|

|

市場調査レポート

商品コード

1710161

業務用芝生機器の世界市場レポート 2025年Commercial Turf Equipment Global Market Report 2025 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 業務用芝生機器の世界市場レポート 2025年 |

|

出版日: 2025年04月03日

発行: The Business Research Company

ページ情報: 英文 200 Pages

納期: 2~10営業日

|

全表示

- 概要

- 目次

業務用芝生機器市場規模は、今後数年間で力強い成長が見込まれます。2029年にはCAGR5.5%で85億6,000万米ドルに成長します。予測期間の成長は、商業造園プロジェクトの増加、都市化の進展、ゴルフコースやレクリエーション施設の増加、芝の健康に対する意識の高まり、スポーツ施設の増加などに起因すると考えられます。予測期間の主な動向としては、GPSや自律型システムなどの技術革新、芝技術の革新、持続可能な手法の需要、専門的な芝管理サービスの需要、スマート機器の採用などが挙げられます。

スポーツ活動への参加者の増加は、今後の業務用芝生機器市場の拡大を牽引すると予測されます。このような参加者の増加は、健康上の利点に対する意識の高まり、施設へのアクセスの改善、社会におけるフィットネスとウェルビーイングへの注目の高まりに起因しています。業務用芝生機器は、試合や練習中の最適なパフォーマンス、安全性、耐久性を確保し、高品質のプレー面を維持するために不可欠です。例えば、米国の非営利団体であるスポーツ・フィットネス産業協会(SFIA)が発表した報告書によると、2023年には米国人の78.8%、2億4,200万人が少なくとも1つのスポーツ活動に参加し、2022年から2.2%増加することが示されています。このように、スポーツ参加者の増加が業務用芝生機器市場の成長を促進しています。

業務用芝生機器市場の主要企業は、肥料や化学物質を効率的かつ均一に広範囲に散布するスプレッダースプレーヤーなどの製品で技術を進化させています。スプレッダースプレーヤは、肥料、殺虫剤、除草剤を均一に散布すると同時に、液状の化学物質を散布して包括的にカバーするように設計された装置です。例えば、2024年3月、米国を拠点とする業務用芝生管理および芝生メンテナンス機器の専門企業であるTurfco社は、T3200スプレッダースプレーヤーを発表しました。T3200の特筆すべき点は、36インチのゲートを通過できることで、このクラスでは最大です。T-Flex15タンクと組み合わせることで、1回の充填で最大140,000平方フィートの散布が可能で、2液を同時または単独で散布できます。この機能により、芝へのダメージが軽減され、正確な位置合わせが可能になります。また、オンデマンド電動ポンプと低メンテナンス要件により、作業効率が向上します。

目次

第1章 エグゼクティブサマリー

第2章 市場の特徴

第3章 市場動向と戦略

第4章 市場- 金利、インフレ、地政学、新型コロナウイルス感染症、そして景気回復が市場に与える影響を含むマクロ経済シナリオ

第5章 世界の成長分析と戦略分析フレームワーク

- 世界の業務用芝生機器PESTEL分析(政治、社会、技術、環境、法的要因、促進要因と抑制要因)

- 最終用途産業の分析

- 世界の業務用芝生機器市場:成長率分析

- 世界の業務用芝生機器市場の実績:規模と成長, 2019-2024

- 世界の業務用芝生機器市場の予測:規模と成長, 2024-2029, 2034F

- 世界の業務用芝生機器総アドレス可能市場(TAM)

