|

|

市場調査レポート

商品コード

1402756

アジア太平洋地域の認証・ブランド保護市場の2030年までの予測-地域別分析:コンポーネント別、技術別、用途別Asia Pacific Authentication and Brand Protection Market Forecast to 2030 - Regional Analysis - by Component, Technology, and Application |

||||||

|

|||||||

| アジア太平洋地域の認証・ブランド保護市場の2030年までの予測-地域別分析:コンポーネント別、技術別、用途別 |

|

出版日: 2023年11月02日

発行: The Insight Partners

ページ情報: 英文 123 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋地域の認証・ブランド保護市場は、2022年に9億2,407万米ドルと評価され、2030年には21億2,797万米ドルに達すると予測され、2022年から2030年までのCAGRは11.0%で成長すると予測されています。

真正品への需要の高まりがアジア太平洋地域の認証・ブランド保護市場に拍車をかける

模倣品市場は世界的に急成長しており、食品・飲料、化学、コンシューマーエレクトロニクス、自動車部品、医療機器、医薬品などの業界に及んでいます。近年、医療機器のエンドユーザーは、模倣品の使用により大きな損失を被っています。ヒンドゥー新聞に掲載された記事によると、規格外品や偽造品(SF)の医療製品のインシデントは、COVID-19パンデミックの間、2020年から2021年にかけて47%増加しました。しかし、現在の市場シナリオでは、エンドユーザーは正規品の利点をより認識するようになっています。そのため、医療機器は徐々に正規品へと移行しています。さらに、医療機器メーカーは、顧客に純正品を確実に届けるため、製品認証ソリューションの調達に積極的に投資しています。このような要因が、認証・ブランド保護ソリューションの需要を高めています。製薬メーカーは、ますます多くの偽薬が市場に出回り、大きな課題に直面しています。したがって、製薬業界にとって、真正な医薬品の供給は不可欠となっています。その結果、この業界では製品認証ソリューションのニーズが急増しています。

インド政府は、偽造医薬品や規格外医薬品をチェックするために、偽造医薬品を検出するのに役立つ追跡・追跡メカニズムとして、製品パッケージにQRコードを付けることを義務付けています。こうした政府の取り組みが、認証・ブランド保護市場を牽引しています。

医療機器や製薬業界と同様に、食品・飲料業界も模倣品や規格外食品・飲料の増加を懸念しています。包装食品に対する需要の急増に伴い、複数の企業が包装食品の供給を開始し、その結果、より多くの偽物や未認証の包装食品製品が陳列されるようになっています。このため、いくつかの国の食品医薬品局(FDA)当局は、包装食品の製造認証に関して厳しい法律を課すようになった。その後、食品メーカーは、自社のブランド・イメージを保護するために、製品認証ラベルを採用し始めました。アルコール、ソフトドリンク、その他の飲料メーカーも認証ラベルを選ぶようになっています。清涼飲料やアルコールの需要は絶えず高まっており、これらの製品は簡単に複製できます。

本物の製品を提供し、ブランドイメージを保護するために規制当局が設定した基準や規制を遵守するため、さまざまな業界のメーカーが表向きまたは裏向きのラベルを調達するケースが増えており、これが認証・ブランド保護市場を後押ししています。

アジア太平洋地域の認証・ブランド保護市場の概要

アジア太平洋諸国の製造業は、様々な商品に対する需要の急増により常に拡大しています。さらに、この地域は多様な製造業を擁する世界の製造拠点となっています。中国、インド、韓国、日本、オーストラリア、その他アジア太平洋地域は、認証・ブランド保護市場における主要国です。コンシューマーエレクトロニクス、医療、食品・飲料産業は、この地域で認証・ブランド保護ソリューションを採用する主要産業の一つです。中国には巨大な産業部門があり、中国製製品に対する需要はここ数十年で増加しています。その一方で、同国では模倣品の生産と販売が増加しており、製品のオリジナル性を主張しブランドイメージを保護するために、OEMの間で認証・ブランド保護ソリューションの需要が高まっています。

アジア太平洋地域の認証・ブランド保護市場の収益と2030年までの予測(金額)

