|

|

市場調査レポート

商品コード

1733573

ネオバンキングの世界市場:2034年までの市場の機会と戦略Neobanking Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| ネオバンキングの世界市場:2034年までの市場の機会と戦略 |

|

出版日: 2025年05月26日

発行: The Business Research Company

ページ情報: 英文 309 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界のネオバンキングの市場規模は、2019年に303億7,883万米ドルと評価され、2024年までCAGR42.00%以上で成長しました。

インターネット普及率の上昇

インターネット普及率の上昇は、歴史的な期間におけるネオバンキング市場の成長を促進しました。特に新興市場において、より多くの人々がインターネットにアクセスできるようになったことで、ネオバンクは実店舗を構えることなく、より幅広い顧客層にリーチできるようになっています。スマートフォンと手頃な価格のモバイル・データの台頭により、シームレスなデジタル・バンキング体験が可能になり、ユーザーはいつでもどこでも口座開設や送金、金融サービスへのアクセスができるようになっています。例えば、シンガポールを拠点とするオンライン・レファレンス・ライブラリーData Reportalによると、2022年10月、世界中で合計50億7,000万人がインターネットを利用しており、これは世界総人口の63.5%に相当します。インターネット・ユーザーも増え続けており、過去12ヶ月で世界の接続人口は1億7,000万人以上増加したとのデータもあります。さらに、ITU(国際通信連合)によると、世界全体で、インターネットに接続できる世帯の割合は2018年の54.7%から2019年には57%に増加しました。2019年には約45億人がインターネットにアクセスできるようになっています。フェイスブックによるInternet.orgなどの取り組みもインターネット普及率の上昇に貢献しました。したがって、インターネット普及率の上昇がネオバンキング市場の成長を牽引しました。

当レポートは、世界のネオバンキング市場について調査し、市場の概要とともに、口座タイプ別、サービス別、用途別、地域・国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 目次

第3章 テーブル一覧

第4章 図表一覧

第5章 レポートの構成

第6章 市場の特徴

- 一般的な市場定義

- サマリー

- ネオバンキング市場の定義とセグメンテーション

- 市場セグメンテーション、口座別

- 法人口座

- 貯蓄口座

- 市場セグメンテーション、サービス別

- モバイルバンキング

- 支払いと送金

- 当座預金/普通預金口座

- ローン

- その他

- 市場セグメンテーション、用途別

- 企業

- 個人

- その他

第7章 主要な市場動向

- ネオバンクは、デジタルコマース向けオープンネットワーク(ONDC)統合型デジタルローンソリューションで融資に革命を起こす

- 先進的なデジタルバンキングソリューションで、安全なアクセスを実現し、恵まれないコミュニティを支援

- 革新的なネオバンキング製品が金融情勢を再定義

- 戦略的コラボレーションにより、人工知能とオープンバンキングでデジタルバンキングを変革

第8章 世界のネオバンキングの成長分析と戦略分析フレームワーク

- 世界:PESTEL分析

- エンドユーザー分析(B2B)

第9章 世界市場の規模と成長

- 市場規模

- 市場成長実績、2019年~2024年

- 市場成長予測、2024年~2029年、2034年

- 成長予測の貢献要因

- 世界のネオバンキングの潜在的市場規模(TAM)

第10章 世界のネオバンキング市場セグメンテーション

- 世界のネオバンキング市場:口座タイプ別

- 世界のネオバンキング市場:サービス別

- 世界のネオバンキング市場:用途別

- 世界のネオバンキング市場、法人口座

- 世界のネオバンキング市場、貯蓄口座

第11章 ネオバンキング市場、地域別・国別分析

- 世界のネオバンキング市場、地域別、実績および予測、2019年~2024年、2029年予測、2034年予測

- 世界のネオバンキング市場、国別、実績および予測、2019年~2024年、2029年予測、2034年予測

第12章 アジア太平洋市場

第13章 西欧市場

第14章 東欧市場

第15章 北米市場

第16章 南米市場

第17章 中東市場

第18章 アフリカ市場

第19章 競合情勢と企業プロファイル

- 企業プロファイル

- Nu Pagamentos SA(NuBank)

- WeBank

- Mashreq Neo Corp.

- Revolut Ltd.

- Chime Financial Inc.

第20章 その他の大手企業と革新企業

- Digibank by DBS

- KakaoBank Corp.

- Upgrade Inc.

- Atom Bank plc

- Ally Financial Inc.

- Aspiration Inc.

- Monzo bank Ltd.

- N26 GmbH

- Starling Bank Ltd.

- Green Dot Corporation

- OakNorth Bank

- Dave Inc.

- Neon

- Varo Bank NA

- SoFi Technologies Inc.

第21章 競合ベンチマーキング

第22章 競合ダッシュボード

第23章 主要な合併と買収

- PayneticsがNovusを買収

- PaparaがRebellionを買収

- GreenwoodがKinlyを買収

第24章 ネオバンキングの最近の動向

- シームレスで費用対効果の高い越境決済ソリューション

- 組み込み金融サービス別住宅所有の変革

- スウェーデンの新しいオンライン銀行が市場をリードする金利を提供

第25章 機会と戦略

第26章 ネオバンキング市場、結論・提言

第27章 付録

Neobanking refers to digital banking services that operate entirely online without traditional physical branch networks. These banks leverage technology to provide a seamless and efficient banking experience, catering to both individual consumers and businesses.

The neobanking market consists of sales, by entities (organizations, sole traders, or partnerships), of neobanking services that are primarily accessed through mobile apps and web-based platforms, where users can open accounts, conduct transactions and access financial services without visiting a physical bank. It is commonly used for both personal and business financial management, enabling users to monitor balances, make transfers and automate payments with ease.

The global neobanking market was valued at $30,378.83 million in 2019 which grew till 2024 at a compound annual growth rate (CAGR) of more than 42.00%.

Increasing Internet Penetration

The increasing internet penetration propelled the growth of the neobanking market in historic period. With more people gaining internet access, especially in emerging markets, neobanks have been able to reach a broader customer base without the need for physical branches. The rise of smartphones and affordable mobile data has enabled seamless digital banking experiences, allowing users to open accounts, transfer funds and access financial services anytime, anywhere. For instance, in October 2022, according to Data Reportal, a Singapore-based online reference library, a total of 5.07 billion people around the world used the internet, equivalent to 63.5% of the world's total population. Internet users continue to grow too, with the data indicating that the world's connected population grew by more than 170 million in the past 12 months. Additionally, according to the ITU (International Telecommunication Union), globally, the percentage of households with internet access increased from 54.7% in 2018 to 57% in 2019. About 4.5 billion people had access to the internet in 2019. Initiatives such as Internet.org by Facebook also contributed to the rise in internet penetration. Therefore, the increasing internet penetration drove the growth of the neobanking market.

Neobanks Revolutionize Lending With Open Network For Digital Commerce (ONDC)-Integrated Digital Loan Solutions

Major companies operating in the neobanking market are focusing on developing innovative solutions such as open network for digital commerce (ONDC)-integrated digital lending to enhance financial inclusion by providing a seamless, paperless loan solution through the ONDC framework. ONDC-integrated digital lending refers to a financial service model that leverages the Open Network for Digital Commerce (ONDC) framework to facilitate seamless and inclusive lending solutions for consumers and small businesses, enabling them to access loans and credit through various digital platforms interconnected within the ONDC ecosystem. For instance, in July 2024, Branch X, an India-based digital bank, launched ONDC Personal Loan, becoming the first neobank in India to introduce a lending solution through the Open Network for Digital Commerce (ONDC). The product leverages a digital-first approach, ensuring a completely paperless and transparent loan application and disbursement process. By integrating Voice AI-driven financial guidance and account aggregator technology, Branch X aims to empower underserved individuals, young professionals and small business owners with improved access to credit while fostering financial literacy.

The global neobanking market is fairly fragmented, with a large number of small players operating in the market. The top ten competitors in the market made up to 17.04% of the total market in 2023.

Neobanking Global Market Opportunities And Strategies To 2034 from The Business Research Company provides the strategists; marketers and senior management with the critical information they need to assess the global neobanking market as it emerges from the COVID-19 shut down.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Where is the largest and fastest-growing market for neobanking? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The neobanking market global report from The Business Research Company answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market's history and forecasts market growth by geography. It places the market within the context of the wider neobanking market; and compares it with other markets.

The report covers the following chapters

- Introduction And Market Characteristics- Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by account type, by service and by application.

