|

|

市場調査レポート

商品コード

1718483

ドライプロセス電極の特許分析と技術動向<2025> Dry-process Electrode Patents Analysis & Technology Trends |

||||||

|

|||||||

| ドライプロセス電極の特許分析と技術動向 |

|

出版日: 2025年05月22日

発行: SNE Research

ページ情報: 英文 205 Pages

納期: お問合せ

|

全表示

- 概要

- 目次

概要

- ドライ電極は、VOCの削減、処理時間の短縮、エネルギー密度の向上といった魅力的な恩恵をもたらす一方で、Teslaのような主要企業が重要な特許を確保しているため、後発企業が差別化なしに技術を導入することは困難です。

- したがって、プロセスの導入や新材料の研究開発を進める際には、既存の特許を技術的に評価し、設計段階で戦略的方向性を確立することが不可欠です。

当レポートでは、ドライ電極市場について調査し、導入に向けた実践的な検討、共同研究戦略、潜在的な用途を含む多角的な分析を提供しています。

目次

第1章 ドライ電極技術の概要

- ドライ電極開発の背景

- ドライプロセスとウェットプロセスの違い

- ドライ電極製造プロセス

第2章 ドライ電極におけるPTFEバインダーの利用

- PTFE(ポリテトラフルオロエチレン)の化学的/物理的性質

- PTFEの繊維メカニズム

- 従来のPVDFバインダーとの比較

第3章 Teslaのドライ電極特許の現状

- Maxwellのウルトラキャパシタ向けコアドライプロセス技術

- Maxwell Technologiesの特許ポートフォリオ

- Maxwell Technologiesのドライ電極特許の検索結果

- Maxwellの特許ポートフォリオの分析

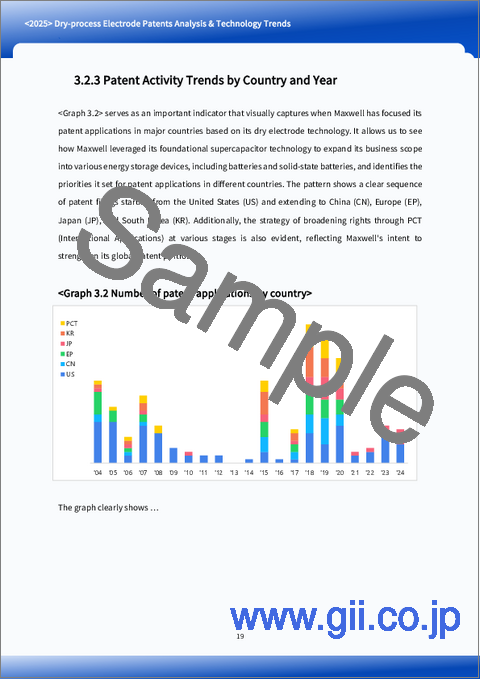

- 特許動向:国別、年別

- 特許動向:年別、技術テーマ別

- 出願シェア:国別、技術テーマ別

- TeslaによるMaxwellの買収と重要な特許の継承

第4章 Maxwell(Tesla)のドライ電極特許の特徴と強み

- 主な請求の技術的構成

- 技術的差別化要因と開発の制約

- 実際の産業利用に対する影響

- 公開特許における技術的説明の例

- ドライ電極からリチウムイオンバッテリーへの移行

第5章 ドライプロセスとその詳細な要素

- 粉末混合(活物質、導電剤、PTFE)段階

- プレス前段階

- ロールプレスとラミネート

- 後処理(熱処理、追加カレンダー加工など)

- プロセスの複雑性と品質管理(QC)要素:段階別

第6章 PTFE特性とプロセスパラメーター間の技術的相関の分析

- PTFEバインダー含有量とプロセスパラメーターの相互作用

- 圧力、温度、PTFEのフィブリル化に対する電極の厚さの影響

- バインダーのフィブリル化方法と技術的差別化要因

第7章 Maxwell(Tesla)の特許ポートフォリオの維持動向と産業に対する影響

- 初期のMaxwell/Tesla特許の有効期限(2026年ごろ)

- 追加出願による技術ポートフォリオの拡大に向けた戦略

- 特許消滅の影響

- Maxwell/Teslaが保有するAlive特許の概要

第8章 差別化戦略と対策

- 産業の対応戦略

- 代替バインダー材料

- プロセスパラメーターの変更

- セミドライプロセスまたはハイブリッドプロセスの導入

- ライセンシングまたは提携による解決

- カスタマイズされたプロセス設計

第9章 ドライ電極技術が主流となる理由

- 基礎的優位性(無溶剤化の重要性)

- 幅広い請求範囲と実証済みの大量生産能力

- 次世代電池(全固体、シリコン負極など)への応用可能性

付録

目次

Product Code: 253

SNE Research's newly released report, "<2025> Dry-process Electrode Patents Analysis & Technology Trends", offers a differentiated perspective on the dry electrode process, which is rapidly emerging as an "innovative technology" within the secondary battery industry.

Rather than simply presenting dry electrode as a promising technology, this report provides a multi-dimensional analysis that includes practical considerations for implementation, collaboration strategies, and potential applications.

- While dry electrode offers compelling benefits such as VOC reduction, shorter processing time, and higher energy density, the fact that leading companies like Tesla have secured key patents makes it difficult for latecomers to introduce the technology without differentiation.

- Therefore, when introducing the process or pursuing R&D on new materials, it is essential to technically assess existing patents and establish strategic direction at the design stage.

This report aims to reduce uncertainty in business execution by systematically organizing the core elements of related patents and key considerations for industrial application.

Key strengths of this report:

1. In-depth guide on patent strategy for dry electrode technology

- The report provides a multi-faceted analysis of major international patents covering core technologies in dry electrode processes such as solvent-free manufacturing and PTFE binder fibrillation, offering actionable design directions and collaboration options for latecomers.

- OEMs, battery manufacturers, and materials suppliers can use this report to assess practical technical questions such as whether modifying specific process parameters can lead to meaningful differentiation, and what to consider when applying the technology under different binder types, temperatures, or pressures.

2. Analysis of over 240 key patent cases and presentation of strategic portfolios

- The report analyzes more than 240 dry electrode-related patents applicable across a wide range of technologies, from supercapacitors to solid-state batteries. Rather than simply listing the patents, it identifies the specific process components addressed by each patent (e.g., binder fibrillation, post-treatment, roll pressing) and clarifies their technical context.

- In particular, for high-potential application areas such as high-nickel cathodes, silicon anodes, and solid-state batteries, the report provides a strategic portfolio focused on technical approaches and potential collaboration or utilization paths. This enables not only materials and equipment suppliers but also securities firms and investors to understand the value and commercial applicability of each technology from multiple perspectives.

3. Integrated analysis from market, technical, and legal perspectives

- The report goes beyond technical characteristics and advantages of dry electrode processes (such as cost savings and line efficiency improvements) to address global regulatory trends (e.g., VOC reduction), pilot line cases at OEM and battery manufacturers, and benefits in safety and energy density.

- It also explores key legal and strategic considerations such as patent publication timing and claim evolution, follow-up applications (e.g., CIP, divisional), and counter-strategy development by latecomers. These insights help stakeholders better manage risks and establish forward-looking technology roadmaps.

- As a result, OEMs, battery and material companies, investors, and research institutions can tailor their R&D, investment, and business strategies to enhance long-term competitiveness.

Who should read this report?

1. Automakers, OEMs, and battery manufacturers

- This report is valuable for companies considering the adoption of dry electrode processes, which offer practical benefits such as reduced CAPEX and OPEX, simplified production lines, and higher energy density. It also provides strategic insights for designing processes while taking into account potential overlap with existing patents.

2. Materials and equipment suppliers

- For companies supplying binders such as PTFE, PVDF, and FEP, conductive additives like carbon nanotubes and graphene, or equipment such as mixers and roll presses, this report helps identify how technical requirements are linked to patent claims in dry processing. It can also guide efforts to establish meaningful technological differentiation.

3. Investment firms and securities companies

- The report supports investment decisions, stock analysis, and partnership or M&A strategies by offering a grounded view of the market potential, patent barriers, and long-term value of dry electrode technologies compared to conventional wet processes.

4. Research institutes and R&D organizations

- By understanding pilot project cases in industry and analyzing patent portfolios, researchers can explore follow-up directions for next-generation battery R&D, including solid-state batteries, silicon anodes, and high-nickel cathodes.

Table of Contents

1. Dry Electrode Technology Overview

- 1.1. Background of Dry Electrode Development

- 1.2. Differences Between Dry and Wet Processes

- 1.3. Dry Electrode Manufacturing Process

2. Application of PTFE Binder in Dry Electrodes

- 2.1. Chemical and Physical Properties of PTFE (Polytetrafluoroethylene)

- 2.2. Fibrous Mechanism of PTFE

- 2.3. Comparison with Conventional PVDF Binders

3. Tesla's Dry Electrode Patents Status

- 3.1. Maxwell's Core Dry Process Technology for Ultracapacitors

- 3.2. Maxwell Technologies Patent Portfolio

- 3.2.1. Search Results for Maxwell Technologies' Dry Electrode Patents

- 3.2.2. Analysis of Maxwell's Patent Portfolio

- 3.2.3. Patent Activity Trends by Country and Year

- 3.2.4. Patent Activity Trends by Year and Technical Theme

- 3.2.5. Filing Share by Country and Technical Theme

- 3.2.5.1. Major Countries Overall (US, CN, EP, JP, KR, PCT)