アジア太平洋地域の認証・ブランド保護市場のセグメンテーション

アジア太平洋地域の認証・ブランド保護市場は、コンポーネント、技術、用途、国によって区分されます。コンポーネントに基づき、アジア太平洋地域の認証・ブランド保護市場は、公開、非公開、フォレンジック、デジタルに区分されます。2022年には、公開セグメントが最大の市場シェアを占めています。

技術別では、アジア太平洋地域の認証・ブランド保護市場は、セキュリティ印刷・改ざん防止ラベル、セキュリティインク・コーティング、OVDS・ホログラム、ユニークコード、バーコード、RFID、認証IC、その他に区分されます。2022年には、バーコードセグメントが最大の市場シェアを占めました。

用途別では、アジア太平洋地域の認証・ブランド保護市場は、コンシューマーエレクトロニクス、自動車、医療、化学、食品・飲料、タバコ、その他に区分されます。2022年には、食品・飲料セグメントが最大の市場シェアを占めました。

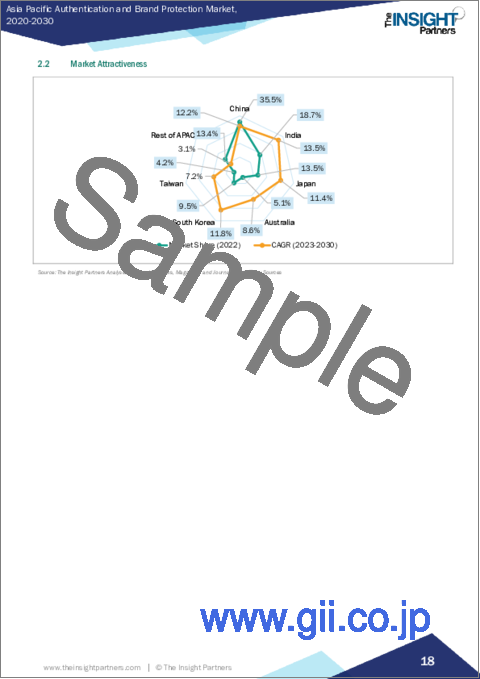

国別では、アジア太平洋地域の認証・ブランド保護市場は、中国、インド、日本、オーストラリア、韓国、台湾、その他アジア太平洋地域に区分されます。2022年のアジア太平洋認証・ブランド保護市場シェアは中国が独占しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 アジア太平洋地域の認証・ブランド保護市場情勢

- エコシステム分析

- 定性的分析

第5章 アジア太平洋地域の認証・ブランド保護市場:主要産業力学

- 促進要因

- 純正品への需要の高まり

- コンシューマーエレクトロニクス製品や自動車部品の模造品に対する懸念の高まり

- 各国政府による厳格な模倣品・海賊版対策規制の施行

- 抑制要因

- 認証ラベルの偽造

- 初期投資が高い

- 機会

- 統合ソリューションの開発

- 新興経済諸国における需要の高まり

- 今後の動向

- 認証・ブランド保護技術の技術的進歩

- 促進要因と抑制要因の影響

第6章 認証・ブランド保護市場:アジア太平洋地域市場分析

- 認証・ブランド保護市場の収益、2022年~2030年

第7章 アジア太平洋地域の認証・ブランド保護市場:コンポーネント別

- 認証・ブランド保護市場:コンポーネント別(2022年、2030年)

- 公開

- 非公開

- フォレンジック

- デジタル

第8章 アジア太平洋地域の認証・ブランド保護市場分析:技術別

- 認証・ブランド保護市場:技術別(2022年および2030年)

- セキュリティ印刷・改ざん防止ラベル

- セキュリティインク・コーティング

- OVDS・ホログラム

- ユニークコード

- バーコード

- RFID

- 認証IC

- その他

第9章 アジア太平洋地域の認証・ブランド保護市場分析:用途別

- 認証・ブランド保護市場:用途別(2022年、2030年)

- コンシューマーエレクトロニクス

- 自動車

- 医療

- 化学

- 食品・飲料

- タバコ

- その他

第10章 アジア太平洋地域の認証・ブランド保護市場:国別分析

第11章 競合情勢

- 主要企業別ヒートマップ分析

- 企業のポジショニングと集中度

第12章 認証・ブランド保護市場の業界情勢

- 市場イニシアティブ

- 合併と買収

- 新規開発

第13章 企業プロファイル

- AlpVision SA

- Applied DNA Sciences, Inc.

- Eastman Kodak Co

- De La Rue Plc

- Avery Dennison Corp

- Giesecke Devrient GmbH

- 3M Co

- Authentix

第14章 付録

List Of Tables

- Table 1. Asia Pacific Authentication and Brand Protection Market Segmentation

- Table 2. Asia Pacific Authentication and Brand Protection Market, by Country - Revenue and Forecast to 2030 (USD Million)

- Table 3. Australia Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Component

- Table 4. Australia Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Technology

- Table 5. Australia Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Application

- Table 6. China Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Component

- Table 7. China Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Technology

- Table 8. China Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Application

- Table 9. India Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Component

- Table 10. India Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Technology

- Table 11. India Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Application

- Table 12. Japan Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Component

- Table 13. Japan Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Technology

- Table 14. Japan Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Application

- Table 15. South Korea Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Component

- Table 16. South Korea Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Technology

- Table 17. South Korea Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Application

- Table 18. Taiwan Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Component

- Table 19. Taiwan Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Technology

- Table 20. Taiwan Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Application

- Table 21. Rest of Asia Pacific Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Component

- Table 22. Rest of Asia Pacific Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Technology

- Table 23. Rest of Asia Pacific Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million) - Application

- Table 24. Company Positioning & Concentration

- Table 25. List of Abbreviation

List Of Figures

- Figure 1. Asia Pacific Authentication and Brand Protection Market Segmentation, By Country

- Figure 2. Ecosystem: Asia Pacific Authentication and Brand Protection Market

- Figure 3. Asia Pacific Authentication and Brand Protection Market - Key Industry Dynamics

- Figure 4. Impact Analysis of Drivers And Restraints

- Figure 5. Asia Pacific Authentication and Brand Protection Market Revenue (US$ Million), 2022 - 2030

- Figure 6. Asia Pacific Authentication and Brand Protection Market Share (%) - Component, 2022 and 2030

- Figure 7. Overt Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 8. Covert Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 9. Forensics Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 10. Digital Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 11. Asia Pacific Authentication and Brand Protection Market Share (%) - Technology, 2022 and 2030

- Figure 12. Security Printing & Tamper Proof Labels Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 13. Security Inks & Coatings Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 14. OVDS and Holograms Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 15. Unique Codes Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 16. Bar Codes Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 17. RFID Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 18. Authentication ICs Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 19. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 20. Asia Pacific Authentication and Brand Protection Market Share (%) - Application, 2022 and 2030

- Figure 21. Consumer Electronics Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 22. Automotive Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 23. Medical Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 24. Chemical Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 25. Food & Beverage Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 26. Tobacco Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 27. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 28. Asia Pacific Authentication and Brand Protection Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 29. Asia Pacific Authentication and Brand Protection Market Breakdown By Key Countries, 2022 And 2030 (%)

- Figure 30. Australia Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million)

- Figure 31. China Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million)

- Figure 32. India Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million)

- Figure 33. Japan Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million)

- Figure 34. South Korea Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million)

- Figure 35. Taiwan Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million)

- Figure 36. Rest of Asia Pacific Authentication and Brand Protection Market Revenue And Forecasts To 2030 (US$ Million)

- Figure 37. Heat Map Analysis By Key Players

The Asia Pacific authentication and brand protection market was valued at US$ 924.07 million in 2022 and is expected to reach US$ 2,127.97 million by 2030; it is estimated to grow at a CAGR of 11.0% from 2022 to 2030.

Accentuating Demand for Genuine Products fuel the Asia Pacific Authentication and Brand Protection Market

The market of counterfeit products is growing rapidly worldwide, encompassing industries such as food & beverages, chemicals, consumer electronics, automotive components, medical devices, and pharmaceuticals. In recent years, medical device end users have incurred significant losses due to the use of duplicate products. According to an article published in the Hindu newspaper, incidents of substandard and falsified (SF) medical products rose by ~47% from 2020 to 2021 during the COVID-19 pandemic. However, the end users in the current market scenario are becoming more aware of the advantages of genuine products. Hence, they are progressively veering toward authentic medical devices. Moreover, medical device manufacturers are progressively investing in the procurement of product authentication solutions to ensure their customers receive original products, which allows them to retain their customers over the long term. This factor is bolstering the demand for authentication and brand protection solutions. Pharmaceutical manufacturers are facing significant challenges with an increasingly large number of fake medicines crowding the market. Hence, supplying authenticated drugs has become essential for pharmaceutical industries. As a result, the need for product authentication solutions has surged in this industry.

The Indian government has mandated a QR code on product packages as a track and trace mechanism that helps detect fake drugs to keep a check on counterfeit and substandard medicines. Such government initiatives drive the authentication and brand protection market.

Similar to the medical device and pharmaceutical industry, the food & beverage industry is concerned about the rise in the availability of duplicate or substandard food and beverages. With the skyrocketing demand for packaged foods, several companies have begun supplying packaged foods, which is leading to more fake and unauthenticated packaged foods products on display. This has led the Food and Drug Administration (FDA) authorities in several countries to impose stringent laws regarding the authentication of the production of packaged foods. Subsequently, food manufacturers have started adopting product authentication labels to protect their brand image. The manufacturers of alcohol, soft drinks, and other beverages are also opting for authentication labels. The demand for soft drinks and alcohol is constantly rising and these products can easily be duplicated.

To adhere to the standards and regulations set by regulatory authorities for offering genuine products and protecting their brand images, manufacturers from different industries are increasingly procuring overt or covert labels, which is boosting the authentication and brand protection market.

Asia Pacific Authentication and Brand Protection Market Overview

The manufacturing sector in Asia Pacific countries is constantly expanding because of an upsurge in the demand for various commodities. Additionally, the region has become a global manufacturing hub with its diverse manufacturing industries. China, India, South Korea, Japan, Australia, and the Rest of Asia Pacific are the key countries in the authentication and brand protection market. Consumer electronics, medical, and food & beverages industries are among the major adopters of authentication and brand protection solutions in the region. China has a massive industrial sector, and the demand for products made in China has increased in the last few decades. On the other hand, the country has been witnessing a rise in the production and sales of counterfeit products, which has propelled the demand for authentication and brand protection solutions among OEMs to claim the originality of the products and protect the brand image.

Asia Pacific Authentication and Brand Protection Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Authentication and Brand Protection Market Segmentation

The Asia Pacific authentication and brand protection market is segmented based on component, technology, application, and country. Based on component, the Asia Pacific authentication and brand protection market is segmented into overt, covert, forensic, and digital. The overt segment held the largest market share in 2022.

Based on technology, the Asia Pacific authentication and brand protection market is segmented into security printing & tamper proof labels, security inks & coatings, OVDS and holograms, unique codes, bar codes, RFID, authentication ICS, and others. The bar codes segment held the largest market share in 2022.

Based on application, the Asia Pacific authentication and brand protection market is segmented into consumer electronics, automotive, medical, chemical, food & beverage, tobacco, and others. The food & beverage segment held the largest market share in 2022.

Based on country, the Asia Pacific authentication and brand protection market is segmented into China, India, Japan, Australia, South Korea, Taiwan, and the Rest of Asia Pacific. China dominated the Asia Pacific authentication and brand protection market share in 2022.

3M Co, Alpvision SA, Applied DNA Sciences, Authentix, Avery Dennison Corporation, De La Rue Plc, Eastman Kodak Co, and Giesecke Devrient GmbH are some of the leading players operating in the Asia Pacific authentication and brand protection market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific authentication and brand protection market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific authentication and brand protection market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Asia Pacific market trends and outlook coupled with the factors driving the Asia Pacific authentication and brand protection market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Authentication and Brand Protection Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.3.1 Qualitative Analysis: Radio-Frequency Identification (RFID) Tags Market

- 4.3 Qualitative Analysis: Recent Trends in Customer Experience in UX/UI

5. Asia Pacific Authentication and Brand Protection Market - Key Industry Dynamics

- 5.1 Drivers

- 5.1.1 Accentuating Demand for Genuine Products

- 5.1.2 Growing Concerns over Duplicate Consumer Electronics Products and Automotive Components

- 5.1.3 Focus of Governments on Implementation of Stringent Anti-Counterfeiting Regulations

- 5.2 Restraints

- 5.2.1 Counterfeiting of Authentication Labelling

- 5.2.2 High Initial Capital Investment

- 5.3 Opportunity

- 5.3.1 Development of Integrated Solutions

- 5.3.2 Rising Demand in Developing Economies

- 5.4 Future Trend

- 5.4.1 Technological Advancement in the Authentication and Brand Protection Technology

- 5.5 Impact of Drivers and Restraints:

6. Authentication and Brand Protection Market - Asia Pacific Market Analysis

- 6.1 Authentication and Brand Protection Market Revenue (US$ Million), 2022 - 2030

7. Asia Pacific Authentication and Brand Protection Market Analysis - Component

- 7.1 Overview

- 7.2 Authentication and Brand Protection Market, by Component (2022 and 2030)

- 7.3 Overt

- 7.3.1 Overview

- 7.3.2 Overt Market Revenue and Forecast to 2030 (US$ Million)

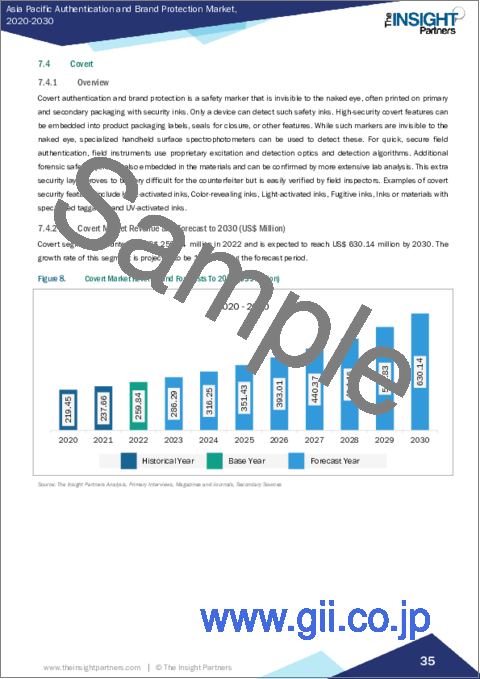

- 7.4 Covert

- 7.4.1 Overview

- 7.4.2 Covert Market Revenue and Forecast to 2030 (US$ Million)

- 7.5 Forensics

- 7.5.1 Overview

- 7.5.2 Forensics Market Revenue and Forecast to 2030 (US$ Million)

- 7.6 Digital

- 7.6.1 Overview

- 7.6.2 Digital Market Revenue and Forecast to 2030 (US$ Million)

8. Asia Pacific Authentication and Brand Protection Market Analysis - Technology

- 8.1 Overview

- 8.2 Authentication and Brand Protection Market, by Technology (2022 and 2030)

- 8.3 Security Printing & Tamper Proof Labels

- 8.3.1 Overview

- 8.3.2 Security Printing & Tamper Proof Labels Market Revenue and Forecast to 2030 (US$ Million)

- 8.4 Security Inks & Coatings

- 8.4.1 Overview

- 8.4.2 Security Inks and Coatings Market Revenue and Forecast to 2030 (US$ Million)

- 8.5 OVDS and Holograms

- 8.5.1 Overview

- 8.5.2 OVDS and Holograms Market Revenue and Forecast to 2030 (US$ Million)

- 8.6 Unique Codes

- 8.6.1 Overview

- 8.6.2 Unique Codes Market Revenue and Forecast to 2030 (US$ Million)

- 8.7 Bar Codes

- 8.7.1 Overview

- 8.7.2 Bar Codes Market Revenue and Forecast to 2030 (US$ Million)

- 8.8 RFID

- 8.8.1 Overview

- 8.8.2 RFID Market Revenue and Forecast to 2030 (US$ Million)

- 8.9 Authentication ICs

- 8.9.1 Overview

- 8.9.2 Authentication ICs Market Revenue and Forecast to 2030 (US$ Million)

- 8.10 Others

- 8.10.1 Overview

- 8.10.2 Others Market Revenue and Forecast to 2030 (US$ Million)

9. Asia Pacific Authentication and Brand Protection Market Analysis - Application

- 9.1 Overview

- 9.2 Authentication and Brand Protection Market, by Application (2022 and 2030)

- 9.3 Consumer Electronics

- 9.3.1 Overview

- 9.3.2 Consumer Electronics Market Revenue and Forecast to 2030 (US$ Million)