- Key Trends - Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Growth Analysis And Strategic Analysis Framework - Analysis on PESTEL, end use industries, market growth rate, global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods, forecast growth contributors and total addressable market (TAM).

- Global Market Size And Growth- Global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional And Country Analysis- Historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison by region and country.

- Market Segmentation -Contains the market values (2019-2024) (2024-2029, 2034F) and analysis for each segment by account type, by service and by application in the market. Historic (2019-2024) and forecast (2024-2029) and (2029-2034) market values and growth and market share comparison by region market.

- Regional Market Size And Growth- Regional market size (2024), historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape- Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major And Innovative Companies- Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking- Briefs on the financials comparison between major players in the market.

- Competitive Dashboard- Briefs on competitive dashboard of major players.

- Key Mergers And Acquisitions- Information on recent mergers and acquisitions in the market covered in the report. This section gives key financial details of mergers and acquisitions, which have shaped the market in recent years.

- Market Opportunities And Strategies- Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions And Recommendations- This section includes recommendations for neobanking providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix- This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

- 1) By Account Type: Business Account; Savings Account; Other Account Types

- 2) By Service: Mobile Banking; Payments And Money Transfer; Checking/Savings Account; Loans; Other Services

- 3) By Application: Enterprises; Personal; Other Applications

- Companies Mentioned: Nu Pagamentos S.A. (NuBank); WeBank; Mashreq Neo Corp.; Revolut Ltd.; Chime Financial Inc.

- Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Mexico; Brazil; France; Germany; UK; Italy; Spain; Russia

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time-series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; neobanking indicators comparison.

- Data segmentations: country and regional historic and forecast data; market share of competitors; market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Table of Contents

1 Executive Summary

- 1.1 Neobanking - Market Attractiveness And Macro economic Landscape

2 Table Of Contents

3 List Of Tables

4 List Of Figures

5 Report Structure

6 Market Characteristics

- 6.1 General Market Definition

- 6.2 Summary

- 6.3 Neobanking Market Definition And Segmentations

- 6.4 Market Segmentation By Account Type

- 6.4.1 Business Account

- 6.4.2 Savings Account

- 6.5 Market Segmentation By Service

- 6.5.1 Mobile Banking

- 6.5.2 Payments And Money Transfer

- 6.5.3 Checking/Savings Account

- 6.5.4 Loans

- 6.5.5 Other Services

- 6.6 Market Segmentation By Application

- 6.6.1 Enterprises

- 6.6.2 Personal

- 6.6.3 Other Application

7 Major Market Trends

- 7.1 Neobanks Revolutionize Lending With Open Network For Digital Commerce (ONDC)-Integrated Digital Loan Solutions

- 7.2 Advanced Digital Banking Solution Empowering Underserved Communities With Secure Access

- 7.3 Innovative Neobanking Products Redefine Financial Landscape

- 7.4 Strategic Collaborations Transform Digital Banking With Artificial Intelligence And Open Banking

8 Global Neobanking Growth Analysis And Strategic Analysis Framework

- 8.1 Global: PESTEL Analysis

- 8.1.1 Political

- 8.1.2 Economic

- 8.1.3 Social

- 8.1.4 Technological

- 8.1.5 Environmental

- 8.1.6 Legal

- 8.2 Analysis Of End User Analysis (B2B)

- 8.2.1 Retail Customers

- 8.2.2 Small and Medium Enterprises (SMEs)

- 8.2.3 Large Enterprises

- 8.2.4 Other End Users (Students & Young Professionals, Unbanked And Underbanked Populations)

9 Global Market Size and Growth

- 9.1 Market Size

- 9.2 Historic Market Growth, 2019 - 2024, Value ($ Million)

- 9.2.1 Market Drivers 2019 - 2024

- 9.2.2 Market Restraints 2019 - 2024

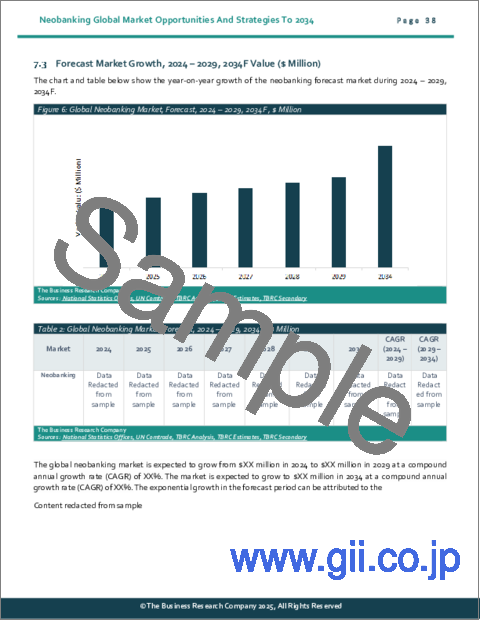

- 9.3 Forecast Market Growth, 2024 - 2029, 2034F Value ($ Million)

- 9.3.1 Market Drivers 2024 - 2029

- 9.3.2 Market Restraints 2024 - 2029

- 9.4 Forecast Growth Contributors/Factors

- 9.4.1 Quantitative Growth Contributors

- 9.4.2 Drivers

- 9.4.3 Restraints

- 9.5 Global Neobanking Total Addressable Market (TAM)

10 Global Neobanking Market Segmentation

- 10.1 Global Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.2 Global Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.3 Global Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.4 Global Neobanking Market, Sub-Segmentation Of Business Account, By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.5 Global Neobanking Market, Sub-Segmentation Of Savings Account, By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

11 Neobanking Market, Regional and Country Analysis

- 11.1 Global Neobanking Market, By Region, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.2 Global Neobanking Market, By Country, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

12 Asia-Pacific Market

- 12.1 Summary

- 12.2 Market Overview

- 12.2.1 Region Information

- 12.2.2 Market Information

- 12.2.3 Background Information

- 12.2.4 Government Initiatives

- 12.2.5 Regulations

- 12.2.6 Regulatory Bodies

- 12.2.7 Major Associations

- 12.2.8 Taxes Levied

- 12.2.9 Corporate Tax Structure

- 12.2.10 Investments

- 12.2.11 Major Companies

- 12.3 Asia-Pacific Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.4 Asia-Pacific Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.5 Asia-Pacific Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.6 Asia-Pacific Neobanking Market: Country Analysis

- 12.7 China Market

- 12.8 Summary

- 12.9 Market Overview

- 12.9.1 Country Information

- 12.9.2 Market Information

- 12.9.3 Background Information

- 12.9.4 Government Initiatives

- 12.9.5 Regulations

- 12.9.6 Regulatory Bodies

- 12.9.7 Major Associations

- 12.9.8 Taxes Levied

- 12.9.9 Corporate Tax Structure

- 12.9.10 Major Companies

- 12.10 China Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.11 China Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.12 China Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.13 India Market

- 12.14 India Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.15 India Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.16 India Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.17 Japan Market

- 12.18 Summary

- 12.19 Market Overview

- 12.19.1 Country Information

- 12.19.2 Market Information

- 12.19.3 Background Information

- 12.19.4 Government Initiatives

- 12.19.5 Regulations

- 12.19.6 Regulatory Bodies

- 12.19.7 Major Associations

- 12.19.8 Taxes Levied

- 12.19.9 Corporate Tax Structure

- 12.19.10 Investments

- 12.19.11 Major Companies

- 12.20 Japan Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.21 Japan Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.22 Japan Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.23 Australia Market

- 12.24 Australia Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.25 Australia Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.26 Australia Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.27 Indonesia Market

- 12.28 Indonesia Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.29 Indonesia Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.30 Indonesia Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.31 South Korea Market

- 12.32 Summary

- 12.33 Market Overview

- 12.33.1 Country Information

- 12.33.2 Market Information

- 12.33.3 Background Information

- 12.33.4 Government Initiatives

- 12.33.5 Regulations

- 12.33.6 Regulatory Bodies

- 12.33.7 Major Associations

- 12.33.8 Taxes Levied

- 12.33.9 Corporate Tax Structure

- 12.33.10 Major Companies

- 12.34 South Korea Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.35 South Korea Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.36 South Korea Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

13 Western Europe Market

- 13.1 Summary

- 13.2 Market Overview

- 13.2.1 Region Information

- 13.2.2 Market Information

- 13.2.3 Background Information

- 13.2.4 Government Initiatives

- 13.2.5 Regulations

- 13.2.6 Regulatory Bodies

- 13.2.7 Major Associations

- 13.2.8 Taxes Levied

- 13.2.9 Corporate tax structure

- 13.2.10 Investments

- 13.2.11 Major Companies

- 13.3 Western Europe Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.4 Western Europe Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.5 Western Europe Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.6 Western Europe Neobanking Market: Country Analysis

- 13.7 UK Market

- 13.8 UK Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.9 UK Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.10 UK Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.11 Germany Market

- 13.12 Germany Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.13 Germany Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.14 Germany Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.15 France Market

- 13.16 France Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.17 France Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.18 France Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.19 Italy Market

- 13.20 Italy Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.21 Italy Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.22 Italy Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.23 Spain Market

- 13.24 Spain Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.25 Spain Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.26 Spain Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

14 Eastern Europe Market

- 14.1 Summary

- 14.2 Market Overview

- 14.2.1 Region Information

- 14.2.2 Market Information

- 14.2.3 Background Information

- 14.2.4 Government Initiatives

- 14.2.5 Regulations

- 14.2.6 Regulatory Bodies

- 14.2.7 Major Associations

- 14.2.8 Taxes Levied

- 14.2.9 Corporate Tax Structure

- 14.2.10 Investments

- 14.2.11 Major companies

- 14.3 Eastern Europe Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.4 Eastern Europe Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.5 Eastern Europe Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.6 Eastern Europe Neobanking Market: Country Analysis

- 14.7 Russia Market

- 14.8 Russia Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.9 Russia Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.10 Russia Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

15 North America Market

- 15.1 Summary

- 15.2 Market Overview

- 15.2.1 Region Information

- 15.2.2 Market Information

- 15.2.3 Background Information

- 15.2.4 Government Initiatives

- 15.2.5 Regulations

- 15.2.6 Regulatory Bodies

- 15.2.7 Major Associations

- 15.2.8 Taxes Levied

- 15.2.9 Corporate Tax Structure

- 15.2.10 Investments

- 15.2.11 Major Companies

- 15.3 North America Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.4 North America Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.5 North America Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.6 North America Neobanking Market: Country Analysis

- 15.7 USA Market

- 15.8 Summary

- 15.9 Market Overview

- 15.9.1 Country Information

- 15.9.2 Market Information

- 15.9.3 Background Information

- 15.9.4 Government Initiatives

- 15.9.5 Regulations

- 15.9.6 Regulatory Bodies

- 15.9.7 Major Associations

- 15.9.8 Taxes Levied

- 15.9.9 Corporate Tax Structure

- 15.9.10 Investments

- 15.9.11 Major Companies

- 15.10 USA Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.11 USA Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.12 USA Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.13 Canada Market

- 15.14 Summary

- 15.15 Market Overview

- 15.15.1 Region Information

- 15.15.2 Market Information

- 15.15.3 Background Information

- 15.15.4 Government Initiatives

- 15.15.5 Regulations

- 15.15.6 Regulatory Bodies

- 15.15.7 Major Associations

- 15.15.8 Taxes Levied

- 15.15.9 Corporate Tax Structure

- 15.15.10 Major Companies

- 15.16 Canada Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.17 Canada Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.18 Canada Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

16 South America Market

- 16.1 Summary

- 16.2 Market Overview

- 16.2.1 Region Information

- 16.2.2 Market Information

- 16.2.3 Background Information

- 16.2.4 Government Initiatives

- 16.2.5 Regulations

- 16.2.6 Regulatory Bodies

- 16.2.7 Major Associations

- 16.2.8 Taxes Levied

- 16.2.9 Corporate Tax Structure

- 16.2.10 Major Companies

- 16.3 South America Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.4 South America Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.5 South America Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.6 South America Neobanking Market: Country Analysis

- 16.7 Brazil Market

- 16.8 Brazil Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.9 Brazil Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.10 Brazil Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

17 Middle East Market

- 17.1 Summary

- 17.2 Market Overview

- 17.2.1 Region Information

- 17.2.2 Market Information

- 17.2.3 Background Information

- 17.2.4 Government Initiatives

- 17.2.5 Regulations

- 17.2.6 Regulatory Bodies

- 17.2.7 Major Associations

- 17.2.8 Taxes Levied

- 17.2.9 Corporate Tax Structure

- 17.2.10 Investments

- 17.2.11 Major Companies

- 17.3 Middle East Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.4 Middle East Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.5 Middle East Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

18 Africa Market

- 18.1 Summary

- 18.2 Market Overview

- 18.2.1 Region Information

- 18.2.2 Market Information

- 18.2.3 Background Information

- 18.2.4 Government Initiatives

- 18.2.5 Regulations

- 18.2.6 Regulatory Bodies

- 18.2.7 Major Associations

- 18.2.8 Taxes Levied

- 18.2.9 Corporate Tax Structure

- 18.2.10 Investments

- 18.2.11 Major Companies

- 18.3 Africa Neobanking Market, Segmentation By Account Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 18.4 Africa Neobanking Market, Segmentation By Service, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 18.5 Africa Neobanking Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

19 Competitive Landscape And Company Profiles

- 19.1 Company Profiles

- 19.2 Nu Pagamentos S.A. (NuBank)

- 19.2.1 Company Overview

- 19.2.2 Products And Services

- 19.2.3 Business Strategy

- 19.2.4 Financial Overview

- 19.3 WeBank

- 19.3.1 Company Overview

- 19.3.2 Products And Services

- 19.3.3 Financial Overview

- 19.4 Mashreq Neo Corp.

- 19.4.1 Company Overview

- 19.4.2 Products And Services

- 19.4.3 Business Strategy

- 19.4.4 Financial Overview

- 19.5 Revolut Ltd.

- 19.5.1 Company Overview

- 19.5.2 Products And Services

- 19.5.3 Financial Overview

- 19.6 Chime Financial Inc.

- 19.6.1 Company Overview

- 19.6.2 Products And Services

- 19.6.3 Financial Overview

20 Other Major And Innovative Companies

- 20.1 Digibank by DBS

- 20.1.1 Company Overview

- 20.1.2 Products And Services

- 20.2 KakaoBank Corp.

- 20.2.1 Company Overview

- 20.2.2 Products And Services

- 20.3 Upgrade Inc.

- 20.3.1 Company Overview

- 20.3.2 Products And Services

- 20.4 Atom Bank plc

- 20.4.1 Company Overview

- 20.4.2 Products And Services

- 20.5 Ally Financial Inc.

- 20.5.1 Company Overview

- 20.5.2 Products And Services

- 20.6 Aspiration Inc.

- 20.6.1 Company Overview

- 20.6.2 Products And Services

- 20.7 Monzo bank Ltd.

- 20.7.1 Company Overview

- 20.7.2 products And Services

- 20.8 N26 GmbH

- 20.8.1 Company Overview

- 20.8.2 Products And Services

- 20.9 Starling Bank Ltd.

- 20.9.1 Company Overview

- 20.9.2 Products And Services

- 20.10 Green Dot Corporation

- 20.10.1 Company Overview

- 20.10.2 Products And Services

- 20.11 OakNorth Bank

- 20.11.1 Company Overview

- 20.11.2 Products And Services

- 20.12 Dave Inc.

- 20.12.1 Company Overview

- 20.12.2 Products And Services

- 20.13 Neon

- 20.13.1 Company Overview

- 20.13.2 Products And Services

- 20.14 Varo Bank NA

- 20.14.1 Company Overview

- 20.14.2 Products And Services

- 20.15 SoFi Technologies Inc.

- 20.15.1 Company Overview

- 20.15.2 Products And Services

21 Competitive Benchmarking

22 Competitive Dashboard

23 Key Mergers And Acquisitions

- 23.1 Paynetics Acquired Novus

- 23.2 Papara Acquired Rebellion

- 23.3 Greenwood Acquired Kinly

24 Recent Developments In Neobanking

- 24.1 Seamless And Cost-Effective Cross-Border Payment Solution

- 24.2 Transforming Homeownership With Embedded Financial Services

- 24.3 New Online Bank in Sweden Offers Market-Leading Interest Rates

25 Opportunities And Strategies

- 25.1 Global Neobanking Market In 2029 - Countries Offering Most New Opportunities

- 25.2 Global Neobanking Market In 2029 - Segments Offering Most New Opportunities

- 25.3 Global Neobanking Market In 2029 - Growth Strategies

- 25.3.1 Market Trend Based Strategies

- 25.3.2 Competitor Strategies

26 Neobanking Market, Conclusions And Recommendations

- 26.1 Conclusions

- 26.2 Recommendations

- 26.2.1 Product

- 26.2.2 Place

- 26.2.3 Price

- 26.2.4 Promotion

- 26.2.5 People

27 Appendix

- 27.1 Geographies Covered

- 27.2 Market Data Sources

- 27.3 Research Methodology

- 27.4 Currencies

- 27.5 The Business Research Company

- 27.6 Copyright and Disclaimer