- 3.2.5.2. US

- 3.2.5.3. CN

- 3.2.5.4. EP

- 3.2.5.5. JP

- 3.2.5.6. KR

- 3.3. Tesla's Acquisition of Maxwell and Inheritance of Key Patents

4. Characteristics and Strengths of Maxwell (Tesla)'s Dry Electrode Patents

- 4.1. Technical Configuration of Key Claims

- 4.2. Technical Differentiators and Development Constraints

- 4.2.1. Impact in Real-World Industrial Applications

- 4.3. Examples of Technical Descriptions in Published Patents

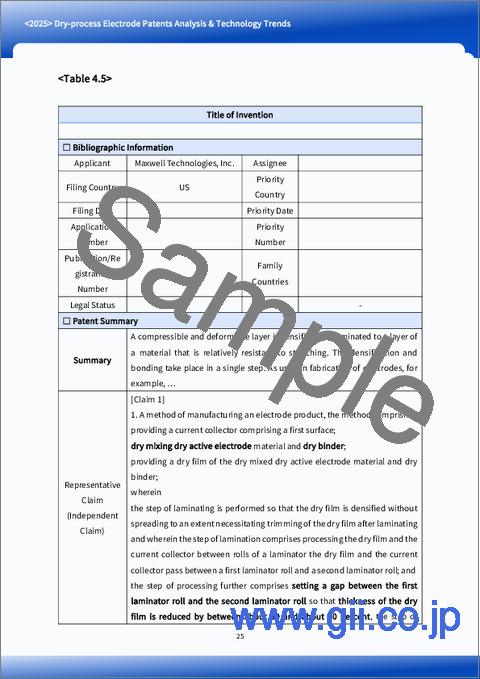

- 4.4. Transition of Dry Electrodes to Lithium-Ion Batteries

5. Dry Process and Its Detailed Factors

- 5.1. Powder Mixing (Active Material, Conductive Agent, PTFE) Stage

- 5.2. Pre-Pressing Stage

- 5.3. Roll Pressing and Lamination

- 5.4. Post-Treatment (Thermal Treatment, Additional Calendaring, etc.)

- 5.5. Process Complexity and Quality Control (QC) Factors by Stage

6. Analysis of Technical Correlation Between PTFE Properties and Process Parameters

- 6.1. Interaction Between PTFE Binder Content and Process Parameters

- 6.2. Effects of Pressure, Temperature, and Electrode Thickness on PTFE Fibrillation

- 6.3. Binder Fibrillation Methods and Technical Differentiators

7. Maintenance Trends of Maxwell (Tesla) Patent Portfolio and Its Industry Impact

- 7.1. Expiration Timeline of Early Maxwell/Tesla Patents (Around 2026)

- 7.2. Strategy for Expanding the Technology Portfolio Through Follow-Up Filings

- 7.3. Impact of Patent Expiration

- 7.4. Overview of Alive Patents Held by Maxwell/Tesla

8. Differentiation Strategies and Countermeasures

- 8.1. Industry Response Strategies

- 8.1.1. Alternative Binder Materials

- 8.1.2. Modifications of Process Parameters

- 8.1.3. Introduction of Semi-Dry or Hybrid Processes

- 8.1.4. Settlements Through Licensing or Collaboration

- 8.1.5. Customized Process Design

9. Why Dry Electrode Technology Dominates

- 9.1. Foundational Advantage (Significance of Solvent-Free Adoption)

- 9.2. Broad Claim Scope and Proven Mass Production Capability

- 9.3. Applicability to Next-Generation Batteries (All-Solid-State, Silicon Anode, etc.)

Appendix

Appendix 1. Analysis of Representative Patent Families

- A 1.1. Representative Patent Families

- A 1.2. Core Inventions

- A 1.3. Examples of Differentiating Patent Claims

- A 1.4. Implications

Appendix 2. Application of Dry Electrodes to Cathodes and Anodes and Patent Implications

- A 2.1. Cathode Applications (NCM, NCA, LFP)

- A 2.2. Anode Applications (Graphite, Silicon Composite)

- A 2.3. Comparison of Application Difficulty Between Cathode and Anode

- A 2.4. Conclusion and Outlook

Appendix 3. Expansion of Dry Electrode Technology to All-Solid-State and Next-Gen. Batteries

- A 3.1. Significance of Dry Processing in All-Solid-State Batteries

- A 3.2. Synergy Between Dry Process and Transition from Lithium-Ion to All-Solid-State Batteries

- A 3.3. Conclusion