第6章 市場セグメンテーション

- 世界の業務用芝生機器市場:製品別、実績と予測, 2019-2024, 2024-2029F, 2034F

- 芝刈り機

- 芝生用トラクター

- エアレーター

- 芝生用噴霧器

- バンカーレーキ

- その他の製品

- 世界の業務用芝生機器市場:燃料タイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- ガソリン駆動

- バッテリー駆動

- 電動

- 世界の業務用芝生機器市場:エンドユーザー別、実績と予測, 2019-2024, 2024-2029F, 2034F

- スポーツ

- ゴルフ

- 世界の業務用芝生機器市場、芝刈り機のタイプ別サブセグメンテーション、実績と予測, 2019-2024, 2024-2029F, 2034F

- リール式芝刈り機

- ロータリー式芝刈り機

- ゼロターン芝刈り機

- 歩行型芝刈り機

- 世界の業務用芝生機器市場、芝刈りトラクターのタイプ別サブセグメンテーション、実績と予測, 2019-2024, 2024-2029F, 2034F

- ユーティリティトラクター

- 小型トラクター

- 特殊芝刈りトラクター

- 世界の業務用芝生機器市場、エアレーターのタイプ別サブセグメンテーション、実績と予測, 2019-2024, 2024-2029F, 2034F

- コアエアレーター

- スパイクエアレーター

- 牽引式エアレーター

- 世界の業務用芝生機器市場、芝生用噴霧器のタイプ別サブセグメンテーション、実績と予測, 2019-2024, 2024-2029F, 2034F

- バックパック式噴霧器

- 牽引式噴霧器

- スキッド式噴霧器

- 独立型噴霧器

- 世界の業務用芝生機器市場、バンカーレーキのタイプ別サブセグメンテーション、実績と予測, 2019-2024, 2024-2029F, 2034F

- 従来型バンカーレーキ

- ロボットバンカーレーキ

- ユーティリティレーキ

- 世界の業務用芝生機器市場、その他の製品のサブセグメンテーション、タイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- シーダーとオーバーシーダー

- トップドレッサ

- リーフブロワー

- 肥料散布機

第7章 地域別・国別分析

- 世界の業務用芝生機器市場:地域別、実績と予測, 2019-2024, 2024-2029F, 2034F

- 世界の業務用芝生機器市場:国別、実績と予測, 2019-2024, 2024-2029F, 2034F

第8章 アジア太平洋市場

第9章 中国市場

第10章 インド市場

第11章 日本市場

第12章 オーストラリア市場

第13章 インドネシア市場

第14章 韓国市場

第15章 西欧市場

第16章 英国市場

第17章 ドイツ市場

第18章 フランス市場

第19章 イタリア市場

第20章 スペイン市場

第21章 東欧市場

第22章 ロシア市場

第23章 北米市場

第24章 米国市場

第25章 カナダ市場

第26章 南米市場

第27章 ブラジル市場

第28章 中東市場

第29章 アフリカ市場

第30章 競合情勢と企業プロファイル

- 業務用芝生機器市場:競合情勢

- 業務用芝生機器市場:企業プロファイル

- Honda Motor Co. Overview, Products and Services, Strategy and Financial Analysis

- Deere & Company Overview, Products and Services, Strategy and Financial Analysis

- Kubota Corporation Overview, Products and Services, Strategy and Financial Analysis

- Stanley Black & Decker Inc. Overview, Products and Services, Strategy and Financial Analysis

- Textron Inc. Overview, Products and Services, Strategy and Financial Analysis

第31章 その他の大手企業と革新的企業

- Husqvarna AB

- The Toro Company

- MTD Products Inc.

- Briggs & Stratton Corporation

- Emak SpA

- STIHL Inc.

- Excel Industries Inc.

- Intimidator Group

- Schiller Grounds Care Inc.

- Smithco Inc.

- Brinly-Hardy Company

- Redexim BV

- Turfco Manufacturing Inc.

- Scag Power Equipment

- Greenman Golf & Turf Solutions

第32章 世界の市場競合ベンチマーキングとダッシュボード

第33章 主要な合併と買収

第34章 最近の市場動向

第35章 市場の潜在力が高い国、セグメント、戦略

- 業務用芝生機器市場2029:新たな機会を提供する国

- 業務用芝生機器市場2029:新たな機会を提供するセグメント

- 業務用芝生機器市場2029:成長戦略

- 市場動向に基づく戦略

- 競合の戦略

第36章 付録

Commercial turf equipment consists of machinery and tools designed for maintaining and managing large grass and turf areas in professional environments such as sports fields, golf courses, parks, and commercial landscapes. Engineered for heavy-duty use, this equipment features advanced technology and durability, providing increased efficiency, precision, and reliability to meet the demanding needs of commercial applications.

The primary products in commercial turf equipment include mowers, turf tractors, aerators, turf sprayers, bunker rakes, and others. Mowers are machines used to cut grass to a consistent height, making them crucial for maintaining lawns and landscapes. They can be gas-powered, battery-powered, or electric-powered and are utilized by various end-users, including those in sports and golf.

The commercial turf equipment market research report is one of a series of new reports from The Business Research Company that provides commercial turf equipment market statistics, including commercial turf equipment industry global market size, regional shares, competitors with a commercial turf equipment market share, detailed commercial turf equipment market segments, market trends and opportunities, and any further data you may need to thrive in the commercial turf equipment industry. This commercial turf equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The commercial turf equipment market size has grown strongly in recent years. It will grow from $6.53 $ billion in 2024 to $6.91 $ billion in 2025 at a compound annual growth rate (CAGR) of 5.8%. The growth in the historic period can be attributed to a rise in disposable income, growth in the parks and recreation sector, economic growth, increasing property values, and expansion of sports leagues.

The commercial turf equipment market size is expected to see strong growth in the next few years. It will grow to $8.56 $ billion in 2029 at a compound annual growth rate (CAGR) of 5.5%. The growth in the forecast period can be attributed to increasing commercial landscaping projects, rising urbanization, growth of golf courses and recreational facilities, growing awareness of turf health, and increase in sports facilities. Major trends in the forecast period include innovations such as GPS and autonomous systems, innovations in turf technology, demand for sustainable practices, demand for professional turf management services, and adoption of smart equipment.

The growing participation in sports activities is anticipated to drive the expansion of the commercial turf equipment market in the future. This rise in participation is attributed to heightened awareness of health benefits, improved access to facilities, and a stronger focus on fitness and well-being in society. Commercial turf equipment is essential for maintaining high-quality playing surfaces, ensuring optimal performance, safety, and durability during games and practices. For example, a report published by the Sports and Fitness Industry Association (SFIA), a US-based nonprofit organization, indicated that 78.8% of Americans, or 242 million people, participated in at least one sports activity in 2023, reflecting a 2.2% increase from 2022. Thus, the increase in sports participation is propelling the growth of the commercial turf equipment market.

Leading companies in the commercial turf equipment market are advancing technology with products such as spreader sprayers, which provide efficient and uniform application of fertilizers and chemicals over large areas. A spreader sprayer is a device designed to evenly distribute fertilizers, pesticides, or herbicides while simultaneously spraying liquid chemicals for comprehensive coverage. For instance, in March 2024, Turfco, a US-based company specializing in commercial lawn care and turf maintenance equipment, introduced the T3200 spreader sprayer. The T3200 is notable for its ability to fit through a 36-inch gate and is the largest in its class. It can be paired with the T-Flex15 tank to cover up to 140,000 square feet per fill and offers the capability to spray two liquids either simultaneously or independently. This feature reduces turf damage and ensures precise alignment, while the on-demand electric pump and low maintenance requirements enhance its operational efficiency.

In January 2022, The Toro Company, a US-based manufacturer of lawnmowers, acquired Intimidator Group for $400 million. This acquisition is intended to bolster The Toro Company's presence in the expanding zero-turn mower market, enhance its product portfolio, and leverage technological and manufacturing efficiencies for future growth. Intimidator Group, also based in the US, specializes in the design and manufacture of commercial turf equipment.

Major companies operating in the commercial turf equipment market are Honda Motor Co., Deere & Company, Kubota Corporation, Stanley Black & Decker Inc., Textron Inc., Husqvarna AB, The Toro Company, MTD Products Inc., Briggs & Stratton Corporation, Emak SpA, STIHL Inc., Excel Industries Inc., Intimidator Group, Schiller Grounds Care Inc., Smithco Inc., Brinly-Hardy Company, Redexim BV, Turfco Manufacturing Inc., Scag Power Equipment, Greenman Golf & Turf Solutions, Protea Machines, Tru-Turf Pty Ltd., Turbo Technologies Inc., TurfTime Equipment LLC, Weibang

North America was the largest region in the commercial turf equipment market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the commercial turf equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the commercial turf equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The commercial turf equipment market consists of sales of sod cutters, trimmers and edgers, blowers, and field groomers. Values in this market are 'factory gate' values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

Commercial Turf Equipment Global Market Report 2025 from The Business Research Company provides strategists, marketers and senior management with the critical information they need to assess the market.

This report focuses on commercial turf equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you within 2-3 working days of order along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Where is the largest and fastest growing market for commercial turf equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The commercial turf equipment market global report from the Business Research Company answers all these questions and many more.

The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market's historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

- Markets Covered:1) By Products: Mowers; Turf Tractors; Aerators; Turf Sprayers; Bunker Rakes; Other Products

- 2) By Fuel Type: Gas-Powered; Battery-Powered; Electric-Powered

- 3) By End-User: Sports; Golf

- Subsegments:

- 1) By Mowers: Reel Mowers; Rotary Mowers; Zero-Turn Mowers; Walk-Behind Mowers

- 2) By Turf Tractors: Utility Tractors; Compact Tractors; Specialty Turf Tractors

- 3) By Aerators: Core Aerators; Spike Aerators; Tow-Behind Aerators

- 4) By Turf Sprayers: Backpack Sprayers; Tow-Behind Sprayers; Skid Sprayers; Stand-Alone Sprayers

- 5) By Bunker Rakes: Conventional Bunker Rakes; Robotic Bunker Rakes; Utility Rakes

- 6) By Other Products: Seeders and Overseeders; Topdressers; Leaf Blowers; Fertilizer Spreaders

- Companies Mentioned: Honda Motor Co.; Deere & Company; Kubota Corporation; Stanley Black & Decker Inc.; Textron Inc.

- Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita,

- Data segmentations: country and regional historic and forecast data, market share of competitors, market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

- Delivery format: PDF, Word and Excel Data Dashboard.

Table of Contents

1. Executive Summary

2. Commercial Turf Equipment Market Characteristics

3. Commercial Turf Equipment Market Trends And Strategies

4. Commercial Turf Equipment Market - Macro Economic Scenario Including The Impact Of Interest Rates, Inflation, Geopolitics, Covid And Recovery On The Market

5. Global Commercial Turf Equipment Growth Analysis And Strategic Analysis Framework

- 5.1. Global Commercial Turf Equipment PESTEL Analysis (Political, Social, Technological, Environmental and Legal Factors, Drivers and Restraints)

- 5.2. Analysis Of End Use Industries

- 5.3. Global Commercial Turf Equipment Market Growth Rate Analysis

- 5.4. Global Commercial Turf Equipment Historic Market Size and Growth, 2019 - 2024, Value ($ Billion)

- 5.5. Global Commercial Turf Equipment Forecast Market Size and Growth, 2024 - 2029, 2034F, Value ($ Billion)

- 5.6. Global Commercial Turf Equipment Total Addressable Market (TAM)

6. Commercial Turf Equipment Market Segmentation

- 6.1. Global Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Mowers

- Turf Tractors

- Aerators

- Turf Sprayers

- Bunker Rakes

- Other Products

- 6.2. Global Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Gas-Powered

- Battery-Powered

- Electric-Powered

- 6.3. Global Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Sports

- Golf

- 6.4. Global Commercial Turf Equipment Market, Sub-Segmentation Of Mowers, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Reel Mowers

- Rotary Mowers

- Zero-Turn Mowers

- Walk-Behind Mowers

- 6.5. Global Commercial Turf Equipment Market, Sub-Segmentation Of Turf Tractors, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Utility Tractors

- Compact Tractors

- Specialty Turf Tractors

- 6.6. Global Commercial Turf Equipment Market, Sub-Segmentation Of Aerators, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Core Aerators

- Spike Aerators

- Tow-Behind Aerators

- 6.7. Global Commercial Turf Equipment Market, Sub-Segmentation Of Turf Sprayers, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Backpack Sprayers

- Tow-Behind Sprayers

- Skid Sprayers

- Stand-Alone Sprayers

- 6.8. Global Commercial Turf Equipment Market, Sub-Segmentation Of Bunker Rakes, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Conventional Bunker Rakes

- Robotic Bunker Rakes

- Utility Rakes

- 6.9. Global Commercial Turf Equipment Market, Sub-Segmentation Of Other Products, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Seeders and Overseeders

- Topdressers

- Leaf Blowers

- Fertilizer Spreaders

7. Commercial Turf Equipment Market Regional And Country Analysis

- 7.1. Global Commercial Turf Equipment Market, Split By Region, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 7.2. Global Commercial Turf Equipment Market, Split By Country, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

8. Asia-Pacific Commercial Turf Equipment Market

- 8.1. Asia-Pacific Commercial Turf Equipment Market Overview

- Region Information, Market Information, Background Information, Government Initiatives, Regulations, Regulatory Bodies, Major Associations, Taxes Levied, Corporate Tax Structure, Investments, Major Companies

- 8.2. Asia-Pacific Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 8.3. Asia-Pacific Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 8.4. Asia-Pacific Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

9. China Commercial Turf Equipment Market

- 9.1. China Commercial Turf Equipment Market Overview

- 9.2. China Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F,$ Billion

- 9.3. China Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F,$ Billion

- 9.4. China Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F,$ Billion

10. India Commercial Turf Equipment Market

- 10.1. India Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 10.2. India Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 10.3. India Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

11. Japan Commercial Turf Equipment Market

- 11.1. Japan Commercial Turf Equipment Market Overview

- 11.2. Japan Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 11.3. Japan Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 11.4. Japan Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

12. Australia Commercial Turf Equipment Market

- 12.1. Australia Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 12.2. Australia Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 12.3. Australia Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

13. Indonesia Commercial Turf Equipment Market

- 13.1. Indonesia Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 13.2. Indonesia Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 13.3. Indonesia Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

14. South Korea Commercial Turf Equipment Market

- 14.1. South Korea Commercial Turf Equipment Market Overview

- 14.2. South Korea Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 14.3. South Korea Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 14.4. South Korea Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

15. Western Europe Commercial Turf Equipment Market

- 15.1. Western Europe Commercial Turf Equipment Market Overview

- 15.2. Western Europe Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 15.3. Western Europe Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 15.4. Western Europe Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

16. UK Commercial Turf Equipment Market

- 16.1. UK Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 16.2. UK Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 16.3. UK Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

17. Germany Commercial Turf Equipment Market

- 17.1. Germany Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 17.2. Germany Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 17.3. Germany Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

18. France Commercial Turf Equipment Market

- 18.1. France Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 18.2. France Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 18.3. France Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

19. Italy Commercial Turf Equipment Market

- 19.1. Italy Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 19.2. Italy Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 19.3. Italy Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

20. Spain Commercial Turf Equipment Market

- 20.1. Spain Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 20.2. Spain Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 20.3. Spain Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

21. Eastern Europe Commercial Turf Equipment Market

- 21.1. Eastern Europe Commercial Turf Equipment Market Overview

- 21.2. Eastern Europe Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 21.3. Eastern Europe Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 21.4. Eastern Europe Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

22. Russia Commercial Turf Equipment Market

- 22.1. Russia Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 22.2. Russia Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 22.3. Russia Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

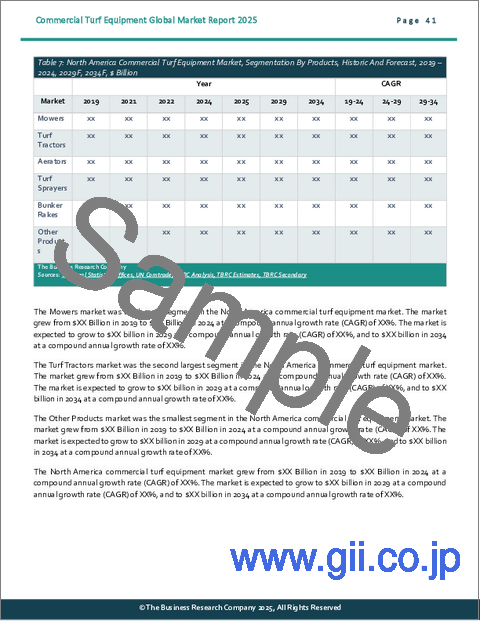

23. North America Commercial Turf Equipment Market

- 23.1. North America Commercial Turf Equipment Market Overview

- 23.2. North America Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 23.3. North America Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 23.4. North America Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

24. USA Commercial Turf Equipment Market

- 24.1. USA Commercial Turf Equipment Market Overview

- 24.2. USA Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 24.3. USA Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 24.4. USA Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

25. Canada Commercial Turf Equipment Market

- 25.1. Canada Commercial Turf Equipment Market Overview

- 25.2. Canada Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 25.3. Canada Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 25.4. Canada Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

26. South America Commercial Turf Equipment Market

- 26.1. South America Commercial Turf Equipment Market Overview

- 26.2. South America Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 26.3. South America Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 26.4. South America Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

27. Brazil Commercial Turf Equipment Market

- 27.1. Brazil Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 27.2. Brazil Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 27.3. Brazil Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

28. Middle East Commercial Turf Equipment Market

- 28.1. Middle East Commercial Turf Equipment Market Overview

- 28.2. Middle East Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 28.3. Middle East Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 28.4. Middle East Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

29. Africa Commercial Turf Equipment Market

- 29.1. Africa Commercial Turf Equipment Market Overview

- 29.2. Africa Commercial Turf Equipment Market, Segmentation By Products, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 29.3. Africa Commercial Turf Equipment Market, Segmentation By Fuel Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 29.4. Africa Commercial Turf Equipment Market, Segmentation By End-User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

30. Commercial Turf Equipment Market Competitive Landscape And Company Profiles

- 30.1. Commercial Turf Equipment Market Competitive Landscape

- 30.2. Commercial Turf Equipment Market Company Profiles

- 30.2.1. Honda Motor Co. Overview, Products and Services, Strategy and Financial Analysis

- 30.2.2. Deere & Company Overview, Products and Services, Strategy and Financial Analysis

- 30.2.3. Kubota Corporation Overview, Products and Services, Strategy and Financial Analysis

- 30.2.4. Stanley Black & Decker Inc. Overview, Products and Services, Strategy and Financial Analysis

- 30.2.5. Textron Inc. Overview, Products and Services, Strategy and Financial Analysis

31. Commercial Turf Equipment Market Other Major And Innovative Companies

- 31.1. Husqvarna AB

- 31.2. The Toro Company

- 31.3. MTD Products Inc.

- 31.4. Briggs & Stratton Corporation

- 31.5. Emak SpA

- 31.6. STIHL Inc.

- 31.7. Excel Industries Inc.

- 31.8. Intimidator Group

- 31.9. Schiller Grounds Care Inc.

- 31.10. Smithco Inc.

- 31.11. Brinly-Hardy Company

- 31.12. Redexim BV

- 31.13. Turfco Manufacturing Inc.

- 31.14. Scag Power Equipment

- 31.15. Greenman Golf & Turf Solutions

32. Global Commercial Turf Equipment Market Competitive Benchmarking And Dashboard

33. Key Mergers And Acquisitions In The Commercial Turf Equipment Market

34. Recent Developments In The Commercial Turf Equipment Market

35. Commercial Turf Equipment Market High Potential Countries, Segments and Strategies

- 35.1 Commercial Turf Equipment Market In 2029 - Countries Offering Most New Opportunities

- 35.2 Commercial Turf Equipment Market In 2029 - Segments Offering Most New Opportunities

- 35.3 Commercial Turf Equipment Market In 2029 - Growth Strategies

- 35.3.1 Market Trend Based Strategies

- 35.3.2 Competitor Strategies

36. Appendix

- 36.1. Abbreviations

- 36.2. Currencies

- 36.3. Historic And Forecast Inflation Rates

- 36.4. Research Inquiries

- 36.5. The Business Research Company

- 36.6. Copyright And Disclaimer