|

|

市場調査レポート

商品コード

1420228

冷凍食品の北米市場:地域別分析 - タイプ別、カテゴリー別、流通チャネル別、予測(~2030年)North America Frozen Entree Market Forecast to 2030 - Regional Analysis - Type, Category, and Distribution Channel |

||||||

|

|||||||

| 冷凍食品の北米市場:地域別分析 - タイプ別、カテゴリー別、流通チャネル別、予測(~2030年) |

|

出版日: 2023年12月15日

発行: The Insight Partners

ページ情報: 英文 85 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

北米の冷凍食品の市場規模は、2022年に134億7,488万米ドルに達し、2022~2030年にかけてCAGR 4.3%で成長し、2030年には188億9,075万米ドルに達すると予測されています。

新興国市場におけるコールドチェーンインフラの不足が北米の冷凍食品市場に拍車をかける

近年、eコマースの出現は消費者の買い物や消費習慣に革命をもたらしました。スマートフォンやインターネットの普及、新たなテクノロジー、購買力の上昇、いつでもどこでもオンライン小売ショッピングができるプラットフォームが提供する利便性などが、eコマース業界を後押しする主な要因となっています。米国商務省小売指標部門によると、米国のeコマース売上高は、2021年に8,700億米ドルに達し、2020年から14.2%増加しました。オンライン食料品売上は2021年に170%成長し、米国の食料品売上全体の9.6%を占めました。

冷凍食品を購入する際、オンライン小売プラットフォームを好む人が増えています。American Frozen Food Instituteによると、冷凍食品のオンライン売上は2020年に前年比75%増となり、冷凍ディナー/食品、肉、鶏肉、シーフードが最大のオンライン売上となった。パンデミック(世界的大流行)の最中、実店舗の閉鎖や政府による社会的規制により、食品・飲料のオンライン販売は大幅に増加しました。

大幅な値引き、ひとつ屋根の下で幅広いブランドが利用できること、宅配オプションが、消費者のオンライン・ショッピングへの関心を高める主な要因となっています。さまざまな地域でeコマースの浸透が進んでいることから、Kellogg's Company、Conagra Brands、Nestle SAなどの冷凍食品メーカーは、Amazon、Lidl、Walmartなどの有名なeコマースプラットフォームを通じて製品を販売することで、オンラインプレゼンスを拡大しました。この要因は、オフラインの小売店への依存をなくすことで、北米の冷凍食品市場の成長に貢献しています。

北米の冷凍食品市場の概要

冷凍食品市場は米国、カナダ、メキシコに区分されます。冷凍食品は北米で広く消費されている食品の一つであるが、これは迅速で簡単な食事ソリューションに対する嗜好が高まっているためです。冷凍食品は利便性が高く、準備の手間が省けるため、共働きや共働き世帯に好まれるクイックフードソリューションです。さらに、消費者は健康的なライフスタイルを採用するようになっており、グルテンフリー、低炭水化物、全粒粉、有機のダイエット製品を求めるようになっています。北米の冷凍食品市場の成長は、環境問題への関心の高まりから植物性食品への嗜好が高まっていることなども背景にあります。新しいフレーバー、より健康的なオプション、国際的な料理など、絶え間ない製品革新が消費者を魅了し、市場成長を後押ししています。2022年9月、Impossible Foods Inc.は8種類のボウル入りの冷凍植物性食品を発売しました。これら8種類の冷凍食品・ボウルは、世界中のウォルマートの店舗(~4,000店)で販売されています。したがって、メーカーによるこのような風味や味の異なる製品イノベーションは、北米の冷凍食品の需要を押し上げると予想されます。

北米の冷凍食品市場の収益と2030年までの予測(100万米ドル)

北米の冷凍食品市場のセグメンテーション

北米の冷凍食品市場は、タイプ、カテゴリー、流通チャネル、国に区分されます。

タイプ別では、北米の冷凍食品市場は肉ベース食品と植物ベース食品に二分されます。植物ベースの食品セグメントはさらに、サツマイモの食品、植物ベースの肉の食品、野菜の食品、その他の植物ベースの食品に分類されます。肉ベースの食品セグメントは2022年に北米の冷凍食品市場で最大のシェアを占めました。

カテゴリー別では、北米の冷凍食品市場は有機と従来型に区分されます。従来型セグメントは、2022年に北米の冷凍食品市場で最大のシェアを占めました。

流通チャネル別では、北米の冷凍食品市場はスーパーマーケットとハイパーマーケット、コンビニエンスストア、オンライン小売、その他に区分されます。スーパーマーケットとハイパーマーケットセグメントは、2022年に北米の冷凍食品市場で最大のシェアを占めました。

