|

|

市場調査レポート

商品コード

1463589

中南米の接着剤・シーラント:2030年までの市場予測 - 地域分析 - 樹脂タイプ別、最終用途産業別South & Central America Adhesives and Sealants Market Forecast to 2030 - Regional Analysis - by Resin Type and by End-Use Industry (Automotive, Aerospace, Paper and Packaging, Building and Construction, Electrical and Electronics, Medical, and Others) |

||||||

|

|||||||

| 中南米の接着剤・シーラント:2030年までの市場予測 - 地域分析 - 樹脂タイプ別、最終用途産業別 |

|

出版日: 2024年01月24日

発行: The Insight Partners

ページ情報: 英文 112 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

中南米の接着剤・シーラント市場は、2022年に16億7,090万米ドルと評価され、2030年には20億5,742万米ドルに達すると予測され、2022年から2030年にかけて2.6%のCAGRで成長すると推定されます。

バイオベース接着剤の開発が中南米の接着剤・シーラント市場を牽引

バイオベースの材料は、環境フットプリントの改善とその使用に伴う石油資源からの独立性により、あらゆる分野で支持を集めています。バイオベースの接着剤は、高分子量からなる天然高分子材料であり、2つの表面を接合するために生体適合性と生分解性ポリマーを利用します。これらのポリマーは、様々な大きく複雑な構造を形成するために連結された分子ビルディング・ブロックから構成されています。近年、バイオベースの接着剤の開発が進んでいます。例えば、大豆ベースの接着剤は、ホルムアルデヒドの毒性に関する懸念を回避するために、尿素ホルムアルデヒド(UF)樹脂に代わるものとして開発されています。大豆タンパク質から調合された接着剤は、望ましい乾燥接着強度を示し、石油樹脂への依存を減らします。接着剤に使用されるバイオベース原料は、再生資源から生産されます。これは、サプライ・チェーンにおける化石原料に比べてCO2排出量の削減につながります。さらに、バイオベース接着剤は、紙の外側のコーティングをクリーンかつ効率的に接着するため、最終用途産業の包装に適しています。また、使い捨ての飲料用ストロー、食器、カトラリーの製造においても、環境に優しい代替品として使用できます。従って、従来の材料が社会と環境に与える影響に対する懸念と意識の高まりにより、接着剤メーカーは環境に優しいバイオベースの材料にシフトしており、予測期間中に接着剤・シーラント市場の成長に有利な機会を提供すると期待されています。

中南米の接着剤・シーラント市場の概要

中南米の接着剤・シーラント市場は、ブラジル、アルゼンチン、その他南米に区分されます。中南米の各国政府は、接着剤・シーラントの需要を後押しするインフラプロジェクトの開発に注力しています。さらに、ブラジルとアルゼンチンでは自動車関連企業の存在感が強く、自動車販売台数の増加が同地域の接着剤・シーラント市場の成長を後押ししています。ブラジル自動車工業会の報告によると、ブラジルの自動車生産台数は11.4%増加し、販売台数は2022年2-3月期に10.9%増加しました。さらに、自動車セクターの主要市場プレーヤーは、有利な自動車市場を開拓するために、中南米での事業能力の開拓と拡大を戦略的に進めています。2022年には、アウディAGが1,920万米ドルを投資してブラジルのパラナ工場での生産を再開し、年間4,000台の生産能力を登録しました。

中南米の接着剤・シーラント市場の収益と2030年までの予測(金額)

中南米の接着剤・シーラントの市場セグメンテーション

中南米の接着剤・シーラント市場は、樹脂タイプ、最終用途産業、国によって区分されます。樹脂タイプに基づき、中南米の接着剤・シーラント市場は接着剤・シーラントに二分されます。2022年には接着剤セグメントがより大きな市場シェアを占めています。さらに、接着剤セグメントはエポキシ、ポリウレタン、アクリル、その他に分類されます。さらに、シーラント分野は、シリコーンシーラント、ウレタンシーラント、アクリルシーラント、ポリサルファイドシーラント、その他に細分化されます。

最終用途産業別に見ると、中南米の接着剤・シーラント市場は自動車、航空宇宙、製紙・包装、建築・建設、電気・電子、医療、その他に区分されます。2022年には、建築・建設セグメントが最大の市場シェアを占めました。

国別では、中南米の接着剤・シーラント市場はブラジル、アルゼンチン、その他南米に区分されます。2022年の中南米の接着剤・シーラント市場シェアはブラジルが独占しました。

Henkel AG and Co KGaA、HB Fuller Company、Sika AG、3M Co、Huntsman International LLC、Dow Inc、Wacker Chemie AG、Parker Hannifin Corpは、中南米の接着剤・シーラント市場で事業を展開する大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 中南米の接着剤・シーラント市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- メーカー

- 流通業者または供給業者

- 最終用途産業

第5章 中南米の接着剤・シーラント市場:主要市場力学

- 市場促進要因

- 建設産業と自動車産業の力強い成長

- 製紙・包装業界からの接着剤・シーラント需要の増加

- 市場抑制要因

- 原材料価格の変動

- 市場機会

- バイオベース接着剤の開発

- 今後の動向

- 先進経済諸国と新興経済諸国による持続可能性への取り組み

- 影響分析

第6章 接着剤・シーラント市場:中南米市場分析

- 中南米の接着剤・シーラントの市場規模(キロトン)

- 接着剤・シーラントの市場収益

- 接着剤・シーラントの市場予測・分析

第7章 中南米の接着剤・シーラント市場分析:樹脂タイプ

- 接着剤

- 接着剤市場の数量、収益と2030年までの予測(キロトン)

- エポキシ

- ポリウレタン

- アクリル

- その他

- シーラント

- シーラント市場の数量、収益と2030年までの予測(キロトン)

- シリコーンシーラント

- ウレタンシーラント

- アクリルシーラント

- ポリサルファイドシーラント

- その他

第8章 中南米の接着剤・シーラント市場分析:最終用途産業

- 自動車

- 航空宇宙

- 紙と包装

- 建築・建設

- 電気・電子

- 医療

- その他

第9章 中南米の接着剤・シーラント市場:国別分析

- 中南米

- 中南米の接着剤・シーラント市場の収益と予測:国別分析

- ブラジル

- アルゼンチン

- その他中南米

- 中南米の接着剤・シーラント市場の収益と予測:国別分析

第10章 競合情勢

- 主要プレーヤー別ヒートマップ分析

第11章 業界情勢

- 製品発売

- パートナーシップ

- 合併と買収

第12章 企業プロファイル

- Henkel AG & Co KGaA

- HB Fuller Co

- Sika AG

- 3M Co

- Huntsman Corp

- Dow Inc

- Wacker Chemie AG

- Parker Hannifin Corp

第13章 付録

List Of Tables

- Table 1. South & Central America Adhesives and Sealants Market Segmentation

- Table 2. South & Central America Adhesives and Sealants Market Volume and Forecasts To 2030 (Kilo Tons)

- Table 3. South & Central America Adhesives and Sealants Market Revenue and Forecasts To 2030 (US$ Million)

- Table 4. Brazil Adhesives and Sealants Market Volume and Forecasts To 2030 (Kilo Tons) - By Resin Type

- Table 5. Brazil Adhesives and Sealants Market Revenue and Forecasts To 2030 (US$ Million) - By Resin Type

- Table 6. Brazil Adhesives and Sealants Market Revenue and Forecasts To 2030 (US$ Million) - By End Use Industry

- Table 7. Argentina Adhesives and Sealants Market Volume and Forecasts To 2030 (Kilo Tons) - By Resin Type

- Table 8. Argentina Adhesives and Sealants Market Revenue and Forecasts To 2030 (US$ Million) - By Resin Type

- Table 9. Argentina Adhesives and Sealants Market Revenue and Forecasts To 2030 (US$ Million) - By End Use Industry

- Table 10. Rest of South & Central America Adhesives and Sealants Market Volume and Forecasts To 2030 (Kilo Tons) - By Resin Type

- Table 11. Rest of South & Central America Adhesives and Sealants Market Revenue and Forecasts To 2030 (US$ Million) - By Resin Type

- Table 12. Rest of South & Central America Adhesives and Sealants Market Revenue and Forecasts To 2030 (US$ Million) - By End Use Industry

- Table 13. Company Positioning & Concentration

List Of Figures

- Figure 1. South & Central America Adhesives and Sealants Market Segmentation, By Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: South & Central America Adhesives and Sealants Market

- Figure 4. South & Central America Adhesives and Sealants Market Impact Analysis of Drivers and Restraints

- Figure 5. South & Central America Adhesives and Sealants Market Volume (Kilo Tons), 2020 - 2030

- Figure 6. South & Central America Adhesives and Sealants Market Revenue (US$ Million), 2020 - 2030

- Figure 7. South & Central America Adhesives and Sealants Market Share (%) - Resin Type, 2022 and 2030

- Figure 8. Adhesives Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 9. Adhesives Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 10. Epoxy Market Volume and Forecasts To 2030 (Kilo Tons)

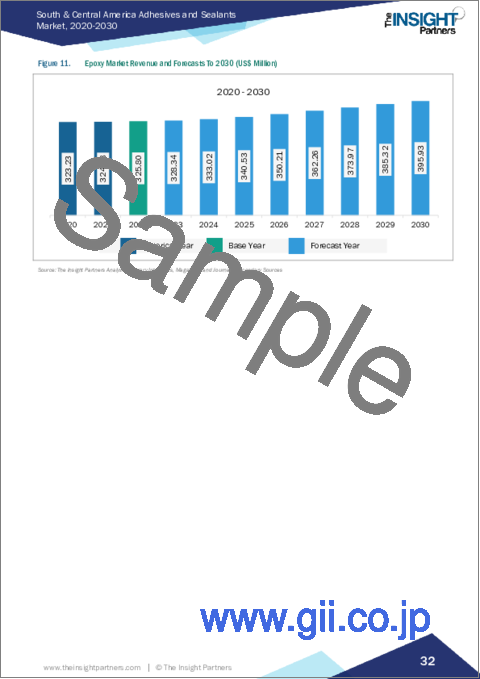

- Figure 11. Epoxy Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 12. Polyurethane Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 13. Polyurethane Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 14. Acrylic Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 15. Acrylic Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 16. Others Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 17. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 18. Sealants Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 19. Sealants Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 20. Silicone Sealant Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 21. Silicone Sealant Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 22. Urethane Sealant Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 23. Urethane Sealant Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 24. Acrylic Sealant Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 25. Acrylic Sealant Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 26. Polysulfide Sealant Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 27. Polysulfide Sealant Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 28. Others Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 29. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 30. South & Central America Adhesives and Sealants Market Share (%) - End Use Industry, 2022 and 2030

- Figure 31. Automotive Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 32. Aerospace Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 33. Paper and Packaging Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 34. Building and Construction Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 35. Electrical and Electronics Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 36. Medical Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 37. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 38. South & Central America Adhesives and Sealants Market, by Key Countries - Revenue (2022) (US$ Million)

- Figure 39. South & Central America Adhesives and Sealants Market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 40. Brazil Adhesives and Sealants Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 41. Brazil Adhesives and Sealants Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 42. Argentina Adhesives and Sealants Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 43. Argentina Adhesives and Sealants Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 44. Rest of South & Central America Adhesives and Sealants Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 45. Rest of South & Central America Adhesives and Sealants Market Revenue and Forecasts To 2030 (US$ Million)

The South & Central America adhesives and sealants market was valued at US$ 1,670.90 million in 2022 and is expected to reach US$ 2,057.42 million by 2030; it is estimated to grow at a CAGR of 2.6% from 2022 to 2030 .

Development of Bio-Based Adhesives fuel the South & Central America Adhesives and Sealants Market

Bio-based materials are gaining traction in all fields due to their improved environmental footprint and independence from petroleum resources that come with their use. Bio-based adhesives are natural polymeric materials consisting of high molecular weight and utilize biocompatible and biodegradable polymers to join two surfaces. These polymers are composed of molecular building blocks linked together to form various large and complex structures. In recent years, there have been developments in bio-based adhesives. For instance, soy-based adhesives are developed to replace urea formaldehyde (UF) resins to avoid concerns related to formaldehyde toxicity. The adhesives formulated from soy protein exhibit desirable dry bonding strength and reduce the dependency on petroleum resins. The biobased raw materials utilized in the adhesive are produced from regenerative sources. This leads to the reduction of CO2 emissions compared to fossil raw materials in the supply chain. Further, biobased adhesives are suitable for packaging end use industry's due to the clean and efficient bonding of outer coating of paper. Also, they can be used as an environmentally friendly alternative in the production of disposable drinking straws, crockery, and cutlery. Hence, owing to the rising concern and awareness about the social and environmental impacts of conventional materials, manufacturers of adhesives are shifting toward environment-friendly bio-based materials, which is expected to offer lucrative opportunities for the adhesives and sealants market growth during the forecast period .

South & Central America Adhesives and Sealants Market Overview

South & Central America adhesives and sealants market is segmented into Brazil, Argentina, and the Rest of South & Central America. The governments of various countries in South & Central America are focusing on developing infrastructure projects that are boosting the demand for adhesives and sealants. Further, the strong presence of automotive companies in Brazil and Argentina and the rise in sales of vehicles are propelling the adhesives and sealants market growth in the region. According to the Brazilian Association of Automotive Vehicle Manufacturers report auto production in Brazil rose by 11.4%, and sales boosted by 10.9% during February-March 2022. Moreover, major market players in the automotive sector have strategized development and expansion of their operational capacities in South & Central America to tap the lucrative automotive market. In 2022, Audi AG invested US$ 19.2 million to restart production at its plant in Parana, Brazil, registering a capacity of 4,000 vehicles per year.

South & Central America Adhesives and Sealants Market Revenue and Forecast to 2030 (US$ Million)

South & Central America Adhesives and Sealants Market Segmentation

The South & Central America adhesives and sealants market is segmented based on resin type, end-use industry, and country. Based on resin type, the South & Central America adhesives and sealants market is bifurcated into adhesives and sealants. The adhesives segment held a larger market share in 2022. Additionally, the adhesives segment is categorized into epoxy, polyurethane, acrylic, and others. Further, the sealants segment is subsegmented into silicone sealant, urethane sealant, acrylic sealant, polysulfide sealant, and others.

Based on end-use industry, the South & Central America adhesives and sealants market is segmented into automotive, aerospace, paper and packaging, building and construction, electrical and electronics, medical, and others. The building and construction segment held the largest market share in 2022.

Based on country, the South & Central America adhesives and sealants market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America adhesives and sealants market share in 2022.

Henkel AG and Co KGaA, HB Fuller Company, Sika AG, 3M Co, Huntsman International LLC, Dow Inc, Wacker Chemie AG, and Parker Hannifin Corp are some of the leading players operating in the South & Central America adhesives and sealants market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

- 2.2.1 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. South & Central America Adhesives and Sealants Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers:

- 4.3.2 Manufacturers:

- 4.3.3 Distributors or Suppliers:

- 4.3.4 End Use Industry:

5. South & Central America Adhesives and Sealants Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Strong Growth of Construction and Automotive Industries

- 5.1.2 Increasing Demand for Adhesives and Sealants from Paper & Packaging Industry

- 5.2 Market Restraints

- 5.2.1 Fluctuation in Prices of Raw Materials

- 5.3 Market Opportunities

- 5.3.1 Development of Bio-Based Adhesives

- 5.4 Future Trends

- 5.4.1 Sustainability Initiatives by Developed and Developing Economies

- 5.5 Impact Analysis

6. Adhesives and Sealants Market - South & Central America Market Analysis

- 6.1 South & Central America Adhesives and Sealants Market Volume (Kilo Tons)

- 6.2 Adhesives and Sealants Market Revenue (US$ Million)

- 6.3 Adhesives and Sealants Market Forecast and Analysis

7. South & Central America Adhesives and Sealants Market Analysis - Resin Type

- 7.1 Adhesives

- 7.1.1 Overview

- 7.1.2 Adhesives Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.1.3 Epoxy

- 7.1.3.1 Overview

- 7.1.4 Epoxy Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.1.4 Polyurethane

- 7.1.4.1 Overview

- 7.1.5 Polyurethane Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.1.6 Acrylic

- 7.1.6.1 Overview

- 7.1.7 Acrylic Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.1.8 Others

- 7.1.8.1 Overview

- 7.1.9 Others Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.2 Sealants

- 7.2.1 Overview

- 7.2.2 Sealants Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.2.3 Silicone Sealant

- 7.2.3.1 Overview

- 7.2.4 Silicone Sealant Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.2.5 Urethane Sealant

- 7.2.5.1 Overview

- 7.2.6 Urethane Sealant Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.2.7 Acrylic Sealant

- 7.2.7.1 Overview

- 7.2.8 Acrylic Sealant Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.2.9 Polysulfide Sealant

- 7.2.9.1 Overview

- 7.2.10 Polysulfide Sealant Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.2.11 Others

- 7.2.11.1 Overview

- 7.2.12 Others Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

8. South & Central America Adhesives and Sealants Market Analysis - End Use Industry

- 8.1 Automotive

- 8.1.1 Overview

- 8.1.2 Automotive Market, Revenue, and Forecast to 2030 (US$ Million)

- 8.2 Aerospace

- 8.2.1 Overview

- 8.2.2 Aerospace Market Revenue, and Forecast to 2030 (US$ Million)

- 8.3 Paper and Packaging

- 8.3.1 Overview

- 8.3.2 Paper and Packaging Market Revenue and Forecast to 2030 (US$ Million)

- 8.4 Building and Construction

- 8.4.1 Overview

- 8.4.2 Building and Construction Market Revenue and Forecast to 2030 (US$ Million)

- 8.5 Electrical and Electronics

- 8.5.1 Overview

- 8.5.2 Electrical and Electronics Market Revenue and Forecast to 2030 (US$ Million)

- 8.6 Medical

- 8.6.1 Overview

- 8.6.2 Medical Market Revenue and Forecast to 2030 (US$ Million)

- 8.7 Others

- 8.7.1 Overview

- 8.7.2 Others Market Revenue and Forecast to 2030 (US$ Million)

9. South & Central America Adhesives and Sealants Market - Country Analysis

- 9.1 South & Central America

- 9.1.1 South & Central America Adhesives and Sealants Market Overview

- 9.1.2 South and Central America Adhesives and Sealants Market Revenue and Forecasts and Analysis - By Countries

- 9.1.2.1 Adhesives and Sealants Market Breakdown by Country

- 9.1.2.2 Brazil Adhesives and Sealants Market Volume and Forecasts to 2030 (Kilo Tons)

- 9.1.2.3 Brazil Adhesives and Sealants Market Revenue and Forecasts to 2030 (US$ Million)

- 9.1.2.3.1 Brazil Adhesives and Sealants Market Breakdown by Resin Type

- 9.1.2.3.2 Brazil Adhesives and Sealants Market Breakdown by Resin Type

- 9.1.2.3.3 Brazil Adhesives and Sealants Market Breakdown by End Use Industry

- 9.1.2.4 Argentina Adhesives and Sealants Market Volume and Forecasts to 2030 (Kilo Tons)

- 9.1.2.5 Argentina Adhesives and Sealants Market Revenue and Forecasts to 2030 (US$ Million)

- 9.1.2.5.1 Argentina Adhesives and Sealants Market Breakdown by Resin Type

- 9.1.2.5.2 Argentina Adhesives and Sealants Market Breakdown by Resin Type

- 9.1.2.5.3 Argentina Adhesives and Sealants Market Breakdown by End Use Industry

- 9.1.2.6 Rest of South & Central America Adhesives and Sealants Market Volume and Forecasts to 2030 (Kilo Tons)

- 9.1.2.7 Rest of South & Central America Adhesives and Sealants Market Revenue and Forecasts to 2030 (US$ Million)

- 9.1.2.7.1 Rest of South & Central America Adhesives and Sealants Market Breakdown by Resin Type

- 9.1.2.7.2 Rest of South & Central America Adhesives and Sealants Market Breakdown by Resin Type

- 9.1.2.7.3 Rest of South & Central America Adhesives and Sealants Market Breakdown by End Use Industry

10. Competitive Landscape

- 10.1 Heat Map Analysis By Key Players

11. Industry Landscape

- 11.1 Product launch

- 11.2 Partnership

- 11.3 Merger & Acquisition

12. Company Profiles

- 12.1 Henkel AG & Co KGaA

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 HB Fuller Co

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Sika AG

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 3M Co

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Huntsman Corp

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Dow Inc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Wacker Chemie AG

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Parker Hannifin Corp

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments