|

|

市場調査レポート

商品コード

1402758

北米の認証・ブランド保護市場の2030年までの予測-地域別分析:コンポーネント別、技術別、用途別North America Authentication and Brand Protection Market Forecast to 2030 - Regional Analysis - by Component, Technology, and Application |

||||||

|

|||||||

| 北米の認証・ブランド保護市場の2030年までの予測-地域別分析:コンポーネント別、技術別、用途別 |

|

出版日: 2023年11月04日

発行: The Insight Partners

ページ情報: 英文 114 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の認証・ブランド保護市場は、2022年に10億6,590万米ドルと評価され、2030年には20億1,076万米ドルに達すると予測され、2022年から2030年までのCAGRは8.3%で成長すると予測されています。

コンシューマーエレクトロニクス製品および自動車部品の模造品に対する懸念の高まりが北米の認証・ブランド保護市場に拍車をかける

先進国および発展途上国のコンシューマーエレクトロニクスおよび自動車産業は、長年にわたってかつてない成長を遂げており、これらの製品に対する需要は毎年伸び続けています。これに伴い、コンシューマーエレクトロニクスや自動車に使用される部品の需要も伸びており、模倣品の供給が増加しています。スマートフォン、タブレット、ノートパソコンは最も人気のあるコンシューマーエレクトロニクス製品の一つです。自動車や電子機器の需要が高いため、電子部品や自動車部品のグレーマーケットが活況を呈しています。消費者向け電子機器やその他の機器のグレーマーケットは、課税の高い国々で活況を呈しています。販売業者はこれらの製品を低税率の国々から直接輸入し、低価格で販売することで、合法的な国内外のOEMとの競争を促進しています。消費者向け電子機器や自動車部品のこのような新興グレーマーケットが、純正品への需要を煽っています。自動車部品産業は広大で、世界中でかなりの数の企業が活動しています。新ブランドの自動車需要が急増しているため、製造工場では自動車部品のニーズが高まっており、それが偽造部品市場に拍車をかけています。偽造品の横行は、過去に何度も自動車の故障や事故と関連し、自動車メーカーのイメージを悪化させてきました。そのため、OEM、アフターマーケット業者、卸売業者、ディーラーは、このような災難を減らすために、正規の自動車部品を求めています。このように、エンドユーザーは現在、複製品の欠点を認識するようになっており、その結果、真正品に対する需要が急増しています。このように、真正製品への需要の高まりは、OEMに製品認証ソリューションの採用を迫り、認証・ブランド保護市場を押し上げています。多くのOEMが認証ラベルを大量に調達しています。

北米の認証・ブランド保護市場概要

北米の主要国である米国、カナダ、メキシコには、多くのメーカーや製品開発者が存在します。この地域では、多くの偽造品が出回っているため、製造業者による認証・ブランド保護製品への需要が大幅に高まっています。さらに、米国の様々な製品メーカーは、製品に関する機密情報の機密性を維持し、ブランドの評価を保護するために多額の費用を費やしています。その上、米国製製品は、世界中のさまざまな国にわたって大きな可視性を持っています。これらすべての要因から、ブランドと企業イメージを保護するために認証製品が必要となります。

米国の製造業者は、製品を偽造から守るために使用できるバーコードやソフトウェアに簡単にアクセスできます。この地域の産業は急成長しているため、この傾向は今後も続くと予想されます。

他方、カナダとメキシコでは製造業が緩やかに成長しており、製造施設からの高度なソリューションや製品に対する需要は米国に比べて低いです。したがって、これらの国々は、認証・ブランド保護ソリューション市場の拡大に顕著な余地をもたらしています。

北米の認証・ブランド保護市場の収益と2030年までの予測(金額)

北米の認証・ブランド保護市場セグメンテーション

北米の認証およびブランド保護市場は、コンポーネント、技術、用途、国によって区分されます。コンポーネントに基づき、北米の認証およびブランド保護市場は、公開、非公開、フォレンジック、デジタルに区分されます。2022年には、公開セグメントが最大の市場シェアを占めています。

