the largest share in 2022.

Based on country, the North America military antenna market is segmented into the US, Canada, and Mexico. The US dominated the North America military antenna market in 2022.

BAE Systems Plc, Comrod Communication AS, Hascall-Denke Corp, L3Harris Technologies Inc, Lockheed Martin Corp, MTI Wireless Edge Ltd, Raytheon Technologies Corp, Rohde and Schwarz GmbH and Co KG, and Thales SA are some of the leading companies operating in the North America military antenna market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Military Antenna Market Landscape

- 4.1 Overview

- 4.2 PORTER'S Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Supplier

- 4.3.2 Military Antenna Manufacturers

- 4.3.3 End Users

5. North America Military Antenna Market - Key Industry Dynamics

- 5.1 North America Military Antenna Market - Key Industry Dynamics

- 5.2 Market Drivers

- 5.2.1 Surging Defense Expenditure

- 5.2.2 Rising Integration of Electronically Steered Phased Array Antennas

- 5.2.3 Growing Incidents of Unstable Geopolitical Scenario and Advent of Modern Warfare Technologies

- 5.2.4 Increasing Number of Contracts for Supply of Military Antenna

- 5.3 Market Restraints

- 5.3.1 Limited Number of Military Antenna Manufacturing Facilities in Developing Countries

- 5.3.2 Threat from Jamming Technologies

- 5.4 Market Opportunities

- 5.4.1 Development of Ultra Compact Antennas for Defense Communication Systems

- 5.4.2 Development of Unmanned Aerial Vehicle (UAV) Communication Systems

- 5.5 Future Trends

- 5.5.1 Deployment of Countermeasure Systems

- 5.6 Impact of Drivers and Restraints:

6. Military Antenna Market - North America Market Analysis

- 6.1 North America Military Antenna Market Revenue (US$ Million), 2022 - 2030

- 6.2 North America Military Antenna Market Forecast and Analysis

7. North America Military Antenna Market Analysis - Type

- 7.1 Overview

- 7.1.1 North America Military Antenna Market, By Type (2022 and 2030)

- 7.2 Aperture Antennas

- 7.2.1 Overview

- 7.2.2 Aperture Antennas Market, Revenue and Forecast to 2030 (US$ Million)

- 7.3 Dipole Antennas

- 7.3.1 Overview

- 7.3.2 Dipole Antennas Market, Revenue and Forecast to 2030 (US$ Million)

- 7.4 Travelling Wave Antennas

- 7.4.1 Overview

- 7.4.2 Travelling Wave Antennas Market, Revenue and Forecast to 2030 (US$ Million)

- 7.5 Monopole Antennas

- 7.5.1 Overview

- 7.5.2 Monopole Antennas Market, Revenue and Forecast to 2030 (US$ Million)

- 7.6 Loop Antennas

- 7.6.1 Overview

- 7.6.2 Loop Antennas Market, Revenue and Forecast to 2030 (US$ Million)

- 7.7 Array Antennas

- 7.7.1 Overview

- 7.7.2 Array Antennas Market, Revenue and Forecast to 2030 (US$ Million)

- 7.8 Others

- 7.8.1 Overview

- 7.8.2 Others Market, Revenue and Forecast to 2030 (US$ Million)

8. North America Military Antenna Market Analysis - Frequency

- 8.1 Overview

- 8.1.1 North America Military Antenna Market, By Frequency (2022 and 2030)

- 8.2 High Frequency

- 8.2.1 Overview

- 8.2.2 High Frequency Market, Revenue and Forecast to 2030 (US$ Million)

- 8.3 Very High Frequency

- 8.3.1 Overview

- 8.3.2 Very High Frequency Market, Revenue and Forecast to 2030 (US$ Million)

- 8.4 Ultra-High Frequency

- 8.4.1 Overview

- 8.4.2 Ultra-High Frequency Market, Revenue and Forecast to 2030 (US$ Million)

9. North America Military Antenna Market Analysis - Platform

- 9.1 Overview

- 9.1.1 North America Military Antenna Market, By Platform (2022 and 2030)

- 9.2 Ground

- 9.2.1 Overview

- 9.2.2 Ground Market, Revenue and Forecast to 2030 (US$ Million)

- 9.3 Airborne

- 9.3.1 Overview

- 9.3.2 Airborne Market, Revenue and Forecast to 2030 (US$ Million)

- 9.4 Marine

- 9.4.1 Overview

- 9.4.2 Marine Market, Revenue and Forecast to 2030 (US$ Million)

10. North America Military Antenna Market Analysis - Application

- 10.1 Overview

- 10.1.1 North America Military Antenna Market, By Application (2022 and 2030)

- 10.2 Communication

- 10.2.1 Overview

- 10.2.2 Communication Market, Revenue and Forecast to 2030 (US$ Million)

- 10.3 Telemetry

- 10.3.1 Overview

- 10.3.2 Telemetry Market, Revenue and Forecast to 2030 (US$ Million)

- 10.4 Electronic Warfare

- 10.4.1 Overview

- 10.4.2 Electronic Warfare Market, Revenue and Forecast to 2030 (US$ Million)

- 10.5 Surveillance

- 10.5.1 Overview

- 10.5.2 Surveillance Market, Revenue and Forecast to 2030 (US$ Million)

- 10.6 Navigation

- 10.6.1 Overview

- 10.6.2 Navigation Market, Revenue and Forecast to 2030 (US$ Million)

11. North America Military Antenna Market - Country Analysis

- 11.1 Overview

- 11.1.1 North America Military Antenna Market Revenue and Forecasts and Analysis - By Country

- 11.1.1.1 US: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.1.1.1 US: North America Military Antenna Market Breakdown by Type

- 11.1.1.1.2 US: North America Military Antenna Market Breakdown by Frequency

- 11.1.1.1.3 US: North America Military Antenna Market Breakdown by Platform

- 11.1.1.1.4 US: North America Military Antenna Market Breakdown by Application

- 11.1.1.2 Canada: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.1.2.1 Canada: North America Military Antenna Market Breakdown by Type

- 11.1.1.2.2 Canada: North America Military Antenna Market Breakdown by Frequency

- 11.1.1.2.3 Canada: North America Military Antenna Market Breakdown by Platform

- 11.1.1.2.4 Canada: North America Military Antenna Market Breakdown by Application

- 11.1.1.3 Mexico: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.1.3.1 Mexico: North America Military Antenna Market Breakdown by Type

- 11.1.1.3.2 Mexico: North America Military Antenna Market Breakdown by Frequency

- 11.1.1.3.3 Mexico: North America Military Antenna Market Breakdown by Platform

- 11.1.1.3.4 Mexico: North America Military Antenna Market Breakdown by Application

- 11.1.1.1 US: North America Military Antenna Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.1 North America Military Antenna Market Revenue and Forecasts and Analysis - By Country

12. Competitive Landscape

- 12.1 Company Positioning & Concentration

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

- 13.3 New Product Development

- 13.4 Merger and Acquisition

14. Company Profiles

- 14.1 Thales SA

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Comrod Communication AS

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 L3Harris Technologies Inc

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Hascall-Denke Corp

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Lockheed Martin Corp

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 MTI Wireless Edge Ltd

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Raytheon Technologies Corp

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Rohde and Schwarz GmbH and Co KG

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 BAE Systems Plc

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners