|

|

市場調査レポート

商品コード

1741564

LIBの主要4材料の市場とSCMの分析<2025.H1> LIB 4 Major Materials Market and SCM Analysis |

||||||

|

|||||||

| LIBの主要4材料の市場とSCMの分析 |

|

出版日: 2025年05月09日

発行: SNE Research

ページ情報: 英文 174 Pages

納期: お問合せ

|

全表示

- 概要

- 目次

市場規模と成長率

2024年前半のLIB市場は、出荷数ベースで前年同期比約23%成長し、パック金額ベースで約515億米ドルの市場規模に達しました。EV需要の伸びが鈍化する一方で、再生可能エネルギー向けエネルギー貯蔵システム(ESS)の拡大が重要な促進要因として浮上しました。

主な市場動向

主要企業は生産能力の拡大と技術革新の推進に引き続き注力しており、特に高電圧・高エネルギー密度電池と急速充電技術が注目を集めています。コスト削減と価格競争力向上の要求に応えるため、コスト効率の高いLFP電池の採用が増加しました。CATLなどの主要企業もLMFPのような代替品を開発し、LFPの弱点を補う活動をしました。

さらに、急速充電と高性能電池技術の急速な進歩が見られ、2025年後半には4680セルを使用したコストと熱安定性の改良された電池の商業的発売が予測されています。

主要LIBメーカーの状況

EV/ESS部門における韓国電池メーカー上位3社(LG Energy Solution、Samsung SDI、SK on)の合計M/Sは2024年に15.6%(207GWh)に低下し、前年から8ポイント低下しました。2023年、合計252GWhで全体1,050GWhの24%を占めていました。M/Sは前年比8ポイント減少し、総出荷数は17.8%減少しました。

LG Energy Solutionは前年同期比6%減の128GWhで、世界第3位となっています。Samsung SDIは17%減の48GWhで4位から7位に転落しました。SK onは前年同期比46%減の31GWhともっとも激しく落ち込みました。

中国のCATLは前年同期比24%増の474GWhで圧倒的な1位を維持しました。BYDは、EVの売上が400万台を超えたことにより、前年同期比23%増の192GWhで続きました。EVEは92.8%増の5,000万Whを超えるESSの出荷により、80.4GWhで4位に急浮上しました。CALBは64GWh(52%増)で5位に浮上し、Guoxuan(50GWh、61%増)が6位、Sunwoda(34GWh、125%増)が9位にランクインしました。

日本企業で唯一トップ10に入ったPanasonicは、2024年に42GWhを記録し、前年比5%減で5位から8位に転落しました。

世界市場の変化と見通し

米国ではIRAが、欧州ではCritical Raw Materials Actが施行され、これらの地域の電池市場は急速に拡大すると予測されます。これに呼応して、韓国、中国、日本の電池メーカーが現地投資を加速しており、それに伴って主要4材料メーカーが単独または合弁で市場に参入しています。世界の自動車メーカーとの直接供給契約も浮上しています。今後、これらの地域で早期に足場を築くことに成功した材料サプライヤーは、産業の競合情勢を再構築する上で重要な役割を果たすとみられます。

当レポートでは、世界のLIB市場について調査分析し、主要4材料(正極、負極、電解質、セパレーター)の市場動向とサプライチェーンの状況に関する情報を提供しています。

目次

第1章 EV/LIBの市場力学

- 世界のEV/LIB市場のレビューと予測

- 主要LIBメーカーのバッテリー(xEV/ESS)出荷数(2024年)

- LIB企業の出荷数の動向と予測:年別

- 主要LIB企業の稼働率の動向

- EVの中長期的市場見通し(~2035年)

- ESSの中長期的市場見通し(~2035年)

- 世界のバッテリー需給の見通し

- 北米/欧州のバッテリー需給の見通し

- (参考)バッテリー使用と出荷数の比較

- (参考)主要4材料の使用ロジック

第2章 正極市場のレビューと予測

- 正極需要の動向

- 正極需要の動向:化学タイプ別(2023年~2024年)

- 正極需要の動向:地域別(2023年~2024年)

- 正極需要の動向:用途別(2023年~2024年)

- 正極消費の動向:セルメーカー別

- 正極消費の予測

- 正極メーカーの市場シェア

- 正極の市場シェア:メーカー別

- 正極の市場シェア:メーカー別(2024年)

- 正極の市場シェア:メーカー別(2025年)

- 正極市場のSCM - 三元系/LFP(2024年)

- 正極市場のSCM - 三元系/LFP(2025年)

- 正極市場の予測(中長期)

- 正極需要の予測:地域別、化学別(2023年~2035年)

- 正極生産能力の予測(2023年~2035年)

- 正極材料の価格動向

- 正極の価格動向:タイプ別(2020年第1四半期~2025年第1四半期)

- 正極前駆体の価格動向:タイプ別

- バッテリーメタルの価格動向:タイプ別

- 主要正極メーカーの動向

第3章 負極市場のレビューと予測

- 世界の負極市場のレビューと予測

- 負極需要の動向

- 負極需要の動向:化学タイプ別(2023年~2024年)

- 負極需要の動向:地域別(2023年~2024年)

- 負極需要の動向:用途別(2023年~2024年)

- 負極消費の動向:セルメーカー別

- 負極消費の予測

- 負極メーカーの市場シェア

- 負極の市場シェア:メーカー別

- 負極の市場シェア:メーカー別(2024年)

- 負極の市場シェア:メーカー別(2025年)

- 負極市場のSCM - NG/AG/Si負極(2024年)

- 負極市場のSCM - NG/AG/Si負極(2025年)

- 負極市場の予測(中長期)

- 負極需要の予測:地域別、化学別(2023年~2035年)

- 負極生産能力の予測(2023年~2035年)

- 負極と材料の価格動向

- グラファイト負極の価格動向:タイプ別(2020年第1四半期~2025年第1四半期)

- 負極原材料の価格動向:タイプ別

- 主要負極メーカーの動向

第4章 セパレーター市場のレビューと予測

- 世界のセパレーター市場のレビューと予測

- セパレーター需要の動向

- セパレーター需要の動向:タイプ別(2023年~2024年)

- セパレーター需要の動向:地域別(2023年~2024年)

- セパレーター需要の動向:用途別(2023年~2024年)

- セパレーター消費の動向:セルメーカー別

- セパレーター消費の予測

- セパレーターメーカーの市場シェア

- セパレーターの市場シェア:メーカー別

- セパレーターの市場シェア:メーカー別(2024年)

- セパレーターの市場シェア:メーカー別(2025年)

- セパレーター市場のSCM-EV/ESS/CE(2024年)

- セパレーター市場のSCM-EV/ESS/CE(2025年)

- セパレーター市場の予測(中長期)

- セパレーター需要の予測(2023年~2035年)

- セパレーター生産能力の予測(2023年~2035年)

- セパレーターの価格動向

- セパレーターの価格動向:タイプ別(2020年第1四半期~2025年第1四半期)

- 主要セパレーターメーカーの動向

第5章 電解質市場のレビューと予測

- 世界の電解質市場のレビューと予測

- 電解質需要の動向

- 電解質需要の動向:電池種別(2023年~2024年)

- 電解質需要の動向:地域別(2023年~2024年)

- 電解質需要の動向:用途別(2023年~2024年)

- 電解質消費の動向:セルメーカー別

- 電解質消費の予測

- 電解質メーカーの市場シェア

- 電解質の市場シェア:メーカー別

- 電解質の市場シェア:メーカー別(2024年)

- 電解質の市場シェア:メーカー別(2025年)

- 電解質市場のSCM(2024年)

- 電解質市場のSCM(2025年)

- 電解質市場の予測(中長期)

- 電解質需要の予測(2023年~2035年)

- 電解質生産能力の予測(2023年~2035年)

- 電解質と材料の価格動向

- 電解質の価格動向:タイプ別(2020年第1四半期~2025年第1四半期)

- 溶剤の価格動向:タイプ別(2020年第1四半期~2025年第1四半期)

- リチウム塩の価格動向(2020年第1四半期~2025年第1四半期)

- 添加剤の価格動向(2020年第1四半期~2025年第1四半期)

- 主要電解質メーカーの動向

1. Introduction

Report Overview

This report aims to analyze the lithium-ion battery (LIB) market and supply chain management (SCM) trends for each half of 2024 (H1/H2), and to comprehensively review the market trends of the four key materials-cathode, anode, electrolyte, and separator-for the first half of 2025.

Overview of Lithium-ion Batteries (LIB)

LIBs are widely used energy storage devices across various sectors such as portable electronics, electric vehicles (EVs), and energy storage systems (ESS). The key components of LIBs are cathode, anode, electrolyte, and separator. The quality and performance of these four major materials directly determine the efficiency and lifespan of the battery.

Importance of the 4 Major Materials

The cathode, anode, electrolyte, and separator each play a critical role in lithium-ion storage and movement, electrical characteristics, and safety. The performance and cost of a battery vary depending on the composition and properties of each material. Therefore, understanding market trends and supply chain conditions of these materials is essential for developing successful strategies in the LIB industry.

2. LIB Market Overview in 2024

Market Size and Growth Rate

In the first half of 2024, the LIB market grew approximately 23% YoY in terms of shipments, reaching a market size of around USD 51.5 billion based on pack value. While growth in EV demand slowed, the expansion of energy storage systems (ESS) for renewable energy emerged as a key growth driver.

Key Market Trends

Major players continued to focus on expanding production capacity and driving technological innovation, with high-voltage, high-energy-density batteries and fast-charging technologies drawing particular attention. In response to demands for cost reduction and improved price competitiveness, the adoption of cost-effective LFP batteries increased. Leading companies such as CATL also made efforts to offset LFP's weaknesses by developing alternatives like LMFP.

Additionally, rapid progress in fast-charging and high-performance battery technologies was observed, with expectations for the commercial launch of improved cost and thermal stability batteries using 4680 cells in the second half of 2025.

Status of Major LIB Manufacturers

The combined M/S of Korea's top three battery manufacturers (LG Energy Solution, Samsung SDI, SK on) in the EV/ESS sector dropped to 15.6% (207GWh) in 2024, down 8 percentage points from the previous year. In 2023, they accounted for 24% of the total 1,050GWh with a combined volume of 252GWh. The M/S decreased by 8 percentage points YoY, while total shipments fell by 17.8%.

LG Energy Solution posted a 6% decline YoY to 128GWh, ranking 3rd globally. Samsung SDI saw a 17% drop to 48GWh, falling from 4th to 7th place. SK on experienced the sharpest decline, dropping 46% YoY to 31GWh and falling to 10th place, largely due to delayed EV OEM orders.

China's CATL maintained its dominant No. 1 position with 24% YoY growth, reaching 474GWh. BYD followed with 192GWh, up 23% YoY, backed by EV sales exceeding 4 million units. EVE surged to 4th place with 80.4GWh, driven by over 50GWh in ESS shipments-a 92.8% increase. CALB rose to 5th with 64GWh (52% growth), while Guoxuan (50GWh, +61%) and Sunwoda (34GWh, +125%) ranked 6th and 9th, respectively.

Panasonic, the only Japanese company in the Top 10, recorded 42GWh in 2024, falling from 5th to 8th with a 5% YoY decline.

Changes and Outlook in the Global Market

With the implementation of the IRA in the U.S. and the Critical Raw Materials Act in Europe, the battery markets in these regions are expected to expand rapidly. In response, Korean, Chinese, and Japanese battery manufacturers are accelerating local investments, accompanied by 4 major materials suppliers either entering the market independently or through joint ventures. Direct supply contracts with global automotive OEMs are also emerging. Going forward, materials suppliers that successfully establish an early foothold in these regions are likely to play a key role in reshaping the industry's competitive landscape.

3. Report Contents

Detailed Analysis of the 2024 LIB and 4 Major Materials Markets

The first section provides an overview of the downstream LIB markets from Q1 2023 to Q1 2024, along with annual and mid-to-long-term outlooks. It includes SNE's insights into the global LIB markets by region and application-covering consumer electronics (CE), electric vehicles (xEVs), and energy storage systems (ESS)-as well as the 2025 annual forecast.

The second section offers an in-depth analysis of key LIB materials manufacturers in Korea, China, and Japan. It covers production capacities and supply volumes of major global companies, as well as detailed supply chain (SCM) structures for each material. Additionally, it examines pricing trends of major materials and raw materials from 2020 to Q1 2024, and provides market outlooks for 2024 and 2025.

The final section breaks down major material suppliers by country (Korea, China, Japan), reviewing their business history, current status, and product offerings. It also includes a comprehensive review of the Top 10 leading companies for each material.

4. Strong Points of This Report

(1) Insight into Recent Market Trends:

The report provides a comprehensive overview of global market trends and key developments in the LIB 4 major materials sector, including demand patterns and supplier performance. It offers in-depth analysis by material type, region, and application.

(2) Supplier and Demand-Side Analysis:

Detailed data is provided on supply status by major LIB material suppliers and demand by cell manufacturers. It also includes price trends and annual forecasts for each material, along with quarterly updates on leading Korean, Chinese, and Japanese producers. Readers can also review supplier rankings and product-specific standings over the past three years.

(3) SCM Overview:

Provides an overview of major LIB manufacturers' supply chains for the 4 major materials.

(4) Analysis of Material Usage Trends:

Details quarterly changes in material usage by key LIB makers from Q1 2023 to Q1 2025.

(5) 2025 Outlook and Mid-to-Long-Term Forecast Through 2035:

Based on 2023-2024 performance data, offers a 2025 market outlook and long-term forecasts through 2035 to support procurement strategies.

This report is published semiannually to provide a comprehensive understanding of the lithium-ion battery and 4 major materials markets, and is expected to serve as a key reference for future market forecasting.

Table of Contents

1. EV / LIB Market Dynamics

- Global EV/LIB Market Review & Forecast

- 1.1. Major LIB Companies Battery (xEV/ESS) Shipments in 2024

- 1.2. Trend and forecast of LIB company shipments by year (Shipment)

- 1.3. Trends in major LIB companies' utilization rates

- 1.4. EV mid- to long-term market outlook (~2035)

- 1.5. ESS mid- to long-term market outlook (~2035)

- 1.6. Global Battery Supply and Demand Outlook

- 1.7. North America/Europe Battery Supply and Demand Outlook

- (Reference) Battery Usage vs. Shipment Volume

- (Reference) Usage Logic of the Four Major Materials

2. Cathode Market Review & Forecast

- 2.1. Cathode Demand Trends

- 2.1.1. Cathode Demand Trends by Chemical type ('23 ~ '24)

- 2.1.2. Cathode Demand Trends by Region ('23 ~ '24)

- 2.1.3. Cathode Demand Trends by Application ('23 ~ '24)

- 2.1.4. Cathode Consumption Trends by Cell makers

- 2.1.5. Cathode Consumption Forecast

- 2.2. Cathode Manufacturers Market Share

- 2.2.1. Cathode Market Share by Manufacturers

- 2.2.2. Cathode Market Share by Manufacturers (2024)

- 2.2.3. Cathode Market Share by Manufacturers (2025F)

- 2.3. Cathode Market SCM (2024) - Ternary / LFP

- 2.3. Cathode Market SCM (2025F) - Ternary / LFP

- 2.4. Cathode Market Forecast (Mid-to-Long term)

- 2.4.1. Cathode Demand Forecast ('23 ~ '35) by Region / Chem.

- 2.4.2. Cathode Production Capacity Forecast ('23 ~'35)

- 2.5. Cathode & Materials Price Trends

- 2.5.1. Cathode Price Trends by Type ('20.1Q ~'25.1Q)

- 2.5.2. Cathode Precursor Price Trends by Type

- 2.5.3. Battery Metal Price Trends by Type

- 2.6. Major Cathode Manufacturers Trends

3. Anode Market Review & Forecast

- Global Anode Market Review & Forecast

- 3.1. Anode Demand Trends

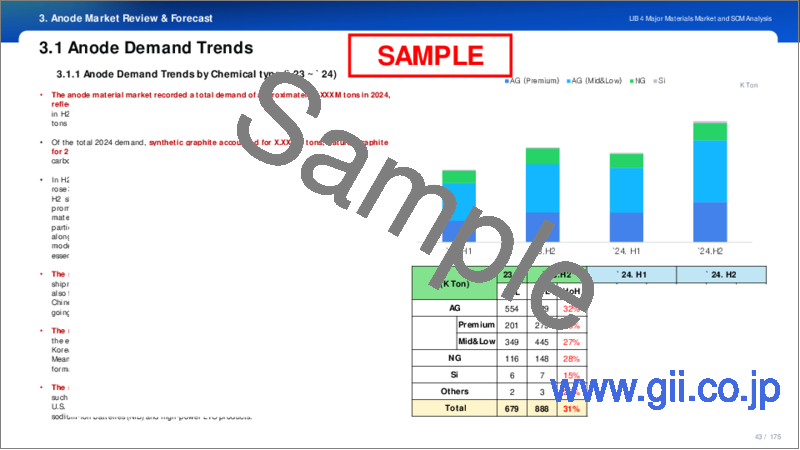

- 3.1.1. Anode Demand Trends by Chemical type ('23 ~ '24)

- 3.1.2. Anode Demand Trends by Region ('23 ~ '24)

- 3.1.3. Anode Demand Trends by Application ('23 ~ '24)

- 3.1.4. Anode Consumption Trends by Cell Makers

- 3.1.5. Anode Consumption Forecast

- 3.2. Anode Manufacturers Market Share

- 3.2.1. Anode Market Share by Manufacturers

- 3.2.2. Anode Market Share by Manufacturers (2024)

- 3.2.3. Anode Market Share by Manufacturers (2025F)

- 3.3. Anode Market SCM (2024) - NG / AG / Si anode

- 3.3. Anode Market SCM (2025F) - NG / AG / Si anode

- 3.4. Anode Market Forecast (Mid-to-Long term)

- 3.4.1. Anode Demand Forecast ('23 ~ '35) by Region / Chem

- 3.4.2. Anode Production Capacity Forecast ('23 ~'35)

- 3.5. Anode & Materials Price Trends

- 3.5.1. Graphite Anode Price Trends by Type ('20.1Q ~'25.1Q)

- 3.5.2. Anode Raw materials Price Trends by Type

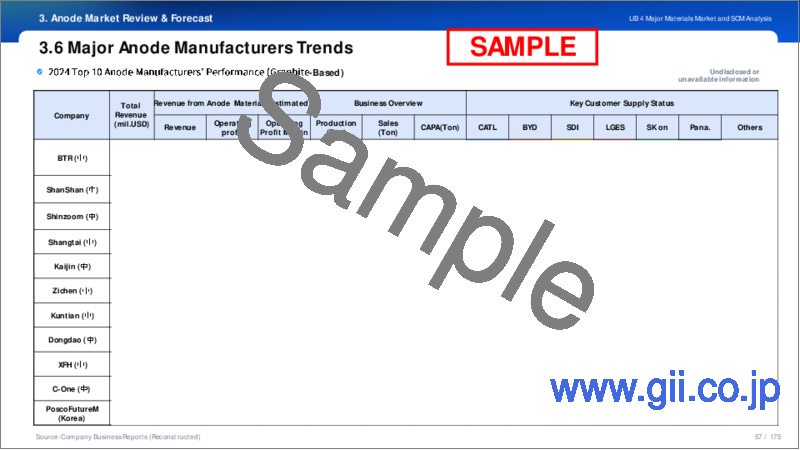

- 3.6. Major Anode Manufacturers Trends

4. Separator Market Review & Forecast

- Global Separator Market Review & Forecast

- 4.1Separator Demand Trends

- 4.1.1. Separator Demand Trends by Type ('23 ~ '24)

- 4.1.2. Separator Demand Trends by Region ('23 ~ '24)

- 4.1.3. Separator Demand Trends by Application ('23 ~ '24)

- 4.1.4. Separator Consumption Trends by Cell makers

- 4.1.5. Separator Consumption Forecast

- 4.2. Separator Manufacturers Market Share

- 4.2.1. Separator Market Share by Manufacturers

- 4.2.2. Separator Market Share by Manufacturers (2024)

- 4.2.3. Separator Market Share by Manufacturers (2025F)

- 4.3. Separator Market SCM (2024) - EV / ESS / CE

- 4.3. Separator Market SCM (2025F) - EV / ESS / CE

- 4.4. Separator Market Forecast (Mid-to-Long term)

- 4.4.1. Separator Demand Forecast ('23 ~'35)

- 4.4.2. Separator Production Capacity Forecast ('23 ~'35)

- 4.5. Separator Price Trends

- 4.5.1. Separator Price Trends by Type ('20.1Q ~'25.1Q)

- 4.6. Major Separator Manufacturers Trends

5. Electrolyte Market Review & Forecast

- Global Electrolyte Market Review & Forecast

- 5.1. Electrolyte Demand Trends

- 5.1.1. Electrolyte Demand Trends by Battery type ('23 ~ '24)

- 5.1.2. Electrolyte Demand Trends by Region ('23 ~ '24)

- 5.1.3. Electrolyte Demand Trends by Application ('23 ~ '24)

- 5.1.4. Electrolyte Consumption Trends by Cell makers

- 5.1.5. Electrolyte Consumption Forecast

- 5.2. Electrolyte Manufacturers Market Share

- 5.2.1. Electrolyte Market Share by Manufacturers

- 5.2.2. Electrolyte Market Share by Manufacturers (2024)

- 5.2.3. Electrolyte Market Share by Manufacturers (2025F)

- 5.3. Electrolyte Market SCM (2024)

- 5.3. Electrolyte Market SCM (2025F)

- 5.4. Electrolyte Market Forecast (Mid-to-Long term)

- 5.4.1. Electrolyte Demand Forecast ('23 ~'35)

- 5.4.2. Electrolyte Production Capacity Forecast ('23 ~'35)

- 5.5. Electrolyte & Materials Price Trends

- 5.5.1. Electrolyte Price Trends by Type ('20.1Q ~'25.1Q)

- 5.5.2. Solvents Price Trends by Type ('20.1Q ~'25.1Q)

- 5.5.3. Lithium Salts Price Trends ('20.1Q ~'25.1Q)

- 5.5.4. Additives Price Trends ('20.1Q ~'25.1Q)

- 5.6. Major Electrolyte Manufacturers Trends