|

|

市場調査レポート

商品コード

1733566

自動車再生の世界市場:2034年までの市場の機会と戦略Automobile Remanufacturing Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| 自動車再生の世界市場:2034年までの市場の機会と戦略 |

|

出版日: 2025年05月26日

発行: The Business Research Company

ページ情報: 英文 322 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界の自動車再生の市場規模は、2019年に500億3,845万米ドルと評価され、2024年までCAGR6.00%以上で成長しました。

新興市場における力強い経済成長

歴史的な期間において、自動車再生市場は新興市場の力強い経済成長によって牽引されました。所得の増加に伴い、自動車に投資する個人や企業が増え、再生部品を含む費用対効果の高いメンテナンス・ソリューションに対する需要が高まっています。さらに、新興国では価格に敏感な市場が多く、値ごろ感が重要な役割を果たすため、高価な新品部品に代わって再生部品が好まれます。これらの地域では、輸送、ロジスティクス、ライドヘイリングサービスが拡大しているため、自動車の使用と消耗がさらに加速し、信頼性の高い再生部品のニーズが高まっています。例えば、貧困削減と生活水準の向上を支援するために発展途上国に資金を貸し付ける国際金融機関である世界銀行によると、中国の国内総生産(GDP)は2021年に17兆8,200億米ドル、2015年に11兆600億米ドルであったのに対し、2022年には17兆9,400億米ドルに成長しました。さらに2022年1月、財務・企業担当大臣によると、インドの国内総生産(GDP)は8%から8.5%、2021年から2022年にかけては9.2%成長しました。したがって、新興市場における力強い経済成長は、自動車再生市場の成長に貢献しました。

当レポートは、世界の自動車再生市場について調査し、市場の概要とともに、タイプ別、製造業者別、用途別、地域・国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 目次

第3章 テーブル一覧

第4章 図表一覧

第5章 レポートの構成

第6章 市場の特徴

- 一般的な市場定義

- サマリー

- 自動車再生市場の定義とセグメンテーション

- 市場セグメンテーション、タイプ別

- エンジンおよび関連部品

- トランスミッション部品

- 電気・電子システム部品

- ホイール・ブレーキシステム関連部品

- その他

- 市場セグメンテーション、製造業者別

- OEM再製造業者

- 独立系再生業者

- 下請け再製造業者

- 市場セグメンテーション、用途別

- 乗用車

- 商用車

第7章 主要な市場動向

- EVバッテリー試験・分解ラインの進歩による持続可能性と効率性の向上

- 再生自動車用ドライブラインパワーインバータの先進ラインの導入

- 再製造の拡大により、中国に手頃な価格の機械ソリューションがもたらされる

第8章 世界の自動車再生の成長分析と戦略分析フレームワーク

- 世界の自動車再生に関するPESTEL分析(政治、社会、技術、環境、法的要因)

- 最終用途産業(B2BおよびB2C)の分析

- 世界の自動車再生市場の成長率分析

- 市場成長実績、2019年~2024年

- 市場成長予測、2024年~2029年、2034年

- 成長予測の貢献要因

- 世界の自動車再生総獲得可能市場(TAM)

第9章 世界の自動車再生市場セグメンテーション

- 世界の自動車再生市場:タイプ別

- 世界の自動車再生市場、製造業者別

- 世界の自動車再生市場:用途別

- 世界の自動車再生市場、エンジン

- 世界の自動車再生市場、トランスミッション

- 世界の自動車再生市場、電気・電子システム部品

- 世界の自動車再生市場、ホイールおよびブレーキシステム関連部品

- 世界の自動車再生市場、その他

第10章 自動車再生市場、地域別・国別分析

- 世界の自動車再生市場、地域別、実績および予測、2019年~2024年、2029年予測、2034年予測

- 世界の自動車再生市場、国別、実績および予測、2019年~2024年、2029年予測、2034年予測

第11章 アジア太平洋市場

第12章 西欧市場

第13章 東欧市場

第14章 北米市場

第15章 中東市場

第16章 アフリカ市場

第17章 競合情勢と企業プロファイル

- 企業プロファイル

- ZF Friedrichshafen AG

- Caterpillar Inc.

- Valeo SA

- Cardone Industries

- PHINIA, Inc.(spin-off of BorgWarner)

第18章 その他の大手企業と革新企業

- Cummins Inc.

- Toyota Motor Corporation

- Faw Group

- SKF AB

- Eaton Corp.

- Denso Corporation

- Robert Bosch GmbH

- Volvo Car Corp.

- Jasper Engines and Transmissions

- ATC Drivetrain LLC

- Carwood Group

- Bayerische Motoren Werke AG(BMW Group)

- Monark Automotive GmbH

- JATCO Ltd.

- Detroit Diesel Remanufaturing LLC.

第19章 競合ベンチマーキング

第20章 競合ダッシュボード

第21章 主要な合併と買収

- BBB CompletesがAll Star Auto Partsを買収

- StellantisがMinority Stake In Miracle Oruideを買収

- LKQ EuropeがRhenoy Groupを買収

第22章 自動車再生の最近の開発

- 再生施設への投資を通じて持続可能性を推進

- 新しい環境に優しい再生施設が持続可能性への取り組みを強化

第23章 機会と戦略

第24章 自動車再生市場、結論・提言

第25章 付録

Automobile remanufacturing refers to the industrial process of restoring used automotive components to a like-new condition, ensuring they meet the original equipment manufacturers (OEM) specifications. This process involves disassembling, cleaning, repairing, replacing worn-out parts, reassembling and testing the components to ensure they perform as efficiently as newly manufactured ones.

The automobile remanufacturing market consists of sales by entities (organizations, sole traders and partnerships) of automobile remanufacturing products and services that are widely used across the automotive industry, catering to both passenger and commercial vehicle markets. It serves as a cost-effective and environmentally friendly alternative to purchasing new automotive components, helping reduce waste and conserve raw materials.

The global automobile remanufacturing market was valued at $50,038.45 million in 2019 which grew till 2024 at a compound annual growth rate (CAGR) of more than 6.00%.

Strong Economic Growth In Emerging Markets

During the historic period, the automobile remanufacturing market was driven by strong economic growth in emerging markets. As incomes rise, more individuals and businesses invest in automobiles, leading to higher demand for cost-effective maintenance solutions, including remanufactured parts. Additionally, emerging economies often have price-sensitive markets where affordability plays a crucial role, making remanufactured components a preferred alternative to expensive new parts. The expansion of transportation, logistics and ride-hailing services in these regions further accelerates vehicle usage and wear and tear, increasing the need for reliable remanufactured parts. For instance, according to the World Bank, an international financial institution that lends money to developing countries to help reduce poverty and improve standards of living, China's gross domestic product (GDP) grew to $17.94 trillion in 2022, compared to $17.82 trillion in 2021 and $11.06 trillion in 2015. Additionally, in January 2022, according to the Minister for Finance and Corporate Affairs, India's gross domestic product (GDP) grew by between 8% and 8.5% and 9.2% in 2021-2022. Therefore, strong economic growth in emerging markets contributed to the growth of the automobile remanufacturing market.

Introduction Of Advanced Line Of Remanufactured Automotive Driveline Power Inverters

Product innovations are a key trend gaining popularity in the automobile remanufacturing market. Major companies operating in the automobile remanufacturing market are innovating new remanufactured products to sustain their position in the market. For instance, in June 2023, Blue Streak Electronics, a Canada-based producer of automotive remanufactured electronics, launched a line of remanufactured automotive driveline power inverters. These inverters undergo a protracted remanufacturing process that includes intensive testing, refurbishment and replacement of critical components to guarantee optimum performance, dependability and lifetime. It converts the DC power from the vehicle's battery into AC power for the driveline systems and charges the battery. Customers may anticipate a product that operates on par with completely new power inverters while reducing waste and carbon footprints.

The global automobile remanufacturing market is fairly fragmented, with large number of players operating in the market. The top ten competitors in the market made up to 20.69% of the total market in 2023.

Automobile Remanufacturing Global Market Opportunities And Strategies To 2034 from The Business Research Company provides the strategists; marketers and senior management with the critical information they need to assess the global automobile remanufacturing market as it emerges from the COVID-19 shut down.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Where is the largest and fastest-growing market for automobile remanufacturing? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The automobile remanufacturing market global report from The Business Research Company answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market's history and forecasts market growth by geography. It places the market within the context of the wider automobile remanufacturing market; and compares it with other markets.

The report covers the following chapters

- Introduction And Market Characteristics- Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by type, by manufacturer and by application.

- Key Trends- Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Macro-Economic Scenario- The report provides an analysis of the interest rates, inflation, geopolitics and covid and recovery on the market.

- Growth Analysis And Strategic Analysis Framework- Analysis on PESTEL, end use industries, market growth rate, global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods, forecast growth contributors and total addressable market (TAM).

- Regional And Country Analysis- Historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison by region and country.

- Market Segmentation- Contains the market values (2019-2024) (2024-2029, 2034F) and analysis for each segment by type, by manufacturer and by application in the market. Historic (2019-2024) and forecast (2024-2029) and (2029-2034) market values and growth and market share comparison by region market.

- Regional Market Size And Growth- Regional market size (2024), historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape- Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major And Innovative Companies- Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking- Briefs on the financials comparison between major players in the market.

- Competitive Dashboard- Briefs on competitive dashboard of major players.

- Key Mergers And Acquisitions- Information on recent mergers and acquisitions in the market covered in the report. This section gives key financial details of mergers and acquisitions, which have shaped the market in recent years.

- Recent Developments- Information on recent developments in the market covered in the report

- Market Opportunities And Strategies- Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions And Recommendations- This section includes recommendations for automobile remanufacturing providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix- This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

- 1) By Types: Engine & Related Parts; Transmission Parts; Electrical & Electronics System Parts; Wheel & Braking System Related Parts; Other Types

- 2) By Manufacturer: Original Equipment Manufacturer (OEM) Remanufacturers; Independent Remanufacturers; Subcontracted Remanufacturers

- 3) By Application: Passenger Vehicles; Commercial Vehicles

- Companies Mentioned: ZF Friedrichshafen AG; Caterpillar Inc.; Valeo SA; Cardone Industries; PHINIA, Inc. (spin-off of BorgWarner)

- Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; UK; Italy; Spain; Russia

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time-series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; automobile remanufacturing indicators comparison.

- Data segmentations: country and regional historic and forecast data; market share of competitors; market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Table of Contents

1 Executive Summary

- 1.1 Automobile Remanufacturing - Market Attractiveness And Macro Economic Landscape

2 Table Of Contents

3 List Of Tables

4 List Of Figures

5 Report Structure

6 Market Characteristics

- 6.1 General Market Definition

- 6.2 Summary

- 6.3 Automobile Remanufacturing Market Definition And Segmentations

- 6.4 Market Segmentation By Type

- 6.4.1 Engine & Related Parts

- 6.4.2 Transmission Parts

- 6.4.3 Electrical & Electronics System Parts

- 6.4.4 Wheel & Braking System Related Parts

- 6.4.5 Other Types

- 6.5 Market Segmentation By Manufacturer

- 6.5.1 Original Equipment Manufacturer (OEM) Remanufacturers

- 6.5.2 Independent Remanufacturers

- 6.5.3 Subcontracted Remanufacturers

- 6.6 Market Segmentation By Application

- 6.6.1 Passenger Vehicles

- 6.6.2 Commercial Vehicles

7 Major Market Trends

- 7.1 Advancements In EV Battery Testing And Disassembly Lines For Enhanced Sustainability And Efficiency

- 7.2 Introduction Of Advanced Line Of Remanufactured Automotive Driveline Power Inverters

- 7.3 Remanufacturing Expansion Brings Affordable Machinery Solutions To China

8 Global Automobile Remanufacturing Growth Analysis And Strategic Analysis Framework

- 8.1 Global Automobile Remanufacturing PESTEL Analysis (Political, Social, Technological, Environmental and Legal Factors)

- 8.2 Analysis Of End Use Industries (B2B And B2C)

- 8.2.1 Automobile Manufacturers

- 8.2.2 Automobile Repair And Service Centers

- 8.2.3 Fleet Operators

- 8.2.4 Consumers

- 8.2.5 Aftermarket Parts Retailers

- 8.3 Global Automobile Remanufacturing Market Growth Rate Analysis

- 8.4 Historic Market Growth, 2019 - 2024, Value ($ Million)

- 8.4.1 Market Drivers 2019 - 2024

- 8.4.2 Market Restraints 2019 - 2024

- 8.5 Forecast Market Growth, 2024 - 2029, 2034F Value ($ Million)