国別では、北米の冷凍食品市場は米国、カナダ、メキシコに区分されます。米国は2022年の北米の冷凍食品市場を独占しました。

Impossible Foods Inc、Kellogg Co、Daiya Foods Inc、Conagra Brands Inc、Nestle SA、Del Monte Foods Inc、Waffle Waffle LLC Inc、B &G Food Inc、Mars Inc、Amy's Kitchen Incは北米の冷凍食品市場で事業を展開する大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要市場洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の冷凍食品の市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- メーカー

- 流通業者または供給業者

- 小売業者

第5章 北米の冷凍食品市場:主要産業力学

- 市場促進要因

- コンビニエンス食品の消費拡大

- eコマースの隆盛

- 市場抑制要因

- 新興諸国におけるコールドチェーンインフラの不足

- 市場機会

- メーカーによる戦略的取り組み

- 今後の動向

- 植物性冷凍食品の人気の高まり

- 促進要因と抑制要因の影響

第6章 冷凍食品市場:北米市場分析

- 北米の冷凍食品市場の収益、2020~2030年

- 北米の冷凍食品市場の予測および分析

- 競合ポジショニング - 主要市場企業

第7章 北米の冷凍食品の市場分析:タイプ別

- 肉ベース食品

- 植物ベース食品

第8章 北米の冷凍食品の市場分析:カテゴリー別

- 有機

- 従来型

第9章 北米の冷凍食品の市場分析:流通チャネル別

- スーパーマーケット・ハイパーマーケット

- コンビニエンスストア

- オンライン小売

- その他

第10章 北米の冷凍食品市場:国別分析

第11章 業界情勢

- 新製品開発

- パートナーシップ

- その他の事業戦略

第12章 競合情勢

- 主要企業別ヒートマップ分析

- 企業のポジショニングと集中度

第13章 企業プロファイル

- Impossible Foods Inc

- Kellogg Co

- Conagra Brands Inc

- Daiya Foods Inc

- Nestle SA

- Del Monte Foods Inc

- B&G Foods Inc

- Waffle Waffle LLC

- Mars Inc

- Amy's Kitchen Inc

第14章 付録

List Of Tables

- Table 1. North America Frozen Entree Market Segmentation

- Table 2. North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Million)

- Table 3. North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Million) - Type

- Table 4. North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Million) - Category

- Table 5. North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Million) - Distribution Channel

- Table 6. US North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Mn) - By Type

- Table 7. US North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Mn) - By Category

- Table 8. US North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Mn) - By Distribution Channel

- Table 9. Canada North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Mn) - By Type

- Table 10. Canada North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Mn) - By Category

- Table 11. Canada North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Mn) - By Distribution Channel

- Table 12. Mexico North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Mn) - By Type

- Table 13. Mexico North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Mn) - By Category

- Table 14. Mexico North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Mn) - By Distribution Channel

- Table 15. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. North America Frozen Entree Market Segmentation, By Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: North America Frozen Entree Market

- Figure 4. North America Frozen Entree Market - Key Industry Dynamics

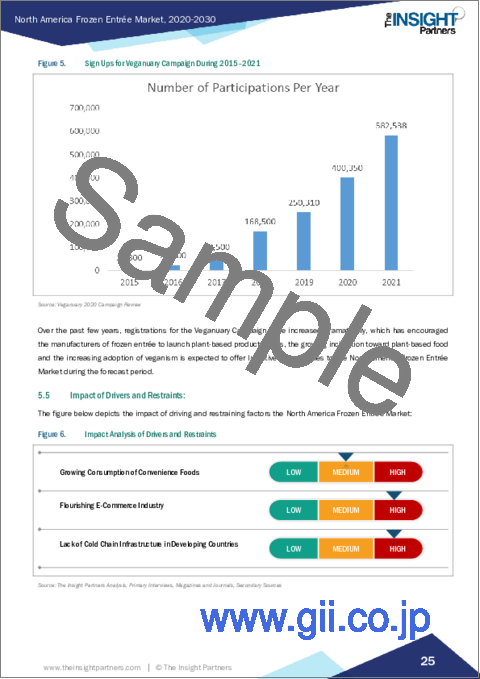

- Figure 5. Sign Ups for Veganuary Campaign During 2015-2021

- Figure 6. Impact Analysis of Drivers and Restraints

- Figure 7. North America Frozen Entree Market Revenue (US$ Million), 2020 - 2030

- Figure 8. North America Frozen Entree Market Share (%) - Type, 2022 and 2030

- Figure 9. Meat Based Entrees Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 10. Plant-Based Entrees Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 11. Plant-Based Meat Entrees Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 12. Sweet Potato Entrees Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 13. Vegetable Entrees Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 14. Other Plant-Based Entrees Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 15. North America Frozen Entree Market Share (%) - Category, 2022 and 2030