技術別では、北米の認証・ブランド保護市場は、セキュリティ印刷・改ざん防止ラベル、セキュリティインク・コーティング、OVDS・ホログラム、ユニークコード、バーコード、RFID、認証IC、その他に区分されます。2022年には、バーコードセグメントが最大の市場シェアを占めました。

用途別では、北米の認証・ブランド保護市場は、コンシューマーエレクトロニクス、自動車、医療、化学、食品・飲料、タバコ、その他に区分されます。2022年には、食品・飲料セグメントが最大の市場シェアを占めました。

国別では、北米の認証・ブランド保護市場は米国、カナダ、メキシコに区分されます。2022年の北米の認証・ブランド保護市場シェアは米国が独占しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の認証・ブランド保護市場情勢

- エコシステム分析

- 定性的分析

第5章 北米の認証・ブランド保護市場:主要産業力学

- 促進要因

- 純正品への需要の高まり

- コンシューマーエレクトロニクス製品や自動車部品の模造品に対する懸念の高まり

- 各国政府による厳格な模倣品・海賊版対策規制の施行

- 抑制要因

- 認証ラベルの偽造

- 初期投資が高い

- 機会

- 統合ソリューションの開発

- 新興経済諸国における需要の高まり

- 今後の動向

- 認証・ブランド保護技術の技術的進歩

- 促進要因と抑制要因の影響

第6章 認証・ブランド保護市場:北米市場分析

- 認証・ブランド保護市場の収益、2022年~2030年

第7章 北米の認証・ブランド保護市場分析:コンポーネント別

- 認証・ブランド保護市場:コンポーネント別(2022年、2030年)

- 公開

- 非公開

- フォレンジック

- デジタル

第8章 北米の認証・ブランド保護市場分析:技術別

- 認証・ブランド保護市場:技術別(2022年、2030年)

- セキュリティ印刷・改ざん防止ラベル

- セキュリティインク・コーティング

- OVDS・ホログラム

- ユニークコード

- バーコード

- RFID

- 認証IC

- その他

第9章 北米の認証・ブランド保護市場分析:用途別

- 認証・ブランド保護市場:用途別(2022年、2030年)

- コンシューマーエレクトロニクス

- 自動車

- 医療

- 化学

- 食品・飲料

- タバコ

- その他

第10章 北米の認証・ブランド保護市場:国別分析

第11章 競合情勢

- 主要企業別ヒートマップ分析

- 企業のポジショニングと集中度

第12章 認証・ブランド保護市場の業界情勢

- 市場イニシアティブ

- 合併と買収

- 新規開発

第13章 企業プロファイル

- AlpVision SA

- Authentic Vision

- Applied DNA Sciences, Inc.

- Eastman Kodak Co

- De La Rue Plc

- Avery Dennison Corp

- Giesecke Devrient GmbH

- 3M Co

- Authentix

第14章 付録

List Of Tables

- Table 1. North America Authentication and Brand Protection Market Segmentation

- Table 2. North America Authentication and Brand Protection Market, by Country - Revenue and Forecast to 2030 (USD Million)

- Table 3. US Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Mn) - By Component

- Table 4. US Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Mn) - By Technology

- Table 5. US Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Mn) - By Application

- Table 6. Canada Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Mn) - By Component

- Table 7. Canada Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Mn) - By Technology

- Table 8. Canada Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Mn) - By Application

- Table 9. Mexico Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Mn) - By Component

- Table 10. Mexico Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Mn) - By Technology

- Table 11. Mexico Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Mn) - By Application

- Table 12. Company Positioning & Concentration

- Table 13. List of Abbreviation

List Of Figures

- Figure 1. North America Authentication and Brand Protection Market Segmentation, By Country

- Figure 2. Ecosystem: North America Authentication and Brand Protection Market

- Figure 3. North America Authentication and Brand Protection Market - Key Industry Dynamics

- Figure 4. Impact Analysis of Drivers And Restraints

- Figure 5. North America Authentication and Brand Protection Market Revenue (US$ Million), 2022 - 2030

- Figure 6. North America Authentication and Brand Protection Market Share (%) - Component, 2022 and 2030

- Figure 7. Overt Market Revenue and Forecasts To 2030 (US$ Million)