- 9.4 Automotive

- 9.4.1 Overview

- 9.4.2 Automotive Market Revenue and Forecast to 2030 (US$ Million)

- 9.5 Medical

- 9.5.1 Overview

- 9.5.2 Medical Market Revenue and Forecast to 2030 (US$ Million)

- 9.6 Chemical

- 9.6.1 Overview

- 9.6.2 Chemical Market Revenue and Forecast to 2030 (US$ Million)

- 9.7 Food & Beverage

- 9.7.1 Overview

- 9.7.2 Food & Beverage Market Revenue and Forecast to 2030 (US$ Million)

- 9.8 Tobacco

- 9.8.1 Overview

- 9.8.2 Tobacco Market Revenue and Forecast to 2030 (US$ Million)

- 9.9 Others

- 9.9.1 Overview

- 9.9.2 Others Market Revenue and Forecast to 2030 (US$ Million)

10. Asia Pacific Authentication and Brand Protection Market - Country Analysis

- 10.1 Asia Pacific Authentication and Brand Protection Market

- 10.1.1 Asia Pacific Authentication and Brand Protection Market Overview

- 10.1.2 Authentication and Brand Protection market Breakdown by Countries

- 10.1.2.1 Australia Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Million)

- 10.1.2.1.1 Australia Authentication and Brand Protection Market Breakdown by Component

- 10.1.2.1.2 Australia Authentication and Brand Protection Market Breakdown by Technology

- 10.1.2.1.3 Australia Authentication and Brand Protection Market Breakdown by Application

- 10.1.2.2 China Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Million)

- 10.1.2.2.1 China Authentication and Brand Protection Market Breakdown by Component

- 10.1.2.2.2 China Authentication and Brand Protection Market Breakdown by Technology

- 10.1.2.2.3 China Authentication and Brand Protection Market Breakdown by Application

- 10.1.2.3 India Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Million)

- 10.1.2.3.1 India Authentication and Brand Protection Market Breakdown by Component

- 10.1.2.3.2 India Authentication and Brand Protection Market Breakdown by Technology

- 10.1.2.3.3 India Authentication and Brand Protection Market Breakdown by Application

- 10.1.2.4 Japan Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Million)

- 10.1.2.4.1 Japan Authentication and Brand Protection Market Breakdown by Component

- 10.1.2.4.2 Japan Authentication and Brand Protection Market Breakdown by Technology

- 10.1.2.4.3 Japan Authentication and Brand Protection Market Breakdown by Application

- 10.1.2.5 South Korea Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Million)

- 10.1.2.5.1 South Korea Authentication and Brand Protection Market Breakdown by Component

- 10.1.2.5.2 South Korea Authentication and Brand Protection Market Breakdown by Technology

- 10.1.2.5.3 South Korea Authentication and Brand Protection Market Breakdown by Application

- 10.1.2.6 Taiwan Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Million)

- 10.1.2.6.1 Taiwan Authentication and Brand Protection Market Breakdown by Component

- 10.1.2.6.2 Taiwan Authentication and Brand Protection Market Breakdown by Technology

- 10.1.2.6.3 Taiwan Authentication and Brand Protection Market Breakdown by Application

- 10.1.2.7 Rest of Asia Pacific Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Million)

- 10.1.2.7.1 Rest of Asia Pacific Authentication and Brand Protection Market Breakdown by Component

- 10.1.2.7.2 Rest of Asia Pacific Authentication and Brand Protection Market Breakdown by Technology

- 10.1.2.7.3 Rest of Asia Pacific Authentication and Brand Protection Market Breakdown by Application

- 10.1.2.1 Australia Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Million)

11. Competitive Landscape

- 11.1 Heat Map Analysis By Key Players

- 11.2 Company Positioning & Concentration

12. Authentication and Brand Protection Market Industry Landscape

- 12.1 Market Initiative

- 12.2 Merger and Acquisition

- 12.3 New Development

13. Company Profiles

- 13.1 AlpVision SA

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.3 Applied DNA Sciences, Inc.

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Eastman Kodak Co

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 De La Rue Plc

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Avery Dennison Corp

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Giesecke Devrient GmbH

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 3M Co

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Authentix

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Word Index