- Figure 16. Organic Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 17. Conventional Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 18. North America Frozen Entree Market Share (%) - Distribution Channel, 2022 and 2030

- Figure 19. Supermarkets and Hypermarkets Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 20. Convenience Stores Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 21. Online Retail Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 22. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 23. North America Frozen Entree Market, by Key Countries, (2022) (US$ Mn)

- Figure 24. North America Frozen Entree Market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 25. US North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 26. Canada North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 27. Mexico North America Frozen Entree Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 28. Company Positioning & Concentration

The North America frozen entree market is expected to grow from US$ 13,474.88 million in 2022 to US$ 18,890.75 million by 2030. It is estimated to grow at a CAGR of 4.3% from 2022 to 2030.

Lack of Cold Chain Infrastructure in Developing Countries Fuel the North America Frozen Entree Market

In recent years, the emergence of e-commerce has revolutionized consumer shopping and spending habits. Smartphone and internet penetration, emerging technologies, rising purchasing power, and convenience provided by online retail shopping platforms from anywhere at any time are among the key factors favoring the e-commerce industry. According to the US Department of Commerce Retail Indicator Division, e-commerce sales in the US reached US$ 870 billion in 2021, up by 14.2% from 2020. Online grocery sales grew by 170% in 2021, accounting for 9.6% of total grocery sales in the US.

People increasingly prefer online retail platforms for purchasing frozen food products such as frozen entree. According to American Frozen Food Institute, online sales of frozen food products increased by 75% in 2020 compared to a year ago, with frozen dinners/entrees, meat, poultry, and seafood being the biggest online sellers. During the pandemic, online sales of food and beverages rose significantly due to the shutdown of brick-and-mortar stores and the social restrictions imposed by governments.

Heavy discounts, wide availability of brands under one roof, and home delivery options are the key factors driving consumers' focus toward online shopping. The rising penetration of e-commerce across different geographies prompted manufacturers of frozen entree such as Kellogg's Company, Conagra Brands, and Nestle SA to expand their online presence by selling their products through well-known e-commerce platforms such as Amazon, Lidl, and Walmart. This factor contributes to the growth of the North America frozen entree market by eliminating the dependency on offline retail stores.

North America Frozen Entree Market Overview

The Frozen Entree Market is segmented into the US, Canada, and Mexico. Frozen food products are among the widely consumed food in North America because of the rising preference for quick and easy meal solutions. Frozen entree is a preferred quick food solution among working individuals and dual-income households as it offers convenience and saves preparation time. Moreover, consumers are increasingly adopting a healthy lifestyle and demanding gluten-free, low-carb, whole-grain, and organic diet products. The growth of the North America Frozen Entree Market across North America is also backed by the factors such as increasing preferences for plant-based foods owing to rising environmental concerns. Continuous product innovation, including new flavors, healthier options, and international cuisines, attracts consumers and drives market growth. In September 2022, Impossible Foods Inc launched frozen plant-based entrees in eight different bowls. These eight frozen entree bowls are available at ~4,000 Walmart outlets worldwide. Hence, such product innovations with different flavors and tastes by manufacturers are anticipated to boost the demand for frozen entrees in North America.

North America Frozen Entree Market Revenue and Forecast to 2030 (US$ Million)

North America Frozen Entree Market Segmentation

The North America frozen entree market is segmented into type, category, distribution channel, and country.

Based on type, the North America frozen entree market is bifurcated into meat-based entrees, plant-based entree. The plant-based entrees segment is further categorized into sweet potato entrees, plant-based meat entrees, vegetable entrees, and other plant-based entrees. The meat-based entrees segment held a largest share of the North America frozen entree market in 2022.

Based on category, the North America frozen entree market is segmented into organic and conventional. The conventional segment held the largest share of the North America frozen entree market in 2022.

Based on distribution channel, the North America frozen entree market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hypermarkets segment held the largest share of the North America frozen entree market in 2022.

Based on country, the North America frozen entree market is segmented int o the US, Canada, and Mexico. The US dominated the North America frozen entree market in 2022.