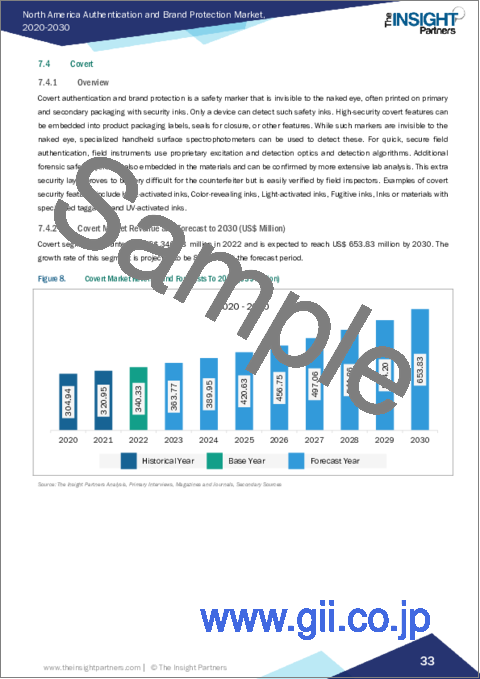

- Figure 8. Covert Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 9. Forensics Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 10. Digital Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 11. Authentication and Brand Protection Market Share (%) - Technology, 2022 and 2030

- Figure 12. Security Printing & Tamper Proof Labels Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 13. Security Inks & Coatings Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 14. OVDS and Holograms Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 15. Unique Codes Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 16. Bar Codes Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 17. RFID Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 18. Authentication ICs Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 19. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 20. North America Authentication and Brand Protection Market Share (%) - Application, 2022 and 2030

- Figure 21. Consumer Electronics Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 22. Automotive Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 23. Medical Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 24. Chemical Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 25. Food & Beverage Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 26. Tobacco Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 27. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 28. Authentication and Brand Protection Market, by Key Countries - Revenue (2022) (US$ Million)

- Figure 29. Authentication and Brand Protection market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 30. US Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 31. Canada Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 32. Mexico Authentication and Brand Protection Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 33. Heat Map Analysis By Key Players

The North America authentication and brand protection market was valued at US$ 1,065.90 million in 2022 and is expected to reach US$ 2,010.76 million by 2030; it is estimated to grow at a CAGR of 8.3% from 2022 to 2030.

Growing Concerns over Duplicate Consumer Electronics Products and Automotive Components fuel the North America Authentication and Brand Protection Market

The Consumer Electronics and Automotive industries in developed and developing countries have witnessed unprecedented growth over the years; the demand for these products continues to grow annually. With this, the demand for components used in consumer electronics and automotive is also growing, prompting a rise in the supply of counterfeit products. Smartphones, tablets, and laptops are among the most popular consumer electronics. The grey market for electronic and automotive components is witnessing a boom because of the high demand for vehicles and electronics. The grey market for consumer electronics and other equipment is booming in highly taxed countries; dealers import these products directly from low-taxed countries and sell them at lower prices, promoting competition against legitimate local and international OEMs. Such an emerging grey market for consumer electronics and automotive parts fuels the demand for genuine products. The automotive component industry is vast, with a significant number of players operating worldwide. Owing to soaring demand for new brands of vehicles, the need for auto parts has upsurged in manufacturing plants, which, in turn, has spurred the market of forged parts. The rampant use of counterfeit products has been associated with several vehicle breakdowns and accidents in the past, tarnishing the image of vehicle manufacturers. Therefore, OEMs, aftermarket players, wholesalers, and dealers seek authorized and genuine auto parts to reduce such mishaps. Thus, end users are now becoming aware of the cons of duplicate products, which is resulting in the soaring demand for authenticating products. Thus, the rising demand for authenticated products is compelling OEMs to adopt product authentication solutions, boosting the authentication and brand protection market. Many OEMs are procuring high volumes of authentication labels.

North America Authentication and Brand Protection Market Overview

The US, Canada, and Mexico, major North American countries, have many manufacturers and product developers. The demand for authentication and brand protection products from manufacturers is substantially higher in the region owing to the availability of a large number of counterfeit products. Additionally, various product manufacturers in the US spend substantial amounts on maintaining the confidentiality of sensitive information about their products and safeguarding the valuation of their brands. Besides, US-manufactured products have significant visibility across different countries worldwide. All these factors necessitate authentication products to protect the brand and company image.

Manufacturers in the US have easy access to bar codes and software that can be used to protect their products from forgery. The demand for overt authentication solutions is considerably high among end users, and the same trend is expected to continue over the years owing to rapid growth of industries in the region.

On the other hand, the manufacturing sector is slowly growing in Canada and Mexico, and there is a lower demand for advanced solutions and products from manufacturing facilities, compared to the US. Hence, these countries present a noticeable scope for the expansion of the authentication and brand protection solutions market.

North America Authentication and Brand Protection Market Revenue and Forecast to 2030 (US$ Million)

North America Authentication and Brand Protection Market Segmentation

The North America authentication and brand protection market is segmented based on component, technology, application, and country. Based on component, the North America authentication and brand protection market is segmented into overt, covert, forensic, and digital. The overt segment held the largest market share in 2022.

Based on technology, the North America authentication and brand protection market is segmented into security printing & tamper proof labels, security inks & coatings, OVDS and holograms, unique codes, bar codes, RFID, authentication ICS, and others. The bar codes segment held the largest market share in 2022.

Based on application, the North America authentication and brand protection market is segmented into consumer electronics, automotive, medical, chemical, food & beverage, tobacco, and others. The food & beverage segment held the largest market share in 2022.

Based on country, the North America authentication and brand protection market is segmented into the US, Canada, Mexico. The US dominated the North America authentication and brand protection market share in 2022.

3M Co, Alpvision SA, Applied DNA Sciences, Authentic Vision, Authentix, Avery Dennison Corporation, De La Rue Plc, Eastman Kodak Co, EDGYN SAS, and Giesecke Devrient GmbH are some of the leading players operating in the North America authentication and brand protection market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America authentication and brand protection market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America authentication and brand protection market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America authentication and brand protection market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summarys

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Authentication and Brand Protection Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 Qualitative Analysis: Radio-Frequency Identification (RFID) Tags Market

- 4.3 Qualitative Analysis: Recent Trends in Customer Experience in UX/UI

5. North America Authentication and Brand Protection Market - Key Industry Dynamics

- 5.1 Drivers

- 5.1.1 Accentuating Demand for Genuine Products

- 5.1.2 Growing Concerns over Duplicate Consumer Electronics Products and Automotive Components

- 5.1.3 Focus of Governments on Implementation of Stringent Anti-Counterfeiting Regulations

- 5.2 Restraints

- 5.2.1 Counterfeiting of Authentication Labelling

- 5.2.2 High Initial Capital Investment

- 5.3 Opportunity

- 5.3.1 Development of Integrated Solutions

- 5.3.2 Rising Demand in Developing Economies

- 5.4 Future Trend

- 5.4.1 Technological Advancement in the Authentication and Brand Protection Technology

- 5.5 Impact of Drivers and Restraints:

6. Authentication and Brand Protection Market - North America Market Analysis

- 6.1 Authentication and Brand Protection Market Revenue (US$ Million), 2022 - 2030

7. North America Authentication and Brand Protection Market Analysis - Component

- 7.1 Overview

- 7.2 Authentication and Brand Protection Market, by Component (2022 and 2030)

- 7.3 Overt

- 7.3.1 Overview

- 7.3.2 Overt Market Revenue and Forecast to 2030 (US$ Million)

- 7.4 Covert

- 7.4.1 Overview

- 7.4.2 Covert Market Revenue and Forecast to 2030 (US$ Million)

- 7.5 Forensics

- 7.5.1 Overview

- 7.5.2 Forensics Market Revenue and Forecast to 2030 (US$ Million)

- 7.6 Digital

- 7.6.1 Overview

- 7.6.2 Digital Market Revenue and Forecast to 2030 (US$ Million)

8. North America Authentication and Brand Protection Market Analysis - Technology

- 8.1 Overview

- 8.2 Authentication and Brand Protection Market, by Technology (2022 and 2030)

- 8.3 Security Printing & Tamper Proof Labels

- 8.3.1 Overview

- 8.3.2 Security Printing & Tamper Proof Labels Market Revenue and Forecast to 2030 (US$ Million)

- 8.4 Security Inks & Coatings

- 8.4.1 Overview

- 8.4.2 Security Inks and Coatings Market Revenue and Forecast to 2030 (US$ Million)

- 8.5 OVDS and Holograms

- 8.5.1 Overview

- 8.5.2 OVDS and Holograms Market Revenue and Forecast to 2030 (US$ Million)

- 8.6 Unique Codes

- 8.6.1 Overview

- 8.6.2 Unique Codes Market Revenue and Forecast to 2030 (US$ Million)

- 8.7 Bar Codes

- 8.7.1 Overview

- 8.7.2 Bar Codes Market Revenue and Forecast to 2030 (US$ Million)

- 8.8 RFID

- 8.8.1 Overview

- 8.8.2 RFID Market Revenue and Forecast to 2030 (US$ Million)

- 8.9 Authentication ICs

- 8.9.1 Overview

- 8.9.2 Authentication ICs Market Revenue and Forecast to 2030 (US$ Million)

- 8.10 Others

- 8.10.1 Overview

- 8.10.2 Others Market Revenue and Forecast to 2030 (US$ Million)

9. North America Authentication and Brand Protection Market Analysis - Application

- 9.1 Overview

- 9.2 Authentication and Brand Protection Market, by Application (2022 and 2030)

- 9.3 Consumer Electronics

- 9.3.1 Overview

- 9.3.2 Consumer Electronics Market Revenue and Forecast to 2030 (US$ Million)

- 9.4 Automotive

- 9.4.1 Overview

- 9.4.2 Automotive Market Revenue and Forecast to 2030 (US$ Million)

- 9.5 Medical

- 9.5.1 Overview

- 9.5.2 Medical Market Revenue and Forecast to 2030 (US$ Million)

- 9.6 Chemical

- 9.6.1 Overview

- 9.6.2 Chemical Market Revenue and Forecast to 2030 (US$ Million)

- 9.7 Food & Beverage

- 9.7.1 Overview

- 9.7.2 Food & Beverage Market Revenue and Forecast to 2030 (US$ Million)

- 9.8 Tobacco

- 9.8.1 Overview

- 9.8.2 Tobacco Market Revenue and Forecast to 2030 (US$ Million)

- 9.9 Others

- 9.9.1 Overview

- 9.9.2 Others Market Revenue and Forecast to 2030 (US$ Million)

10. North America Authentication and Brand Protection Market - Country Analysis

- 10.1 North America

- 10.1.1 North America Authentication and Brand Protection Market Overview

- 10.1.2 North America Authentication and Brand Protection Market Revenue and Forecasts and Analysis - By Countries

- 10.1.2.1 North America Authentication and Brand Protection Market Revenue and Forecasts and Analysis - By Country

- 10.1.2.2 US Authentication and Brand Protection Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.2.1 US Authentication and Brand Protection Market Breakdown by Component

- 10.1.2.2.2 US Authentication and Brand Protection Market Breakdown by Technology

- 10.1.2.2.3 US Authentication and Brand Protection Market Breakdown by Application

- 10.1.2.3 Canada Authentication and Brand Protection Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.3.1 Canada Authentication and Brand Protection Market Breakdown by Component

- 10.1.2.3.2 Canada Authentication and Brand Protection Market Breakdown by Technology

- 10.1.2.3.3 Canada Authentication and Brand Protection Market Breakdown by Application

- 10.1.2.4 Mexico Authentication and Brand Protection Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.4.1 Mexico Authentication and Brand Protection Market Breakdown by Component

- 10.1.2.4.2 Mexico Authentication and Brand Protection Market Breakdown by Technology

- 10.1.2.4.3 Mexico Authentication and Brand Protection Market Breakdown by Application

11. Competitive Landscape

- 11.1 Heat Map Analysis By Key Players

- 11.2 Company Positioning & Concentration

12. Authentication and Brand Protection Market Industry Landscape

- 12.1 Market Initiative

- 12.2 Merger and Acquisition

- 12.3 New Development

13. Company Profiles

- 13.1 AlpVision SA

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Authentic Vision

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Applied DNA Sciences, Inc.

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Eastman Kodak Co

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 De La Rue Plc

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Avery Dennison Corp

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Giesecke Devrient GmbH

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 3M Co

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Authentix

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Word Index