- 8.5.1 Market Drivers 2024 - 2029

- 8.5.2 Market Restraints 2024 - 2029

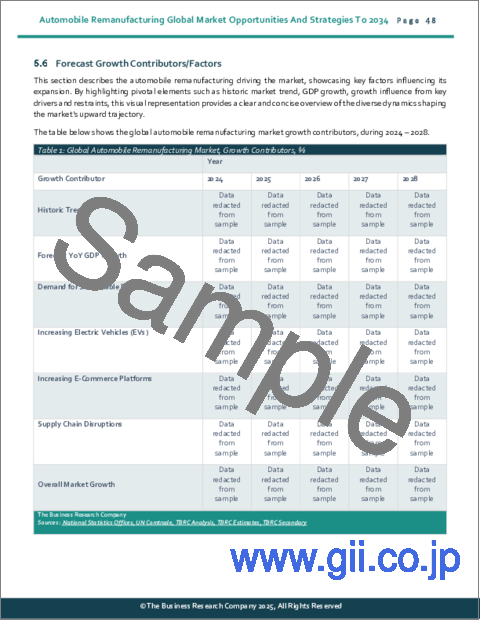

- 8.6 Forecast Growth Contributors/Factors

- 8.6.1 Quantitative Growth Contributors

- 8.6.2 Drivers

- 8.6.3 Restraints

- 8.7 Global Automobile Remanufacturing Total Addressable Market (TAM)

9 Global Automobile Remanufacturing Market Segmentation

- 9.1 Global Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.2 Global Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.3 Global Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.4 Global Automobile Remanufacturing Market, Sub-Segmentation Of Engine, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.5 Global Automobile Remanufacturing Market, Sub-Segmentation Of Transmission, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.6 Global Automobile Remanufacturing Market, Sub-Segmentation Of Electrical And Electronics System Parts, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.7 Global Automobile Remanufacturing Market, Sub-Segmentation Of Wheel And Breaking System Related Parts, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.8 Global Automobile Remanufacturing Market, Sub-Segmentation Of Other Types, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

10 Automobile Remanufacturing Market, Regional and Country Analysis

- 10.1 Global Automobile Remanufacturing Market, By Region, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.2 Global Automobile Remanufacturing Market, By Country, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

11 Asia-Pacific Market

- 11.1 Summary

- 11.2 Market Overview

- 11.2.1 Region Information

- 11.2.2 Market Information

- 11.2.3 Background Information

- 11.2.4 Government Initiatives

- 11.2.5 Regulations

- 11.2.6 Regulatory Bodies

- 11.2.7 Major Associations

- 11.2.8 Taxes Levied

- 11.2.9 Corporate Tax Structure

- 11.2.10 Investments

- 11.2.11 Major Companies

- 11.3 Asia-Pacific Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.4 Asia-Pacific Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.5 Asia-Pacific Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.6 Asia-Pacific Automobile Remanufacturing Market: Country Analysis

- 11.7 China Market

- 11.8 Summary

- 11.9 Market Overview

- 11.9.1 Country Information

- 11.9.2 Market Information

- 11.9.3 Background Information

- 11.9.4 Government Initiatives

- 11.9.5 Regulations

- 11.9.6 Regulatory Bodies

- 11.9.7 Major Associations

- 11.9.8 Taxes Levied

- 11.9.9 Corporate Tax Structure

- 11.9.10 Investments

- 11.9.11 Major Companies

- 11.10 China Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.11 China Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.12 China Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.13 India Market

- 11.14 India Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.15 India Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.16 India Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.17 Japan Market

- 11.18 Summary

- 11.19 Market Overview

- 11.19.1 Country Information

- 11.19.2 Market Information

- 11.19.3 Background Information

- 11.19.4 Government Initiatives

- 11.19.5 Regulations

- 11.19.6 Regulatory Bodies

- 11.19.7 Major Associations

- 11.19.8 Taxes Levied

- 11.19.9 Corporate Tax Structure

- 11.19.10 Investments

- 11.19.11 Major Companies

- 11.20 Japan Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.21 Japan Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.22 Japan Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.23 Australia Market

- 11.24 Australia Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.25 Australia Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.26 Australia Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.27 Indonesia Market

- 11.28 Indonesia Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.29 Indonesia Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.30 Indonesia Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.31 South Korea Market

- 11.32 Summary

- 11.33 Market Overview

- 11.33.1 Country Information

- 11.33.2 Market Information

- 11.33.3 Background Information

- 11.33.4 Government Initiatives

- 11.33.5 Regulations

- 11.33.6 Regulatory Bodies

- 11.33.7 Major Associations

- 11.33.8 Taxes Levied

- 11.33.9 Corporate Tax Structure

- 11.33.10 Investment

- 11.33.11 Major Companies

- 11.34 South Korea Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.35 South Korea Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.36 South Korea Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

12 Western Europe Market

- 12.1 Summary

- 12.2 Market Overview

- 12.2.1 Region Information

- 12.2.2 Market Information

- 12.2.3 Background Information

- 12.2.4 Government Initiatives

- 12.2.5 Regulations

- 12.2.6 Regulatory Bodies

- 12.2.7 Major Associations

- 12.2.8 Taxes Levied

- 12.2.9 Corporate tax structure

- 12.2.10 Investments

- 12.2.11 Major Companies

- 12.3 Western Europe Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.4 Western Europe Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.5 Western Europe Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.6 Western Europe Automobile Remanufacturing Market: Country Analysis

- 12.7 UK Market

- 12.8 UK Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.9 UK Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.10 UK Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.11 Germany Market

- 12.12 Germany Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.13 Germany Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.14 Germany Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.15 France Market

- 12.16 France Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.17 France Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.18 France Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.19 Italy Market

- 12.20 Italy Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.21 Italy Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.22 Italy Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.23 Spain Market

- 12.24 Spain Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.25 Spain Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.26 Spain Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

13 Eastern Europe Market

- 13.1 Summary

- 13.2 Market Overview

- 13.2.1 Region Information

- 13.2.2 Market Information

- 13.2.3 Background Information

- 13.2.4 Government Initiatives

- 13.2.5 Regulations

- 13.2.6 Regulatory Bodies

- 13.2.7 Major Associations

- 13.2.8 Taxes Levied

- 13.2.9 Corporate Tax Structure

- 13.2.10 Investments

- 13.2.11 Major companies

- 13.3 Eastern Europe Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.4 Eastern Europe Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.5 Eastern Europe Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.6 Eastern Europe Automobile Remanufacturing Market: Country Analysis

- 13.7 Russia Market

- 13.8 Russia Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.9 Russia Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.10 Russia Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

14 North America Market

- 14.1 Summary

- 14.2 Market Overview

- 14.2.1 Region Information

- 14.2.2 Market Information

- 14.2.3 Background Information

- 14.2.4 Government Initiatives

- 14.2.5 Regulations

- 14.2.6 Regulatory Bodies

- 14.2.7 Major Associations

- 14.2.8 Taxes Levied

- 14.2.9 Corporate Tax Structure

- 14.2.10 Investments

- 14.2.11 Major Companies

- 14.3 North America Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.4 North America Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.5 North America Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.6 North America Automobile Remanufacturing Market: Country Analysis

- 14.7 USA Market

- 14.8 Summary

- 14.9 Market Overview

- 14.9.1 Country Information

- 14.9.2 Market Information

- 14.9.3 Background Information

- 14.9.4 Government Initiatives

- 14.9.5 Regulations

- 14.9.6 Regulatory Bodies

- 14.9.7 Major Associations

- 14.9.8 Taxes Levied

- 14.9.9 Corporate Tax Structure

- 14.9.10 Investments

- 14.9.11 Major Companies

- 14.10 USA Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.11 USA Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.12 USA Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.13 Canada Market

- 14.14 Summary

- 14.15 Market Overview

- 14.15.1 Region Information

- 14.15.2 Market Information

- 14.15.3 Background Information

- 14.15.4 Government Initiatives

- 14.15.5 Regulations

- 14.15.6 Regulatory Bodies

- 14.15.7 Major Associations

- 14.15.8 Taxes Levied

- 14.15.9 Corporate Tax Structure

- 14.15.10 Investments

- 14.15.11 Major Companies

- 14.16 Canada Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.17 Canada Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.18 Canada Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

15 Middle East Market

- 15.1 Summary

- 15.2 Market Overview

- 15.2.1 Region Information

- 15.2.2 Market Information

- 15.2.3 Background Information

- 15.2.4 Government Initiatives

- 15.2.5 Regulations

- 15.2.6 Regulatory Bodies

- 15.2.7 Major Associations

- 15.2.8 Taxes Levied

- 15.2.9 Corporate Tax Structure

- 15.2.10 Major Companies

- 15.3 Middle East Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.4 Middle East Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.5 Middle East Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

16 Africa Market

- 16.1 Summary

- 16.2 Market Overview

- 16.2.1 Region Information

- 16.2.2 Market Information

- 16.2.3 Background Information

- 16.2.4 Government Initiatives

- 16.2.5 Regulations

- 16.2.6 Regulatory Bodies

- 16.2.7 Major Associations

- 16.2.8 Taxes Levied

- 16.2.9 Corporate Tax Structure

- 16.2.10 Major Companies

- 16.3 Africa Automobile Remanufacturing Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.4 Africa Automobile Remanufacturing Market, Segmentation By Manufacturer, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.5 Africa Automobile Remanufacturing Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

17 Competitive Landscape and Company Profiles

- 17.1 Company Profiles

- 17.2 ZF Friedrichshafen AG

- 17.2.1 Company Overview

- 17.2.2 Products And Services

- 17.2.3 Business Strategy

- 17.2.4 Financial Overview

- 17.3 Caterpillar Inc.

- 17.3.1 Company Overview

- 17.3.2 Products And Services

- 17.3.3 Financial Overview

- 17.4 Valeo SA

- 17.4.1 Company Overview

- 17.4.2 Products And Services

- 17.4.3 Business Strategy

- 17.4.4 Financial Overview

- 17.5 Cardone Industries

- 17.5.1 Company Overview

- 17.5.2 Products And Services

- 17.5.3 Financial Overview

- 17.6 PHINIA, Inc. (spin-off of BorgWarner)

- 17.6.1 Company Overview

- 17.6.2 Products And Services

- 17.6.3 Financial Overview

18 Other Major And Innovative Companies

- 18.1 Cummins Inc.

- 18.1.1 Company Overview

- 18.1.2 Products And Services

- 18.2 Toyota Motor Corporation

- 18.2.1 Company Overview

- 18.2.2 Products And Services

- 18.3 Faw Group

- 18.3.1 Company Overview

- 18.3.2 Products And Services

- 18.4 SKF AB

- 18.4.1 Company Overview

- 18.4.2 Products And Services

- 18.5 Eaton Corp.

- 18.5.1 Company Overview

- 18.5.2 Products And Services

- 18.6 Denso Corporation

- 18.6.1 Company Overview

- 18.6.2 Products And Services

- 18.7 Robert Bosch GmbH

- 18.7.1 Company Overview

- 18.7.2 products And Services

- 18.8 Volvo Car Corp.

- 18.8.1 Company Overview

- 18.8.2 Products And Services

- 18.9 Jasper Engines and Transmissions

- 18.9.1 Company Overview

- 18.9.2 Products And Services

- 18.10 ATC Drivetrain LLC

- 18.10.1 Company Overview

- 18.10.2 Products And Services

- 18.11 Carwood Group

- 18.11.1 Company Overview

- 18.11.2 Products And Services

- 18.12 Bayerische Motoren Werke AG (BMW Group)

- 18.12.1 Company Overview

- 18.12.2 Products And Services

- 18.13 Monark Automotive GmbH

- 18.13.1 Company Overview

- 18.13.2 Products And Services

- 18.14 JATCO Ltd.

- 18.14.1 Company Overview

- 18.14.2 Products And Services

- 18.15 Detroit Diesel Remanufaturing LLC.

- 18.15.1 Company Overview

- 18.15.2 Products And Services

19 Competitive Benchmarking

20 Competitive Dashboard

21 Key Mergers And Acquisitions

- 21.1 BBB Completes Acquired All Star Auto Parts

- 21.2 Stellantis Acquired Minority Stake In Miracle Oruide

- 21.3 LKQ Europe Acquired Rhenoy Group

22 Recent Development In Automobile Remanufacturing

- 22.1 Advancing Sustainability Through Investment In Refactory Facilities

- 22.2 New Eco-Friendly Remanufacturing Facility Enhances Sustainability Efforts

23 Opportunities And Strategies

- 23.1 Global Automobile Remanufacturing Market In 2029 - Countries Offering Most New Opportunities

- 23.2 Global Automobile Remanufacturing Market In 2029 - Segments Offering Most New Opportunities

- 23.3 Global Automobile Remanufacturing Market In 2029 - Growth Strategies

- 23.3.1 Market Trend Based Strategies

- 23.3.2 Competitor Strategies

24 Automobile Remanufacturing Market, Conclusions And Recommendations

- 24.1 Conclusions

- 24.2 Recommendations

- 24.2.1 Product

- 24.2.2 Place

- 24.2.3 Price

- 24.2.4 Promotion

- 24.2.5 People

25 Appendix

- 25.1 Geographies Covered

- 25.2 Market Data Sources

- 25.3 Research Methodology

- 25.4 Currencies

- 25.5 The Business Research Company

- 25.6 Copyright and Disclaimer