Impossible Foods Inc, Kellogg Co, Daiya Foods Inc, Conagra Brands Inc, Nestle SA, Del Monte Foods Inc, Waffle Waffle LLC Inc, B & G Food Inc, Mars Inc, and Amy's Kitchen Inc are some of the leading companies operating in the North America frozen entree market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America Frozen Entree Market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in North America Frozen Entree Market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America Market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Market Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Frozen Entree Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers:

- 4.3.2 Manufacturers:

- 4.3.3 Distributors or Suppliers:

- 4.3.4 Retailers

5. North America Frozen Entree Market - Key Industry Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Consumption of Convenience Foods

- 5.1.2 Flourishing E-Commerce Industry

- 5.2 Market Restraints

- 5.2.1 Lack of Cold Chain Infrastructure in Developing Countries

- 5.3 Market Opportunities

- 5.3.1 Strategic Initiatives by Manufacturers

- 5.4 Future Trends

- 5.4.1 Burgeoning Popularity of Plant-Based Frozen Meals

- 5.5 Impact of Drivers and Restraints:

6. Frozen Entree Market - North America Market Analysis

- 6.1 North America Frozen Entree Market Revenue (US$ Million), 2020 - 2030

- 6.2 North America Frozen Entree Market Forecast and Analysis

- 6.3 Competitive Positioning - Key Market Players

7. North America Frozen Entree Market Analysis - Type

- 7.1 Meat Based Entrees

- 7.1.1 Overview

- 7.1.2 Meat Based Entrees Market Revenue and Forecast to 2030 (US$ Million)

- 7.2 Plant-Based Entrees

- 7.2.1 Overview

- 7.2.2 Plant-Based Entrees Market Revenue and Forecast to 2030 (US$ Million)

- 7.2.3 Plant-Based Meat Entrees

- 7.2.3.1 Overview

- 7.2.3.2 Plant-Based Meat Entrees: North America Frozen Entree Market - Revenue and Forecast to 2028 (US$ Million)

- 7.2.4 Sweet Potato Entrees

- 7.2.4.1 Overview

- 7.2.4.2 Sweet Potato Entrees: North America Frozen Entree Market - Revenue and Forecast to 2028 (US$ Million)

- 7.2.5 Vegetable Entrees

- 7.2.5.1 Overview

- 7.2.5.2 Vegetable Entrees: North America Frozen Entree Market - Revenue and Forecast to 2028 (US$ Million)

- 7.2.6 Other Plant-Based Entrees

- 7.2.6.1 Overview

- 7.2.6.2 Other Plant-Based Entrees: North America Frozen Entree Market - Revenue and Forecast to 2028 (US$ Million)

8. North America Frozen Entree Market Analysis - Category

- 8.1 Organic

- 8.1.1 Overview

- 8.1.2 Organic Market Revenue and Forecast to 2030 (US$ Million)

- 8.2 Conventional

- 8.2.1 Overview

- 8.2.2 Conventional Market Revenue and Forecast to 2030 (US$ Million)

9. North America Frozen Entree Market Analysis - Distribution Channel

- 9.1 Supermarkets and Hypermarkets

- 9.1.1 Overview

- 9.1.2 Supermarkets and Hypermarkets Market Revenue, and Forecast to 2030 (US$ Million)

- 9.2 Convenience Stores

- 9.2.1 Overview

- 9.2.2 Convenience Stores Market Revenue, and Forecast to 2030 (US$ Million)

- 9.3 Online Retail

- 9.3.1 Overview

- 9.3.2 Online Retail Market Revenue, and Forecast to 2030 (US$ Million)

- 9.4 Others

- 9.4.1 Overview

- 9.4.2 Others Market Revenue, and Forecast to 2030 (US$ Million)

10. North America Frozen Entree Market - Country Analysis

- 10.1 Overview

- 10.1.1.1 North America Frozen Entree Market Breakdown by Country

- 10.1.1.2 US North America Frozen Entree Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.1.2.1 US North America Frozen Entree Market Breakdown by Type

- 10.1.1.2.2 US North America Frozen Entree Market Breakdown by Category

- 10.1.1.2.3 US North America Frozen Entree Market Breakdown by Distribution Channel

- 10.1.1.3 Canada North America Frozen Entree Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.1.3.1 Canada North America Frozen Entree Market Breakdown by Type

- 10.1.1.3.2 Canada North America Frozen Entree Market Breakdown by Category

- 10.1.1.3.3 Canada North America Frozen Entree Market Breakdown by Distribution Channel

- 10.1.1.4 Mexico North America Frozen Entree Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.1.4.1 Mexico North America Frozen Entree Market Breakdown by Type

- 10.1.1.4.2 Mexico North America Frozen Entree Market Breakdown by Category

- 10.1.1.4.3 Mexico North America Frozen Entree Market Breakdown by Distribution Channel

11. Industry Landscape

- 11.1 Overview

- 11.2 New Product Development

- 11.3 Partnerships

- 11.4 Other Business Strategies

12. Competitive Landscape

- 12.1 Heat Map Analysis By Key Players

- 12.2 Company Positioning & Concentration

13. Company Profiles

- 13.1 Impossible Foods Inc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Kellogg Co

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Conagra Brands Inc

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Daiya Foods Inc

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Nestle SA

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Del Monte Foods Inc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 B&G Foods Inc

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Waffle Waffle LLC

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Mars Inc

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Amy's Kitchen Inc

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments